Scale Your CPA Firm Without Adding Headcount

Build your offshore team that works your way, trained, compliant, and white-labeled under your firm.

👉 Book a Discovery Call

If the IRS asks for Form 886‑L, it is a request for proof, not a penalty. Send clear evidence that ties out to the cent and you stay in control.

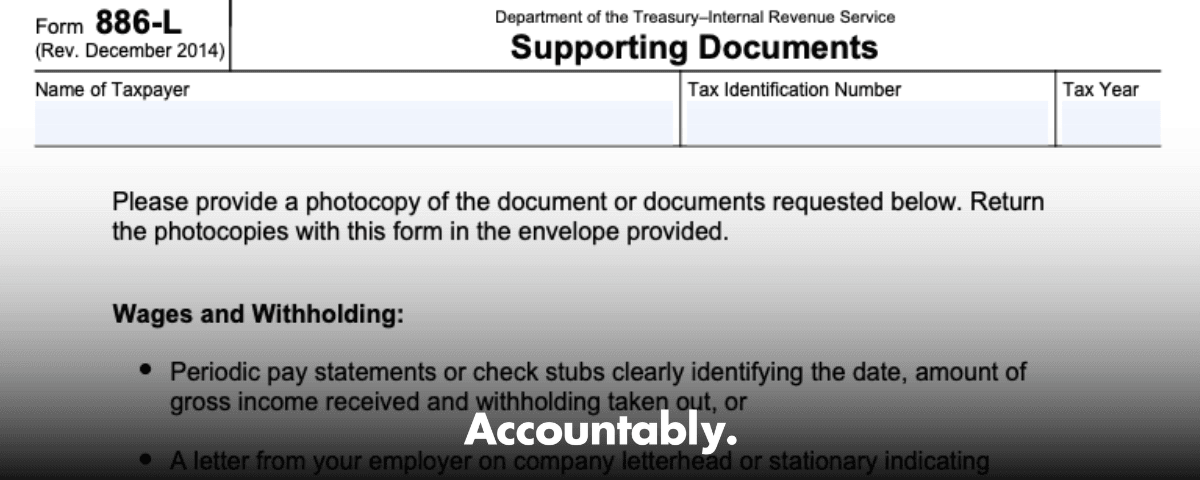

Form 886‑L is used during IRS correspondence exams to verify wages and withholding on a Form 1040. Think of it as a one‑page cover for your proof. You will typically include pay statements or an employer letter on company letterhead, plus W‑2s or 1099s and, if needed, a Wage and Income Transcript. The goal is simple, show that the income and withholding you filed match what the employer actually paid and withheld for the exact tax year under review.

Key takeaways

- Form 886‑L is an IRS correspondence exam worksheet that asks for proof of wages and withholding you reported on your Form 1040.

- Your packet should include an employer letter on letterhead, W‑2s or 1099s, and year‑to‑date pay stubs that match the tax year and reconcile to the cent.

- Match every figure to the return and submit by the deadline shown on the IRS notice to avoid proposed assessments.

- Do not confuse 886‑L with 886‑A. 886‑A explains issues and proposed adjustments. 886‑L is where you provide the documents that prove your numbers.

- India’s 10IE and 10‑IEA are unrelated to U.S. audits. Keep jurisdictions separate to avoid confusion.

What Form 886‑L is used for

When the IRS spots a mismatch or needs clarity on wages and withholding, Form 886‑L gives you a checklist of evidence to send. You attach:

Hundreds of Firms Have Already Used This Framework.

Join the growing list of CPA and accounting firms using Accountably’s Offshore Playbook to scale faster.

💬 Get Your FREE Playbook

👉 Visit Jugal Thacker’s LinkedIn

Send him a connection request and message “Playbook” to get your copy.

- An employer letter on company letterhead that confirms employment dates, total gross wages for the tax year, and total taxes withheld, with a real verifier contact.

- W‑2s or 1099s for the exact year under exam.

- Pay statements that show pay periods and year‑to‑date totals for gross wages and withholding lines.

- Wage and Income Transcripts if you need to show what the IRS already has on file.

- When records are missing, bank deposit records or direct deposit advices, paired with a brief signed statement and employer verification.

Submit your packet to the specific address, fax, portal, or upload system shown on your notice. Accuracy matters more than volume. A thin, perfectly reconciled packet closes faster than a thick, messy one.

886‑L vs 886‑A vs India’s 10IE/10‑IEA

You will often see 886‑L paired with 886‑A. Here is how to keep them straight and avoid sloppy responses that trigger follow‑ups.

| Form | Jurisdiction | Primary function | When you use it |

| 886‑L | U.S. IRS | Verify wages and withholding with documents | During a correspondence exam when the IRS asks for proof |

| 886‑A | U.S. IRS | Explain items and proposed adjustments | When the IRS outlines issues or you respond to their explanations |

| 10IE / 10‑IEA | India CBDT | Elect new tax regime or revert to old | Indian filings only, not part of a U.S. IRS audit |

Pro tip, if both 886‑A and 886‑L arrive together, reply to each in a way that reads like one story. The narrative on 886‑A explains the issue. The exhibits you send with 886‑L prove the numbers the narrative is talking about.

Improve Margins Without Compromising Quality

Offshore staffing helps firms deliver more, scale faster, and stay compliant, without adding local headcount.

👉 Book a Discovery CallWho this guide is for, and how to use it

If you are a CPA, EA, or firm manager who handles IRS mail, use this as your playbook. The steps below will help you keep responses on time, reduce back‑and‑forth with examiners, and protect client relationships during stressful weeks. We will cover what to send, how to reconcile, how to organize exhibits so they are easy to review, and how to document delivery.

Your north star is reconciliation. If your employer letter, final pay stub, W‑2, and return totals agree, you have already done the hardest part.

The wage documentation you need, organized for fast review

Wage documentation checklist

Build a packet that any examiner can follow in minutes. Include:

- Employer verification letter on company letterhead with employment start and end dates, total gross wages for the tax year, and total federal and state withholding, plus Social Security and Medicare if requested. Add a verifier’s name, title, phone, and email.

- Copies of W‑2s or 1099s that match the tax year under exam.

- Pay stubs showing pay periods and year‑to‑date totals for gross wages and all withholding lines.

- IRS Wage and Income Transcript for the year, when helpful.

- If payroll records are missing, bank deposit records or direct deposit advices paired with a short signed statement that explains gaps and references employer verification.

Tie every number on your 1040 to a document in this list. If an amount changed after year end, include the corrected W‑2 or a payroll adjustment report and a two‑sentence explanation.

Employer verification letter, a simple template you can share

Ask HR or payroll to place this on letterhead, keep it factual, and make sure totals match the final pay stub and W‑2.

To whom it may concern, This letter confirms that [Employee Full Legal Name], SSN ending [XXXX], was employed by [Employer Name] from [MM/DD/YYYY] to [MM/DD/YYYY]. For tax year [YYYY], total gross wages were [amount]. Federal income tax withheld was [amount]. Social Security and Medicare withholding were [amount] and [amount]. Contact [Verifier Name, Title] at [phone] or [email] to confirm. Sincerely, [Name, Title]

If retro pay or corrections affected totals, add one line that explains it and attach support.

Step by step, filling out Form 886‑L correctly

Form 886‑L is short, which makes correctness non‑negotiable. Set the notice next to your source records, and work line by line.

Before you start

- Confirm the tax year on the notice and on every document you plan to send.

- Pull the final pay stub for that year. If payroll switched systems midyear, collect both sets.

- If you worked for multiple employers, prep a separate mini‑packet for each, labeled clearly.

- If your name changed, confirm that payroll and SSA records still tie to you for that year.

Fill the top fields perfectly

- Enter the taxpayer’s legal name exactly as it appears on payroll and SSA records.

- Enter the SSN or EIN carefully, no transposed digits.

- Enter the correct tax year, for example 2023, not the current year by mistake.

- If this packet covers a spouse’s wages, state it clearly in your cover letter.

Cross‑check to the cent

- Reconcile W‑2 Box 1 wages to the final year‑to‑date pay stub.

- Reconcile federal withholding on the W‑2 to the year‑to‑date withholding on the final pay stub.

- If any figure differs, explain it on a one‑page note and attach support.

Build exhibits that read like a story

A neat packet saves everyone time. Use a simple index and put documents in the same order on every case.

- Cover letter, one paragraph that lists the exhibits and totals you are proving.

- Exhibit A, employer letter on letterhead.

- Exhibit B, final pay stub with year‑to‑date lines highlighted.

- Exhibit C, W‑2 for the tax year.

- Exhibit D, Wage and Income Transcript, if included.

- Exhibit E, corrections or explanations, such as an amended W‑2.

Make your packet easy to grade. Label exhibits, highlight the exact lines that prove each number, and state totals in your cover letter exactly as they appear on the return.

Submission, security, and proof of timely response

Your notice tells you where and how to respond. Follow it exactly and document the send.

How to send your 886‑L packet

- Mail, send to the exact address on your notice, use certified mail with tracking, and keep the receipt with the case file.

- Fax, if a number is provided, include a cover sheet with taxpayer name, TIN, tax year, and the letter or case number. Save the fax confirmation.

- Secure upload or portal, only use links or portals listed on your notice. Avoid plain email unless the IRS provides a secure method.

Create a short transmission log with the date sent, channel, tracking number, and the recipient shown on the notice. If the IRS asks later, you have instant proof of timely submission.

Privacy and redaction

Redact what is not needed. Keep names, dates, totals, and the last four digits where they appear on original documents. Mask full bank account numbers and unrelated pages. Save a combined PDF in the exhibit order shown on your index.

Version and year alignment

Use the copy of Form 886‑L that came with the notice or download the current version directly from the IRS website. More important than the revision date is that your packet shows the correct tax year and that all totals reconcile to that year’s return. If your client filed 2023, but the packet includes 2024 stubs, you will trigger a follow‑up.

Common pitfalls that cause delays

- Totals on the W‑2 and final pay stub do not match, especially Box 1 wages and federal withholding.

- Employer letter totals that do not tie to the pay stub or W‑2.

- Including documents from the wrong year.

- Illegible images or photos of checks rather than real pay stubs.

- Missing verifier contact information on the employer letter.

- Names or SSNs that do not match official records exactly.

Fixes are straightforward. Reconcile to the cent, get a clean employer letter, and resend quickly with a short explanation. The faster you correct, the sooner the examiner can close.

Real‑world examples that close cases quickly

One employer, one year

You worked at one company all year. Include the employer letter, the final pay stub, and the W‑2. If all three agree, your packet is clean and usually closes without back‑and‑forth.

Two employers in one year

Create two mini‑packets inside your response. For each employer, include the letter, final pay stub, and W‑2. Label clearly so an examiner can open your file and follow the trail.

Payroll system change midyear

Include stubs from both systems. In your cover letter, note the date of the change and highlight the year‑to‑date lines that carry forward. When the last stub and the W‑2 agree, the case moves.

Corrected W‑2 after filing

Send the corrected W‑2, a one‑page explanation of what changed and why, and a quick comparison that shows the old and new totals. If the corrected totals now match your final pay stub, say so plainly.

Tighten your internal workflow so 886‑L responses do not clog reviews

Even simple correspondence exams can jam a firm’s queue during peak season. A little structure keeps the work moving and protects margins.

A lightweight SOP you can adopt today

- Intake, log the notice, due date, and requested items, then assign the case.

- Evidence gathering, request the employer letter on letterhead and pull W‑2s, pay stubs, and, if helpful, the Wage and Income Transcript.

- Reconciliation, tie totals to the cent across pay stub, employer letter, W‑2, and the filed return.

- Assembly, label exhibits and build a one‑page cover letter with a summary table of the exact totals you are proving.

- QA, a second set of eyes confirms name, TIN, tax year, and totals, then checks that exhibits are in order.

- Transmission, send by the channel listed on the notice, log tracking, and save a copy of everything in the case file.

Suggested naming conventions

- 2023_886L_Cover_Summary.pdf

- 2023_886L_ExA_EmployerLetter_ABC‑Inc.pdf

- 2023_886L_ExB_FinalPayStub_ABC‑Inc_12‑29.pdf

- 2023_886L_ExC_W‑2_ABC‑Inc.pdf

- 2023_886L_ExD_WageIncomeTranscript.pdf

Use the same convention for every case. Consistency reduces review time and makes cross‑training easier.

Quality checks that prevent rework

- Names and SSN match across all documents.

- Tax year is correct on every page.

- W‑2, final pay stub, employer letter, and return totals agree to the cent.

- Employer letter includes a real verifier and contact information.

- Sensitive data is redacted, packet is in exhibit order, and the cover letter totals match the return.

Where Accountably fits, only when relevant

Some firms handle 886‑L responses with ease, others feel the pinch when peak season hits and reviewers are buried. If your team needs help, Accountably can integrate trained offshore professionals into your workflow with clear SOPs, standardized workpapers, and layered quality control, so partner time in review goes down and delivery stays predictable. We work inside your systems and templates, we keep file naming and version control tight, and we document submissions with simple audit logs. If you do not need extra capacity, use this guide and you are set.

Our rule in production, structure first, then speed. When the packet is built to your standards, the send takes care of itself.

FAQs

Is Form 886‑L filed with my tax return?

No. You use it only when the IRS asks during a correspondence exam. It serves as a request for supporting wage and withholding documents.

What if my employer will not issue a letter?

Send the final pay stub and W‑2 now so you meet the deadline. Add a short note that an employer letter is pending and give a target date. If necessary, include bank deposit records and a brief signed statement explaining gaps.

Can I submit electronically?

Use the submission channel on your notice. If a secure upload or portal is offered, use it. Otherwise, mail or fax as directed, keep tracking, and save confirmations.

What if the numbers do not match to the cent?

Explain the difference on one page and attach support, such as a corrected W‑2 or a payroll adjustment report. Make it easy for the examiner to see exactly how the totals reconcile.

Do I need to send a Wage and Income Transcript?

Not always. It is helpful when you want to show the examiner what the IRS already has on file, but clean employer documents are usually enough.

What, How, Wow, your quick playbook

- What, Form 886‑L is the IRS’s one‑page request for wage and withholding proof during a correspondence exam. You respond with employer documents that match your return.

- How, gather a letter on company letterhead, W‑2s, and final pay stubs, reconcile to the cent, organize exhibits, and send by the method on your notice with tracking.

- Wow, when the employer letter, final pay stub, W‑2, and return totals agree, cases close faster, examiners ask fewer questions, and you protect client trust.

Final checklist before you send

- Verify the legal name and SSN exactly as on payroll and SSA records.

- Confirm the tax year on every document and filename.

- Reconcile Box 1 wages and federal withholding to the cent across W‑2, final pay stub, and the return.

- Include an employer letter with employment dates, total gross wages, total taxes withheld, and a verifier’s contact.

- Label exhibits, highlight the lines that prove each total, and save a combined PDF.

- Send by the channel specified on your notice, track delivery, and log what you sent.

Simplify Delivery, Improve Margins, Stay in Control.

Offshore support that works exactly like your in-house team.

💼 Let’s Talk