Scale Your CPA Firm Without Adding Headcount

Build your offshore team that works your way, trained, compliant, and white-labeled under your firm.

👉 Book a Discovery Call

Schedule J is less about forms, more about proof. When you show that an expense is reasonable, necessary, allowed by local law, tied to property subject to claims, and properly netted, you keep the deduction.

Key Takeaways

- Schedule J is where you deduct funeral and administration expenses that relate to property subject to creditors’ claims, and only to that extent. Expenses connected to property not subject to claims move to Schedule L.

- The deduction is capped by the value of property subject to claims plus amounts actually paid from other gross‑estate property by the return due date.

- Net reimbursements, for example the SSA one‑time death payment of 255, before you total funeral expenses. Keep invoices and proof of payment.

- Use Schedule PC for protective claims when §2053 items are unsettled, and coordinate updates with a supplemental Form 706 or Form 843 when the claim resolves.

- Do not double deduct administration expenses on Form 706 and Form 1041. Funeral costs are only deductible on the estate tax return.

What Schedule J is for and when it applies

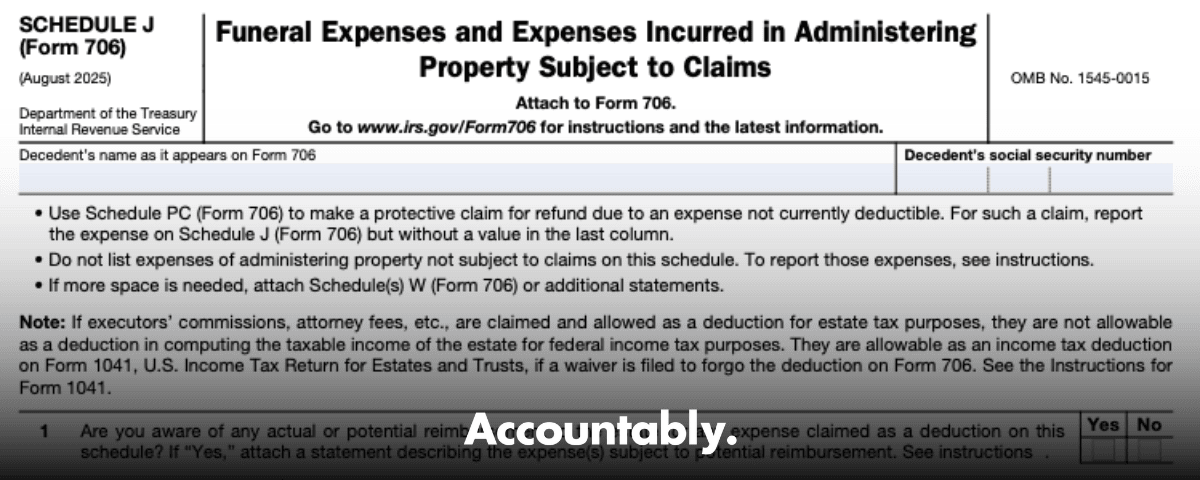

Form 706 computes the estate tax, and Schedule J narrows the base by itemizing deductible funeral and administration expenses that are both reasonable and necessary, that are allowed under local law, and that are attributable to property subject to claims. You complete Schedule J if you claim a deduction on Form 706, Part V, item 14.

Two ideas drive Schedule J:

Hundreds of Firms Have Already Used This Framework.

Join the growing list of CPA and accounting firms using Accountably’s Offshore Playbook to scale faster.

💬 Get Your FREE Playbook

👉 Visit Jugal Thacker’s LinkedIn

Send him a connection request and message “Playbook” to get your copy.

- What counts. Funeral costs and administration expenses like executor, attorney, accountant, appraisal, court, and certain carrying costs, provided local law allows them and the items are tied to property subject to claims.

- Where it counts. Expenses for property not subject to claims do not belong on J. They belong on Schedule L. If you are dealing with debts and liens, that is Schedule K.

The cap and the “property subject to claims” test

Your total deduction on J cannot exceed the value of property subject to claims included in the gross estate, plus the amount actually paid out of other gross‑estate property by the Form 706 due date. Whether an asset is subject to claims depends on applicable local law. In plain terms, ask which assets would bear the burden of paying these expenses in the final settlement. That answer sets your ceiling.

Quick map of where expenses land

| Item or context | Subject to claims? | Put it on |

| Probate real estate, sole‑name cash | Usually yes | Schedule J |

| Revocable trust assets at death | Often no | Schedule L |

| POD or beneficiary‑designated accounts | Often no | Schedule L |

| Debts of decedent, mortgages | N A | Schedule K |

Always tie your classification to your state’s statutes and probate practice notes, then document it in the file. The IRS will look at the classification and the cap.

Funeral expenses, what to deduct and how to document

On Schedule J line 2, list each funeral charge with payee name, address, description, and amount. Then reduce each item by reimbursements, for example the SSA lump‑sum death payment of 255 or VA benefits, and show the net deductible amount. Keep invoices, contracts, and proof of payment. If you are still waiting on a final bill, use a supported estimate and label the line as paid, agreed, or estimated.

Improve Margins Without Compromising Quality

Offshore staffing helps firms deliver more, scale faster, and stay compliant, without adding local headcount.

👉 Book a Discovery CallTypical line items you can list and support:

- Funeral home professional services, embalming, casket, burial vault, crematory fees, flowers, obituary notices, cemetery plot or marker, and related required charges, all net of reimbursements.

- Reasonable costs authorized by local practice, paid from estate funds, that are necessary to complete disposition. Document scope of services and timing.

Avoid adding family travel or reception costs, which are usually non‑deductible personal expenses. When in doubt, document local law and keep it off Schedule J unless you can show necessity and allowance under that law.

Tip, net first, then total. Schedule J expects you to subtract reimbursements from each funeral item before you carry totals. It keeps the math clean and the audit shorter.

Administration expenses that belong on Schedule J

After funeral costs, itemize administration expenses connected to property subject to claims. This commonly includes executor commissions, attorney fees, accountant fees, appraisal fees, court costs, and necessary carrying costs like insurance or utilities on probate real estate during administration. List the payee, address, nature of the expense, amount, and status, paid, agreed, estimated, and support with engagement letters, fee schedules, orders, or invoices.

Two guardrails matter here:

- No double dipping. If you deduct administration expenses on the estate tax return, you cannot also deduct them on the estate’s Form 1041. Funeral expenses are only deductible on the estate tax return.

- Stay within local law and practice. What is reasonable depends on the size and character of the estate and your state’s allowances. Document both.

Executor, attorney, and accountant fees, how to keep them allowed

Executor commissions. Show the computation, cite any will provisions setting compensation, and confirm it falls within local statutory or customary ranges. If the executor is a non‑professional and fees exceed 10,000, the IRS may solicit Form 4421 to substantiate commissions and attorney fees. Keep a signed declaration ready if requested, along with a running ledger of time and services.

Attorney fees. Deduct amounts actually paid or reasonably expected for estate administration, including probate work and Form 706 preparation. Substantiate with fee agreements, court approvals if applicable, billing detail, and status notes. If fees are not final by examination, the IRS may accept supported estimates, subject to later reconciliation.

Accountant fees. Deduct work tied to administering property subject to claims, for example fiduciary accounting, 706 calculations, valuation support, and related tax advice. Keep engagement terms and itemized invoices that tie the work to the estate’s administration, not to beneficiary‑specific planning.

Guardrail, commissions and fees deducted on 706 cannot also be deducted on 1041. Choose the return that fits your strategy and document the choice in the file.

Other allowable costs, appraisals, court fees, maintenance, and interest

Appraisal fees. Include the appraiser’s name, credentials, purpose, valuation date, and the property covered. Make sure the appraisal fits the return’s valuation method, date of death or alternate valuation date, and file timing.

Court costs. Filing fees, certified copies, publication costs, and guardian ad litem charges are typical where required by the proceeding. Tie each fee to the case docket.

Maintenance and insurance. Deduct reasonable carrying costs paid from estate funds to preserve property subject to claims during administration, for example utilities, ordinary repairs, hazard insurance, and property taxes that come due in the administration period. Keep invoices and dates.

Post‑death interest. Interest may be deductible if local law permits and the amount is reasonable. Document the creditor, the rate, the accrual period, and the authority that makes the payment necessary to administer the estate.

Property subject to claims versus not subject to claims, and why it changes schedules

Start every Schedule J build by mapping the estate. Which assets would bear these expenses under local law, that is, which assets are subject to claims. Those expenses go on J, subject to the cap. Expenses tied to property that is not subject to claims belong on Schedule L. If you are dealing with debts, mortgages, or other claims against the decedent, that is Schedule K.

At‑a‑glance placement table

| Asset or cost | Likely schedule | Note |

| Probate real property insurance and utilities during administration | J | Tie to property subject to claims under state law. |

| Trustee fee paid by a revocable trust at death | L | Trustees’ commissions do not go on J. If paid in administering property not subject to claims, use L. |

| Appraisal fee for probate assets | J | Connect to the specific assets and the valuation date. |

| Bank loan interest incurred to pay estate tax | K or J | Interest on certain obligations may be deductible; document purpose and authority. |

Using Schedule PC for protective claims, and keeping refund rights open

When an expense is not currently deductible under §2053, for example a claim that is unresolved or contingent, file Schedule PC with the original Form 706 as a protective claim. On the affected schedule, such as J or L, list the item without an amount in the last column. Schedule PC preserves the refund while the claim matures.

When the contingency resolves, you have two paths within 90 days of payment or final determination, whichever is later. Either file a supplemental Form 706 with an updated Schedule PC and the schedules affected, checking Part I, lines 13 and 14a, and entering the filing date of the initial protective claim on line 14b. Or file Form 843 marked as a notification that the protective claim is ready for consideration. Include substantiation in either case.

Good news, ancillary expenses like attorneys’ fees, court costs, appraisal fees, and accounting fees that relate to resolving the protected claim are presumed included if the Schedule PC adequately identified the claim. Each still must meet §2053 requirements.

Netting reimbursements correctly

Social Security’s one‑time death payment is 255 for eligible survivors. If the estate paid funeral expenses, net that reimbursement against the relevant funeral items before you total. Keep the SSA acknowledgment or payment record in the file. If the VA pays a burial allowance, net that too.

Reporting mechanics, how to complete Schedule J cleanly

- Use Schedule J to list funeral expenses and administration costs tied to property subject to claims, then carry totals to Form 706, Part V, item 14. If you need more lines, use Schedule W and label it as a continuation for Schedule J.

- For unsettled §2053 items, include the entry on the right schedule without an amount in the last column, and attach Schedule PC to preserve a refund claim. If you file the initial notice after the original return, use Form 843.

- Do not list expenses for administering property not subject to claims on J. Move them to Schedule L and apply the same documentation standard.

A simple three‑step workflow you can reuse

- Map the estate. List assets subject to claims under local law and those that are not. Flag any debts and liens for Schedule K.

- Build J and L side by side. Itemize, attach proof, net reimbursements, and mark each line as paid, agreed, or estimated.

- Protect the gray areas. If a claim is not yet deductible, file Schedule PC with the return and circle back with a supplemental 706 or Form 843 when resolved.

Documentation standards and common pitfalls

The IRS tests three things first, necessity, reasonableness under local law, and whether the expense relates to property subject to claims. Build your file around those questions and you will pass most reviews quickly.

Avoid these missteps:

- Double deductions. Do not claim the same administration expense on Form 706 and Form 1041. Funeral expenses belong only on 706.

- Missing netting. Forgetting to offset the SSA or VA payment leads to quick adjustments.

- Trustees’ commissions on J. Those go on L when paid for property not subject to claims.

- Weak fee support. For larger non‑professional executor commissions or evolving attorney fees, be ready with Form 4421 if requested and with time and billing detail.

- Bad classification. Guessing on subject‑to‑claims status risks blowing the cap. Tie every allocation to local authority.

Quick checklist you can paste into your binder

- Identify property subject to claims under state law and compute the cap.

- Build funeral expense detail, net SSA and VA, and total.

- Itemize administration expenses, attach invoices, orders, or engagement letters, and confirm they are not also on 1041.

- Place trustees’ commissions and other non‑claim property costs on Schedule L.

- Use Schedule PC for unresolved §2053 items and track the 90‑day post‑resolution notice window.

- Extend with Schedule W if you run out of lines, then reconcile totals.

FAQs

What is Schedule J on Form 706, in one sentence?

It is the schedule where you deduct funeral and administration expenses tied to property subject to claims, itemized with payee information, net of reimbursements, and supported by documentation, subject to a cap that depends on your local law and what you actually paid by the due date.

Do I use Schedule J if I am filing purely for portability?

Yes, if you are filing Form 706 to elect portability and you have deductible §2053 items tied to property subject to claims, you still use Schedule J to report them, following the same cap and documentation rules.

Where do expenses for trust‑held property go?

If the property is not subject to claims under local law, use Schedule L instead of J. Trustees’ commissions paid by the trust generally belong on L, not J.

How do I keep refund rights open for a disputed claim?

Attach Schedule PC with the original Form 706, list the item on the relevant schedule without an amount in the last column, and give notice within 90 days after the claim is paid or finally determined by filing a supplemental 706 with updated PC or a Form 843.

What about the 255 Social Security payment?

Eligible survivors may receive a one‑time 255 payment. Net that against funeral expenses if the estate paid them, and keep SSA documentation in your file.

If capacity is your bottleneck

If your firm hits a wall during estate season, the issue is usually delivery, not demand. When reviewers spend nights cleaning workpapers, classification grids, and reimbursement netting, growth slows. If you need stable capacity without losing control, Accountably integrates trained offshore teams into your systems, with SOPs for Schedule J and L builds, standardized naming, layered reviews, turnaround SLAs, and escalation paths. The goal is simple, reduce revisions, protect reviewer time, and ship accurate returns on schedule. Only consider it if you want an operational partner, not resumes.

Compliance note

This article reflects the IRS Instructions for Form 706 as of September 2025, including the sections on Schedule J, Schedule L, Schedule K, Schedule W, and Schedule PC. Always confirm current instructions and local law before filing, and maintain records that support reasonableness, necessity, and the property‑subject‑to‑claims test.

Simplify Delivery, Improve Margins, Stay in Control.

Offshore support that works exactly like your in-house team.

💼 Let’s Talk