Scale Your CPA Firm Without Adding Headcount

Build your offshore team that works your way, trained, compliant, and white-labeled under your firm.

👉 Book a Discovery Call

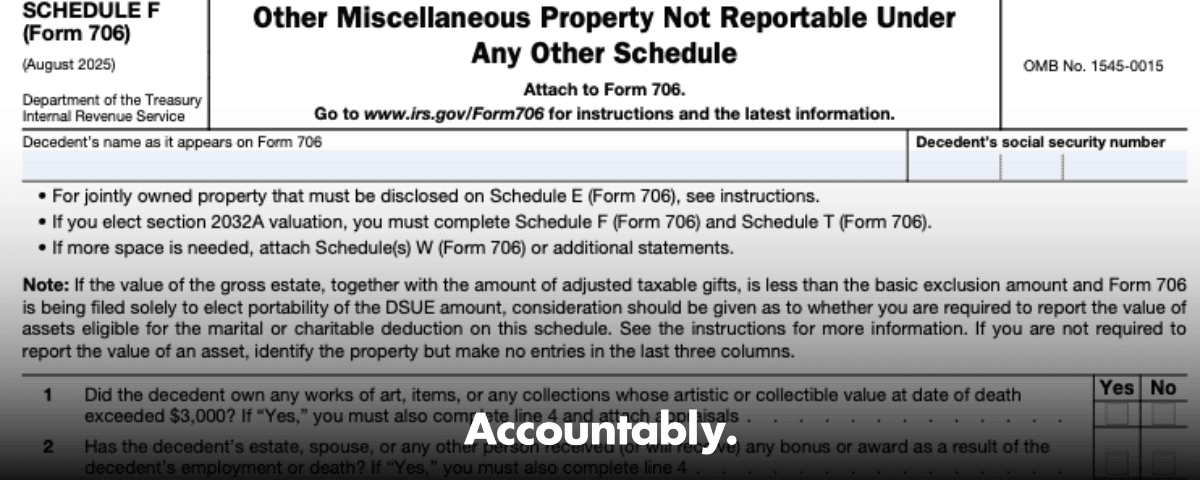

Schedule F is where you list the estate’s miscellaneous property that is not reported on other schedules, and you must attach Schedule F even if you have no items to list, you still answer its questions.

Key Takeaways

- Schedule F covers household goods, jewelry, artwork, collectibles, vehicles, rights, royalties, leaseholds, judgments, refunds and checks due, digital assets, interests in unincorporated businesses, and section 2044 property, that is QTIP.

- If any single item, or a collection of similar items, is valued above 3,000, attach an expert appraisal and the appraiser’s qualifications under oath. This is straight from the 2025 IRS instructions and Treasury regulations.

- Insurance on another person’s life that benefits the decedent belongs on Schedule F, and you attach Form 712 for each policy. Insurance on the decedent’s life is Schedule D.

- Schedule F asks about safe deposit boxes. If the decedent had access, you must disclose location and explain any omitted contents.

- Real estate inside a sole proprietorship is reported on Schedule F, not Schedule A, and a jointly owned partnership interest belongs on Schedule E.

What Schedule F Is For, And When You Must File It

Think of Schedule F as your catch all. If it is not real estate, not stocks or bonds, not mortgages or cash, and not on the other specialty schedules, it probably lives here. That includes:

- Household goods and personal effects, jewelry, artwork, collectibles

- Automobiles and other vehicles

- Farm products, crops, livestock, and machinery

- Rights, royalties, leaseholds, judgments, reversionary or remainder interests

- Business interests in partnerships, LLC interests if closely held, and any unincorporated business

- Insurance on the life of another, with Form 712 exhibits

- Digital assets, including cryptocurrency and NFTs, when owned at death

Even if you have no items to report, the IRS still requires you to attach Schedule F and answer its questions. Skipping the schedule because you think it is blank is a common exam trigger.

Hundreds of Firms Have Already Used This Framework.

Join the growing list of CPA and accounting firms using Accountably’s Offshore Playbook to scale faster.

💬 Get Your FREE Playbook

👉 Visit Jugal Thacker’s LinkedIn

Send him a connection request and message “Playbook” to get your copy.

A quick word on digital assets. The 2025 IRS instructions now spell out that digital assets like crypto or NFTs are includible when the decedent owned them. Pull date stamped statements and independent pricing at the valuation date and add them to your exhibits list.

How To Value Schedule F Property The Right Way

You value everything at fair market value on the date of death, unless you elect alternate valuation. For common items you can use market guides or dealer letters. When in doubt, think about what a willing buyer would pay a willing seller, with neither required to act.

Appraisal triggers you cannot ignore

Here is the bright line most people miss. If any item, or a collection of similar items, is valued above 3,000, you must attach an expert appraisal under oath and a statement about the appraiser’s qualifications. That rule covers art, jewelry, coins, stamps, rugs, silver, antiques, and similar property. No shortcuts here, because this requirement is set in the regulations and repeated in the 2025 instructions.

Improve Margins Without Compromising Quality

Offshore staffing helps firms deliver more, scale faster, and stay compliant, without adding local headcount.

👉 Book a Discovery CallFor higher end art, you may optionally request an IRS Statement of Value before you file if a piece is appraised at 50,000 or more. This can help head off disputes on very expensive items, although there is a user fee and a specific submission process.

Evidence the IRS actually accepts

Use this quick guide to match asset types with supporting proof. Keep every exhibit date aligned with the date of death.

| Asset type | Primary evidence the IRS accepts |

| Household goods and personal effects | Expert appraisal when item or similar collection exceeds 3,000, list and describe items clearly |

| Art, jewelry, coins, stamps, rugs, antiques | Expert appraisal under oath plus appraiser qualifications when over 3,000, photos and provenance help |

| Ordinary vehicles | Dealer letter or recognized price guide showing make, model, options, mileage, and condition at the valuation date |

| Collectible or high value vehicles | Qualified appraisal plus appraiser credentials, include comps and market notes |

| Digital assets | Date stamped platform statements, independent pricing sources, wallet addresses, and cost basis if known |

| Farm products, crops, livestock, machinery | Farm appraiser report, recent sales, condition and hours of use |

| Rights, royalties, leaseholds | Agreements, 1099s, payment history, present value calculation with stated discount or capitalization rate |

We keep a simple rule when preparing exhibits. If a claim requires judgment, or the value can swing with expertise, we use a qualified appraiser and we document their credentials in the file. It saves time later.

High‑Value Collectibles, How To Keep Them Out Of Audit Trouble

When an estate has art, jewelry, coins, stamps, or rare books, Schedule F becomes the spotlight. The rule is crisp and it is easy to miss during a rush to file.

- If a single item is worth more than 3,000, attach a qualified appraisal and the appraiser’s credentials.

- If a collection of similar items exceeds 10,000, attach the appraisal for the collection and the appraiser’s qualifications.

- For very high end art or specialty pieces, include clear photos, provenance, bills of sale, and comparable sales. If a book value does not exist, the appraisal must explain the market and show comps.

Practical tip, photograph the item next to a slip with the decedent’s name and the date you inspected it. It helps anchor the file to the valuation date and avoids mix ups with look alike items.

A few judgment calls we handle early:

- When a car is collectible, do not rely on a generic price guide. Use a specialist appraiser who knows that market.

- When a collection is large, inventory it with a simple spreadsheet, description, source, and estimated value, then decide if the 10,000 rule is likely. Order the appraisal before you do the rest of the return, reviews go faster when the big items are locked.

- If the collection is split among heirs, still value it as of the date of death, then show post death allocations in your notes.

Reporting Financial Rights, Royalties, And Leaseholds On Schedule F

Rights and royalties look small on paper and big during an exam. Treat each one like a mini engagement.

What to list

- Music, book, and software royalties

- Oil, gas, and mineral interests that are contractual, not fee simple real estate

- Licensing income, franchise fees, and brand rights

- Leaseholds where the estate holds the tenant’s interest, or a leasehold created by contract that has resale value

Describe the asset so a stranger can identify it, then give the date‑of‑death fair market value and the method. If the income stream is material or volatile, use a present value model that ties directly to the contract terms.

Valuation documentation you should attach

| Requirement | Evidence you attach |

| Market based | Comparable sales or lease rates, a short memo explaining adjustments |

| Income based | Three to five years of history, forward projection, discount or cap rate, and your sources |

| Expert based | Appraisal report, appraiser’s qualifications, and a one page summary of methods |

Keep the math simple to follow. If you capitalize income, say so and show the rate. If you discount cash flows, list your assumptions. Label each exhibit with a short name that matches the line item on Schedule F.

Reporting procedures and clean exhibits

- List the contract name and parties, the effective date, the governing law, and any renewal options.

- Cross reference exhibits, for example “Exhibit R‑2, Royalty Contract, Track 1, 2019‑2024 Statements.”

- If the interest is inside a business, decide whether you are reporting the business as an unincorporated proprietorship on Schedule F or as a partnership on Schedule E. Do not split it across schedules unless the Form 706 instructions tell you to do that.

- For intellectual property, show how you derived the present value, then attach the agreement, the royalty history, and your rate support. Short, clear, and dated to the valuation date.

Business Interests And Sole Proprietorship Property

If the decedent owned an unincorporated business, Schedule F is where you list it. The key is to value what a buyer would pay for the business as of the date of death, then show the pieces that drive that total.

What to include

- Operating assets, inventory, cash on hand, receivables, and work in process

- Trade names, customer lists, small licenses, and informal rights that have value

- Liabilities that reduce equity, for example lines of credit, equipment notes, tax owed

If the proprietorship holds real estate, the Form 706 instructions tell you to keep that property inside the proprietorship on Schedule F, not to move it to Schedule A. This is where many returns go sideways, so map assets first, then pick the schedule.

Small checklist that prevents common mistakes

| Task | Risk if missed | Action you take |

| Map the business to Schedule F | IRS scrutiny | Inventory the business, then value it as of the date of death |

| Appraise complex interests | Adjustment on exam | Hire a business or farm appraiser for unique markets |

| Net out liabilities | Overvaluation | Show debt and attach statements as of the date of death |

| Include rights and intangibles | Underreporting | Add customer contracts, brand rights, and small licenses |

| Move trust assets to G | Double counting | If transferred to a revocable trust, report on Schedule G |

A quick story from the field

We reviewed an estate where the proprietorship’s farm equipment was listed on Schedule A with the decedent’s land, then again inside the business. The duplicate value was over six figures. The fix was simple, map assets to the right schedule, show a clean appraisal, and net the equipment loan. That saved time, fees, and a very tense call with the beneficiaries.

Motor Vehicles, Farm Assets, And Special Valuations

Vehicles are straightforward when they are ordinary and tough when they are not.

Valuing motor vehicles

- Use a dealer letter or a recognized guide, for example Kelley, and make sure it reflects make, model, options, mileage, condition, and location as of the date of death.

- If the vehicle is collectible or clearly above ordinary book pricing, get a qualified appraisal and include the appraiser’s credentials.

- If the vehicle sits inside a sole proprietorship, report it with the business on Schedule F and note your valuation method.

- For farm trucks and equipment used in a going concern, use a farm appraiser who understands local demand and seasonal price swings.

Special assets that need more than a guide

Guides help, but they do not capture rarity or provenance. For specialty autos, collections, or unusual machinery, rely on a qualified appraiser, show comparable sales, and explain condition and upgrades. If the item is part of a larger business, anchor it to that business valuation and avoid listing it twice.

When ordinary price guides do not reflect the market you are valuing, switch to a specialist appraisal and attach the expert’s qualifications. It saves you from explaining why a book price missed reality.

Insurance On Another’s Life, What To Attach, And How To Describe It

When the decedent owned a policy on someone else’s life, or was the beneficiary of such a policy and the proceeds are payable to the estate, list it on Schedule F at date‑of‑death value. Treat the insurer’s data as your primary evidence.

What to include and how to prove it

- Attach Form 712 for each policy. Confirm the insurer, policy number, face amount, cash surrender value, any outstanding loans, and the valuation date.

- Describe any incidents of ownership or assignments, for example the decedent’s right to change beneficiaries or to borrow, because those details affect inclusion and value.

- If a private contract or settlement changes value, add a short memo that explains the method the insurer used. When value is not straightforward, add an independent appraisal or a letter from the insurer.

Tip, request Form 712 early, week one of your engagement, since carriers can be slow and you do not want this to hold up filing.

If you conclude a policy is not includible, answer Schedule F’s questions, then add a short exhibit that explains the exclusion and points to your documents.

Future Interests, Reversionary, Remainder, And QTIP

Future interests count even if no one can touch the cash today. If the decedent owned it at death, list and value it.

What to identify

- Reversionary interests, where property could return to the decedent or the estate because the decedent was the original transferor.

- Remainder interests owned by the decedent in property someone else transferred.

- QTIP property under section 2044, included at full date‑of‑death value when the decedent held a qualifying income interest for life.

How to document and value

- Attach the governing trust or contract, highlight the relevant clauses, and include a timeline.

- If cash flows are predictable, use a present value method with clear inputs, life tables when needed, and your discount or capitalization rate.

- For QTIP, show the prior election and the marital deduction reference from the earlier return, then include the asset schedule supporting the current value.

When values are judgment heavy, order a qualified appraisal and include the appraiser’s credentials. Keep the math simple and reproducible.

Debts, Claims, Refunds, And Checks Payable To The Decedent

Schedule F also picks up amounts owed to the decedent at death. These items are easy to miss, then they snowball into correspondence later.

What belongs on the list

- Unpaid loans, promissory notes, and accounts receivable, show the obligor, principal, accrued interest if appropriate, and the fair market value at the valuation date.

- Refunds and overpayments, for example tax refunds, vendor credits, uncashed dividends, and posthumous royalties.

- Checks payable to the decedent, show the payer and the collectible amount. If received after death, note the receipt date in your file.

Attach ledgers, notes, court judgments, correspondence, and any policy statements that support amounts due. If collectibility is uncertain, include a short memo and any evidence for your haircut or reserve.

Safe‑Deposit Boxes, Documentation Discipline, And Avoidable Errors

Start Schedule F by answering the safe‑deposit box question. If a box exists, list the location and custodian, then inventory includible contents with specific descriptions and date‑of‑death values.

Field checklist that saves arguments

- Secure timely access, bring a witness, and photograph items as they are removed.

- Document cash, jewelry, stock certificates, deeds, policy documents, and similar assets.

- Explain any nonincludible items with ownership proof and keep copies in the file.

- If any item exceeds 3,000, or a collection exceeds 10,000, order a qualified appraisal and attach the appraiser’s credentials.

- If you find insurance documents, request Form 712 right away.

Two frequent mistakes, misclassifying assets held in a revocable trust that really belong on Schedule G, and failing to answer the safe‑deposit box question. Fix both before you finalize values.

Exhibits And Workpaper Structure The IRS Loves

The review goes smoother when your exhibits mirror the return lines. Use short names, clear dates, and consistent labels.

Sample exhibits list for a clean Schedule F

| Line item | Exhibit name | Contents |

| Jewelry, ring | J‑1 Appraisal, 06‑15‑2025 | Qualified appraisal, credentials, photos |

| Vehicle, SUV | V‑1 Dealer Letter, 07‑02‑2025 | Make, model, options, mileage, condition |

| Digital assets | D‑1 Wallet Statement, 05‑30‑2025 | Platform statement, independent pricing, addresses |

| Royalty interest | R‑2 Contract and PV Model | Agreement, history, projection, discount rate |

| Insurance, other’s life | I‑1 Form 712, Policy 123 | Carrier form, loan balance, CSV |

Aim for a one to one match between each Schedule F description and an exhibit. Reviewers move faster, and so does any future examiner.

Frequently Asked Questions

What is Schedule F on the estate tax return?

Schedule F is where you report non‑real‑estate property and miscellaneous rights that do not fit on other schedules. You list personal property, collectibles, vehicles, unincorporated business interests, rights, royalties, leaseholds, and amounts owed to the decedent, then support values with appraisals or other evidence when required.

Who needs to file Schedule F?

Any estate filing Form 706 that owns personal property, monetary claims, or miscellaneous interests should complete Schedule F. Even if you have no items to report, attach the schedule and answer its questions, then avoid moving revocable trust assets to Schedule F, those belong on Schedule G.

What counts as a “qualified appraisal” for Schedule F?

A qualified appraisal is prepared, signed, and dated by an appraiser with the education and experience to value that specific type of property. The report must show the date‑of‑death value and the method used, and you should include the appraiser’s credentials when an appraisal is required, for example any single collectible over 3,000, or a similar‑item collection over 10,000.

Where do I report insurance on someone else’s life?

On Schedule F. Attach Form 712 for each policy and describe any incidents of ownership or assignments. Insurance on the decedent’s own life is handled elsewhere, so check the Form 706 instructions before you place it.

Closing Checklist And A Note On Execution

- Inventory every item that is not reported on another schedule.

- Value at date‑of‑death fair market value, or alternate valuation if elected.

- Order qualified appraisals when single items exceed 3,000, or similar‑item collections exceed 10,000, and include appraiser credentials.

- Attach Form 712 for insurance on another’s life.

- Answer the safe‑deposit box question, document contents, and explain exclusions.

- Keep proprietorship real estate and equipment with the business on Schedule F, not Schedule A.

- Cross reference every item to an exhibit.

If your team is buried in production during filing season, and you want standardized workpapers, exhibit naming, and review‑ready files for Form 706 schedules, a disciplined delivery partner helps.

Accountably supports U.S. firms with structured offshore teams who work in your systems, your templates, and to your review standards, so your partners can focus on strategy while Schedule F lands cleanly and on time.

Simplify Delivery, Improve Margins, Stay in Control.

Offshore support that works exactly like your in-house team.

💼 Let’s Talk