Scale Your CPA Firm Without Adding Headcount

Build your offshore team that works your way, trained, compliant, and white-labeled under your firm.

👉 Book a Discovery Call

Quick reality check: Form 10837 is an IRS workforce form used to document Weather and Safety Leave, not a taxpayer filing or a tax form you attach to a return. It is optional, and it lives inside the IRS’s leave framework.

Key Takeaways

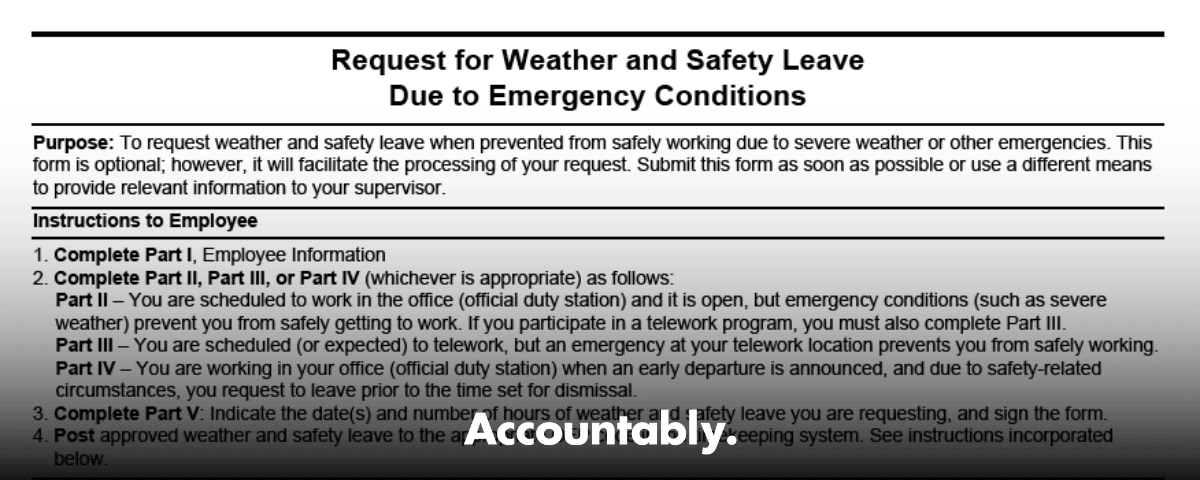

- Form 10837 is an IRS workforce form titled “Request for Weather and Safety Leave Due to Emergency Conditions.” It is used by employees to document requests when they cannot safely work at an approved location. It is not a tax return form.

- Latest revision is listed as Feb 2025 on the IRS Forms directory, which confirms currency as of August 6, 2025. Always download the current PDF from irs.gov.

- The form is optional, and managers may accept other documentation. Agencies look to OPM rules under 5 CFR part 630, subpart P, and IRS IRM 6.630.4 for eligibility, telework readiness, and documentation standards.

- Telework-ready employees are generally expected to work when offices close, except in narrow cases. Weather and Safety Leave, WSL, applies when you cannot safely travel to or perform work at an approved location.

- Managers can waive documentation for short absences, up to four hours, but they still apply the same WSL rules. Keep a clean record trail in case of review.

What Is Form 10837

Form 10837, “Request for Weather and Safety Leave Due to Emergency Conditions,” helps an IRS employee document a WSL request when severe weather or another emergency prevents safe work at an approved site, office or telework site. The IRS treats it as an optional documentation tool inside its absence and leave policies, not as a tax filing. If you are outside the IRS, you would not use this form, but you can learn from its structure to strengthen your own internal leave processes.

The operational backbone behind this form is found in the Internal Revenue Manual, IRM 6.630.4, and OPM’s governmentwide rules at 5 CFR part 630, subpart P. Those sources define when WSL can be granted, what “telework ready” means, and the expectations for employee and manager actions during closures or safety threats.

Hundreds of Firms Have Already Used This Framework.

Join the growing list of CPA and accounting firms using Accountably’s Offshore Playbook to scale faster.

💬 Get Your FREE Playbook

👉 Visit Jugal Thacker’s LinkedIn

Send him a connection request and message “Playbook” to get your copy.

Why IRS Uses WSL

- To keep people safe when travel or on-site work is not safe.

- To avoid paying leave when telework is reasonably available and safe.

- To document, in a standardized way, who requested what, when, and why.

The 2025 Update You Should Know

If you have seen third-party sites that show earlier “Rev. January 2022” versions, bookmark the official source instead. The IRS Forms directory lists Form 10837 with a Feb 2025 revision. That directory entry is the best indicator of the current version, and it was last reviewed or updated by IRS on August 6, 2025. Download from irs.gov to avoid stale copies.

Form 10837 appears in the IRS Forms directory with the official title and revision date. Treat that directory as your version of record.

Who Should Use This Form

- IRS employees who need to request Weather and Safety Leave because an emergency makes it unsafe to work at an approved location, whether on site or at a telework site.

- Immediate managers who review requests and apply IRM and OPM criteria, including telework readiness and documentation needs.

- HR and timekeeping staff who maintain records and code time correctly after a manager’s approval.

If you lead a CPA or EA firm, you will not file this IRS workforce form. However, the discipline behind it is worth modeling in your firm’s HR SOPs, for example, a one-page internal request form, a defined approval path, and a short list of acceptable evidence. That approach reduces confusion during storms and other emergencies.

Improve Margins Without Compromising Quality

Offshore staffing helps firms deliver more, scale faster, and stay compliant, without adding local headcount.

👉 Book a Discovery CallWhere To Get Form 10837

- Go to the IRS Forms directory and search for “Form 10837.” Confirm the title, “Request for Weather and Safety Leave Due to Emergency Conditions,” and check the revision date, currently Feb 2025. Download the PDF locally, avoid third-party editors for sensitive data.

Pro tip, do not rely on non‑IRS repositories for the live version. Use third-party sites only for quick previews, then switch to irs.gov for the copy you actually submit.

How Weather and Safety Leave Works, Plain Language

WSL is paid leave that covers a period when you cannot safely travel to or perform work at an approved location. It is not a shortcut when you prefer not to work, and it is not a substitute for planning. If telework is available and safe, you are expected to work, with narrow exceptions for unanticipated conditions or unsafe telework locations.

Core Eligibility Signals

- There is a weather or safety condition that makes work unsafe at your approved location.

- You contacted your manager as early as practicable.

- You were prepared to telework if that was reasonably anticipated, unless conditions made preparation impossible.

If a threat makes your telework site unsafe, for example a home security incident, agencies can grant WSL for the day while you resolve the safety issue, then shift you to a safe location.

Step‑By‑Step, Completing Form 10837

Follow your internal policy first, then use Form 10837 to memorialize the request.

- Identify yourself

- Enter your name and the identifiers your agency requires. If your policy uses employee IDs rather than SSNs, follow that policy.

- Add contact info so a manager can reach you quickly.

- Specify the period

- List the start and end dates and times you are requesting WSL.

- If conditions change mid‑day, annotate that in your notes so payroll can code time correctly.

- Describe the condition

- Write a short, factual description. Examples, “County sheriff closed Highway 2 at 6,15 a.m. due to flooding,” or “Telework site lost power and internet at 9,05 a.m.”

- Add links or files, weather alerts, office closure notices, or emergency orders if available.

- Address telework readiness

- State whether you were telework‑ready and why telework was not feasible or safe. If conditions were unanticipated, note that clearly.

- Sign and date

- Use your agency’s e‑signature method or print and sign if required. Route to your manager per policy.

- Manager action

- Approve or deny based on IRM and OPM rules. If you approve, keep the record, code time per your system, and note any waiver of documentation for requests of four hours or less.

Documentation That Helps

- Official operating status announcements, closure emails, or hotline screenshots.

- Weather warnings from public authorities.

- Photos or power outage confirmations when the telework site is impacted.

- Any internal incident report that explains a safety threat at the worksite or telework site.

Fast Reference, Roles and Actions

| Role | What you do | Notes that matter |

| Employee | Submit Form 10837 with times, dates, short description, and telework feasibility | Contact your manager fast, keep copies of alerts and outage notes |

| Manager | Apply IRM and OPM criteria, approve or deny, record decision | You can waive documentation for requests of 4 hours or less, keep consistent standards across the team |

| Timekeeper/HR | Code WSL per policy, retain records | Follow coding guidance tied to office status and timing, for example the IRS OFP codes in IRM examples |

When in doubt, keep your notes short and factual. The goal is to show that work at an approved location was not safe or feasible, not to write a novel.

Telework Scenarios You Will See

- Office closed, you are telework‑ready and safe, you work your normal hours. WSL does not apply.

- Office open, conditions make travel unsafe, you request WSL for the time you cannot safely report, then work the remainder if feasible.

- Telework site becomes unsafe, an active threat or outage, you request WSL for the affected period and coordinate a safe alternate site with your manager.

“Telework‑ready” is not a slogan. If you can reasonably anticipate a closure, you take home the gear and files you need. If you fail to prepare when a storm is clearly forecast, your manager can deny WSL.

Submission, Routing, and Recordkeeping

Submit Form 10837 the way your policy requires, usually by secure upload or email to your manager or timekeeping inbox. Save a local PDF for your files, and keep any supporting evidence. Managers should preserve the approval record and maintain consistent standards across teams, especially during regional events that affect many employees at once.

Coding and Timing Details

Time coding follows your agency’s timekeeping system. In the IRS, the IRM provides examples that align WSL time with operating status, such as office open versus office closed, using specific codes. Your objective is to show a clean timeline of work, WSL, and any other leave, so audits or payroll checks do not stall.

Privacy and Security Tips

Handle this form the way you would handle any HR record. Use official systems, not public file editors. Download the PDF from irs.gov, complete it in a trusted PDF tool, and send it through approved channels. If you include screenshots or documents that display personal addresses or phone numbers, redact what is not required for the decision.

If your policy allows short requests without documentation, managers can waive it for up to four hours. Keep a simple note that you applied the waiver and why, for example “unsafe travel due to flash flood warnings, short period, documentation waived.”

WSL vs Administrative Leave vs “Telework Anyway”

OPM guidance separates investigative leave, notice leave, administrative leave, and weather and safety leave. WSL is specifically for conditions that prevent safe work at an approved location. If you are telework‑ready and safe, you generally work, even when the office is closed, unless an exception applies. That is why managers look closely at telework feasibility before approving WSL. (opm.gov)

Edge Cases To Watch

- A closure is announced, you forgot your laptop at the office despite days of warnings. If your lack of preparation caused the inability to work, managers can deny WSL.

- A sudden, unanticipated event hits, for example a transformer explosion that takes down power and internet in your neighborhood without warning. WSL may apply for the period you cannot safely work, document it and notify your manager quickly.

- Safety risk at the worksite or approved telework site, for example an active threat. Agencies may grant WSL that day and then move you to a safe approved location as soon as possible. (opm.gov)

Practical Examples

- Flooded roads, office open, you cannot safely travel. You message your manager at 6,30 a.m., request WSL for the morning, and attach a county closure alert. You shift to telework at noon once roads reopen.

- Office closed, you are telework‑ready and safe. You work a normal day.

- Ice storm knocks out power at your home. You request WSL for the outage period, provide the outage notice, and coordinate to work from a safe alternate site later in the day.

What Accounting Firms Can Borrow From This

You may never use Form 10837 in private practice, but you can borrow its discipline. Build a one‑page internal “Emergency Leave Request,” tie it to a clear approval path, define acceptable evidence, and pre‑write three standard email templates, employee, manager request, and approval. This small amount of structure keeps production moving during storms and protects your team.

At Accountably, we see the same pattern in delivery. The firms that hold up best under pressure are the ones with simple SOPs, documented handoffs, and reliable workpaper standards. That is exactly how disciplined offshore delivery avoids chaos during peak season, spare mentions, predictable turnaround, documented reviews, and continuity plans so a single outage does not derail a deadline.

Minimal mention, because the focus here is your process. If you need help standardizing documentation discipline and review protection in your firm, that is where our team spends its time.

FAQs, Straight Answers

Is Form 10837 a tax form I file with a return?

No. It is an IRS workforce form used to document Weather and Safety Leave requests, optional under the IRM. It is not submitted with a tax return and does not affect your personal or business taxes.

What is the current version and where do I download it?

The IRS Forms directory lists Form 10837 with a Feb 2025 revision. Search and download it directly from irs.gov to ensure you have the current PDF.

If the office is closed, do teleworkers get Weather and Safety Leave automatically?

In general, no. Telework‑ready employees are expected to work unless a specific exception applies, for example an unanticipated condition that prevented preparation or an unsafe telework site. (opm.gov)

What documentation should I attach?

Short, factual proof, office status announcements, public weather alerts, outage notices, or other evidence that shows you could not safely work at an approved location. Managers can waive documentation for requests of four hours or less, and should note the waiver.

Can private employers use this form?

No, it is tailored to federal workforce rules. Private employers can, however, create a similarly structured internal form and SOP that define eligibility, evidence, and approval steps.

Where do I find the rules that sit behind WSL?

Start with OPM’s 5 CFR part 630, subpart P, and the IRS’s IRM 6.630.4, which explain how WSL works, how telework affects eligibility, and how managers should decide.

A Simple Playbook You Can Adopt Today

- Write a one‑page WSL request form that mirrors the essentials, dates and times, reason, telework feasibility, signature, manager signoff.

- Publish a two‑step routing path, manager then HR or timekeeping, with a same‑day target for decisions during emergencies.

- List acceptable documentation, with examples and a short list of credible sources, agency announcements, public alerts, outage confirmations.

- Keep a template set, employee request email, manager approval note, timekeeping code checklist.

- Review your policy once a year before storm season.

Final Notes, Trust and Freshness

We checked this guide against official sources as of November 1, 2025. The IRS Forms directory lists Form 10837 with a Feb 2025 revision date, and the IRM confirms the form is optional documentation within WSL policy. OPM’s guidance sets the baseline for how telework interacts with WSL. Always confirm the latest version and policies before you submit.

This article was prepared by our team and cross‑checked against the IRS Forms directory and the Internal Revenue Manual. If you handle sensitive employee data, use official systems, not public editors. This content is for educational purposes and does not replace your agency’s policy or legal counsel.

About Process Discipline at Accountably

Accountably builds controlled offshore delivery for CPA and EA firms. We obsess over workpaper standards, review protection, and issue escalation, because those are the same muscles that keep operations steady when bad weather, outages, or flu season hits. If you want help turning “ad hoc” into “on time,” with visibility and quality controls that scale, our team can plug into your workflow, your templates, and your deadlines.

- Structured SOPs, fewer review cycles

- Predictable turnaround, clear SLAs

- Continuity plans so one absence does not stop delivery

Simplify Delivery, Improve Margins, Stay in Control.

Offshore support that works exactly like your in-house team.

💼 Let’s Talk