Scale Your CPA Firm Without Adding Headcount

Build your offshore team that works your way, trained, compliant, and white-labeled under your firm.

👉 Book a Discovery Call

I have been in that scramble more than once, and it is avoidable. The good news, once you understand what Form 8038 is, who files it, and when it is actually due, the work becomes routine and calm.

Key Takeaways

- Form 8038 is the IRS information return for tax‑exempt private activity bond issues. It documents issuer data, bond terms, use of proceeds, private use, arbitrage status, refundings, and volume cap details.

- The due date is not “six months after year end.” It is the 15th day of the second calendar month after the close of the calendar quarter in which the bonds were issued. There is no Form 8868 extension for Form 8038, use late‑filing relief under Rev. Proc. 2002‑48 if needed.

- Use the correct form: Form 8038 for private activity bonds, Form 8038‑G for governmental bonds, and Form 8038‑GC for eligible small governmental issues.

- The current instructions, revised September 2025, add guidance reflecting spaceport legislation and update line guidance. Always download the latest instructions from IRS.gov before you file.

- You generally mail Form 8038 to the Ogden, Utah address. Standard 8038, 8038‑G, and 8038‑GC are not e‑filed, while 8038‑CP is e‑filed through approved providers.

What Form 8038 does and who files it

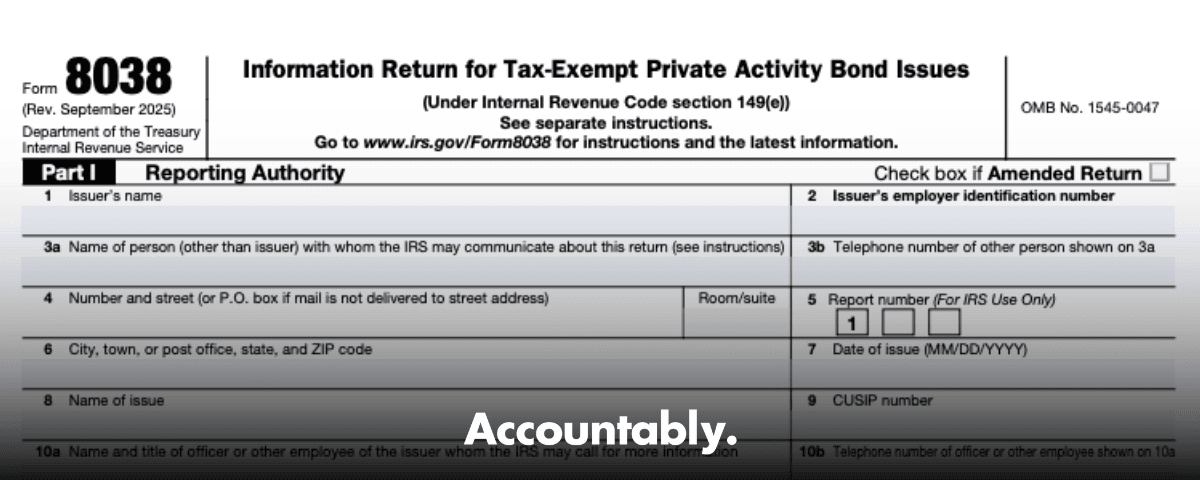

Form 8038, Information Return for Tax‑Exempt Private Activity Bond Issues, is how an issuer reports the core facts of a qualified private activity bond issue to the IRS. Think of it as your compliance snapshot on the issue date, capturing issuer identification, bond terms, the qualified purpose category, arbitrage and private business use disclosures, refunding facts, and volume cap data. State and local government issuers, including instrumentalities and conduit issuers, file a separate Form 8038 for each private activity bond issue.

If your financing is a governmental bond, use Form 8038‑G. If you have small governmental issues under the applicable thresholds, you may use 8038‑GC. For qualified 501(c)(3) financings, the governmental issuer still files Form 8038, even if a nonprofit borrower benefits.

Hundreds of Firms Have Already Used This Framework.

Join the growing list of CPA and accounting firms using Accountably’s Offshore Playbook to scale faster.

💬 Get Your FREE Playbook

👉 Visit Jugal Thacker’s LinkedIn

Send him a connection request and message “Playbook” to get your copy.

The actual deadline, with plain‑English examples

Here is the rule in one line. File Form 8038 by the 15th day of the second calendar month after the end of the calendar quarter in which your issue was issued. That means:

- Bonds issued on March 10, 2025, are in the first quarter, so your Form 8038 is due by May 15, 2025.

- Bonds issued on July 2, 2025, are in the third quarter, so your due date is November 15, 2025.

If you miss the due date, do not use Form 8868. Instead, request late‑filing relief under Rev. Proc. 2002‑48. At the top of Form 8038, write “Request for Relief under section 3 of Rev. Proc. 2002‑48,” and attach a brief letter explaining why the filing was late and whether the issue is under IRS examination. Mail it with the return to Ogden, Utah.

Where to file and how submissions work in 2025

Standard Form 8038, 8038‑G, and 8038‑GC are mailed to the IRS Service Center in Ogden, Utah. The instructions list the address and explain private delivery service options if you need tracking. Keep proof of mailing.

Improve Margins Without Compromising Quality

Offshore staffing helps firms deliver more, scale faster, and stay compliant, without adding local headcount.

👉 Book a Discovery CallQuick truth, 8038‑CP is different. It is now filed electronically via authorized e‑file providers, and many issuers are required to e‑file if they file at least 10 federal returns in the calendar year. Use the January 2022 8038‑CP and follow the current instructions for timing and acknowledgments.

Purpose categories, what changed, and why it matters

Form 8038 tracks the type of private activity bond you issued, from qualified 501(c)(3) bonds to exempt facility bonds like airports, docks, and specific infrastructure. The 2025 instructions reflect new legislative additions, including spaceports, and refresh guidance for specific line entries. Earlier IRS updates also added categories for qualified broadband projects and qualified carbon dioxide capture facilities, so make sure your purpose selection matches the current line labels in the instructions you download. Line letters can shift across revisions, which is why relying on a two‑year‑old cheat sheet can create errors.

As a rule, enter the issue price in the box for the facility type that applies and complete the related sections for volume cap, reissuance, and use of proceeds. When in doubt, follow the definitions in the instructions for Issue, Issue Price, Arbitrage Rebate, and the specific facility types you are financing.

Recent developments you should know before you file

2025 instruction changes at a glance

The September 2025 Instructions for Form 8038 call out legislative changes that affect exempt facility categories and update guidance for certain lines. Spaceport authority appears in the “What’s New” section, with specifics on how to report it inside Part II, Type of Issue. In addition, the instructions highlight new guidance on line entries that may shift which lettered line you use for a given facility type. Always check the most recent PDF on IRS.gov on the day you prepare the form.

A few practical notes from our filing experience this year, and how the instructions back them up:

- If your bonds finance a spaceport facility under section 142, the instructions explain where to report the issue price and what to type in the description field.

- For volume cap reporting, the instructions list which exempt facility bonds are outside the unified state volume cap, and the partial exclusions for high‑speed rail, broadband, and carbon capture. Watch the 75 percent rule and the government ownership carve‑out.

- For reissuance situations, line 20b directs you to describe the original type of issue and enter the amount treated as reissued, including volume cap details where required.

Pro tip, line letters change across revisions. In 2022, IRS announced new lines for qualified broadband and carbon capture projects. In 2025, the instructions reorganize certain entries and add spaceport guidance. Use the current instructions, not a legacy line map, when you complete Part II.

Table, fast compliance cues for 2025 filers

| Item | What to check | Why it matters |

| Purpose line in Part II | Match your facility type to the current line letters in the 09‑2025 instructions | Line letters moved in recent revisions, avoid misclassification. |

| Volume cap entries | Apply 75 percent rule and government ownership carve‑out for broadband, high‑speed rail, carbon capture | Prevent over or under reporting of cap usage. |

| Line 20b reissuance | Describe the original issue type and amount treated as reissued | Ensures correct treatment on modifications or remedial actions. |

| Ogden mailing address | Use the address in the current instructions, keep proof of mailing | Establishes timely filing. |

Step‑by‑step, completing Form 8038 without rework

Part I, Reporting Authority

- Enter the issuer’s legal name, EIN, address, and a real contact who answers the phone. The IRS uses this for follow‑up. If you designate a non‑employee contact, complete the specific contact lines and still fill out lines 10a and 10b.

- Date of issue, use the definition in the instructions, generally the first date bonds are exchanged for funds.

Quick check, set your tickler for the quarter rule on the issue date. That date drives your filing deadline, not your fiscal year end.

Part II, Type of Issue

- Pick the facility type that fits your financing and enter the issue price in that box. Follow the specific notes for airports and spaceports, empowerment zone facilities, and other specialized categories cited in the instructions.

- If your bonds are treated as reissued because of a significant modification or remedial action, complete line 20b with the original type and the amount treated as reissued.

Part III, Description of Bonds

- Report final maturity, issue price, stated redemption price at maturity, weighted average maturity, and yield. Use the definitions and carry yield to four decimals, and write “VR” for variable rate issues.

Parts IV to VIII, Uses, property, refundings, and volume cap

- Capture use of proceeds, including costs of issuance and reserve funds, and describe property financed where required.

- If refunding, complete the refunded bond description lines with dates and amounts.

- For volume cap, follow the itemized list of facilities that are outside the cap and the partial exclusion rules, then attach carryforward documentation as needed.

Documentation that makes reviews go quickly

Set up a small “8038 packet” in your records. Include the signed return, proof of mailing, the closing transcript, the allocation of proceeds, legal opinions, and any volume cap carryforward forms. This saves hours if the IRS writes with a question or if you need to amend later. The 2025 instructions emphasize accurate issuer identity, correct purpose classification, and complete line entries, and your packet is how you prove it.

If your internal team is stretched, bring discipline to the process with SOPs, standardized workpapers, and a short review checklist. That structure cuts review time, holds quality, and keeps you on calendar.

Filing methods and timing, avoid the two biggest mistakes

Mistake 1, assuming you can e‑file a standard 8038

Standard Form 8038, 8038‑G, and 8038‑GC are not e‑filed. You print, sign, and mail them to the Ogden, Utah Service Center, using a trackable method if you want extra assurance. By contrast, Form 8038‑CP, which is the credit payment return, is filed electronically through authorized providers, and many issuers must e‑file it starting with 2024 filings if they file at least 10 federal returns in the calendar year.

For 8038‑CP timing, remember the credit payment return ties to the interest payment date. For fixed rate bonds, file no earlier than 90 days and no later than 45 days before the interest payment date. The IRS sends an electronic acknowledgment within 24 hours, but payment timing still depends on compliance checks, so file early. Use the January 2022 version of Form 8038‑CP.

Mistake 2, misreading the quarter‑based 8038 due date

Your Form 8038 due date follows the issue date’s calendar quarter, not your fiscal year. The rule, file by the 15th day of the second month after the quarter closes. A few examples to cement it:

- Issue date April 25, 2025, second quarter, due by August 15, 2025.

- Issue date December 1, 2025, fourth quarter, due by February 15, 2026.

If you discover a miss, do not panic. Use the Rev. Proc. 2002‑48 late‑filing relief process. Write the required statement on the form, include a brief explanation letter, and mail it to Ogden. Keep copies in your records.

Quick reference, which form when

| Situation | Use this form | Timing highlight |

| Private activity bonds, including qualified 501(c)(3) bonds | Form 8038 | 15th day of the second month after the quarter of issuance, mail to Ogden. |

| Governmental bonds, issue price ≥ 100,000 | Form 8038‑G | Same quarter‑based deadline, mail to Ogden. |

| Small governmental issues under the 8038‑GC thresholds | Form 8038‑GC | Single issues follow quarter rule, consolidated filings are due the 15th day of the second month of the following year. |

| Direct‑pay credit payments | Form 8038‑CP | E‑file with an authorized provider, 45 to 90 days before the interest payment date for fixed rate bonds. |

Recordkeeping, what to file and what to keep

Create a simple checklist for each issue:

- Signed Form 8038 and all attachments.

- Proof of mailing or delivery.

- Closing transcript, including the trust indenture and tax certificate.

- Proceeds allocation and draw schedules.

- Volume cap allocation and carryforward forms, if applicable.

- Notes supporting yield calculations and arbitrage compliance, even if no rebate is due.

Keep the packet for as long as it may be material for federal tax administration. The Paperwork Reduction Act notice reminds issuers to retain books and records linked to a filed form.

A simple workflow you can reuse every time

- Start a calendar event the day the bonds price, and set a second reminder for the day they close. Use the closing date as your working issue date unless the documents say otherwise.

- On closing day, open the latest instructions from IRS.gov and build your form directly against those definitions.

- Complete Parts I through VIII using your closing transcript, then run a short review using a two person check.

- Print, sign, mail, and file your proof of mailing with the packet.

- If facts change and a reissuance is triggered later, complete line 20b per the instructions and retain documentation.

If your team is buried in other filings, a standardized workpaper and a brief pre‑mail review checklist save time. One page beats back‑and‑forth emails every time.

Compliance watchouts and how to avoid them

- Using an outdated line map. Line letters and descriptions shift over time. The 2025 instructions add spaceport guidance and update line references. Always pull the current PDF when you prepare the form.

- Misclassifying the facility type. Purpose codes drive downstream entries like volume cap. If you finance a broadband or carbon capture project, confirm whether your entry is in the current line and apply the 75 percent and ownership rules in the volume cap section.

- Listing the wrong final maturity or yield. Use the definitions in the instructions, carry yield to four decimals, and write “VR” for variable rate.

- Missing reissuance disclosure. If you have a significant modification or a remedial action, fill out line 20b and describe the original type.

- Mailing to the wrong address. Use the Ogden, Utah address in the current instructions and keep proof of mailing.

FAQs

Who files Form 8038 and for which bonds?

State and local government issuers, including instrumentalities and conduit issuers, file Form 8038 for each tax‑exempt private activity bond issue. Governmental bonds use Form 8038‑G, and some small governmental issues use 8038‑GC.

What is the current due date for Form 8038?

File by the 15th day of the second calendar month after the quarter in which the bonds were issued. The deadline is tied to the issue date’s quarter, not your fiscal year end.

Can I e‑file Form 8038?

No. Standard 8038, 8038‑G, and 8038‑GC are mailed. Only Form 8038‑CP is e‑filed through authorized providers, and many issuers must e‑file it if they file 10 or more federal returns in the year.

What if I missed the filing deadline?

Request late‑filing relief under Rev. Proc. 2002‑48. Mark the top of the form with the request language, attach a brief explanation, and mail to Ogden. Keep a copy for your records.

Did Form 8038 change for broadband, carbon capture, or spaceports?

Yes. In 2022 the IRS announced new reporting entries for qualified broadband projects and qualified carbon dioxide capture facilities. The 2025 instructions add spaceport guidance and update line references. Check the latest instructions before you choose your line.

How structured delivery helps you hit every Form 8038 deadline

You do not need more people, you need better structure. A short standard operating procedure, clean workpapers tied to the closing transcript, and a review checklist cut prep time and stop rework. If you partner with an external team, insist on SOP‑driven execution, consistent naming, and a two layer review so the signed form matches the instructions in effect that day. That is how we keep filings on calendar without drama.

Accountably works with CPA and accounting firms that support issuers and conduit borrowers. When a firm needs steady production during filing season, we integrate trained teams into their workflow, use your templates, and run multi layer reviews so filings go out clean and on time. A disciplined system beats heroics every quarter.

Closing thought

Form 8038 is precise work, not guesswork. If you ground your process in the current instructions, use the quarter‑based deadline, and keep a tidy packet, you will file on time and sleep well. When in doubt, open the latest instructions from IRS.gov, apply the definitions exactly, and do the simple things right, name, dates, amounts, purpose line, and signatures. That is what keeps your tax‑exempt status safe and your audits quiet.

Simplify Delivery, Improve Margins, Stay in Control.

Offshore support that works exactly like your in-house team.

💼 Let’s Talk