Scale Your CPA Firm Without Adding Headcount

Build your offshore team that works your way, trained, compliant, and white-labeled under your firm.

👉 Book a Discovery Call

The relief in their voice when the transcript came through was real. If you are in that situation now, you can get there too.

Key takeaways

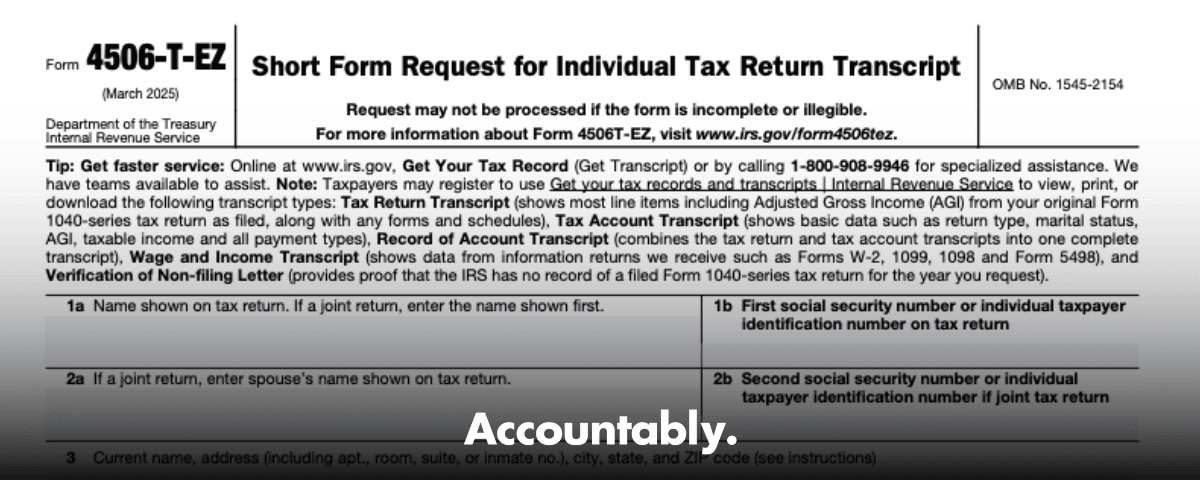

- Use Form 4506-T-EZ to ask the IRS for a free tax return transcript of your Form 1040 for the current year and the prior three years, it is not a full copy of your return.

- Processing is typically about 10 business days for mailed requests, and the IRS must receive your signed form within 120 days of the signature date.

- The fastest path is online, use IRS Get Transcript in your Individual Online Account, then print or download your transcript immediately when available.

- If a lender needs transcripts sent directly to them, that goes through the IVES program with Form 4506-C, not 4506-T-EZ.

- Fiscal-year filers and non‑individual returns should use Form 4506-T instead.

You are asking for a transcript, a summary of your original 1040 data, not a photocopy of your entire return.

What Form 4506-T-EZ does and when to use it

Form 4506-T-EZ gives you a no-cost copy of your IRS tax return transcript for your individual Form 1040, for the current year and up to three prior years. That transcript shows most lines from the return as originally filed and it is what lenders, schools, and agencies usually accept for income verification. If you need an actual signed copy of your return with attachments, that is Form 4506, and there is a fee. If you need account history, wage and income data, or a record of account, that is Form 4506-T. If a bank wants to get your transcript directly from the IRS for a loan decision, they should use the IVES process with Form 4506-C.

Hundreds of Firms Have Already Used This Framework.

Join the growing list of CPA and accounting firms using Accountably’s Offshore Playbook to scale faster.

💬 Get Your FREE Playbook

👉 Visit Jugal Thacker’s LinkedIn

Send him a connection request and message “Playbook” to get your copy.

A few boundaries to keep you on track:

- You must be an individual 1040 filer using a calendar year.

- Businesses, estates, trusts, partnerships, and fiscal‑year filers should use Form 4506-T.

- Since July 2019, the IRS mails transcripts only to the taxpayer’s address of record, not to third parties. For direct-to-lender delivery, IVES with Form 4506-C is the channel.

The fastest way, use IRS Get Transcript first

If time is tight, start online. Sign in to your Individual Online Account on IRS.gov, go to Get Transcript, and download your Tax Return Transcript. When your current-year transcript is available depends on how and when you filed, and whether you had a balance due, the IRS explains typical availability windows on their transcript availability page. If online access is not an option, you can still request the transcript by mail or phone, delivery is usually 5 to 10 calendar days to your address of record.

- Online, view, print, or download in your Individual Online Account.

- Mail, request a Tax Return Transcript if you prefer paper.

- Phone, call 800-908-9946 for the automated transcript service.

How to complete Form 4506-T-EZ accurately

Use the IRS March 2025 version so your request is processed cleanly. Here is a simple checklist you can follow line by line, it mirrors the current form and instructions.

Improve Margins Without Compromising Quality

Offshore staffing helps firms deliver more, scale faster, and stay compliant, without adding local headcount.

👉 Book a Discovery Call- Line 1a and 1b, enter your name exactly as it appeared on the filed return and your SSN or ITIN.

- Line 2a and 2b, for joint returns, enter your spouse’s name and SSN or ITIN.

- Line 3, your current address, if you use a P.O. box, include it.

- Line 4, the prior address from your last filed return if different. If you moved and have not told the IRS, consider filing Form 8822 to update your address.

- Line 5, optional Customer File Number, up to 10 digits, not an SSN, this prints on your transcript for tracking.

- Line 6, list the year or years you want, for example, 2022, 2023. Most requests finish in about 10 business days.

- Sign and date, the IRS must receive your form within 120 days of your signature or it will be rejected. Only one signature is needed for a jointly filed return, and you must check the authority box in the signature area.

Submission, mail or fax your form to the IRS RAIVS unit that corresponds to your state, the form’s “Where to file” table lists Austin, Kansas City, or Ogden with the current fax numbers. Use the address that matches your most recent return if the chart shows more than one option for your state.

Pro tip, match the name and address to your last processed return, inconsistent identity details are a common reason for rejections.

4506-T-EZ vs 4506-T vs 4506 vs 4506-C

Quick comparison table

| Form | Best for | What you get | Years available | Cost | Who receives it |

| 4506-T-EZ | Individuals needing a basic 1040 transcript | Tax Return Transcript, original-filed line items | Current year plus 3 prior | Free | Mailed to your address of record |

| 4506-T | Individuals or entities needing more types | Return, Account, Record of Account, Wage and Income, or Non‑Filing | Varies by transcript type | Free | Mailed to your address of record |

| 4506 | Exact copy of your filed return | Full photocopy with attachments | Current year plus up to 7 prior | Fee applies | Mailed to your address of record |

| 4506-C | Lender income verification through IVES | Transcripts delivered to lender via IVES | Varies by transcript type | IVES per‑transcript fee | Delivered to your lender via IVES |

Notes you should know:

- Transcript requests by mail go only to the taxpayer’s address of record, the IRS stopped third‑party mailing in July 2019.

- Lenders that need transcripts directly should use IVES with 4506-C, the program charges a per‑transcript fee.

- “Tax Return Transcript” usually meets mortgage needs, but confirm with your lender before you order.

Timing, availability, and what affects “how fast”

Two clocks are in play, processing time and delivery time. Most properly completed 4506-T-EZ requests are processed in about 10 business days, then delivery by mail typically adds another 5 to 10 calendar days. If your current-year transcript is not available yet, check the IRS availability schedule, e-filed returns with a refund are often available in 2 to 3 weeks, paper-filed returns take longer. Paying a balance due can also delay availability.

If your deadline is aggressive, start with Get Transcript online. If you cannot pass the identity verification, fall back to mail or phone while you also submit 4506-T-EZ as a backup. That way you are working two paths at once.

When a third party needs it directly

If a lender, scholarship program, or agency insists on receiving the transcript directly from the IRS, route them to IVES. They or their vendor will submit Form 4506-C, and with your consent, the IRS sends the transcript to the participant’s secure mailbox or web portal. This avoids the third‑party mailing restriction on 4506-T/4506-T-EZ.

Step‑by‑step, filing Form 4506-T-EZ

- Confirm you are eligible

- You file a Form 1040 on a calendar year, and you only need a Tax Return Transcript.

- You do not need wage and income details or account history.

- Gather your details

- Exact name and SSN or ITIN from your last filed return.

- Current address, plus the prior address if you moved, consider Form 8822 if you have not updated the IRS.

- The tax years you want, usually the last three and the current year when available.

- Optional, a Customer File Number to print on the transcript for tracking.

- Complete and sign

- Fill lines 1 through 6 clearly.

- Sign and date, check the authority box.

- Remember, the IRS must receive your form within 120 days of the signature.

- Send to the right IRS unit

- Mail or fax to Austin, Kansas City, or Ogden, based on your state.

- Use the fax numbers listed on the current March 2025 form to save a few days.

- Track and plan

- Allow about 10 business days for processing, plus mail time, and build that into any lender or program deadline.

- Keep a copy of what you sent, including the signature date, in case you need to re‑request.

If timing is mission critical, combine methods, try Get Transcript online first, then submit 4506-T-EZ by fax as a safety net.

Accessibility, privacy, and masking

IRS transcripts partially mask personally identifiable information to protect you. Financial entries, including your AGI, remain fully visible for tax prep and income verification. This is by design and it does not reduce usefulness for most lending decisions.

Common pitfalls and how to avoid rejections

- Names and numbers do not match IRS records, enter names exactly as shown on the last processed return, and use the correct SSN or ITIN for line 1b, or 2b for spouse.

- Address mismatch, if you moved and never filed Form 8822, your transcript will still be mailed to the old address, update first if needed.

- Signature issues, missing signature, date, or unchecked authority box can cause a rejection, and the IRS will reject forms received more than 120 days after the signature date.

- Wrong form for the job, fiscal‑year filers and entities should use 4506‑T, lenders needing direct delivery should use 4506‑C through IVES.

For firm owners, make transcripts part of your delivery checklist

If you run a CPA, EA, or accounting firm, transcripts are a small step that can save weeks of back‑and‑forth during lending season. Standardize your client intake with a transcript checklist, confirm years available, choose the right channel, and decide when your team uses Get Transcript versus submitting 4506-T-EZ as a backstop. If you are scaling capacity and want consistent, accurate execution across busy seasons, integrate transcript requests into your documented SOPs so reviews move faster and clients hit their deadlines.

Accountably note, if your firm partners with Accountably for offshore delivery, your team can work inside your systems and check transcript status as part of your month‑end or tax prep workflow, which keeps reviewers out of preventable loops and keeps clients calm. Keep the focus on accuracy, security, and timely turnaround, not resume chasing.

FAQs

What is Form 4506-T-EZ used for?

It is the short form to request a free Tax Return Transcript for your individual 1040 for the current year and three prior years. It is commonly used for loans, financial aid, and other income verification needs when a summary of your filed return is enough.

How long does 4506-T-EZ take?

Most requests are processed in about 10 business days. Mailed delivery usually adds 5 to 10 calendar days. If you need it faster and your transcript is available, use IRS Get Transcript in your Individual Online Account to view or download immediately.

Can the IRS send my transcript directly to my lender?

Not with 4506-T-EZ or 4506-T, transcripts by mail go to your address of record. Lenders should use the IVES program with Form 4506‑C to receive transcripts directly from the IRS.

What if I need a full copy of my return?

Request a photocopy with Form 4506, fees apply, and it covers the current year plus up to seven prior years. For many loan use cases, a Tax Return Transcript is enough, check with your lender first.

Which years are available?

Tax Return Transcripts are generally available for the current tax year and the prior three processing years. Availability depends on how and when you filed and whether you owed a balance.

Final checklist and CTA

- Choose the right path, online Get Transcript for speed, 4506-T-EZ by mail or fax as a backup, or 4506‑C through IVES if a lender needs it directly.

- Fill the form cleanly, correct name, SSN or ITIN, current and prior address, years requested, and a clear signature and date.

- Plan timing, allow about 10 business days for processing, plus mail time, or download online when available.

- Keep privacy in mind, transcripts mask personal identifiers while keeping financial entries fully visible for verification.

If you lead an accounting firm and want transcripts handled the same way every time, document the process, set SLAs, and give your reviewers clean, standardized workpapers. That is how you protect deadlines and your team’s sanity.

Compliance and freshness note

This article reflects IRS pages last reviewed by the IRS on July 17, 2025 for Get Transcript and October 15, 2025 for About Form 4506‑T‑EZ. Always confirm you are using the March 2025 form revision and the current “Where to file” addresses and fax numbers printed on the form before you submit.

Sources used in this guide include the IRS About Form 4506-T-EZ page and current March 2025 Form 4506-T‑EZ, Get Transcript guidance, transcript availability timing, and IVES references for 4506‑C.

Simplify Delivery, Improve Margins, Stay in Control.

Offshore support that works exactly like your in-house team.

💼 Let’s Talk