Scale Your CPA Firm Without Adding Headcount

Build your offshore team that works your way, trained, compliant, and white-labeled under your firm.

👉 Book a Discovery Call

You file it, you pay the tax, and you document exactly what happened so nothing slips through later.

This guide is written for you, the trustee, designated filer, or CPA who needs a practical, warm walkthrough that keeps you out of penalty territory and protects client trust.

Key Takeaways

- Form 706‑QDT is used when a Qualified Domestic Trust for a non‑U.S. citizen spouse has a taxable event, lifetime principal distributions, certain annuity corpus amounts, or the spouse’s death.

- Annual returns for distributions are generally due by April 15 for the prior calendar year, returns due after the spouse’s death are due within 9 months of death. Filing extensions are available with Form 4768, payment deadlines can differ.

- A QDOT must have at least one U.S. trustee with the legal right to withhold QDOT tax from corpus distributions. Trustees or a designated filer may be responsible for filing and paying.

- The 08‑2025 instructions added direct deposit fields for refunds on Part III, so you can route overpayments quickly.

- If there are multiple QDOTs from the same decedent, a designated filer can be named. Each trustee still prepares Schedule B for their trust and sends it to the designated filer at least 60 days before the deadline.

If a QDOT has a taxable event this year, put a pin in April 15 next year, then add a second pin at 9 months after the surviving spouse’s death if that event applies. Those two dates drive almost every decision you make.

Hundreds of Firms Have Already Used This Framework.

Join the growing list of CPA and accounting firms using Accountably’s Offshore Playbook to scale faster.

💬 Get Your FREE Playbook

👉 Visit Jugal Thacker’s LinkedIn

Send him a connection request and message “Playbook” to get your copy.

What Form 706‑QDT covers, and when it applies

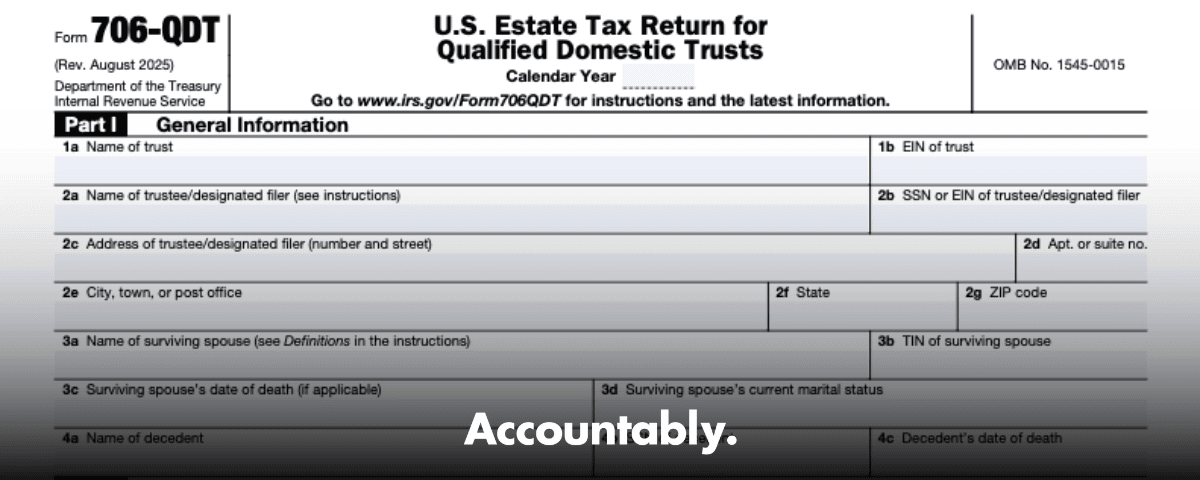

At its core, Form 706‑QDT reports and computes the special estate tax tied to a QDOT, a trust structure that preserves the marital deduction when the surviving spouse is not a U.S. citizen. You file to report tax on taxable principal distributions, the corpus portion of certain annuity payments, and the value remaining in the QDOT at the spouse’s death. It is not an income tax form, it is an estate tax form that springs to life when defined events occur.

The instructions also allow a limited use case, notifying the IRS that future filing is no longer required if the surviving spouse becomes a U.S. citizen and the regulatory conditions are met. That change needs to be handled exactly as the instructions describe.

QDOT basics you must confirm before you file

A QDOT only works if it meets section 2056A requirements and, importantly, the governing instrument gives at least one U.S. trustee the authority to withhold QDOT tax from corpus distributions. This withholding right is not optional. It must be clear in the document and real in practice.

Improve Margins Without Compromising Quality

Offshore staffing helps firms deliver more, scale faster, and stay compliant, without adding local headcount.

👉 Book a Discovery CallTwo more structural points that save headaches later:

- The QDOT election is made on the decedent’s Form 706. If a qualifying trust is listed and not specifically excluded, the election is treated as made. Courts can allow time to modify a trust to qualify, and the determination is made as of the Form 706 filing timeline.

- The regulations spell out security and administration rules, including conditions for foreign real property, bonds or letters of credit, and ongoing statements. These exist to ensure the U.S. can collect the section 2056A tax.

Who files, and who pays

In a one‑QDOT world, the trustee files Form 706‑QDT and pays the tax. If there are multiple QDOTs from the same decedent, the executor can name a designated filer who files one consolidated return and pays the tax for all QDOTs. Even then, each QDOT’s trustee completes a separate Schedule B and gets it to the designated filer at least 60 days before the due date. Plan that handoff early, especially during peak season.

Just as important, section 2056A makes trustees personally liable for this tax. Treat filing, payment, and documentation like a fiduciary risk area, because it is. Build sign‑offs and date controls into your workflow so personal exposure does not sneak up on you.

What‑How‑Wow framework for this guide

- What, a clear explanation of Form 706‑QDT events, due dates, people who file, and required attachments.

- How, practical steps, checklists, sample timelines, and a comparison to Form 706‑NA because many cross‑border estates touch both worlds.

- Wow, hard‑won tips from real filings, including how to avoid a review bottleneck, how to coordinate multiple trustees without last‑minute chaos, and where 2025 updates matter in daily work. We will also flag the new direct deposit lines and 2025 exclusion levels that shape planning conversations.

Taxable events you must report

Here is the simple way to think about reportable items. If the QDOT’s principal leaves the protective wrapper, or the spouse dies, or certain annuity corpus is paid, you likely have a Form 706‑QDT reporting obligation. When in doubt, check the instructions and your trust language, then document your decision so review goes fast.

Event‑to‑reporting map

| Event | What you report on Form 706‑QDT |

| Principal distribution to surviving spouse | Amount distributed, compute QDOT tax on the corpus portion, include trustee withholding and credits |

| Annuity with corpus component | Tax on the corpus portion, follow the regulation agreement language if applicable |

| Surviving spouse’s death | Value of QDOT property on date of death, compute tax, include any distributions earlier that year |

| Hardship distribution | Report the distribution year on the annual return, track documentation and regulatory conditions |

| QDOT ceases to qualify | File within 9 months of cessation and include that year’s reportable distributions |

These requirements come straight from the 2025 instructions and the regulations, so keep the table handy when you review transactions.

Deadlines, extensions, and payments

Two clocks matter.

- Annual clock, returns to report distributions are generally due on or after January 1 and no later than April 15 of the year after the calendar year in which the taxable event or hardship distribution occurred.

- Death clock, if you are filing because the surviving spouse died, file and pay within 9 months of the date of death. You must also include all reportable distributions made during that calendar year, which can create a due date earlier than April 15.

You can request a 6‑month filing extension on Form 4768. That buys filing time, it does not automatically move the payment date, so plan cash.

Deadline snapshot

| Trigger | Due date |

| Distribution or other taxable event during calendar year | By April 15 of the following year |

| Surviving spouse’s death | Within 9 months after date of death |

| QDOT ceases to qualify | Within 9 months after cessation |

| Filing extension | File Form 4768 for up to 6 months, payment rules still apply |

Dates and examples are set out in the 08‑2025 instructions and the regulations.

2025 updates you should actually use

- Direct deposit, if Part III, line 15a shows an overpayment, you can enter routing and account details on new lines 15b through 15d. This speeds refunds and reduces back‑office follow‑up.

- Payments, if Part III, line 14 shows a balance due, the IRS directs you to its electronic payment channels. Set this up before the signing meeting so the release is smooth.

- Planning context, for 2025 the federal basic exclusion amount is 13,990,000, and the annual gift exclusion is 19,000. These do not change how you compute QDOT tax on a distribution, which looks back to the decedent’s estate tax structure, but they matter for broader planning and spouse citizenship timing.

Quick workflow tip, schedule a 20‑minute huddle two weeks before April 15 to confirm totals, attachments, payment method, and who is pressing submit. That tiny meeting saves hour‑long fire drills.

Step‑by‑step filing workflow

Follow this sequence when you are the trustee filing the complete return.

- Gather facts

- Confirm the QDOT’s qualifying status and the U.S. trustee’s withholding authority in the governing instrument.

- Pull the year’s distributions, any annuity payments, and spouse death data if applicable.

- Compute tax and build schedules

- Prepare Schedule B for each QDOT if you are a designated filer, otherwise complete Schedule A totals and Part III tax computation in the order the instructions specify.

- Attach what proves your position

- Include each Schedule B when a designated filer is used. Attach valuations, statements that support amounts, and any required agreements for annuities.

- File and pay

- File by the correct date, pay electronically, and, if you have an overpayment, use the new direct deposit lines.

- Archive and calendar

- Save a clean package, then calendar next year’s April 15 with a 30‑, 14‑, and 2‑day reminder.

If there are multiple QDOTs and a designated filer, get each trustee’s Schedule B at least 60 days before the due date. Build that date into your engagement letter so everyone manages to it.

Trustee authority, personal liability, and how to stay protected

The governing instrument must give a U.S. trustee real power to withhold QDOT tax on corpus distributions. Without that power, the trust does not qualify. Keep a copy of the instrument excerpt with your workpapers and highlight the withholding clause so reviewers find it fast.

Trustees are not just administrators here, they are on the hook. Section 2056A says each trustee is personally liable for the tax tied to taxable events. In practice that means you want documented controls, a clear sign‑off trail, and an agreed payment path before you release funds to the spouse.

Designated filer coordination

If an executor named a designated filer because there are multiple QDOTs, every trustee still completes a separate Schedule B and gets it to the designated filer at least 60 days before the deadline. The designated filer then summarizes everything on Schedule A and files one return with all Schedules B attached. Treat this like a mini‑consolidation project and keep version control tight.

Election, security, and special assets

Real life QDOTs hold all kinds of property, sometimes foreign real estate or a residence. The regulations cover security arrangements, letters of credit, and special rules like the personal residence exclusion allocation. If you see foreign real property inching toward 35 percent of trust assets, review the regulatory thresholds and timing so the trust does not fail QDOT status.

Documentation, identification, and valuations

Strong documentation is your fastest path through review. Build your packet with these items.

Trustee identification set

- Full legal name, TIN or EIN, address, and citizenship or place of organization.

- Proof that a required U.S. trustee is in place, and that the withholding power exists in the governing instrument.

- If a designated filer is used, attach each QDOT’s Schedule B to the filed return.

Valuations and appraisals

- For spouse’s death or corpus‑at‑death reporting, include fair market value support as of the valuation date.

- For public securities, include statements or quotations for the valuation date.

- For real estate and closely held interests, obtain qualified appraisals with methods and assumptions spelled out.

- Keep a summary memo that ties each valuation to the reported lines so reviewers can follow your math without guesswork.

While the instructions focus on schedules and order of assembly, attaching the right valuation support is a practical necessity, especially when distributions and death occur in the same calendar year. It keeps questions short and refunds faster if you are due one.

706‑QDT vs 706‑NA at a glance

Many cross‑border estates involve both conversations, 706‑QDT for QDOT events and 706‑NA for nonresident, non‑citizen decedents with U.S.‑situs assets. Here is a quick comparison to ground your planning.

| Topic | Form 706‑QDT | Form 706‑NA |

| Purpose | Report QDOT estate tax on defined taxable events | File estate and GST tax for NRNC decedents with U.S.‑situs assets |

| Typical filer | Trustee or designated filer | Executor or person in possession of property |

| Core triggers | Principal distributions, annuity corpus, spouse’s death, cessation of QDOT | U.S.‑situs asset transfers at death |

| Due date anchor | April 15 for prior‑year events, 9 months after spouse’s death | Generally 9 months after date of death |

| Notable 2025 update | New refund direct deposit fields on Part III | Redesign, new refund direct deposit fields on Part II, reduced ETCL fee to 56 starting May 21, 2025 |

Form 706‑NA’s 09‑2025 instructions confirm the redesign, direct deposit, and ETCL fee change. Keep this in mind if you are handling both returns for the same family.

Planning note, while QDOT tax calculations look back to the decedent’s estate tax context, the broader estate conversation in 2025 includes a basic exclusion of 13,990,000 and a 19,000 annual gift exclusion, with different rules for gifts to non‑citizen spouses. These numbers shape timing decisions around citizenship and gifting.

Common pitfalls and how to avoid them

- Missing the 60‑day handoff from each trustee to a designated filer, solve this with a shared calendar and a short status tracker.

- Releasing principal before tax is calculated and funded, hold distributions until the tax computation, withholding, and payment path are documented.

- Treating hardship distributions casually, they still trigger an annual return and documentation.

- Forgetting to include all reportable distributions in the year the spouse dies, the death return must sweep those in.

Practical examples and micro‑anecdotes

- Review bottleneck avoided, one firm asked each trustee for Schedule B two months early, then ran a 20‑minute review to reconcile totals against bank confirmations. The final filing took half the time because nothing was re‑keyed on deadline day.

- Death‑year timing, a spouse died in June, so the 706‑QDT was due 9 months later in March. Team added all distributions from January through June to that return, rather than waiting for the following April 15. That alignment matched the instructions and avoided a mismatch.

- Direct deposit win, a trustee entered Part III routing and account details for a modest overpayment, and the refund posted faster than paper. In 2025, use the new fields.

How disciplined delivery helps complex estate and trust filings

If you manage multiple QDOTs, moving parts multiply fast. What I have seen work best is a disciplined delivery model, one set of SOPs, structured workpapers, and a layered review. That is the operating stance Accountably uses when it supports U.S. firms on specialized estate and trust workloads, teams trained on IRS workflows, U.S. tools, and security with role‑based access, SOC‑aligned controls, and zero local storage. Mentioning it here only because QDOT filings are unforgiving, and structure protects you when deadlines stack up. Use it as a model, with or without outside help.

FAQs

What is Form 706‑QDT, in one sentence?

It is the return the trustee or designated filer uses to report and pay the QDOT estate tax on principal distributions, certain annuity corpus, and the value in the trust at the surviving spouse’s death.

When is Form 706‑QDT due?

Generally by April 15 for prior‑year distributions, or within 9 months after the surviving spouse’s death for death‑year filings. Use Form 4768 for a filing extension, and remember payment timing can differ.

Who is responsible for filing and paying?

The trustee usually files and pays. If there are multiple QDOTs from one decedent, a designated filer can be named, but each trustee must deliver Schedule B to that filer at least 60 days before the due date.

What makes a trust a QDOT?

The trust must meet section 2056A requirements, including at least one U.S. trustee with legal authority to withhold the QDOT tax from corpus distributions. The QDOT election is made on the decedent’s Form 706.

Are trustees personally liable?

Yes. Section 2056A states that each trustee is personally liable for the tax tied to taxable events. Build controls and do not release principal before funding the tax.

Quick checklist before you press submit

- Confirm qualifying QDOT status and the U.S. trustee’s withholding power.

- Identify all reportable distributions and any annuity corpus amounts.

- If the spouse died, pull the QDOT value as of the date of death, and include all distributions from that calendar year.

- Prepare schedules in the order the instructions require, attach each Schedule B if you are the designated filer.

- File by the correct date, pay electronically, and use direct deposit fields for refunds.

706‑QDT and the 706‑NA hub

If you landed here from a Form 706‑NA page, you are in the right neighborhood. 706‑NA applies to nonresident, non‑citizen decedents with U.S.‑situs assets, while 706‑QDT covers QDOT taxable events for a surviving spouse who is not a U.S. citizen. The IRS released updated 706‑NA instructions in 09‑2025 that added direct deposit fields and noted a reduced fee for estate tax closing letters. Keep both pages handy if you work with cross‑border estates.

Final word and disclaimer

Treat Form 706‑QDT like a flight checklist, confirm QDOT status, capture every taxable event, hit the correct due date, and attach clean support. You will feel the stress lift when your file reads like a story a reviewer can follow.

This article provides general information only, it is not legal or tax advice. Always consult the current IRS instructions and regulations for your facts. 2025 sources cited above, including the 08‑2025 Form 706‑QDT instructions, the 09‑2025 Form 706‑NA instructions, and section 2056A regulations, should guide your filings.

Simplify Delivery, Improve Margins, Stay in Control.

Offshore support that works exactly like your in-house team.

💼 Let’s Talk