If you get those right, you protect margins and sleep better. If you miss them, interest and penalties pile up quickly. The good news, you can build a simple, dependable routine that keeps Form 720 off your worry list.

Key Takeaways

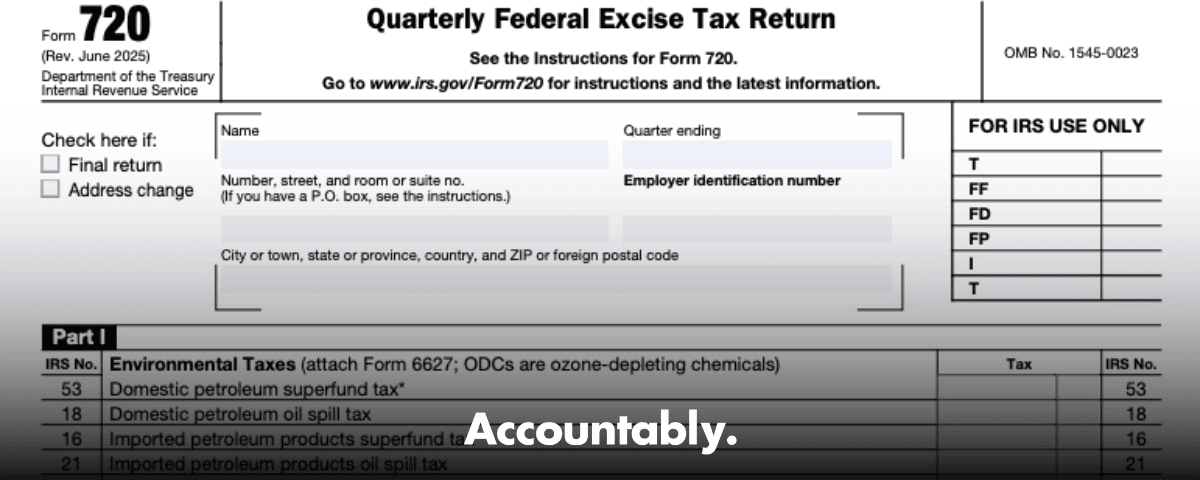

- Form 720 is the IRS quarterly return for specific excise taxes, including fuel, air transportation, indoor tanning, environmental items, PCORI, and the corporate stock repurchase excise tax. File by April 30, July 31, October 31, and January 31.

- Many Part I taxes require semi‑monthly deposits via EFTPS. To be on time, you must initiate EFTPS by 8:00 p.m. Eastern at least one day before the deposit due date. A quarterly net Part I liability of 2,500 or less may be paid with the return.

- PCORI is unusual. You report and pay it annually on the second‑quarter Form 720, due July 31, and no deposits are required.

- 2025 updates include inflation‑adjusted air travel amounts and the post‑2024 expiration of most 6426/6427 fuel mixture credits. The stock repurchase tax continues to be reported on Form 720 with Form 7208 attached.

- If you discover errors, fix them with Form 720‑X and attach support. Do not adjust a prior quarter on the current 720.

What is Form 720

Form 720 is the IRS Quarterly Federal Excise Tax Return. You use it to report and pay excise taxes on specific goods, services, and activities, such as fuel, air transportation, indoor tanning, certain environmental items, and more. You report each liability by IRS tax number on Parts I and II, then reconcile deposits and payments in Part III.

In plain terms, Form 720 is the scoreboard for your excise activity each quarter, mapped line by line to IRS tax numbers, with deposits and credits reconciled before you hit submit.

A few quick clarifications that save time in review:

- IRS No. 33 on Form 720 is the retail excise tax on truck, trailer, and tractor chassis, not the Heavy Highway Vehicle Use Tax. Heavy vehicle use is Form 2290, a different return altogether.

- PCORI, IRS No. 133, is reported once per year on the Q2 Form 720 due July 31, even though Form 720 itself is a quarterly return.

- The 1 percent corporate stock repurchase excise tax, IRS No. 150, is computed on Form 7208 and then reported on the first Form 720 due after your tax year ends.

Who Must File Form 720

You must file a Form 720 for any quarter in which you are liable for, or must collect, any excise tax listed on the form. If you filed in a prior quarter and have not filed a final return, you must keep filing even for zero‑liability quarters. Typical filers include fuel producers and distributors, airlines and ticketing agents that collect air transportation taxes, indoor tanning providers, manufacturers and retailers subject to specific environmental or retail excises, and plan sponsors that owe the annual PCORI fee.

Use this quick check:

- Did you incur or collect a tax shown in Parts I or II this quarter?

- Did you file last quarter and not check the final‑return box?

- Are you the plan sponsor responsible for the annual PCORI fee due with the Q2 Form 720?

If the answer is yes to any of these, you have a 720 filing obligation.

Federal Excise Tax Categories Covered

Form 720 groups excise taxes by category and IRS tax number. You will compute each on the required base, such as gallons, tickets, weight, or per‑item rates, then list totals by line.

Core Categories You Will See

- Fuel taxes in Part I with unit‑based rates and multiple IRS numbers, often with Schedule A for deposit reconciliation and Schedule T for fuel movement reporting.

- Air transportation taxes, including the percentage tax, the domestic segment amount, and the international facilities amount, all inflation‑adjusted for 2025.

- Retail excise on trucks, trailers, and tractors, IRS No. 33.

- Environmental and specialty items, such as ozone‑depleting chemicals, sport fishing equipment, and communications taxes.

- PCORI, IRS No. 133, reported annually on the Q2 return.

- Corporate stock repurchases, IRS No. 150, calculated on Form 7208, then reported on 720.

A Few Notable IRS Numbers

- IRS No. 26, 27, 28, air travel taxes, with 2025 amounts of 5.20 per domestic segment and 22.90 for international facilities, plus the Alaska or Hawaii domestic segment amount.

- IRS No. 33, retail tax on truck, trailer, and tractor chassis and bodies, section 4051.

- IRS No. 140, indoor tanning services, 10 percent of the amount paid.

- IRS No. 133, PCORI fee, calculated on average covered lives and due with the Q2 Form 720. The applicable rate for plan years ending Oct 1, 2024 through Sep 30, 2025 is 3.47 per covered life.

- IRS No. 150, stock repurchase excise tax, reported with Form 7208 attached to your first quarter after year end.

Up next, we will pin down your calendar, the deposit clock, and the 95 percent rule so you do not leave money on the table through avoidable penalties.

Quarterly Due Dates and Deposit Rules

You file Form 720 four times a year, the last day of the month after each quarter, April 30, July 31, October 31, and January 31. If the due date falls on a weekend or DC holiday, you have until the next business day.

Many Part I excise taxes require semi‑monthly deposits. The two periods are the 1st through the 15th, and the 16th through month‑end. For the regular method, your deposit is due by the 14th day after the period closes. Practically, that is the 29th for the first period and the 14th of the following month for the second period, adjusting for weekends and holidays.

To be considered on time with EFTPS, schedule the transfer by 8:00 p.m. Eastern at least one day before the deposit due date. If you miss that cutoff, you can still make an on‑time same‑day wire through the Federal Tax Collection Service if your bank supports it.

Semi‑Monthly Deposit Snapshot

| Period | Close date | Typical deposit due |

| 1–15 | 15th | 29th |

| 16–EOM | End of month | 14th of next month |

Deposits must equal at least 95 percent of the net tax liability for the period, unless you qualify and elect the safe harbor. Under the safe harbor, each deposit can be one‑sixth, 16.67 percent, of your lookback quarter net liability, with an additional 12.23 percent catch‑up in September’s special period. You must pay any underpayment by the return due date and check the safe harbor box.

Thresholds and Exceptions That Change Your Cash Flow

- If your quarterly net Part I liability is 2,500 or less, you can pay with the return instead of making deposits. You still complete Schedule A to record each semi‑monthly liability.

- Most Part II taxes do not require deposits. The floor stocks tax is a special case, and the repurchase of corporate stock tax is treated as a single annual payment computed on Form 7208.

- Air and communications taxes can use an alternative deposit method tied to amounts billed or tickets sold, with a different deposit timing rule.

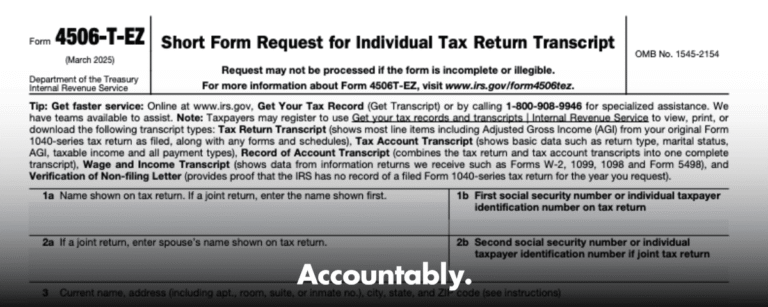

What You Need Before You Start

A calm quarter starts with a complete packet. Here is what I advise teams to gather before they even open a draft:

- Entity basics, EIN, legal name, address, and the quarter you are filing.

- A list of applicable IRS tax numbers and lines for this quarter’s activity.

- Units and bases by line, gallons, tickets, weight, counts, or receipts, along with current rates.

- Your semi‑monthly liability ledger for Part I, so Schedule A is quick to complete.

- Proof of deposits and any credits you will claim on Schedule C.

- The e‑file credentials for your chosen transmitter and EFTPS access, along with backup same‑day wire instructions in case a deposit needs to go today.

Pro tip from experience, set calendar holds for the two deposit windows and the quarter‑end filing deadline, and add an 8:00 p.m. Eastern reminder the day before each deposit due date. It sounds basic, it prevents the most common penalty I see.

Step‑by‑Step Filing Process

Choose Your E‑File Channel

You can e‑file Form 720 through an IRS‑authorized transmitter or ERO that participates in the excise e‑file program for Forms 720, 2290, and 8849. If you paper file, send it to the Ogden, Utah address. Electronic filing is faster and gives you an acceptance acknowledgment you can archive with your workpapers.

- Confirm the correct quarter.

- Map only the tax numbers you actually owe.

- Attach required schedules, for example Schedule A for deposits, Schedule C for credits, Schedule T for two‑party fuel exchanges.

Select Tax Categories With Care

Match each activity to the exact IRS number and rate. A few examples that often come up in reviews:

- Air travel taxes, IRS Nos. 26, 27, 28, include a percentage and fixed amounts per segment or facility, with 2025 inflation adjustments.

- Retail truck and trailer tax, IRS No. 33, is not the heavy highway vehicle use tax. Keep those separate in your checklist to avoid mis‑coding.

- Fuel lines span many IRS numbers. If you move product between terminals or parties, confirm when Schedule T is required.

- PCORI, IRS No. 133, appears on the Q2 return only, due July 31. No deposits are required.

Keep your workpapers clean, use consistent file names, include unit‑to‑rate math, and summarize per line. That one discipline speeds reviewer sign‑off every time in my experience.

Payment Options and IRS Acknowledgment

For most excise liabilities, deposits must be electronic. EFTPS is the standard, and an on‑time deposit means you initiated payment by 8:00 p.m. Eastern at least one day before the due date. If you miss the cutoff, use the same‑day wire option through the Federal Tax Collection Service if your bank supports it.

You may also be able to pay certain balances due, including amounts on line 10 of Form 720, using IRS Direct Pay for businesses, which allows online bank payments without EFTPS enrollment. For large or frequent payments, EFTPS remains the best fit. Always retain the confirmation or EFT trace number with your quarter’s 720 workpapers.

If your net Part I liability for the quarter is 2,500 or less, you can pay with the return instead of making deposits. Record semi‑monthly liabilities on Schedule A even if you qualify for this small‑balance rule.

When you e‑file and pay, keep the IRS acceptance acknowledgment and your payment confirmation. Those two documents resolve most penalty notices quickly when timing or application questions arise.

Common Line Items and IRS Numbers

Here is a fast map for items that show up frequently in reviews:

- IRS No. 26, Transportation of persons by air, report the percentage tax and domestic segment amount. 2025 domestic segment amount is 5.20 per segment. IRS No. 27, international facilities amount is 22.90 per person, and the Alaska or Hawaii amount is 11.40 per departure.

- IRS No. 33, Retail tax on truck, trailer, and semitrailer chassis and bodies, and tractors, section 4051. If claiming the section 4051(d) tire credit, see the specific line instructions.

- Fuel lines, multiple IRS numbers, gallon‑based rates, often requiring Schedule A for deposits and Schedule T for two‑party exchanges.

- IRS No. 140, indoor tanning services, 10 percent of the amount paid by the customer.

- IRS No. 133, PCORI fee, due only on the second‑quarter Form 720, no deposits required.

- IRS No. 150, stock repurchase excise tax, compute on Form 7208, then report on the first 720 due after your tax year ends.

- IRS No. 142, designated drug sales during statutory periods, for manufacturers and importers subject to section 5000D.

Credits, Schedules, and What Changed After 2024

If you claim credits, use Schedule C and tie each claim to the same IRS number. For fuel claimants, document the unit details and regulatory basis.

Important 2025 changes you should reflect in your checklist:

- The section 6426 and 6427 credits or refunds for mixtures of biodiesel, renewable diesel, agri‑biodiesel, and most alternative fuels expired for sales, uses, or removals after December 31, 2024. Do not carry those credits into 2025 returns.

- The section 6426(k) credit for sustainable aviation fuel mixtures continues, but the section 6427 mechanism for direct refund of excess credit ended after 2024.

I recommend adding a one‑page “credit sunset” sheet to your 2025 binder so reviewers can see, at a glance, which lines are still eligible and which are not.

Amending Returns With Form 720‑X

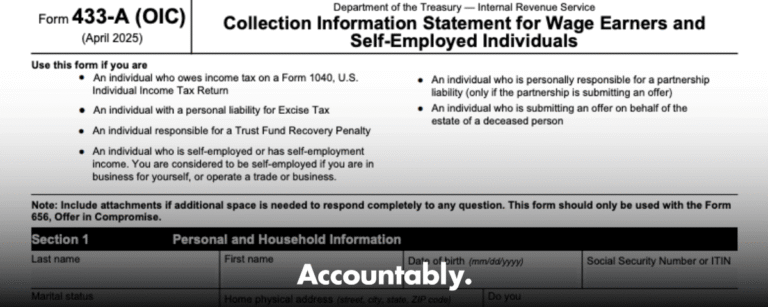

If you find an error, file Form 720‑X as soon as possible. On the 720‑X, show the original amount, the corrected amount, and the difference, by line and schedule. Attach your revised schedules and a clear explanation. Pay any increase with the amendment, and keep invoices, calculations, and related notices together with the amendment packet. Do not try to fix a prior quarter on the current Form 720.

For the corporate stock repurchase tax, if you need to amend the computation, file a corrected Form 7208 marked “Amended” and attach it to Form 720‑X.

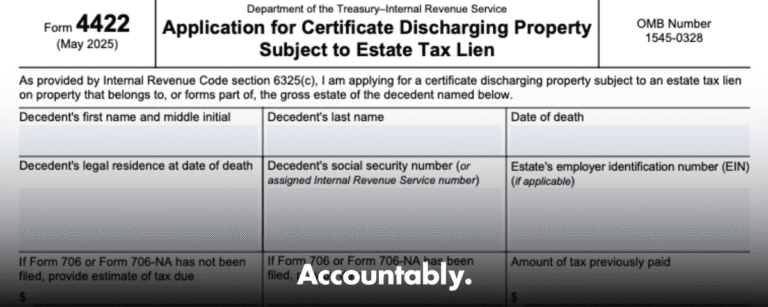

Penalties, Interest, and Trust Fund Exposure

Here is how penalties typically show up on Form 720 accounts:

- Failure to file piles up at 5 percent of unpaid tax per month, capped at 25 percent.

- Failure to pay adds 0.5 percent per month, capped at 25 percent.

- Interest accrues daily from the due date until paid.

If you collect certain taxes, such as communications, air transportation, or indoor tanning, but do not remit them, the Trust Fund Recovery Penalty can apply to responsible persons for the full amount collected and not paid. Keep strong controls over collected taxes, deposit calendars, and sign‑off workflows.

Recent IRS Updates and 2025 Changes You Should Know

- Air travel amounts increased for 2025, domestic segment amount to 5.20 and the international facilities amount to 22.90 per person. Update your ticketing logic and deposits accordingly.

- Most section 6426/6427 fuel mixture and alternative fuel credits expired after 2024. Clean up Schedule C templates and remove sunset lines to avoid over‑claiming. The SAF mixture credit under 6426(k) remains.

- The corporate stock repurchase excise tax remains in effect. Compute on Form 7208 and attach it to the first 720 due after your tax year ends. If you had years ending on or before June 30, 2024, the initial due date was October 31, 2024.

- PCORI, with an applicable rate of 3.47 for plan years ending Oct 1, 2024 through Sep 30, 2025, is still reported annually on the Q2 Form 720 and does not require deposits.

Practical Workflow Tips From Our Team

- Build a standing quarter‑start checklist that includes rate updates, active IRS numbers, and a credit sunset sheet.

- Close each semi‑monthly period with a one‑page liability summary. It makes Schedule A a two‑minute task instead of a two‑hour hunt.

- Set two reminders for each deposit, one three days before, one at 3:30 p.m. Eastern the business day before, so the 8:00 p.m. deadline never sneaks up.

FAQs

What is Form 720 used for?

You use Form 720 to report and pay federal excise taxes on specified goods and services, line by line by IRS number. It is filed quarterly, and many Part I items require semi‑monthly deposits recorded on Schedule A.

Do I need to file Form 720 for my LLC?

If your LLC incurs a listed excise liability, yes. If you filed in a prior quarter and did not file a final return, you must keep filing even for zero quarters. Check each quarter’s activity against the IRS numbers in Parts I and II.

How do I know if PCORI applies to me?

Plan sponsors of applicable self‑insured health plans, and issuers of specified health insurance policies, owe the PCORI fee. You report and pay it annually with the Q2 Form 720 due July 31. No deposits are required for PCORI.

What happens if I do not file or I miss deposits?

Late filing can trigger a 5 percent per month penalty, late payment 0.5 percent per month, and interest accrues daily. Collected taxes that are not remitted can create Trust Fund Recovery Penalty exposure for responsible persons.

Can I pay Form 720 electronically without EFTPS?

EFTPS is the default for deposits. For some balance due payments, Direct Pay for businesses may be available, but if deposits are required, use EFTPS or a same‑day wire through FTCS to remain timely. Keep the confirmation number with your records.

Final Pointers and A Light Note on Support

If you remember only three things, remember these, map every activity to the correct IRS number, keep a clean Schedule A ledger all quarter, and respect the EFTPS 8:00 p.m. Eastern cutoff the day before your deposit is due. Those three habits eliminate most notices I see.

For firms that feel underwater each quarter, structure often beats heroics. If your internal team is stuck in production, a disciplined delivery system can standardize SOPs, tighten documentation, and protect review time so Form 720 work flows on schedule. That is the kind of operational lift Accountably focuses on for CPA and EA firms, with workflow discipline and review protection built in where it matters. Use us sparingly, rely on us where needed.

Disclaimer

This guide is educational and general in nature. Excise rates, thresholds, and filing mechanics change. Confirm current rates and instructions before you file, and consult your tax advisor for your specific facts. Key rules cited here reference the June 2025 Instructions for Form 720, Publication 510 (March 2025), the IRS PCORI page updated August 7, 2025, and IRS stock repurchase excise guidance.