Scale Your CPA Firm Without Adding Headcount

Build your offshore team that works your way, trained, compliant, and white-labeled under your firm.

👉 Book a Discovery Call

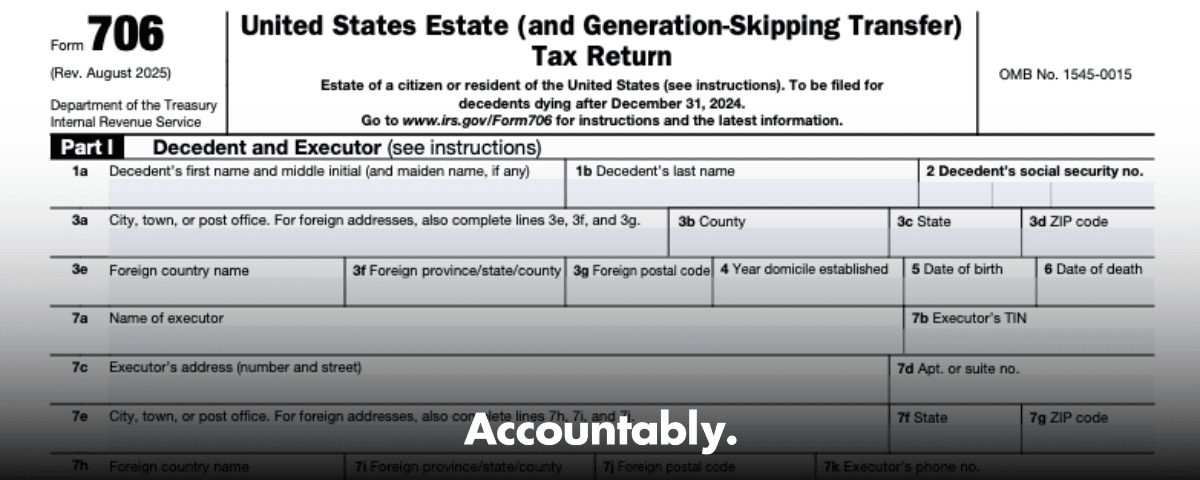

This guide translates IRS Form 706 into plain English. You will see exactly when you must file, what to include, how to elect portability of the deceased spouse’s unused exclusion, and where mistakes tend to happen. I will also show practical ways to steady the delivery process, so you do not get stuck in endless reviews or scramble for appraisals at the last minute. Key figures are current as of October 25, 2025, and I cite the IRS and other trusted sources so you can double check anything you need.

If the estate wants portability, file a complete and timely Form 706. Timely means within nine months of death or within a valid six month extension.

Please remember, this is general information for education, not legal or tax advice. Form 706 touches Your Money or Your Life topics, so when you face facts that differ from these examples, talk with your estate attorney and CPA.

Hundreds of Firms Have Already Used This Framework.

Join the growing list of CPA and accounting firms using Accountably’s Offshore Playbook to scale faster.

💬 Get Your FREE Playbook

👉 Visit Jugal Thacker’s LinkedIn

Send him a connection request and message “Playbook” to get your copy.

Key Takeaways

- File Form 706 if the gross estate plus adjusted taxable gifts and specific exemption exceed the 2025 threshold of $13.99 million, or file a “portability only” return to preserve DSUE for a surviving spouse.

- The due date is nine months after death. Use Form 4768 for an automatic six month filing extension. The extension does not extend time to pay.

- Portability requires a timely filed return. If no filing was required and you missed the deadline, limited late relief exists under Revenue Procedure 2022‑32.

- Nonresident decedents use Form 706‑NA, and generally only a $13,000 unified credit applies, the rough equivalent of $60,000 of taxable estate. Portability is not available for estates of nonresident noncitizen decedents.

- Paper filing is still the norm for Form 706 in 2025, with e‑file targeted for tax year 2026. Mail original returns to the IRS in Kansas City, MO 64999, and use the Pershing Road street address for private delivery services.

What Form 706 does, in plain terms

Form 706 is the estate and generation‑skipping transfer tax return. You use it to report the decedent’s gross estate at fair market value, claim deductions and credits, compute any estate and GST taxes due, and, when you want it, elect portability of unused exclusion to the surviving spouse. Think of it as the estate’s final accounting to the IRS, tied to support like appraisals, bank and brokerage statements, insurance data, gift history, and trust documents.

You will place assets and deductions on the right schedules, A through at least R, and you will attach evidence that proves each number. The return is paper filed for 2025, so plan printing, assembly, mailing, and tracking. The IRS is working toward electronic filing for the 706 series, and the current target is tax year 2026, so do not assume e‑file is available this season.

When you are filing for portability only, the IRS lets you streamline valuation for certain marital or charitable deduction assets, however, you still must estimate and include those values in the recapitulation and complete the DSUE section. The portability election happens on a timely filed and complete return.

Improve Margins Without Compromising Quality

Offshore staffing helps firms deliver more, scale faster, and stay compliant, without adding local headcount.

👉 Book a Discovery CallWho this guide helps

- You, as executor or personal representative, who needs a clear, step by step view to get this done on time.

- CPA and EA firms that want fewer review loops and a repeatable way to stand up accurate, audit‑ready 706 files during peak season.

- Attorneys and trust officers who want a clean handoff between estate administration and the tax return.

As we go, I will call out filing rules that commonly trip up even experienced teams, along with practical ways to add capacity without losing quality. Where it is helpful, I will reference tools firms use, like CCH Axcess, UltraTax, ProConnect, Lacerte, Drake, TaxDome, Karbon, and Suralink, because your process matters as much as your technical conclusions.

When you must file Form 706

You start by testing the federal filing threshold. Add the decedent’s gross estate at fair market value, adjusted taxable gifts, and any specific exemption. If that total is over the 2025 basic exclusion of $13.99 million, you must file Form 706. Even if you are under the threshold, you still file a “portability only” return to preserve the deceased spouse’s unused exclusion for the survivor. The IRS instructions make both points clear.

You also work to a hard timeline. The due date is nine months after the date of death. If you need more time to prepare a complete return, submit Form 4768 for an automatic six month extension to file. The extension does not extend time to pay the tax, so plan liquidity early.

If you are electing portability, the return must be timely, either within nine months or within the valid Form 4768 extension window. Late relief exists for small estates, but it is limited, so do not bank on it.

Federal filing threshold, simplified

- For 2025 decedents, the basic exclusion amount is $13,990,000 per person. If the decedent’s gross estate plus adjusted taxable gifts and specific exemption exceeds that number, file Form 706.

- You may file even if you are under the threshold, specifically to elect portability of DSUE to the surviving spouse.

- Paper filing is still required in 2025. Do not assume e‑file is live yet for the 706 series.

What about 2026 and beyond? Under current law, the doubled exclusion is scheduled to sunset after December 31, 2025, which would push the basic exclusion to a lower inflation‑adjusted level, often estimated near the $7 million range per person. This is a policy call, so track official updates before you plan lifetime gifts or liquidity.

Portability only filing

If there is a surviving spouse, you can elect to transfer the decedent’s unused exclusion by filing a complete and timely Form 706. That election fixes the DSUE for the survivor, which can then shelter later lifetime gifts or the survivor’s taxable estate. The portability election is made on the return itself, and the IRS considers a timely, complete filing as the election.

If you missed the nine month deadline and there was no filing requirement, you may rely on the simplified late election relief in Revenue Procedure 2022‑32, which generally gives you until the fifth anniversary of the date of death to file and elect portability, as long as you meet its conditions. Treat this as a safety net, not a plan.

A quick DSUE checklist

- Calendar the nine month due date and, if needed, file Form 4768 before the original due date to extend filing by six months.

- Complete all required schedules. For assets deductible under the marital or charitable deduction, you may estimate values for a portability‑only return, but they still factor into your recapitulation.

- Document the DSUE computation, keep appraisals and statements, and match values to what beneficiaries will use for basis.

Deadlines, extensions, and payments

The rule is simple. You file the return and you pay any estate and GST tax within nine months after death. If you cannot complete the return, file Form 4768 for a six month extension to file, up to 15 months after death. The extension does not stop interest on unpaid tax from accruing after the nine month mark.

When cash is tight, you may request more time to pay for reasonable cause under IRC §6161, or, if a closely held business exceeds 35 percent of the adjusted gross estate, you may elect §6166 to pay in installments. Plan ahead because both options require a timely filed return and supporting statements, and interest generally applies.

Payment timing, made practical

- Identify the due date on day one, then work backward to schedule appraisals, reconcile brokerage statements, and fix liquidity.

- If tax is due, pay by the nine month date. Use EFTPS or check to the United States Treasury. If you extend filing, you still pay by nine months.

- If you expect to use §6166, coordinate with the closely held business’ financials and be ready to attach the required statements.

Portability is tied to timeliness. A complete, timely Form 706 is the cleanest way to lock the DSUE. Late portability relief exists, but it is discretionary and comes with conditions.

Where to mail Form 706 in 2025

Form 706 remains a paper return in 2025. Mail original returns to: Department of the Treasury, Internal Revenue Service, Kansas City, MO 64999. For private delivery services, use: 333 W. Pershing Road, Kansas City, MO 64108. For supplemental returns, the IRS uses its Florence, Kentucky address. Always check the current instructions before you ship.

If you manage multiple estates each season, a simple control sheet helps. Track: date of death, nine month due date, whether Form 4768 was filed, payment confirmation, carrier and tracking number, and whether you requested an Estate Tax Closing Letter through Pay.gov.

Where Accountably fits

Most firms stumble on delivery, not on technical answers. If your team is swamped by appraisals, schedules, scan naming, and review loops, that is a delivery system problem. This is where disciplined offshore delivery, set up correctly, helps you hold the nine month line without burning weekends. Accountably only appears where it is operationally relevant. For 706 work, the value is in standardized workpapers, predictable turnaround windows, and multi‑layer review that protects partner time. That way, you preserve DSUE, close on schedule, and keep trust with the family at a hard moment.

Portability and the DSUE election, step by step

Portability lets a surviving spouse use the deceased spouse’s unused exclusion. You make the election by filing a complete and timely Form 706. The election becomes effective on the date of death, so the survivor can apply DSUE to gifts or to their later estate. If the survivor remarries, the “last deceased spouse” rule governs which DSUE applies. The IRS explains the mechanics clearly in the current instructions.

Translation, if you want the survivor to keep the shelter, you must file Form 706 on time, even if no estate tax is due.

Building a clean DSUE file

- Gather a full asset list and gift history early. Confirm Form 709 filings and match adjusted taxable gifts.

- Secure appraisals where needed and align them to the date of death.

- Complete Part VI for portability and compute DSUE precisely. Portability is deemed elected on a timely, complete return.

- If you were not required to file and you missed the deadline, consider Rev. Proc. 2022‑32. It offers a simplified late election method for qualifying estates up to the fifth anniversary of death. Mark the top of the return with the required legend.

Practical DSUE cautions

- DSUE does not pass to future spouses. It is tied to the last deceased spouse at the time of a transfer.

- The survivor uses DSUE before their own basic exclusion. Plan gifts accordingly.

- Coordinate with beneficiary basis reporting to avoid mismatches that trigger questions later.

Estate and GST tax exemptions and rates

For 2025, the federal estate and GST exemptions are $13.99 million per person, with a top marginal rate of 40 percent on amounts above the applicable exclusion. The annual gift tax exclusion is $19,000 for 2025. Keep an eye on official updates, but use these figures for returns due now.

Planning beyond 2025 requires caution. Unless Congress acts, the doubled exclusion is set to sunset after December 31, 2025, which would bring the basic exclusion down to an inflation‑adjusted level near $7 million per person. Track legislation and IRS updates before moving large gifts.

Quick reference table

| Item | 2025 amount | Notes |

| Estate tax basic exclusion | $13,990,000 | Applies to estate and gift, indexed for inflation. |

| GST exemption | $13,990,000 | Allocate on Form 706 to trusts and direct skips. |

| Top rate (estate, GST) | 40% | Applies to amounts above exclusion. |

| Annual gift exclusion | $19,000 | Per donee, 2025. |

Calculating the gross estate

You include the fair market value of all assets the decedent owned or controlled on the date of death. That means real property, bank and brokerage accounts, marketable securities, retirement accounts, life insurance with incidents of ownership, business interests, and tangible personal property. List each item on the proper schedule and support it with statements or appraisals. Do not net debts or expenses here, since deductions come later. If the decedent was a nonresident, use Form 706‑NA and include only U.S.‑situs property.

Asset-to-schedule map

| Asset | Where it goes | Evidence you will want |

| Real estate | Schedule A | Qualified appraisal at date of death |

| Marketable securities | Schedule B | Monthly statements, date‑of‑death pricing |

| Closely held business | Schedule F | Appraisal, five‑year financials, cap rates, discounts |

| Life insurance | Schedule D | Policy statements and ownership confirmation |

| Joint property | Schedule E | Titles, retitled account statements |

| Annuities | Schedule I | Payout details, contract values |

| Debts and expenses | Schedule J | Invoices, receipts, engagement letters |

Accountably note, used sparingly: If your firm routinely chases missing statements or reworks schedule mapping at review, you can standardize document requests and file naming across all 706 jobs. That one change tends to cut review time meaningfully and it protects the DSUE election timeline in busy seasons.

Valuation rules and required appraisals

If you want a smooth review, start with defensible values. Form 706 asks for fair market value on the date of death, or on the alternate valuation date if you properly elect it. This is not a guess. It is a supportable number that a willing buyer and willing seller would agree to, with no compulsion and with reasonable knowledge of the facts.

Here is how I approach it when time is tight and accuracy matters.

- Real estate. Order qualified appraisals early. Ask the appraiser to tie comps to the date of death and to explain adjustments in plain language. If the estate plans to elect alternate valuation, explain that up front so you can plan scheduling.

- Closely held businesses. Use a qualified valuation analyst. Provide five years of financials, customer concentration, and management details. If you expect discounts for lack of control or marketability, ask the analyst to cite empirical studies and to show the math in a way a reviewer can trace.

- Marketable securities. Pull date of death statements and compute values using the IRS averaging conventions where required. Print price sources for thinly traded issues.

- Retirement accounts and annuities. Coordinate with custodians early. For IRAs and qualified plans, confirm beneficiary designations and include payout calculations if relevant.

- Life insurance. Confirm ownership and incidents of ownership. Even when proceeds are payable to a beneficiary, ownership details can pull value into the estate.

- Digital assets. Include value of online businesses, cryptocurrencies, and any monetized channels or intellectual property. Keep screenshots and export data with timestamps.

- Tangible property. Photograph key items. For collectibles, use specialized appraisers and keep provenance documents.

If you elect alternate valuation, apply it consistently to all assets that qualify and document declines or events that affect value. I flag assets that do not qualify so reviewers do not waste time asking why a number did not change.

Substantiating discounts without drama

Discounts save tax, but they also draw attention. If you are taking a marketability or minority discount, show the work.

- Identify the exact interest and rights.

- Provide control and transfer restrictions from operating agreements.

- Use recognized studies and methods.

- Bridge the discount to the final number with a short narrative that a non‑valuation expert can follow.

A tight one page summary on top of the full report helps the reviewer stay oriented.

Avoiding double counting with prior gifts

Tie every post‑1976 taxable gift to Form 709. Check values, dates, and whether any split gift elections or GST allocations changed the numbers you will use on the estate return. A quick three column worksheet, gift description, Form 709 reference, adjusted amount, prevents mistakes that cause you to redo workpapers a week before mailing.

Key schedules and a clean documentation trail

Form 706 is a series of schedules that tell a story. Your job is to keep that story simple to follow. I build an indexed binder or a digital folder with a naming standard. Each schedule gets its own folder and each exhibit has a prefix that links it to a line number. Reviewers love this and exam teams find it easy to follow.

Schedule by schedule essentials

- Schedule A, real estate. Appraisal, deed, tax card, and any post‑death sale contract if relevant to alternate valuation.

- Schedule B, stocks and bonds. Monthly statements, price printouts, and cost basis support if you want to help beneficiaries later.

- Schedule C, mortgages and notes. Note documents, payment histories, and collateral descriptions.

- Schedule D, insurance. Policy pages, ownership evidence, and beneficiary confirmations.

- Schedule E, joint property. Titles and contribution evidence for right of survivorship analysis.

- Schedule F, business interests. Full valuation report, governing agreements, capitalization tables.

- Schedule G, transfers. Documentation for retained interests and string provisions.

- Schedule H, powers of appointment. Documents that grant or release powers.

- Schedule I, annuities. Contracts, payout schedules, actuarial computations.

- Schedule J, funeral and administration expenses. Invoices, receipts, engagement letters, and payment proofs.

- Schedule K, debts and mortgages. Statements with balances as of death, payoff letters.

- Schedule L, previously taxed property. Prior Form 706 and asset mapping.

- Schedule M, marital deduction. Trusts and marital bequests, QTIP elections, prenuptial agreements.

- Schedule O and P, gifts and prior transfers. Copies of Forms 709, allocation statements.

- Schedule R and R‑1, GST. Allocation statements and trust terms needed to compute inclusion ratios.

A simple workpaper map you can copy

| Schedule | What reviewers look for | Your shortcut |

| A and B | Appraisal dates, price sources | Label every exhibit with the schedule and line number |

| D and E | Ownership, beneficiary logic | One page summary of title and incidents of ownership |

| F | Discount support, comps | Short abstract in front of the valuation report |

| J | Proof of payment | Bank proof or EFTPS proof stapled behind each invoice |

| M | QTIP clarity | Highlight exact paragraphs where the marital trust terms live |

| R | GST allocations | A one page grid of trusts, allocations, and inclusion ratios |

A note on delivery, used sparingly. Many firms lose time here because workpapers are not named, version control is unclear, and checklists are missing. Even one standard file hierarchy across 706 jobs can cut review time and helps preserve the portability deadline when the calendar gets tight. Accountably teams often implement this structure so every review starts from the same map, not from a scramble.

Coordinating Form 706 with Forms 1040 and 1041

A clean estate return matches the income tax picture. Separate pre‑death and post‑death income, then reconcile items that otherwise cause confusion later.

Align Form 706 numbers with the decedent’s final Form 1040 and the estate’s Form 1041. This prevents basis and timing conflicts and it lowers audit risk.

Four coordination moves

- Reconcile retirement accounts. On Form 706, you report the account’s value at death. On the 1040 and 1041, you pick up income when distributions occur. Keep a memo that shows date of death values, beneficiaries, and distribution plans, because heirs often ask about basis and taxable amounts.

- Decide where to deduct administration expenses. You can deduct them on Form 706 or on Form 1041, but not both. I use a simple decision rule. If the estate will be taxable, take deductions on 706. If not, move them to 1041 where they may offset income in respect of a decedent. Whatever you choose, keep a statement in the workpapers that documents the choice.

- Step up in basis. Beneficiaries often need basis confirmations for in‑kind distributions. Include a basis schedule derived from your appraisals so the family does not guess later.

- Gift history. Tie out the adjusted taxable gifts to prior Form 709s. If prior valuations changed, explain the change with references to corrected statements or appraisals.

Payment of estate and GST taxes

Payment is due nine months after the date of death. If the estate is taxable, plan cash early.

Payment options that keep you on time

- EFTPS. Best for tracking. Confirm enrollment weeks before the due date if the estate is new to EFTPS.

- Check. Payable to United States Treasury. Match the check amount to your transmittal and keep a copy in the file.

- Installments. If a closely held business exceeds 35 percent of the adjusted gross estate, consider an election under section 6166 for installment payments. Expect an interest only period followed by up to ten annual installments. This requires a timely filed return and detailed statements. If you do not qualify, request an extension of time to pay under section 6161 for reasonable cause.

- Asset sales. If you will sell assets, coordinate appraisal timing, broker instructions, and closing dates to hit the nine month payment date.

Small controls that prevent last minute stress

- Build a liquidity schedule in month one. List cash on hand, expected cash flows, debts due, and projected tax.

- If you are filing Form 4768 for more time to file, still pay what you estimate by the nine month mark. It stops interest growth and calms everyone down.

- Keep proof of payment in the binder. EFTPS confirmations or bank images of the cleared check save hours later.

Mailing and tracking the return

Form 706 is paper filed for 2025. Mail the original return to the IRS service center listed in the current instructions for estate tax returns. Use a trackable carrier, keep the label and full copy of what you mailed, and retain a scanned copy in your workpapers. If you need a Closing Letter, request it through Pay.gov and note the date you submitted the request. For private delivery services, use the street address listed in the instructions rather than the PO Box style address.

A simple one page shipping control sheet helps. Include date mailed, carrier, tracking number, return addressee, and a checklist of enclosures. Attach it to the inside cover of your binder or the front of your digital workspace so anyone on the team can answer a status question in seconds.

Special situations, nonresident decedents, and Form 706‑NA

If the decedent was not a U.S. citizen or U.S. resident at death, you prepare Form 706‑NA instead of Form 706. You include only U.S.‑situs assets such as U.S. real estate, tangible property located in the U.S., and stock of U.S. corporations. The unified credit for nonresident noncitizens is generally $13,000, which is the tax on roughly $60,000 of U.S.‑situated property. You file within nine months of death, the same as Form 706, and you may request a six month extension to file with Form 4768. Portability is not available for nonresident noncitizen decedents.

Quick 706‑NA checklist

- Confirm status, nonresident noncitizen, for estate tax purposes. Tie this to domicile, not just immigration status.

- Identify U.S.‑situs assets and exclude non‑U.S. property. Get appraisals that meet U.S. standards.

- Apply the unified credit correctly, generally capped at $13,000, and review any treaty provisions that may increase credits or deductions.

- Calendar the nine month due date, consider Form 4768 for filing relief, and pay by nine months to limit interest.

Pro tip, separate 706‑NA workpapers by asset type and situs. Exam questions on situs go faster when your exhibits already show location evidence and valuation support.

Liquidity challenges and payment relief, sections 6161 and 6166

Estate tax is due at nine months, even when the estate is illiquid. If your cash plan comes up short, you have two relief paths.

- Section 6161, time to pay for reasonable cause or undue hardship, usually short term, interest applies.

- Section 6166, installment payments when a closely held business exceeds 35 percent of the adjusted gross estate. You can defer principal for up to five years, then pay in up to ten annual installments. Interest is paid annually, and a portion may qualify for a special rate. A timely, properly supported election is required.

How to prepare a clean 6166 election

- Verify the business qualifies as a closely held business interest and that it exceeds the 35 percent test. Summarize ownership, headcount or shareholder count, and voting thresholds.

- Attach the required notice of election with the amount to be paid in installments, the first installment date, number of installments, schedules and line references for the business interests, and facts showing eligibility.

- Expect the IRS to ask for a bond or agree to a special lien under section 6324A, often equal to the deferred tax plus four years of interest.

If you are not eligible for 6166, request a 6161 extension and document the hardship. You can combine the two, using 6166 for the business‑related portion and 6161 for the remainder or for installments coming due within the hardship window.

Common mistakes and audit risks

Small, preventable errors cause the most pain. Here is what I see most often and how you can avoid it.

- Missing the nine month due date, which risks the portability election. Calendar the date of death, file Form 4768 if needed, and keep mailing proofs.

- Incomplete or late appraisals for real estate and closely held businesses. Order early and make sure valuation dates match the date of death, or the alternate valuation date if elected.

- Poor DSUE files, weak gift tie‑outs, and missing 709 references. Reconcile every post‑1976 taxable gift to a Form 709 before you draft the return.

- Reporting gaps between Form 706 and the final Form 1040 and the estate’s Form 1041. Add a one page reconciliation memo for retirement accounts, insurance, and administration expenses so basis and timing align.

- Wrong annual exclusion and exemption amounts in planning memos. For 2025, the annual gift exclusion is $19,000 and the estate and GST basic exclusion is $13,990,000 per person.

A delivery note, used sparingly. Firms that standardize file naming, checklists, and review notes reduce rework and keep partner time focused on judgment calls, not on hunting exhibits. If you want outside help, use a team that works in your systems under your SOPs and hits your turnaround targets rather than sending CVs. That is the difference between staffing and real delivery.

Planning strategies to reduce estate and GST taxes

Planning splits into three buckets. You remove assets from the taxable base, you shift future growth, or you improve how and when you pay tax. Mix and match to fit the family, the business, and the calendar.

Direct, simple moves

- Use the annual gift tax exclusion, $19,000 per donee in 2025, or $38,000 if spouses split gifts. Pay tuition and medical bills directly to providers, which do not consume exclusion. File Form 709 when required.

- Charitable planning, from outright gifts to donor advised funds and CRTs. You may reduce the estate while targeting income benefits.

Shifting appreciation

- ILITs for life insurance. Keep proceeds outside the estate and create liquidity for taxes or equalization.

- GRATs, excellent when rates and volatility favor near‑term appreciation. Move future growth with a low gift value.

- Sales to IDGTs, shift appreciation to the trust while the grantor pays income tax on the trust’s earnings.

- Family entities and discounts, align with real business or investment needs. Use qualified appraisals and avoid paper‑only structures.

Paying smarter, not just sooner

- Section 6166, if a closely held business dominates the estate, defer and amortize the estate tax while maintaining control of the enterprise.

- Liquidity ladders, set aside a cash or line of credit plan that matches the nine month payment and the first years of interest.

Planning rule of thumb, get your values right, file on time, then choose the least disruptive way to fund the tax. The smartest plan still fails if you miss the deadline.

FAQs, fast answers you can trust

What is the purpose of Form 706?

You use it to report the decedent’s gross estate, claim deductions, compute estate and GST taxes, and, if desired, elect portability of DSUE for the surviving spouse. The form is paper filed for 2025 and tracks values to supporting schedules and appraisals.

Who must file Form 706?

File if the gross estate plus adjusted taxable gifts and specific exemption exceed $13,990,000 for 2025, or file a portability‑only return to preserve DSUE even when the estate is under the threshold. File within nine months of death, or within a valid six month extension to file, and remember the extension does not extend time to pay.

Who prepares Form 706?

As executor, you sign the return. In practice, estates retain a CPA or EA firm and an estate attorney to assemble schedules, tie out gift history, draft elections, coordinate appraisals, and manage deadlines. The executor still owns the calendar and the documents.

What is the difference between Form 706 and Form 709?

Form 706 reports the estate at death, computes estate and GST taxes, and can elect portability. Form 709 reports lifetime gifts above the annual exclusion or other gifts that require reporting, and it tracks how much of the lifetime exclusion has been used.

What address do I use to mail Form 706?

Mail original returns to Department of the Treasury, Internal Revenue Service, Kansas City, MO 64999. Use 333 W. Pershing Road, Kansas City, MO 64108 for private delivery. Supplemental or amended filings go to the IRS Florence, KY address shown in the current instructions.

Step by step, how to assemble and mail a complete file

1.Here is the production flow I use for estates of every size. It cuts rework and calms the nine month deadline.

- Intake and inventory

- Gather the will, trust documents, beneficiary designations, gift history, and statements.

- Build a master asset list with schedule assignments and who will provide each document.

- Appraisals and pricing

- Order real estate and closely held business appraisals early.

- Capture marketable security pricing and broker statements as of the date of death.

- If you plan to elect alternate valuation, confirm eligibility and track six month values.

- Draft and reconcile

- Complete schedules with cross‑references to exhibits.

- Reconcile post‑1976 gifts to Forms 709 and tie DSUE computations to those values.

- Decide where to take administration expenses, 706 or 1041, and memorialize the choice in a memo that sits in front of Schedule J.

- Calendar and payments

- Fix the exact due date, nine months after death, and submit Form 4768 if you need extra time to file, not to pay.

- If tax is due, pay by nine months. If liquidity is tight, consider §6161, and if a closely held business dominates, consider §6166.

- Assembly and mailing

- Print the original return, wet sign where required, and assemble with schedules and exhibits.

- Mail to the Kansas City address in the instructions, use trackable service, and keep the receipt with a copy of the mailed packet. Use the street address for private delivery services.

- After filing

- If you want an Estate Tax Closing Letter, request it through Pay.gov and note the request date in your control sheet.

- Keep digital and physical copies of everything. Maintain a status log so anyone on your team can answer questions instantly.

A brief word on delivery support

You may not need outside help for every estate. When you do, ask for a delivery partner who works inside your systems and templates, meets your security standards, and is accountable for turnaround and review quality. That is where an offshore delivery system, built with SOPs, standardized workpapers, and multi‑layer reviews, can protect deadlines and DSUE elections during busy seasons. Mentioning this once, because the process matters.

Nonresident questions, quick answers

Do nonresident noncitizen decedents get portability?

No. Portability is not available for estates of nonresident noncitizens. If you are filing 706‑NA, do not plan on DSUE.

What credit applies for 706‑NA?

Generally, the maximum unified credit is $13,000, roughly the tax on $60,000 of U.S.‑situs property, unless a treaty increases it. Review the instructions and any treaty articles that apply.

Where do I mail 706‑NA?

Use the estate tax service center addresses listed in the current instructions and on the “Where to file” page for forms beginning with 7. Check the most current page before mailing, addresses can change after instructions are printed.

A short, human conclusion

If you are the executor, you carry a lot in a short time. Form 706 rewards a steady process, clean valuations, and thoughtful planning. Start early, build your file one schedule at a time, and keep the nine month date circled on your calendar. If there is a surviving spouse, a timely, complete return protects portability and can be worth millions later. If the estate is illiquid, do not wait to explore §6166 or §6161. And if you handle many estates each season, standardize your workpapers so your reviewers spend time on judgment, not on hunting exhibits.

File on time, value carefully, and document every decision. That is how you protect families, minimize tax, and close estates with confidence.

Final compliance notes

- 2025 numbers you will need right now: basic exclusion $13,990,000, annual gift exclusion $19,000, top estate and GST tax rate 40 percent.

- Due date is nine months after death. Form 4768 gives you six more months to file, not to pay.

- Mail original 706 returns to Kansas City, MO 64999, and use 333 W. Pershing Road for private delivery. Supplemental returns go to Florence, KY. Always check the current IRS pages before you ship.

- Late portability relief may be available under Rev. Proc. 2022‑32 if the estate was not otherwise required to file. Use the required legend on the top of the return.

- filing deadline, Form 4768 extensions, DSUE portability, and 706‑NA basics.

Simplify Delivery, Improve Margins, Stay in Control.

Offshore support that works exactly like your in-house team.

💼 Let’s Talk