Scale Your CPA Firm Without Adding Headcount

Build your offshore team that works your way, trained, compliant, and white-labeled under your firm.

👉 Book a Discovery Call

If you are a business owner or the accountant your clients lean on, this walkthrough shows exactly how to prepare Form 433‑B (OIC), how to compute the minimum offer using asset equity and future income, and how to send a complete package that reduces back‑and‑forth. I will speak to you directly, give you checklists you can copy, and include practical examples so you can move with confidence.

Key Takeaways

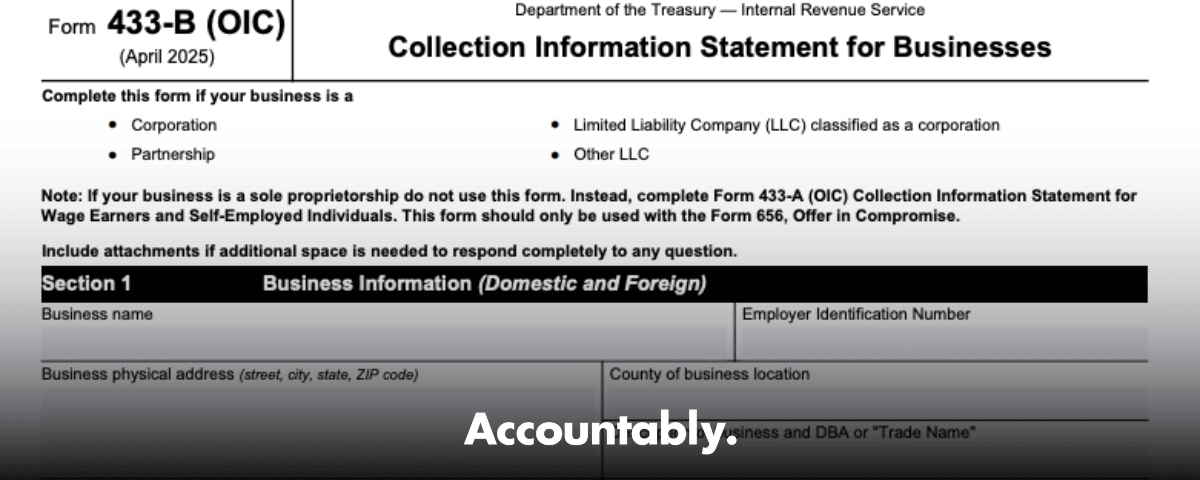

- Form 433‑B (OIC) is the business Collection Information Statement the IRS uses to evaluate a corporate, partnership, or LLC business Offer in Compromise. The current 433‑B (OIC) PDF is the April 2025 revision, listed on the IRS downloads index.

- The IRS sets your minimum offer by adding available asset equity to future income, 12 months for a lump sum offer or 24 months for a periodic plan. You put the final number on Form 656.

- Asset equity is typically “quick sale” value, often fair market value times 0.8, minus any loans, as shown on the asset lines in 433‑A/B (OIC) instructions and worksheets.

- Your package includes Form 433‑B (OIC), Form 656, the nonrefundable fee of 205, the initial payment, and organized support. Businesses file by mail or via the designated IRS email option, while online filing is for individuals only.

- The IRS usually pauses other collection activity while a processable offer is under review, and if the IRS does not make a determination within 24 months of the Centralized OIC unit receiving Form 656, the offer is deemed accepted by law. Track the received date.

Who Should Use Form 433‑B (OIC)

Use Form 433‑B (OIC) if your business is a corporation, partnership, or an LLC taxed as a corporation and you are submitting an Offer in Compromise on business tax liabilities. Sole proprietors use Form 433‑A (OIC). The IRS “About Form 656” page confirms that Form 656‑B includes both 433‑A (OIC) for individuals and 433‑B (OIC) for businesses.

Your goal is simple, show the IRS a complete, current picture of your business’s ability to pay, with every figure tied to a document they can verify.

Hundreds of Firms Have Already Used This Framework.

Join the growing list of CPA and accounting firms using Accountably’s Offshore Playbook to scale faster.

💬 Get Your FREE Playbook

👉 Visit Jugal Thacker’s LinkedIn

Send him a connection request and message “Playbook” to get your copy.

What To Gather First, So Review Goes Faster

Pull these items before you touch the form. It saves hours later.

- Bank activity, at least six months for each business account so deposits tie to your reported gross receipts. Most practitioners use six to twelve months to build reliable averages.

- Financials, a current profit and loss and a balance sheet, preferably year‑to‑date with enough history to support six to twelve month averages.

- Accounts receivable aging, customers, invoice amounts, and 30‑60‑90 plus buckets.

- Debt documentation, loan agreements and recent lender statements showing balances, payments, rates, and collateral.

- Asset value support, vehicle guides, equipment quotes, or broker opinions for property, along with loan balances for equity math. Use quick sale value conventions shown in the OIC materials.

- Payroll and deposits, recent 941s and deposit proof if you have employees. The booklet explains current‑compliance expectations for processability.

- Special‑circumstance exhibits, clear proof if a disaster, legal event, or sudden client loss materially changed income or costs. The booklet explains where to include this narrative.

Quick checklist you can print • Six to twelve months of bank activity for each account • Current P&L and balance sheet • AR aging and contact list • Debt notes and lender statements • Asset value support and loan balances • Payroll reports and deposit proof • Special‑circumstance memo with labeled exhibits

Fill The Form In Order And Tie Every Field To Support

Accuracy begins with consistent records. Enter business legal name, EIN, addresses, website, number of employees, average monthly payroll, and payroll service details exactly as they appear in your filings and payroll system. Then list owners, officers, and responsible persons with titles and percentages. The OIC instructions emphasize complete financial statements and correct officer information with your Form 656 package.

Improve Margins Without Compromising Quality

Offshore staffing helps firms deliver more, scale faster, and stay compliant, without adding local headcount.

👉 Book a Discovery CallAssets, How To Compute Available Equity

List cash and investments, digital assets if applicable, accounts receivable, and then vehicles, equipment, and real property. For hard assets, compute equity using quick sale value, often fair market value multiplied by 0.8, then subtract debt. Keep your valuation source in the workpapers. The IRS OIC materials and examples reflect this quick sale approach and require you to carry the equity into the minimum offer worksheet.

Income And Expenses, Build Defensible Averages

Average the most recent six to twelve months for gross monthly income and necessary business expenses. Enter those in the income and expense sections, then compute remaining monthly income that will feed the 12 or 24 month multiplier on Form 656. The booklet provides the payment option rules and multipliers you must use.

From Numbers To Minimum Offer, The Math You Must Get Right

Once your asset equity and your remaining monthly income are set, translate them into the minimum offer that matches IRS rules.

The 12 Or 24 Month Future‑Income Factor

- Lump sum option, multiply remaining monthly income by 12, then add available asset equity.

- Periodic payment option, multiply remaining monthly income by 24, then add available asset equity. You put this figure on Form 656 and pick your payment plan. The rules appear in the Offer in Compromise booklet and on the IRS OIC overview page.

Why The IRS Uses Quick Sale Value

The IRS does not assume top‑of‑market liquidation. A quick sale factor reflects pressure, costs, and time, which is why OIC calculations often use about 80 percent of fair market value before subtracting loans. Document your valuation method and keep screenshots or written quotes in the file. The OIC materials and worksheets show how equity flows into the offer computation.

Cash And AR, Make Them Reconcile

Reviewers compare bank deposits, AR aging, and your revenue line. If deposits do not match your P&L trend or if the AR buckets do not make sense, expect follow‑up questions. Bring six to twelve months of bank activity and a P&L that reconcile cleanly, as the booklet instructs you to include complete financial statements with Form 656.

Special Circumstances, When The Standard Number Is Too High

If the standard formula overstates your ability to pay, present a short narrative with labeled exhibits. Examples include a machine failure that changed margins, a verified disaster, or the loss of a key customer with contracts attached. The booklet explains how to present special circumstances and where to attach them in the package.

Keep the memo tight, one page of facts, one page of numbers, and exhibits labeled to match each claim. Reviewers appreciate clarity.

Assemble A Package That Moves Without Delays

Your package should be audit‑ready. Include:

- Form 433‑B (OIC), signed by an authorized officer.

- Form 656 for the business, signed and dated.

- The nonrefundable application fee of 205, unless a specific waiver applies. The IRS shows the current fee on its OIC page and in news releases.

- The initial payment based on your selected option. Lump sum offers usually include 20 percent, periodic plans include the first monthly payment, as the OIC page explains.

- Supporting documents organized in the same order as the form, bank activity, financials, AR, debt statements, and valuation notes.

Where And How To Send It

- Mail, use the address listed in the current Form 656‑B booklet and keep proof of delivery.

- Email, the IRS allows submission by email to one of two designated sites listed in the booklet, follow their file size and naming guidance.

- Online filing is available to individuals through an IRS Online Account, not for businesses. If you are filing a business OIC, use mail or email.

Avoid Return Triggers

A returned offer is different from a rejection. Returns are process issues, for example missing fee or payment, ineligible status, or incomplete information. Returns carry no appeal rights, although you can fix the problem and resubmit. The IRS OIC and Tax Topics pages explain these differences and your appeal window after a rejection.

Example, Turning Records Into A Minimum Offer

- Vehicles and equipment, FMV 250,000, quick sale 0.8, 200,000, loans total 170,000, equity 30,000.

- Property, FMV 500,000, quick sale 0.8, 400,000, mortgage 395,000, equity 5,000.

- Cash available, 12,000 after normal float.

- Net collectible AR, 18,000 after allowances.

Asset equity subtotal is 65,000. Remaining monthly income averages 2,800 using a clean 12 month P&L and bank analysis. Lump sum option, 2,800 times 12 equals 33,600. Minimum offer, 65,000 plus 33,600 equals 98,600, then propose terms on Form 656 that match cash realities. The method mirrors the IRS booklet.

What To Expect After You File

Once the IRS deems your offer processable, it moves to investigation. During this time, your fee and initial payment are applied to your balance, and the IRS generally pauses other collection actions, as described on the OIC overview page. Stay current on all new taxes and deposits while the offer is pending.

Most business offers take months, and many resolve within six to twelve months in practice. If the IRS does not make a determination within 24 months of the correct Centralized OIC unit receiving your Form 656, the offer is deemed accepted by statute. The 24 month clock starts when COIC receives the offer, not when you mail it. Keep proof of the IRS received date.

Accepted, Rejected, Or Returned

- Accepted, follow the payment terms and remain fully compliant for five years after acceptance or the offer can default. The IRM and the booklet reinforce post‑acceptance compliance.

- Rejected, you can appeal within 30 days. Focus on specific income, expense, or equity items and attach targeted documents that support your position.

- Returned, the IRS did not process your offer, often due to a missing piece or ineligibility. Fix the issue, then resubmit. The OIC page and IRS tips describe common reasons offers are not processed.

Practitioner’s Corner, How To Cut Review Time

If you are a CPA, EA, or controller juggling multiple entities, Form 433‑B (OIC) cases get stuck when workpapers are inconsistent. Protect your review time with:

- Standard file naming tied to the order of the form.

- A two‑page exhibits index where every number on the form points to an exhibit.

- A pre‑review checklist for equity math and the 12 or 24 month multiplier.

If your internal capacity is tight, consider a disciplined offshore delivery model that builds OIC packages inside your systems with your templates. At Accountably, we integrate trained offshore accountants into your workflow so workpapers, exhibits, and review flow match IRS expectations and protect partner time. Mentioned here only because some firms need a reliable way to scale this work without sacrificing control.

Compliance Reminders You Should Not Skip

- All required returns must be filed.

- Employers must make current federal tax deposits. The IRS screens for processability and can return incomplete or non‑compliant submissions.

- If you select periodic payments, keep paying monthly during review unless a waiver applies. Missing a payment can cause a return.

Your best defense is a complete, current, well‑labeled package. Clean inputs, clear outputs, and fewer questions.

What, How, Wow, A Simple Framework For Stronger OICs

- What, define every number with a document.

- How, show your method, quick sale equity, 12 or 24 month income multiplier, and labeled exhibits.

- Wow, add original insight, for example a month‑by‑month bridge from last year’s cash flow to this year’s lower margin, with proof.

A Sample “Exhibits Index” You Can Copy

| Box or line on 433‑B (OIC) | Exhibit label | Source |

| Cash, operating account ending balance | EXH‑BANK‑1 | Bank statements, Jan to Jun |

| Accounts receivable total and aging | EXH‑AR‑1 | AR aging, detail export |

| Vehicle equity | EXH‑VEH‑1 | Guide value printout, loan statement |

| Equipment equity | EXH‑EQ‑1 | Dealer quote, loan statement |

| Real property equity | EXH‑RE‑1 | Broker opinion, mortgage statement |

| Gross monthly income | EXH‑P&L‑1 | P&L YTD, bank deposit tie‑out |

| Business expenses | EXH‑P&L‑2 | P&L detail, vendor rollup |

| Special circumstances | EXH‑SC‑1 | Narrative, contracts, insurance letter |

Keep this table on top of your exhibits so any reviewer can find support in seconds. It shortens calls and cuts revisions.

Submission Options, One More Look

- Mail to the Centralized OIC site listed in the current 656‑B booklet, keep proof of delivery.

- Email to a designated site listed in the booklet, follow naming and size rules.

- Individuals can use the IRS online account to file, not businesses. The IRS OIC page confirms these options and the fee.

Costs, Fee, And Initial Payment

The application fee is 205 per Form 656 and there is an initial payment requirement tied to your payment option. Low‑income certification can waive the fee and initial payment for qualifying individuals, which the IRS reiterates in 2024 and 2025 tips and news pages. Businesses should plan for the fee.

Micro‑Anecdote, The Two‑Page Fix

We once inherited an offer that had stalled for months. The facts were fine, the workpapers were not. We rebuilt the exhibits index, labeled each number, and added a short special‑circumstances memo with a lender letter. The reviewer could see the story in the numbers, the call time dropped by half, and the offer moved.

Quality Control, A 10‑Minute Final Pass

- Scan every signature line.

- Confirm the 12 or 24 month multiplier selection matches the payment option on Form 656.

- Recompute equity math for vehicles, equipment, and property.

- Confirm that any return filed within the last ten weeks is included as a copy, as instructed in the booklet.

- Save a single PDF set in the order of the form so the reviewer can follow it without hunting.

Slow is smooth, smooth is fast. Ten minutes at the end prevents weeks of delay.

FAQs, Short Answers You Can Use

What is Form 433‑B (OIC) for a business

It is the IRS Collection Information Statement for businesses applying for an Offer in Compromise. Corporations, partnerships, and LLCs taxed as corporations use this form to disclose assets, liabilities, income, and expenses so the IRS can compute reasonable collection potential.

How do I calculate the minimum offer

Add available asset equity to future income using the correct factor, 12 months for lump sum, 24 months for periodic payments. You record the result on Form 656 and select your payment option.

Can a business file an OIC online

Individuals can file an OIC online through an IRS online account. Businesses submit by mail or by email to the designated Centralized OIC sites listed in the booklet.

What happens to collections while my offer is pending

Once your offer is processable, the IRS generally pauses other collection actions while it evaluates the offer. You must stay current on new filings and deposits.

How long will this take

Many offers resolve within several months. If the IRS does not make a determination within 24 months of the COIC unit receiving your offer, it is deemed accepted by statute, unless it has been rejected, returned, or withdrawn.

What is the current OIC application fee

The fee is 205 per Form 656. The IRS confirms the fee on its OIC page and in recent notices and tips.

Extra Help For Accounting Firms

If you handle multiple business OICs during busy season, you know where the time goes, inconsistent workpapers, missing exhibits, and last‑minute reconciliations. If you need additional hands without creating chaos, Accountably can integrate trained offshore accountants into your workflow, use your templates, and build OIC packages that follow your standards and the IRS booklet, which protects partner review time. We mention this only where it helps, not as a blanket pitch.

Ethics, Scams, And Your Best Defense

The IRS regularly warns about “pennies on the dollar” marketing and OIC mills. Work with licensed professionals, use the IRS pre‑qualifier, and rely on the current Form 656‑B booklet for rules, fees, and submission sites.

Final Checklist Before You Send

- Sign every required page.

- Match each number on the form to a labeled exhibit in your index.

- Include Form 656, the 205 fee, and the correct initial payment.

- Insert copies of any return filed within ten weeks of submission, as the booklet instructs.

- Send by trackable mail to the correct COIC site or use the designated email option in the booklet. Keep proof of the IRS received date because the 24 month statute runs from that date.

CTA, Your Next Step

If you want a second set of eyes on your calculation or you need help packaging evidence so an IRS reviewer can follow it without guesswork, bring in a trusted professional. If your internal team needs capacity to standardize OIC workpapers and reduce review friction, ask how our team at Accountably can support the process inside your systems, with your templates, and to your quality bar.

Simplify Delivery, Improve Margins, Stay in Control.

Offshore support that works exactly like your in-house team.

💼 Let’s Talk