Scale Your CPA Firm Without Adding Headcount

Build your offshore team that works your way, trained, compliant, and white-labeled under your firm.

👉 Book a Discovery Call

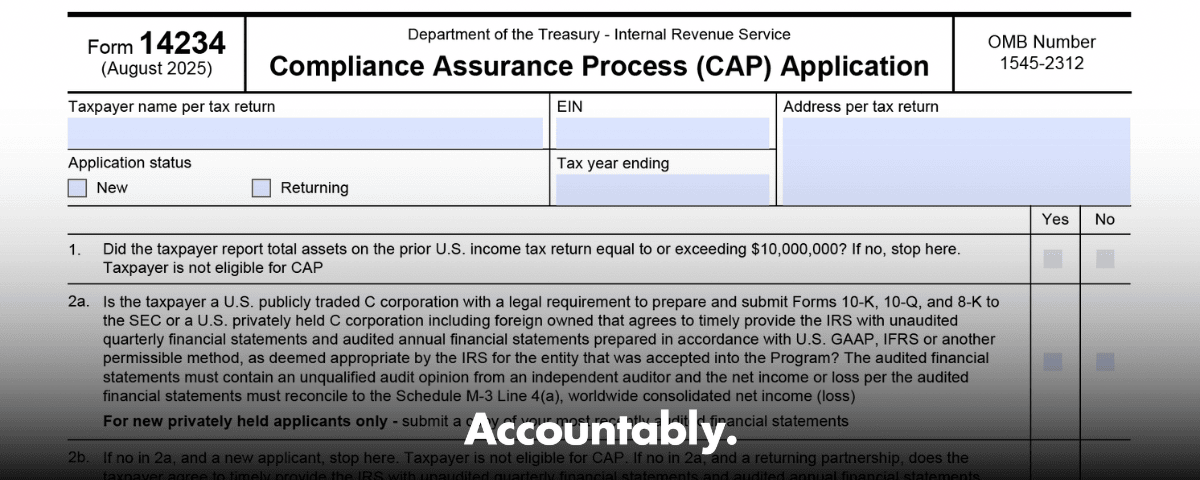

If you are preparing your package now, one detail can trip teams up. The window that runs from September 3 to October 31, 2025 applies to the 2026 CAP year, not 2025. You apply in 2025 for the 2026 cycle, and the IRS notifies applicants in February 2026. The current application set is Form 14234 plus Sub‑Forms A through E, and it comes with stricter timing around MITT and CBAQ, along with Bridge Plus requirements that include a draft return 30 days before filing.

Key Takeaways

- The September 3 to October 31, 2025 window is for the 2026 CAP year. Expect acceptance decisions in February 2026.

- Your application set includes Form 14234 plus Sub‑Forms 14234‑A, 14234‑B (MITT), 14234‑C, 14234‑D, and 14234‑E (CBAQ).

- New applicants email the CAP program mailbox using the subject line “CAP Application – Tax Year [YYYY].” Returning applicants send materials to their account coordinator or case manager.

- CBAQ timing differs for new and returning applicants. Accepted taxpayers also file an initial CBAQ within 90 days after the prior tax year end, interim CBAQs within 30 days of any material transaction, and a final CBAQ with the filed return.

- Bridge Plus is now permanent and requires a draft return 30 days before filing for consistency review.

These points are drawn from the IRS CAP application page, IRM 4.51.8, CBAQ and MITT guidance, and the CAP FAQs that explain Bridge Plus.

What CAP Is, Why Form 14234 Matters

CAP, the Compliance Assurance Process, is a cooperative program for large corporate taxpayers that resolves issues in real time so you file a cleaner return and shorten the audit cycle. Form 14234 is your entry point, and Sub‑Forms A–E round out the risk and process information the IRS needs to evaluate you. Accepted taxpayers sign an annual MOU, then work issues with the team in pre‑filing and post‑filing.

Hundreds of Firms Have Already Used This Framework.

Join the growing list of CPA and accounting firms using Accountably’s Offshore Playbook to scale faster.

💬 Get Your FREE Playbook

👉 Visit Jugal Thacker’s LinkedIn

Send him a connection request and message “Playbook” to get your copy.

If you remember one thing, remember this, CAP is a timing program. Clean, on‑time submissions keep you eligible. Slips on CBAQ or MITT can put your participation at risk.

Avoid the Year Mix‑up, The 2025 Window Is For 2026

Here is the piece that causes unnecessary stress. The IRS opened the 2026 CAP application period for September 3 through October 31, 2025, with decisions targeted for February 2026. That means if you are compiling your package in October 2025, you are applying for the 2026 CAP year. Do not label your subject line or internal calendars as “CAP 2025” for this window. Use “CAP Application – Tax Year 2026.”

Who Should Be Reading This

If you lead tax for a U.S. public or privately held C‑corporation with assets of 10M or more, or you advise one, this is for you. The IRS expanded eligibility to include privately held domestic and foreign C‑corporations and continued open‑year rules with specific exceptions for IRA and CHIPS items. This change matters if you previously sat on the sidelines because your company was private.

Improve Margins Without Compromising Quality

Offshore staffing helps firms deliver more, scale faster, and stay compliant, without adding local headcount.

👉 Book a Discovery CallHow This Guide Helps You

You will get a step‑by‑step look at eligibility, the full 14234 dossier, submission routing for new versus returning applicants, selection and notification, and the ongoing duties that come after acceptance. I will also give you a simple operating rhythm that reduces scramble, a checklist you can drop into your project plan, and practical tips from the trenches, like how to standardize filenames so your AC can review without friction. All of it is designed for fast reading and immediate use by you and your team.

My promise to you, no fluff, just what to send, when to send it, and how to keep your place in the program.

Why Operational Discipline Decides CAP Outcomes

In CAP work, quality comes from repeatable process. You win with simple SOPs, tidy workpapers, and version control that protect reviewers from hunting for information. You also win when your internal review team is not buried in production, which is where many tax teams stall in October. If you need outside help, choose partners who operate inside your systems and templates, follow your MOU‑driven cadence, and respect your security standards, rather than just handing you resumes. That mix of capacity and control keeps you on time with CAP forms, MITT updates, and CBAQ filings.

Accountably fits here when you want disciplined offshore execution that follows your playbook, not ours. We integrate trained teams into your workflow, help you standardize files and checklists, and protect review time so you can focus on issues that truly require judgment. Use us sparingly where it helps, for example, preparing MITT tie‑outs or packaging the draft return for a Bridge Plus check, and keep decision rights with your in‑house leads.

Eligibility, Timeline, and What Changed for 2026

You apply between September 3 and October 31, 2025 for the 2026 CAP year. The IRS aims to notify applicants in February 2026. To be eligible, you must have assets of 10M or more, be a U.S. publicly traded C‑corp or a U.S. privately held C‑corp, including foreign owned, and you cannot be under investigation or in litigation that limits IRS access to current records. Private companies must supply audited financials with an unqualified opinion, and reconcile book income to Schedule M‑3 Line 4(a).

Two big updates matter this cycle. First, eligibility now explicitly includes privately held C‑corps, subject to the same asset and suitability criteria. Second, the IRS made Bridge Plus permanent, a lighter touch path for lower‑risk taxpayers that still requires a draft return 30 days before filing for consistency review.

The headline is simple, plan for the 2025 window, label your subject line “CAP Application, Tax Year 2026,” and expect a decision in February 2026.

Your CAP Application Set, Form 14234 Plus Sub‑Forms A–E

Your application is a single, disciplined package built around Form 14234. The IRS lists five companion sub‑forms you include or update as required. Keep filenames clear, include dates in YYYY‑MM‑DD format, and use a cover checklist so your account coordinator, or the CAP mailbox, can validate completeness in minutes.

What Each Form Does

| Form | Title | What it tells the IRS | Who submits |

| 14234 | CAP Application | Core company profile, contacts, representations | All applicants |

| 14234‑A | Research Credit Questionnaire (CRCQ) | R&D credit overview and posture | As applicable |

| 14234‑B | Material Intercompany Transactions Template (MITT) | Transfer pricing transactions, IP, financing | New applicants, plus accepted taxpayers per schedule |

| 14234‑C | Taxpayer Initial Issues List (TIIL) | Potential material issues to track | All applicants |

| 14234‑D | Tax Control Framework Questionnaire (TCFQ) | Controls for tax reporting and governance | All applicants |

| 14234‑E | Cross‑Border Activities Questionnaire (CBAQ) | Cross‑border structure and activity | New applicants with the application, accepted taxpayers per schedule |

CBAQ Timing, New vs. Accepted Taxpayers

- New applicants, include Form 14234‑E with your application, and base it on the last filed return, not projections for the CAP year. The IRS calls this the Application CBAQ.

- Accepted taxpayers, submit an initial CBAQ within 90 days after the prior tax year end, an interim CBAQ within 30 days of any material cross‑border transaction, and a final CBAQ with the filed return. Late or inaccurate CBAQs can put your CAP participation at risk.

MITT Timing, New vs. Accepted Taxpayers

- New applicants, submit an Application MITT with your package, based on the last filed return. Include transfer pricing studies for IP or financing and your current global tax org chart.

- Accepted taxpayers, file the initial prior year MITT within 90 days after the prior tax year end, an interim MITT within 30 days of any new material transaction or material change, and the final prior year MITT when you file the prior year return. Late or incomplete MITTs also put participation at risk.

Quick gut check, calendar‑year company applying in October 2025 for CAP 2026, your Application CBAQ and Application MITT use the last filed return data, while your initial CBAQ and initial prior year MITT for active CAP years follow the 90‑day rule.

Submission Routing, New vs. Returning Applicants

The routing is clean, which is why using the right subject line matters.

- New applicants, email the full application to the CAP program mailbox with the subject “CAP Application, Tax Year 2026.” Follow any IRS page notes about sending CBAQ or MITT on separate paths, then attach both to your master package for your records.

- Returning applicants, send the package to your assigned account coordinator or case manager, not the general mailbox.

Pro move, validate every PDF before you send it. Open, check legibility, verify the naming, then run a quick MOU obligations scan to ensure your filings match what the team expects to see at this point in the year. That small habit avoids the back‑and‑forth that eats your October.

Submit a complete application between September 3 and October 31, 2025, use correct routing, and expect acceptance decisions in February 2026.

Selection, Approval, and How Decisions Are Made

Once you submit, the IRS screens for eligibility and suitability, then forwards qualifying applications to the LB&I compliance practice area director for evaluation. You receive written notice from your territory manager. Approval letters confirm acceptance and your program phase, and non‑acceptance letters explain why you were declined. The IRS can decline applicants in its discretion for sound tax administration.

If approved, you will receive the CAP MOU, which you must sign and return to your account coordinator by the date requested. You sign a new MOU each CAP year. Failure to comply with the MOU can result in removal from CAP.

How To Make Review Easy For Your AC

- Use a single folder per form, place support right next to the form, and mirror the IRS form labels in your filenames.

- Keep a one‑page issues map that links the TIIL to the workpapers and policies that back each position.

- Record who prepared and who reviewed each item, with date stamps, so the IRS can follow your trail without asking you to explain it live.

I have watched teams cut review time in half just by cleaning filenames and adding a short issues map. Your team will feel calmer, and your AC will see you are serious about controls.

Build a Clean, Repeatable Filing Rhythm

CAP is won in the small details you repeat every year. Here is a simple rhythm you can adopt.

- Kickoff, set owners and dates

- Confirm your application window plan, your subject line, and routing. Load key dates, including CBAQ and MITT timelines.

- Decide who owns each form, and set a two‑step review, preparer then reviewer, for every file.

- Assemble the package

- Draft Form 14234 and Sub‑Forms A–E with the latest support, then run a quality pass focused on dates, signatures, and naming.

- Early reviewer check

- Have someone who did not prepare the file review for legibility and completeness. Think of this as your internal AC.

- Finalize and submit

- Send the package, confirm receipt, and log the exact timestamp and mailbox or coordinator.

- Prepare for selection

- Organize your MOU signing plan, and pre‑stage your CBAQ and MITT calendars so you are ready the minute you are accepted.

Where Accountably helps, if needed, is in the unglamorous work, preparing standardized workpapers, keeping your naming and version control consistent, and packaging the draft return for Bridge Plus checks. You stay in charge of positions and strategy. We keep the production side smooth so your reviewers can stay in review.

Post‑Acceptance, What You Owe Under The MOU

Once accepted, sign and return the CAP Memorandum of Understanding by the date on the letter. The MOU sets the cooperation, transparency, and timeline rules that keep CAP running smoothly. If you miss deadlines, withhold required information, or drift from agreed procedures, you risk removal from CAP. Keep auditable records so the IRS can trace your work without friction.

Bridge Plus, What Changes In Practice

Bridge Plus is for taxpayers with fewer material issues who have shown a strong compliance track record. You still sign the MOU, and you still have to produce a clear documentation package soon after your audited financial statements are final. The IRS risk team reviews that package, then, you must submit a draft return 30 days before filing. If the draft ties to your documentation, you file. If the filed return matches, you receive the appropriate acceptance letter.

What this means for you, have your book‑to‑tax reconciliation, credit utilization, and supporting schedules buttoned up early, and plan your draft return review at least a month before your filing date. Your goal is consistency across the package, then the draft, then the final.

A Practical Operating Calendar, Calendar‑Year Company

Use this as a starting point and adapt to your facts.

- January to March 2026, prepare and submit your initial CBAQ and initial prior year MITT within 90 days after the 2025 year end, calendar‑year example due by March 31, 2026. Note estimates where needed.

- Throughout 2026, if you complete any material cross‑border transaction or a material change to an intercompany transaction, file an interim CBAQ or interim MITT within 30 days of that event. Keep a running log so you do not miss the 30‑day clock.

- Filing day for the 2025 return in 2026, submit the final CBAQ and the final prior year MITT on the day you file the return.

- Bridge Plus only, submit a draft return 30 days before filing for a consistency check. Build that date into your critical path.

Think of these as four beats you repeat every year, initial, interim, draft return if in Bridge Plus, final. If you teach your team that cadence, CAP feels predictable.

Documentation, Security, and Retention

Treat your CAP workpapers like audit workpapers. Keep originals, timestamps, reviewer notes, and correspondence together. The IRS general guidance says you keep records as long as they may be needed for tax administration, which often means through the statute of limitations that applies to your return, with at least four years for employment tax records. For many corporations, planning for at least three to seven years for key items is common, based on the situation. Align your policy with your legal team, your auditors, and any industry requirements.

For privacy and security, limit access by role, keep audit logs, and avoid local file storage. If you work with outside support, make sure the work is performed inside your systems, follow your templates, and respect your confidentiality rules.

FAQs, Straight Answers

What events trigger an “interim CBAQ” within 30 days?

File an interim CBAQ within 30 days when you complete a material cross‑border transaction or when information marked “to be determined” on your initial CBAQ becomes known. Common triggers include acquisitions, divestitures, new IP arrangements, financing changes, and significant new contracts across borders. Keep it focused on the updates, do not re‑send the entire file.

How does Form 14234 interact with APA or MAP?

Form 14234 and its sub‑forms do not replace APA or MAP. Instead, keep your positions consistent across processes, align timelines, and disclose assumptions. If your CAP issues touch APA or MAP items, your AC will expect cross‑references and timely updates so the IRS team can see a single, coherent story. The IRM emphasizes a coordinated team approach, with your AC as the primary point of contact, so keep your contacts list and powers of attorney current.

Are there penalties for late or incomplete CBAQ or MITT?

The IRS states that late, inaccurate, or incomplete CBAQ or MITT submissions place your CAP participation at risk. The practical risk is removal, lost certainty, and extra work. If a delay is unavoidable, request an extension from your case and issue territory manager in advance, and document why.

How long should we retain records supporting CBAQ and MITT?

Keep records for as long as they are needed to support items on your return. The IRS highlights the period of limitations concept, which is often at least three years for income tax returns, and at least four years for employment tax records. Many companies choose longer retention for transfer pricing and cross‑border files. Align with your counsel, external auditors, and your CAP MOU obligations.

Can a third‑party advisor submit Form 14234 on our behalf?

Yes, as long as you properly authorize them. Provide an up‑to‑date Form 2848, Power of Attorney and Declaration of Representative, and list designated contacts. The IRM notes that your AC will expect a clear contacts list and authorities as part of case setup.

We are a private C‑corp. What extra financials are required?

Private C‑corps must provide audited annual financial statements with an unqualified opinion, plus unaudited quarterly financials. The audited net income or loss must reconcile to Schedule M‑3 Line 4(a). Have your auditors’ timeline locked early so your CAP package timing does not drift.

Put It All Together

Here is the short version you can take to your next team stand‑up.

- Confirm you are applying in the Sept 3 to Oct 31, 2025 window for the 2026 CAP year, and set the email subject to “CAP Application, Tax Year 2026.”

- Assemble Form 14234 plus Sub‑Forms A through E, check filenames, signatures, and support.

- New applicants, include Application CBAQ and Application MITT based on your last filed return.

- Returning applicants, route to your account coordinator, not the general mailbox.

- After acceptance, sign the MOU promptly, then run the initial, interim, and final CBAQ and MITT cadence on time.

- Bridge Plus, plan the draft return 30 days before filing and check for consistency.

If your in‑house team is buried in production, bring in help for packaging and review protection, not for decisions. Accountably can slot disciplined offshore staff into your workflow, inside your systems, so you keep control while your reviewers get time back.

Final Word

You do not need theatrics to succeed in CAP. You need a reliable calendar, clean files, and a team that knows their beats, initial, interim, draft if required, final. Mark your window, Sept 3 to Oct 31, 2025, label the subject line correctly, and keep your MOU cadence tight. If you do that, February 2026 becomes a formality, not a fire drill.

If you want a one‑page checklist you can paste into your project plan, tell me your filing calendar, and I will tailor it to your quarter closes and team size.

Simplify Delivery, Improve Margins, Stay in Control.

Offshore support that works exactly like your in-house team.

💼 Let’s Talk