Scale Your CPA Firm Without Adding Headcount

Build your offshore team that works your way, trained, compliant, and white-labeled under your firm.

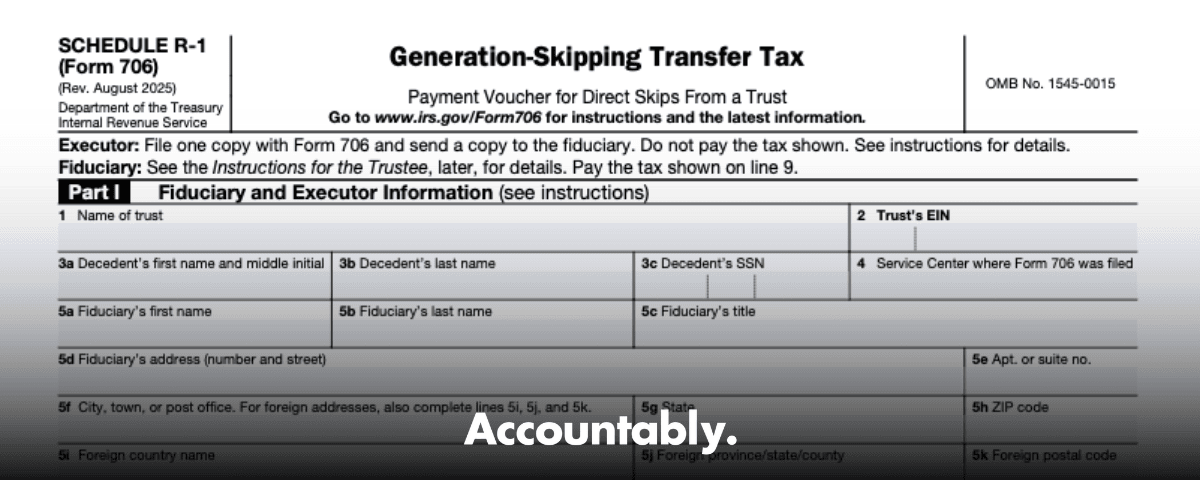

👉 Book a Discovery CallSchedule R-1 is your map for direct skips from trustee or payor held property that are included in the decedent’s gross estate, and it clarifies who files and pays the GST, the executor or the trustee or payor.

Key Takeaways

- Use Schedule R-1 to report direct skips from trustee or payor held property that sit inside the decedent’s gross estate, for example a trust distribution or insurer held proceeds treated as a trust. These entries feed Schedule R on Form 706 so the estate can compute GST and allocate exemption.

- Filing and payment shift based on aggregation. If trustee held direct skips for a single trustee or payor total at least $250,000 for decedents dying on or after June 24, 1996, the trustee or payor files R-1 and pays the GST. If the total is below $250,000 for post 6, 24, 1996 deaths, the executor files Form 706 with Schedules R and R-1 and pays. For pre 6, 24, 1996 deaths, the cut off is $100,000.

- Insurers that hold proceeds in settlement options are treated like trustees. Aggregate policies by company to test the $250,000 threshold.

- The estate tax return is due 9 months after death, and that due date governs when Schedule R-1 notices must go out. Place of filing follows section 6091 rules.

- If any executor is also a trustee of the trust, you report those direct skips on Schedule R, not R-1, even when they would otherwise appear on R-1.

What Schedule R-1 really does

Although it rides with Form 706, Schedule R-1 serves a distinct job. It lists the trustee or payor held property interests that trigger a direct skip at death, identifies the fiduciary who must pay GST, and gives you a place to allocate GST exemption at the trust level. You enter the trust or payor name and EIN, list each direct skip, and link those entries back to Schedule R so the estate can compute tax and apply inclusion ratios. The executor prepares Schedule R-1, attaches one copy to the estate return, and sends two copies to the fiduciary before the estate return due date. The fiduciary signs and files the copy to pay the GST.

R-1 and Schedule R, how they fit

Think of Schedule R as the estate’s summary for GST at death, and Schedule R-1 as the trust level detail and payment notification. Schedule R tallies the amounts and exemption allocations. Schedule R-1 itemizes the direct skips for each trust or payor and routes liability to the right filer when thresholds are met. If the executor is also a trustee of that trust, put those skips on Schedule R, not R-1.

The 2025 check

As of October 25, 2025, the IRS Form 706 instructions continue to direct you to divide direct skips between Schedule R and Schedule R-1 using the trustee or payor rules and the $250,000 aggregation test. A 2025 draft of Schedule R-1 reflects the same structure, including trustee payment mechanics, but always confirm the final release before filing.

Hundreds of Firms Have Already Used This Framework.

Join the growing list of CPA and accounting firms using Accountably’s Offshore Playbook to scale faster.

💬 Get Your FREE Playbook

👉 Visit Jugal Thacker’s LinkedIn

Send him a connection request and message “Playbook” to get your copy.

Quick table, who files and when

| Who files | When due | Where to file |

| Executor or trustee or payor, based on aggregation thresholds | 9 months after date of death, same as Form 706 due date, extensions apply | As directed by section 6091 and the Form 706 instructions |

| Attach R-1 | With Form 706 or 706-NA | Send two signed copies of R-1 to the fiduciary before the due date |

The 9 month rule comes from section 6075. Filing place defaults to section 6091 and the related regulations, and the Form 706 instructions show the current service center guidance.

Bottom line, if trustee or payor held direct skips reach $250,000 or more for a single fiduciary, they file and pay using Schedule R-1. Below that, the executor carries it on Form 706 and Schedule R, and can recover GST from the trustee or recipient when appropriate.

Who must file and how to time it

If a decedent’s estate includes direct skips from or continuing in trust, you prepare Schedule R-1 with Form 706 so the GST is identified and coordinated. The executor completes the R-1, attaches a copy to Form 706, and must send two copies to the fiduciary before the estate return due date. The fiduciary signs and files the copy to pay GST. The due date tracks the estate return, 9 months from date of death, with extensions available.

Improve Margins Without Compromising Quality

Offshore staffing helps firms deliver more, scale faster, and stay compliant, without adding local headcount.

👉 Book a Discovery CallIf any executor also serves as a trustee of the trust making the transfer, all direct skips for that trust go on Schedule R, not R-1. This keeps the reporting in one place and avoids duplicate filings for the same fiduciary.

Ordinary trusts versus other trust arrangements

- Ordinary trusts, as defined in Reg. section 301.7701-4(a), report direct skips on Schedule R-1 regardless of size, unless the executor is also a trustee.

- Non ordinary trusts, including insurer or annuity arrangements treated as trusts for GST, use the $250,000 test. If the tentative maximum direct skips from that entity are $250,000 or more, report on R-1. If less, show on Schedule R.

Insurer as trustee, why aggregation matters

If the proceeds of a life policy are includible in the estate and payable to a skip person, the insurer is treated like a trustee. Add up all tentative maximum direct skips from the same company. At $250,000 or more, the insurer bears filing and payment using Schedule R-1. Below that, the executor keeps it on the estate return. Annuity survivor benefits can fall under the same rule.

Roles, liability, and recovery rights

Under the regulations, liability for a direct skip at death moves with the threshold:

- For decedents dying on or after June 24, 1996, if the total trustee or payor held direct skip property for a single fiduciary is less than $250,000, the executor files Form 706 and pays the GST, not the trustee.

- If it equals or exceeds $250,000, that trustee or payor files Schedule R-1 and pays. Examples in the regulation walk through insurance payouts at $300,000 and $200,000 to show the cutoff.

- For decedents dying before June 24, 1996, the cutoff is $100,000.

Executors often retain rights to recover GST paid from the trustee or distributee. Trustees are not strict guarantors for every mistake, however trustees can face personal exposure if they knew about missing filings or inclusion ratio errors and did nothing. The regulation outlines those limits.

Common pitfalls we see in reviews

- Treating insurer settlements as individual payouts, not as trust like arrangements that must be aggregated by company for the $250,000 test.

- Forgetting the executor as trustee rule. If an executor is a trustee, those direct skips belong on Schedule R.

- Missing the timing, sending R-1 copies to the fiduciary after the estate due date. The instructions require you to deliver them before that date.

- Misplacing the exemption allocation, lines on R-1 and Schedule R both serve exemption allocation, and once you allocate, it is irrevocable.

Quick checklist, before you finalize

- Confirm who files, run the $250,000 or $100,000 test by trustee or payor.

- Identify skip persons and the trust EIN for every direct skip.

- Align values with estate tax value, including alternate or special use values if elected.

- Allocate GST exemption where needed, and confirm inclusion ratios.

- Send two copies of R-1 to the fiduciary before the due date, attach one copy to Form 706.

When in doubt, read the Form 706 instructions for the current filing year, then confirm the trustee liability and insurer aggregation examples in the regulations. It clears up ninety percent of disputes in minutes.

The aggregation thresholds, explained with examples

You test each trustee or payor on their own. Add the tentative maximum direct skips for that fiduciary. Then decide who files and pays.

| Scenario | Facts | Filing party |

| Post 6, 24, 1996 death, insurer pays grandchild, policy total $200,000 | Insurer is treated as trustee, total under $250,000 | Executor files Form 706, GST paid by estate |

| Post 6, 24, 1996 death, same insurer pays $300,000 across two policies | Aggregate by company to $300,000, at or above $250,000 | Insurer files R-1, pays GST |

| Pre 6, 24, 1996 death, trustee holds $90,000 for skip person | Under $100,000 cutoff | Executor files and pays |

| Pre 6, 24, 1996 death, trustee holds $150,000 | At or above $100,000 cutoff | Trustee files R-1 and pays |

These fact patterns track the regulation examples and the instructions for dividing direct skips between Schedule R and Schedule R-1.

What counts in the total

- Use the estate tax value for each property interest subject to the direct skip. If you elected alternate valuation or special use valuation, carry those values here as well.

- For non ordinary trust situations, like insurer settlements and annuities held by the payor, aggregate by entity, not by beneficiary or policy number.

- For ordinary trusts, direct skips are reportable on Schedule R-1 regardless of size, unless the executor is a trustee.

Step by step, completing Schedule R-1

- Use a simple sequence so nothing gets missed.

- Identify the fiduciary

- Trust or payor legal name and EIN. Match it to your estate schedules, for example Schedule G for insurance, Schedule I for annuities.

- List every direct skip

- Enter each property interest, description, and estate tax value. If you used alternate valuation or special use, use those numbers.

- Compute the tentative maximum direct skip

- Subtract estate and state death taxes and other charges that the property must bear, then you have the tentative maximum.

- Allocate GST exemption

- You can allocate on Schedule R-1 or on Schedule R. The allocation is irrevocable once made. Confirm the inclusion ratio after allocation.

- Get signatures and deliver copies

- Attach one copy of R-1 to Form 706, send two signed copies to the fiduciary before the due date. The fiduciary signs and files the copy to pay the GST.

Software workflow that avoids rework

Different tax packages label screens differently, so build a repeatable checklist that lives outside any one product:

- Trust identity, enter trust or payor legal name and EIN in the GST section.

- Beneficiaries, flag skip persons and assign shares.

- Direct skip items, add each property interest with estate tax value.

- Threshold test, total trustee or payor held amounts to apply the $250,000 or $100,000 test.

- Exemption allocation, enter amounts and verify the resulting inclusion ratio.

- Output, confirm that Schedule R picks up the totals and that each trust or payor produces a separate R-1.

A brief peer review on the inclusion ratio and the threshold test saves hours of downstream cleanup. Ask a second reviewer to validate both before you lock the return.

Quality control, review, and documentation

- Keep copies of the R-1 you sent to the fiduciary, with delivery dates. The IRM reminds processors to verify lines and timeliness, so your file should make that easy.

- Tie every R-1 item back to the estate schedules and the valuation method used.

- Document your exemption allocation logic and resulting inclusion ratio. If you correct an error, keep a clear trail.

If your team is buried in production and review loops, consider separating preparation, senior review, and quality sign off. That structure is how firms keep partners out of endless review cycles and still hit deadlines.

R-1 in practice, scenarios and tips

Trustee held direct skips in a continuing trust

You, as trustee, will file and pay on Schedule R-1 when the aggregated trustee held direct skip amount for your trust reaches $250,000 for decedents dying on or after June 24, 1996. Below that, the executor files and pays with the estate return, then may seek recovery from the trust or recipient depending on governing documents and state law. The regulation gives insurer examples that mirror the same math.

Practical tip, if several small accounts add up to the threshold, the trustee or payor is still on the hook once you cross $250,000. Build an internal roll up so you do not miss aggregation across assets or policies.

Executor as trustee, keep it on Schedule R

If any executor is a trustee of the trust at issue, report those direct skips on Schedule R, not R-1, even if the amounts exceed the threshold. This is a process rule that keeps filing in one place. Put a bold note in your file so no one generates a stray R-1 later in the engagement.

Insurance and annuities, watch the entity level test

- Insurance proceeds held by the company in settlement options are treated as held in trust. Aggregate policies by company.

- Annuity survivor benefits included on Schedule I can create the same result. Use the estate tax value for each interest.

- At or above $250,000 per company, the company, treated as trustee, files R-1 and pays. Below that, the executor does.

FAQs

Are there new IRS rules on inheritance or Schedule R-1 in 2025?

There is a 2025 draft of Schedule R-1 that maintains the trustee payment framework and the way the tentative maximum direct skip flows, and the current Form 706 instructions continue to use the same divide between Schedule R and R-1 with the $250,000 aggregation test. Always confirm the year specific instructions attached to your Form 706 package before filing.

Does every estate have to file Form 706?

No. You file Form 706 if the estate exceeds the filing threshold for the year of death or you are electing portability. The instructions page for the year of death controls, so check the current thresholds in the official instructions before you plan the filing.

Who must file Schedule R and who files Schedule R-1?

The executor reports GST on Schedule R for direct skips at death, unless the rules specifically move those skips to Schedule R-1 because they are from trustee or payor held property and the $250,000 test is met, or because they come from an ordinary trust. The fiduciary pays the GST when R-1 applies.

What is a direct skip and who is a skip person?

A direct skip is a transfer to a skip person that is subject to federal estate or gift tax. When property is transferred to a trust, it is a direct skip only if the trust is a skip person. The regulation provides the definitions you need to classify the transfer correctly.

Where do I file and what is the due date for R-1?

Timing tracks the estate return, 9 months from the date of death, extensions available. Place of filing follows section 6091 and related regulations, and the Form 706 instructions tell you the current service center. Send two copies of Schedule R-1 to the fiduciary before the due date and attach one copy to Form 706.

Note, this article is general information for U.S. federal tax. For a specific estate, review the year of death instructions and the applicable regulations, and consult counsel where needed.

Putting it all together, a simple action plan

- Start with the people, list every trustee or payor and gather EINs.

- Build your aggregation roll up by fiduciary, then apply the $250,000 or $100,000 cutoff.

- Decide who files and pays, executor versus trustee or payor, and document the decision.

- Complete Schedule R-1 entries with estate tax values, compute the tentative maximum, and allocate exemption.

- Send two signed copies of R-1 to the fiduciary before the due date, attach one copy to Form 706, and keep proof of delivery.

A brief word on production and review

If you are an accounting firm, your sticking point is not finding clients, it is consistent delivery at scale. Schedule R-1 work stalls when reviewers chase missing EINs, weak workpapers, and unclear exemption allocations. To protect partner time, standardize workpapers, use layered review, and track R-1 copies sent to fiduciaries with dates. If you need outside capacity that respects your workflow and review standards, an offshore delivery model only works when it is run like operations, not staffing.

Accountably partners with CPA and EA firms that need disciplined offshore delivery, for example month end, tax, and GST production that must be accurate, secure, and review friendly. If R-1 season is stretching your team, we can integrate trained offshore teams into your systems with SOPs, file standards, and layered QC to cut review time without giving up control.

Key terms you will see on Schedule R and R-1

- Direct skip, a transfer to a skip person that is subject to federal estate or gift tax.

- Skip person, generally a person two or more generations below the transferor, or a trust that meets the definition in the regulation.

- Tentative maximum direct skip, the direct skip amount after subtracting taxes and charges borne by the property. See the R-1 lines and instructions.

- Inclusion ratio, the percentage of the transfer subject to GST after exemption allocation, computed from your Schedule R and R-1 allocations.

Closing thoughts

You do not need to white knuckle Schedule R-1. Decide who files by running the aggregation test with clean trust and payor lists, tie every item to an estate schedule and valuation method, then allocate exemption with intention. Deliver R-1 copies to fiduciaries on time, keep proof, and move your review forward with a checklist. That is how you meet deadlines without replaying the same conversations.

Simplify Delivery, Improve Margins, Stay in Control.

Offshore support that works exactly like your in-house team.

💼 Let’s Talk