Scale Your CPA Firm Without Adding Headcount

Build your offshore team that works your way, trained, compliant, and white-labeled under your firm.

👉 Book a Discovery Call

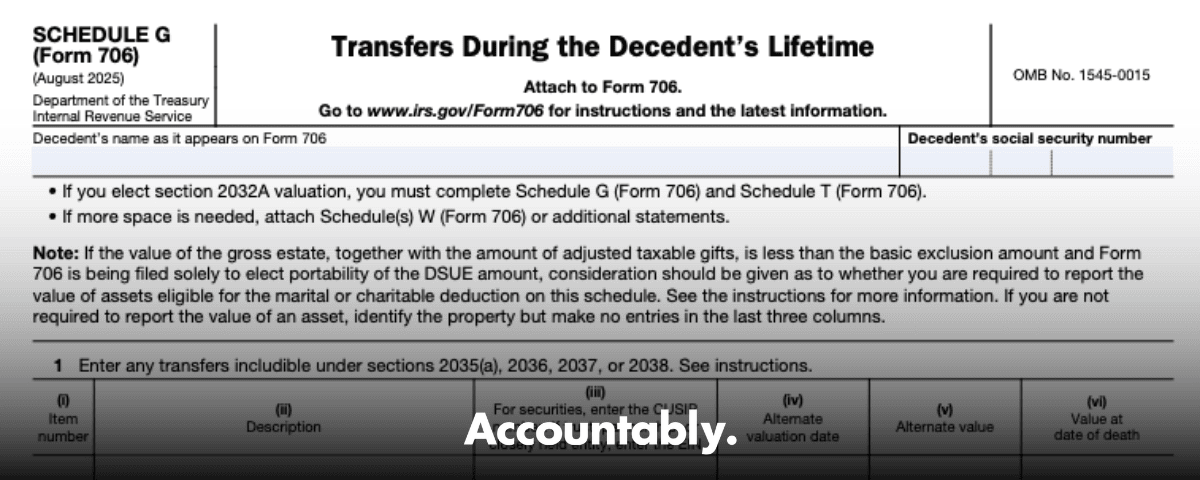

At most firms, the struggle is not finding clients, it is getting work out the door on time without review whiplash. Schedule G is where weak documentation, unclear review notes, or missing 709s turn into rework. This guide shows you how to treat Schedule G like a controllable workflow, not a last‑minute fire drill.

Key Takeaways

- Schedule G reports lifetime transfers that the Code pulls into the gross estate, mainly under §2035, §2036, §2037, §2038, and related rules for insurance incidents of ownership under §2042. You complete Schedule G when the decedent made transfers that trigger these sections, or when Form 706, Part IV, lines 12 or 13a are “Yes.”

- Within the three‑year window, certain items come back into the estate, including gift tax paid on gifts within three years, and some insurance or power releases. The includible amount is measured using date‑of‑death fair market value unless alternate valuation is properly elected.

- For each transfer, identify the transferee, date, description, value, consideration, and the exact retained right or power. Attach governing instruments for trust or written transfers, verified or certified where required.

- Reconcile Schedule G with every relevant Form 709, recompute adjusted taxable gifts for Part II, and make sure portability math and any DSUE entries line up in the return.

- Clean workpapers are everything. Label, index, and cross‑reference so a reviewer can trace a line item from the transfer instrument to the Schedule G row in under one minute.

- Use a standardized document pack, a two‑step internal QC, and turnaround SLAs for request lists so Schedule G never holds the filing hostage.

- When in doubt, disclose. A short statement that explains your conclusion for a gray‑area transfer is often the fastest path to a smooth acceptance.

Schedule G is a documentation test wrapped in a tax schedule. Win the paperwork, and the tax math follows.

What Schedule G Actually Does

In plain English, Schedule G lists lifetime transfers that the estate tax rules treat as still connected to the decedent at death. You report transfers within three years that pull back under §2035, and you report older transfers if the decedent kept a string, for example, a power to revoke, to change beneficiaries, to control enjoyment or income, which trigger §2036–§2038. Insurance can also land here through related ownership or power rules, even when it is not includible under §2042 on Schedule D.

Hundreds of Firms Have Already Used This Framework.

Join the growing list of CPA and accounting firms using Accountably’s Offshore Playbook to scale faster.

💬 Get Your FREE Playbook

👉 Visit Jugal Thacker’s LinkedIn

Send him a connection request and message “Playbook” to get your copy.

Your job is to describe each transfer, identify the recipient, explain any consideration, and show the includible amount using the valuation date rules that apply to the estate. If only part of a transferred asset meets a trigger, include only that part and explain your computation in the description or an attachment. If there is a written transfer instrument, attach a copy, certified or verified as appropriate.

How To Work Schedule G From Intake To Filing

Here is a field‑tested path that keeps you out of trouble and keeps reviewers happy:

1.Intake interview and inventory

Improve Margins Without Compromising Quality

Offshore staffing helps firms deliver more, scale faster, and stay compliant, without adding local headcount.

👉 Book a Discovery Call- Ask direct questions about any late‑life transfers, trust changes, policy assignments, loan forgiveness, and beneficiary changes.

- Build a chronological list of transfers by date, asset, recipient, and whether a power or string remained.

- Pull source documents fast

- Request every Form 709 since 1977, gift‑splitting elections, and allocation of GST exemption.

- Gather trust instruments and amendments, deeds, assignments, policy records, and bank proofs of consideration.

- If the transfer is on paper, plan to attach it to Schedule G per the instructions.

- Three‑year sweep

- Flag gifts, insurance changes, and power releases within three years of death.

- Confirm whether gift tax was paid within three years, since that specific tax amount has its own inclusion line on Schedule G.

- Retained‑interest screen

- For older transfers, check for rights to income, possession, or control, or a power to revoke or alter beneficial enjoyment. If a string exists at death, you likely have inclusion under §2036–§2038.

- Valuation choice

- Use date‑of‑death value unless the estate elected alternate valuation on Part III. If only a portion is includible, document the fraction and show the math.

- Reconcile to the tax computation

- Tie your Schedule G items to adjusted taxable gifts for Part II, line 4, and to the tentative tax base. Confirm portability math if the estate is electing DSUE.

Your Schedule G Document Pack

- Fully executed gift or trust instruments, plus amendments.

- All Forms 709 with schedules and any appraisals used.

- Insurance policies, Form 712s, and assignment paperwork when relevant.

- Appraisals or statements to substantiate value at transfer and at death.

- A one‑page mapping that links each transfer to a line on Schedule G and to the supporting document.

If a reviewer can find the instrument, the date, and the value in under sixty seconds, your workpapers are ready for prime time.

The Wow, Pro‑Level Insights That Prevent Exams

Here are patterns we see that save time and headaches.

- Insurance assignments with late premiums If the decedent assigned a policy and kept paying premiums near death, dig in. You may have a §2035 three‑year issue, or you may need to consider whether incidents of ownership or a power make it a §2036–§2038 problem. Tie payments to bank statements and match dates to the assignment.

- “Loans” that never acted like loans If there is a note with no payments and a last‑minute write‑off, expect gift characterization. If the release happened within three years, look for §2035 consequences that change Schedule G and the tax base.

- Power releases that came too late Relinquishing a power to revoke or alter within three years can still pull the property back. Confirm timing against the date of death, and attach the document that shows the release.

- Family entities where enjoyment never changed A transfer to an entity is not the end of the analysis. If the decedent still enjoyed the property or controlled distributions, §2036 may apply.

- Partial inclusion, not all or nothing Many reviewers lose time arguing absolutes. If only part of a transferred asset meets an inclusion rule, include that part and explain the fraction. The instructions anticipate this, and a brief note can save a round of questions.

Transfers Within Three Years Of Death

Start with the simple pass, a three‑year calendar sweep. Create a list of every transfer, assignment, forgiveness, or power change in that window. Tag each item as potentially includible, or as only relevant for adjusted taxable gifts. Then prove your conclusion with documents.

Key items to look for:

- Gift tax paid on gifts within three years, reported on the specific Schedule G line.

- Life insurance transfers or power changes, especially if the decedent kept any control or paid premiums.

- Releases of a power to revoke, to alter enjoyment, or to change beneficiaries.

- Transactions that look like gifts on cleanup, for example, forgiving a child’s note a few months before death.

Life Insurance Specifics That Touch Schedule G

Not all insurance is only a Schedule D story. Policies can be includible because of retained rights or powers tied to §2036–§2038, even if §2042 does not apply. Always request Form 712 and the assignment history, then decide whether the right place is Schedule D, Schedule G, or both.

Practical steps:

- Confirm who owned the policy just before death, who could change beneficiaries, and who could borrow or surrender.

- Tie every change in ownership or power to a dated instrument.

- If the transfer or power change is within three years, analyze §2035 treatment and value at death.

Releases Of Powers

If the decedent gave up a power to revoke or alter enjoyment within three years, you likely have Schedule G inclusion. Capture the exact date of the release, the governing section, and the property affected. Attach the instrument that evidences the release and show your date‑of‑death value if includible.

Retained Interests And Revocable Transfers

Even years‑old transfers belong on Schedule G if the decedent kept a string. Classic triggers include a revocable trust under §2038, a retained life estate or income right under §2036, or certain reversionary interests under §2037. Spell out the retained right and the property affected.

Spotting The Strings, Fast

- Did the decedent keep the right to revoke, amend, or direct distributions, even jointly with another person.

- Did the decedent keep the right to income, rents, or use of the property.

- Did the decedent keep decision power that affects who benefits or when. If any answer is yes, you likely have inclusion. Explain the right clearly in your description and include the governing document.

Common Trust Types You Will See

- Revocable living trusts, almost always includible under §2038.

- Grantor trusts that were effectively controlled, which may trigger §2036 if enjoyment never really changed.

- Split‑interest trusts where the decedent held a life interest, a term annuity, or a similar benefit that continued to death.

The earlier you isolate the exact right that remained with the decedent, the faster your reviewer will sign off.

Reporting Requirements And Documentation, What To Include And How To Prove It

Schedule G is only as strong as its paper trail. Treat every entry like you are teaching a new reviewer how you got there. You want a clear description, the Code trigger you relied on, and documents that speak for themselves.

Core Data Points For Each Transfer

- Date of transfer and a simple title, for example, 5,000 shares of ABC, Inc., revocable trust funding.

- Transferee’s full legal name, address, and tax ID if available.

- Property description, valuation method, and value at transfer.

- Any consideration paid, with copies of checks or wires.

- The exact retained right or power, and the section you believe applies, for example, §2036 income right, or §2038 power to revoke.

- If within three years of death, a clear note that this item is part of the three year sweep.

The best description reads like a workpaper caption. A reviewer should know what happened, why it matters, and where to find the proof.

Attachments That Cut Review Time

- Executed gift instruments, trust agreements, deeds, assignments, and amendments.

- All relevant Forms 709 and appraisals used when the gift was reported.

- Policy records, Form 712, and any assignment or beneficiary change for insurance.

- Brokerage or bank statements for value and consideration.

- A one page mapping that ties each Schedule G entry to the exact document tab.

Identifying Transferees And Valuation Details

Precision here avoids questions later. Record the right names, show value clearly, and explain how much is actually includible when only part of a transfer is subject to the rule.

Transferee Checklist

- Full legal name and mailing address.

- Relationship to the decedent.

- SSN or EIN if you have it.

- For trusts, list the formal trust name, the trustee, and a short description of beneficiary classes.

- For entities, record entity type, EIN, and a list of beneficial owners if relevant to inclusion.

Valuation Notes That Keep You Safe

- Identify the valuation date you used, date of death or alternate valuation.

- Name the method, for example, quoted market price, appraisal, or capitalized cash flow.

- If you included only a portion, show the fraction and basic math in the description, and put the full computation in the workpapers.

Quick Reference Table

| Required detail | Why it matters | Where it goes |

| Full identity of transferee | Matches to Form 709 and confirms relationship | Description box and workpapers |

| Exact dates | Three year test and statute support | Description and timeline |

| Property facts | Confirms what moved and what stayed | Description and attachments |

| Valuation method | Supports includible amount | Description and valuation tab |

| Retained right or power | Establishes Code trigger | Description with Code citation |

Transfers Within Three Years, A Focused Workflow

The three year lookback is where surprises hide. Build a simple two pass process.

Pass One, Calendar Sweep

- Pull a list of gifts, assignments, power releases, policy changes, and debt forgiveness in the three years before death.

- Mark each item as potentially includible, only an adjusted taxable gift, or unrelated.

Pass Two, Document To Decision

- Pull the governing paper for every flagged item.

- Decide the section, the includible amount, and the valuation date.

- Write one short sentence in the description to explain your conclusion.

- If uncertain, disclose and attach the doc. A brief explanation is faster than a later inquiry.

Retained Interests And Revocable Transfers, Getting Specific

If the decedent kept any string, spell it out. Words like control or enjoy are too vague. Say exactly what remained.

Examples Of Clear Strings

- Right to revoke or amend distributions under a trust, a classic §2038 trigger.

- Right to income or possession for life, often §2036.

- A reversionary interest that depended on surviving a beneficiary, the §2037 pattern.

- Insurance incidents of ownership or the ability to change beneficiaries, often analyzed with §2042 in view.

Describe The String Like This

- “Decedent retained a power to revoke in Article V until death. §2038 inclusion. Entire trust includible at date of death value.”

- “Decedent retained a right to net income for life under Section 2, paragraph b. §2036 inclusion. Asset value included less the actuarial remainder as shown in attached worksheet.”

- “Decedent released power to amend on March 3, 2024. Death on January 10, 2025 within three years. §2035 consideration applied. See attached release.”

Clarity earns speed. The more precise the string, the faster your senior reviewer moves on to the next schedule.

Coordination With Forms 709 And Adjusted Taxable Gifts

Your Schedule G must match the donor’s gift history. Reconcile before you compute the estate tax base so you avoid rework and phone calls after filing.

A Straightforward Reconciliation Process

- Inventory every Form 709 filed since 1977. Note gift splitting elections and GST allocations.

- Build a worksheet of post 1976 gifts that remain as adjusted taxable gifts, which flow to Form 706 Part II.

- Tie each Schedule G entry back to the original 709 where reported. Confirm descriptions, values, and whether later appraisals changed your view.

- Recompute adjusted taxable gifts, then compare to your estate tax computation and DSUE entries.

- If the estate elects portability, confirm the prior DSUE reported on any earlier estate return for a predeceased spouse, and document how this return will report the new DSUE, if any.

Gift Splitting And Spousal Coordination

If the decedent split gifts with a spouse on Form 709, your numbers must reflect that history. Verify agreements, community property factors where relevant, and any surviving spouse elections. If the spouse is the personal representative, align signatures and statements in the return to avoid a simple but frustrating mismatch.

Common Pitfalls And Inclusion Triggers

Here are the traps we see most.

- Revocable trust funded over many years with a late power release. If the release is inside three years, you may still have inclusion.

- Notes to family members that never had a payment history, followed by forgiveness in the last year. Treat it like a gift and check §2035.

- Entity transfers where the decedent still directed distributions, controlled redemptions, or kept personal use of property. That looks like §2036.

- Insurance owned by an irrevocable trust but with a retained ability to change beneficiaries or borrow. Review the precise powers and the policy file.

- Partial inclusion missed. For example, a one half interest transferred years ago with a retained income right in only that half. Include the half, not the entire asset, and show the reasoning.

When something looks like control, put the instrument on the table and quote the actual clause. The clause is your best friend.

Impact On Gross Estate And The Tax Computation

Schedule G entries change the estate tax base in real dollars. They influence the gross estate, adjusted taxable gifts, tentative tax, unified credit used, and DSUE.

The Math, In Plain Steps

- Determine what is includible at date of death value, or alternate valuation if elected.

- Add adjusted taxable gifts to the gross estate to compute the tentative tax base.

- Compute tentative tax, subtract credits including the unified credit, and factor in credit for gift taxes paid when appropriate.

- Confirm math on portability if elected, so DSUE is neither overstated nor left on the table.

Three Year Lookback Effects, A Handy Table

| Item to review | What to document | Where it flows |

| Gift tax paid within three years | Payment proof, gift detail | Specific line on Schedule G and credit coordination |

| Insurance transfer or power change | Policy, dates, rights held or released | Schedule G description and valuation |

| Power to revoke or alter, released within three years | Release instrument, date | Schedule G inclusion analysis |

| Debt forgiveness that acts like a gift | Note, payment history, release | Schedule G if within three years, or adjusted taxable gifts |

| Post 1976 gifts | 709 schedules, appraisals | Form 706 Part II, adjusted taxable gifts |

A Brief Note On Process And People

Most firms know the rules. Where they lose time is process. Schedule G touches documents from multiple sources, often late in the engagement. A simple checklist, a naming standard for files, and a two stage review reduces revisions. If your team is buried in production during peak season, consider building a controlled delivery lane just for Schedules that drive tax math, including Schedule G, Schedule M, and Schedule O. A predictable lane keeps partners out of endless review loops and protects deadlines.

One hour invested in a standardized document pack can save a full day of downstream rework on a complex estate.

Practical Tips, Recordkeeping, And A Reusable Workflow

You do not need a bigger return room. You need a cleaner path.

The Schedule G Worksheet Your Team Can Reuse

- A chronological log of transfers, with columns for date, asset, recipient, value, consideration, code section, and includible amount.

- A link column that points to the exact page in the PDF binder where the proof lives.

- A status column for open items, for example, waiting on Form 712, or valuation pending.

- A reviewer note column that explains conclusions in one sentence.

Naming Standards That Reviewers Love

- 2023 07 15 Trust Amendment Article V, power to revoke removed, certified copy.pdf

- 2022 03 10 Policy 712, Northwestern 1234567, ownership history page 3.pdf

- 2019 12 31 Form 709, Schedules A and B, appraisals bundle.pdf

Internal QC Before The Partner Review

- Confirm every Schedule G entry ties to a document, a valuation note, and a clear Code trigger.

- Refoot the worksheet to the Schedule G total and to Part II adjusted taxable gifts.

- Read descriptions out loud. If the story is not obvious to a new person, rewrite it.

FAQs, Straight Answers In A Few Lines

What is Schedule G on Form 706

Schedule G reports lifetime transfers that are pulled into the estate tax base, including transfers within three years, and transfers with retained rights like the power to revoke or the right to income. You list each transfer, show value, cite the section, and attach the governing document.

How do I know if a transfer goes on Schedule G or just into adjusted taxable gifts

Ask two questions. Did the decedent retain a right or power that lasted to death, or release it within three years. If yes, you likely have Schedule G. If not, it may only affect adjusted taxable gifts in Part II. When unsure, disclose briefly and attach the instrument.

Do life insurance policies always go on Schedule G

No. Insurance is often handled on Schedule D under §2042 when incidents of ownership were held at death. It can also appear on Schedule G when a transfer or power release within three years, or a retained right under §2036 or §2038 makes the policy includible. Pull Form 712 and the assignment history before you decide.

What documents must I attach

Attach written transfer instruments, trust agreements and amendments, policy records, and any Form 709 that explains the gift. Include appraisals or statements that support value. If a document explains your conclusion in one paragraph, attach it.

How does Schedule G affect portability and DSUE

Schedule G items raise or confirm the tax base that drives the computation. That math can change the available unified credit and any DSUE reported on the return. Reconcile adjusted taxable gifts and confirm prior portability entries before you finalize the return.

Where Accountably Fits, Only When It Helps

If your bottleneck is delivery, not knowledge, a controlled offshore lane can stabilize peak season. Accountably integrates trained offshore teams into your workflow, with standardized workpapers, layered review, and turnaround SLAs that cut revision cycles on schedules like G. This is not a staffing resume drop, it is a delivery system that protects quality and keeps partners focused on client strategy.

Closing Thoughts And A Simple Call To Action

Schedule G is less about tax theory and more about telling a clear story, who received what, when it moved, what value you used, and which string remained. If you keep those five facts tight, your tax math follows and your review time drops.

Start small. Build a one page Schedule G worksheet, a short request list, and a clean naming standard. Then use them on every estate. Consistency beats heroics.

If you want a second set of eyes on your Schedule G workflow, or you are ready to set up a stable delivery lane for estate schedules, our team can help you design the structure and the document pack.

Simplify Delivery, Improve Margins, Stay in Control.

Offshore support that works exactly like your in-house team.

💼 Let’s Talk