Scale Your CPA Firm Without Adding Headcount

Build your offshore team that works your way, trained, compliant, and white-labeled under your firm.

👉 Book a Discovery Call

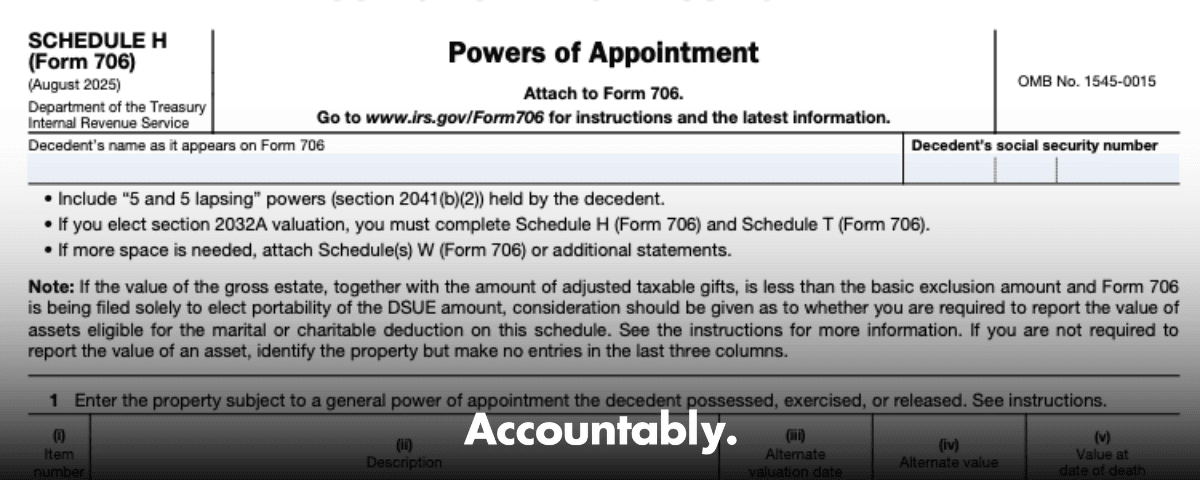

If that sounds familiar, this guide is for you. You will learn exactly what belongs on Form 706 Schedule H, how to spot a general power of appointment fast, how to document your position, and how to avoid duplicate reporting with other schedules. I will point to the governing code and IRS instructions so you can close files with confidence.

Schedule H is short, but it can change the taxable estate. Treat it like a pressure gauge, not a checkbox.

Key Takeaways

- Schedule H reports property includible in the gross estate because the decedent held a general power of appointment.

- A general power exists if the power could be exercised in favor of the decedent, the decedent’s estate, the decedent’s creditors, or the creditors of the decedent’s estate.

- Limited or special powers that are barred from benefiting the decedent do not belong on Schedule H. An ascertainable standard tied to health, education, support, or maintenance keeps a power from being “general.”

- Report only property actually subject to the general power at death, and account for any partial exercises, releases, or lapses, including the 5,000 or 5 percent lapse rule.

- Keep your return aligned, coordinate with Schedules G, M, and R, and document how you valued the assets and why the power is general, not limited.

What Schedule H Covers On Form 706

Form 706 Schedule H asks you to identify and value assets that come into the estate because the decedent held a general power of appointment. In practical terms, this is any power the decedent could use to direct property to themselves, to their estate, or to the estate’s or personal creditors. That definition comes straight from section 2041, and it is the hinge for Schedule H.

Hundreds of Firms Have Already Used This Framework.

Join the growing list of CPA and accounting firms using Accountably’s Offshore Playbook to scale faster.

💬 Get Your FREE Playbook

👉 Visit Jugal Thacker’s LinkedIn

Send him a connection request and message “Playbook” to get your copy.

Two common situations trigger inclusion:

- The decedent held a broad lifetime or testamentary power to consume, invade, or appoint trust principal for their own benefit.

- The decedent exercised or released a general power before death in a way that would have made the property includible if they had owned it outright, such as a transfer with a retained life interest or one taking effect at death.

When you include property on Schedule H, you still apply normal valuation rules. Use fair market value at the date of death, or use the alternate valuation date if you have made that election for the return, and attach support.

Definition first, documents second, valuation third. If you follow that order, Schedule H reviews move faster and with fewer comments.

Improve Margins Without Compromising Quality

Offshore staffing helps firms deliver more, scale faster, and stay compliant, without adding local headcount.

👉 Book a Discovery CallQuick Test, Is This A General Power

Here is a field test your seniors can run in minutes. It keeps review notes short and clear.

- Could the decedent appoint the property to themselves, to their estate, or to either set of creditors. If yes, it is a general power, include on Schedule H.

- Is the power limited by an ascertainable standard for health, education, support, or maintenance. If yes, it is not a general power, exclude, and cite the standard in your workpaper.

- Is the decedent’s power exercisable only with the person who created the power, or only with an adverse party who has a substantial interest. If yes, it is not a general power. Document the joint holder and why their interest is adverse.

- Did the decedent hold the power as a trustee. Trustee status alone does not save it. Look at what the instrument actually permits. If the trustee can distribute for the trustee’s own benefit without a true limit, that can still be a general power.

What To Include, What To Leave Out

Use the table below when you prepare the folder cover sheet for Schedule H. It keeps the team aligned and prevents double counting with other schedules.

| Item | Include on Schedule H | Why |

| Broad power to appoint to self, estate, or creditors | Yes | Classic general power under IRC 2041. |

| Power limited by health, education, support, or maintenance | No | Ascertainable standard, not a general power. |

| Power exercisable only with the donor | No | Not a general power when joint with creator. |

| Power exercisable only with an adverse party | No | Adverse party exception applies. |

| Lapse of a withdrawal right | Maybe | Include only beyond the greater of 5,000 or 5 percent of trust value at lapse. |

| Property affected by a pre‑death release or modification | Maybe | Include if the release or exercise would make it includible as if owned. |

A Short Example You Can Recognize

- Mom is income beneficiary of a family trust. The trust lets her appoint principal to herself for any reason, and by will to anyone. That is a general power. Report trust assets subject to the power on Schedule H at fair market value.

- Same facts, except distributions to Mom are limited to amounts needed for health, education, support, or maintenance. That is not a general power. Do not include on Schedule H, document the standard in the file.

When a file has both powers across different trusts, split your workpapers and label them so the reviewer does not have to hunt for the right instrument. That small move saves real time when deadlines are tight.

Identifying General Powers Of Appointment With Confidence

You already know the definition. Now apply it to common edge cases that trip up returns.

Withdrawal Rights And The 5 And 5 Rule

Crummey‑style withdrawal powers can lapse each year. A lapse is treated as a release, but only beyond the greater of 5,000 or 5 percent of the value of the assets subject to the power at the time of lapse. When you are preparing Schedule H for a decedent who had standing withdrawal rights, calculate the lapse amounts over the threshold and include only the portion that crosses that line. Keep the math and the trust balance schedule in the workpapers.

Joint Powers And Adverse Parties

If the decedent could act only with the person who created the power, the power is not general. The same is true when the decedent could act only with a person who holds a substantial, adverse interest in the property, for example, a remainder beneficiary who would lose value if the decedent appointed the property away. Note that if, after applying those rules, the power is still general and is exercisable in favor of that other person, the statute treats inclusion on a fractional basis. Cite section 2041 for your position.

Trustee Powers, Titles Do Not Control

Do not assume trustee title protects the decedent. The question is what the instrument allows. If a trustee who is also a beneficiary can distribute to themselves without a true limit, that can be a general power. Regulations and IRS guidance have treated these as powers of appointment in substance, which means they can pull assets into the estate.

Pre‑Death Exercises, Releases, Or Modifications

If the decedent exercised or released a general power before death, you still may have inclusion on Schedule H if the action mirrors a transfer that would be includible for an owner, such as a transfer with a retained life interest or one taking effect at death. That instruction appears in the IRS guidance for the schedule. Your memo should quote the relevant paragraph and map the facts.

Documentation And Valuation, What Reviewers Expect To See

You will value assets on the date of death unless you elected alternate valuation, in which case you will price each item under that election. Attach appraisals for real property and closely held business interests, broker statements for marketables, and any actuarial schedules for split interests. This is the same approach you use across Form 706, and the instructions for 706 and 706‑NA reinforce it.

Build a simple workpaper stack for Schedule H:

- Cover sheet with the yes or no test, cite IRC 2041 and the specific trust clause.

- Copy of the governing instrument with tabs to the power language.

- Valuation support, date of death or alternate date, with a short paragraph on method.

- Exercise, release, or lapse documentation, with the 5,000 or 5 percent calculation if relevant.

- Cross‑references to Schedules G, M, and R where you carry values or deductions to avoid duplication.

A two‑page memo beats a trail of sticky notes. Explain what the power is, why it is general or not, what you valued, and where you carried the number.

Avoid The Classic Pitfalls

- Treating an HEMS clause as if it were broad discretion. HEMS is an ascertainable standard, so it usually prevents inclusion as a general power. Cite it and move on.

- Missing fractional inclusion when a joint power is exercisable in favor of another person. The statute can force a fractional approach, so read the joint power carefully.

- Forgetting the lapse threshold on withdrawal rights. Only amounts over 5,000 or 5 percent produce release treatment for Schedule H inclusion.

- Double counting with other schedules. Keep your recapitulation clean by linking Schedule H lines to the recap and to Schedules G, M, and R.

Fill‑Out Steps You Can Hand To A Senior

- Answer Part 4, Question 14 on Form 706. If yes, complete Schedule H.

- For each power, list the instrument, date, and a short description of the property subject to the power.

- Show the includible portion, net of any pre‑death exercise or release, and attach support.

- If the return is being filed only to elect portability and the special rule of Regulations section 20.2010‑2(a)(7)(ii) applies to assets on Schedule H, do not enter values in the last three columns, and follow the recapitulation item 10 instruction. This is an uncommon case, but when it applies, it changes how you present values on the recap.

Coordination With Other Schedules

- Schedule G, Pre‑death transfers. If a pre‑death exercise or release of a power mirrors a transfer that would be includible for an owner, the instructions say to treat it as includible. Your Schedule H disclosure should reference the related Schedule G item if you cross reference any details there.

- Schedule M, Marital deduction. Be clear when a trust with a spouse beneficiary uses a limited power that preserves the marital deduction versus a broad power that might change inclusion. Keep your deduction math aligned with your Schedule H position, and describe the trust terms briefly in your memo.

- Schedule R, GST. A misread power can ripple into GST exposure and allocation choices. If you carry values to Schedule R, note it on your Schedule H cover sheet so reviewers see the connection.

Planning Notes You Can Use In Client Meetings

- Be intentional with power language in new trusts. If the settlor wants flexibility without estate inclusion, tie distributions to a real HEMS standard and keep the beneficiary off distribution decisions for their own benefit. That keeps you out of general power territory.

- Watch trustee selection. Giving a beneficiary broad distribution power while serving as trustee can create a general power in substance, not just on paper. Adjust the document or delegate discretion to a truly independent fiduciary.

- Track Crummey powers over time. Your future Schedule H analysis is only as good as the historical lapse records. Keep yearly values and notices in one place so you can apply the 5,000 or 5 percent threshold accurately.

FAQ, Short And Direct

What exactly belongs on Form 706 Schedule H

Property the decedent could appoint to themselves, their estate, or their creditors because they held a general power of appointment. Include the asset’s value, describe the instrument, and explain any exercise, release, or lapse.

How do I know if a power is not general

If distributions are limited by an ascertainable standard tied to health, education, support, or maintenance, the power is not general. Also, powers exercisable only with the donor or with an adverse party are not general.

Do lapses of withdrawal rights always cause inclusion

No. A lapse is treated as a release only beyond the greater of 5,000 or 5 percent of the property subject to the power at the time of lapse. Include only the excess. Keep the calculation in your file.

Which valuation date should I use on Schedule H

Use date‑of‑death value unless you elected the alternate valuation date for the entire return, in which case apply the election consistently and support the pricing.

Any special instruction I could miss on a portability‑only return

Yes. If the special rule in Regulations section 20.2010‑2(a)(7)(ii) applies and you report assets on Schedule H, the instructions say not to enter values in the last three columns for those items and to follow the recapitulation guidance.

A Simple Checklist For Your Next File

- Identify every instrument with appointment language, tag the clauses, and run the quick test.

- Decide, general or limited, and write two sentences that cite the authority.

- Value the assets, date of death or alternate date, and attach support.

- If there was a lapse, exercise, or release, compute the includible portion and keep the math.

- Cross‑check Schedules G, M, and R so you do not double count.

Where Accountably Fits, If You Need Help

Most firms do not struggle for lack of clients. The bottleneck is delivery quality and review time. If your team loses hours each season arguing over Schedule H classifications, standardized workpapers, clear SOPs, and layered review fix that. This is the kind of controlled offshore delivery work our team at Accountably builds, so your partners spend less time in review and more time on strategy. Keep mentions light, keep the workflow strong, and get the return out the door.

Final Word

When you treat Form 706 Schedule H as a focused analysis, not a formality, review friction drops and audit readiness improves. Use the statute for definition, use the instructions for process, document your call, and align your schedules. Do that, and the late‑night debates turn into quick sign‑offs.

Small note on freshness, This guide cites the IRS’s 706 instructions published in October 2024 and section 2041 as of 2023, both current as of October 24, 2025. Always check the latest instructions with each filing season.

Simplify Delivery, Improve Margins, Stay in Control.

Offshore support that works exactly like your in-house team.

💼 Let’s Talk