Scale Your CPA Firm Without Adding Headcount

Build your offshore team that works your way, trained, compliant, and white-labeled under your firm.

👉 Book a Discovery Call

Short version, you document the distribution or termination, match people and TINs, apply the inclusion ratio, and send the right packet to the right place, on the right date.

Before we dive in, one practical California note. The State Controller requires a California GST return whenever a federal 706‑GS(D) or 706‑GS(T) is filed, and they want a complete copy of the federal return with all schedules in the envelope. Mail it to the State Controller, Local Government Programs and Services Division, Tax Administration Section, P.O. Box 942850, Sacramento, CA 94250‑5880, not the Franchise Tax Board. Filing runs January 1 through April 15 for the year after the distribution or termination. Interest on underpayments tracks IRC 6621 and compounds daily under IRC 6622.

Key Takeaways

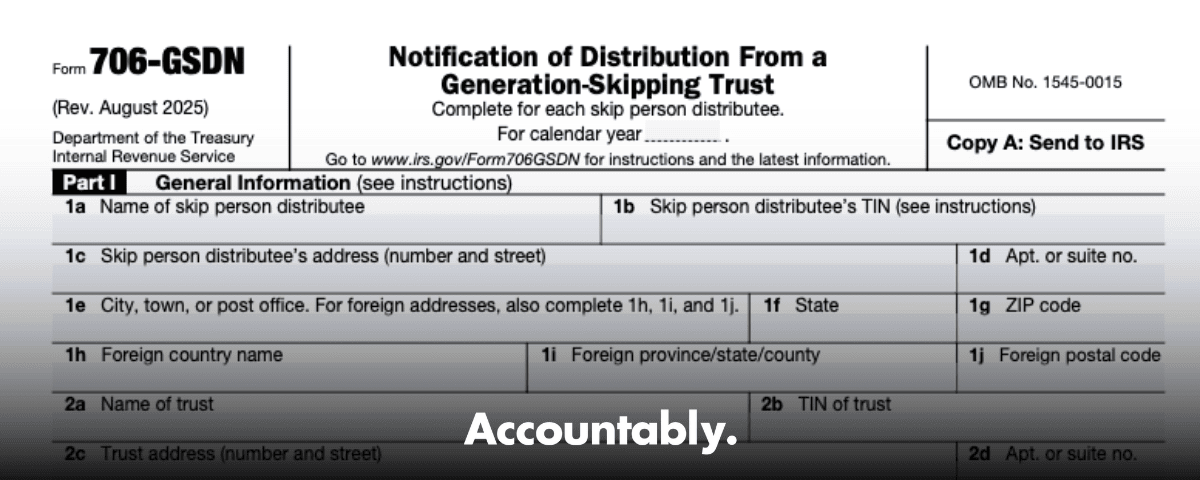

- Form 706‑GSDN, often discussed alongside the trustee’s 706‑GS(D‑1), is the information layer that ties the skip distributee’s SSN, the trust’s EIN, dates, property descriptions, fair market values, and the allocation of GST exemption that sets the inclusion ratio. It feeds the tax return, 706‑GS(D), when a taxable distribution occurs.

- The skip distributee files 706‑GS(D) by April 15 of the year after the distribution, and may request an automatic 6‑month extension with Form 7004. The trustee files 706‑GS(D‑1) to the IRS and furnishes the beneficiary by the same April 15 timeline.

- California mirrors the federal trigger. If you file 706‑GS(D) or 706‑GS(T), you also send a California GST return plus a complete federal copy to the State Controller’s Office at P.O. Box 942850, Sacramento, CA 94250‑5880. Do not mail it to the Franchise Tax Board.

- The inclusion ratio controls the taxable portion. The tax equals the distribution multiplied by the inclusion ratio multiplied by the current maximum GST rate.

- Practical filing detail, Form 7004 extensions for 706‑GS(D) are not e‑filed. Paper‑file Form 7004 by the original April 15 due date.

What Form 706‑GSDN Does, In Real Life

Although 706‑GSDN is an information notice, it plays a central role in clean GST compliance. It ties together the people, the trust, and the numbers that the tax return relies on. You, or your advisor, will gather:

Hundreds of Firms Have Already Used This Framework.

Join the growing list of CPA and accounting firms using Accountably’s Offshore Playbook to scale faster.

💬 Get Your FREE Playbook

👉 Visit Jugal Thacker’s LinkedIn

Send him a connection request and message “Playbook” to get your copy.

- Identifiers, the skip person’s full legal name, SSN, and address, and the trust’s legal name and EIN.

- Event details, distribution or termination date, asset description, and fair market value.

- Exemption and ratios, allocation history, inclusion ratio for the interest, and any prior taxable events to keep computations consistent.

On the federal side, this data sits in the 706‑GS(D‑1) that the trustee files with the IRS and furnishes to you by April 15 of the year after the distribution. The IRS address for Copy A on the 706‑GS(D‑1) is the Florence, Kentucky service center, and that is still the correct “where to file” for the trustee’s copy.

Once you have the trustee’s notice, you compute the tax on your Form 706‑GS(D), using your SSN and the trust EIN for matching. The 706‑GS(D) instructions confirm the due window, January 1 through April 15 of the year after the calendar year of distributions, with an automatic 6‑month filing extension available via Form 7004 filed by April 15.

A quick word on rates and ratios

- Inclusion ratio, generally 1 minus the fraction of GST exemption allocated to that interest.

- GST rate, the maximum estate tax rate in effect when the transfer occurs, 40 percent for transfers after December 31, 2012, per the IRS tables in the 706‑GS(D) and 706‑GS(T) instructions.

Put simply, Tax = Distribution × Inclusion Ratio × GST Rate.

Improve Margins Without Compromising Quality

Offshore staffing helps firms deliver more, scale faster, and stay compliant, without adding local headcount.

👉 Book a Discovery CallWhen a Distribution Is Actually Taxable

A taxable distribution happens when a trust pays income or principal to a skip person, usually someone two or more generations below the transferor. The distributee, not the trustee, reports and pays the GST on 706‑GS(D). The trustee’s job is to send the 706‑GS(D‑1) detail, property descriptions, fair market values, and the inclusion ratio that anchors your computation.

| Concept | What it means in practice |

| GST trigger | Trust distribution to a skip person under the governing instrument. |

| Skip transfer | Benefit skips a non‑skip generation to land with a skip person. |

| Inclusion ratio | The taxable slice of the distribution after exemption allocations. |

| Computation | Distribution × inclusion ratio × current GST rate. |

If you receive a 706‑GS(D‑1) and every distribution shows an inclusion ratio of zero, you do not file 706‑GS(D). The 706‑GS(D) instructions spell that out directly.

Pro tip, ask the trustee for the workpapers that support the inclusion ratio, especially for blended interests and late allocations. It makes review and any future exam faster and calmer.

Who Files What, And Who Receives It

- You, as the skip distributee, file Form 706‑GS(D) for taxable distributions and pay the GST due. Due January 1 through April 15 of the year after the distribution year, with an automatic 6‑month filing extension available via Form 7004 if filed by April 15.

- The trustee files Form 706‑GS(D‑1) with the IRS and furnishes you a copy by that same April 15. Keep an eye on the Florence, KY address for Copy A.

- For California, mirror the federal role. If you filed a federal 706‑GS(D) or 706‑GS(T), you must mail a California GST return plus a complete federal copy with all schedules to the State Controller’s Office, LGPS Division, Tax Administration Section, P.O. Box 942850, Sacramento, CA 94250‑5880. Do not send it to the Franchise Tax Board.

Small historical footnote for planning conversations, California’s GST tax does not apply to transfers after December 31, 2004, but the State Controller still administers the reporting program and requires the copy of the federal return and schedules.

If you run a busy CPA or EA firm and need seasonal lift without sacrificing review quality, a disciplined workpaper process is your safety net. This is one place where Accountably’s structured teams, standard naming, and layered reviews can trim your partner review time on 706 packages without giving up control. Use it when the calendar gets tight, not as a crutch.

Federal‑to‑State Filing Linkage, How The Pieces Fit

Think of your federal return as the source file that California expects to see. Whenever you file a federal Form 706‑GS(D) for a taxable distribution, or a 706‑GS(T) for a taxable termination, you prepare the matching California GST return and mail a complete copy of the federal filing with all schedules. This keeps the numbers, the people, and the dates perfectly aligned. If the federal file changes later, update your California records so interest and adjustments track cleanly.

The timing mirrors the federal calendar. Distributions and terminations made in a calendar year flow into returns due the next year, from January 1 through April 15. If you extend federally with Form 7004, include proof in your California packet. California wants the full federal copy, so do not trim schedules you think are “not relevant.” They help the state match inclusion ratios, valuation pages, and trustee disclosures to your numbers.

Tip, place the trust EIN and the distributee SSN on the upper right corner of every enclosure page. Matching goes faster and you avoid “missing schedule” letters that are really indexing delays.

California Filers, Who Does What

- If you are the skip distributee and you filed federal Form 706‑GS(D), you mail the California GST return with a complete federal copy.

- If you are the trustee or other filer who filed federal Form 706‑GS(T), you mail the California GST return that mirrors your federal role, again with a complete federal copy.

- Mail everything to the State Controller, Local Government Programs and Services Division, Tax Administration Section, P.O. Box 942850, Sacramento, CA 94250‑5880. Do not send anything to the Franchise Tax Board.

California Filing Requirements And Deadlines

The California window is straightforward. Returns are due January 1 through April 15 for distributions or terminations made in the prior calendar year. Payments track the same date. A timely federal Form 7004 grants an automatic six‑month filing extension, which you can rely on for timing, but it does not extend time to pay. Interest on underpayments follows the short‑term federal underpayment rate and compounds daily. Overpayments earn interest at the federal overpayment rate. For practical purposes, calendar your payment decision for April 15 even if you plan to extend.

| Trigger | Due Date Window | Extension Link |

| Distribution | Jan 1–Apr 15 of the following year | File Form 7004 by Apr 15 |

| Termination | Jan 1–Apr 15 of the following year | File Form 7004 by Apr 15 |

If you are coordinating multiple beneficiaries, build a master calendar with each distributee’s filing duty. I have seen families with four beneficiaries where two filed, one assumed the trustee filed for everyone, and one waited for a K‑1 that never mattered for GST. A clear owner for each filing prevents those headaches.

Mailing Instructions And Required Enclosures

You are mailing to a post office box, so plan for tracking. Use a service that provides delivery confirmation and keep a full digital scan of the package. Label the outer envelope, “California GST Return, federal 706‑GS copy enclosed,” so the mailroom routes it straight to the tax unit.

Include these items for a clean first pass:

- The signed California GST return.

- A complete, signed federal Form 706‑GS(D) or 706‑GS(T), all pages.

- All federal schedules, worksheets, and valuation reports used to compute inclusion ratios and tax.

- The trustee’s Form 706‑GS(D‑1) notices for the relevant year, copies are fine.

- Identification pages that show the skip distributee name and SSN and the trust name and EIN.

- If extended, a copy of filed Form 7004.

- Payment voucher or check, if tax is due.

Practical note, place a cover sheet at the top with contact info, the distributee name and SSN, the trust name and EIN, the tax year, and a numbered list of enclosures. If the file is ever pulled for review, your cover sheet becomes the index and saves everyone time.

Enclosure Checklist You Can Reuse

- Cover sheet, contact info, SSN, EIN, and enclosure index

- California GST return, signed

- Federal 706‑GS(D) or 706‑GS(T), signed, all pages

- Trustee 706‑GS(D‑1) copies furnished for the year

- Valuations and appraisals supporting noncash distributions

- Inclusion ratio worksheet, with allocation dates and amounts

- Proof of federal extension, Form 7004, if applicable

- Proof of payment or payment voucher

If your firm handles a stack of these each spring, save a template cover sheet and a standard naming convention for PDFs, for example, “706‑GSDN_2024_LastName_SSN4_TrustEIN4.pdf.” A small system prevents big rework later.

Key Data Elements And Supporting Schedules

Your goal is to make the tax math verifiable. Start with perfect identifiers. Then line up the event, the valuation, and the ratio.

- Distributee, full legal name, SSN, and address, exactly as used on federal Form 706‑GS(D).

- Trust, legal name, EIN, and trustee name and address, matching the trustee’s 706‑GS(D‑1).

- Event, the distribution or termination date, a clear asset description, and fair market value on that date.

- Inclusion ratio, show the allocation history and the computation, especially for blended interests and late allocations.

- Cross‑references, if the trust issued K‑1s for income, add a short note that explains how DNI does or does not relate to the GST event. It helps reviewers follow the story.

Required Federal Attachments

Bring the complete federal picture. California’s reviewers should be able to tie your numbers to the federal forms without guessing.

| Item | Purpose |

| Federal return, all pages, signed | Establishes base liability and filer identity |

| GST schedules and worksheets | Verifies ratios, allocations, and tax math |

| Trustee 706‑GS(D‑1) notices | Confirms property, values, and inclusion ratio |

| Valuations and appraisals | Substantiates noncash distributions and discounts |

| Prior year ratio support | Shows how earlier allocations affect current events |

Quality check, if you distribute closely held equity, include a valuation summary with the effective date, standard of value, and any discounts. Your reviewer will thank you, and your future self will too.

Trust And Distributee Identifiers, Getting Them Exactly Right

Small miskeys create big delays. Match the distributee’s name and SSN to the federal return header, including suffixes like Jr. or II. Match the trust’s legal name and EIN to the governing instrument and the trustee’s notices. If the trustee changed, include a one‑page explanation with the new address and effective date. For multi‑entity structures, add a diagram that shows the distributing trust and any related trusts, then note whether each is GST exempt, partially exempt, or nonexempt.

Quick Valuation Tips For Common Assets

- Public securities, tie to a recognized pricing source on the distribution date, include closing price detail for clarity.

- Cash and cash equivalents, attach a bank statement page that straddles the date.

- Real property, include a recent appraisal summary or a reasonable method for value if the event precedes a full appraisal, then update when the appraisal closes.

- Closely held entities, summarize the valuation approach and any discounts, for example, lack of control or marketability, with the effective date.

Comparing 706‑GS(D), 706‑GS(D‑1), And 706

Use this overview when someone on the team asks, “Which one am I filing?”

| Form | Who files | What it does | When it matters |

| 706‑GS(D) | Skip distributee | Computes and pays GST on taxable distributions | Due Jan 1 to Apr 15 of the year after the distribution year, with a possible 6‑month filing extension |

| 706‑GS(D‑1) | Trustee | Notifies the IRS and the distributee, provides property, value, and inclusion ratio | Must be furnished to the distributee for their 706‑GS(D) computation |

| 706 | Executor | Estate tax return, allocates GST exemption, establishes ratios that govern later trust events | Filed by the estate, affects future distributions via inclusion ratio |

One sentence you can paste in your file, “As a skip distributee, file 706‑GS(D) using your SSN, the trust’s EIN, and the trustee’s valuation and inclusion ratio from 706‑GS(D‑1).”

When you see families with old trusts and complex history, pull the earliest 706 with GST allocations and the most recent inclusion ratio worksheets. A 20‑minute review here can prevent a misapplied ratio that would otherwise ripple through multiple returns.

Extensions, Penalties, And Interest Calculations

Put the dates on the calendar first. The original due date is April 15 of the year after the distribution year. If you need time to collect valuations or reconcile blended ratios, file Form 7004 by April 15. That buys you a filing extension until October 15. Remember, the extension does not extend time to pay. If tax is likely, plan a payment by April 15 to curb interest.

Interest on underpayments compounds daily. Overpayments accrue interest at the federal overpayment rate. If you anticipate a refund because a distribution was later reclassified or valued lower after an appraisal finalizes, add a simple memo that explains why you expect a difference. It makes refund processing smoother.

Filing Extensions, How To Work Them

- Calendar the April 15 filing date and the October 15 extended date.

- File Form 7004 by April 15 to secure the 6‑month filing extension.

- If tax is due, pay by April 15 to reduce interest, even if you are waiting on final appraisals.

- Include a copy of the filed 7004 in your California mailing if you are relying on the extension for timing.

A simple rule helps busy seasons. If your team has the trustee’s 706‑GS(D‑1), the valuation support, and a confirmed inclusion ratio by March 31, aim to file by April 15. If any of those are pending, extend and send a good faith payment with a short internal note that lists what is outstanding.

Penalties And Interest, What To Expect

- Late filing without extension can trigger penalties, and interest starts on the original due date.

- An accurate return that is late but extended avoids late filing penalties, but interest still applies if a balance exists.

- For California tracking, keep proof of mailing and delivery for both the extension and the return. If a notice arrives later, you can show timely action.

Common Errors And How To Avoid Them

You can eliminate most problems with three habits, perfect IDs, clean workpapers, and a short cover memo that explains the inclusion ratio.

- Missing federal schedules, California expects a complete federal copy, including all worksheets.

- Misrouted mail, send to the State Controller’s Office, not the Franchise Tax Board.

- Mismatched identifiers, names, SSNs, EINs, or trustee addresses that do not line up across forms.

- Sloppy workpaper naming, reviewers waste time hunting for values, which slows approvals and increases questions.

- Ratio mistakes, ignoring prior allocations or blended interests that change the inclusion ratio.

- Deadline drift, forgetting that Form 7004 extends filing, not payment.

Review Checklist Before You Seal The Envelope

- Header data matches across 706‑GS(D), 706‑GS(D‑1), and California packet

- Inclusion ratio math ties to allocations with dates, amounts, and sources

- Distribution descriptions and fair market values are specific and supported

- Federal return is complete, signed, and includes every schedule used

- Proof of extension, if used, is attached

- Payment decision documented and included, if tax is due

- Tracking number created and stored with the PDF scan

If you manage a firm, consider standard operating procedures and version‑controlled workpapers for these filings. This is where a structured delivery partner like Accountably can help by enforcing naming, checklists, and multi‑layer review that cut partner review time, while your team keeps control of client relationships and policy calls.

When To Seek Professional Guidance

You do not need a specialist for every case. You do need one when classification or valuation can flip the tax result. Here are common triggers.

| Scenario | Why a professional helps |

| §2611(a) classification questions | Correctly distinguishing taxable distribution, direct skip, or taxable termination prevents penalties and amended returns |

| Blended inclusion ratios | Prior allocations, late allocations, or partial exemptions change the math and the filing duty |

| Noncash assets | Real estate and closely held equity require support that stands up on exam |

| Exemption allocation timing | Early, late, or retroactive allocations can change the inclusion ratio and payment strategy |

| Interest computations | Planning payments and refunds saves money when values shift after appraisals |

If you are running point for a family and feel the facts drifting into gray zones, pull in an estate tax attorney or a CPA with deep GST experience. A one hour consult that confirms classification and ratio mechanics is often worth far more than it costs.

Frequently Asked Questions

What is the main purpose of Form 706

Form 706 reports a decedent’s gross estate, deductions, and the estate tax, and it handles GST allocation elections that later control inclusion ratios in trusts. Executors also use it to make portability elections when applicable. It sets the stage for how future trust distributions will be taxed.

What is “Form 706 GST”

People use “Form 706 GST” as shorthand for the generation‑skipping transfer tax forms. In practice, 706‑GS(D) is the return a skip distributee files for taxable distributions, 706‑GS(D‑1) is the trustee’s notice to the IRS and the distributee, and 706‑GS(T) covers taxable terminations. These forms work together, with the inclusion ratio determining the taxable share.

What happens if you do not file Form 8606

If you skip Form 8606 for IRA basis, you risk paying tax twice on after‑tax contributions and you invite notices and interest. File late with a clear reconstruction of basis. While it is a different topic than GST, it comes up often in the same client folders, so keep your basis records clean.

Who must file IRS Form 706

You file IRS Form 706 if you are the executor of an estate that meets the federal filing threshold or needs to make elections that require a timely filed return, such as portability. The nine‑month deadline applies, with a six‑month extension available, and payment is due at the original deadline.

Putting It All Together

By now you can see the path. You collect clean identifiers, match trustee notices to your return, apply the inclusion ratio correctly, and mail a complete federal copy with your California packet by April 15, or by October 15 if you filed a timely extension. You avoid the usual traps, missing schedules, weak valuation pages, or mismatched IDs, and you keep proof of mailing for peace of mind.

If you are a firm leader, build a repeatable system, not a hero culture. Standard workpapers, documented reviews, and predictable turnaround free partners to focus on strategy and client trust. If you want outside help that plays inside your systems, Accountably integrates trained offshore teams with SOP‑driven execution, structured workpapers, and multi‑layer review, so you protect quality while gaining capacity. Use it when you want control, not chaos.

Final reminder, bold your calendar with April 15 and October 15, label every page with the SSN and EIN, and include the full federal return and schedules. Do those three things and your 706‑GSDN season gets a lot quieter.

Simplify Delivery, Improve Margins, Stay in Control.

Offshore support that works exactly like your in-house team.

💼 Let’s Talk