Scale Your CPA Firm Without Adding Headcount

Build your offshore team that works your way, trained, compliant, and white-labeled under your firm.

👉 Book a Discovery Call

This guide is general information to help you prepare. It is not tax or legal advice. Always confirm details on the IRS and FinCEN sites, and talk with a qualified expat tax professional about your situation.

Key Takeaways

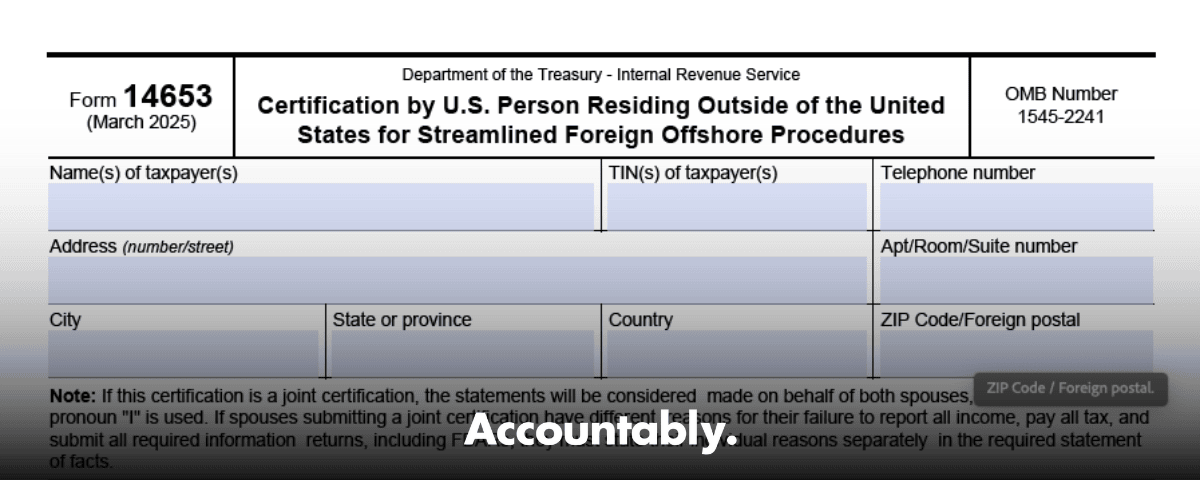

- Use the current Form 14653, revision March 2025. Print, sign, and date under penalties of perjury.

- Attach a copy of your signed Form 14653 to each of the three paper‑filed delinquent or amended returns and any required information returns. Do not attach it to FBARs.

- File the last six years of FBARs electronically through FinCEN’s BSA E‑Filing and, when prompted, choose “Other” and enter “Streamlined Filing Compliance Procedures.”

- You must be eligible. That means your conduct was non‑willful and, for the foreign track, you met the non‑residency standard in at least one of the last three tax years.

- Mail your streamlined package on paper to the IRS address listed for the Streamlined Foreign Offshore Procedures. E‑filing the returns is not allowed for this program.

Quick memory hook: use the 3‑and‑6 rule, attach your signed 14653 to the three paper returns, and e‑file six FBARs through FinCEN.

What Form 14653 is and why it matters

Form 14653 is your signed certification to the IRS. In it, you explain with facts and dates why you missed U.S. filings while living abroad and how you fully corrected them. Your signature is under penalties of perjury, which is why specifics and accuracy matter. The form confirms three things in plain terms.

Hundreds of Firms Have Already Used This Framework.

Join the growing list of CPA and accounting firms using Accountably’s Offshore Playbook to scale faster.

💬 Get Your FREE Playbook

👉 Visit Jugal Thacker’s LinkedIn

Send him a connection request and message “Playbook” to get your copy.

- You are eligible for the Streamlined Foreign Offshore Procedures.

- Your past noncompliance was non‑willful.

- All required FBARs for the last six years have now been filed.

You place the original signed 14653 in your package and attach a copy to each delinquent or amended return and any information returns you include. Keep your own complete set with proofs.

Who should use Form 14653

You use Form 14653 if you are a U.S. person living outside the United States and you qualify for the Streamlined Foreign Offshore Procedures. There are two gates you must pass.

- Non‑willful conduct. Your misses happened because of negligence, inadvertence, mistake, or a good‑faith misunderstanding of the law, not an intentional or reckless choice.

- Non‑residency for at least one of the last three tax years that are due. For citizens and lawful permanent residents, that usually means no U.S. abode and at least 330 full days outside the United States in a qualifying year. If you are not a citizen or LPR, you qualify by failing the substantial presence test in a qualifying year.

If the IRS has already opened a civil examination for any tax year or you are under criminal investigation, you cannot use streamlined. Check that status first.

Improve Margins Without Compromising Quality

Offshore staffing helps firms deliver more, scale faster, and stay compliant, without adding local headcount.

👉 Book a Discovery CallWhat you file, and where it goes

Your Streamlined Foreign Offshore package is paper only. You mail three complete delinquent or amended federal returns, write “Streamlined Foreign Offshore” in red at the top of each first page, include payments for tax and statutory interest, and include your signed Form 14653. Send it to the IRS streamlined address listed on the official page and keep delivery proof.

Your FBARs are separate. File six years electronically through FinCEN’s BSA E‑Filing site. When the form asks why you are filing late, choose “Other” and type “Streamlined Filing Compliance Procedures.” Save the acknowledgements for your records.

Quick table, what goes where

| Item | Years | How you file | Notes |

| Form 1040 + information returns | Most recent 3 years | Paper mail to the IRS streamlined address | Write “Streamlined Foreign Offshore” in red at the top of page 1. Include tax and interest. Attach a copy of Form 14653 to each return. |

| FBAR, FinCEN Form 114 | Most recent 6 years | E‑file through FinCEN BSA E‑Filing | Choose “Other,” enter “Streamlined Filing Compliance Procedures.” Do not attach Form 14653. |

| Form 14653 | 1 original + copies | Original in the package, copies attached to each return | Use Rev. 3‑2025 and sign under penalties of perjury. |

Eligibility details, in practical terms

To qualify for the Streamlined Foreign Offshore track, two things must be true.

- Your conduct was non‑willful.

- You met the program’s non‑residency standard in at least one of the last three tax years with a due date that has passed.

If either fails, do not file under streamlined without professional advice. Submitting an ineligible package risks denial and normal penalties.

The non‑residency requirement, made simple

- Citizens and LPRs. You meet the test in any one relevant year if you had no U.S. abode and were physically outside the United States for at least 330 full days in a 12‑month period that falls within that year. Temporary trips do not necessarily defeat this, and keeping a dwelling does not always mean you had a U.S. abode. Track exact dates, flights, and where you lived and worked.

- Non‑citizens who are not LPRs. You qualify by failing the substantial presence test in any one relevant year as defined by statute and IRS guidance. Keep travel logs and entry‑exit records.

When filing jointly, each spouse must independently meet the applicable test. If your reasons for non‑willfulness differ, each spouse must include a separate statement in the narrative.

The non‑willful standard, what to show

Non‑willful means your misses were due to negligence, inadvertence, mistake, or a good‑faith misunderstanding. In your certification, be direct and specific about what you believed, who advised you if anyone, when you learned the rules, and how quickly you fixed everything. Avoid vague language. Link facts to dates and to documents in your package.

- Strong signals of non‑willful conduct include prompt remediation after discovery, no concealment, and a clear explanation of assumptions that turned out wrong, such as believing an employer or bank handled U.S. filings.

- Risky signals include false statements, omissions after warnings, or patterns suggesting you knew the duty and chose to ignore it.

Evidence that strengthens your Form 14653

Build a dated paper trail that matches your narrative. Include:

- Proof of foreign residence, such as lease agreements, utility bills, employer assignment letters, and payroll records.

- Passport stamps, boarding passes, or travel logs that support 330 full days abroad, plus notes addressing “no U.S. abode” if you are a citizen or LPR.

- Advisor engagement letters or emails that show what you were told and when, especially if you relied on mistaken professional advice.

- Remediation proof, such as FBAR submission confirmations and details about when you prepared and mailed each return and paid the amounts due.

Keep a full copy of everything you mail, plus shipping tracking, in a single folder.

What to prepare before you file

Get organized first. Accuracy beats speed, and a neat package shortens review time.

- Calculate tax and statutory interest for the most recent three years. Include checks or electronic payment details that match each return.

- Prepare any required information returns for those years, such as Forms 8938, 3520, or 5471. At the top of each first page, write “Streamlined Foreign Offshore” in red.

- E‑file the last six FBARs through FinCEN’s BSA E‑Filing site, choose “Other,” and enter “Streamlined Filing Compliance Procedures.” Save each confirmation.

- Complete Form 14653 using the March 2025 revision. Draft a dated, fact‑specific non‑willful statement. Sign under penalties of perjury.

- Attach a copy of your signed Form 14653 to each return and information return, never to FBARs.

- Create a clean index for your package so a reviewer can follow the flow without hunting for documents.

Special notes many filers miss

- Section 965 transition tax. If you had previously unreported income tied to specified foreign corporations, address Section 965 as required in the streamlined instructions. That can affect which years you include and how you compute amounts.

- ITINs. If you need an ITIN, include a complete ITIN application with your submission. A missing TIN can slow or block processing under streamlined.

Where and how to send your package

Mail the entire Streamlined Foreign Offshore package on paper to the IRS address shown on the official streamlined page. Returns under these procedures are not e‑filed. Use a trackable courier and keep the delivery proof with your records.

Write “Streamlined Foreign Offshore” in red at the top of each first page for your three returns and each information return. This simple routing step keeps your package flowing to the right unit.

For FBARs, submit through FinCEN’s BSA E‑Filing portal. Save each acknowledgement for your records. Place the six confirmations behind your index as a separate tab.

How to complete Form 14653, step by step

Follow the form from top to bottom and keep your answers tight and anchored to dates.

- Header and identity List your name, SSN or ITIN, and your current foreign address. Identify the three covered tax years. Use the March 2025 revision of the form.

- Eligibility certification Check that you are using the Streamlined Foreign Offshore Procedures, not the domestic version. Confirm you meet the non‑residency standard for at least one of the three years and that your conduct was non‑willful.

- FBAR confirmation Affirm that all required FBARs for the last six years are now filed. FBARs are submitted through FinCEN, not mailed with your tax returns.

- Narrative statement Write a concise, chronological narrative. Explain what you believed, who advised you if anyone, when you learned of the filing duties, and how you corrected everything. Include dates and point to documents in your package, such as bank letters or emails with an advisor. Sign and date under penalties of perjury.

What the narrative should cover

- Residency and the qualifying year. Name the year you rely on for non‑residency, list exact dates abroad, and address the “no U.S. abode” element if you are a citizen or LPR.

- Cause and discovery. If you relied on professional advice, say so and attach proof. If a FATCA notice or bank letter alerted you, include the date.

- Actions and accounts. List what you filed and when, including three returns, related information returns, and six FBARs. Briefly summarize foreign accounts by type, country, and peak values.

- Attestation. Close with a dated non‑willful attestation and your signature.

A simple example structure you can adapt

- “From 2019 to 2024, I lived in Country A. In 2022, I spent 350 full days outside the United States and had no U.S. abode. In January 2025, I received a bank notice referencing FATCA, which led me to research my U.S. reporting duties. On February 5, 2025, I learned about FBAR and Form 8938 and realized I had filing gaps.

- “I contacted a professional on February 12, 2025, and gathered account statements for 2019 through 2024. I filed six years of FBARs through FinCEN on March 10, 2025, choosing ‘Other’ and entering ‘Streamlined Filing Compliance Procedures.’ I prepared three returns for 2022, 2021, and 2020 and am mailing them with this package and payment of tax and interest.

- “My failure was a good‑faith misunderstanding. I believed my foreign employer handled all local and U.S. reporting. I did not conceal accounts or income. Once I learned the rules, I corrected everything promptly.”

The filing package checklist

Use this checklist as you assemble your package. Place documents in a logical order with a cover sheet and index.

- Three signed delinquent or amended returns, each first page marked “Streamlined Foreign Offshore” in red. Include all information returns for those years.

- Original signed Form 14653 plus a copy attached to each return and information return.

- Tax and interest payments that match the returns. Put your TIN on the check.

- Proof of six FBAR submissions from the FinCEN portal.

- Supporting evidence, such as residency records, advisor letters, bank statements, and travel logs.

- A neat index that cross‑references each attachment so reviewers can follow your facts quickly.

Late deferral elections for treaty‑qualified plans

If you missed a timely deferral election for a treaty‑qualified retirement or savings plan, you can request retroactive relief in your streamlined submission. Include a dated statement explaining the facts and discovery, cite the relevant treaty article, attach support, and reflect any tax adjustments with payment. For certain Canadian plans, Form 8891 is not required when making the late election, but you must still show why relief is appropriate. Attach the election to each affected return, not to FBARs.

Common mistakes that slow or sink a submission

- Using an outdated form. Use the March 2025 revision of Form 14653 and sign it.

- Vague narratives. Replace generalities with a dated, factual story tied to documents.

- Forgetting the red “Streamlined Foreign Offshore” header on each first page. This simple line helps with internal routing.

- Attaching Form 14653 to FBARs. Do not do this. FBARs are filed through FinCEN, and your certification stays with your paper returns.

- Mailing to the wrong address or trying to e‑file the returns. Streamlined returns are mailed to the IRS streamlined address shown on the official page.

- Missing information returns. Include Forms 8938, 3520, 5471, and others when required for those three years.

- Leaving out tax and interest. Include payment for each of the three years in your package.

What happens after you submit

Once your package arrives, the IRS performs an initial eligibility and risk screen. They check that you used the foreign streamlined track, that Form 14653 is complete and signed, and that your three years of returns and payments are present. If accepted, the IRS processes the returns and later issues a notice confirming compliance under the streamlined procedures and relief from the listed penalties. If information is missing or you are ineligible, they will request items or issue a denial letter. Processing often takes weeks or months, and balances or refunds can arise from recalculations.

If you catch an error after mailing your package, you can correct it by sending amended returns and an amended Form 14653. Write “Amended Streamlined Foreign Offshore” in red on the first page of each corrected return and note that your certification is amended. Include a brief explanation of the error and your fix.

Timeline tips that help

- Keep courier tracking and your index handy. If the IRS asks for something, you can respond quickly.

- Save each FBAR submission confirmation. If asked, you can show you completed the six years through FinCEN.

- If you are unsure about eligibility because of a past contact with the IRS, review the streamlined eligibility page about civil exams and criminal investigations before you send a package.

Good‑faith misunderstandings, explained

Many expat misses start with reasonable but wrong assumptions. Maybe you moved on short notice and thought U.S. filing stopped when you paid local tax. Maybe you believed a bank or employer handled U.S. reporting. The streamlined rules recognize that honest mistakes happen. Your Form 14653 should show good‑faith misunderstanding and prompt correction, not intent to hide. Keep your narrative specific and avoid filler.

Build a credible story with documents

- Timeline proof. Travel logs, passport stamps, and employer letters help prove 330 full days abroad and no U.S. abode in the qualifying year.

- Advice trail. Copies of organizer questions, emails, or engagement letters can show what you were told and when.

- Remediation proof. Include dated FBAR acknowledgements and details about when you filed each return and paid the amounts due.

Foreign vs. domestic streamlined, a quick comparison

| Feature | Foreign streamlined, Form 14653 | Domestic streamlined, Form 14654 |

| Residency test | Non‑residency in at least one of the last three years, often 330 full days abroad and no U.S. abode for citizens and LPRs, or failing substantial presence for non‑LPRs | U.S. residents use the domestic track |

| Penalty structure | Relief from failure‑to‑file, failure‑to‑pay, accuracy, information return, and FBAR penalties if eligible and complete | Different penalty terms apply |

| Filing method | Paper returns mailed to the IRS streamlined address | Paper returns mailed to the IRS streamlined address |

| Certification | Form 14653, Rev. 3‑2025 | Form 14654 |

A note for firms that handle volume SFOP work

If you lead a CPA or EA practice and your team processes many SFOP packages during peak season, you know the bottlenecks. Structured workpapers, checklists, and layered reviews cut partner time stuck in review. Accountably can help standardize files, protect quality, and keep turnaround predictable so reviewers focus on judgment calls rather than file wrangling. Use us where it adds value, and keep your brand front and center with clients.

FAQs

What is the Streamlined Filing Compliance Program in one line?

It is an IRS program that lets eligible taxpayers fix offshore reporting lapses by filing three years of returns and six years of FBARs with a signed non‑willful certification, often with penalty relief when the submission is complete and truthful.

Which Form 14653 version should I use?

Use the March 2025 revision. Print, sign, and date it, then attach copies to each return in your package.

Where do I mail my streamlined package?

Mail it to the Streamlined Foreign Offshore address shown on the IRS site for this program. Use a trackable courier and keep proof of delivery.

How do I file the six years of FBARs?

E‑file through FinCEN’s BSA E‑Filing site. Choose “Other” as the reason for late filing, then enter “Streamlined Filing Compliance Procedures.” Save your confirmations.

What if I made a mistake after sending my package?

You can correct errors by submitting amended returns and an amended Form 14653. Write “Amended Streamlined Foreign Offshore” in red on each corrected return and note the certification is amended. Include a brief explanation.

Can I use streamlined if the IRS already contacted me for an examination?

No. If the IRS has initiated a civil exam for any tax year, or you are under criminal investigation, you are ineligible for streamlined. Confirm your status before preparing a package.

Do FBARs have a specific annual due date?

Yes. The FBAR is due April 15 for the prior year with an automatic extension to October 15. For streamlined catch‑up filings, you still e‑file through FinCEN.

Final checklist and next steps

- Confirm eligibility, including the non‑residency test and non‑willful conduct.

- Use Form 14653, Rev. 3‑2025, and sign under penalties of perjury.

- Prepare three years of returns with required information returns, write “Streamlined Foreign Offshore” in red on each first page, and include tax and interest.

- E‑file six years of FBARs with the “Other” reason and the “Streamlined Filing Compliance Procedures” explanation. Save confirmations.

- Mail the paper package to the IRS streamlined address and keep tracking.

You can fix this. Be specific in your narrative, attach the right evidence, and follow the checklist step by step. That steady approach gets you across the finish line.

Sources and resources

- IRS, U.S. taxpayers residing outside the United States, including streamlined steps, address, FBAR note, and late deferral guidance.

- IRS, Streamlined filing compliance procedures, including eligibility and exam‑status limits.

- IRS, Form 14653 PDF, Rev. 3‑2025.

- IRS, FBAR resource page, including due dates and e‑filing rules.

- FinCEN, BSA E‑Filing portal.

Simplify Delivery, Improve Margins, Stay in Control.

Offshore support that works exactly like your in-house team.

💼 Let’s Talk