Scale Your CPA Firm Without Adding Headcount

Build your offshore team that works your way, trained, compliant, and white-labeled under your firm.

👉 Book a Discovery Call

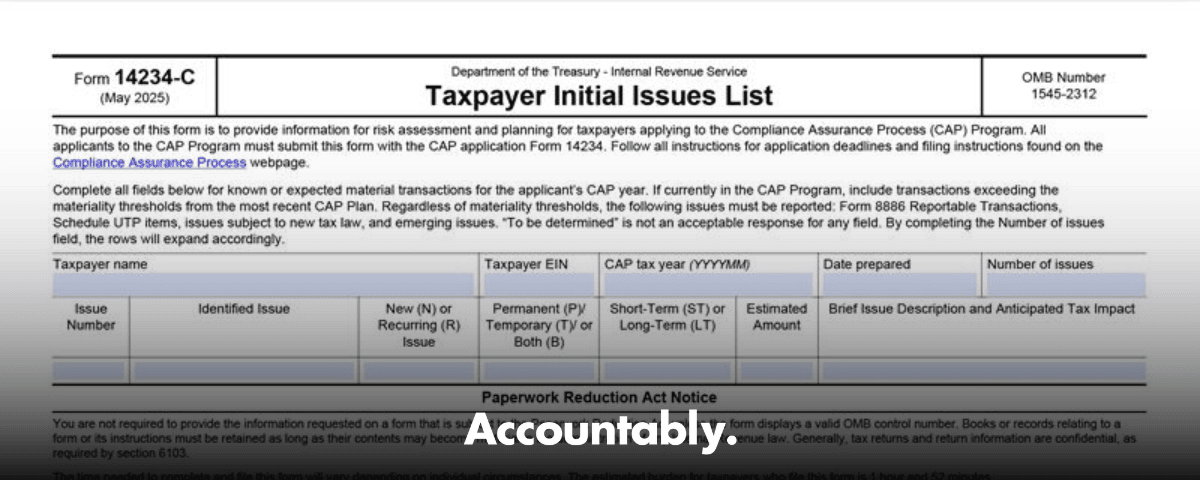

Form 14234-C, the Taxpayer Initial Issues List, is the one place you capture every material issue from completed transactions you want the IRS CAP team to review in real time. When this list is clear, complete, and documented, your CAP year moves faster, your reviews are smoother, and your team spends less time chasing files and more time resolving issues before filing.

Key Takeaways

- Form 14234-C, TIIL, is the real-time inventory of material tax issues and completed transactions you want reviewed under CAP. It is part of the required Form 14234 application package.

- The current application period running from September 3 to October 31, 2025 applies to the 2026 CAP year. New applicants email their package to the CAP mailbox, returning applicants submit through their account coordinator or case manager.

- Align TIIL entries with the MITT, Form 14234-B, for intercompany transactions and with the CBAQ, Form 14234-E, for cross-border items. Keep CBAQ timing in mind, initial within 90 days after the prior year end, interim within 30 days of a material change, and final at return filing.

- Use audit‑ready support for each line item, contracts, workpapers, calculations, financial statement tie‑outs, and keep versions current through CAP milestones.

- Bridge Plus is permanent starting with the 2025 CAP year, so plan TIIL scope and evidence with that streamlined phase in mind.

When your TIIL is complete, specific, and linked to evidence, you control the CAP timeline instead of the timeline controlling you.

What Form 14234-C Is, and Why It Matters

Think of Form 14234-C as your single source of truth for the CAP year. You use it to list every material issue tied to completed business transactions, then you state the facts, affected tax years, counterparties, dollar amounts, positions, methods, and the exact files that back it up. You also flag anything with cross-border implications and match those items to the MITT and CBAQ forms so the IRS team can assess risk and plan reviews early.

Hundreds of Firms Have Already Used This Framework.

Join the growing list of CPA and accounting firms using Accountably’s Offshore Playbook to scale faster.

💬 Get Your FREE Playbook

👉 Visit Jugal Thacker’s LinkedIn

Send him a connection request and message “Playbook” to get your copy.

The payoff is real. A clear TIIL helps the CAP team scope efficiently, prioritize meetings, and resolve issues before filing. Incomplete or vague entries do the opposite, they stall triage, trigger follow‑ups, and can jeopardize your standing under the CAP Memorandum of Understanding, MOU.

Who Files TIIL and When

If you are applying to CAP, you include Form 14234-C with the Form 14234 package. The IRS lists TIIL alongside the other subforms, CRCQ, MITT, TCFQ, and CBAQ, as part of the annual application. For the cycle happening now, September 3 through October 31, 2025, the application is for the 2026 CAP year. The IRS has stated it will notify applicants of acceptance in February 2026.

- New applicants email the application to the CAP mailbox using the subject line “CAP Application” plus the tax year.

- Returning applicants submit through their assigned account coordinator or case manager.

Eligibility continues to include U.S. publicly traded corporations and, as expanded, domestic or foreign privately held C‑corporations with assets of 10 million dollars or more, subject to suitability criteria.

Improve Margins Without Compromising Quality

Offshore staffing helps firms deliver more, scale faster, and stay compliant, without adding local headcount.

👉 Book a Discovery CallQuick Submission Timeline, 2025 to 2026

- Sep 3 to Oct 31, 2025, submit CAP application with TIIL.

- February 2026, IRS informs applicants of acceptance.

- Throughout CAP year, keep TIIL current and aligned with CBAQ updates within 30 days of material cross‑border changes, and finalize CBAQ at return filing.

Note, always confirm the IRS dates on the official pages for your filing year, since the agency announces the period annually.

What To Include In Your TIIL

Each TIIL entry should read like a tight, decision‑ready brief. Aim for enough detail that a reviewer who has never seen the transaction can understand the facts, the tax position, the size of the issue, and where to find the proof.

- Description of the completed transaction or issue, with dates and jurisdictions

- Counterparties and related parties

- Affected tax year or years, and the dollar impact or range

- Code sections, treaties, and authorities relied on

- Proposed treatment and method, transfer pricing method if applicable

- Exact supporting files, filenames and dates, and how they tie to the financials

- Cross‑references to MITT and CBAQ entries, if relevant

The Five Essentials At A Glance

| Element | What to include | Why it matters |

| Description | Transaction, period, code section or treaty article | Enables precise triage |

| Exposure | Amount or range, include tax, penalties, interest if known | Drives prioritization |

| Support | Contracts, workpapers, financial tie‑outs, with filenames and dates | Cuts follow‑ups |

| Position | Conclusion and basis, method, and assumptions | Clarifies the path to agreement |

| Status | Open or agreed, next milestone and owner | Anchors the CAP plan |

A crisp TIIL is not just helpful, it is required to get the most from real‑time review. Keep it current across the CAP milestones, and update promptly if facts or amounts change.

Aligning TIIL With MITT, Form 14234-B, and CBAQ, Form 14234-E

Your TIIL does not live alone. Intercompany items sit on the MITT, Form 14234‑B, and cross‑border activity sits on the CBAQ, Form 14234‑E. Make sure every related-party transaction that is material appears as a discrete TIIL issue, with a line that points to the corresponding MITT row. Do the same for international items and point to the matching CBAQ entries. This one‑to‑one mapping helps the CAP team connect facts, methods, and risk without guesswork.

CBAQ Timing You Cannot Miss

- Initial CBAQ, within 90 days after the prior tax year end, based on projections for the CAP year.

- Interim CBAQ, within 30 days of any material new cross‑border transaction or when previously unknown answers become available.

- Final CBAQ, at the time you file the return for the CAP year.

Missed or incomplete CBAQs are treated as significant failures under the MOU, so link your CBAQ calendar to your TIIL updates and deal calendar.

For new applicants, the Application CBAQ is based on the last filed return, not on plans for the current year. Keep that difference in mind when you draft your TIIL during the application phase.

Reporting Intercompany Transactions On TIIL

Report each material intercompany category with precision, services, royalties, loans, inventory flows, cost sharing, guarantee fees, cash pools, and any unique items. Identify the entities and jurisdictions, quantify amounts and years, state your pricing approach, and reference the exact agreements, studies, and invoices. Then link to the matching MITT and, if cross‑border, the CBAQ line. The goal is to make the review traceable from TIIL to MITT to source file without extra emails.

A Quick Example Entry

- Issue ID: INTL‑SVCS‑2025‑01

- Description: Shared services fee, HQ to EU subsidiary, calendar 2025

- Counterparties: US Parent, EU Sub

- Amount: 18.2 million, estimated range 17.5 to 19.5 million

- Method: TNMM, tested party EU Sub, 3.5 percent mark‑up on relevant base

- Authority: Treas. Reg. §1.482‑9, treaty article 7 for PE analysis

- Position: Deductible to payer, income to recipient, no PE created

- Support: Services agreement dated 1‑15‑2025, TP report 2025 draft 2, invoices Q1‑Q4, GL extracts, tie‑out to audited financials note 12

- Cross‑refs: MITT row 22, CBAQ section 3.2

- Status: Open, ready for initial CAP discussion in May

Treaty Positions and Competent Authority

If you expect to rely on a treaty, spell it out on the TIIL. Cite the treaty and article, list the facts that matter, the affected years, and quantify related amounts or withholding. If Competent Authority or MAP is possible, name the counterparty jurisdiction and expected timing so the CAP team can stage the review and coordinate. Keep prior MAP cases or APAs in view, include identifiers when available. This prevents late surprises and sets expectations on sequencing and evidence.

Documentation Standards, Audit‑Ready Support, and Version Control

Treat every TIIL line as audit‑ready from day one. That means executed agreements, board approvals if applicable, working calculations with assumptions, financial statement tie‑outs to the return schedules, and clear mapping to the exact entries in your ERP or consolidation system. If you work from audited GAAP or IFRS financials, include the mapping to the return and note any book‑to‑tax differences. The IRS pages emphasize using the CAP package forms and the MOU as your guideposts, so keep your evidence synchronized with those milestones.

Recommended practice

- Store electronic copies with consistent names and dates, avoid one‑off labels

- Keep a short abstract at the top of each issue folder, what changed, what to review next

- Record owners, reviewers, and due dates in a simple index that matches your TIIL IDs

- Note any privacy redactions, and why they were applied, in a log the CAP team can see if asked

When your files are this tight, reviews move quickly and your team avoids the ping‑pong of follow‑up questions.

Timing, Deadlines, and a Clean Filing Calendar

You have two clocks to watch. The first is the CAP application window. For the current cycle, the IRS is accepting applications for the 2026 CAP year from September 3 through October 31, 2025, with acceptance notices expected in February 2026. New applicants email the package to the CAP program mailbox, returning applicants route through their account coordinator or case manager.

The second clock is your ongoing maintenance. Once you are in CAP, you keep Form 14234-C current across the year. If facts change, you update promptly under the MOU and send the revision to your coordinator, or to the CAP mailbox if you are still in the application phase. The Internal Revenue Manual also confirms that the application period is announced annually, and that returning applicants submit through their assigned coordinator while new applicants email the program mailbox with the subject line “CAP Application” and the tax year.

Suggested TIIL Build Timeline

| Milestone | What you do | Why it helps |

| Pre‑window prep, July to August 2025 | Draft TIIL entries, line up support, map to MITT and CBAQ | Lets you file early in the window |

| Application window, Sep 3 to Oct 31, 2025 | Submit TIIL with the full Form 14234 package | Meets eligibility review timelines |

| Q4 to Q1 working period | Refresh entries after closings and audits, confirm tie‑outs | Keeps real‑time review on track |

| February 2026, acceptance notifications | Incorporate IRS feedback into issue plans | Speeds scoping once the year begins |

| CAP year in progress | Update TIIL after material changes within MOU timing | Avoids surprises in pre‑filing review |

Note, always validate the current year’s dates on the IRS CAP pages, the agency posts the official window and milestones each cycle.

Bridge Plus, What It Means For Your TIIL

Bridge Plus is now a permanent part of CAP. Even in this streamlined phase, you still report all material issues and completed transactions you expect to present during the CAP year. Your TIIL should tie directly to your book‑to‑tax reconciliation and the supporting documentation you will provide after audited financials, so the team can scope quickly inside a shorter window. The IRS describes CAP as a real‑time resolution process that depends on timely, transparent issue listings and evidence.

If a new material transaction pops up after submission, update the TIIL and provide interim disclosures that align with the CBAQ rules for cross‑border items. This alignment prevents timing gaps across teams and avoids rework later.

Common Pitfalls You Can Prevent

Even seasoned teams stumble on the same handful of issues. Here are the traps we see most often, and how to avoid them.

- Vague scope lines. Replace “restructuring” with the specific action, dates, entities, amounts, and code sections so triage is fast and accurate.

- Missing cross‑references. If the item lives on the MITT or the CBAQ, point to the exact row or section.

- No exposure estimate. A range still helps reviewers sort priorities and plan the calendar.

- Weak support. If a reviewer cannot trace the number to a contract, invoice, and the financials, the issue will stall.

- Stale entries. If the facts changed after submission, update the TIIL and note the delta. The MOU expects timeliness and cooperation.

A Quick Scope Checklist

- Did you list every material transaction that affects the return, including related‑party and cross‑border items

- Did each TIIL line include the affected tax years, statutes or treaty articles, dollar amounts or range, and a clear proposed treatment

- Did you link every related‑party item to the MITT and every cross‑border item to the CBAQ entry

- Did you attach or reference the exact support files with filenames and dates

- Did you assign an owner and a next milestone for each item

A precise TIIL shortens meetings, reduces follow‑ups, and protects your place in CAP by aligning with the MOU.

CBAQ Timing That Must Match Your TIIL

Cross‑border entries are time sensitive. Accepted taxpayers submit an initial CBAQ within 90 days after the prior tax year end, an interim within 30 days of a material new transaction or when a previously unknown answer becomes available, and a final CBAQ when you file the return. New applicants submit an Application CBAQ based on the last filed return, not on plans for the current year. Keep your TIIL in sync with these CBAQ stages to prevent review gaps.

Updating Form 14234‑C After Material Changes

Material change means new facts, new transactions, or new amounts that would alter a listed position or create a new issue. When that happens, update the TIIL pronto. Send the revision to your account coordinator if you are a returning participant, or to the CAP mailbox if you are a new applicant still in the application phase. Include a short change note that cites the original TIIL ID, the changed facts, and the revised exposure range. The IRM reinforces that adherence to the MOU is central to staying in CAP.

Practical tips

- Use versioned filenames, for example TIIL_v5_2025‑10‑29, so both sides know which list is current.

- Add a one‑page change log to the top of the TIIL that shows date, owner, and a two‑line summary of the update.

- Mirror any cross‑border changes in your CBAQ within 30 days and set a calendar reminder to submit.

Data Governance, Security, and Confidentiality

You are handling sensitive information. Keep access narrow, log who touches what, and store evidence so it can be retrieved fast during reviews.

Access Controls And Roles

- Assign a primary owner, reviewer, and approver for each TIIL line, with backups.

- Enforce least‑privilege access and review entitlements on a schedule.

- Record approvals with timestamps and rationale so changes are auditable.

- Tag entries that contain PII or privileged content and follow agreed handling rules.

These habits pay off during CAP discussions, especially when the IRS requests quick corroboration. The IRM highlights the role of the AC as your primary contact and the importance of defined points of contact, which is easier when you maintain clear internal ownership.

Confidential Data Handling

Treat TIIL content like governed records. Use secure transmission per CAP instructions, include only necessary PII, and document any redactions. Keep formats consistent across TIIL, MITT, and CBAQ so reviewers can match entries without extra explanations. The IRS notes that late or incomplete cross‑border submissions can put participation at risk, so align your confidentiality practices with your CBAQ timing.

Documentation Standards, What “Audit‑Ready” Looks Like

Each TIIL line should have a small, complete file set behind it.

- Executed contracts or board approvals that show the legal facts

- Workpapers with inputs, assumptions, and outputs that a reviewer can re‑perform

- Financial tie‑outs that point to audited statements and to the tax return schedules

- Prior exam history, APAs, or MAP outcomes, with IDs when you have them

- Cross‑references to the MITT row and CBAQ section where the same transaction appears

The IRS lists Form 14234‑C with the other required CAP application forms, which signals its central role in scoping and pre‑filing resolution. Keeping the support this tight helps the team resolve issues in real time.

Where Accountably Fits, Briefly

If your team is stretched thin, you can still meet these standards without sacrificing control. Accountably integrates trained offshore professionals into your workflow to standardize workpapers, maintain naming logic, and keep multi‑layer reviews moving, all inside your systems and templates. This is useful when you are assembling TIIL support across many entities and jurisdictions, since the heavy lift is organization, not judgment. Use this only if it helps your team focus on positions and strategy.

Short version, you keep the steering wheel, we help with the engine room so the file set stays complete and on time.

Coordination Across Tax, Legal, and Finance Teams

If your TIIL feels hard, it is usually a coordination problem. You can fix that with clear owners, an agreed naming system, and a simple way to track sign‑offs. Start by assigning a primary owner for each TIIL section, then lock standards for how you will title files, version workpapers, and reference the exact line on the return or the financials.

Legal reviews each entry for privilege and litigation risk. That includes checking redactions so you do not withhold facts the CAP team needs. Finance supplies the evidence that moves reviews quickly, audited financials, book to tax reconciliations, trial balances, and the journal entries that tie to the issue. When Tax, Legal, and Finance work from the same checklists and calendars, your meetings get shorter, and the decisions come sooner.

Role Map, Who Does What

| Function | Primary responsibilities | Outputs to attach or reference |

| Tax lead | Drafts TIIL, sets exposure ranges, cites authority, sets owners and due dates | TIIL line entries, issue briefs, exposure models |

| Tax preparer or analyst | Builds workpapers, collects contracts, prepares tie‑outs and calculations | Calculations, GL extracts, filename list with dates |

| Finance | Provides audited financials and reconciliations, confirms amounts | Financial statement excerpts, book to tax bridge, JE detail |

| Legal | Reviews privilege and redactions, confirms agreements are final and executed | Agreement copies, board approvals, redaction log |

| TP specialist | Prepares or updates TP studies and intercompany methods | TP reports, method selection memo, benchmarking files |

| Program coordinator | Tracks versions, submissions, and confirmations from IRS | Change log, submission receipts, meeting notes |

The best TIILs read the same way across teams, because the labels, file names, and IDs match in every folder.

Data Governance And Confidentiality, Day To Day

You want control and speed at the same time. You get both by keeping access tight, naming clean, and logging activity. Use role based access so only the people working the issue can see or edit it. Record approvals and rationale so you can show who decided what and when. Flag PII, privileged content, and highly sensitive contracts, then store them in governed folders with the same TIIL IDs.

Practical moves you can make this week

- Build a short file naming template and stick with it, for example TIILID_Issue_ShortName_YYYY‑MM‑DD_vN.

- Add a front sheet to each issue folder, facts, position, amounts, support list, owners, next milestone.

- Keep a simple change log that shows the date, the change, and who approved it.

- Maintain one index that maps TIIL to Forms 14234, 14234‑A, 14234‑B, 14234‑D, and 14234‑E.

Action Steps To Produce A Complete TIIL

Turn the framework into action. Here is a sequence you can run with your team to get a complete, audit ready TIIL on time.

- List every material issue tied to completed transactions for the CAP year. Start with restructurings, acquisitions or dispositions, financing, accounting method or period changes, significant credits, transfer pricing positions, and any large deductions or exclusions.

- For each item, write a tight description in two or three sentences, include the tax year or years, the dollar amount or range, the counterparties, and the proposed tax treatment.

- Add the authority you rely on, code sections, regulations, treaty articles, and any relevant rulings or guidance.

- Link to the exact support, contracts, board approvals, invoices, GL extracts, audited financial statement excerpts, and workpapers. Note filenames and dates.

- Map related party items to the MITT, Form 14234‑B, and cross‑border items to the CBAQ, Form 14234‑E. Use the same IDs across forms.

- Assign an owner and next milestone for each line, then set calendar reminders for updates tied to closings, quarter ends, and pre‑filing meetings.

- Review the whole list once for clarity and once for completeness. Ask, could a reviewer understand the issue without email back and forth, and can they re‑perform the math from the files we listed.

TIIL Readiness Checklist

- Each material issue listed with clear facts, dates, parties, and amounts

- Affected tax years stated, with proposed treatment and method

- Exposure range included, tax, penalties, interest if known

- Evidence attached or referenced with filenames and dates

- Mapping to MITT and CBAQ complete and consistent

- Owners, reviewers, and next milestones recorded

- Version control and a simple change log in place

Example, What A Strong Entry Looks Like

- Issue ID, REORG‑2025‑02

- Description, Legal entity simplification, merger of three dormant subs into US Parent on March 15, 2025, with cancellation of intercompany notes and release of guarantees

- Parties, US Parent, US Sub A, US Sub B, US Sub C

- Amount, elimination of 42.6 million of intercompany debt, no external cash settlement

- Authority, IRC sections 332 and 368, Rev. Rul. cites noted in memo

- Position, nonrecognition applies, basis and attribute rules set per memo, no COD income

- Support, merger agreement executed 03‑01‑2025, board minutes 03‑10‑2025, GL entries with JE numbers, legal memos, tie‑out to audited financials note 14

- Cross‑refs, MITT rows 7 and 8 for note eliminations

- Status, Open, target review meeting the week of May 12, owner J. Rivera

Where Accountably Helps, Without Taking The Wheel

When your internal team is buried in production, your TIIL can slip. Accountably plugs in inside your systems to standardize workpapers, control naming and versions, and keep reviews moving with preparer to senior to quality checks. You keep strategy and positions. We handle the heavy lift of file discipline so you meet the window and show up to CAP with clean, traceable support. Use this only if it makes your team faster and calmer.

FAQs, Focused On Form 14234‑C And CAP

Who needs to file Form 14234‑C, the TIIL

If you are applying to CAP as a new or returning participant, you file the TIIL with your Form 14234 package. Returning participants route updates through the assigned account coordinator or case manager. If you are accepted, you keep the TIIL current across the CAP year under the MOU.

What counts as a “material” issue for the TIIL

Use judgment, but think size, sensitivity, and likelihood of IRS interest. Restructurings, acquisitions and dispositions, intercompany pricing and significant services or royalties, financing, method or period changes, large credits, and any item that moves the return meaningfully. If you would expect questions in a normal exam, include it.

How should I estimate exposure or risk on a TIIL line

You can provide a range. Include tax, penalties, and interest if you have it. The goal is prioritization, not perfect precision. A reasonable range helps the review team plan the calendar and put the right people in the room.

Do I list cross‑border items on TIIL or only on CBAQ

Both. Put the issue on the TIIL with the facts, position, and amounts, then point to the specific CBAQ section. Keep CBAQ timing in mind, initial within 90 days after the prior year end, interim within 30 days of material change, and final at return filing. Update TIIL when cross‑border facts change.

How do I align TIIL with the MITT for intercompany transactions

Use the same IDs across your forms. For each related party item on the TIIL, point to the matching MITT row. Make sure the counterparties, amounts, and methods match. This saves time and prevents duplicate questions.

What happens if I discover a new issue after I submit my TIIL

Update the TIIL as soon as you confirm the facts and amounts, then send the revision under MOU procedures. Include a short change note that references the original issue ID and the impact. For cross‑border items, mirror the change in your CBAQ within 30 days.

What documents should be ready for each TIIL line

Executed agreements, board approvals if applicable, invoices, transfer pricing files if relevant, working calculations with assumptions, GL extracts, and audited financial statement tie‑outs. If you filed elections, method changes, or disclosures, include those forms or memos in the folder. Keep filenames and dates consistent.

Does Bridge Plus change how I build my TIIL

The standard is the same. You still list all material issues and completed transactions, tie directly to the book to tax reconciliation, and keep evidence ready. The difference is speed, which makes clarity and complete mapping even more important.

Final Checklist And Next Steps

Run this final pass before you submit.

- Every material issue is listed and easy to read in two or three sentences

- Affected years, counterparties, amounts or ranges, and positions are clear

- Evidence is attached or referenced with filenames and dates, and ties to the financials

- MITT and CBAQ cross‑references are consistent and complete

- Owners and next milestones are set and on the calendar

- Version control is in place and the change log is current

- Submission route is confirmed, CAP mailbox for new applicants, coordinator for returning participants

File early if you can. Early submissions give you time to fix gaps and reduce stress as the window closes.

Conclusion

You now have a practical way to build a clean, complete TIIL for Form 14234‑C. Start with a full list of material issues, write short, specific entries, and back each one with audit ready support that ties to the financials and the return. Keep the TIIL in sync with your MITT and CBAQ, update fast when facts change, and record who owns what so reviews move without delay.

If your team needs help keeping the workpapers disciplined while you stay focused on positions and strategy, Accountably can support the file build inside your systems with standardized workpapers, multi layer reviews, and predictable turnaround. Use it where it truly helps your process.

Compliance note, this guide reflects program details as of October 29, 2025. Always confirm the current year’s CAP application window and form instructions on the IRS site or with your advisor.

You are ready. Build your list, attach your proof, and give your team and the IRS a clear path to pre filing agreement.

Simplify Delivery, Improve Margins, Stay in Control.

Offshore support that works exactly like your in-house team.

💼 Let’s Talk