Scale Your CPA Firm Without Adding Headcount

Build your offshore team that works your way, trained, compliant, and white-labeled under your firm.

👉 Book a Discovery Call

We slowed down, matched assets line by line, and ran Schedule Q. Watching that credit wipe out a big slice of tax felt like opening a stuck window. Fresh air, less pressure, and a clean file. You can have that too when you handle Schedule Q with care.

Key Takeaways

- Schedule Q lets you claim the Section 2013 credit so the IRS does not tax the same property twice across two estates. The prior transferor must have died within 10 years before, or 2 years after, your decedent.

- Include only property your decedent actually owned in a beneficial sense, such as outright interests or assets subject to a general power of appointment, not bare legal title.

- The credit is capped by percentage reductions based on timing and by a maximum equal to the portion of your current estate tax that relates to that same property.

- If the prior estate used special‑use valuation and later triggered 2032A recapture, replace those special‑use amounts with fair market value for the Schedule Q computation, and treat the recapture as federal estate tax paid by the transferor.

- Attach proof. That means the prior Form 706 showing tax paid, appraisals or valuation work, death certificates, and your worksheet computations. Schedule Q is completed before certain other credits are finalized in Part 2 to keep the math consistent.

This article reflects IRS Instructions for Form 706, revision dated October 2024, reviewed on October 25, 2025. Always confirm the current instructions before filing.

What Schedule Q Does, in Plain English

Schedule Q is where you claim the prior‑transfer credit. Congress wrote Section 2013 to avoid double taxation when identical property appears in two estates within a tight window. If your decedent received property from someone who died within 10 years before, or 2 years after, your decedent, and that earlier estate actually paid federal estate tax on that property, you can claim a credit on your decedent’s Form 706. The rules cover property passing by will or trust, and property that passed because your decedent held or received a general power of appointment.

Hundreds of Firms Have Already Used This Framework.

Join the growing list of CPA and accounting firms using Accountably’s Offshore Playbook to scale faster.

💬 Get Your FREE Playbook

👉 Visit Jugal Thacker’s LinkedIn

Send him a connection request and message “Playbook” to get your copy.

Two big guardrails keep the credit grounded in fairness:

- A timing reduction applies if the transferor died more than 2 years before your decedent. The available credit steps down the farther apart the deaths are.

- A ceiling limits the credit so you never reduce tax below the amount attributable to that same property in the current estate. In short, you cannot turn the credit into a refund generator.

Think of Schedule Q as a reconciliation. You identify the exact assets that were taxed in the prior estate and that your decedent actually owned at death, you bring forward the right values and taxes from the transferor’s return, you apply the timing percentage, and you apply the overall cap. The IRS provides a worksheet in the 706 instructions to walk through the math.

The What‑How‑Wow Snapshot

- What: A credit against your current estate tax for property previously taxed in a transferor’s estate within a 10‑year lookback or a 2‑year forward window.

- How: Use the Schedule Q worksheet to compute the allowable credit by transferor, apply timing percentages, then apply the overall limitation so the credit never exceeds the current tax tied to that property.

- Wow: If the prior estate elected special‑use valuation and later triggered 2032A recapture within two years after your decedent’s death, you substitute fair market value for those assets and count the recapture as prior estate tax paid. This single adjustment can meaningfully increase the allowable credit.

Who Qualifies for the Prior‑Transfer Credit

To qualify, your decedent must have been the beneficial owner of the same property that was included in the transferor’s taxable estate and that prior estate must have actually paid federal estate tax on it. Bare legal title does not count. General powers of appointment do count. Charitable transfers generally do not qualify because the prior estate did not pay tax on those amounts. Report each transferor’s details on Schedule Q.

Improve Margins Without Compromising Quality

Offshore staffing helps firms deliver more, scale faster, and stay compliant, without adding local headcount.

👉 Book a Discovery CallQuick gut check, ask yourself, did my decedent really benefit from the property and did the prior estate truly pay estate tax on it, not just list it, but pay tax. If either answer is no, stop and reassess.

What Counts as “Property” Here

The instructions define property broadly for Section 2013 purposes. You are looking for any interest your decedent beneficially owned, including interests obtained by exercise or nonexercise of a general power of appointment. Exclude interests where your decedent held only bare legal title, like a trustee title with no beneficial ownership.

Handy Inclusion Table

| Item | Inclusion rule | Valuation rule you bring forward |

| Direct bequest to your decedent | Include if beneficially owned and included in gross estate | Use the value used in the transferor’s estate tax, subject to percent reductions and overall cap |

| General power assets | Include if subject to a general power of appointment | Same as above, treat as “property” for Section 2013 |

| Property passing by exercise or nonexercise of power | Include if your decedent had beneficial ownership | Same framework as direct bequest |

| Charitable bequests | Exclude, no prior estate tax paid | Not part of the credit base |

Sources for the definitions and mechanics are in the code and instructions.

Timing Rules You Cannot Miss

There are two timing lanes, and you must be in one of them:

- The transferor died within 10 years before your decedent, percent reductions apply if more than 2 years apart.

- The transferor died within 2 years after your decedent, the credit is potentially 100 percent of the computed amount, with the usual overall limitation.

Percent Allowable, at a Glance

- 0 to 2 years between deaths, 100 percent

- Over 2 to 4 years, 80 percent

- Over 4 to 6 years, 60 percent

- Over 6 to 8 years, 40 percent

- Over 8 to 10 years, 20 percent

- Over 10 years, no credit

These percentages come from Section 2013 and are also shown in the instructions. Measure strictly from date of death to date of death.

Mini Checklist, Eligibility Proof Pack

- Certified death certificates for both the transferor and your decedent

- The transferor’s filed Form 706, tax computation pages, and proof of estate tax paid

- Documents proving how the property passed and that your decedent had beneficial ownership, for example will, trust, or power of appointment

- Appraisals or valuation workpapers, plus fair market value support if 2032A recapture affects your numbers

- Your completed Schedule Q worksheet by transferor, saved for your files even though it is not filed with the return

Tip, complete Schedule Q before finishing Schedule P, the foreign death tax credit, since Part 2 credits stack in a specific order on Form 706.

Computing the Credit, Step by Step

When you strip away the form labels, Schedule Q is a clean sequence. You verify timing, tie the property to your decedent’s gross estate, bring forward the prior estate’s tax, then apply the percentage and the overall cap. Here is the flow I use with teams during review.

The Practical Flow

1. Confirm timing

- Check the two windows. The transferor died within 10 years before your decedent, or within 2 years after.

- Measure date to date, not month to month. Keep copies of both death certificates in the file.

- Match property

- Prove the asset is the same property that was taxed in the prior estate and that your decedent beneficially owned it.

- Use wills, trusts, deeds, brokerage statements, and power of appointment documents.

- Exclude charity‑bound amounts and bare legal title.

- Gather numbers

- From the prior Form 706, capture the gross value of the prior transfer and the taxable estate that produced estate tax.

- Note any special‑use valuation and, if recapture later applied, prepare to substitute fair market value only for those recaptured assets.

- Pull the prior estate tax actually paid that is attributable to the prior transfer.

- Run the worksheet

- Compute the ratio for the prior transfer, apply the percentage based on years between deaths, and limit the credit to the portion of your current tentative tax tied to the same property.

- Repeat by transferor if there are multiple prior transfers.

- Report and attach

- Enter totals on Schedule Q, Part 5.

- Attach your computations and copies of the prior return pages that show tax paid.

- Keep the full worksheet and backup in your workpapers for exam.

Worked Example, Numbers You Can Follow

Say your decedent, Ann, died on March 1, 2025. Her mother, Beth, died on July 1, 2019, and left Ann an apartment building that was included in Beth’s taxable estate. Beth’s estate paid federal estate tax.

- Time between deaths is just under 6 years, so the percentage is 60 percent.

- Beth’s worksheet shows the apartment building was 2,000,000 of the 10,000,000 taxable estate, and Beth’s total estate tax was 3,600,000.

- Prior transfer ratio is 2,000,000 divided by 10,000,000, or 0.20.

- Prior estate tax attributable to that property is 3,600,000 x 0.20 = 720,000.

- Apply the 60 percent timing factor, so the interim credit is 432,000.

- Now cap it. Compute the portion of Ann’s tentative estate tax that is attributable to that same building in her 2025 estate. Suppose that portion calculates to 410,000.

- Your Schedule Q credit is limited to 410,000.

This is why you cannot skip the cap. The timing percentage may still exceed the current tax on the same property. The goal is to prevent double tax, not to create a net subsidy.

Evidence Table to Keep Your File Tight

| Step | What you save | Why it matters |

| Timing | Both death certificates, docket notes | Proves the 10‑year or 2‑year window |

| Ownership | Will, trust, deed, POA docs, account statements | Proves beneficial ownership of the exact asset |

| Prior values | Prior 706 schedules, tax computation pages | Shows prior taxable estate and tax paid |

| Valuation support | Appraisal reports, cost approaches, FMV memos | Supports ratios and any substitutions |

| Worksheet | Your Schedule Q computation by transferor | Recreates your math for fast exam review |

What If There Are Multiple Transferors

Handle each transferor separately. Some assets might come from a spouse and others from a parent or grandparent. You will:

- Build a packet for each transferor, then total the credits at the end.

- Apply the correct timing percentage for each relationship, since dates differ.

- Watch for interactions if a single asset traces through two estates. Trace it carefully, and avoid double counting.

Advisory Tip, Keep Your Review Short and Effective

- Use standardized workpaper naming for every Schedule Q claim. A consistent “Q‑Beth‑2019‑DocSet” folder saves time in review.

- Put the timing proof, ownership proof, values, and math in that order.

- Add a one‑page summary that states the timing percentage, the ratio, the prior tax attributable to the property, the cap amount, and the final allowed credit. A partner can bless a clean summary in minutes.

If your team is underwater near filing, carve out Schedule Q early. It is one of the easiest ways to materially reduce tax, but only if you leave enough time to collect prior return pages and appraisals.

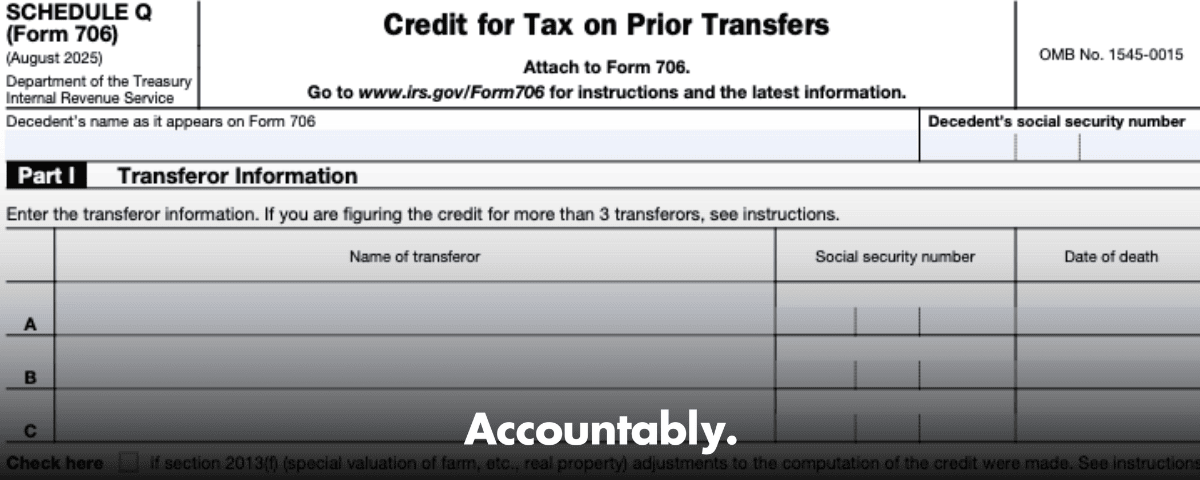

Transferor Information, Exactly What the IRS Expects

The most common snag is an incomplete transferor section. Treat it like a passport application. Every blank must be right.

Fields to Complete With Care

- Transferor’s name and relationship to your decedent

- Transferor’s date of death

- Gross value of the prior transfer that passed to your decedent

- Prior taxable estate figure used to compute tax

- Whether values reflect special‑use valuation or fair market value

- Notation if 2032A recapture later applied, and your FMV substitution for just those assets

Pro tip, if the prior estate used special‑use valuation, include a short memo in your file that explains whether recapture occurred and how you handled it in the Schedule Q math. Keep it separate from your main appraisal files to speed up reviewer sign‑off.

Valuation When 2013(f) Applies

Sometimes the prior estate made a valid special‑use election for farm or closely held business property. Later, a recapture event occurred. When that happens, you replace the prior special‑use values with fair market value solely for the affected assets in your Schedule Q computation. You do not touch unrelated assets.

- Increase both the “gross value of prior transfer” and the “prior taxable estate” by the fair market value of the recaptured items.

- Use the prior transferor’s date of death for those FMV numbers, or the prior estate’s valid alternate valuation date if that was elected.

- Keep the appraisal that supports the fair market numbers with your Schedule Q packet.

Adjust only the portion that triggered recapture. If the farm tract was recaptured, do not revise the vacation home.

Mini Table, What Changes and What Stays

| Asset | Prior method | What you swap in | What stays unchanged |

| Farm tract A | Special‑use value | FMV at transferor’s death | All other non‑recaptured assets |

| Operating company shares | Special‑use value | FMV at transferor’s death | Unrelated marketable securities |

| Cash equivalents | N/A | No change | No change |

Coordinating With Other Schedules

Schedule Q does not live alone. Keep these tie‑outs in mind:

- Schedule F, G, H, and I, make sure the same property shows up once, with consistent descriptions and values.

- Schedule P, foreign death tax credit, run that math in sequence so the overall Form 706 Part 2 computation is accurate.

- Portability, if you are filing to elect DSUE, your Schedule Q work still needs to be clean because it changes the tax base and can shift whether DSUE is material.

- Gift interactions, if the prior transferor’s taxable estate incorporated gift tax paid, make sure your ratio and tax attributable amounts track the instructions.

Documentation That Gets Approvals Faster

- Prior 706 complete copy or, at minimum, the summary pages, Schedule A‑like property detail, and the tax computation pages

- Proof of tax paid, for example the notice of assessment and payment confirmation, if available

- Your appraisal list with report dates, appraisers, and methods used

- Chain‑of‑title or account ownership proofs to show the decedent’s beneficial ownership

A tidy packet wins. The IRS examiner wants to check timing, property identity, prior tax, and your cap. Give them a short path to yes.

How Teams Keep Schedule Q Clean at Scale

If you run a multi‑office practice, a repeatable workflow matters more than heroics in April.

- Use SOPs for Schedule Q claims, including a standardized index and naming rules.

- Layer your review, preparer to senior to quality reviewer, to catch timing or ownership breaks early.

- Track turnaround in a simple SLA sheet so Schedule Q claims do not get buried behind returns with no credits at stake.

A quick note on context, at Accountably we support firms with disciplined offshore delivery that keeps these workpapers straight while partners focus on strategy. That means standardized workpaper names, multi‑layer reviews, and continuity plans so a single vacation does not stall a credit claim. Keep the focus on control and quality, not resumes.

Common Pitfalls, Coordination, and Your Audit‑Ready Packet

Even strong teams trip on the same handful of issues. You can avoid them with a simple checklist.

Frequent Errors You Can Eliminate

- Missing the timing window by a few days because dates were assumed, not verified

- Treating bare legal title as beneficial ownership

- Forgetting to substitute fair market value for assets that later triggered special‑use recapture

- Pulling the prior estate’s total tax as the credit base without applying the ratio

- Skipping the overall cap tied to your current tentative tax on the same property

- Not attaching the computation summary or the prior 706 pages that show tax paid

Quick Coordination Reminders

- Run Schedule Q before finalizing other credits in Part 2 so numbers land in the right order.

- Tie Schedule Q property descriptions to your main schedules word for word.

- If portability is elected, store your Schedule Q packet in the same folder tree you use for DSUE support.

Your Audit‑Ready Packet, a One‑Page Index

- Timing proof, both death certificates

- Ownership proof, governing documents, and account statements

- Prior return pages, values, and tax paid

- Appraisals and any fair market value substitutions for recaptured assets

- Schedule Q worksheet and a one‑page math summary

- Final Schedule Q as filed with Form 706

FAQs

What is Form 706 Schedule Q in one sentence

It is where you claim a credit for federal estate tax previously paid on the same property in a transferor’s estate when the deaths occur within the 10‑year lookback or 2‑year forward window and your decedent beneficially owned that property.

Does charity‑bound property qualify

No, because the prior estate would not have paid estate tax on amounts fully offset by the charitable deduction.

How do the percentage reductions work

You start at 100 percent if deaths are within two years, then step down to 80, 60, 40, and 20 percent as the gap widens to ten years, and zero beyond that. Always measure date to date and apply the overall cap.

What if the prior return used special‑use valuation

If recapture later applied, replace the special‑use values with fair market value for those assets when you run your Schedule Q math. Leave unrelated items unchanged.

Do I file Schedule Q if there is no credit

No. If you are not claiming a credit, you do not file Schedule Q.

A Calm Close, Then a Clean File

If you remember nothing else, remember this sequence. Verify timing, prove beneficial ownership, bring forward the right prior values and tax, apply the percentage, and cap the result to your current tax on the same property. Attach what you used and say clearly, on one page, how you got your number.

If your team needs structured help building a repeatable Schedule Q process and keeping review time under control, you can lean on a disciplined delivery model. Accountably works with CPA and EA firms to deploy trained offshore teams that operate inside your systems, follow your templates, and protect reviewer time with layered quality control. When the workpapers are clean, Schedule Q becomes a fast win for clients and a lighter lift for partners.

Simplify Delivery, Improve Margins, Stay in Control.

Offshore support that works exactly like your in-house team.

💼 Let’s Talk