Scale Your CPA Firm Without Adding Headcount

Build your offshore team that works your way, trained, compliant, and white-labeled under your firm.

👉 Book a Discovery Call

If you have ever chased deeds, statements, or citizenship records the night before filing, you know the feeling. This guide helps you avoid that scramble, so you file confidently and move on.

Key Takeaways

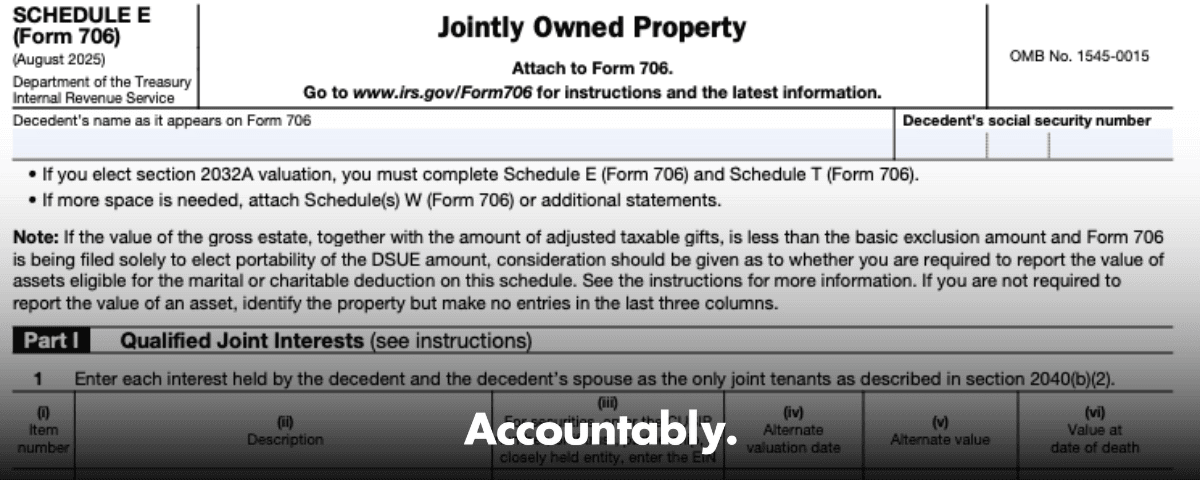

- Schedule E reports jointly owned property. Use Part 1 for qualified joint interests with a U.S. citizen spouse under section 2040(b)(2), and use Part 2 for all other joint interests.

- In Part 1, list the asset at its full fair market value, then include only one half in the gross estate. You cannot use this rule if the surviving spouse is not a U.S. citizen.

- In Part 2, the default includible amount is 100%, unless you prove that the decedent did not furnish all the consideration. Bring documentation that shows the survivor’s original ownership or separate funds.

- Community property and tenancy in common are generally not listed on Schedule E. Report them on the appropriate asset schedules instead.

- Deadlines matter. Form 706 is due 9 months after death, with a 6 month filing extension available on Form 4768. Portability requires timely filing, and certain small estates can use the late portability relief window up to 5 years under Rev. Proc. 2022‑32.

What Schedule E Actually Captures

Schedule E is for property the decedent held as a joint tenant with right of survivorship or as a tenant by the entirety. You complete it if any joint property existed at death, even if nothing is ultimately includible. Do not use Schedule E for tenancy in common or for community property held as such, those belong on the appropriate asset schedules of Form 706.

Pro tip, keep your Schedule E list tight and precise. If title does not include survivorship rights, it likely does not belong on Schedule E, and misclassification can throw off both inclusion and your review path.

Hundreds of Firms Have Already Used This Framework.

Join the growing list of CPA and accounting firms using Accountably’s Offshore Playbook to scale faster.

💬 Get Your FREE Playbook

👉 Visit Jugal Thacker’s LinkedIn

Send him a connection request and message “Playbook” to get your copy.

Quick Comparison

| Category | Where to report | What you include | Notes |

| Qualified joint interest with a U.S.-citizen spouse | Schedule E, Part 1 | Report full value on the detail, include 50% in the gross estate | Section 2040(b)(2) rule, citizenship is required. |

| Other joint interests, survivorship on title | Schedule E, Part 2 | Default 100%, reduce only with proof of other tenant’s consideration | Use hard evidence to adjust the percentage. |

| Community property, tenancy in common | Appropriate asset schedules (A through I) | Only the decedent’s interest | Not listed on Schedule E. |

When Part 1 Applies, Qualified Joint Interests With A U.S. Citizen Spouse

Part 1 is your friend when the facts are clean. To qualify, the decedent and surviving spouse must have held the property as tenants by the entirety, or as joint tenants with right of survivorship, and they must be the only joint tenants. The surviving spouse must be a U.S. citizen. When those conditions are met, you list the asset at full value on the schedule and include only one half in the gross estate.

Getting the 50% inclusion right, FMV, line 1a and 1b

- Describe the property carefully, use the same description standards you would use on Schedules A, B, C, or F, depending on the asset type. Enter the full date of death value in the value columns.

- Aggregate the full values on line 1a, then carry one half to line 1b, which feeds the gross estate. Keep your workpapers clear so your reviewer sees the math at a glance.

Three pitfalls we see most

- Citizenship not verified. The 50% rule does not apply if the survivor is not a U.S. citizen. In that case, list the item in Part 2 and apply the consideration test, or handle through a QDOT and Schedule M if applicable.

- Title mismatch. If the deed lacks survivorship rights, you are likely in tenancy in common territory, which belongs on other schedules, not on Schedule E.

- Community property confusion. In community property states, do not assume Part 1 applies. Community property is generally reported on the underlying asset schedules, not on Schedule E.

Part 2, All Other Jointly Owned Property

Part 2 holds everything that is not a qualified joint spousal interest. That includes joint property with nonspouse parties, and spousal joint interests that fail the Part 1 rules. You list the surviving co-tenant’s name and address, describe the asset, then you determine the percentage includible. The default is 100%. You lower that only when your documentation proves the decedent did not furnish all the consideration, or when the survivor contributed separate funds.

If you are filing solely to elect portability under the special rules, and an asset that would otherwise be on Schedule E is treated as marital or charitable deduction property, follow the instructions not to enter values in the schedule’s last columns. The IRS explains how to estimate and report the value when filing just for portability.

Improve Margins Without Compromising Quality

Offshore staffing helps firms deliver more, scale faster, and stay compliant, without adding local headcount.

👉 Book a Discovery CallProving A Lower Percentage In Part 2 Without Headaches

The IRS instructions are clear. You may exclude the portion that belonged to the other tenant, or that was acquired with that tenant’s funds, if you prove it. Think in terms of a short, labeled exhibit for each asset. Your reviewer should be able to follow the money and the timeline in minutes, not hours.

Build a tight documentation packet

- Title history, recorded deeds, and closing statements that show prior ownership splits and survivorship rights.

- Funding proof, cancelled checks, wire confirmations, bank statements, and loan documents that trace who furnished the purchase price or improvements. Dates and amounts matter.

- If the survivor received the interest by gift, bequest, devise, or inheritance, include the operative instrument and valuations that support the transfer.

- An allocation schedule that reconciles dollars to percentages and addresses liens or mortgages, so your includible percentage is obvious.

Sample exhibit label you can adapt “Exhibit E-2, 123 Harbor Ave., Joint Account Ending 4810. Survivor furnished 40% of purchase funds. See closing statement dated 7-15-2018 and wires on 7-12-2018 totaling 160,000 from Account ABC. Includible percentage, 60%, includible amount, 420,000.”

Community property and noncitizen spouse situations

- Community property is generally reported on the underlying asset schedules, not on Schedule E. Be careful not to force community property into Part 2. Track the decedent’s interest per state law.

- If the surviving spouse is not a U.S. citizen, you cannot use the Part 1 half inclusion, so the item belongs in Part 2 unless you are using a QDOT strategy reported on Schedule M. Validate citizenship early, and document choices in your file memo.

Filing Deadlines, Extensions, And Portability That Actually Stick

Here is the timing that protects your estate positions.

- Form 706 is due 9 months after the date of death. If you need more time, file Form 4768 by the original due date for an automatic 6 month extension. The extension is to file, not to pay. Interest accrues on unpaid tax from the original due date.

- If you are filing solely to elect portability of DSUE, the return must be timely. For small estates that were not required to file under section 6018(a), the IRS provides late portability relief. You can file a complete Form 706 within 5 years of death and mark it “Filed Pursuant to Rev. Proc. 2022‑32.” If the estate actually had a filing requirement, this relief does not apply.

- Where to file, the IRS shows Kansas City, MO for original Form 706 returns during calendar year 2025, and Florence, KY for amended and certain estate and gift operations mail. Always check the current page for addresses.

One more operational note, examiners verify the portability election. Keep your DSUE calculation and any marital or charitable schedules clean, labeled, and easy to follow.

Step By Step, Completing Schedule E Accurately

- Map the asset to the right place

- Confirm the title. If it is joint with survivorship or by entirety, consider Schedule E.

- If it is tenancy in common or community property, use the appropriate asset schedule instead.

- Choose Part 1 or Part 2

- Part 1, only if it is a qualified joint spousal interest and the spouse is a U.S. citizen. Report full value, include one half.

- Part 2, for everything else. Start at 100%, then reduce with documented consideration from the survivor.

- Describe and value precisely

- Mirror the description rules used on Schedules A, B, C, and F, and enter full value in the schedule columns.

- Keep appraisals and statements in the file.

- Attach exhibits when excluding any portion

- Use short written exhibits with cross references to statements and closing documents.

- Include an allocation schedule that reconciles people, percentages, and dollars.

- Reconcile to the recapitulation

- Ensure Schedule E totals flow to the gross estate, tax computation, and, if applicable, to marital or charitable schedules and portability calculations.

- If you are filing only to elect portability, follow the special instruction about estimated values and leaving the last columns blank where required.

Common Errors We See, And How To Fix Them

- Mixing up Schedule E with the individual income tax Schedule E. On Form 706, Schedule E is only for jointly owned property at death, not rental income or pass-throughs. Use the 1040 world only when you are doing the decedent’s final individual return.

- Listing community property on Schedule E. Move those items to the asset schedules and report only the decedent’s interest.

- Applying the 50% rule when the spouse is not a U.S. citizen. Switch to Part 2 or use a QDOT where appropriate and document the path.

- Dropping the ball on documentation. If you are excluding any portion in Part 2, you need bank records, closing papers, and tracing. Vague statements are not enough.

- Missing the filing date and losing portability. Use Form 4768 by the original due date, and if the estate was not required to file, remember the 5 year late portability relief.

FAQs

What is Form 706 Schedule E, in plain terms

It is the estate tax schedule where you list property the decedent held as a joint tenant with right of survivorship or by the entirety. You use Part 1 for qualified joint spousal interests with a U.S. citizen, and Part 2 for all other joint interests.

How does the 50% rule work for a home owned with a spouse

If the interest qualifies under section 2040(b)(2) and the surviving spouse is a U.S. citizen, you report the full value but include only one half in the gross estate. Confirm title and citizenship before you rely on this.

Do community property items go on Schedule E

Generally no. Community property is reported on the underlying asset schedules, and you include only the decedent’s interest. Many review delays come from forcing community property into Schedule E.

What are the key filing dates for Form 706 and portability

Form 706 is due 9 months after death, with a 6 month filing extension available on Form 4768. Portability requires timely filing, and small estates with no filing requirement can use the late portability relief window up to 5 years from death under Rev. Proc. 2022‑32.

Where do I mail Form 706

For calendar year 2025, the IRS “Where to File” page shows Kansas City, MO for original Form 706 returns. Addresses can change, so always check the current page before you ship.

Final Checklist You Can Paste Into Your Workpapers

- Verify title type and survivorship rights, then assign each asset to Part 1, Part 2, or other schedules.

- Confirm spouse citizenship before using the 50% rule.

- For Part 2 exclusions, attach exhibits that trace funding and show the survivor’s consideration with hard documents.

- Reconcile Schedule E totals to the recapitulation and any marital or charitable schedules. If filing solely for portability, follow the special instruction on estimated values.

- Calendar the 9 month due date and file Form 4768 by that date if you need a 6 month extension.

A Light Note On Process Discipline

If you are tired of late nights rebuilding workpapers, consider tightening your documentation process for joint assets. Many firms pair a short “Schedule E packet” with a standing review checklist, which cuts rework and protects deadlines. If you need structured help with documentation discipline, review flow, or seasonal capacity, Accountably integrates trained offshore teams inside your tools and templates, with clear SOPs and layered review to keep reviewers out of endless loops. Use it only where it adds control, not as a shortcut.

Closing

You now have a straightforward way to sort joint property, choose the right part of Schedule E, and prove the includible share without spinning your wheels. Protect your dates, document your exclusions with source records, and keep your file tight. When you sign, the return should feel balanced and well supported, and the reviewer should have nothing left to chase. If you want a second set of eyes on your Schedule E packet or a ready-made checklist you can adapt, say the word.

Simplify Delivery, Improve Margins, Stay in Control.

Offshore support that works exactly like your in-house team.

💼 Let’s Talk