Scale Your CPA Firm Without Adding Headcount

Build your offshore team that works your way, trained, compliant, and white-labeled under your firm.

👉 Book a Discovery Call

Here is the good news. You can turn Schedule B into one of the most predictable parts of the return. The key is disciplined data, documented valuation methods, and a review‑friendly workpaper pack that any senior can follow.

Key Takeaways

- Schedule B lists every stock, bond, fund, or security in the gross estate and reports fair market value on the date of death. Use means, not guesses, and keep the support you used.

- Market‑traded securities rely on the mean between the highest and lowest selling prices when available. If trades are missing, use weighted averages from the nearest trading days or bona fide bid‑ask means, then document everything.

- For weekend or holiday deaths, compute value by averaging or prorating between adjacent trading days, as the regulations and instructions describe, and keep your math in the file.

- Add accrued bond interest and handle dividends by the record date and ex‑dividend rules. If the stock traded ex‑dividend on the death date and the dividend was already declared but payable to holders of record after death, add the dividend to the stock’s value.

- Thin, private, or closely held interests require valuation support under IRC §2031 and accepted appraisal standards. Use a qualified appraiser when discounts or complex facts appear.

- The 2025 basic exclusion amount is 13,990,000, so you should confirm the filing requirement and portability decisions before you go deep in the return.

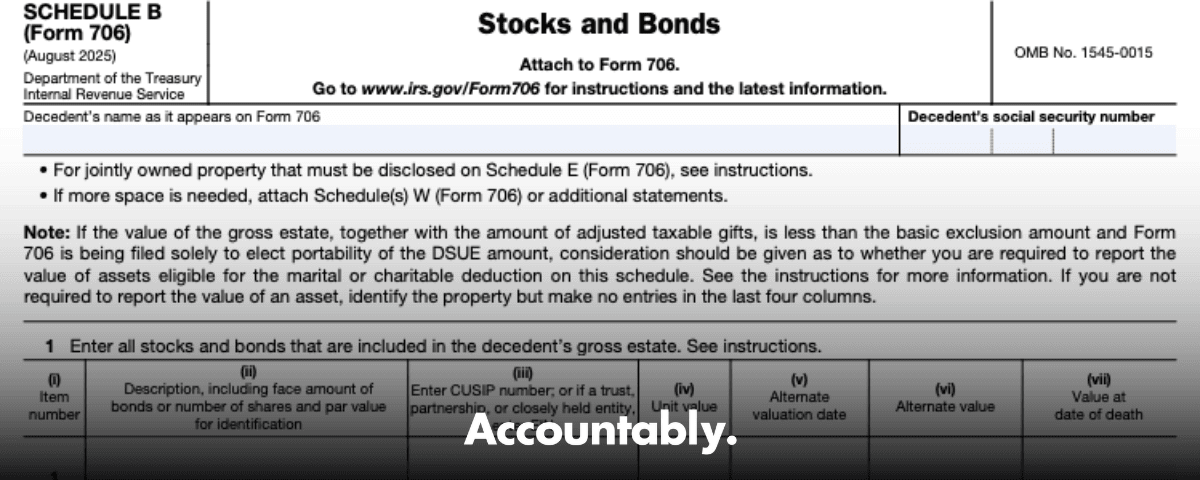

What Schedule B Does And When You Must Use It

Schedule B is the estate’s security ledger. You list each position, identify it clearly, and report the date‑of‑death fair market value. For listed securities, the regulations point you to the mean of selling prices or to weighted averages from the nearest trading days when no sale occurred. The instructions also tell you exactly what to describe, including the nine‑digit CUSIP, exchange, and unit value. Keep the broker’s letter or statements and any pricing printouts you relied on, then attach or cross‑reference them in the return.

The fair market value of a listed security on the valuation date is generally the mean between the highest and lowest quoted selling prices that day. If there were no sales, use a weighted average from the nearest dates before and after, or use bid‑ask means when sales are not available.

Hundreds of Firms Have Already Used This Framework.

Join the growing list of CPA and accounting firms using Accountably’s Offshore Playbook to scale faster.

💬 Get Your FREE Playbook

👉 Visit Jugal Thacker’s LinkedIn

Send him a connection request and message “Playbook” to get your copy.

Where this gets messy in practice is not the rule, it is the execution. You need clean holdings data, documented methods for non‑trading days, and a repeatable way to treat dividends and accrued interest. That is what speeds reviews.

Who This Guide Is For

- You lead or review estate tax engagements and want fast, defensible Schedule B files that pass partner review on the first round.

- You handle data gathering from brokers, trustees, or family offices and need a clear checklist.

- You manage preparers and want workpapers that reduce back‑and‑forth.

Before You Start, Gather These Documents And Data

Pull date‑of‑death evidence for every position, then tie totals to your recapitulation. At minimum, get:

- Broker statements on, or closest to, the date of death, plus a broker’s letter listing positions, share counts, CUSIPs, and any accrued dividends or interest.

- Pricing support for each security, for example exchange reports, pricing service printouts, or broker quotes that show bid, ask, high, low, close, and time stamps. Note your selected mean.

- Dividend details, declaration date, record date, payment date, and per‑share amount.

- Bond coupon schedules and day‑count convention so you can compute accrued interest.

- For private or thin securities, corporate records, recent financials, and a qualified appraisal if discounts or control issues are in play.

Pro tip from our reviews, name every file with a clear pattern. Example: Ticker_CUSIP_YYYYMMDD_Source.pdf. Put your method memo at the front of the binder. The reviewer should understand your approach before they see a single number.

Improve Margins Without Compromising Quality

Offshore staffing helps firms deliver more, scale faster, and stay compliant, without adding local headcount.

👉 Book a Discovery CallValuation Rules For Market‑Traded Securities, The Fast Path To Defensible Numbers

For an actively traded stock or bond, start with the regulations and apply them exactly.

- If trades occurred on the death date, use the mean between the highest and lowest selling prices for that date.

- If there were no sales that day, find sales within a reasonable period before and after, then compute a weighted average of the means, weighted inversely by trading‑day distance to the valuation date. Document your weighting.

- If only closing prices exist for a listed bond, use the mean of the closing price on the valuation date and the prior trading day, or use the weighted method when those closes are on the nearest before and after dates.

- If you cannot find sales within a reasonable period, use the mean of bona fide bid and asked prices for the valuation date or a weighted average from the nearest dates before and after.

Keep your source pages in the file, and show your math next to each line item. If your firm uses alternate valuation under section 2032, follow the instructions’ examples so the columns in Schedule B align with your election.

A Quick Reality Check On Filing Thresholds In 2025

Confirm that the estate must file. For decedents who died in 2025, the basic exclusion amount is 13,990,000. If you are electing portability, you may file even when the estate is under the threshold. Review the current IRS guidance before you set deadlines, because the threshold is inflation‑indexed.

Weekend, Holiday, And No‑Trade Day Methods, How To Compute And How To Prove It

Non‑trading days are where many files stumble. The rules are clear, but you must document the exact method you used and why it fits the facts.

If death occurs on a weekend or holiday, use adjacent trading days and either average or prorate to the death date as the regulations and instructions permit. The eCFR shows a Sunday example that simply averages Friday and Monday. The Form 706‑QDT instructions describe a prorating approach between the nearest trading day means. Keep a short memo in the workpapers that shows which method you used and your rationale.

Worked Examples You Can Paste Into Your Workpapers

1.Sunday death, listed common stock

- Friday mean 20.00, Monday mean 23.00.

- Regulation example result equals 21.50, the simple average. Cite the eCFR example directly in your memo.

- Saturday death, same facts, using a calendar‑proportion method

- Friday mean 20.00, Monday mean 23.00.

- Weight by proximity, Saturday is closer to Friday. Compute FMV as two parts Friday plus one part Monday, then divide by three. Result equals 21.00. Note that the instructions allow proration between adjacent trading days, so this method is acceptable when explained and supported.

- No sale on the death date, but trades before and after

- Use the weighted average of the means on the nearest trading dates.

- Weight inversely by the number of trading days between each sale date and the valuation date. Document the number of trading days you used.

Keep the screenshot or PDF from the exchange or pricing service in the binder and reference the page number in your Schedule B description. Reviewers should not have to guess where your numbers came from.

Handling Missing Sales, Bid‑Ask Only, Or Thin Trading

When sales are not available within a reasonable period, switch to bona fide bid and ask quotes.

- Compute the mean as bid plus ask, then divide by two.

- If quotes exist only before and after the death date, use the weighted method described for sales.

- For thin or wide spreads, add a short note stating why bid‑ask was the best available evidence.

Bid‑Ask Mean Worksheet

| Input | Example | Filed Exhibit |

| Bid | 19.80 | Exchange printout |

| Ask | 20.20 | Broker quote |

| Mean | 20.00 | Workpaper calc |

| Why bid‑ask | No sales near DOD | Method memo |

| Adjustment | Saturday proration | Averaging worksheet |

Accrued Dividends And Interest, Getting The Timing Right

Dividends hinge on the record date, not the payment date. If death occurs after the record date and before payment, include the dividend. If the stock traded ex‑dividend on the death date, add the dividend to the stock’s value, do not list a separate receivable for that dividend on Schedule B. The regulation states this explicitly.

If a dividend was declared before death, payable to holders of record after death, and the stock is selling ex‑dividend on the date of death, add the dividend to the quotation to determine FMV as of the date of death.

For bonds, include accrued interest in the bond’s value on Schedule B. Compute as days since the last coupon divided by the day‑count year, then multiply by the annual coupon. Keep the coupon schedule and day‑count shown in the file. The instructions’ examples illustrate how to present interest due and accrued interest within Schedule B.

Quick Formula And Example

- Accrued interest equals days since last coupon divided by 365, then multiplied by annual interest.

- Example, par 1,000, 5 percent annual coupon, 60 days since last payment. Accrued equals 60 divided by 365 times 50, which is 8.22. Add 8.22 to the bond’s mean price for the date of death. Cite your source page.

Reporting Nonmarketable, Closely Held, And Special Cases

When no public market exists, value under IRC §2031 principles. Consider earnings, cash flows, assets, comparable public companies, and transaction data. When you claim discounts for lack of control or marketability, you need a qualified appraisal and transparent assumptions. Attach what you relied on, including recent financial statements and any expert reports. The regulations require you to submit complete data when market quotes do not reflect fair value.

What Good Appraisal Support Looks Like

- Clear standard of value and valuation date.

- Methods that fit the facts, such as discounted cash flow, guideline public company, or guideline transactions.

- Support for discounts, with empirical studies and company‑specific factors.

- Reconciliation, why the appraiser weighted certain methods.

- Exhibits, financial statements, cap table, organizational documents.

Identifying And Reporting Worthless Securities

Worthless or nominal‑value positions go last on Schedule B. List issuer name, share count, par value if any, and report 0 for value. Attach proof, for example incorporation details, address, board minutes, issuer letters, creditor notices, bankruptcy filings, and any valuation opinions you used. If a broker held the position, include their letter. The instructions expect you to show the basis for reporting no value.

Evidence Pack Example

| Evidence | Source | Date |

| Broker letter | XYZ Brokerage | 02‑15‑2024 |

| Board minutes | ABC Corp. | 08‑30‑2023 |

| Bankruptcy docket | Case 21‑12345 | 11‑10‑2023 |

| Valuation opinion | ASA credentialed | 01‑05‑2024 |

Description Requirements That Speed Review

Describe each item so a reviewer can confirm identity without chasing you.

- Stocks, number of shares, common or preferred, exact issuer name, exchange, per‑share price, and CUSIP.

- Bonds, face amount, obligor, maturity, interest rate, coupon dates, exchange, and CUSIP.

- For unlisted issues, include the principal business office.

- If the interest is in a trust, partnership, or closely held entity, include the EIN in the description column.

Mutual Funds, ETFs, ADRs, And Money Market Shares

Treat registered investment companies and ETFs like other listed securities. Use the same hierarchy of evidence. For money market funds, confirm whether the fund transacts at a stable price or a floating NAV on the death date and cite the source page you used. If you see stale prices, switch to bid‑ask methodology with a short explanation.

Pledged And Margin Securities

If the decedent held a margin account or pledged securities, include the full value of those securities in the gross estate. The related debt is handled as a deduction under the debt regulations, not as a reduction of the asset value on Schedule B. Cite the pledge or margin agreement in your workpapers.

Attachments, Exhibits, And How To Make Your File “Review‑Proof”

Think of Schedule B as two things, the filled form and the evidence binder. Your goal is that any senior can follow the trail.

Minimum Attachments To Include

- Broker’s account statement or letter that lists each security, share count, CUSIP, and per‑share value as of the date of death.

- Pricing printouts, exchange screenshots, or broker quotes that show high, low, bid, ask, or close, with date and time.

- Weekend or no‑trade worksheets that show your averaging or proration math and the exact rule you applied, with a citation.

- Dividend and bond interest schedules with record dates, payment dates, and your accrual calculations.

- Appraisals and company documents for nonmarketable interests, plus any discount support.

One‑Page Method Memo Outline

- Valuation date and whether alternate valuation was elected.

- Evidence hierarchy you used, trades, then closes, then bid‑ask.

- Weekend or holiday approach and examples with numbers.

- Dividend and accrued interest treatment with citations.

- Exceptions, thin trading, wide spreads, corporate actions.

- Cross‑references to exhibit page numbers.

Reconciling Schedule B With The Rest Of Form 706

Tie Schedule B to your recapitulation so totals agree everywhere.

- Reconcile Schedule B totals to Part 5, and make sure any items that belong on Schedule C, such as pure cash or separately held interest receivables, are not double counted.

- Cross‑check with Schedules A, C, D, E, and F when securities or proceeds show up in multiple places, for example insurance proceeds at a broker or jointly held positions.

- Confirm that dividends included due to the record date are not also included as separate receivables.

- If you list a security at zero, confirm that no other schedule shows a different value or description for the same asset.

A Simple Review Checklist You Can Use Today

- Each position has a CUSIP, exchange, and unit value.

- A source page supports each price, and the math is next to the item.

- Weekend or no‑trade computations are shown with weights and citations.

- Dividends follow the record‑date rule, and ex‑dividend adjustments are added to the stock price, not listed separately.

- Bond accrued interest is calculated and added to value with a coupon schedule in the file.

- Nonmarketable interests include an appraisal or full support under §2031 factors.

Where A Structured Delivery Model Helps, Without Losing Control

You might already have strong tax talent, yet peak‑season spikes and review loops create bottlenecks. A disciplined offshore delivery layer can help when it is built like operations, not staffing. The work stays in your systems, follows your SOPs, and moves through standardized workpapers, multi‑layer review, SLAs for turnaround, and continuity plans. That is how teams reduce revision cycles and keep partner time focused on strategy and client conversations, while maintaining security and documentation standards. Use this approach only if you can preserve U.S. standards, workflow visibility, and quality control from intake to final review.

Frequently Asked Questions

Who must complete Schedule B?

If the gross estate includes any stocks or bonds, you must complete Schedule B and attach it to Form 706. The instructions list the description details to include and remind you to attach supporting evidence such as broker letters and pricing printouts.

What is the correct way to value securities on the date of death?

Use the mean between the highest and lowest selling prices on the valuation date when available. If no sales occurred that day, use the weighted average method from the nearest trading days, or use bona fide bid‑ask means. Keep a memo and proof pages that match your numbers.

How do I handle weekend or holiday deaths?

Use adjacent trading days and either average or prorate to the death date. The regulations include a Sunday example that averages Friday and Monday, and the instructions for QDT describe a prorating approach. Show your math and cite your source in the file.

What about ex‑dividend dates and record dates?

If death occurs after the record date and before payment, include the dividend on Schedule B. If the stock is selling ex‑dividend on the death date and the dividend was declared before death, add the dividend to the stock’s value rather than listing a separate receivable.

Do I include accrued interest on bonds?

Yes. Compute accrued interest from the last coupon to the date of death using the day‑count for the issue, then add it to the bond’s value. The instructions show how interest due and accrued interest can appear within Schedule B.

What is the filing threshold in 2025?

For decedents who died in 2025, the basic exclusion amount is 13,990,000. Review portability and any elections early so you do not lose time later.

Put It All Together, The Fast, Defensible Schedule B Workflow

- Gather broker letters, statements, and pricing sources that cover the date of death.

- Choose the correct valuation method, trades, closes, or bid‑ask, and document it in a one‑page memo.

- Compute weekend or no‑trade values with averaging or proration, and keep the worksheets.

- Add dividends and accrued interest according to the record date and coupon schedule rules.

- For nonmarketable interests, include the appraisal and §2031 support.

- Reconcile Schedule B to the rest of the return and cross‑reference every exhibit.

When your description lines are complete, your pricing pages are attached, and your weekend math is shown, reviews become faster, clients see fewer delays, and the file is ready for an IRS question on day one.

Light help from Accountably, only when it adds control

If your team needs capacity without losing control, a disciplined offshore delivery layer can standardize Schedule B workpapers, enforce SOPs, and protect review time with multi‑layer checks and clear SLAs. The work stays in your systems, with your templates, and your standards, so quality, security, and accountability remain intact.

Simplify Delivery, Improve Margins, Stay in Control.

Offshore support that works exactly like your in-house team.

💼 Let’s Talk