Scale Your CPA Firm Without Adding Headcount

Build your offshore team that works your way, trained, compliant, and white-labeled under your firm.

👉 Book a Discovery Call

The MITT is not paperwork, it is your fast path to early issue identification and return certainty inside CAP.

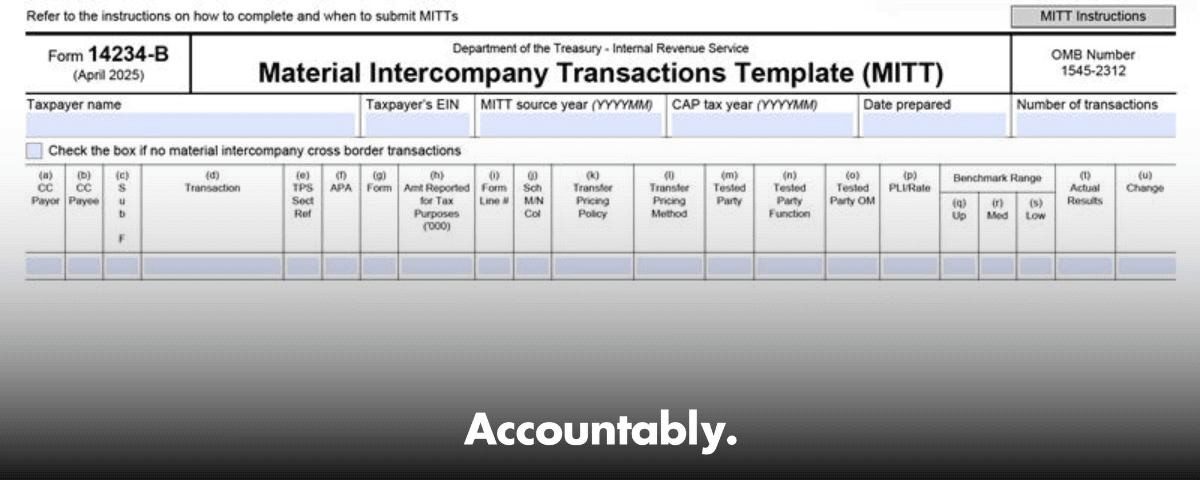

At a glance, Form 14234‑B is the Material Intercompany Transactions Template the IRS uses to review your related‑party transactions in real time during CAP. You complete it at the transaction level, then the IRS team uses it to risk assess, prioritize, and resolve issues so your return can be accepted faster. The current MITT is a fillable PDF, updated in April 2025.

Key Takeaways

- Form 14234‑B is the IRS Material Intercompany Transactions Template used in the Compliance Assurance Process to disclose related‑party transactions at the line‑item level.

- For the 2026 CAP year, the application window runs from September 3 to October 31, 2025. New applicants email the CAP application to the program mailbox with “CAP Application” and the tax year in the subject. Returning applicants submit through their account coordinator or case manager.

- MITT submissions follow different paths for new versus accepted taxpayers, and there are application, initial prior year, interim, and final prior year versions with specific timing.

- Treat the MITT like an auditable register, complete every required field, and tie each line to documentation that supports the pricing method used.

What Form 14234‑B (MITT) Is, And Why It Matters

Form 14234‑B is the standardized way CAP reviewers see your intercompany world. You list each material related‑party transaction in its own row, supply party identifiers, a clear description, tax‑relevant amounts, and the transfer pricing policy you applied. The IRS uses this structure to risk assess quickly, ask sharper questions, and move toward acceptance within the CAP year.

Hundreds of Firms Have Already Used This Framework.

Join the growing list of CPA and accounting firms using Accountably’s Offshore Playbook to scale faster.

💬 Get Your FREE Playbook

👉 Visit Jugal Thacker’s LinkedIn

Send him a connection request and message “Playbook” to get your copy.

A few things to keep in mind about the current cycle:

- The 2026 CAP application window is September 3 through October 31, 2025. Getting your MITT workflow ready before that window saves painful scrambles later.

- The latest posted PDF of Form 14234‑B shows an April 2025 revision. Always download the current form from IRS.gov so your fields and codes match what reviewers expect.

Who Should Use the MITT Inside CAP

If you are a large corporate taxpayer in CAP with material intercompany transactions in the CAP year, you will complete the MITT. The IRS Large Business and International division relies on the MITT for fast, consistent disclosure, and it is part of the core application set for CAP along with the CRCQ, TIIL, TCFQ, and CBAQ.

New Applicants vs. Accepted Taxpayers

- New applicants submit an “application MITT.” This version is based on the last filed return and must include transfer pricing studies for IP and financing plus a current global tax org chart. The IRS uses it to help determine suitability.

- Accepted taxpayers submit three flavors over the cycle: an initial prior year MITT within 90 days after the prior tax year end, interim MITTs within 30 days of new or materially changed transactions, and a final prior year MITT when the prior year return is filed.

CAP 2026 Application Window, Submission Paths, And What To Send

Here is the big picture for timing and routing:

Improve Margins Without Compromising Quality

Offshore staffing helps firms deliver more, scale faster, and stay compliant, without adding local headcount.

👉 Book a Discovery Call- Window: September 3 to October 31, 2025 for the 2026 CAP year.

- How to apply:

- Returning applicants, send the application package to your account coordinator or case manager.

- New applicants, email the package to the CAP program mailbox, subject line “CAP Application” plus the tax year. The Internal Revenue Manual also lists [email protected] for new applications.

- What to include: the Form 14234 series, that is 14234, 14234‑A, 14234‑B (MITT), 14234‑C, 14234‑D, and 14234‑E. Acceptance triggers a written notice and a Memorandum of Understanding you must sign by the requested date.

The Four MITT Variants At A Glance

- Application MITT, for first‑time applicants, based on the last filed year with required attachments.

- Initial prior year MITT, due within 90 days after the prior tax year end, used for initial transfer pricing risk assessment.

- Interim MITT, due within 30 days after a new material transaction or a material change to one previously reported.

- Final prior year MITT, due when the prior year return is filed, used for post‑filing review.

In short, the CAP team wants a current, traceable ledger of what happened between related parties, how you priced it, and where it lands on the return. If you build the MITT once with clean structure, updating it becomes straightforward and review time drops.

The Full CAP Package, What Goes With Your MITT

Your application is more than a single PDF. To keep your file moving, assemble the complete CAP set in one shot:

- Form 14234, CAP Application

- Form 14234‑A, Research Credit Questionnaire (CRCQ)

- Form 14234‑B, Material Intercompany Transactions Template (MITT)

- Form 14234‑C, Taxpayer Initial Issues List (TIIL)

- Form 14234‑D, Tax Control Framework Questionnaire (TCFQ)

- Form 14234‑E, Cross Border Activities Questionnaire (CBAQ)

If anything is missing or late, the IRS can defer or decline your application. When in doubt, over‑communicate with your account coordinator about timing and file formats.

Quick Reference, CAP Forms

| Form | Title | Purpose in CAP |

| 14234 | CAP Application | Core application document |

| 14234‑A | CRCQ | Screens research credit risk |

| 14234‑B | MITT | Transaction‑level related‑party disclosure |

| 14234‑C | TIIL | Lists initial issues for review |

| 14234‑D | TCFQ | Describes your tax control framework |

| 14234‑E | CBAQ | Surfaces cross‑border topics early |

What To Gather Before You Fill Form 14234‑B

Think of the MITT as a ledger that ties directly to pricing files and the return. You will need, for each material transaction:

- Entity identifiers, legal names, roles, and EINs where applicable.

- A crisp, specific description of the transaction that a reviewer can understand without internal jargon.

- Monetary amounts relevant for tax, not book figures, plus adjustments.

- Transfer pricing policy and method used, and the tested party.

- Agreement references, pricing schedules, and, if applicable, APA or MAP identifiers.

- Jurisdictions, function profiles, and ownership relationships that explain who does what.

- Return line or schedule tie‑outs.

- A pointer to where documentation lives.

Pro tip, many CAP materials expect dates in compact formats. Use the exact format shown on the current PDF for the CAP tax year and transaction dates, then keep it consistent across the file. When fiscal calendars do not align, add a short note explaining your mapping so reviewers do not have to guess.

The MITT, How To Fill It Cleanly

Here is a practical way to work across columns A through U without getting stuck:

- Identifiers and parties Assign a unique transaction ID, capture the transaction date, and state the payor and payee with legal names and EINs. If a party has no EIN, mark N/A and provide an available local tax ID or registered address, then add country and tax jurisdiction for clarity.

- Economics and characterization Describe the transaction type and the economics behind it, reference the contract or intercompany agreement, and state how you treat it for accounting and tax purposes.

- Amounts and currency Enter the gross amount, currency, and the tax basis or gain or loss as needed. Report tax numbers you can reconcile later, not management P&L figures.

- Policy, method, and benchmarking State the transfer pricing method used, identify the tested party, and summarize the rationale. If you relied on a benchmark, cite it. The IRS uses this to understand risk quickly.

- Terms, adjustments, and documentation Include payment terms or elections, any tax adjustments or uncertain tax positions, and a pointer to the workpapers, APA, or study page numbers that support your position. That last piece saves your team and the IRS hours in review.

Why Aggregation Usually Backfires

It is tempting to bundle similar transactions to shorten the file. Resist that unless your transfer pricing documentation aggregates them with the same method. The IRS prefers individual listing, and the MITT FAQ is explicit on this point.

Operating Margin And Other PLIs

Even if you used a different profit level indicator in your analysis, the IRS still asks for the tested party operating margin. Include it, and then list the PLI you used in your study so reviewers can compare.

Source Year vs. CAP Tax Year, Getting Timing Right

Two dates tend to trip teams up, when the economic activity occurred versus when it flows into the CAP‑reviewed return. Keep both clear:

- Source Year, the period when the transaction occurred in your books.

- CAP Tax Year, the year the item is reviewed in CAP and lands on the return.

Use the current form’s date formats. When a service or license spans periods, pick the approach your policy and accounting support, then explain your allocation in a brief note so the reviewer can follow the money trail without extra emails. The goal is simple, the IRS should be able to reconcile from MITT line to return line in one pass.

When Calendars Do Not Match

If you run a 52–53 week or non‑calendar year, keep each MITT row anchored to the economic period in your ledger, then tie it to the CAP‑reviewed return year. If you need pro‑rata splits or keys, write them down in plain language. Reviewers want to see the logic, not guess it.

Submission Methods, New vs. Accepted

- New applicants Complete the full CAP application set during the window and email it to the CAP program mailbox with “CAP Application” plus the tax year in the subject. Your application MITT must be based on the last filed return and include transfer pricing studies for IP and financing and a current global tax org chart.

- Accepted taxpayers Follow the MOU and your coordinator’s instructions. File the initial prior year MITT within 90 days after the prior year end, file interim MITTs within 30 days of new or materially changed transactions, and file the final prior year MITT when you file the prior year return. Late or incomplete submissions can jeopardize participation.

MITT Timing, Quick Table

| MITT type | When it is due | What it is used for |

| Application MITT | With the CAP application | Suitability review for first‑time applicants |

| Initial prior year MITT | Within 90 days after prior year end | Initial TP risk assessment for the CAP year |

| Interim MITT | Within 30 days of a new or materially changed transaction | Updates the risk assessment during the cycle |

| Final prior year MITT | When the prior year return is filed | Post‑filing review of the prior year return |

Post‑Acceptance Responsibilities And The MOU

Once accepted, sign and return your MOU by the IRS requested date. Then work inside those protocols, keep disclosures complete and current, and elevate issues early. The IRS can remove a taxpayer that does not cooperate or keep submissions accurate and timely. Staying proactive is the easiest way to keep the cycle smooth.

What “Good” Looks Like In Practice

- Consistent, complete MITT rows that tie to agreements and studies.

- A quick‑open folder with page‑numbered support for each transaction.

- Clear ownership and deadlines for initial, interim, and final MITTs.

- Early heads‑up to your coordinator when a new material item emerges.

Where Accountably Helps, Only When It Matters

If your tax team is drowning in production work, you still need the MITT to be spotless. This is where disciplined offshore delivery can help you standardize workpapers, keep naming and version control tight, and move items through a multi‑layer review without burning partner time. Accountably integrates trained offshore teams into your systems and templates so you keep control, and your reviewers see consistent files every time.

Common Pitfalls And How To Avoid Them

- Incomplete rows Every required field must be filled for each material transaction. If a party lacks an EIN, write N/A and provide the local identifier you do have, plus country and jurisdiction.

- Using book numbers Report tax amounts you can reconcile to the return or to the tax workpapers, not management P&L figures.

- Vague descriptions “Service fee” is not enough. Say what the service covered, the period, and the basis for the charge.

- Aggregating transactions without support Only aggregate when your transfer pricing documentation aggregates those items under the same method. Otherwise, list transactions individually.

- Missing operating margins or PLI signals Include the tested party operating margin and the PLI used in your analysis so reviewers can line up the story.

Records, Retention, And Versioning

Keep the completed MITT and the full source set that supports each row, including agreements, pricing studies, benchmarking, memos, and page‑numbered references. Save versions with prepared‑by and date stamps, plus a simple index. When the IRS asks a question, being able to open the exact page in seconds changes the tone of the entire review. The MITT FAQ even highlights the value of page numbers for saving exam time.

FAQs

Do I need to file the MITT if I have no material intercompany transactions?

If you have none for the CAP year, indicate that on the form, include preparer details, and submit a short explanation. Keep the evidence that led you to “none,” for example controls, policies, and reconciliations, in case the IRS asks during the cycle.

Can I submit the CAP application anytime before year end?

No. For CAP 2026, the IRS window is September 3 to October 31, 2025. Applications outside that window are not considered. Plan your internal MITT readiness several weeks earlier so you are not chasing signatures on the last day.

Where do new applicants send the CAP application?

Email the application to the CAP program mailbox with the subject “CAP Application” plus the tax year. The IRS also lists the mailbox address in the Internal Revenue Manual for new applications. Returning applicants send materials directly to their account coordinator or case manager.

What happens if my MITT is late or incomplete after I am accepted?

The IRS treats late or incomplete MITTs as significant failures to follow the MOU. That can put your participation at risk, so communicate early if you need an extension and keep quality controls tight.

Can I use estimates on the initial prior year MITT?

Yes, if timing requires it. Note the use of estimates on the form, and update with final numbers on the final prior year MITT when the return is filed.

Final Checklist Before You Submit

- Download the current April 2025 MITT PDF from IRS.gov and confirm fields match your data model.

- Confirm you are filing in the correct path, application MITT for new applicants, initial, interim, or final MITT for accepted taxpayers.

- Validate IDs, names, EINs or local IDs, jurisdictions, and tested party selection.

- Tie every MITT line to a document and a return line, and record the page number where support lives.

- Bundle the full CAP set, Forms 14234, 14234‑A, 14234‑B, 14234‑C, 14234‑D, and 14234‑E, then route through the right channel during the September 3 to October 31, 2025 window.

Close

You do not need a bigger team to get Form 14234‑B right, you need a tighter system. Build a clean MITT once, keep it current, and you will shorten review loops and earn earlier certainty. If you want help standardizing the workpapers and review layers behind the MITT, our team at Accountably can plug in to your systems, keep your structure clean, and protect partner time. Either way, your next step is simple, line up your data, check the current IRS forms and dates above, and start your MITT with confidence.

Simplify Delivery, Improve Margins, Stay in Control.

Offshore support that works exactly like your in-house team.

💼 Let’s Talk