Scale Your CPA Firm Without Adding Headcount

Build your offshore team that works your way, trained, compliant, and white-labeled under your firm.

👉 Book a Discovery Call

A 1099‑S is a reporting form. It tells the IRS you sold real estate. It does not, by itself, mean you owe tax. In many main‑home sales, you will legally exclude the gain. In other cases, you will report the sale and compute the actual profit or loss the right way, with the right forms.

Key Takeaways

- A 1099‑S reports the gross proceeds from your real estate sale or exchange, not your gain. The closing or settlement agent usually files it and furnishes your copy.

- You can qualify to exclude up to $250,000 of gain, or $500,000 if married filing jointly, on a main‑home sale when you meet the use and ownership tests. If you receive a 1099‑S for a home you can fully exclude, you still generally report the sale, then show the exclusion on your return.

- Sales of personal or investment property route to Form 8949 and Schedule D. Rental or business property routes to Form 4797, including depreciation recapture where it applies.

- For 2024 closings, the recipient copy for 1099‑S is due to you by February 18, 2025. Filers generally send the IRS copy by February 28, 2025 if on paper, or March 31, 2025 if e‑filed. Frequent filers that submit 10 or more information returns must e‑file.

What Form 1099‑S is and what it is not

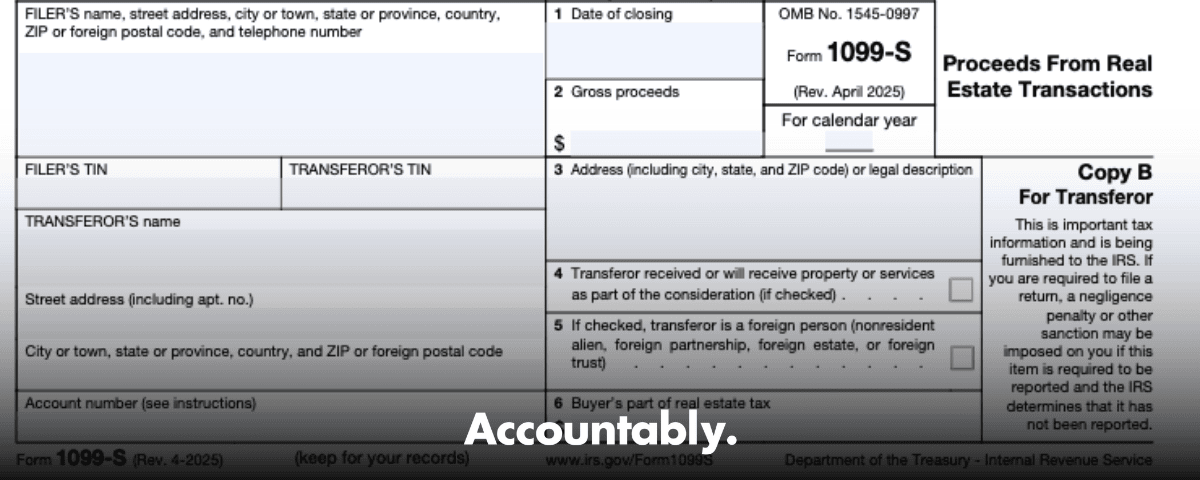

Form 1099‑S, Proceeds From Real Estate Transactions, reports the gross proceeds from your sale or exchange of real property, for example land, a house or condo, a commercial building, or shares in a co‑op. The form lists the closing date, the property address or legal description, and the total proceeds the settlement treated as paid for the property. It is typically prepared and filed by the person responsible for closing, often the title, escrow, or settlement agent named on your Closing Disclosure.

Put simply, 1099‑S says “a sale happened and here is the total paid for the property.” It does not calculate your gain or your tax.

Receiving a 1099‑S does not automatically create tax. If the property was your main home and you meet the ownership and use tests, you may exclude up to $250,000 of gain, or $500,000 if married filing jointly, and still comply with reporting requirements on your return. If it was a rental, a flip, land, or another investment, you will report the sale on the correct forms and compute the actual gain or loss with your basis and selling costs.

Hundreds of Firms Have Already Used This Framework.

Join the growing list of CPA and accounting firms using Accountably’s Offshore Playbook to scale faster.

💬 Get Your FREE Playbook

👉 Visit Jugal Thacker’s LinkedIn

Send him a connection request and message “Playbook” to get your copy.

Where 1099‑S info flows on your return

- Personal or investment property, including second homes and lots, flows to Form 8949 and Schedule D. You reconcile the 1099‑S proceeds with your basis and any adjustments.

- Rental or business property flows to Form 4797, which also handles depreciation recapture on real property, with any remaining Section 1231 amounts often landing on Schedule D.

Who files Form 1099‑S for your closing

The IRS assigns the filing duty to exactly one party. By default, it is the person responsible for closing, commonly the settlement or closing agent listed on the Closing Disclosure. If there is no single settlement agent or no Closing Disclosure, the rules use a clear fallback order. The parties can also sign a written designation naming a single responsible filer, and each signer must keep that agreement for four years.

The default and the fallback order

- Default, the responsible closing party files, usually the settlement or escrow agent shown on the Closing Disclosure.

- If no single party is responsible, the order is: transferee’s attorney, then transferor’s attorney, then the title or escrow company that disburses the proceeds. If still no one qualifies, the order continues to the mortgage lender, the seller’s broker, the buyer’s broker, then the buyer. The goal is one filer per transferor, no duplicates.

Designated filer option

You can override the default with a signed designation agreement that names the filer, identifies both parties and the property, and includes addresses and TINs. The designated filer signs the agreement and assumes the duty to file and furnish the 1099‑S. Keep that agreement for four years.

Transactions covered and the big exceptions

Most sales or exchanges of U.S. real property are reportable on Form 1099‑S, including homes, condos, commercial buildings, land, stock in a housing cooperative, and noncontingent interests in standing timber. Even some nontaxable transfers, for example a like‑kind exchange, are reportable, although special entries apply.

Common exceptions where no 1099‑S is required

- Fully excludable principal residence sales, but only if the seller gives the proper written certification that the home qualifies and the entire gain is excluded, with the correct dollar threshold, for example $250,000 or $500,000 if married. Keep the signed certification for four years.

- Transfers by corporations or government entities, certain exempt volume transferors, gifts and bequests, foreclosures or deeds in lieu, and de minimis transfers under $600. Non‑affixed mobile homes, burial plots, and certain natural resource interests are also out.

In short, most standard sales are reportable. If you believe an exception applies, make sure the paperwork, especially a principal residence certification when used, is in the file before everyone leaves the closing table.

What the 1099‑S tells you to check, first

When your copy arrives, grab your Closing Disclosure and confirm the core details match. You want the right closing date, the right property, and the right number for gross proceeds, which means the total amount realized before subtracting your selling expenses. Also look for any non‑cash consideration, whether the transferor was flagged as a foreign person, and whether the buyer‑allocated portion of prepaid property taxes was reported.

Improve Margins Without Compromising Quality

Offshore staffing helps firms deliver more, scale faster, and stay compliant, without adding local headcount.

👉 Book a Discovery CallThe quick box‑by‑box guide

| Box | What it shows | What you should verify |

| 1 | Date of closing | Match your Closing Disclosure date. |

| 2 | Gross proceeds | This is the total amount realized, including liabilities assumed, not reduced by commissions or legal fees. Compare to the contract price and settlement records. |

| 3 | Property address or legal description | Make sure it identifies the exact property sold. |

| 4 | Property or services received | If non‑cash consideration was part of the deal, this box is checked. |

| 5 | Transferor is a foreign person | If checked, FIRPTA withholding rules may apply to the buyer. |

| 6 | Buyer’s part of real estate tax | Shows prepaid tax that is allocable to the buyer when paid in advance, based on the Closing Disclosure. |

A note on Box 5. If the seller is a foreign person, the buyer is typically the withholding agent under FIRPTA and must withhold 15% of the amount realized, unless a valid exception or a withholding certificate applies. That FIRPTA withholding is handled on Forms 8288 and 8288‑A. The 1099‑S flag does not collect the tax, it alerts everyone that FIRPTA rules may be in play.

How receiving a 1099‑S affects your tax return

Start by identifying the property type and how you used it. That single choice routes the numbers to the right place.

- Main home, first test the Section 121 exclusion. If you meet both the ownership and use tests within the 5‑year window and have not used the exclusion in the past two years, you may exclude up to $250,000 of gain, or $500,000 if married filing jointly. If you receive a 1099‑S, you generally still report the sale, then show the exclusion.

- Personal or investment property, report on Form 8949 and Schedule D. You enter the 1099‑S proceeds, your basis, and selling costs, then compute the real gain or loss.

- Rental or business property, report on Form 4797, which also captures any depreciation recapture for real property. Some amounts then flow to Schedule D.

Compute your basis carefully. Include purchase price, closing costs that increase basis, and capital improvements. Subtract accumulated depreciation if the property was ever used for rental or business, and remember that losses on personal‑use property are not deductible, even if a 1099‑S was issued.

The “1099‑S means tax due” myth

It is common to panic when a large dollar figure shows up on Box 2. That number is gross proceeds, not profit. Your basis, improvements, and legitimate selling costs count, and home‑sale exclusions are real and often large. If you qualify, you can show the exclusion directly on Form 8949 using the code and adjustment approach the IRS describes, which results in a zeroed‑out gain for the excludable portion.

Covered sales and nuanced exceptions, with examples

- Fully excludable main‑home sale, you may avoid a 1099‑S if, on or before January 31 of the year after the sale, the seller provides a signed certification that all conditions for the full exclusion are met, including the correct threshold, and there has been no period of nonqualified use after 2008. If you do not obtain the certification, you must file and furnish the form.

- Debt satisfaction events like foreclosures, deeds in lieu, and abandonments generally are not reported on 1099‑S under the exceptions, but they can still have tax consequences that show up elsewhere.

- De minimis transfers, less than $600 in total consideration, do not require a 1099‑S. Be sure the contract and settlement records support that conclusion.

Practical tip, confirm the exception during the closing process, not months later during tax season, and keep the paperwork. It prevents duplicate filings and cleanup work.

What firms should know about filing mechanics

If you are the responsible filer, furnish Copy B to the seller by the IRS due date for that year and file with the IRS by the appropriate method and deadline. For 2024 transactions, the recipient copy is due February 18, 2025, because February 15 falls on a weekend and the following Monday is a federal holiday. Paper filings to the IRS are generally due February 28, and e‑filings by March 31. Also, if you file 10 or more information returns in aggregate, you must e‑file.

If your firm struggles with consistency at scale, treat 1099‑S as an operations workflow. Clear SOPs for designation agreements, TIN validation, file naming, and checklists for Box 2 and Box 6 calculations will cut down on corrections and late notices. If you need structured offshore capacity that works inside your systems, Accountably can integrate trained teams with your SOPs so you keep control of quality and deadlines while smoothing seasonal spikes. Use this only if it truly helps your operation, not as a band‑aid.

Reporting different property types the right way

Main home

If you meet the ownership and use tests for Section 121, exclude up to $250,000 of gain, or $500,000 if married filing jointly. Military and some government personnel can suspend the 5‑year test period for up to 10 years while on qualified extended duty. If you receive a 1099‑S, you generally still report the sale, then show the exclusion in the Form 8949 adjustment as instructed. Keep records of basis, improvements, and selling costs.

Vacation home or personal‑use timeshare

These are personal‑use properties. Gains are taxable and are reported on Form 8949 and Schedule D. Losses on personal‑use property are not deductible, but if a 1099‑S was issued you still enter the sale and then use the IRS’s “L” adjustment to zero out the nondeductible loss, per the Schedule D and Form 8949 instructions.

Inherited property

Inherited property generally gets a stepped‑up basis to the fair market value at the decedent’s date of death. That basis often reduces or eliminates gain, and losses are handled under capital rules. Report on Form 8949 and Schedule D. Keep the appraisal or estate documentation that supports your basis.

Investment land, lots, or second homes held for investment

Enter the 1099‑S proceeds and your basis on Form 8949. Include capital improvements and selling costs in basis where allowed. If the asset was ever depreciated, check the rules in Publication 544 and see whether any portion of gain must be treated through Form 4797.

Rental or business real estate

Report on Form 4797 and compute any depreciation recapture for real property. Section 1250 recapture can apply in specific situations, and remaining gains may flow to Schedule D as Section 1231 gains. Keep depreciation schedules and detail the improvements, placed‑in‑service dates, and methods you used.

Step‑by‑step, from 1099‑S to your tax forms

- Gather records. Closing Disclosure, prior purchase documents, settlement charges, major improvements, and any depreciation schedules if the property was rented or used in business.

- Classify the property, main home, personal‑use, investment, or rental/business. The classification drives the form.

- Compute basis. Start with purchase price, add eligible closing costs and capital improvements, subtract depreciation where applicable.

- Compare 1099‑S gross proceeds to your basis to compute gain or loss. Enter selling expenses as adjustments where the instructions allow.

- Select the correct route. Use Form 8949 and Schedule D for personal or investment property, use Form 4797 for rental/business property. For main‑home exclusions, follow the 8949 instructions to show the exclusion as an adjustment.

If your software has a “1099‑S” checkbox or an interview flow for “Sale of main home,” use it. It routes the data to the correct schedules and prompts you for the required exclusion entries.

Timing, copies, and compliance guardrails

You should receive your 1099‑S copy from the filer by the IRS recipient deadline for that tax year. For sales that closed in 2024, that date is February 18, 2025, due to weekend and holiday adjustments. Filers who submit on paper have a February 28 IRS deadline, while electronic filers generally have until March 31. If your operation files 10 or more information returns, you must file electronically using approved systems such as IRIS.

Retention matters. If a designated filer agreement was used for the transaction, each signer must retain that agreement for four years. Keep seller certifications for principal residence exceptions for the same period, and keep the settlement documents and basis support in your tax file.

Quick deadline table, 2024 closings

| What | Due date |

| Furnish 1099‑S to seller | February 18, 2025 |

| File with IRS, paper | February 28, 2025 |

| File with IRS, e‑file | March 31, 2025 |

Source, IRS due‑date guidance for 1099‑S furnishing and the general instructions for filing information returns.

A short note on foreign sellers and FIRPTA

If Box 5 indicates the transferor is a foreign person, the buyer is usually required to withhold 15% of the amount realized under FIRPTA, unless an exception or a withholding certificate applies. Withholding is reported and remitted on Forms 8288 and 8288‑A within the timelines set by the IRS. Real estate teams should coordinate early, because missing FIRPTA obligations can shift liability to the buyer.

When you see a foreign‑seller flag, do not guess. Confirm documentation, consider a withholding certificate when appropriate, and make sure names, TINs, and addresses on 8288‑A are complete to avoid delays in crediting the withholding. Publication 515 outlines the broader rules and definitions.

How to enter 1099‑S in tax software without headaches

- Main home sales, use the “Sale of your home” interview. Enter the 1099‑S proceeds, basis, improvements, and selling costs. If you qualify for the Section 121 exclusion, the software will add the adjustment on Form 8949 so the excludable portion does not create taxable gain. If you receive a 1099‑S and your gain is fully excludable, you generally still report the sale, then show the exclusion.

- Personal‑use sales with a loss, enter the 1099‑S, then use code “L” in the 8949 adjustment to reflect that the loss is nondeductible, which zeros it out on Schedule D.

- Investment sales, enter as a capital asset sale. Attach basis and improvements. If part of the property was depreciated, follow Pub. 544 and your software’s prompts.

- Rental or business sales, enter through the asset disposition workflow so the program completes Form 4797 and calculates any depreciation recapture correctly.

Keep the Closing Disclosure, purchase docs, improvement receipts, and any designation or certification forms with your records for at least four years. That paper trail makes notices easier to resolve.

FAQs

What is Form 1099‑S used for?

It reports the gross proceeds from a real estate sale or exchange to you and the IRS. The form shows the closing date, total proceeds, property details, and certain flags like foreign‑seller status. You then report the sale on your tax return using Form 8949 and Schedule D or Form 4797, depending on use.

Will I get a 1099‑S when I sell my house?

Usually, yes, because the closing agent has a duty to report most sales. If your entire gain is excludable and you provide the required certification as a principal residence, the filer can rely on it and may not issue a 1099‑S. If you do receive one, you generally still report the sale and show your exclusion.

Do I have to report a 1099‑S on my return?

If you receive a 1099‑S, you generally report the sale even if your main‑home gain is fully excludable. The IRS reconciles these forms, so entering it correctly prevents mismatch notices. Use Form 8949 and Schedule D, or Form 4797 for rentals or business property.

How do I enter a 1099‑S for a loss on a vacation home?

Enter the sale on Form 8949, then use adjustment code “L” to show the loss is nondeductible personal‑use property. Your Schedule D will reflect zero gain or loss for that item. Keep your records, since the 1099‑S proceeds still flowed to the IRS.

What if the seller was a foreign person?

FIRPTA may require the buyer to withhold 15% of the amount realized and file Forms 8288 and 8288‑A. Box 5 on 1099‑S is a signal, not the withholding itself. Work with the closing team early to determine if an exception or a withholding certificate applies.

When to pull in help

If you are a homeowner, a good tax pro can save time and stress, especially when a home was partially rented, improved over many years, or sold soon after a previous exclusion. If you are a firm, treat 1099‑S as a delivery workflow with real controls. Standardized workpapers, clear SOPs for designated filer agreements, and early checks for Box 5 and Box 6 reduce rework and late notices. When you are ready to scale those workflows without losing control, Accountably can embed trained offshore teams inside your systems and templates so you protect quality, security, and deadlines.

Bottom line

A 1099‑S confirms a real estate sale. Your tax result comes from your facts, not just the gross proceeds on the form. Classify the property, compute your basis, apply the home‑sale exclusion when you qualify, and file by the deadlines. Keep the designation agreement or home‑sale certification on file when used, and save the settlement and basis records for at least four years. For the official rules and step‑by‑steps, rely on the IRS instructions and publications referenced throughout this guide.

Disclaimer, This content is for general information only and is not tax, legal, or accounting advice. Always review the latest IRS instructions and consult a qualified professional for your specific situation.

Simplify Delivery, Improve Margins, Stay in Control.

Offshore support that works exactly like your in-house team.

💼 Let’s Talk