Scale Your CPA Firm Without Adding Headcount

Build your offshore team that works your way, trained, compliant, and white-labeled under your firm.

👉 Book a Discovery Call

Your job is to roll up accurate, season‑level activity without exposing private data. Treat 13206 like your program’s scorecard, not a data dump.

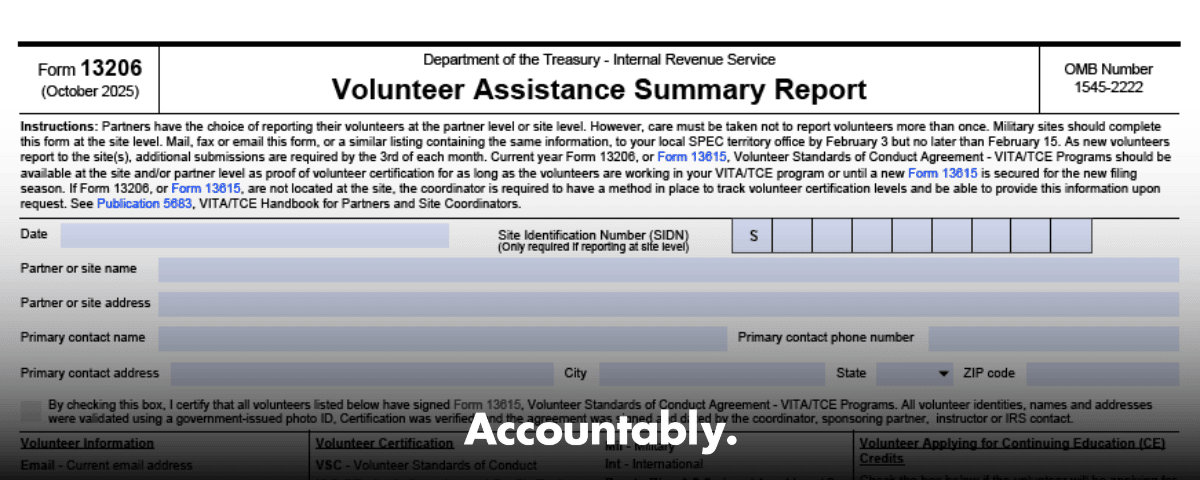

As of October 29, 2025, the IRS lists Form 13206 with a current revision of Rev. 10‑2025 and a posted date of September 23, 2025. You can access it from the IRS Forms site and from the VITA/TCE Site coordinator corner. The collection is covered under OMB Control No. 1545‑2222, which the Office of Management and Budget shows as revised in 2025 for the VITA/TCE information collection.

Key takeaways

- Form 13206 is the Volunteer Assistance Summary Report for VITA/TCE programs. It captures program‑level activity for the filing season so the IRS can see scope, quality priorities, and resource needs.

- The latest available version shows Rev. 10‑2025, posted September 23, 2025. Always download the current PDF from IRS.gov before you compile.

- The form is part of the VITA/TCE information collection under OMB Control No. 1545‑2222, with a 2025 supporting statement that confirms its use to report volunteer information.

- Think summary, not raw detail. Report totals, follow the fields exactly as they appear on the current form, and avoid adding any personal information that the form does not request.

- Build a short internal checklist so your counts for volunteers, hours, sites, and returns prepared are validated before submission. That simple step saves corrections later.

What Form 13206 is, and why it matters

Form 13206 is the IRS’s summary view of your VITA or TCE program’s work for the season. It lets site coordinators and program managers report the scale of assistance, including totals that reflect volunteers, time invested, and return activity, in one official place the IRS recognizes. This common format supports oversight and consistent quality across locations.

Hundreds of Firms Have Already Used This Framework.

Join the growing list of CPA and accounting firms using Accountably’s Offshore Playbook to scale faster.

💬 Get Your FREE Playbook

👉 Visit Jugal Thacker’s LinkedIn

Send him a connection request and message “Playbook” to get your copy.

For 2025, the IRS posts 13206 as a current, downloadable PDF. If your browser struggles to render the interactive PDF, download it and open it in a current PDF reader. Keep a saved copy of the specific revision you used, along with the date you pulled it, so your records show that you filed with the latest version available at the time.

The Paperwork Reduction Act coverage for VITA/TCE reporting sits under OMB Control No. 1545‑2222. OMB’s 2025 supporting statement explains that Form 13206 is used by partners to provide information about volunteers. It also shows estimated respondent counts and burden, which is a useful proxy for how the IRS expects programs to engage with this collection.

How the IRS expects you to use 13206

In practice, you use 13206 after the filing season to summarize program activity. The supporting statement shows one response per respondent for this form, which aligns with a season‑level summary cadence. That means you should plan your internal process around a single, accurate rollup rather than piecemeal updates.

Improve Margins Without Compromising Quality

Offshore staffing helps firms deliver more, scale faster, and stay compliant, without adding local headcount.

👉 Book a Discovery CallWhat goes in your totals will mirror the fields on the current PDF. Because forms can change, resist the urge to carry forward last year’s column headers. Download the new file each year, scan for any field shifts, and adjust your template before you start compiling. The official IRS “Site coordinator corner” keeps a live link to the current 13206, which is a good habit check before you lock your report.

The WOW, a smarter path to accurate totals

Here is the simple truth. Most errors are not math errors, they are workflow errors. A volunteer event did not get logged, a satellite site closed early, or hours never moved from a sign‑in sheet into your tracker. The cure is a short, repeatable cadence that pairs your people calendar with your returns calendar. Each week, reconcile hours and site dates against any e‑file transmission spikes or event schedules. A five‑minute weekly cross‑check makes the end‑of‑season rollup faster and cleaner.

A quick personal system that works

- Block 15 minutes every Friday to update volunteer hours and site counts.

- Cross‑check your updates with any unusual return bursts, like campus events or library pop‑ups.

- Keep a one‑page change log. If you fix a count, write what changed, who approved it, and when.

- Before you finalize 13206, run one peer review. A fresh set of eyes will spot odd ratios fast.

Small programs often think they are too busy for documentation. In my experience, the smallest programs benefit the most, because a single missed event can skew their season picture.

Verify currency first, then complete the form

The IRS forms index shows Form 13206 at Rev. 10‑2025, posted September 23, 2025. Confirm that stamp on the PDF footer when you download it, then file using that revision. If a newer revision appears, use the newer file and note the change in your records.

OMB’s 2025 filing reflects an updated VITA/TCE collection under Control No. 1545‑2222, with a burden table that includes Form 13206. This is your evidence that the form you are using is part of an active, reviewed information collection in 2025. Save a copy of the supporting statement link in your working papers.

The fast “currency check” routine

- Pull the current 13206 from the IRS forms index. Note the revision month and posted date.

- Open it in a current PDF reader so all fields render correctly.

- Record the revision and download date in your compliance log.

- If your organization caches forms on an intranet, replace old copies the same day.

What to collect, and common sources

Your totals should match the fields on the current form. While specific labels can change, most programs track these categories well:

- Volunteers and volunteer hours, summarized by role or certification if the current form requests it.

- Sites operated during the season.

- Returns prepared, broken out by the current form’s definitions, for example e‑file versus paper, or other groupings the IRS is using this year.

- Any program activity metrics that appear on the current revision.

You likely already have the data, just spread across sources. The trick is to align names and dates.

Typical data sources you can trust

- Timekeeping logs, sign‑in sheets, or volunteer schedule exports.

- Site calendars, event registrations, and closure notices.

- E‑file transmission reports and end‑of‑day tallies.

- Quality review summaries that often reconcile totals at week’s end.

- Training completion lists if the current form ties activity to certification status.

If the form does not ask for personal information, do not include it. Stick to aggregated counts and the exact fields on the current PDF. When in doubt, check the “Site coordinator corner” resources or your SPEC relationship manager before adding anything beyond what the form requires.

A clean, 30‑minute completion checklist

Use this when you are ready to finalize your season‑level report.

- Confirm you have the latest 13206. Verify Rev. month and posted date.

- Reconcile volunteer hours by week, then by site, to remove duplicates.

- Match site counts to your location list for the season, including pop‑ups.

- Tie return totals to your final transmission reports and paper files.

- Run an internal review. Have one colleague check ratios, for example returns per volunteer hour, to catch obvious outliers.

- Save your final PDF, plus a CSV of the underlying numbers, with dates and initials.

- Log the OMB control number, the revision you used, and the date you downloaded it.

Helpful table, single‑view prep

| Item you need | Where to get it | Quick validation step |

| Current 13206 PDF | IRS forms index or Site coordinator corner | Confirm Rev. 10‑2025 and posted 09‑23‑2025 on IRS.gov listings |

| Volunteer hours total | Time logs or scheduler exports | Sample 3 weeks and tie back to daily sign‑ins |

| Sites operated | Master site list, pop‑up event list | Match addresses and dates to event calendar |

| Returns prepared | E‑file transmissions, paper batch log | Ensure totals align with last transmission date |

| Reviewer sign‑off | Internal checklist | Freeze a PDF copy with date and initials |

Sources for the current revision and posted date are live on IRS.gov at the time of writing. Always repeat the check on the day you file.

Guardrails that prevent rework

- Close the loop weekly. Five minutes each Friday beats a one‑day scramble in April.

- Treat pop‑ups as separate sites in your tracking tools if the form expects site counts.

- Use consistent naming for events and locations so your rollups do not split one site into two lines.

- Keep a short amendment path. If you discover a miss after you submit your program totals, update your log and follow your program’s correction process promptly.

Compliance, OMB control, and proof you did it right

The 2025 OMB supporting statement confirms that 13206 is part of the VITA/TCE information collection under Control No. 1545‑2222. It also shows the expected respondent volume and a one‑per‑respondent rhythm for this form, which supports using it as a season‑closing summary. Keep that citation in your records as your compliance anchor.

The IRS forms index lists the current revision and posted date. When an auditor or funder asks, you can point to the date you downloaded the current file and the visible Rev. month on the PDF. That is your evidence that you used the right form.

Filing currency alerts you should adopt

- Check the IRS forms index for 13206 at the beginning and end of the filing season. Watch for any mid‑year postings.

- Confirm your copy is Rev. 10‑2025, posted 09‑23‑2025, before you finalize 2025 season totals. If a newer Rev. appears, swap it in and document the change.

- Bookmark the Site coordinator corner. It centralizes the volunteer program materials and links the current 13206.

Common mistakes and quick fixes

- Mixing people data into a summary form. If the current 13206 only asks for totals, keep names and other personal details out of the submission. Maintain those details securely in your internal records.

- Counting volunteers twice. Build a “do not double count” rule into your spreadsheet if a person served at multiple sites.

- Leaving out pop‑ups. Tag temporary events in your site list so they roll up with permanent sites.

- Relying on a single source. Cross‑check hours and returns at least once with a second system.

Quality review that saves you time

- Ratio scan. If your returns‑per‑hour jumps 3x for one site, investigate.

- Date scan. Make sure your busiest weeks line up with outreach or campus events.

- Peer scan. A colleague who did not prepare the numbers will catch oddities fast.

Records, signatures, and retention

Follow your program’s retention policy for volunteer documentation, time records, and rollups that support your 13206 totals. Keep a clean, dated copy of the PDF you submitted, a machine‑readable export of the underlying counts, and your “currency check” log with the IRS revision and posted date. If your sponsor or governing partner asks for coordinator sign‑off, keep the signed copy with the same packet. The IRS VITA/TCE resource pages are the best place to confirm any signature or retention specifics your program requires.

Security notes you should not skip

- Limit access to the working folder to staff who need it.

- Avoid emailing raw spreadsheets. Use a shared drive with version history.

- If you must transmit files, encrypt them and store only the final PDF plus a locked archive.

Your report should be replicable. If a reviewer picked up your archive six months from now, they should be able to rebuild your totals from the same sources without guesswork.

Accessing and working with the PDF

Grab the current Form 13206 from IRS.gov. The IRS forms index lists the product with Rev. 10‑2025 and a 09‑23‑2025 posted date. If your browser shows a “requires Adobe Reader” message, download the file and open it in a current PDF application so all fields render properly.

The Site coordinator corner also links directly to 13206 and other VITA/TCE tools, including training and quality review materials. Keep those nearby as you reconcile hours and returns, since they often answer practical questions that come up during your rollup.

Simple workflow to compile accurate totals

- Set your reporting window. Match the filing season dates your program used.

- Pull raw counts by site. Include permanent locations and pop‑ups.

- Reconcile volunteer hours against schedules and any paper sign‑ins.

- Reconcile returns prepared against e‑file transmissions and a paper stack count if applicable.

- Compare totals to any internal dashboards you keep.

- Run a one‑page “variance list” with notes for any site or week that looks unusual.

- Complete 13206 using the exact fields on the current PDF.

- Peer review, lock the file, and archive the inputs.

A quick comparison table you can adapt

| Task | Owner | When | Output |

| Pull hours from scheduler | Site lead | Weekly | CSV of hours by person and site |

| Tie hours to sites | Program admin | Weekly | Hours by site rollup |

| Reconcile returns | E‑file coordinator | Weekly | Returns by site summary |

| Final compilation | Coordinator | End of season | 13206 PDF draft |

| Peer review | Second reviewer | Within 2 days | Sign‑off and archive notes |

Where this fits in your bigger program picture

Form 13206 is one line in a larger quality and oversight system. The IRS maintains a consistent set of volunteer program resources and expects season‑level summaries to be accurate and supportable. When you treat 13206 like your scoreboard, you also make life easier for training, site reviews, and future funding conversations.

If you run your VITA/TCE work inside a CPA or EA firm environment, make sure your client‑service workload does not bury your community commitments. This is where predictable operations help. At Accountably, our role with firms is building disciplined delivery systems, templates, and review steps so production work is on time, and summary reporting, like a 13206 rollup, does not become a last‑minute fire drill. Mention us only if that kind of operational guardrail would remove stress for your team, and keep the focus on your program’s public‑service goals.

What good looks like by the numbers

- Your final totals match your weekly rollups within a tiny variance.

- Every site on your list appears in your counts, including temporary locations.

- You can reproduce any number in under ten minutes using saved files and a short log.

- You have a dated note in your archive with the IRS revision, posted date, and the OMB control number you relied on.

FAQs about Form 13206

What is the latest revision and where do I find it?

As of October 29, 2025, the IRS lists Form 13206 as Rev. 10‑2025 with a posted date of September 23, 2025. You can find it on the IRS forms index or through the Site coordinator corner. Always download a fresh copy before you compile.

Is Form 13206 an annual submission?

Yes. OMB’s 2025 supporting statement for Control No. 1545‑2222 shows one response per respondent for Form 13206, which supports a season‑level, annual summary of program activity.

Does the form require personal information?

Follow the current PDF exactly. If the form only requests totals, do not include names or other personal details. Keep any personal data in your secure internal records and provide only what the current 13206 asks for. Use the IRS Site coordinator corner to confirm current practice if you are unsure.

What should I keep for my records?

Archive the final PDF, the CSV or spreadsheet that produced your totals, and a short log that notes the IRS revision month, the posted date, and the OMB control number. Save a link or PDF of the IRS listing and the OMB supporting statement you relied on in case someone asks later.

Where can I confirm the OMB control number?

The VITA/TCE information collection is under OMB Control No. 1545‑2222. The 2025 supporting statement is posted on OMB’s site and references Form 13206 among the instruments covered.

Quick resources

- IRS forms index entries for 13206, showing Rev. 10‑2025 and the 09‑23‑2025 posted date.

- Site coordinator corner, the IRS’s hub for VITA/TCE program materials and links.

- OMB 2025 supporting statement for Control No. 1545‑2222, confirming 13206’s role in the collection.

Final notes and a simple call to action

If you remember one thing, remember to verify currency before you compile. Pull the current 13206, confirm the revision, reconcile your weekly sources, and save a tidy archive with dates and initials. That little routine turns a nerve‑wracking task into a confident submission backed by evidence. If you want help building a simple, repeatable process for season‑end rollups inside your existing systems, our team at Accountably spends every day designing checklists, review steps, and naming rules that keep work on time and easy to audit. Use us as a resource if that removes stress for you and your volunteers.

You do the work that helps people file safely and on time. 13206 is how you make sure the scale of that effort is seen and respected.

Editorial and research note

This guide reflects the IRS and OMB sources available on October 29, 2025, including the IRS forms index and the OMB 2025 supporting statement for Control No. 1545‑2222. A human editor reviewed this piece for accuracy and clarity. Check the IRS links once more on the day you file in case a new revision posts.

Simplify Delivery, Improve Margins, Stay in Control.

Offshore support that works exactly like your in-house team.

💼 Let’s Talk