Scale Your CPA Firm Without Adding Headcount

Build your offshore team that works your way, trained, compliant, and white-labeled under your firm.

👉 Book a Discovery Call

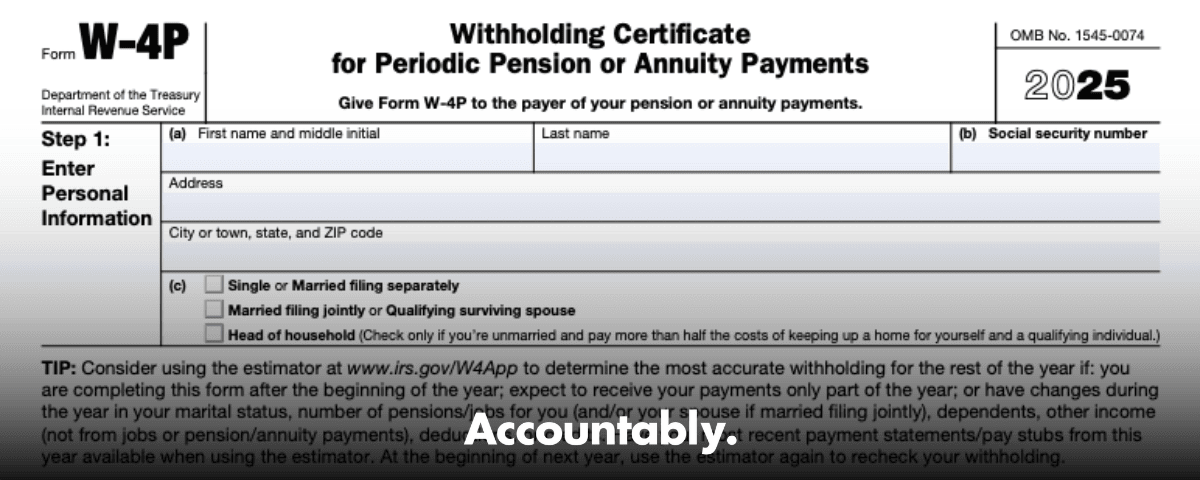

You will use Form W‑4P to tell your pension or annuity payor how much federal income tax to withhold from your regular, recurring payments. Since 2022, the IRS redesigned this form, it no longer uses “allowances.” Instead, it uses simple steps, adjustments, and an optional extra flat amount, which makes tuning your withholding more precise. If you do nothing, your payor generally withholds as if you are single with no adjustments, which often withholds more than needed for married filers and less for retirees with other income.

Key Takeaways

- Form W‑4P applies to taxable, periodic pension or annuity payments, the checks that arrive on a regular schedule, not lump sums. Nonperiodic and rollover distributions use Form W‑4R.

- The modern W‑4P has 5 steps, no “allowances.” Step 1 and Step 5 are required, Steps 2–4 are optional adjustments, plus you can add an extra flat amount.

- If you do not give a 2022 or later W‑4P, withholding defaults as if you checked Single with no entries in Steps 2–4. You can also elect “No Withholding” on the form, with exceptions for payments delivered outside the United States.

- Payors compute withholding using IRS Publication 15‑T Worksheet 1B for periodic pensions and annuities.

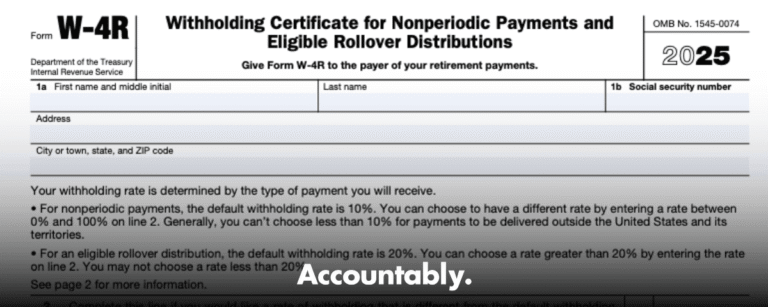

- Use W‑4R for nonperiodic withdrawals. The default rate is 10 percent for most nonperiodic distributions, and 20 percent mandatory withholding applies to eligible rollover distributions unless you do a direct rollover.

What Form W‑4P Is And How It Works

Form W‑4P tells your payor how to withhold federal income tax from your periodic pension or annuity payments so those withholdings track your true yearly tax.

Here is the plain‑English version of the current form:

- Step 1, You, this is your name, address, SSN, and filing status.

- Step 2, Multiple pensions or a working spouse, enter the Step 2 amount if you want the tables to account for another job or pension.

- Step 3, Claim dependents and certain credits, if relevant to your situation.

- Step 4, Fine‑tuning,

- 4(a) other income you expect that does not have withholding,

- 4(b) deductions beyond the standard deduction,

- 4(c) any extra flat amount to add each payment.

- Step 5, Sign and date, no signature, no change.

Your payor uses Publication 15‑T’s pension worksheet to translate those entries into the per‑payment withholding amount. You do not have to run the math yourself, though you can estimate results with the IRS Tax Withholding Estimator.

Hundreds of Firms Have Already Used This Framework.

Join the growing list of CPA and accounting firms using Accountably’s Offshore Playbook to scale faster.

💬 Get Your FREE Playbook

👉 Visit Jugal Thacker’s LinkedIn

Send him a connection request and message “Playbook” to get your copy.

Defaults And “No Withholding,” What Really Happens

- No W‑4P on file for payments beginning after 2021, the payor treats you as Single with nothing entered in Steps 2–4.

- Want zero federal withholding on periodic payments, write “No Withholding” in the space below Step 4(c). This is allowed for U.S. recipients with a U.S. address, however, a U.S. person generally cannot elect no withholding if the payment is delivered outside the United States or its territories.

Covered Payments, And What Uses A Different Form

Periodic means regular checks, for more than one year, for example, monthly pension checks or annuity installments. For these, use W‑4P and the payor withholds like wages. One‑time or irregular withdrawals are nonperiodic, those use W‑4R. Eligible rollover distributions, like a 401(k) lump sum paid to you, have a flat 20 percent mandatory withholding unless you do a direct rollover.

| Covered by W‑4P | Not Covered by W‑4P |

| Taxable periodic pension or annuity payments | Nonperiodic withdrawals, use W‑4R |

| Withheld using Pub. 15‑T Worksheet 1B | Eligible rollover distributions, 20 percent unless direct rollover |

| You may elect “No Withholding,” with limits for payments delivered outside the U.S. | IRA on‑demand withdrawals are usually nonperiodic |

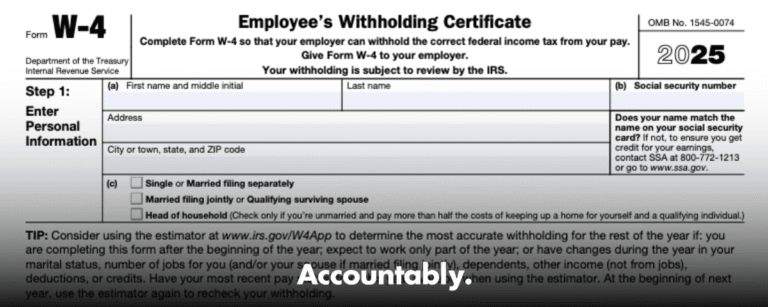

Note, military retirement uses Form W‑4, not W‑4P.

Quick Start, The 10‑Minute Setup

- Gather your latest 1099‑R, your monthly pension amount, and last year’s total tax.

- Open the IRS Tax Withholding Estimator, map your other income, then note the extra tax you want covered by pension withholding.

- Complete W‑4P Step 1 and Step 5.

- Use Step 2 for another job or pension, Step 3 if you qualify for credits, Step 4(a) for other income, Step 4(b) for deductions, Step 4(c) for a simple flat extra.

- Send the signed form to your plan or annuity payor, not the IRS, and keep a copy for your records. Recheck midyear if your income changes.

Pro tip, if you prefer one clean knob to turn, leave Steps 2–4(a)(b) blank and enter a round number in Step 4(c) as your extra per‑payment withholding. It is easy to adjust later.

Choosing A Filing Status And Using The Steps

Filing Status, A Simple but Powerful Choice

Pick the filing status you expect on your tax return. Single often withholds more per dollar than Married filing jointly because of how the tables work. If you are married and your spouse has income, you can still choose Single to build in a cushion, then back off later if your refunds get too big. You can change this anytime by filing a new W‑4P.

Step 2, When You Or Your Spouse Has Other Wages Or Pensions

If you have more than one pension or your spouse still works, Step 2 helps the payor withhold closer to your real annual tax. The form gives a specific dollar entry that the payor uses in the IRS worksheet, which is more precise than guessing. If that feels too fiddly, skip Step 2 and put a safe, flat extra in Step 4(c).

Improve Margins Without Compromising Quality

Offshore staffing helps firms deliver more, scale faster, and stay compliant, without adding local headcount.

👉 Book a Discovery CallStep 3, Credits For Dependents

Some retirees still claim dependents or certain credits. Step 3 lets you reflect that so withholding does not overshoot. If your credits change during the year, send an updated form so your checks keep pace.

Step 4, Other Income, Deductions, And Extra

- 4(a) Other income without withholding, for example bank interest or a small side gig, increases the annual amount your payor treats as taxable for withholding.

- 4(b) Deductions beyond the standard deduction reduce the annual amount subject to withholding.

- 4(c) Extra flat amount per payment. This is the easiest way to land on your target. Your payor simply adds this tax to every check.

How Withholding Is Calculated Behind The Scenes

Your payor uses Publication 15‑T, Worksheet 1B. They annualize your payment, apply your Step 2–4 entries, and then use the IRS percentage method tables to get the per‑payment tax. You do not need to supply tables or math, the worksheet is built for payors of pensions and annuities. This is why clean, accurate W‑4P entries are so important, the results flow directly from those lines.

An Easy Example

- Your monthly pension is 2,500.

- You file as Married filing jointly.

- You want a little extra cushion of 75 per month.

You complete Step 1, leave Steps 2–4(a)(b) blank, enter 75 on Step 4(c), sign Step 5, and send it in. Your payor calculates the baseline tax from the tables, then adds 75 to every monthly check’s withholding. If your spouse later starts a part‑time job, file a new W‑4P and either use Step 2 or bump Step 4(c) to, say, 140.

When You Might Choose “No Withholding”

If most of your tax is covered elsewhere, or your income is low, you can elect “No Withholding” by writing those words under Step 4(c). Be sure this will not create a balance due or penalty at tax time. Also, a U.S. person generally cannot choose no withholding if the payment is delivered outside the United States or its territories. If in doubt, keep a small amount withheld or make quarterly estimated payments.

Some retirees use a strategy where they do very little withholding during the year, then use a December IRA distribution with high withholding to cover the whole year’s tax. The IRS treats that withholding as paid evenly across the year, which can help avoid penalties. This idea applies to IRAs and W‑4R, not to ongoing pensions, but it shows how flexible withholding can be in retirement planning.

What Not To Use W‑4P For

- Nonperiodic withdrawals from pensions or IRAs, use W‑4R. The default rate is 10 percent unless you pick another rate on W‑4R, between 0 and 100 percent.

- Eligible rollover distributions paid to you, expect 20 percent mandatory withholding unless you choose a direct rollover.

- Military retirement pay, this uses Form W‑4.

Step‑By‑Step Completion Checklist

Personal Details

- Enter your legal name, address, and SSN as they appear on official records.

- Use the address where you receive mail, and update it if you move.

- Sign and date, unsigned forms are not valid.

Select Filing Status

- Choose the status you expect to file.

- Married and want a buffer, you may choose Single to increase withholding, then adjust later if refunds run large.

Adjustments And Extras

- Use Step 2 if there are multiple jobs or pensions in the household.

- Use Step 3 if you qualify for credits.

- Use Step 4(a) for other income without withholding, Step 4(b) for deductions, and Step 4(c) for a round extra per check.

Submit It Correctly

- Send the signed W‑4P to your payor or plan administrator, never to the IRS.

- Keep a dated copy with your tax records and your 1099‑R.

- Confirm processing and check your next payment to verify the new amount.

Common Mistakes And Simple Fixes

| Mistake | What It Causes | The Fix |

| Not filing a new W‑4P after retirement changes | Surprise balance due or big refund | Review midyear and each January, file an updated W‑4P |

| Assuming “allowances” still apply | Wrong entries and off‑target withholding | Use the steps on the modern form, there are no allowances now |

| Leaving Step 5 unsigned | Default withholding, no change | Sign and date |

| Using W‑4P for a one‑time withdrawal | Incorrect default results | Use W‑4R for nonperiodic payments, or expect 20 percent on eligible rollovers |

| Forgetting state rules | State balance due | Ask your payor about state withholding elections and forms |

Estimating Your Withholding The Smart Way

I like to start with last year’s “total tax” from Form 1040, then layer in changes for this year. If you want to avoid quarterly estimates, aim for withholding that covers at least 100 percent of last year’s tax, 110 percent if your adjusted gross income was higher in the prior year, then fine‑tune in Step 4(c). The IRS Publication 505 explains how to translate your estimate into the extra per‑payment number.

A Quick Example You Can Copy

- Last year’s total tax, 7,200.

- You have 12 pension checks per year.

- You want withholding to cover all 7,200.

If the baseline withholding from the tables is about 450 per month, you still need 150 more per month. Enter 150 on Step 4(c). Check your next payment to confirm the new total is close to 600.

Special Cases You Should Know

- Payments delivered outside the United States, a U.S. person generally cannot elect no withholding. Keep a W‑4P on file and withhold at least something.

- Nonresident aliens have separate rules and forms. Payors follow Pub. 515, and different rates can apply.

- Multiple pensions, consider using Step 2 or putting the entire extra on the largest pension for simplicity.

- IRAs versus pensions, IRAs often fall under W‑4R for withdrawals, while employer pensions use W‑4P. Plan ahead at the start of the year so all sources work together.

If you run an accounting firm or benefits team, standardize your client or participant packet. Include a current W‑4P, an at‑a‑glance decision table, and a one‑page “how to choose Step 4(c)” guide. This simple structure prevents avoidable errors and tickets in busy season.

FAQs

What is Form W‑4P used for in 2025?

It tells your payor how much federal income tax to withhold from periodic pension or annuity payments. It uses a step‑based method, not allowances, and works with IRS Pub. 15‑T tables.

How much tax should I withhold from my pension?

Enough to match your expected tax. Use the IRS Estimator, review last year’s tax, then adjust Step 4(c) to close the gap. Recheck when life changes.

What happens if I do not submit a W‑4P?

The payor treats you as Single with no adjustments in Steps 2–4 on the 2022‑plus form, which may be too high or too low for your situation. File a W‑4P to customize it.

Can I choose no federal withholding?

Yes, write “No Withholding” on the W‑4P, but watch for penalties at filing and remember the restriction for payments delivered outside the United States.

Do I use W‑4P for a lump sum or IRA withdrawal?

No. Use W‑4R for nonperiodic distributions. Most nonperiodic withdrawals default to 10 percent unless you pick another rate, and eligible rollover distributions paid to you have 20 percent mandatory withholding unless you do a direct rollover.

When To Update Your W‑4P

Update whenever your facts change so your withholding stays accurate.

- Filing status changes, marriage, divorce, or the passing of a spouse.

- Income shifts, you or your spouse start or stop work, add Social Security, or take larger IRA withdrawals.

- Deductions and credits move, for example, paying off a mortgage or gaining a dependent.

- Yearly checkup, a quick January refresh keeps you on track before the first payments of the year.

Recordkeeping And Security

Keep a copy of every W‑4P you submit, plus confirmations from your payor, with your 1099‑R forms. If you send forms electronically, use secure channels and avoid emailing full SSNs without encryption. When you call your payor, have your copy handy so you can confirm exactly what you filed.

A Helpful Comparison Table

| Scenario | Form | Typical Default | Can Set 0%? | Notes |

| Monthly pension from a prior employer | W‑4P | Single, no Steps 2–4 entries if no form | Yes, write “No Withholding,” U.S. delivery rules apply | Uses Pub. 15‑T Worksheet 1B |

| One‑time IRA withdrawal | W‑4R | 10 percent | Yes, choose 0–100 percent | Many IRAs let you pick a custom rate |

| 401(k) eligible rollover paid to you | W‑4R or default rules | 20 percent mandatory unless direct rollover | No, unless direct rollover | Consider direct rollover to avoid 20 percent withheld |

| Military retirement pay | W‑4 | Wage withholding rules | Yes, if you qualify | Uses payroll tables, not W‑4P |

For Accounting Firms And Plan Teams

If you support retirees at scale, add structure that reduces rework.

- Provide the current W‑4P with a one‑page guide.

- Prebuild examples for common cases, single pension only, dual‑income household, plus Social Security.

- Train staff on Pub. 15‑T Worksheet 1B so answers are consistent.

- Maintain a “when to use W‑4R” decision tree to prevent misfiling.

At Accountably, we help firms build clean, disciplined delivery for this kind of recurring work. Clear SOPs, standard checklists, and a consistent review layer mean retirees get accurate guidance the first time, and your team avoids back‑and‑forth in peak season. Keep your own templates and workflow, our point is to encourage structure so you protect accuracy and trust.

Wrap‑Up, Make Your Withholding Work For You

You want steady cash flow and no tax surprises. With the 2025 W‑4P, you can get there in minutes. Choose your filing status, decide whether to use Steps 2–4, add a simple extra amount if you prefer one knob to turn, then sign and send it to your payor. Put a reminder on your calendar for a midyear check, and adjust if life changes.

The goal is not to beat the system. The goal is to pay the right amount on time with the least stress. A small update now can save you a long phone call later.

This article is educational, not tax advice. Tax rules change, and your situation is unique. Use the IRS Tax Withholding Estimator, review the current instructions for Forms W‑4P and W‑4R, and speak with a qualified tax professional if you are unsure.

Simplify Delivery, Improve Margins, Stay in Control.

Offshore support that works exactly like your in-house team.

💼 Let’s Talk