Scale Your CPA Firm Without Adding Headcount

Build your offshore team that works your way, trained, compliant, and white-labeled under your firm.

👉 Book a Discovery Call

If you send the right documents, in the right order, by the date on the notice, you can usually close the loop without drama. That is what this guide will help you do. The form is used after you receive a notice, it is not filed with your original return.

Think of Form 886‑H‑AOC as a short, IRS‑approved shopping list for your proof. Follow it, and you lower the chance of delays or disallowance.

Key Takeaways

- Form 886‑H‑AOC is an IRS cover sheet and document list you use to respond to a notice about the American Opportunity Tax Credit, not something you file with your tax return.

- Your packet should include Form 1098‑T for the year, proof of your actual payments, enrollment records showing at least half‑time status, and itemized receipts for required books and supplies.

- The American Opportunity Credit can be up to $2,500 per eligible student, with up to 40% refundable for most taxpayers. Income limits and eligibility rules apply.

- Match 1098‑T Box 1 to the bursar ledger, subtract scholarships and grants, and attach separate payment proof if Box 1 does not capture everything you paid.

- Send your documents by the deadline on your IRS letter. Many notices allow secure upload through the IRS Document Upload Tool, which gives an immediate confirmation. If uploading is not offered, mail with tracking and keep copies.

What Form 886‑H‑AOC is and when to use it

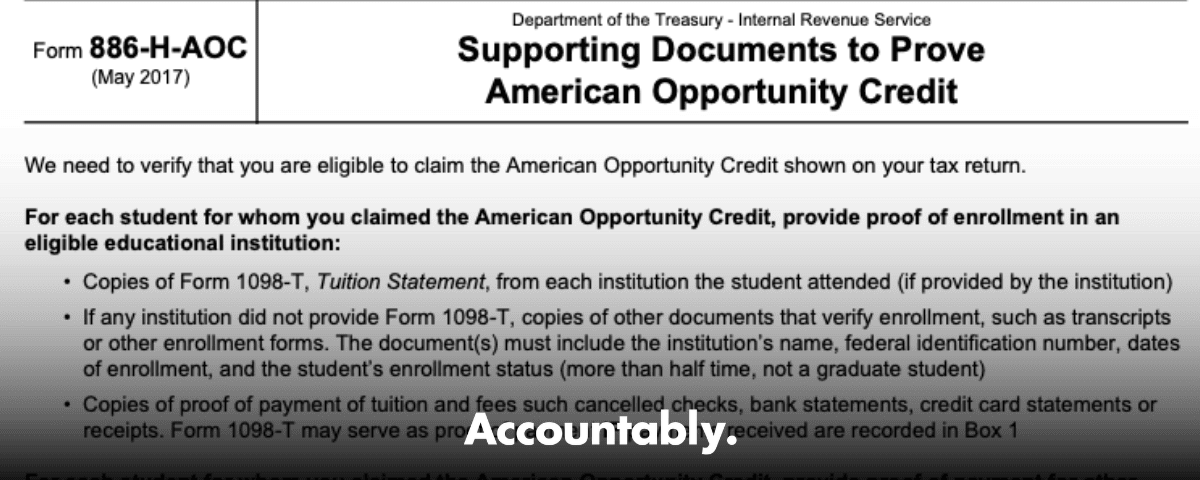

Form 886‑H‑AOC is a short IRS checklist labeled “Supporting Documents to Prove American Opportunity Credit.” The IRS includes it in exam letters or references it online, and it spells out which documents you should send. You only use it after you receive an IRS notice. Your goal is to show that the amounts you claimed on Form 8863 were actually paid for an eligible student and that the student met the enrollment rules.

Hundreds of Firms Have Already Used This Framework.

Join the growing list of CPA and accounting firms using Accountably’s Offshore Playbook to scale faster.

💬 Get Your FREE Playbook

👉 Visit Jugal Thacker’s LinkedIn

Send him a connection request and message “Playbook” to get your copy.

The heart of your response is simple, the school’s Form 1098‑T for the calendar year, proof of your payments for qualified expenses, and enrollment evidence confirming at least half‑time status in a degree or certificate program for at least one academic period that began in the tax year, or in the first three months of the next year if you paid in the tax year.

Quick refresher on the American Opportunity Credit

The American Opportunity Credit is figured as 100 percent of the first $2,000 of qualified education expenses you paid for an eligible student, plus 25 percent of the next $2,000, for a maximum of $2,500 per student each year. Up to 40 percent of the credit can be refundable for most taxpayers, subject to special rules for certain under‑24 students. Eligibility and income phaseouts apply, and you can claim the credit for a student for up to four tax years.

Key eligibility points your documents must support, the student was enrolled at least half‑time in a program leading to a recognized credential for at least one academic period beginning in the tax year, or in the first three months of the next year if paid in the tax year, and the student has not already used the credit in four earlier years.

Improve Margins Without Compromising Quality

Offshore staffing helps firms deliver more, scale faster, and stay compliant, without adding local headcount.

👉 Book a Discovery CallWhat the IRS usually asks for

When the IRS reviews an AOTC claim, it relies on a concise set of records:

- Form 1098‑T for the correct calendar year with Box 1, payments received for qualified tuition and related expenses. Scholarships and grants are shown in Box 5. Box 1 can differ from what you personally paid, which is why reconciliation matters.

- Proof you paid the qualified amounts you claimed, bank or credit card statements, canceled checks, or a detailed bursar account showing charges and payments, especially when Box 1 is incomplete.

- Enrollment evidence showing at least half‑time status and the academic periods covered, for example an enrollment verification, class schedule, or registrar letter.

- Itemized receipts for required books, supplies, and equipment, plus matching payment proof. Materials can qualify even if purchased outside the bookstore when they are required for coursework.

Practical tip, build the packet one student at a time and one year at a time. Put the 1098‑T up front, then payments, then materials, then enrollment, and finish with a one‑page reconciliation. That order mirrors how exam reviewers work.

Qualified education expenses, what counts and what does not

Qualified education expenses for the AOTC include tuition and required fees and, for this credit, required books and supplies even if purchased off campus. They do not include room and board, insurance, transportation, or other personal costs. Use only the amounts you actually paid in the tax year, adjusted for scholarships and grants, when you compute the credit and when you build your response packet.

Qualified vs not qualified, quick table

| Expense type | Counts for AOTC? | What to include in your 886‑H‑AOC packet |

| Tuition and required fees | Yes | 1098‑T Box 1, bursar activity, payment statements |

| Required books and supplies | Yes | Itemized receipts plus matching payment proof |

| Room and board | No | Exclude from your support packet |

| Optional equipment or parking | No | Exclude unless the school explicitly required it |

Source, IRS Publication 970 and Instructions for Form 8863.

The role of Form 1098‑T and how to reconcile Box 1

Start with the school’s Form 1098‑T for the calendar year under review. Box 1 shows payments received for qualified tuition and related expenses, reduced by refunds in the same year. Box 5 shows scholarships and grants. Because schools report payments received, not necessarily what you personally paid out of pocket, Box 1 often needs a reconciliation to your bursar ledger and your bank or card statements.

Here is a clean way to reconcile, put the 1098‑T on top, confirm the student identifiers match your return, print the bursar activity for the calendar year to show charges, payments, scholarships, and refunds, then add bank or card statements that highlight your tuition and fee payments not obvious on the ledger. Subtract scholarships and grants applied to tuition or required fees before you compute the credit. If you made December payments for a semester beginning in the first three months of the next year, those payments can still count in the year you paid. Note that this timing rule is recognized for AOTC.

Simple reconciliation flow

- 1098‑T for the correct calendar year, Box 1 and Box 5 noted.

- Bursar ledger, calendar year view, charges, payments, scholarships, refunds.

- Bank or card statements, highlight tuition and bookstore charges.

- Subtract scholarships and grants that cover tuition or required fees.

- One‑page summary that ties to Form 8863 and the credit you claimed.

Keep the story linear, a reviewer should be able to trace any number on your summary back to a page in your packet in seconds.

Proving books, supplies, and required equipment

You can include required books, supplies, and equipment in your AOTC support. The IRS expects itemized receipts that show the vendor, date, item description, and amount, plus independent payment proof. When possible, pair materials with a syllabus or course list that shows they were required. If the campus bookstore receipt is missing, ask for a reprint or use the online order confirmation and your statement.

Acceptable expense receipts

- Original or digital receipts with vendor name, date, item description, and amount.

- Order confirmations that list items and totals.

- Bookstore or merchant account statements if a receipt is not available.

- A brief note or syllabus excerpt showing the item was required for the course.

Then match each receipt to the statement that shows you paid it, bank, card, or canceled check. The IRS looks for independent payment evidence in addition to receipts.

Proof of payment that aligns with IRS expectations

Acceptable payment evidence includes bank or credit card statements with the merchant name and date, or check images. If you paid cash, get a signed seller statement and back it up with any related records you can gather, for example a bookstore account printout or order email.

Enrollment and student‑status evidence to include

A student must be enrolled at least half‑time in a program leading to a recognized credential for at least one academic period beginning in the tax year, or in the first three months of the next year if you paid in the tax year. Include an enrollment verification or a class schedule that lists the student, ID, term dates, and at least half‑time status. If status changed, add add‑drop or registrar records to show the timeline.

Use institution‑issued records for identity, term dates, and half‑time status, those carry the most weight during review.

How to submit your response, upload or mail

Your IRS letter will show your options. Many notices now allow you to submit scans, photos, or PDFs using the IRS Document Upload Tool. You enter the access code or the notice number from your letter, upload your files, and you get confirmation that the IRS received them. If your notice does not allow uploading, mail your packet using a trackable service and keep a complete copy.

How long to keep your records

Keep your support for at least three years after you filed the return, since that is the general period of limitations for assessment and refunds in typical cases. If you filed early, the IRS treats your return as filed on the due date for this timing rule.

Organizing your Form 886‑H‑AOC packet

Here is the structure I use so a reviewer can follow your story quickly.

Gather required documents

- Form 1098‑T for the calendar year, Box 1 payments received, plus Box 5 scholarships.

- Proof of payment for any qualified expenses not fully reflected on the 1098‑T, including required course materials.

- Enrollment records that show at least half‑time status and the terms covered.

If records are incomplete, contact the registrar, bursar, or bookstore for reprints. For clarity, ask the school for a one‑page letter on letterhead that confirms student name, ID, degree program, terms attended, and half‑time status.

Organize by expense type, student, and term

- Use sections, Tuition and Required Fees, then Books and Supplies, then Enrollment, then your one‑page reconciliation.

- Label every page with student name, tax year, and a simple index number, for example S1‑2024‑T1.

- Reconcile, Box 1 plus required materials, minus scholarships and refunds, equals adjusted qualified expenses that tie to Form 8863.

Submit before the deadline and get confirmation

Respond by the date on your letter. If upload is offered, use the Document Upload Tool so you can get an immediate receipt. If not, mail with tracking. Either way, keep a full copy of everything you sent.

Common issues that cause delays, and how to avoid them

- Box 1 on the 1098‑T does not match what you claimed. Fix this with a bursar ledger and statements that reconcile your actual payments.

- Claiming books or supplies without itemized receipts or payment proof. Add receipts and match them to statements.

- Missing enrollment proof for half‑time status. Include an official class schedule, enrollment verification, or registrar letter.

- Sending only the 1098‑T when you also claimed items not on the form. Provide separate proof for anything outside Box 1.

A short cover letter you can adapt

Re, Form 886‑H‑AOC response for Tax Year 2024, Student, Jordan Kim, SSN ending 1234 We claimed the American Opportunity Credit on our 2024 return. Enclosed are documents supporting the claim, organized as follows, 1) 1098‑T with Box 1 payments, 2) Bursar ledger and statements that tie payments to the 1098‑T, 3) Itemized receipts and payment proof for required books and supplies, 4) Enrollment records confirming at least half‑time status for spring and fall 2024. A one‑page reconciliation is on page 1. Please let me know if you need anything else.

Due diligence for preparers and firms

If you are a paid preparer, you must complete Form 8867, Paid Preparer’s Due Diligence Checklist, when a return claims the AOTC. Build client SOPs that mirror IRS language and keep due diligence records for at least three years. The IRS maintains guidance pages and a tools hub that reference Form 886‑H‑AOC as a supporting document set.

Firm tip, standardize a one‑page reconciliation, a packet order, and a naming convention. These three steps remove most review bottlenecks across teams.

Your step‑by‑step 886‑H‑AOC checklist

- Confirm your notice references the American Opportunity Credit and calls for Form 886‑H‑AOC documents. Note the response deadline and the submission method offered.

- Print the 1098‑T for the calendar year. Identify Box 1 payments and Box 5 scholarships, then gather bursar activity and payment statements that match your out‑of‑pocket amounts.

- Collect itemized receipts for required books and supplies and add matching payment proof.

- Pull enrollment verification or a class schedule that shows at least half‑time status and the terms covered.

- Build a one‑page reconciliation, Box 1 plus required materials, minus scholarships and refunds, then compute the credit per Form 8863 rules.

- Submit through the IRS Document Upload Tool if your letter allows, or mail with tracking. Keep a full copy.

Example reconciliation with scholarships and timing

Say Box 1 shows 4,800 for 2024, scholarships on Box 5 are 1,500 applied to spring, and you bought 400 in required textbooks in August. Adjusted qualified expenses, 4,800 plus 400 minus 1,500 equals 3,700. Under AOTC rules, payments in December for a semester beginning in the first three months of the next year still count in the year you paid. That is why the calendar year view matters.

When Box 1 is blank or incomplete

If Box 1 is blank or appears incomplete, fall back on the bursar ledger and your statements to show what you paid and when. Put the ledger behind the 1098‑T, highlight matching entries, and label each page. The IRS instructions explain how schools report Box 1 and why it may differ from your own payments.

FAQs that match real IRS reviews

What is Form 886‑H‑AOC used for?

It is an IRS checklist and cover sheet for documents that prove your American Opportunity Credit. You send it after receiving a notice.

Can I upload documents instead of mailing them?

Often yes. If your letter authorizes it, use the IRS Document Upload Tool to submit JPGs, PNGs, or PDFs and get a confirmation. If the letter does not authorize upload, mail with tracking.

How long should I keep these records?

Keep support for at least three years after you filed the return, since that is the general period of limitations for assessment and refunds in typical cases.

Do books and supplies count if I did not buy them at the school?

Yes, if they were required for the course. Include itemized receipts, payment proof, and, when available, a syllabus or materials list.

Is Form 8606 part of this?

No. Form 8606 tracks IRA basis and Roth conversions and is unrelated to Form 886‑H‑AOC. Focus on 1098‑T, payments, enrollment, and required materials.

What if the IRS disallows my AOTC?

If the IRS disallows the credit, you may need to file Form 8862 before you can claim it again. Review Publication 970 and consider a professional response or appeal if you have solid documents.

For accounting firms, a simple way to stop review bottlenecks

If you run a CPA or EA firm, you have seen this cycle, notices arrive during peak season, partners get stuck in review, and responses drag because files are inconsistent. A small dose of structure fixes most of it.

- Mirror IRS language in your SOPs for Box 1, scholarships, half‑time status, and timing of academic periods.

- Standardize packet order, 1098‑T, bursar ledger, payment statements, materials, enrollment, reconciliation.

- Bake in preparer due diligence and Form 8867 retention for AOTC returns.

- Track notice deadlines and submission confirmations in a central log, especially for uploaded responses.

If your team is buried and you need disciplined capacity without losing control, Accountably can integrate trained offshore talent into your existing systems to assemble clean, review‑ready 886‑H‑AOC packets that follow your SOPs, your templates, and your security standards. We focus on file naming, version control, and layered quality checks so partners spend less time in review and more time advising clients. Use us only where it adds value, and always keep the work inside your firm’s workflow.

Ready‑to‑use cover inventory template

Cover inventory, AOTC support, Tax Year 20XX Taxpayer, Jamie Alvarez, SSN ending 6789 Student, Maya Alvarez, Student ID 12345678

- 1098‑T, 2024, Box 1 payments highlighted

- Bursar ledger, Jan 1 to Dec 31, payments and scholarships highlighted

- Bank statements, Feb, Aug, Dec, tuition and bookstore charges circled

- Receipts for required books and supplies with matching payment evidence

- Enrollment verification, spring and fall, at least half‑time

- One‑page reconciliation to Form 8863

Final checklist before you submit

- Every number in your summary ties to a document in your packet.

- Dates line up with the tax year and the academic period timing rule.

- Your upload or mailing method gives you a receipt.

- You saved a complete copy and will keep it for at least three years.

Short note on scope and intent

This guide is educational and reflects IRS materials available as of October 27, 2025. For complex cases or prior disallowances, consider professional help. Publication 970 and the 1098‑T instructions are your primary references for AOTC rules.

Conclusion

You now have a clear plan for responding to an IRS request with Form 886‑H‑AOC. Put the 1098‑T up front, reconcile payments and scholarships, prove required materials, and document half‑time enrollment. Submit through the IRS Document Upload Tool when the notice allows, or mail with tracking, and keep your files for three years. A clean, labeled packet is usually all it takes to protect your American Opportunity Credit.

Simplify Delivery, Improve Margins, Stay in Control.

Offshore support that works exactly like your in-house team.

💼 Let’s Talk