Scale Your CPA Firm Without Adding Headcount

Build your offshore team that works your way, trained, compliant, and white-labeled under your firm.

👉 Book a Discovery Call

The appraisal date did not match the valuation date, the deed pages were out of order, and nobody could find proof the donee was a qualified organization. The fix was simple, organize and substantiate, but the clock was ticking. That return taught me a lasting lesson. When you claim the Schedule U exclusion, your paperwork is your parachute.

Key Takeaways

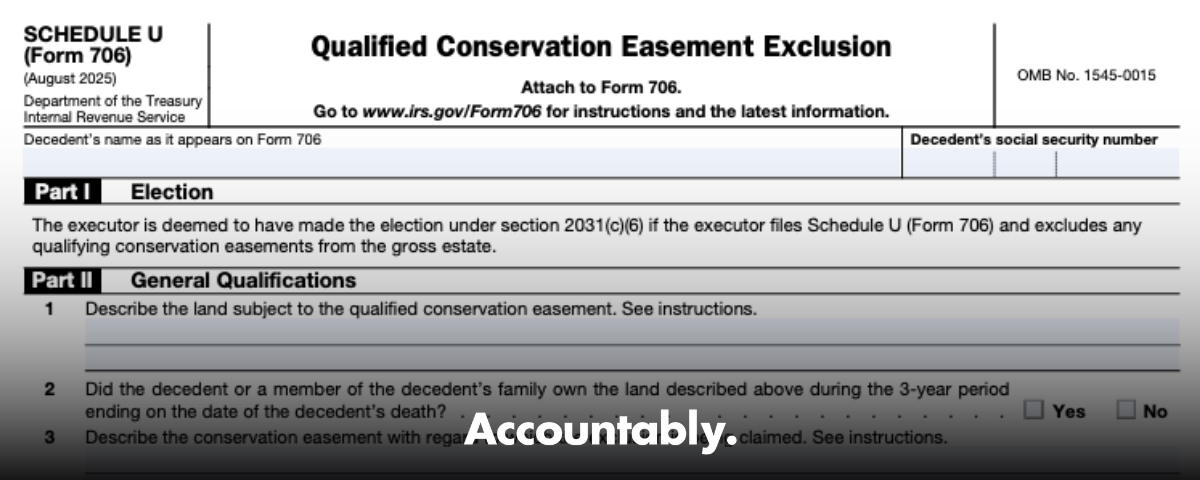

- Schedule U is how you elect the IRC §2031(c) exclusion for land under a qualified conservation easement, which can reduce the gross estate before deductions and credits.

- The exclusion is the lesser of the applicable percentage of the land’s value, after certain reductions, or 500,000. The applicable percentage starts at 40%, then drops by 2 percentage points for each point the easement value is below 30% of the land’s value. Once elected, the choice is irrevocable.

- You must file a timely Form 706 to make the election and include Schedule U with required details and attachments.

- If development rights are retained, you generally must reduce value for those rights unless all parties sign and attach a binding agreement to permanently extinguish them within 2 years of death or by the sale date, with personal liability if not completed.

- State death taxes are claimed as a deduction on Form 706, Part II, line 3b, not on Schedule U. Keep evidence and, if needed, update within 4 years.

What Schedule U Does, In Plain English

Schedule U on Form 706 is the estate’s election to exclude a portion of the value of land that is subject to a qualified conservation easement. You attach the schedule to a timely filed Form 706 and reduce the gross estate by the allowable exclusion, which then flows through the Part V recapitulation and lowers the estate tax before credits.

The exclusion is capped. You take the lesser of, one, the “applicable percentage” of the land’s value after specific reductions, and, two, 500,000. The “applicable percentage” starts at 40% and steps down by 2 percentage points for every percentage point the easement’s value is below 30% of the land value. That structure rewards deeper restrictions while keeping a firm ceiling on the benefit.

Hundreds of Firms Have Already Used This Framework.

Join the growing list of CPA and accounting firms using Accountably’s Offshore Playbook to scale faster.

💬 Get Your FREE Playbook

👉 Visit Jugal Thacker’s LinkedIn

Send him a connection request and message “Playbook” to get your copy.

Tip: If the easement was contributed on a date when the values differ from the estate’s valuation date, the instructions require a separate worksheet using the values as of the contribution date, attached to Schedule U. Label it “worksheet attached.”

How It Reduces Your Estate Tax Base

Here is the flow you will actually feel in the numbers:

- You include the decedent’s interest in the land on the proper asset schedule, usually Schedule A for real estate, at the estate’s valuation date numbers.

- Schedule U computes the qualified conservation easement exclusion and you carry that reduction to Part V, item 12, which lowers the gross estate before you compute deductions and credits.

- You then proceed through administration expenses, debts, losses, marital and charitable deductions, and credits. The lower base created by Schedule U can meaningfully shrink the final tax.

When You Should Use Schedule U

Use Schedule U when the estate owns land that is subject to a qualified conservation easement that meets the requirements of section 170(h), and you want to elect the section 2031(c) exclusion. You must file the election on a timely Form 706, including extensions. If you do not file on time, you can lose the exclusion even if the easement itself is valid.

Improve Margins Without Compromising Quality

Offshore staffing helps firms deliver more, scale faster, and stay compliant, without adding local headcount.

👉 Book a Discovery CallThe 40% Rule, The 30% Test, And The 500,000 Cap

- Start with the land’s estate tax value, then reduce for retained development rights unless you attach a proper extinguishment agreement.

- Apply the applicable percentage, up to 40%, subject to the 30% easement value test described above.

- Never exceed 500,000 of exclusion. That ceiling still applies even when your percentage math suggests a larger amount.

The Practical “Why”

If your goals include honoring conservation, reducing estate tax, and keeping reviews smooth, Schedule U is a powerful tool. The key is discipline. You need a recorded deed with enforceable, perpetual restrictions, a qualified appraisal, and evidence the donee is a qualified organization. You also need to align valuation choices, like alternate valuation, with your Schedule U math, then carry the results consistently into Part V. Done right, the return reads clean, the exclusion is defensible, and the estate saves real money.

Eligibility And Documentation, Step By Step

Confirm The Land And Ownership Tests

For land to qualify, all of the following must be true.

- Ownership, you or a family member owned the land for the 3 year period ending on the date of death.

- Easement timing, by the election date, a qualified conservation easement must have been granted by the decedent, a family member, the executor, or a trustee of a trust holding the land.

- Location, the land is in the United States or a U.S. territory.

- Indirect ownership, if the land sits in an entity, the decedent must have owned at least 30% of that entity, applying look through rules.

What Makes The Easement “Qualified”

The easement must satisfy section 170(h), meaning it is, one, a qualified real property interest, two, contributed to a qualified organization, and, three, granted exclusively for conservation purposes. In practice, that means a perpetual restriction, a donee that meets the Code definition, and a conservation purpose such as preserving open space or natural habitats with a significant public benefit.

The Attachments You Should Have Ready

- The recorded conservation easement deed, including legal description, restriction terms, any retained rights, and proof of recordation.

- A qualified appraisal that explains before and after fair market values as of the estate’s valuation date, plus methods and comparables. You must explain how you determined value and attach appraisals.

- Identification of the property on the asset schedules, by schedule and item number, and a narrative that states the conservation purpose and the grant date.

- Evidence the donee is a qualified organization under section 170(h).

Field note: When the easement value at contribution differs from the estate valuation date, attach the separate worksheet using contribution date values, and write “worksheet attached” at the top of Schedule U. This avoids avoidable correspondence.

Retained Development Rights, And The Two Year Clock

If the donor retained development rights, you must reduce the exclusion by the value of those rights unless every person with an interest in the land signs a binding agreement to permanently extinguish them. The agreement must say it is made under section 2031(c)(5), list all interested parties, identify the property by schedule and item, describe the specific rights to be extinguished, and include a consent that is binding under local law. If the agreement is not implemented by the earlier of two years after death or the sale date, the signers are personally liable for additional tax, and they must file and pay that tax by the last day of the sixth month after that date. Attach the signed agreement to the return.

Timing, Valuation Date, And Coordination

- Timely filing, you must make the Schedule U election on a timely Form 706, including extensions. Miss the deadline, and the exclusion can be lost.

- Alternate valuation, choosing the alternate valuation date can change both the land value and the easement math. Model both paths before you commit.

- Contribution date differences, if values differ between contribution and estate valuation dates, complete the required worksheet and attach it to Schedule U.

What To Write On Schedule U, Line By Line

- Line 1, list the property by the Form 706 schedule, line, and item number. If the easement covers part of an item, describe the exact portion.

- Line 3, describe the easement so the Service can value it. State grant date and grantor.

- Line 4, enter the estate tax gross value of the land, not reduced by mortgages.

- Line 5, enter the date of death value of the qualifying easement granted prior to death, if applicable.

- Line 7, reduce for retained development rights unless you attached the proper extinguishment agreement.

- Line 10, total value of qualified conservation easements on which the exclusion is based, and attach appraisal support with an explanation of how you determined value. The normal method is before and after FMV.

Quick check: Put the decedent’s land interests on the right asset schedules first, then compute the exclusion on Schedule U, then flow the exclusion to Part V item 12. This ordering keeps the math clean and avoids foot fault errors.

Computation At A Glance

| Step | What You Do | Why It Matters |

| 1 | Identify each parcel and the portion under easement, tie to Form 706 schedules and item numbers | Keeps valuation and mapping consistent |

| 2 | Decide valuation date and model alternate valuation if elected | The chosen date drives both land and easement values |

| 3 | Determine land value and any retained development rights | Required adjustments under §2031(c) |

| 4 | Determine easement value, usually before and after FMV | The standard valuation method for conservation easements |

| 5 | Apply applicable percentage and the 500,000 cap | Computes the exclusion, subject to statutory ceiling |

| 6 | Carry exclusion to Part V, item 12 | Reduces the gross estate before deductions and credits |

| 7 | Attach deed, appraisal, and any extinguishment agreement | Substantiation keeps the exclusion intact |

The Errors That Cause Pain, And How To Avoid Them

- Appraisal timing mismatch, the appraisal’s effective date does not match the valuation date, or the method does not show before and after. Fix, order an appraisal keyed to the estate’s valuation date that explains methods and comps.

- Missing or incomplete deed, missing exhibits, unclear metes and bounds, or no proof of recordation. Fix, attach the recorded instrument with full legal description and conservation purpose.

- Ignoring retained development rights, no reduction or no extinguishment agreement. Fix, reduce for retained rights or attach a proper 2031(c)(5) agreement signed by all interest holders.

- Late election, filing after the deadline without an extension. Fix, calendar your Form 706 due date and file Schedule U with the original, not later.

Interactions With Other Schedules You Will Touch

Schedule J, Expenses Of Administration

List funeral costs and administration expenses that are subject to claims on Schedule J and carry them to Part V, item 14. Use Schedule L for expenses of administering property not subject to claims. Consider protective claims on Schedule PC when timing is uncertain.

Schedule K, Debts, Mortgages, And Liens

Report valid debts and mortgages at death and carry totals to Part V, items 15 and 16. For real estate on Schedule A, include the full value and list the unpaid mortgage under description, then deduct the unpaid amount on Schedule K if the estate is liable.

Schedule L, Net Losses During Administration

Deduct post death casualty or theft losses on Schedule L. Keep insurance offsets and documentation, and consider Schedule PC for protective claims.

Schedule M, The Marital Deduction

Claim only what actually passes to the surviving spouse and is included in the gross estate, with careful attention to QTIP and terminable interest rules. Attach supporting court orders or computations when needed.

State Death Tax Deduction, Where It Actually Goes

Claim the state death tax deduction on Form 706, Part II, line 3b. The deduction can be claimed on an anticipated basis, but it will not be finally allowed unless the tax is paid and claimed within the 4 year period, subject to section 2058(b). Keep certificates or state documentation to close the loop.

Charitable Deduction, When A Post Death Easement Is Granted

If the executor grants a qualifying conservation easement after death, you may claim a charitable contribution deduction under section 2031(c)(9), typically on Schedule O, if requirements are met. This is separate from the Schedule U exclusion math and should be modeled together for the best overall outcome.

Reminder: On Form 706, deduction sequencing affects the Part V base, not the integrity of the exclusion itself. Keep your cross references tight so the totals in Part V align with every supporting schedule.

Workpapers, Review Flow, And A Simple Operational Playbook

Your On Return Checklist

- Map parcels to Form 706 schedules and item numbers, include acreage and legal descriptions.

- Insert a clean Schedule U packet, recorded deed first, then the appraisal, then any 2031(c)(5) extinguishment agreement.

- Add a one page memo that states the conservation purpose, grant date, valuation method, applicable percentage math, and the final exclusion you carried to Part V, item 12, with page references.

- Cross check Part V totals to Schedules J, K, L, M, and to Part II, line 3b for state death taxes.

Where A Partner’s Time Actually Saves Tax

Partners should focus on four review items.

- Eligibility, verify 170(h) elements and the 3 year ownership rule.

- Valuation, confirm before and after appraisal, contribution date worksheet if needed, and alternate valuation modeling.

- Development rights, either an accurate reduction or a signed and compliant extinguishment agreement.

- Flow through, check that Schedule U amounts land on Part V correctly and that related deductions live on the right schedules.

A Light Note On Support

If your internal team is buried during filing season, you can still keep Schedule U airtight by standardizing workpapers and review steps. Accountably supports firms with disciplined, SOP driven tax production, including attachment checklists, valuation cross walks, and review protection so partners spend time on decisions, not document hunts. Use this kind of help sparingly and only where it keeps control in your hands and protects quality.

Frequently Asked Questions

Does Schedule U change how state estate or inheritance taxes are computed?

Not directly. Each state follows its own rules. For federal purposes, claim state death taxes on Part II, line 3b, with the required timing and documentation. Model state interactions separately and keep your receipts and certificates for the federal file.

Can I amend if new deductible expenses or state tax updates arrive later?

Yes. File supplements with documentation and mind statute dates. For state death taxes, the deduction generally must be claimed within 4 years of the federal filing, with exceptions under section 2058(b).

How does portability interact with Schedule U?

Portability does not change the exclusion’s computation, but it changes the overall tax picture. Model DSUE alongside your Schedule U math so you do not trade a good exclusion for a poor overall plan. Reference the Form 706 instructions to confirm current DSUE mechanics for the decedent’s date of death.

What if the decedent was a nonresident noncitizen?

Different rules apply. Nonresidents generally file Form 706 NA, with their own state death tax deduction rules and deadlines. Check the current instructions for that form and keep treaty issues in view.

Which software supports detailed attachments for Schedule U?

Most enterprise tax platforms can handle large PDFs and XML mapping for Form 706 exhibits. Your controls matter more than the brand. Validate schemas, attachment limits, and transmission logs before you file to avoid last minute compression or formatting errors.

Final Filing Checklist

- Timely Form 706, with Schedule U completed and, if needed, the contribution date worksheet.

- Recorded deed, qualified appraisal, donee evidence, and property identification by schedule and item.

- Retained development rights either reduced or extinguished via a signed 2031(c)(5) agreement.

- Consistent cross references to Part V and the correct placement of other deductions and the state death tax deduction.

Simplify Delivery, Improve Margins, Stay in Control.

Offshore support that works exactly like your in-house team.

💼 Let’s Talk