Scale Your CPA Firm Without Adding Headcount

Build your offshore team that works your way, trained, compliant, and white-labeled under your firm.

👉 Book a Discovery Call

We pulled a long evening, assembled a clean Form 4422 packet, and got a conditional commitment in time. If you have ever felt that same knot in your stomach, this guide is for you.

Key Takeaways

- IRS Form 4422 requests a certificate that “discharges” a specific property from the federal estate tax lien under IRC §6324 so you can close, refinance, or transfer title on that parcel only. The lien remains on other estate assets.

- You submit Form 4422 with a full supporting packet, then the IRS issues the discharge certificate at or around closing, typically on Form 792.

- File early. The form’s own instructions tell you to submit at least 45 days before the date you need the certificate.

- Where to send it. E‑fax to 877‑477‑9243 or mail to IRS Advisory Estate Tax Lien Group, 55 South Market St, Mail Stop 5350, San Jose, CA 95113‑2324.

- For 2025 estates, the basic exclusion amount is 13,990,000, and the annual gift exclusion is 19,000. These figures affect whether an estate return is required and how much tax must be protected at closing.

If there is a Form 706 filing requirement, the federal estate tax lien attaches to all gross estate property at death. Use Form 4422 to obtain a property‑specific discharge so the buyer takes clean title.

What Form 4422 Does, And When You Need It

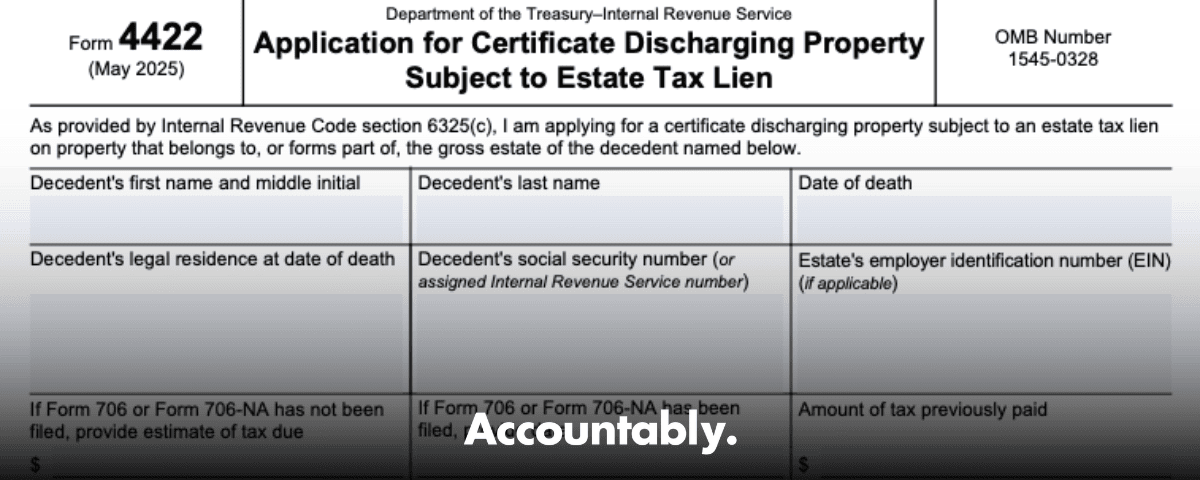

Form 4422, Application for Certificate Discharging Property Subject to Estate Tax Lien, is the IRS gateway to removing the estate tax lien from a particular property that is being sold, refinanced, or otherwise conveyed. It does not eliminate estate tax. It simply clears the title on that property while preserving the government’s claim on other assets or proceeds. You use it when the estate has, or is expected to have, a Form 706 filing requirement, which is what triggers the automatic lien in the first place.

Hundreds of Firms Have Already Used This Framework.

Join the growing list of CPA and accounting firms using Accountably’s Offshore Playbook to scale faster.

💬 Get Your FREE Playbook

👉 Visit Jugal Thacker’s LinkedIn

Send him a connection request and message “Playbook” to get your copy.

Behind the scenes, the IRS Advisory Estate Tax Lien Group reviews your packet, confirms the tax exposure and equity, and then issues the certificate of discharge under IRC §6325(c). Advisory can require partial payment, escrow, or other protections depending on the estate’s posture. The certificate issued at closing is Form 792.

Situations Where Form 4422 Is The Right Path

- The estate is selling a residence or investment property and needs clean title for the buyer.

- The estate is refinancing and the lender requires removal of the estate tax lien from that property.

- A parcel held in the gross estate must be released from the lien with proceeds set aside in escrow, pending final tax.

When You Might Need A Different Form

- If the lien at issue is a recorded Notice of Federal Tax Lien for income or employment taxes, use Form 14135 for a discharge, not Form 4422.

- For nonresident estates requiring transfer certificates, follow the IRS transfer certificate route, not Form 4422.

How Form 4422 Fits With The Lien Rules

The estate tax lien arises automatically upon death and attaches to all property that forms part of the gross estate. It does not need to be recorded to be valid. Because of that, title companies often pause until the IRS agrees to discharge the specific property being conveyed. Form 4422 is how you ask for that discharge.

Advisory can approve a discharge in several ways. The Internal Revenue Manual lists paths that include paying an adequate amount from sale proceeds, proving the government’s interest has no value, demonstrating that remaining property covers at least double the liability, or substituting escrowed proceeds. You will see these principles show up in commitment letters and escrow instructions.

Improve Margins Without Compromising Quality

Offshore staffing helps firms deliver more, scale faster, and stay compliant, without adding local headcount.

👉 Book a Discovery CallThe Packet You Will Build

In practice, your Form 4422 packet is only as good as the documentation behind it. Advisory wants a clean picture of value, equity, and timing before it signs off. Expect to include:

- A precise property description, valuation support, and the draft settlement statement.

- Estate posture documents, either the filed Form 706 with proof of payments or a credible draft 706 or inventory with appraisals if the return is not filed yet.

- Proof of your authority, full contact details, and the title or escrow officer’s information for scheduling.

- Any deferral context, such as a Form 4768 filing or a 6166 installment request, and, if needed, a proposed escrow using IRS Form 15056.

As a U.S.‑led offshore partner to accounting firms, Accountably steps in only where it is helpful, for example, to standardize workpapers, name files consistently, and keep escrow drafts, appraisals, and 706 schedules synchronized so Advisory can review faster. The point is control, not volume.

IRS Form 4422, Step‑By‑Step

Think of your submission in three parts, identity, property, and proof. You will complete the form itself, then stack the supporting evidence in a clear, labeled order so an IRS advisor can verify every figure.

Step 1, Fill The Top Of The Form With Exact Identifiers

- Decedent’s full legal name, SSN, and date of death.

- Estate EIN, if one has been assigned.

- Decedent’s last address at death.

- Whether Form 706 has been filed, with filing date and any payments made to date. Cross‑check these items against the court appointment, draft 706 or inventory, and correspondence so every datum matches across documents. Small mismatches trigger follow‑ups and slow you down.

Step 2, Describe The Property And The Transaction

- Legal description and street address.

- Estimated fair market value and the basis for that value, usually a current appraisal.

- Proposed sale or refinance terms, the buyer or lender name, and the title or escrow contact with phone and email.

- A draft closing statement showing estimated net proceeds and senior liens, taxes, and fees paid at closing.

Step 3, Explain How The Tax Will Be Protected

Depending on where the estate stands, the IRS may require one of the following to protect the government’s interest.

- Part payment from proceeds in an amount at least equal to the government’s interest in the property.

- An escrow under Form 15056 that holds proceeds subject to the lien until the tax is determined.

- A showing that remaining estate property, after the sale, still covers at least double the unpaid liability when combined with senior liens.

Your cover letter should make this logic easy to follow, for example, “Property sells for X, liens and costs total Y, net is Z, we propose escrow of Z with Form 15056 until the 706 is closed,” or, “Remaining estate assets exceed two times the estimated tax, see schedule.”

Step 4, Note Any Timing Or Deferral Requests

If you have filed Form 4768 for extra time to file or pay, or you are pursuing a 6166 election for installments, state that in the packet and include proof. Advisory coordinates with Estate and Gift Exam when returns are not yet filed or when special elections affect cash needs, timing, or collateral.

Step 5, Sign Under Penalties Of Perjury

The executor, administrator, or authorized representative signs. If counsel prepared the packet, include counsel’s information and, when applicable, a disclosure authorization so the IRS can speak with your title officer or attorney during the review. Keep your daytime phone and email visible on page one and on the cover letter.

What Happens After You Submit

Advisory reviews your package and often issues a conditional commitment letter. If an escrow is required, the group reviews the draft Form 15056, approves the escrow agent, and settles the amount that must be held or paid. After closing, once conditions are met, Advisory prepares and releases the discharge certificate on Form 792. Title then records that certificate so the buyer takes clear title.

Pro tip, send a clean, labeled PDF set, one tab per document, and include the title officer’s direct contact. Response time improves when Advisory can reach the person scheduling closing.

When Form 4422 Is Not Enough

If the property to be discharged is tied to a special use valuation recapture lien or to an income‑tax NFTL, the Advisory team may require different forms or additional review. The Internal Revenue Manual explains that Form 4422 is also used in certain §6324B special use cases, but documentation can be more involved, including draft Form 706‑A in some situations. When in doubt, ask Advisory early.

Accountably’s role for firms is simple here, keep everyone on the same page. We standardize file names, keep escrow drafts synced with the settlement statement, and maintain a single source folder so nothing goes missing during last‑minute changes.

The Exact Data You Will Need For Form 4422

When I help teams prep Form 4422, I start a shared checklist so nothing slips. You can use the same approach. Gather these items before you touch the form, then check each one against your court letters and draft 706 so the story is consistent.

Identity And Filing Posture

- Decedent’s full legal name, SSN or ITIN, and date of death

- Estate EIN, or a note that the EIN has been requested

- Decedent’s last address at death

- Whether Form 706 has been filed, the filing date, and any payments made

- Executor or administrator details, name, mailing address, email, and daytime phone

- Attorney of record, firm, mailing address, email, and phone

Property And Deal Terms

- Legal description, street address, and parcel number if available

- Fair market value support, current appraisal or broker opinion

- Draft purchase agreement or refinance terms

- Draft settlement statement that shows liens, taxes, fees, and expected net proceeds

- Title or escrow company name, file number, officer, direct phone, and email

How The IRS Interest Will Be Protected

- If proceeds will pay part of the tax, show how much and when

- If escrow will hold funds, include a draft escrow agreement and the proposed amount

- If remaining estate assets cover at least double the estimated liability, add a short schedule proving it with supporting values

- If you are requesting a deferral or extension, include those filings and dates

Keep the math tight. Advisory wants to see how X sale price drops to Y net proceeds, how much goes to the IRS or into escrow, and what remains to cover expenses and beneficiaries.

Supporting Documents That Make Or Break Your Packet

The most common delay I see is missing or mismatched support. Here is a clean structure that gets faster responses.

Estate Tax Posture

- Filed Form 706 with proof of payments, or

- A credible draft 706, or a detailed inventory and appraisals that roll up to a 706‑style summary

- Notes about any special valuation elections you intend to make, for example §2032A, and how those affect the reported values

Property And Transaction Evidence

- Appraisal, valuation letter, or broker opinion with the date and method

- Purchase agreement, payoff letters for senior liens, and the draft settlement statement

- Title or escrow contact details for scheduling and last minute questions

Authority And Communication

- Letters testamentary or letters of administration, plus any court orders that matter

- If a third party needs to speak with Advisory, include your disclosure authorization so IRS can discuss specifics with your attorney or the title officer

- Your signed statement under penalties of perjury on Form 4422

Timing, Extensions, And Installments

- A filed Form 4768 if you need extra time to file or pay

- A note on any planned 6161, 6163, or 6166 requests, plus supporting cash‑flow schedules

- If proceeds will not fully satisfy the expected tax, propose an escrow amount and timeline for release after the 706 is resolved

Accountably’s role for firms here is practical. We do not flood you with resumes. We set up file standards so your 706 schedules, appraisal PDFs, and escrow drafts use the same naming logic and version control, which cuts review time and reduces follow‑up.

Sample Table, Where To Find The Numbers

| Item | Where To Pull It | Quality Check |

| Decedent identifiers | Court petition, SSA records, prior returns | Match across 706, letters of appointment, and Form 4422 |

| Estate EIN | IRS confirmation letter | Match to 706 draft header and bank accounts |

| FMV of property | Appraisal or BPO, within 6 to 12 months | Date, method, and any condition notes are visible |

| Senior liens | Payoff letters, tax bills, HOA, utilities | Confirm good‑through date covers closing |

| Net proceeds | Draft settlement statement | Math ties to escrow agreement proposal |

| 706 posture | Filed return or draft 706, inventory | Numbers agree with appraisals and bank statements |

If one document conflicts with another, fix it before you submit. Advisory will spot it, and you will lose a week to back‑and‑forth.

Related Forms You May Need With Form 4422

You are not filing in a vacuum. A strong Form 4422 packet often rides alongside a few related submissions. Use this section as your quick planning map.

Form 706, The Anchor

Even if you are not ready to file the final return, a draft 706 or a 706‑style inventory shows Advisory that your values are grounded, not guessed. Include schedules for real estate, financial accounts, debts, administration expenses, and elections you expect to take.

Form 4768, More Time To File Or Pay

Closings rarely line up perfectly with estate tax deadlines. If you need more time, file Form 4768 to extend time to file and, when applicable, to request extra time to pay. In your 4422 cover letter, state that you filed 4768, include the filing date, and explain how the extension interacts with the sale or refinance.

Installment Or Deferral, IRC 6161, 6163, 6166

- 6161, extension of time to pay for reasonable cause

- 6163, extension in case of reversionary or remainder interests

- 6166, installments for closely held business interests

If you will request any of these, attach your draft request, cash‑flow schedules, and the basis for eligibility. Advisory will factor that plan into the discharge.

Disclosure Authorization For Advisors

If your attorney or title officer will discuss details with Advisory, include your disclosure authorization so IRS can speak with them. It prevents phone tag with the executor and keeps momentum during the last mile to closing.

When You Need A Different Discharge Path

If you are dealing with a recorded Notice of Federal Tax Lien for a non‑estate tax liability, use the application for that lien type instead. Also, some nonresident cases use transfer certificates rather than Form 4422. If your fact pattern is unusual, ask Advisory early and document the answer in your file.

Building A Packet That Speeds Review

Here is the assembly we use in practice, and it reliably earns faster updates.

- Cover letter, one page, that tells the story in numbers, sale price, liens, costs, net proceeds, and how the tax will be protected

- Form 4422, signed and dated, with all contact info visible

- Authority set, letters of appointment and any court orders

- Estate tax posture, filed 706 with proof of payment, or draft 706 or inventory with appraisals

- Property valuation, appraisal or BPO with method and date

- Deal documents, purchase agreement or refi terms, payoff letters, draft settlement statement

- Timing documents, Form 4768 filing proof, any 6161, 6163, or 6166 draft, and escrow agreement if proposed

- Title and escrow contact sheet with direct phones and emails

Accountably can help firms create this standard once, then repeat it for each closing. That consistency is what removes “heroics” from your busy season and turns it into a repeatable process.

Timeline, File Form 4422 Well Ahead Of Closing

Start early and work backward from the day you need the certificate. A simple calendar makes the difference between a calm closing and a scramble.

60–75 Day Back‑Plan

| H4: Timing | H4: Task | H4: Owner | H4: Notes |

| Day 0 | Closing date target | Title | Build in room for weekends and holidays |

| Day minus 7 | Confirm certificate release logistics | Escrow | Who picks it up, or confirm e‑recording |

| Day minus 14 | Advisory status check, all conditions met | Executor or attorney | Confirm escrow amount and wiring |

| Day minus 21 | Submit escrow agreement or revised draft statement | Attorney or title | Keep a change log for version control |

| Day minus 30 | Advisory follow‑up, respond to questions | Executor | Keep all responses in one PDF |

| Day minus 45 | Submit complete Form 4422 packet | Executor or attorney | Include direct contact info on page one |

| Day minus 60–75 | Order appraisal, gather payoffs, draft 706 | Executor or CPA | Start the standard packet assembly |

Put the closing date in bold at the top of your cover letter. Then map the math that gets the IRS comfortable, and list who to call at title if a same‑day update is needed.

Weekly Rhythm That Works

- Monday, confirm any new payoffs or contract changes

- Wednesday, check in with Advisory with a short, numbered update

- Friday, send a status note to your title officer and beneficiaries so everyone stays calm

File Mechanics, Keep It Clean And Trackable

- Submit a single PDF when possible, labeled sections, and bookmarks for each exhibit

- Put your direct phone and email on the first page of the cover letter and in the Form 4422 contact block

- Ask your title officer to be on standby for quick document tweaks so you do not lose a week to minor edits

- Keep a running list of questions and answers with Advisory, date‑stamped, so nothing is lost when people are out of office

Real‑World Pitfalls To Avoid

- Mismatched names or dates between Form 4422, court letters, and the draft 706

- An appraisal that is too old or lacks method and condition notes

- A draft settlement statement that does not foot to the penny

- Missing evidence for a special valuation election you plan to claim

- Silence after submission, set calendar reminders to check status every week

Where Accountably helps teams is not flashy. We enforce standard naming, version control, and a single source of truth for every exhibit. That alone cuts review time and prevents last‑minute chaos when someone is out sick or leaves mid‑engagement.

Completing The Top Of Form 4422, Line‑By‑Line Clarity

Think of the top block as your ID check. If you get it right, Advisory trusts the rest of the packet more.

Decedent And Estate Identifiers

- Enter the decedent’s full legal name as it appears on court papers

- Use the correct SSN or ITIN and the exact date of death

- Enter the estate EIN, and make sure it matches the draft 706 header

- If you filed 706, include the filing date and all payments to date

- If you did not file yet, state that clearly and reference the draft 706 or inventory in your exhibits

Checklist to prevent errors:

- Match every identifier to court letters, bank letters, and the 706 draft

- Check numerals against IRS assignment notices

- Have a second person verify the date of death and EIN

Filing Status Details

- heck the box for 706 status, filed or not filed

- If filed, list the filing date and the amount paid so far

- If not filed, give your best estimate of the gross estate, deductions, and the estimated tax, and tie those to the appraisal and inventory exhibits

- Disclose any deferral efforts or installment plans and include filing dates or draft requests

Reporting Gross Estate Values The Right Way

You do not need perfect hindsight to complete Form 4422, but you do need a consistent method. Use 706 rules as your measuring stick.

- Real property, fair market value supported by appraisal or a solid valuation letter

- Personal property and financial accounts, list values by date of death with statements

- Special adjustments, note if you plan to elect a special use valuation and how that affects the number you show here

- Attach a one‑page roll‑up that reconciles your exhibit values to the total gross estate shown on the form

Signature And Certification, What Your Name Commits To

When you sign Form 4422, you certify under penalties of perjury that the facts and attachments are true, correct, and complete. Before you sign:

- Read the packet like a reviewer, not a drafter

- Confirm that the math in your cover letter ties to the settlement statement and any escrow proposal

- Make sure your title and capacity match your court appointment, for example, Executor or Administrator

- If counsel prepared the materials, have them sign where appropriate and include full contact details

Your signature is not a formality. It is the hinge on which the entire packet swings. Sign only when the exhibits and numbers can survive scrutiny.

Applicant And Attorney Information That Speeds Approval

Do the reviewer a favor and make every phone call or email easy.

What To Include

- Executor or administrator name, mailing address, email, and daytime phone

- Attorney name, firm, mailing address, email, and phone

- Title or escrow contact, file number, direct phone, and email

- A short contact sheet page with all three, so Advisory can reach the right person fast

Disclosure To Let IRS Speak With Your Team

If your title officer or attorney will talk directly with Advisory about payoff figures, escrow mechanics, or the certificate release, include your disclosure authorization. It saves days.

A Cover Letter Outline You Can Reuse

Subject, Request for Certificate of Discharge under IRC §6325 for [Property Address], Estate of [Name], SSN XXX‑XX‑[last 4], DOD [MM/DD/YYYY]

- Sale price is [amount], liens and closing costs total [amount], net proceeds are [amount]

- We propose [payment amount] to IRS at closing, with [amount] into escrow until 706 is resolved, or, remaining estate assets cover at least double the estimated liability, see Exhibit [#]

- Enclosed, Form 4422, authority set, draft 706 or filed 706 with proof of payments, appraisal, contract, draft settlement statement, disclosure authorization, and timing exhibits

- Contact, executor [name, phone, email], attorney [name, phone, email], title officer [name, phone, email] Thank you for your review. We are available same day for any follow‑ups.

Quality Control, The Five‑Minute Final Check

- Names, SSN, EIN, and dates match everywhere

- Settlement statement math ties to the cover letter and escrow draft

- Appraisal or valuation is current and consistent with the number on the form

- Every exhibit is labeled and bookmarked in the PDF

- Contact sheet is on top, with direct lines for executor, attorney, and title

Where Accountably Fits, Only Where It Helps

Some firms ask us to step in for the heavy lift, others just want a tighter process. Either way, our lane is delivery discipline. We create SOPs for packet assembly, enforce workpaper standards, and keep reviews flowing so partners are not stuck in last‑minute edits. That is it, structured execution so you can hit deadlines without burning your team.

How To File, From Buttoned‑Up Packet To Clean Title

- Assemble a single, clean PDF with bookmarks and an index page

- Submit the packet to the IRS Advisory Estate Tax Lien Group, per current instructions

- Calendar a weekly check‑in and keep a short log of questions and answers

- When Advisory issues a conditional commitment, finalize any escrow or payment details with title

- After closing, confirm the certificate of discharge is recorded so the buyer takes clear title

Quick Primer, What Is The Federal Estate Tax

The estate tax is a transfer tax on the value of a decedent’s taxable estate. You start with the worldwide gross estate, subtract allowable deductions, and apply credits. If the filing threshold applies and there is tax due, the estate tax lien attaches at death. You compute and report on Form 706. If property needs to be sold or refinanced before the tax is resolved, that is when Form 4422 comes into play.

What Happens To Property While The Lien Exists

Every includible asset sits under an automatic lien until the tax is paid or the IRS issues a discharge for that specific property. You can still sell or refinance, but the buyer and lender will expect a property‑specific discharge and, if needed, payment or escrow at closing. After the IRS issues and title records the certificate, the buyer takes clean title. The lien remains on other estate assets until resolved.

Where To Find IRS Form 4422

You can download the current fillable PDF and instructions from the IRS website. If you have a unique fact pattern or a timing crunch, call the Advisory Estate Tax Lien Group for current submission details. There is no e‑file option, so plan for transmission and review time. File at least 45 days before you need the certificate.

Related Topics Worth Skimming

- Form 706, valuation and deduction rules

- Form 4768, extending time to file or pay

- Installments and deferrals, 6161, 6163, 6166

- Disclosure authorizations for professionals who need to speak with IRS

- Internal guidance for lien discharges and how Advisory evaluates protection of the government’s interest

FAQs

What is Form 4422, in one sentence?

It is the IRS application you use to discharge the federal estate tax lien from a specific property so you can close while the estate tax is still being finalized.

Who signs Form 4422?

The executor, administrator, or authorized representative signs under penalties of perjury. If counsel prepared the packet, include counsel’s details and disclosure authorization.

Do I report an inheritance as income?

Generally, an inheritance is not income. Income earned after you inherit, or gains when you sell inherited property, are taxable. Talk with a tax professional about basis and reporting.

Who gets a deceased person’s tax refund?

Usually the estate, handled by the executor. If there is no executor, a surviving spouse may claim it, and the IRS may require a short form to authorize the payment.

Final Word And A Simple Next Step

You now have a clear plan to prepare, file, and follow through on Form 4422 without last‑minute drama. Start early, keep the math simple, and hand Advisory a packet that answers questions before they are asked. If your firm needs help standardizing the work so you stop losing days to version chaos, our team at Accountably can set up the delivery structure and file standards that make 4422 packets smooth to review.

Simplify Delivery, Improve Margins, Stay in Control.

Offshore support that works exactly like your in-house team.

💼 Let’s Talk