Scale Your CPA Firm Without Adding Headcount

Build your offshore team that works your way, trained, compliant, and white-labeled under your firm.

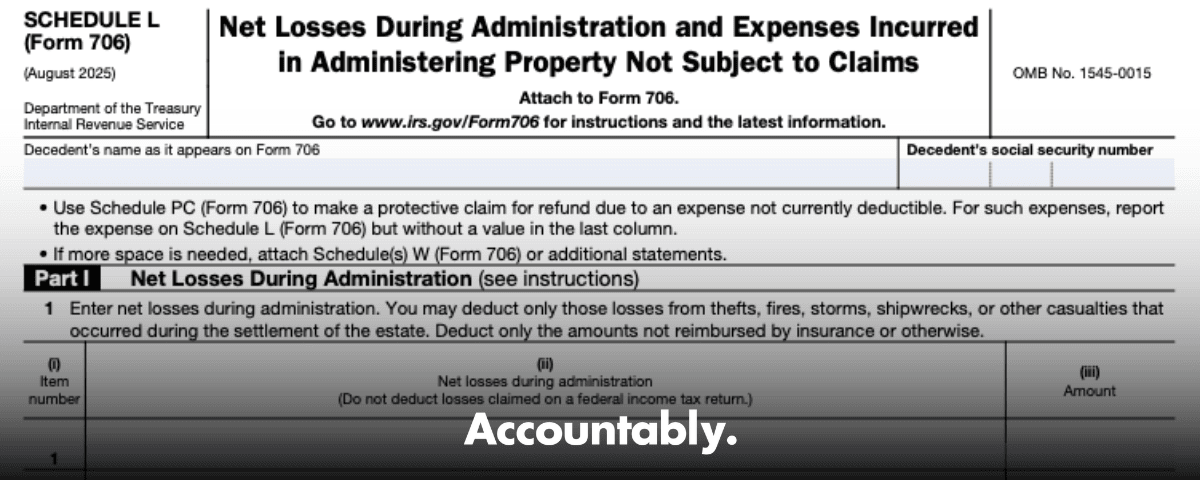

👉 Book a Discovery CallIf you are filing Form 706, use Schedule L to report unreimbursed administration‑period casualty or theft losses, and to deduct paid expenses for administering property not subject to claims, such as revocable trust assets.

Important context before you start, Form 706 is required only when the estate must file or you are electing portability, it is not a stand‑alone return you file just to claim a loss. For 2025 decedents, the basic exclusion amount is 13,990,000, and Form 706 is generally due 9 months after death, with an automatic 6‑month filing extension available on Form 4768. Executors filing only to elect portability have special timing relief up to the fifth anniversary of death under Rev. Proc. 2022‑32.

Key takeaways

- Schedule L has two lanes, Part I, net losses during administration from theft, fire, storm, or other casualty that hit estate‑included property, only the unreimbursed amount, and Part II, expenses you paid to administer property that is included in the gross estate but is not subject to claims, often revocable trust assets.

- Do not duplicate deductions across returns. Administration expenses and administration‑period casualty or theft losses can be taken on the estate tax return or on Form 1041 if you file a 642(g) waiver, not both.

- For Part II items, deduct only amounts you actually paid before the assessment statute under section 6501 expires, generally three years after filing, unless extended, estimates are allowed only if they are reasonably certain and will be paid before that statute closes.

- Identify the exact asset that suffered the loss and show where it appears in the gross estate schedules. Alternate valuation reductions are not Schedule L losses. Insurance reimbursements reduce or eliminate the deduction.

- Reserve Schedule K and Schedule J for different things. Debts at death and mortgages belong on Schedule K, funeral and expenses of administering property subject to claims go on Schedule J, not on Schedule L.

What Schedule L covers, and what it does not

Part I, net losses during administration

You may deduct losses from thefts, fires, storms, shipwrecks, or other casualties that occur while you are settling the estate. The loss must hit property that was included in the gross estate, it must happen after death and before distribution, and it must be unreimbursed by insurance or other recovery. In the description, identify the specific item and where you reported it in the gross estate schedules, for example Schedule A, item number, and state any insurance collected. You cannot treat a value drop from market swings or alternate valuation as a loss for Schedule L, and you cannot deduct amounts you already used on an income tax return.

Plain‑English example, a garage break‑in after death leads to the theft of listed artwork that you reported on Schedule F. If the insurer denies the claim and you sell the remaining piece at a lower price, your Schedule L loss is the unreimbursed damage, measured and documented with police reports, appraisals, and insurer correspondence, not a general “decline in value.”

Hundreds of Firms Have Already Used This Framework.

Join the growing list of CPA and accounting firms using Accountably’s Offshore Playbook to scale faster.

💬 Get Your FREE Playbook

👉 Visit Jugal Thacker’s LinkedIn

Send him a connection request and message “Playbook” to get your copy.

Part II, expenses for administering property not subject to claims

These are the costs of settling and transferring title to assets that are in the gross estate but outside the probate estate, commonly a revocable trust. Think trustee fees attributable to winding up, attorney and accountant time to finalize the trust’s interest, and other costs necessary to vest clear title in beneficiaries. The key litmus tests are, the expense would have been deductible if the asset were subject to claims, and it was paid before the section 6501 assessment period ended. The regulations include helpful examples on what qualifies and what does not.

Quick rule of thumb, show that the work was caused by death, necessary to settle the decedent’s interest or clear title, and actually paid before the assessment statute closed. Keep your vouchers.

When you must file Form 706, where Schedule L fits

You file Form 706 if the estate exceeds the filing threshold for the year of death or you are making the portability election. For 2025 decedents, the basic exclusion amount is 13,990,000, and the return is due 9 months after death, with a 6‑month extension available. Executors who had no filing requirement can still file by the fifth anniversary solely to elect portability under Rev. Proc. 2022‑32. If you are not filing Form 706 at all, you do not file Schedule L by itself.

Improve Margins Without Compromising Quality

Offshore staffing helps firms deliver more, scale faster, and stay compliant, without adding local headcount.

👉 Book a Discovery CallCareful with scope creep, expenses of administering property subject to claims belong on Schedule J, debts at death and mortgages belong on Schedule K, and state or foreign death taxes have their own rules. Schedule L focuses on unreimbursed administration‑period casualty or theft losses and on paid expenses to administer property not subject to claims.

How to document losses and expenses so Schedule L survives review

The records examiners expect to see

For casualty or theft, contemporaneous evidence is your best friend. Collect police or fire reports, insurance denials or partial‑payment letters, before and after appraisals, and photos. For expenses, save invoices, engagement letters, detailed time sheets, cancelled checks or wire confirmations, and if a court reviews the trust accounting, include that approval. The 706 instructions and the regulations repeatedly point you to substantiation, identity of the asset, and proof that the amount was paid.

| Record type | Purpose |

| Invoices and receipts | Show the nature of each expense and the amount paid |

| Time records and engagement letters | Substantiate professional services and reasonableness |

| Police or fire reports | Tie the casualty to a dated event during administration |

| Insurer correspondence | Prove the loss was unreimbursed or only partially reimbursed |

| Appraisals and photos | Establish value and damage before and after the event |

| Bank proof, checks, or wires | Prove payment date within the allowable assessment period |

Attach a short memo that connects the dots, what happened, which asset was affected, where it is listed in the gross estate, what you were paid or denied by insurance, and the net amount you are claiming. That memo often saves hours on follow‑up.

Coordination with Form 1041 and the no‑double‑deduction rule

You cannot use the same dollars to reduce both estate tax and estate income tax. Section 642(g) says administration expenses and administration‑period casualty or theft losses are either deducted on Form 706 or, if you file a waiver statement, on Form 1041, not both. If you choose the income tax route, include the 642(g) waiver with the 1041 and understand that the waiver is an irrevocable relinquishment of the estate‑tax deduction for that item. The Form 1041 instructions reiterate this coordination and waiver requirement.

Practical approach that works, run a side‑by‑side comparison. If the estate is taxable at 40 percent, a Schedule L deduction may be more valuable than an income tax deduction at trust rates. If the estate is under the filing threshold and you are not filing 706, the 1041 path likely governs, subject to the waiver and normal income tax rules.

Avoiding category mistakes across J, K, and L

- Use Schedule J for funeral and for expenses of administering property subject to claims. Do not park those costs on L.

- Use Schedule K for debts of the decedent and for mortgages and liens where appropriate. Do not move a debt that existed at death to L.

- Use Schedule L only for unreimbursed administration‑period casualty or theft losses and for paid expenses to administer property not subject to claims. Identify the affected asset on the gross‑estate schedule.

Timing rules you cannot ignore

For Part II expenses, the regulations and instructions require that the expense be paid before the section 6501 assessment statute closes. That period is generally three years from the date you file Form 706, but it can be extended by agreement or affected by other statute rules. The instructions also allow a reasonably certain estimate if it will be paid before that statute closes. If payment will occur later, consider a section 2053 protective claim for refund to preserve the benefit when the amount becomes deductible.

Tip, when in doubt about timing, file Schedule PC with the original 706 to protect later payments, or use Form 843 if you are filing after the 706 was already sent. Then, notify the IRS within about 90 days after the contingency is resolved and the item is paid.

Protective claims, how and when

- With the original 706, attach one Schedule PC for each separate claim or expense you want to protect. If you are filing the protective claim after filing 706, submit Form 843. Each protected item needs its own Schedule PC or Form 843.

- Keep the acknowledgment letter the IRS sends. If you do not receive it within 180 days, follow up at the number listed in the instructions.

- When the amount is finally paid or becomes certain, perfect the claim by notifying the IRS within the stated window, via a supplemental 706 with updated Schedule PC or via Form 843. Include the supporting math and evidence.

Examples that mirror real life

Theft during administration, unreimbursed

A decedent’s coin collection, reported on Schedule F, is stolen two months after death. Insurance denies coverage due to a policy lapse. You obtain a police report, a qualified appraisal, and photographs taken for probate. On Schedule L, Part I, describe the event and asset, reference the Schedule F item number, and deduct the unreimbursed loss. Do not also claim the same loss on the estate’s Form 1041 unless you file the 642(g) waiver and choose the income tax route instead.

Trust‑administration expenses, paid within the assessment period

A revocable trust holds a brokerage account and a rental property that are included in the gross estate. Attorney, accountant, and trustee fees are incurred to settle the trust, sell the rental, and deliver clear title. You pay these within the assessment period. On Schedule L, Part II, list each payee, the services, the amount, and cite the gross‑estate schedule and item number for the underlying assets. Keep vouchers for review.

Planning notes, common pitfalls, FAQs, and next steps

Planning notes to protect value

- Be precise about where each deduction belongs. The fastest way to trigger questions is to mix items across J, K, and L. Use the instructions’ headings as a checklist.

- Build your substantiation file as you go, not at the end. Label evidence with dates, payees, the asset schedule and item number, and the payment method.

- Watch the assessment statute. If an expense will be paid later than the normal window, preserve it with Schedule PC or Form 843.

- Stay current on section 2053 developments. Treasury has proposed present‑value discounting for some claims and expenses paid more than three years after death. Check the latest guidance for your filing year and facts.

Frequently asked questions

What exactly goes on Schedule L?

Two things. Part I takes unreimbursed losses from theft, fire, storm, or other casualty during administration that hit property included in the gross estate, and Part II takes paid expenses to administer property included in the gross estate that is not subject to claims, often revocable trust assets. Identify the asset by its gross‑estate schedule and item number.

Do I file Schedule L if the estate is not required to file Form 706?

No. Schedule L is a schedule to Form 706. You include it when you are filing Form 706, for example because the estate exceeds the filing threshold or you are electing portability. If you are not filing 706, consider the Form 1041 route, observing the 642(g) waiver rules.

How do I avoid double deductions with Form 1041?

Choose where to deduct, not both. If you want to take administration expenses or administration‑period casualty or theft losses on Form 1041, file the 642(g) waiver with the 1041. That waiver is an irrevocable give‑up of the estate‑tax deduction for that item.

What are the key filing dates for 2025 decedents?

Form 706 is due 9 months after death, and you can request an automatic 6‑month extension on Form 4768. For portability when no 706 was otherwise required, Rev. Proc. 2022‑32 allows filing by the fifth anniversary of death. The 2025 basic exclusion amount is 13,990,000.

Alternate valuation was elected. Can I still claim a Schedule L loss?

You cannot claim as a Schedule L loss the same amount by which you reduced the gross estate under the alternate valuation election. You can still claim a separate, unreimbursed casualty or theft loss that meets the rules, with full documentation.

Quick checklist before you file

- Confirm Form 706 is required or you are filing solely for portability. Note the 2025 threshold and due dates.

- Map each deduction to J, K, or L. Err on the side of the schedule that matches the instruction header.

- For Schedule L, verify unreimbursed loss and tie it to a listed asset, or confirm an administering‑property‑not‑subject‑to‑claims expense was paid within the assessment statute.

- If timing is tight or payment is uncertain, attach Schedule PC with the original 706, or use Form 843 later, then perfect the claim with evidence when paid.

- Decide income tax versus estate tax for elective items, and, if using 1041, attach the 642(g) waiver.

Where Accountably fits, only when it truly helps

If your team is at capacity, the hard part is not the law, it is the execution. A disciplined workpaper stack and SOP‑driven review can cut Schedule L rework dramatically. Accountably integrates trained offshore professionals into your firm’s workflow, inside your systems and templates, with U.S.‑led QA that emphasizes naming standards, documentation discipline, and on‑time review cycles. Use this kind of structure for busy season stability, not as a shortcut. Mentioning it here is intentional because precise Schedule L support hinges on file control, review protection, and predictable turnaround, not on staffing bodies.

Closing thought and disclaimer

When you treat Schedule L like a small project, with a clear map of what goes where, strong records, and a conscious election strategy, you protect more for the heirs and spend less time in back‑and‑forth. This guide is for educational purposes, not legal or tax advice, and it reflects IRS instructions available as of September 2025. Always confirm the latest year‑specific instructions and regulations before filing.

Simplify Delivery, Improve Margins, Stay in Control.

Offshore support that works exactly like your in-house team.

💼 Let’s Talk