Scale Your CPA Firm Without Adding Headcount

Build your offshore team that works your way, trained, compliant, and white-labeled under your firm.

👉 Book a Discovery Call

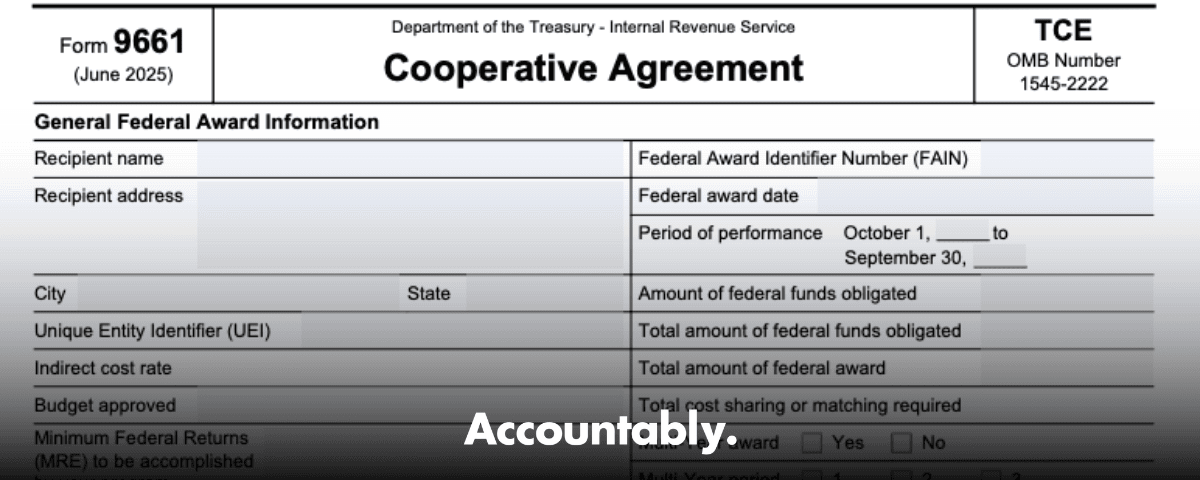

This guide keeps it simple. You will see what Form 9661 is, who needs it, how to fill it out without errors, how to sign and save a timestamped copy, and how to keep your data safe. I will also flag where employers often mix it up with other onboarding forms like I‑9, W‑4, or WOTC ETA 9061, and I will share a short comparison so you do not confuse them.

Key Takeaways

- Form 9661, also called the A‑9661 application, is a concise, two page employment application that collects your personal details, background, and reason for applying. On many publisher pages you will see it tied to “application for employment 9661” or “Adams 9661.” Average fill time is shown as about 30 seconds when your info is ready.

- You can open A‑9661 through a hosted PDF page, select Get Form, and type, edit, and e‑sign in your browser. Some copies are not natively “fillable,” the online editor adds the typing and signature layer for you. Keep the final, timestamped PDF.

- Required areas cover personal identifiers, position details, background history, and certification. If you see a field reference like “t 32851 employment,” treat it as a required item in that editor’s workflow.

- Do not confuse A‑9661 with I‑9 or W‑4. I‑9 verifies work authorization and has federal retention rules. W‑4 sets paycheck withholding. WOTC ETA 9061 is for tax credit screening. These are separate documents.

- If you need help with the hosted editor, you can reach the publisher’s support at the posted email and phone on their site. Hours may vary by page, so check their contact page for the current schedule.

What Is Form 9661, A‑9661

Form 9661, often labeled A‑9661, is a standard two page employment application. It captures who you are, how to contact you, your education and work history, and why you are applying. Many publishers present A‑9661 as a quick entry PDF with a browser editor, so you can type, correct, and sign without installing software. When the site lists an average “30 seconds to complete,” read that as the time to input text if you already have your dates and details handy.

Quick rule of thumb, if an employer or policy tells you to submit “A‑9661,” use that exact form so your application flows through their review and audit steps.

Hundreds of Firms Have Already Used This Framework.

Join the growing list of CPA and accounting firms using Accountably’s Offshore Playbook to scale faster.

💬 Get Your FREE Playbook

👉 Visit Jugal Thacker’s LinkedIn

Send him a connection request and message “Playbook” to get your copy.

You may also see older references to “Adams 9661.” That is a long running employment application style that many teams recognize. Different publishers map that template into online editors, so the fields you see can vary in label text but still cover the same basics.

Who Should Use This Form

If a recruiter, job post, or portal explicitly asks for A‑9661, use it. You will finish faster than typing a freeform email, and reviewers can compare your details side by side with other applicants. The form also helps HR standardize documentation for background checks and internal audits.

Typical applicant profiles

- Candidates who need a clean two page snapshot of identity, contact info, and history.

- Contractors converting to employee status who must submit a formal application record.

- College or seasonal applicants when a firm wants the same layout for every file.

If speed matters, use the online editor. Even when the underlying PDF is not “fillable,” the editor lets you type, fix typos, and sign, then export a final PDF. Save the timestamped receipt or confirmation for your records.

Improve Margins Without Compromising Quality

Offshore staffing helps firms deliver more, scale faster, and stay compliant, without adding local headcount.

👉 Book a Discovery CallWhen A‑9661 Is Required

Use A‑9661 when the hiring team or policy says, submit the two page application labeled A‑9661 or “application for employment 9661.” Many review teams rely on that exact template to keep screening consistent. Some hosted pages also surface a field label like “t 32851 employment,” which you should treat as mandatory inside that editor. If you skip required items you will get a follow up, which delays decisions.

A quick note for firms

If you run hiring for an accounting practice or a multi entity business, A‑9661 can reduce back and forth during busy season. The trick is not the PDF, it is the discipline around file naming, checklists, and review steps. That is where teams stall. Keep reading for a simple structure you can copy.

Form 9661 PDF Details, Purpose, And Scope

A‑9661’s job is simple, gather essential applicant data quickly and cleanly so reviewers can make a decision. Expect a sequence of sections, usually personal identifiers, position details, background, then certification and signature. Many publisher pages explain that you can click Get Form and complete the document online, even if the original PDF has no native form fields. The editor adds typing, corrections, and e‑signature, then outputs a final PDF.

Keep your entries consistent with your IDs, resume, and any attachments. Small mismatches cause most review delays.

What the form covers

- Personal identifiers, full legal name, current address, contact info.

- Position details, role you want, availability date, and pay expectations if requested.

- Background history, education, employers, job titles, start and end dates, and credentials.

- Certification, your signature and date to attest that the information is true.

Editing Steps At A Glance

Here is the quick path many hosted pages describe. Open the A‑9661 page, select Get Form, complete the fields in order, correct any flagged fields, sign electronically, click Done, then save the final PDF for your records. If you hit a snag, the publisher lists a support email and phone on their site.

Practical prep that saves time

- Have your address history, employer names, titles, and dates ready.

- Standardize date formats and name spellings across resume and form.

- If you see any internal field reference such as “t 32851 employment,” complete it before you sign.

Required Information And Fields

Most versions of A‑9661 ask for four core areas. You will enter your legal name as it appears on government ID, your current address, phone, and email. You will note the role you are applying for and your earliest available start date. You will list education and employment history in reverse chronological order. Then you will sign and date the certification.

Keep the paragraphs short and the details exact. If the editor flags a required field, fix it immediately. If the employer asks for salary expectations, answer plainly or enter “open to discussion” if they allow free text.

Accuracy And Honesty

Treat every entry as a formal statement. A‑9661 is not a casual survey. Hiring teams use your responses to validate identity, confirm work history, and queue next steps. Misstatements can lead to denial or withdrawal of an offer. Match dates, employer names, and credentials to your resume and any proof you attach. If your situation changes while the employer is reviewing your file, send an update so the record stays current.

Truthful personal details

- Type your full legal name exactly as on your government ID.

- Use month and year ranges for addresses and employment so background checks reconcile.

- Avoid estimates. If you do not know an exact day, use the correct month and year and keep that same pattern on your resume.

Complete background disclosures

If the application asks about criminal history or other sensitive items, follow the instructions closely and use accurate legal terms. Provide dates, jurisdictions, and outcomes if you are asked for them. If the form requests documents, attach clean copies and label them clearly. Transparency speeds review.

Documents And Consistency

Make every supporting document line up with what you typed into A‑9661. That means the same name format, the same dates, and the same employer names. If you include diplomas, licenses, or certificates, send clear scans. If you translate any record, use a certified translator and include the translator’s statement.

- Match references, pay stubs, or offer letters to the job titles and date ranges you list.

- Use consistent file names that mirror form sections, for example, Doe_Jane_License_CPA.pdf.

- Keep originals and store the final PDF plus your timestamped receipt in a safe place.

How To Access The Online Editor

Open the A‑9661 page, select Get Form, and let the editor load in your browser. You can type directly onto the PDF, correct text, and add your digital signature. Even when the underlying file is not a native fillable PDF, the editor gives you the fields you need. When you finish, click Done and download the final document. If you need assistance, the publisher lists support options on their contact and FAQ pages.

If the page is slow, try another browser, clear your cache, or disable a strict content filter until you export the finished PDF.

Step By Step Editing Process

- Click Get Form to launch the editor. 2) Complete the personal section first. 3) Enter position details. 4) Add education and employment history. 5) Review any additional questions. 6) Sign and date electronically. 7) Select Done and save the PDF.

Work in order. The editor may flag required items as you go. Fix anything in red before you move forward. Keep an eye out for internal field references like “t 32851 employment,” which some editors surface for tracking inside the workflow. Complete them before you sign.

Adding Text, Making Changes, And Signing

Use the text tool to type cleanly. Keep lines short so the text fits the visible box on the PDF. For mobile editing, pinch to zoom and check alignment. When you are ready to sign, use the editor’s signature tool or upload a saved signature image if the tool allows it. If your process requires notarization, confirm that requirement with the employer first.

Tips For Fast, Error Free Completion

- Preload your address, phone, email, past employer names, and start and end months.

- Enter data in sequence and resolve any validation prompt before you move on.

- Recheck your Social Security number if the employer requests it in their workflow.

- Save a final copy to an encrypted drive and store a second copy in a secure cloud folder.

If you run into trouble with the editor or need account help, the publisher lists support at [email protected] and via phone on their site. Hours differ by page, so confirm the current schedule on Contact Us or Terms.

Final Review, Submission, And Receipts

Do one last pass across both pages. Read names and dates aloud. Make sure your reason for applying matches the role title you entered. Confirm that every required field has content. Add your e‑signature, click Done, and save the completed PDF. Keep the timestamped confirmation the editor provides. If the employer uses a portal, upload the file there and watch for a submission receipt.

Keep a copy of the final PDF and the submission confirmation. If a reviewer cannot open your file, you can resend without starting over.

Security And Privacy Basics

Your application contains sensitive data. Treat it like a tax document.

- Transfer files over TLS, which you already have when the website shows HTTPS in your browser.

- Password protect local copies, set link expirations if you share, and audit access where possible.

- Retain only what you need for the hiring process and delete extra copies once you are done.

If you prefer, edit locally in a trusted PDF tool, then upload the final document to the employer’s portal. Either way, review the publisher’s privacy notice before you submit personal data.

For Accounting Firms And Busy HR Teams, Why This Matters

Most firms do not stall because they cannot find candidates. They stall because delivery breaks down when details are inconsistent and reviewers get buried in back and forth. A simple SOP fixes most of it.

- Set a standard file name, Applicant_Last_First_A9661_YYYYMMDD.pdf.

- Require a two minute self check, names and dates must match resume and ID.

- Use a short checklist, fields complete, signature present, attachments labeled.

If you manage large seasonal waves, structure helps you avoid review bottlenecks. At Accountably, we care about disciplined workflows because they protect deadlines and quality. If you need a light template for intake checklists and file naming, adapt the bullets above to your stack. Keep the process, even if you change the tools.

Do Not Confuse A‑9661 With Other Hiring Forms

A‑9661 is not a work authorization form and not a tax withholding form. Here are the quick distinctions with trusted sources.

- Form I‑9 verifies identity and work authorization. Employers must retain I‑9 for three years after the date of hire or one year after the date employment ends, whichever is later.

- Form W‑4 sets federal income tax withholding. Employees give W‑4 to their employer, not the IRS. Employers generally must honor a revised W‑4 by the first payroll period ending on or after day 30 from receipt, unless an IRS lock in letter applies.

- ETA Form 9061 is a Work Opportunity Tax Credit screening form used with IRS Form 8850. It is not an employment application.

Alternatives If A‑9661 Does Not Fit

Sometimes an employer needs different information. If A‑9661 does not capture role specific screening, use the employer’s standard application or an applicant tracking system export that maps to the same data points. If the process requires background consent or special disclosures, add the correct authorization form rather than forcing it into A‑9661 text boxes.

Comparable Employment Forms, A Quick Table

| Form | Purpose | Who completes | When used | Key notes |

| A‑9661 application | Standard two page employment application to capture identity, contact, education, work history, and reason for applying | Applicant | When an employer requests “application for employment 9661” or “A‑9661” | Often edited online, then e‑signed and saved as PDF. |

| Form I‑9 | Verify identity and work authorization | Employee and employer | Within onboarding timelines set by DHS, see current I‑9 instructions | Retain for three years after hire or one year after termination, whichever is later. Do not mail to USCIS. |

| Form W‑4 | Set paycheck withholding | Employee, submit to employer | At hire or when life or income changes | Employer must implement a revised W‑4 by the first payroll period ending on or after day 30, absent a lock in letter. |

| ETA 9061 | WOTC screening with IRS Form 8850 | Employer or applicant, per state instructions | At or near hire to claim potential WOTC | Uses DOL template. Current form shows Rev. May 2023 with OMB control details. |

State New Hire Reporting

After you hire someone, most states require new hire reporting within a set number of days, often within 20 calendar days. States publish their rules inside the federal Office of Child Support Services IRG profiles. For example, California lists reporting within 20 days, and several other states show the same timeframe on their profiles. Always check your state’s page for exact rules.

Tip for employers, put “create I‑9 file, capture W‑4, submit state new hire report” into your onboarding checklist so you do not miss deadlines. The A‑9661 application is not a substitute for these.

Support And Contact Information For The Hosted Editor

If you used a hosted editor to complete A‑9661, the publisher lists contact methods on their site. You can reach support at the published email and phone, and you will see the company’s Delaware address on their Contact and Terms pages. Check those pages for current support hours, which may differ by page.

- Email support at the posted support address.

- Call the listed phone number during the support window shown on their site.

- Keep a brief note of any support interactions for your records.

This site states it is not a law firm. If you need legal guidance about disclosures or recordkeeping, talk with counsel or your compliance team.

Frequently Asked Questions

What is Form 9661, A‑9661

It is a two page employment application used to collect your personal details, background, and reason for applying. Many publisher pages show average completion at about 30 seconds when your info is ready, and they let you type and sign in a browser even if the PDF itself is not natively form fillable.

Is A‑9661 the same as Form I‑9

No. I‑9 verifies identity and work authorization. Employers must retain I‑9 for three years after the date of hire or one year after employment ends, whichever is later. A‑9661 is an application. You will often complete both during onboarding, but they serve different purposes.

What is 9061

ETA Form 9061 is the U.S. Department of Labor’s Individual Characteristics Form used with the Work Opportunity Tax Credit program. It is part of WOTC screening, not a general job application. It is commonly completed with IRS Form 8850 as states process WOTC certifications.

Where do I send my W‑4

You give W‑4 to your employer, not to the IRS. If you submit a revised W‑4, the employer generally must implement it by the first payroll period that ends on or after day 30 from receipt, unless a lock in letter rules apply.

Do I have to report new hires to a state agency

If you are an employer, yes, in most states you must report new hires within a defined window, often within 20 days. Check your state’s profile on the federal Office of Child Support Services site for the exact rule.

Mini Checklist You Can Copy

- Open the A‑9661 page and click Get Form.

- Enter personal identifiers, position details, background, then sign.

- Match every date and name to your resume and ID.

- Click Done, save the final PDF, and keep the timestamped confirmation.

- If you are the employer, complete I‑9 and W‑4, then submit your state new hire report on time.

Final Notes, Accuracy, Trust, And A Light CTA

You want your application to move without friction. That happens when your A‑9661 is complete, consistent, and easy to review. If something does not look right, pause, fix it, and then sign. If your organization handles high volumes, adopt a one page SOP for intake, file names, and pre review checks. Small habits protect your time.

If you run an accounting firm and need help building disciplined delivery around hiring files and day to day client work, our team at Accountably focuses on controlled offshore delivery and review protection. Use only what helps you right now and keep your process simple.

This guide is for information, not legal advice. For questions about disclosures, retention, or state rules, talk with your counsel or the issuing authority.

Small disclosure, we used editorial tools, including AI, to help draft and structure this guide, then our team reviewed it for accuracy and clarity. External facts that can change were checked against official sources dated through September 2025.

Simplify Delivery, Improve Margins, Stay in Control.

Offshore support that works exactly like your in-house team.

💼 Let’s Talk