Scale Your CPA Firm Without Adding Headcount

Build your offshore team that works your way, trained, compliant, and white-labeled under your firm.

👉 Book a Discovery Call

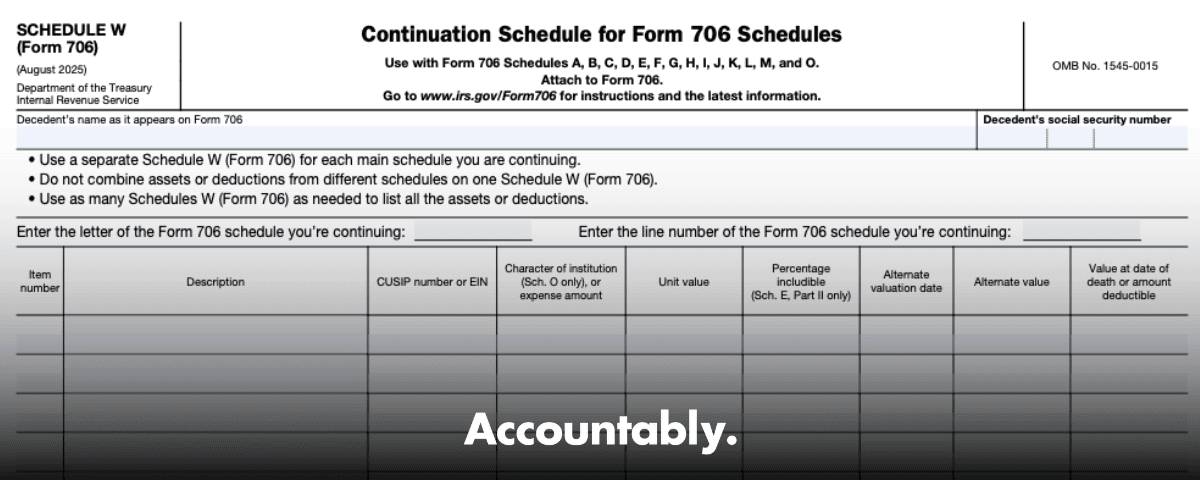

You are here because you want a return that closes cleanly, preserves DSUE when needed, and stands up to questions. Schedule W is not where you make the marital deduction or the portability election. It is the continuation schedule you use when the main schedules run out of space. Use it right, and your Form 706 flows. Use it casually, and you invite review friction, math mismatches, and time you cannot spare.

Key Takeaways

- Schedule W is the continuation schedule for Form 706. Use it when you need more lines for assets or deductions on a main schedule, then carry the total back to that schedule. It is not the marital deduction schedule and it is not the portability page.

- Marital deduction entries belong on Schedule M. If you run out of lines, continue them on Schedule W, then bring the total back to Schedule M. QTIP and QDOT elections are made on Schedule M, not on Schedule W.

- Portability, including DSUE, is elected and figured in Part VI of Form 706. Schedule W only helps you present clean supporting detail that feeds the return.

- File Form 706 within nine months of death. You can request a six‑month filing extension with Form 4768, however the extension does not extend the time to pay. Interest runs from the original due date on any unpaid tax.

- For 2025 deaths, the basic exclusion amount is 13,990,000 and the corresponding applicable credit is 5,541,800. Be cautious with 2026 or later figures, they depend on law and IRS adjustments in effect at that time.

What Schedule W actually is, and where it fits

Schedule W is the IRS’s standardized continuation page for Form 706 schedules. When a main schedule runs out of lines, you do not invent your own format, you add Schedule W. You list the extra items there, number them clearly, and carry the total back to the original schedule. That way, everything ties to one place and your recapitulation totals are easy to follow.

Which schedules can you continue on Schedule W

Per the IRS instructions, use Schedule W to continue asset schedules A through I and deduction schedules J, K, L, M, and O. Do not mix different schedules on the same Schedule W page, use one continuation page per schedule, and as many pages as needed. Then add up the continuation page and bring the total back to the matching line on the main schedule.

Hundreds of Firms Have Already Used This Framework.

Join the growing list of CPA and accounting firms using Accountably’s Offshore Playbook to scale faster.

💬 Get Your FREE Playbook

👉 Visit Jugal Thacker’s LinkedIn

Send him a connection request and message “Playbook” to get your copy.

Quick rule of thumb, if you need more room on Schedules A through I or J, K, L, M, O, reach for Schedule W, keep items numbered, and roll totals back to the right line. That single habit prevents most tie‑out headaches.

What Schedule W is not

- It is not the marital deduction page. That is Schedule M, including any QTIP or QDOT election language.

- It is not where you elect portability or compute DSUE. That work lives in Part VI of Form 706.

- It is not for GST computations. GST is handled on Schedules R and R‑1. Use Schedule W only when the IRS allows continuation for the listed schedules, then bring totals back.

Deadlines, extensions, and payment timing you cannot miss

- File Form 706 within nine months of the date of death.

- You may request a six‑month filing extension with Form 4768.

- The extension covers filing only, it does not extend time to pay. Interest starts from the nine‑month due date if tax is unpaid. Penalties can apply without reasonable cause.

If portability matters, timing matters even more. A timely and complete Form 706 is required to elect portability of DSUE to the surviving spouse. If you did not have a filing requirement and missed the deadline, Revenue Procedure 2022‑32 provides a simplified late‑election method for up to five years from date of death, with strict conditions and a required statement on the return.

2025 baseline figures

For decedents dying in 2025, the basic exclusion amount is 13,990,000 and the applicable credit amount is 5,541,800. Keep an eye on future IRS guidance and any legislation before you hard‑code 2026 figures in planning memos or client letters.

Improve Margins Without Compromising Quality

Offshore staffing helps firms deliver more, scale faster, and stay compliant, without adding local headcount.

👉 Book a Discovery CallHow Schedule W keeps your return audit‑ready

Think of Schedule W as your consistency tool. If you list ten rental properties on Schedule A and you have five more, do not tack them onto a free‑form spreadsheet. Put them on Schedule W for Schedule A, number the lines, include parcel IDs, valuation date, valuation method, and any appraisal reference number, then carry the total back to Schedule A. You have now created a straight line from the asset list to the recapitulation and to the tax computation, which reduces questions and protects timing.

Here is a simple framework you can reuse for every continuation page:

- Identify the parent schedule at the top of Schedule W, for example, “Schedule M, line 4, marital deduction, QTIP.”

- Use the same column structure as the parent schedule, for example, description, date of death value, alternate valuation if elected, deductions if applicable.

- Number the items starting at 1 and continue in order if you have multiple W pages for the same schedule.

- Add a subtotal for each Schedule W page and a grand total if you have several continuation pages. Carry that back to the parent schedule line.

- Cross‑foot to Part V and the overall recapitulation.

Using Schedule W with Schedule M, QTIP, and QDOT, the right way

When you claim the marital deduction, you list those assets on Schedule M. If you run out of room on Schedule M, continue on Schedule W, but keep the QTIP or QDOT election language on Schedule M itself and attach any required statements. Many review delays happen because QTIP property is listed on a free‑form attachment and the election is unclear. Put the property details on Schedule W, keep the election on Schedule M, and your intent is obvious.

- QTIP election, list the QTIP assets on Schedule M and insert their value. That listing is how you make the election, and it is irrevocable. Use Schedule W only to add more lines, then carry the total back to Schedule M.

- QDOT for a noncitizen surviving spouse, follow the Schedule M instructions and QDOT requirements, then use Schedule W only as continuation if you need more lines.

Example, clean QTIP continuation

- Schedule M, line 4 shows “QTIP election, see attached statement,” then lists items 1 through 12.

- Schedule W headers read “Schedule M, line 4 continuation.” Items 13 through 28 follow the same columns and include trust name, governing document date, and appraisal ID.

- The Schedule W total ties back to the Schedule M QTIP line. The QTIP election statement sits right behind Schedule M.

Portability and DSUE, how Schedule W supports a clean election

Portability is elected and computed in Part VI of Form 706, not on Schedule W. That said, a clean continuation schedule helps you demonstrate completeness and accuracy, which reduces back‑and‑forth that can jeopardize timing. Here is the practical checklist I use:

- Confirm a timely and complete filing to elect DSUE. Timely means nine months from death or within the six‑month filed extension window.

- If there was no filing requirement and you missed the deadline, consider the five‑year simplified late election under Rev. Proc. 2022‑32. Add the required legend on page 1 of Form 706 and follow the conditions carefully.

- Reconcile lifetime taxable gifts with prior Forms 709 and the tax computation pages.

- Tie every asset and deduction to the correct schedule, use Schedule W to expand, and then make sure Part V, the recapitulation, matches the schedule totals. This reduces questions around the DSUE figure in Part VI.

Portability lives in Part VI. Schedule W simply keeps the rest of your house in order so your DSUE calculation is credible and easy to verify.

GST planning and where Schedule W fits, and where it does not

Generation‑skipping transfer tax is reported on Schedules R and R‑1. You will often attach trust instruments and valuation support. Use Schedule W only when the IRS permits continuation for the listed schedules and keep all GST computations where they belong. Then cross‑reference trusts and beneficiaries across the return so inclusion ratios and allocations line up. That clarity is what prevents follow‑up letters.

Practical trust detail to include on supporting pages

- Trust name and date, trustee contact, and EIN if available.

- Beneficiary class and generation, for example, child, grandchild, great‑grandchild.

- Funding source that ties back to Schedules A through I or to Schedule M.

- Appraisal references and page numbers so an agent can find what you found quickly.

Valuations, attachments, and the nine‑month clock

Strong valuations keep everything else standing. For real estate and closely held businesses, attach qualified appraisals, identify the valuation date, and tag each item with an appraisal ID in your Schedule W continuation pages so the link is unmistakable. If you elect alternate valuation, confirm the election on the face of the return and keep your Schedule W columns consistent with that choice. Finally, remember that the extension is for filing only. If tax is due, interest starts at the nine‑month mark.

2025 figures to anchor tax modeling

- Basic exclusion amount, 13,990,000

- Applicable credit amount, 5,541,800

- Annual gift exclusion, 19,000 Model cash and payment options early, Sections 6161 and 6166 can help with timing and liquidity in specific cases, but they do not stop interest on unpaid amounts.

A simple table you can reuse, where Schedule W supports each area

| Schedule | Purpose on Form 706 | When to use Schedule W | Quick tip to speed review |

| A through I | Asset schedules | When you need more lines for property detail | Repeat the parent schedule’s columns and numbering so totals tie out cleanly. |

| J | Funeral and administration expenses | Overflow of itemized costs | Group similar items, for example publication fees or appraisals, then subtotal on each W page. |

| K | Debts and mortgages | Overflow of debt items | Include account numbers or legal descriptions to avoid ID confusion. |

| L | Net losses | Overflow of loss items | Cross‑reference supporting statements so timing and amounts are clear. |

| M | Marital deduction | Overflow of assets qualifying for marital deduction | Keep QTIP or QDOT election language on Schedule M, not on the W page. |

| O | Charitable gifts | Overflow of bequests | Attach governing document excerpts or court orders if they affect amounts. |

Common mistakes with Schedule W, and how to avoid them fast

- Mixing different schedules on one Schedule W page. Use one continuation page per schedule, then carry totals back to that schedule.

- Changing column headers or omitting them on the continuation page. Mirror the parent schedule so reviewers do not have to translate formats.

- Forgetting to roll up the continuation totals to the parent schedule. Every Schedule W needs a trail back to the main schedule line and to Part V.

- Putting the QTIP election on a continuation page, or burying it in a free‑form attachment. Keep elections on Schedule M and use W strictly for extra rows.

- Trying to compute portability on Schedule W. Elect and figure DSUE in Part VI, and keep your continuation pages clean and factual.

A quick QA loop I use before signing

- Totals on each Schedule W match the parent schedule line.

- All continuation pages are labeled with the parent schedule letter and line number.

- Numbering restarts at 1 for each schedule, not for the entire return.

- Cross‑foot to Part V and then to the tax computation.

- If portability applies, Part VI’s numbers reconcile to gifts reported on prior Forms 709.

Filing procedures and recordkeeping, built for fewer questions

- File Form 706 within nine months of death. Request a six‑month extension to file on Form 4768 if needed. Pay any tax by the nine‑month deadline to stop interest.

- If making or preserving portability, confirm a complete return. If you missed filing and there was no requirement, consider the five‑year late election under Rev. Proc. 2022‑32 with the required legend on page 1.

- Attach certified death certificate, appraisals, relevant schedule statements, and prior Forms 709.

- Keep a digital index of assets, valuations, governing instruments, and payments. Seven years is a sensible retention target in practice.

Micro‑anecdote, the ten minutes that saved a month

We once had a return with over sixty parcels across three states. The team built Schedule A to page capacity, added three Schedule W pages with parcel IDs, county, and valuation method, then rolled totals back to Schedule A. An IRS reviewer later told us that the clear W pages ended the exam before it began. Ten extra minutes up front, a month saved later.

Where a disciplined offshore partner helps without taking over your workflow

If your internal capacity is thin, you do not need a resume stack, you need clean execution. A partner that can follow your templates, number every item, attach appraisals correctly, and roll totals back to the right lines keeps your return moving. At Accountably, our teams work inside your systems and checklists, so continuation pages are consistent, elections stay where they belong, and your Part VI portability math is easy to trust. Use help where it saves review time, not where it adds noise.

Light touch, high discipline. That is how offshore support should feel on an estate return.

Step‑by‑step, building a bulletproof Schedule W flow

- Start with the parent schedule filled to capacity, for example, Schedule M.

- Create Schedule W labeled “Schedule M continuation,” then carry forward the same columns, description, value, notes if applicable.

- Number each item and cross‑reference documents, for example, “Appraisal ID 23‑011, page 7.”

- Subtotal each W page and then compute a grand total for the continuation set.

- Move the grand total back to the correct line on Schedule M and verify the math in Part V.

- If portability applies, check that Part VI’s inputs reconcile to the taxable estate after deductions and prior gifts.

Documentation checklist to pair with your W pages

- Valuation support, qualified appraisals for real estate and closely held businesses.

- Governing instruments, will and trust excerpts if they affect amounts or elections.

- Prior Forms 709 with gift details that feed the applicable exclusion math.

- Liquidity plan if tax is due, for example, 6161 or 6166 discussion notes for client files.

Portability pitfalls we see, and how a clean file avoids them

- Late filing without an extension when DSUE matters. You cannot elect portability without a timely, complete return, unless Rev. Proc. 2022‑32 applies and you qualify for the simplified late election. Put the required legend on the filed return.

- Incomplete gift histories. Reconcile every prior Form 709 to the Part II tax computation and Part VI portability section. Your continuation pages should point to the right exhibits.

- Confusing marital deduction presentations. Keep Schedule M clean and use Schedule W only to extend the line count. QTIP elections belong on Schedule M.

2025 planning note on thresholds

Anchor 2025 plans to the 13,990,000 basic exclusion and 5,541,800 credit. Avoid promising fixed 2026 numbers in client letters until official IRS figures and any new law are in place. A simple “subject to change” line protects clients and your team.

Quality control, the last five minutes before you file

- Confirm that every Schedule W page references exactly one parent schedule.

- Make sure every continuation page subtotal rolls into a single grand total, then to the specific line on the parent schedule.

- Reconcile Part V recapitulation to the sum of schedules, including W continuations.

- If electing portability, confirm Part VI line‑by‑line ties to the tax computation and gifts.

- Save a PDF portfolio with bookmarks by schedule, including W pages, so reviewers and clients can find everything in seconds.

Quick glossary, so your team talks about the same things

- Schedule W, the IRS continuation schedule for Form 706. Use it to add lines for allowed schedules, then carry totals back.

- Schedule M, the marital deduction schedule. QTIP and QDOT elections are made here.

- DSUE, deceased spousal unused exclusion. Elected and figured in Part VI with a timely, complete filing, or under Rev. Proc. 2022‑32 if eligible.

- Form 4768, the application for a six‑month extension to file Form 706. Payment due dates do not move.

FAQs

What is Form 706 Schedule W used for

Schedule W is the continuation schedule for Form 706. Use it when a main schedule lacks space, for example Schedules A through I for assets or J, K, L, M, O for deductions. You list additional items on Schedule W and then carry the total back to the parent schedule.

Is Schedule W where I claim the marital deduction or elect QTIP

No. You claim the marital deduction and make QTIP or QDOT elections on Schedule M. If you need more lines, use Schedule W as the continuation for Schedule M, then bring the total back to Schedule M.

Does Schedule W handle portability or DSUE

No. Portability is elected and computed in Part VI of Form 706. A well organized Schedule W supports a clean filing but does not replace the Part VI computations.

What is the Form 706 filing deadline, and does an extension help with payment

File within nine months of death. You can request a six‑month extension to file with Form 4768, however the extension does not extend the time to pay. Interest begins at the original due date on any unpaid tax.

What is the estate tax basic exclusion amount for 2025

For decedents dying in 2025, the basic exclusion amount is 13,990,000 and the applicable credit is 5,541,800, per the IRS. Confirm future years directly with IRS guidance before quoting numbers.

Can I get late portability relief if I missed filing and there was no requirement

Possibly. Revenue Procedure 2022‑32 provides a simplified late election for up to five years from the date of death for estates that were not otherwise required to file. You must include a specific legend on the return and meet all conditions.

Final thoughts, keep it steady, keep it standard

When your continuation pages look just like the parent schedule, reviewers move faster, portability stays safe, and your client gets closure without extra drama. If your team is stretched, bring in help that understands your templates and keeps your elections where they belong. At Accountably, we slot into your workflow, organize continuation pages, and cut review time, without changing how you practice.

Simplify Delivery, Improve Margins, Stay in Control.

Offshore support that works exactly like your in-house team.

💼 Let’s Talk