Scale Your CPA Firm Without Adding Headcount

Build your offshore team that works your way, trained, compliant, and white-labeled under your firm.

👉 Book a Discovery Call

The good news, you can turn Form W-4R into a calm, predictable workflow. When you use the current-year form, confirm the right default, and document elections the right way, you reduce noise for everyone and protect the firm.

Key Takeaways

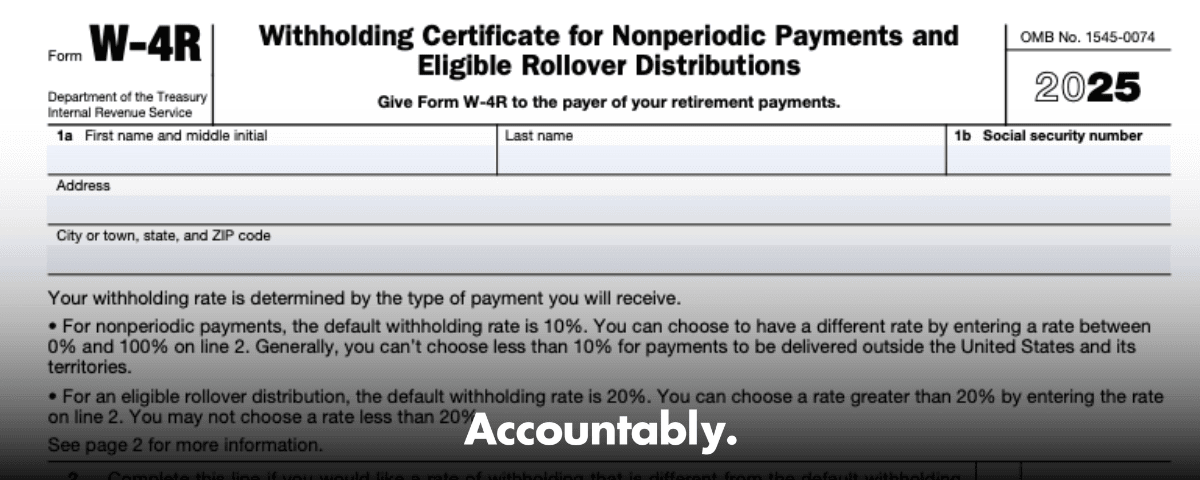

- Form W-4R sets federal withholding for taxable nonperiodic payments and for eligible rollover distributions from employer plans. IRAs use W-4R for nonperiodic payments. For IRAs, the default is 10% unless the payee elects another whole-number rate. For eligible rollover distributions from employer plans, the default is 20% unless a direct rollover is chosen.

- For nonperiodic payments, the payee can choose any whole-number rate from 0% to 100%. For eligible rollover distributions, the payee can choose a rate that is at least 20% or higher, never lower.

- IRAs are not subject to the 20% mandatory withholding rule that applies to eligible rollover distributions from employer plans. For withholding purposes, distributions from any IRA are not treated as eligible rollover distributions.

- Use the current‑year Form W-4R. The 2025 version was posted on December 17, 2024, and payors had to use the 2025 form for distributions on or after January 1, 2025, or a compliant substitute within 30 days after final release.

- Substitute and electronic versions must mirror IRS text and include the 2025 Marginal Rate Tables or a compliant link positioned exactly as the IRS specifies.

What Form W-4R does, in plain English

Form W-4R is the withholding certificate you use to tell the payor how much federal income tax to withhold from a taxable nonperiodic distribution, for example an IRA payout on demand, or from an eligible rollover distribution from an employer plan if it is not directly rolled over. If no valid W-4R is on file, the payor must apply the default rules, which are different for nonperiodic payments and for eligible rollover distributions.

In short, W-4R is how the payee picks the rate for nonperiodic payments, and it is how a payee can request more than the default on an eligible rollover distribution. The defaults still apply if the payee does nothing.

Here is the key split that trips people up:

Hundreds of Firms Have Already Used This Framework.

Join the growing list of CPA and accounting firms using Accountably’s Offshore Playbook to scale faster.

💬 Get Your FREE Playbook

👉 Visit Jugal Thacker’s LinkedIn

Send him a connection request and message “Playbook” to get your copy.

- Nonperiodic payments, including IRA distributions payable on demand, default to 10% withholding if the payee does not file a valid form. The payee can choose any whole-number rate from 0% to 100%, except for payments delivered outside the United States where a rate below 10% is generally not allowed.

- Eligible rollover distributions, which occur with employer retirement plans when the distribution is not a direct rollover, are subject to a mandatory 20% default. The payee cannot choose a lower rate, but can request a higher whole-number rate on W-4R line 2. Direct rollovers are not subject to withholding.

A common misconception is that the 20% rule applies to IRAs. It does not. For withholding, the IRS says distributions from any IRA are not eligible rollover distributions, so you follow the nonperiodic rules and the 10% default unless the payee elects another rate.

Why the current-year form matters in 2025

Since 2023, the IRS has required the redesigned W‑4R for nonperiodic payments and eligible rollover distributions, separate from W‑4P, which now covers periodic payments. The 2025 W‑4R must be used for 2025 distributions, and if you use substitutes, they must include the 2025 Marginal Rate Tables and specific on‑screen text and linking rules. The IRS allows a short adoption window for substitutes, the later of January 1, 2025, or 30 days after the IRS releases the final form. The 2025 W‑4R was posted on December 17, 2024, so the 30‑day point was January 16, 2025.

If you honor an outdated election or accept a noncompliant substitute, you risk incorrect withholding and potential secondary liability. That is why you will see custodians, CPAs, and recordkeepers refresh their processes every January and again when forms or instructions update.

Quick example to anchor the rules

- You process a one‑time IRA distribution for a client who does not file W‑4R. You must withhold 10%. If the client files W‑4R and enters 0 on line 2, you can withhold 0%. If the distribution is delivered outside the United States, a rate below 10% is generally not permitted.

- You process a lump sum from a 401(k) that is paid to the participant, not a direct rollover. You must withhold 20%. The participant can ask for more than 20%, never less. If it is a direct rollover, no federal income tax withholding applies.

Next, we will get specific about how to fill, file, and operationalize W‑4R so you avoid rush fixes and after‑the‑fact corrections.

How W‑4R works, step by step, with the rules that matter

Nonperiodic IRA payments, your election range, and the 10% default

For taxable nonperiodic payments, which include IRA distributions payable on demand, the payee can choose any whole‑number rate from 0% to 100% on line 2 of W‑4R. If no valid election is on file, you must use the 10% default. If the payment is delivered outside the United States, a rate below 10% is generally not allowed. These are the day‑to‑day rules you will apply most often in IRA operations.

Improve Margins Without Compromising Quality

Offshore staffing helps firms deliver more, scale faster, and stay compliant, without adding local headcount.

👉 Book a Discovery CallPractical tips I share with teams:

- Always validate the Social Security number. If the SSN is invalid or missing, you cannot honor a rate below 10%.

- Store the current‑year form with the payout record. If a client changes their mind, have them submit a new W‑4R before the payment is processed.

- For recurring IRA payouts that are payable on demand, treat them as nonperiodic. Build a calendar to re‑solicit each year so the file does not go stale.

Eligible rollover distributions, the 20% rule, and the direct rollover exception

For eligible rollover distributions from employer plans, the law requires 20% federal income tax withholding if the payment is made to the participant. The payee may request a higher rate, but never less than 20%. If the distribution is a direct rollover to an eligible plan or IRA, then no federal income tax withholding applies. This distinction is the heart of many corrections each spring, so it is worth documenting in your SOPs.

Important nuance, for withholding, IRA distributions are not treated as eligible rollover distributions, so the 20% rule does not apply to IRAs. Use the nonperiodic 10% default framework for IRAs unless the payee elects another rate.

Current-year form requirement and the 2025 adoption window

Use the current‑year W‑4R for distributions made in that year. The 2025 W‑4R was posted on December 17, 2024, and payors had to begin using the 2025 form for distributions on or after January 1, 2025, with an allowance for substitutes to be in use by the later of that date or 30 days after final release, which landed on January 16, 2025. If you deploy a substitute, it must mirror IRS text and include the 2025 Marginal Rate Tables or a compliant link placed exactly below line 2 with the IRS‑specified wording.

From an operations view, I recommend a January 2 checklist, confirm your custody system references the new form year, confirm your e‑signature pack mirrors the required language, and run a test submission with a mock account to capture the electronic audit trail. The IRS wants electronic substitutes to replicate the paper language and tables, and to maintain records you can furnish on request.

W‑4R vs W‑4P, quick comparison

Use W‑4R for nonperiodic payments and for eligible rollover distributions from employer plans. Use W‑4P for periodic pension or annuity payments. If a client files the wrong form, you will see misapplied defaults or an election you cannot honor.

| Item | W‑4R | W‑4P |

| Purpose | Nonperiodic payments and eligible rollover distributions | Periodic pension or annuity payments |

| Default if no valid form | 10% for nonperiodic payments, 20% for eligible rollover distributions | Wage‑table method, as if Single with no adjustments if no valid W‑4P |

| Election range | 0% to 100% for nonperiodic, 20% minimum for eligible rollover distributions | Adjust via filing status and optional amounts |

| Direct rollover | No withholding on direct rollover | Not applicable, periodic payments are not eligible rollover distributions |

| Current‑year use | Must use current‑year form or compliant substitute | Must use current‑year form or compliant substitute |

Sources for the rules shown above are the IRS pages for pensions and annuities, the 1099‑R instructions, and Publication 15‑A for substitute form standards.

A quick planning idea clients often ask about

Some retirees prefer to meet most or all of their annual federal tax through withholding on year‑end IRA distributions, especially on the required minimum distribution, because the IRS treats amounts withheld from IRA distributions as if paid evenly throughout the year. It is a legitimate strategy when done carefully, and it can reduce quarterly estimated payment chores, but confirm the federal and state angles before you recommend it.

Implementation playbook for custodians, CPAs, and ops teams

The minimum SOP I recommend

- Confirm payment type before you apply a rate. If it is a nonperiodic IRA payment, start from 10% unless a valid W‑4R election says otherwise. If it is an eligible rollover distribution from an employer plan that is not a direct rollover, start from 20% and allow only higher rates.

- Use the current‑year W‑4R or a compliant substitute. Verify that 2025 substitutes include the IRS‑required language and the 2025 Marginal Rate Tables or the exact compliant link below line 2.

- Validate identity and SSN before honoring rates below 10%. If the SSN is incorrect, default to 10% for nonperiodic payments.

- Send or document the required withholding notice and maintain the election, revocation, and timing records with the distribution file.

- Deposit and report correctly. Use Form 945 for federal income tax withheld from pensions and annuities, and furnish Form 1099‑R to recipients by January 31.

Annual withholding notification, what to send and when

The law requires payors to notify payees of the right to elect out of withholding or to change an election. For periodic payments, give notice at least once each calendar year. For nonperiodic distributions, provide the notice at the time of distribution, or earlier when it gives the payee reasonable time to respond. For IRA distributions that are payable on demand and scheduled quarterly or more often, you can send a blanket notice for the calendar year. Keep the language simple and keep a record of the mailing.

A short, compliant template you can adapt:

Notice of Federal Income Tax Withholding on Retirement Distributions Federal law allows you to choose whether federal income tax will be withheld from the taxable portion of your nonperiodic distribution. If you do not make a choice, we will withhold at the default rate. You may change your election at any time by submitting IRS Form W‑4R. You remain responsible for any tax due and may be subject to estimated tax penalties if your withholding and estimated payments are not enough.

Include the default that applies to the payment type in your notice, 10% for nonperiodic payments, 20% for eligible rollover distributions paid to the payee, and describe the direct rollover exception. For IRA audiences, be clear that IRAs do not use the 20% mandatory withholding rule.

Substitute and electronic forms, common pitfalls

The IRS is strict about substitutes. Electronic systems must replicate the paper text between lines 1 and 2, display the exact line 2 language, and include the 2025 Marginal Rate Tables or an IRS‑compliant link positioned immediately below line 2 with the required preface text. Paper substitutes must include the instructions and the 2025 tables on the form, not just a link. Pop‑ups and hoverboxes are not allowed within those steps. Build a quick audit against these points before every January cutover.

Timing matters too. For 2025, substitutes had to be in use by the later of January 1, 2025, or 30 days after the final form release, which was January 16, 2025. Put a recurring calendar hold for testing, approvals, and deployment each December so you are not racing the clock.

Errors I see most often, and how to prevent them

- Treating IRA payouts as if the 20% rule applies. Fix this with a one‑line check in your workflow, “IRA or employer plan?” and a quick helper table on the screen.

- Accepting an outdated form or a partial screen capture from a client portal. Require the full current‑year form or a compliant electronic capture with the exact IRS text and tables.

- Missing the annual notice for scheduled payments. Automate a yearly blanket notice with tracked delivery and simple response options.

- Forgetting reporting alignment. Tie W‑4R choices to your 1099‑R coding and Form 945 deposit schedule so the numbers reconcile on the first pass.

Where operations meets delivery

If your firm handles a high volume of distributions, W‑4R is not just a tax form, it is part of your delivery system. You want consistent SOPs, current forms, clean documentation, and clear review gates so partners are not stuck in rework. When teams are buried in production, these simple controls drift. If you need help designing a disciplined, review‑friendly workflow for W‑4R and other compliance tasks, Accountably can integrate trained offshore teams into your process without giving up control or quality. Use us sparingly where we add value, for example for document checks, year‑start cutovers, and queue management during peak season.

Key compliance dates and quick timeline for 2025

- IRS posted the 2025 Form W‑4R on December 17, 2024.

- Use the 2025 form for distributions on or after January 1, 2025. If you use substitutes, they had to be in use by the later of January 1, 2025, or 30 days after final release, which was January 16, 2025.

- The IRS’s “About Form W‑4R” page is the fastest way to confirm current status, since it is updated during the year. Check it before each annual cutover.

FAQs

What is Form W‑4R used for?

It tells the payor how much federal income tax to withhold from taxable nonperiodic payments and from eligible rollover distributions, unless the latter is a direct rollover. It does not control periodic pension withholding, which is handled on W‑4P.

What is the default withholding if a payee does not submit W‑4R?

For nonperiodic payments, the default is 10%. For eligible rollover distributions paid to the participant, the default is 20%, and the payee cannot choose less than 20%. Direct rollovers have no federal withholding.

Can an IRA distribution ever be subject to the 20% eligible rollover rule?

No. For withholding purposes, distributions from any IRA are not eligible rollover distributions. Use the nonperiodic rules, including the 10% default and the ability to choose 0% to 100%.

What rate can the payee choose on W‑4R?

For nonperiodic payments, any whole‑number rate from 0% to 100%. For eligible rollover distributions, any whole‑number rate of at least 20%. Payments delivered outside the United States generally cannot use a rate below 10% for nonperiodic payments.

Do we need to send an annual withholding notice?

Yes. For periodic payments, send notice at least once each calendar year. For nonperiodic payments, send the notice at the time of distribution or earlier to give reasonable time to respond. For IRA distributions payable on demand on a schedule, a blanket annual notice is acceptable.

What exactly must our substitute or electronic W‑4R include?

It must mirror IRS text between lines 1 and 2, display the exact line 2 language, and include the 2025 Marginal Rate Tables or an IRS‑compliant link placed immediately below line 2 with the required preface text. Paper substitutes must include instructions and tables on the form.

How do we report and deposit tax withheld from these distributions?

Report federal income tax withheld on Form 945 and furnish 1099‑R by January 31. Maintain records that tie each payment to the election on file.

Any planning tip clients often use with W‑4R?

Some clients meet most of their annual federal tax via withholding on a late‑year IRA distribution, because the IRS treats that withholding as if it was paid evenly across the year. It can simplify estimated payments, but confirm applicability and state rules before suggesting it.

Final checklist

- Identify payment type first, IRA nonperiodic payment or employer plan eligible rollover distribution. Apply the correct default.

- Use the current‑year W‑4R or a compliant substitute, verify the 2025 tables and required wording.

- Validate identity, SSN, and delivery location, do not honor rates below 10% when rules prohibit it.

- Send the required notice and store the election with timing evidence.

- Reconcile withholding to your 1099‑R and Form 945 reporting.

Closing thought

When W‑4R is current, clear, and documented, you protect clients from surprises and protect your teams from rework. If you want help building these controls into your delivery process without slowing the work, Accountably can plug in as a disciplined extension of your team where it truly helps.

Disclaimer, This article is for general information, not tax or legal advice. Always confirm facts with the current IRS form, instructions, and publications. Pages cited were last reviewed by the IRS in 2025 as noted on those pages.

Simplify Delivery, Improve Margins, Stay in Control.

Offshore support that works exactly like your in-house team.

💼 Let’s Talk