Scale Your CPA Firm Without Adding Headcount

Build your offshore team that works your way, trained, compliant, and white-labeled under your firm.

👉 Book a Discovery Call

Think of your W‑4 as a dimmer switch for taxes, not an on or off button. You can fine tune it to fit your life and your goals.

Key Takeaways

- Form W‑4 tells your employer how much federal income tax to take from each paycheck, and the 2025 version keeps the five‑step format, no allowances.

- Use the current 2025 W‑4, grab it directly from the IRS page called “About Form W‑4,” then the PDF. Update it when your life or income changes.

- Step 3 on the 2025 form uses 2,000 per child under 17 and 500 per other dependent, and you can also include other credits in that step.

- If you claim exempt for 2025, you must meet the no‑tax‑liability rules and give your employer a new form by February 17, 2026.

- To dial in accuracy, use the IRS Tax Withholding Estimator or Publication 505 worksheets, then adjust Step 4(a), 4(b), or 4(c).

- Safe harbor rules help you avoid underpayment penalties, usually 90 percent of this year’s tax or 100 percent of last year’s tax, 110 percent for higher incomes.

What Form W‑4 Is And Why It Matters

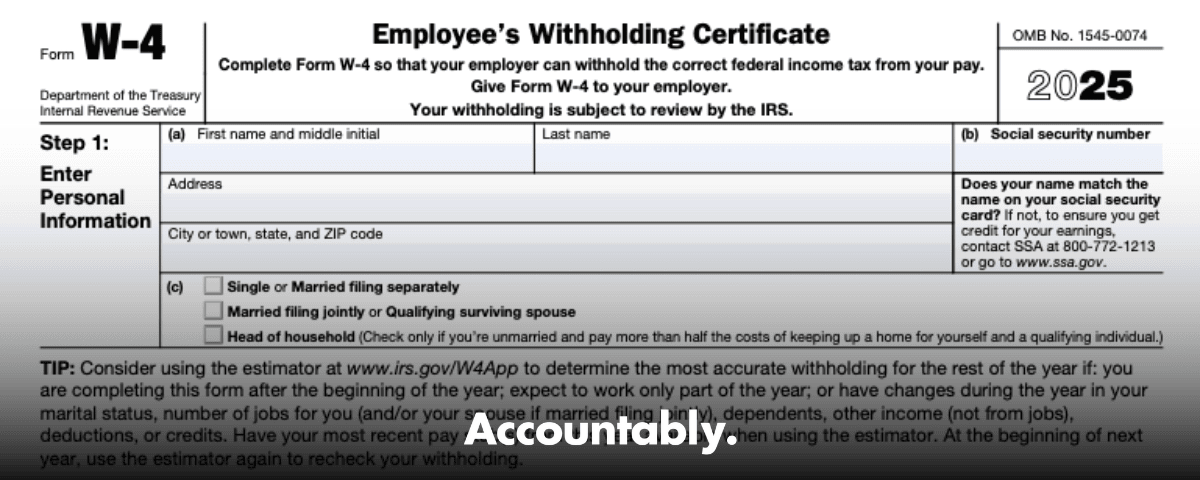

Form W‑4, the Employee’s Withholding Certificate, tells your employer the inputs they need to calculate federal income tax from each paycheck. Fill it out right, and your withholding will align closely with your year‑end tax bill, which keeps your cash flow steady and reduces surprises at filing time. The IRS updates guidance and the PDF each year, so start with the current 2025 form.

Since the 2020 redesign, the W‑4 moved to a clear five‑step layout. No allowances. You set filing status, handle multiple jobs or a working spouse, claim dependents and certain credits, add other income or deductions, then sign. That structure remains in 2025, which keeps the process familiar.

If you only remember one thing, remember this, you can update your W‑4 any time during the year when your situation changes.

Hundreds of Firms Have Already Used This Framework.

Join the growing list of CPA and accounting firms using Accountably’s Offshore Playbook to scale faster.

💬 Get Your FREE Playbook

👉 Visit Jugal Thacker’s LinkedIn

Send him a connection request and message “Playbook” to get your copy.

Common moments to update, a new job, a raise, a second job, your spouse starts or stops working, a new child, a change in itemized deductions, or meaningful non‑wage income. Publication 505 walks through how each input affects withholding, and the IRS estimator can reflect those changes quickly.

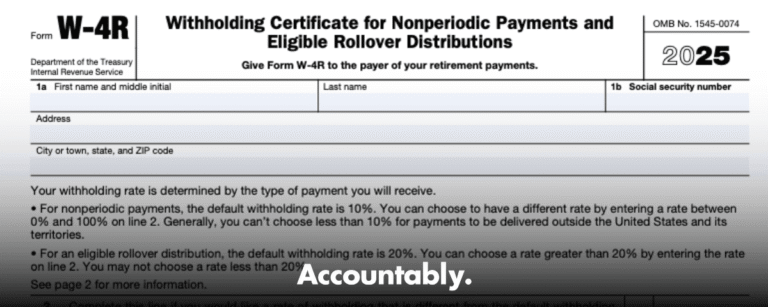

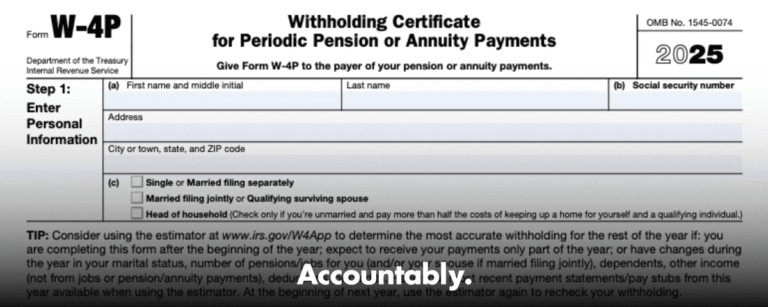

W‑4 vs W‑2, Different Forms, Different Jobs

Your W‑4 sets your withholding today. Your W‑2 reports your annual wages and taxes withheld after the year ends, and your employer must furnish it around late January. That W‑2 supports your tax return when you reconcile what you already paid with what you owe. The form names look alike, the purposes do not.

Snapshot Comparison

| Item | What it does | When it matters |

| Form W‑4 | Tells payroll how much federal income tax to withhold each check | When you start a job or update withholding during the year |

| Form W‑2 | Reports wages and taxes withheld for the full year | Furnished by late January for the prior tax year, used to file your return |

Employers must file W‑2 information with SSA by the due date and furnish copies to employees by the January deadline that year. Dates can shift when weekends or holidays intervene, so your employer may use the next business day when January 31 falls on a weekend or holiday.

The 2025 W‑4 At A Glance

The 2025 W‑4 keeps the same five steps you have seen recently:

- Step 1, your name, SSN, and filing status.

- Step 2, multiple jobs or a working spouse, choose the estimator, the worksheet, or the two‑jobs checkbox when there are only two jobs.

- Step 3, dependents and credits, the form instructs you to multiply qualifying children under 17 by 2,000 and other dependents by 500, then you can add other credits to that total.

- Step 4, optional adjustments, other income, deductions, and extra withholding.

- Step 5, sign and date.

A note for 2025, the IRS also published guidance on how to reflect certain 2025 law changes inside today’s W‑4 by using Step 4(b) or by adding eligible credits in Step 3. If you qualify for new or enhanced deductions or an increased child tax credit for 2025, the IRS explains how to adjust your entries so your withholding keeps pace.

Improve Margins Without Compromising Quality

Offshore staffing helps firms deliver more, scale faster, and stay compliant, without adding local headcount.

👉 Book a Discovery CallQuick rule of thumb, put known credits in Step 3, use Step 4(b) for deductions beyond the standard deduction, and use Step 4(c) when you want a simple extra dollar amount taken each payday.

Where To Get The 2025 Form And How To Use It

Always download the current W‑4 from the IRS page labeled “About Form W‑4,” then open the 2025 PDF. Many employers also embed it in electronic onboarding, which is fine, just confirm it is the 2025 revision.

Before you fill it out, grab your latest pay stub and last year’s return, then run the IRS Tax Withholding Estimator. It will show how each move changes your take‑home pay and your expected refund or balance due. If you prefer worksheets, Publication 505 includes step‑by‑step worksheets for other income, deductions, and extra withholding.

You do not need to guess. The estimator and Pub. 505 tell you exactly how much to add on Step 4(c) or how to fill Step 3 and 4(b) for the result you want.

How To Fill Out The 2025 Form W‑4, Step By Step

You can finish a W‑4 in a few minutes if you move in order and keep your latest pay stub nearby. I walk new hires through this sequence during onboarding, it keeps mistakes low and saves rework later.

Step 1, Filing Status And Basics

- Enter your legal name, address, and Social Security number.

- Pick your filing status, Single or Married filing separately, Married filing jointly or Qualifying surviving spouse, or Head of household.

- Your status drives your standard deduction and tax brackets, so make sure it matches how you expect to file for 2025.

Step 2, Multiple Jobs Or Working Spouse

- If you have more than one job at a time, or you are married and both of you work, complete this step.

- Use one of three options:

- IRS estimator for the most accurate result,

- Multiple Jobs Worksheet on the form,

- Check the Step 2 box when there are only two jobs with similar pay.

- Only complete Step 2 on the W‑4 for the highest paying job unless the worksheet tells you otherwise.

Step 3, Dependents And Certain Credits

- Enter the total from your qualifying children under 17 at 2,000 each and other dependents at 500 each.

- You can include other credits here if the instructions allow. This directly reduces how much your employer withholds during the year.

Step 4, Optional Adjustments

- 4(a) Other income you expect that will not have withholding, for example interest, dividends, or side income that is not on payroll.

- 4(b) Deductions beyond the standard deduction, use the Deductions Worksheet to estimate.

- 4(c) Extra dollar amount to withhold each paycheck, a simple way to cover side income or to target a smaller refund.

- Pick one or more of these to fine tune. If you want clean and simple, 4(c) is often the fastest dial.

Step 5, Sign And Date

- Unsigned forms are not valid. Sign, date, and submit to payroll or upload through your HR portal.

Pro tip, if your situation is complex, fill a draft, run numbers in the IRS estimator, then adjust Step 4 until the result matches your target.

Real‑World Scenarios You Can Copy

One Job, No Dependents

- Complete Step 1, skip Step 2, skip Step 3, leave Step 4 blank unless you want a smaller refund or expect non‑wage income, then sign.

- If your refund was too large last year, add a small amount on 4(c), for example 25 or 50 per check, and monitor the next pay stub.

Married, Both Working, Similar Pay

- Complete Step 1, then in Step 2 check the box for two jobs if pay is similar.

- Enter dependents in Step 3, consider using the estimator to confirm accuracy.

- If itemizing, use Step 4(b). If you prefer simplicity, add a per‑pay amount on 4(c) to cover the gap the estimator shows.

Second Job Or Side Income

- If a second W‑2 job is much smaller, do Step 2 on the higher paying job only.

- For 1099 side income, you have two routes, make quarterly estimates or add a flat amount on 4(c) of your primary job to cover both income tax and self‑employment tax. Many people do a hybrid, a baseline 4(c) amount plus small quarterly payments when income spikes.

Itemized Deductions

- When your total itemized deductions will exceed the standard deduction, complete the Deductions Worksheet and carry the result to Step 4(b).

- If the math feels heavy, use the estimator, note the suggested additional withholding, and put that figure on 4(c) instead.

Bonuses, RSUs, Or Variable Pay

- Supplemental wages often have separate withholding mechanics. If large payouts push your tax higher overall, add a temporary 4(c) amount for the pay periods around those events, then remove it later.

When You Should Update Your W‑4

Update your W‑4 any time your tax picture changes. You do not need to wait for open enrollment or a new year.

- Life changes, marriage, divorce, birth or adoption, or a dependent leaving your household.

- Income changes, a raise, a spouse starting or stopping work, a new second job, a big bonus, or a strong year of investment income.

- Deduction changes, you start itemizing, your mortgage interest drops, or medical expenses increase.

- Results review, last year you owed a lot or received a refund larger than you want. Adjust now rather than waiting for next tax season.

Quick habit, review your W‑4 every January and again in late summer. Two check‑ins catch most surprises while there is still time to adjust.

Adjusting Withholding, More Or Less Taken From Pay

If you want more withheld, add an extra amount on Step 4(c). If you want less withheld, claim Step 3 credits you qualify for and reflect deductions on Step 4(b) when they exceed the standard deduction. If you have more than one job, complete Step 2 on the highest paying job and avoid making separate, conflicting changes on lower‑paying W‑4s.

A simple playbook I use with employees:

- Start with the estimator so you see the refund or amount due.

- If you will owe, put that annual gap divided by remaining pay periods on Step 4(c).

- If you want a smaller refund, reduce 4(c) or move some credits and deductions in Steps 3 and 4(b) only as the instructions allow.

- Recheck a month later to confirm your pay stub reflects the change.

Special Cases, Exempt, Multiple Jobs, And Spousal Income

Claiming Exempt

You may claim exempt only if you had no federal income tax liability last year and you expect none this year. If you qualify, federal income tax stops for the rest of the year, but Social Security and Medicare still apply. Exempt must be renewed every calendar year or it expires automatically. If your income picture changes during the year, file a new W‑4 immediately and remove exempt.

Coordinating Across Two Incomes

If you and your spouse both work, treat your combined income as one tax picture. Use the estimator together, then complete Step 2 on the higher paying job only. Claim Step 3 dependents on just one W‑4 so you do not double count. If you still expect to owe, add a flat 4(c) amount on the higher paying job to cover the difference.

Self‑Employment, Estimates, And Using W‑4 Strategically

When you have 1099 or business income alongside a W‑2 paycheck, your W‑4 can carry some of the load. Estimate the tax on your side income, including both income tax and self‑employment tax, then split that total across remaining pay periods and put it on Step 4(c). For variable months, many people keep a base 4(c) amount and top up with quarterly estimated payments when income spikes.

A quick framework:

- Forecast net self‑employment income for the year.

- Add expected income tax and self‑employment tax on that amount.

- Divide by the number of remaining pay periods and enter that figure in Step 4(c) on your main W‑2 job.

- Revisit each quarter, raise or lower the 4(c) amount as needed.

If cash is tight, a blended approach helps, modest 4(c) withholding plus smaller quarterly estimates spreads the burden through the year.

State Withholding Forms And Reciprocity

Federal W‑4 covers only federal income tax. Most states require a separate state withholding form, and a few follow the federal W‑4. Some states have no individual income tax, for example Alaska, Florida, Nevada, South Dakota, Tennessee, Texas, and Washington, while New Hampshire generally taxes certain investment income. If you live in one state and work in another, look for a reciprocity agreement and complete the specific paperwork so withholding happens in the correct state.

Employers, keep a short checklist by state, form name, where to submit, and any reciprocity steps for border commuters. Employees, ask HR which state form applies and whether your state lets you use the federal W‑4 for state withholding.

For Employers And Accounting Firms, Smoother W‑4 Intake = Fewer Headaches

If you manage payroll, the fastest way to reduce W‑4 errors is to standardize the process. Build a short SOP, a single intake checklist, and a 10‑minute review routine. Keep completed forms, estimator screenshots if employees share them, and approval notes in one secure place with clear naming so reviewers can find items in seconds.

Where it is appropriate, a delivery partner like Accountably can help firms operationalize this discipline, not by handing over resumes, but by running a controlled workflow that protects review time, standardizes files, and maintains continuity when volumes spike. Mention it once and move on, the point here is that structure lowers risk and speeds payroll day.

A Simple W‑4 Intake SOP You Can Adopt

- New hire or change request arrives, HR verifies the 2025 PDF or e‑form version.

- Employee runs the IRS estimator, brings a pay stub, and fills the draft W‑4.

- Reviewer checks Step 2 logic, Step 3 credits, and Step 4 entries for internal consistency.

- Payroll inputs the change, a second person verifies the entries in the system.

- Store the signed W‑4 in your secure folder with a standardized file name, employee‑YYYYMMDD‑W4.pdf.

- Confirm the change on the next paycheck, correct immediately if the amount looks off.

Most W‑4 problems are really workflow problems. A 6 step checklist removes guesswork and rework.

FAQs

What is a W‑4 used for?

It tells your employer how much federal income tax to withhold from each paycheck. You set filing status, handle multiple jobs, claim dependents and credits, add other income or deductions, and request extra withholding if needed. Update it whenever your situation changes.

How do I fill out my W‑4 correctly?

Move step by step. Pick filing status, address multiple jobs in Step 2, claim dependents in Step 3, use Step 4 for other income, deductions, or extra withholding, then sign. Use the IRS estimator with your pay stub to confirm the result and adjust 4(b) or 4(c) until it matches your goal.

Is it better to put 0 or 1 on a W‑4?

Neither, the form no longer uses allowances. Use the five‑step layout to reflect your real situation. Credits go in Step 3, deductions in Step 4(b), and any extra per‑pay amount in Step 4(c).

How do I decide what to withhold?

Decide based on your expected total income, credits, and deductions for the year. Run the estimator, then either enter other income and deductions on the form or add a flat 4(c) amount per paycheck to hit your desired refund or balance due.

Can I change my W‑4 during the year?

Yes, anytime. Submit a new W‑4 after a raise, second job, marriage, divorce, a new child, or when you see you are trending toward a large refund or a balance due. Your payroll updates should show on the next one or two paychecks.

What if I have self‑employment income too?

You can boost withholding on your W‑2 job using Step 4(c) to cover the tax on your side income, or make quarterly estimated payments, or both. Re‑check quarterly so you do not fall behind.

Practical Checklists You Can Save

Employee, Before You Submit

- Latest pay stub and last year’s return

- IRS estimator result screenshot or numbers

- Step 2 calculation complete for multiple jobs

- Dependents and credits verified for Step 3

- Deductions worksheet or 4(c) amount ready

- Signed and dated W‑4 uploaded to HR

Payroll Admin, Quick Review

- 2025 form version used

- Consistent entries across Step 2, Step 3, and Step 4

- Signature and date present

- Change applied in payroll system and verified

- File stored with a standard name, with access limited by role

Conclusion

If you treat Form W‑4 like a dimmer switch and not a light switch, you will get far better results. Start with the 2025 form, confirm your filing status, handle multiple jobs, enter credits, and use Step 4 to fine tune. Update after any life or income change and check again midyear to keep things on track. Employers, a short SOP keeps the process clean, employees get accurate paychecks, and you avoid rework.

Simplify Delivery, Improve Margins, Stay in Control.

Offshore support that works exactly like your in-house team.

💼 Let’s Talk