Scale Your CPA Firm Without Adding Headcount

Build your offshore team that works your way, trained, compliant, and white-labeled under your firm.

👉 Book a Discovery Call

You will use the form to set the date of the “sale,” confirm whether you were personally on the hook for the loan, and calculate any gain, loss, or possible cancellation of debt income. The rules below reflect IRS guidance current as of November 4, 2025.

Key takeaways

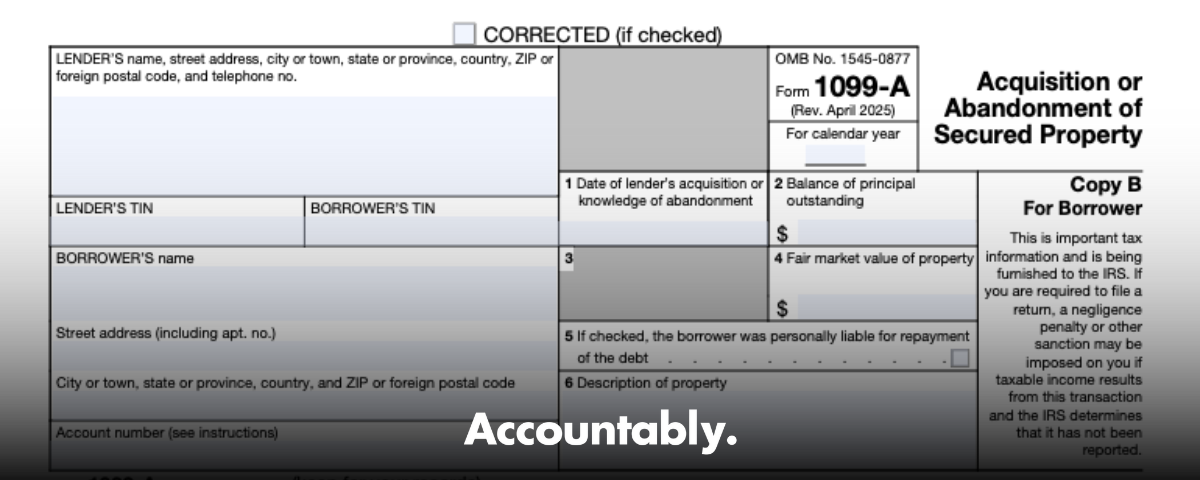

- Form 1099-A shows a lender’s acquisition of, or knowledge of abandonment of, property that secured a debt. Personal-use items like your family car are generally not reported here. Business, investment, intangible property, and real property are in scope.

- Box 1 sets your “date sold” for tax reporting, which fixes the tax year.

- You will compare Box 2, the principal balance, with Box 4, the fair market value, to figure the amount realized. How you compare them depends on Box 5, which tells you if the loan was recourse.

- Deadlines matter. Lenders must furnish Copy B by January 31. They file with the IRS by February 28 on paper or March 31 electronically. Keep these dates on your radar each year.

- If debt is later forgiven, you may also receive Form 1099-C. In some same‑year cases, a lender can file only 1099‑C and satisfy the 1099‑A requirement.

What Form 1099-A is, and what it covers

Form 1099-A is issued when a lender acquires an interest in secured property, such as through foreclosure or deed in lieu, or when the lender has reason to know the property was abandoned. It captures the key facts you need to compute tax results, especially the date, your principal balance, the property’s fair market value, and whether you were personally liable. For tax purposes, “property” includes real estate, intangibles, and tangible business or investment assets. A notable carveout, the IRS does not require reporting for tangible personal property used only for personal purposes, like a personal-use vehicle.

Why the boxes matter

- Box 1, Date of acquisition or knowledge of abandonment, anchors the reporting year and acts as your “date sold.”

- Box 2, Balance of principal outstanding, and Box 4, FMV, work together to compute your amount realized.

- Box 5, Personal liability checkbox, tells you whether the debt was recourse. That single checkbox changes everything about timing and pricing of the deemed sale, and it also determines if canceled debt income can exist.

Quick primer on recourse vs nonrecourse, in human terms

- Recourse debt, you are personally liable. In a foreclosure, your amount realized is the smaller of the debt or the property’s FMV, and any shortfall can be ordinary cancellation of debt income unless an exclusion applies.

- Nonrecourse debt, you are not personally liable. The full outstanding debt becomes your amount realized, and there is generally no separate COD income from the deficiency.

A simple example to orient you

Say the loan balance in Box 2 is 300,000 and Box 4 shows 250,000 FMV.

Hundreds of Firms Have Already Used This Framework.

Join the growing list of CPA and accounting firms using Accountably’s Offshore Playbook to scale faster.

💬 Get Your FREE Playbook

👉 Visit Jugal Thacker’s LinkedIn

Send him a connection request and message “Playbook” to get your copy.

- If Box 5 is checked, recourse, your amount realized is 250,000. The 50,000 difference may be COD income if the lender forgives it, subject to exclusions.

- If Box 5 is not checked, nonrecourse, your amount realized is 300,000. No separate COD income arises from that 50,000 difference.

Where this content fits on Accountably.com

If you run a CPA or EA firm, you already know January moves fast. When 1099-A and follow‑on 1099‑C forms hit, teams can get buried in reviews, file naming issues, and inconsistent workpapers. Where it helps, Accountably integrates trained offshore teams into your workflow, so your staff can spend more time on client strategy, not chasing Box 1 dates. Use the guidance here to keep your analysis accurate, then standardize your checklists and templates before busy season.

Who files, who receives, and the calendar you should expect

Who files and why

The filer is the lender or other party that holds the security interest. They file Form 1099-A when they acquire an interest in the collateral, or when they first know you abandoned it. If they cancel debt of 600 or more in the same calendar year and file Form 1099-C, they can meet the 1099-A requirement by completing specific boxes on 1099-C.

Who receives and when

You, the borrower, receive Copy B. The due date to furnish recipient statements is January 31 for the year after the acquisition or abandonment event. Lenders must file Copy A with the IRS by February 28 on paper, or by March 31 if they file electronically. If your form is missing by early February, contact the lender quickly so you have time to file your return correctly.

Improve Margins Without Compromising Quality

Offshore staffing helps firms deliver more, scale faster, and stay compliant, without adding local headcount.

👉 Book a Discovery CallWhat property types are in scope

Real property, such as a home or rental, and property used in a trade, business, or investment, as well as intangibles, fall under 1099-A. The IRS specifically excludes tangible personal property used only for personal purposes. So if a lender repossesses a personal-use car, that does not generally trigger a 1099-A, while a work truck used in your business usually does.

File corrections and move on

If any box is wrong, ask the lender to issue a corrected 1099-A and file it with the IRS. Keep your emails, letters, appraisals, payoff statements, and closing documents. If you must file before the correction arrives, include an explanation and your supporting records. That paper trail helps you respond if the IRS sends a notice later.

How to read the key boxes on Form 1099-A

Box 1, the anchor date

Box 1 is the date of the lender’s acquisition or knowledge of abandonment. For tax reporting, that date acts as your “date sold.” It decides the year you report the deemed sale, whether on Schedule D or Form 4797, and it can affect whether a 1099‑C is also in the same year. If the date looks off, ask for a fix right away.

Box 5, the personal liability indicator

This checkbox tells you whether you were personally liable when the debt was created or last modified. If the box is checked, the loan is treated as recourse, which means a deficiency can become ordinary income if the lender forgives it. If it is not checked, the debt is treated as nonrecourse, which changes how you compute the amount realized and usually eliminates separate COD income from any shortfall.

Boxes 2 and 4, the math drivers

- Box 2, Balance of principal outstanding, is the loan principal at the time the lender took the property or learned of abandonment.

- Box 4, FMV of property, is generally the foreclosure sale proceeds for a foreclosure. In a deed in lieu or abandonment with recourse debt, the lender may use an appraisal amount. These figures feed directly into your amount realized.

A quick workflow you can follow

- Confirm Box 1, so your reporting lands in the right tax year.

- Confirm Box 5, so you know whether to treat the loan as recourse or nonrecourse.

- Pull Box 2 and Box 4, then compute the amount realized based on recourse status.

- Compare the amount realized to your adjusted basis to compute gain or loss. See IRS guidance for how recourse vs nonrecourse changes that math.

Timing rules, abandonment, and why Box 5 changes everything

Abandonment feels like walking away, but for taxes, it depends on whether you were personally liable. That is why Box 5 is your hinge.

If Box 5 is not checked, nonrecourse

You are not personally liable. Abandonment is treated like a sale on the Box 1 date, and your sales price equals the Box 2 principal balance. That timing matters for which tax year you report the gain or loss and how you line up any depreciation recapture if the property was business or rental.

If Box 5 is checked, recourse

You are personally liable. Abandonment does not trigger the sale. The sale happens when the lender actually takes the property, for example by completing foreclosure or accepting a deed in lieu. When that sale occurs, your amount realized is generally the smaller of Box 2 or Box 4, plus any actual proceeds the lender received at a foreclosure auction.

Practical checklist for timing

- Read Box 5 first.

- Then confirm Box 1 to lock the reporting year.

- If nonrecourse, treat Box 1 as the sale date.

- If recourse, wait for the actual foreclosure or deed in lieu to mark the sale.

- Keep any 1099-C that arrives. It may show the year any forgiven amount became income, or the year you claim an exclusion.

Determining your sales price, step by step

For nonrecourse debt

- Sales price equals Box 2 principal outstanding on the Box 1 date.

- You do not compute separate cancellation of debt income from any shortfall.

- You still compute gain or loss by comparing that sales price with your adjusted basis.

For recourse debt

- Start with the smaller of Box 2 or Box 4 as your sales price for the property.

- If there was a foreclosure sale and the lender received auction proceeds, include those proceeds as required by your facts.

- Any difference between the total debt and the FMV that is actually canceled can become ordinary income, unless you qualify for an exclusion.

Mini-examples you can copy

- Nonrecourse example, rental: Box 2 is 180,000, Box 4 is 160,000, Box 5 is not checked. Your amount realized is 180,000. You report the deemed sale on the Box 1 date, then compute gain or loss on Form 4797, including depreciation recapture as needed.

- Recourse example, equipment used in a business: Box 2 is 95,000, Box 4 is 70,000, Box 5 is checked. Your amount realized for the sale is 70,000. If the lender later cancels the 25,000 shortfall, that 25,000 is potential ordinary income unless you qualify for an exclusion.

Quick sanity check: if the numbers on your form seem out of line with the foreclosure sale results or an appraisal you have, ask for a corrected form before you file.

Using 1099-A to calculate gain or loss, without getting lost in forms

Step 1, identify your sales price

Use the recourse rules above to pick the right number. Write it down, because you will use the same amount in the next steps.

Step 2, compute adjusted basis

Take your original cost, add improvements, and subtract depreciation if the property was business or rental. Improvements are capital items like a new roof or major system. Repairs that kept the property in normal condition generally do not increase basis.

Step 3, determine gain or loss

Sales price minus adjusted basis equals gain or loss.

- Personal-use property, such as a home that does not meet exclusion rules, cannot generate a deductible loss, even if the numbers are negative.

- Investment or business property can generate deductible losses, with special rules for Section 1231 gains and 1245 or 1250 recapture.

Real-world framing

- If you used the property in your business, expect depreciation recapture to turn part of any gain into ordinary income.

- If it was a rental, you will generally use Form 4797 and attach statements that show basis details, prior depreciation, and how you derived the sales price from Boxes 2, 4, and 5.

Where to report, simplified

- Personal or investment property, use Schedule D, and include Form 8949 if you need to list the transaction details.

- Business or rental, use Form 4797. Depreciation recapture rules apply.

- Primary residence, start with Schedule D for the sale, then test the home sale exclusion.

- Any recourse COD that is taxable belongs on your Form 1040 as ordinary income. If you qualify for an exclusion, complete Form 982 and attach it.

If you manage a team, standardize this workflow into a one-page checklist and template workpaper. Your future self will thank you during busy season. If you need a production-ready version, this is exactly the kind of standardized workpaper system Accountably can build inside your existing tech stack, so reviews move faster and errors drop.

Cancellation of Debt income, Form 1099-C, and how it ties into 1099-A

When a lender forgives part of a recourse loan, that relief often creates ordinary income called cancellation of debt. You will usually see that reported on Form 1099-C if the forgiven amount is 600 or more. When 1099-A and 1099-C relate to the same property, use 1099-A to set the sale mechanics and 1099-C to show the amount of debt that was canceled.

Do you always have COD income

No. If the debt was nonrecourse, you generally do not recognize COD income from any shortfall. Your amount realized is the debt, and the story ends there for COD. If the debt was recourse and the lender forgives a deficiency, you may have COD income unless an exclusion applies.

The three most common exclusions

- Insolvency, you qualified if your total debts exceeded the fair market value of your total assets immediately before the discharge. You will complete Form 982 and keep a detailed worksheet to prove the calculation.

- Bankruptcy, debts discharged in a Title 11 case are excluded, and you will also complete Form 982.

- Qualified principal residence indebtedness, if you meet the rules and the discharged mortgage was acquisition or improvement debt on your main home, you may exclude some or all of the forgiven amount, up to statutory limits in effect for the year of discharge.

A quick example

You had a recourse mortgage with 400,000 outstanding. The lender took the property when FMV was 340,000, then forgave the 60,000 difference. For the property sale, your amount realized is 340,000. Separately, you evaluate the 60,000 for COD income. If you qualify for insolvency or another exclusion, you file Form 982 and keep your calculation with your records.

Special rules for your principal residence

A foreclosure or deed in lieu on your main home can trigger both a property sale and forgiveness. You will do two analyses.

- First, treat the foreclosure as a sale. Compare the correct sales price to your adjusted basis. If you have a gain, test whether you qualify for the home sale exclusion. The exclusion can apply even though the property was foreclosed if you still meet the ownership and use tests.

- Second, if there is a recourse deficiency that was forgiven, determine whether you can exclude that forgiven amount under the qualified principal residence rules or insolvency or bankruptcy. If you qualify, complete Form 982.

Documentation to keep

- Closing or trustee’s sale statements, payoff letters, and any lender notices.

- Appraisals or broker price opinions used to set FMV.

- Depreciation schedules if the property was ever used as a rental or business asset.

- Your insolvency worksheet if you claim that exclusion.

- Copies of any corrected 1099-A or 1099-C.

State tax watchouts

States often start from the federal result, but they do not always follow the same COD exclusions or the same basis, depreciation, or home sale rules. Add a quick state-level check to your workflow so you do not get surprised later. If you operate across multiple states, build a one-page matrix of the key differences for your team. That is a simple way to reduce review time and rework.

Common 1099-A mistakes and how to fix them fast

Wrong Box 1 date

If the acquisition or abandonment date does not match your records, it can push the sale into the wrong tax year. Compare Box 1 to trustee sale records, the deed in lieu date, or lender notices. If it is wrong, ask the lender for a corrected form. Keep a simple packet with proof of the correct date, such as the recorded deed or sale confirmation, so you are ready if the IRS asks later.

Mismatched fair market value in Box 4

Box 4 should reflect a reasonable fair market value. In a foreclosure, it often mirrors sale proceeds, and in a deed in lieu it may be an appraisal figure. If Box 4 is far off from the sale or appraisal you have, request a correction and include the documents you relied on. That one box can swing your gain, loss, or potential COD.

Box 5 checked when it should not be

This is the hinge. If the loan was nonrecourse and Box 5 was checked, your return could wrongly show COD income. Pull your loan documents and any state anti-deficiency rules that applied, then ask for a corrected 1099-A if needed. If the debt was modified over time, confirm whether recourse status changed with a later amendment.

Box 2 does not reflect principal only

Box 2 should be principal, not accrued interest or penalties. If you see an amount that appears to include more than principal, ask the lender to verify how it was computed and to correct if needed. Your sale price and any separate COD analysis start here.

Missing or vague Box 6 description

For multi-property borrowers, a vague description can cause mix ups. Ask for a corrected description that clearly identifies the parcel, unit, or asset, then label your workpapers with that exact description.

When the lender will not correct

If the lender refuses or delays, prepare a clean reconciliation that shows what you used and why. File on time using your best support, attach a short explanation if the difference is material, and keep your packet handy. If a corrected form arrives later, amend only if the change affects your tax.

Deadlines you should put on your calendar

- January 31, expect Copy B of Form 1099-A.

- Late February, paper filers submit to the IRS by February 28.

- March 31, electronic filers submit to the IRS by March 31.

- If a date falls on a weekend or holiday, the next business day applies.

Quick timeline table

| Event | Date you should know | What you do | | Borrower receives Copy B | January 31 | Review Boxes 1, 2, 4, 5, and 6, then request corrections fast | | Lender files with IRS, paper | February 28 | Confirm your copy is correct and matched to your account | | Lender files with IRS, electronic | March 31 | If corrections were issued, keep the corrected Copy B with your return | | Missing or wrong form | As soon as noticed | Contact the lender, document everything, and proceed with support if needed |

Reporting map, so you pick the right tax form

| Property use | Where you report | Key notes | | Personal or investment property | Schedule D, and Form 8949 if needed | Personal losses are not deductible, investment property follows capital rules | | Business or rental property | Form 4797 | Apply Section 1231 treatment and any 1245 or 1250 recapture | | Primary residence | Schedule D | Test the home sale exclusion if you have a gain | | Recourse COD income | Form 1040, with Form 982 if excluded | Insolvency, bankruptcy, or principal residence rules may exclude income |

Three mini case studies to make this concrete

- Primary home, recourse, deed in lieu: Box 1 shows June 12, Box 2 is 415,000, Box 4 is 390,000, Box 5 is checked. Treat the sale with 390,000 as amount realized, compare to basis, then review whether the 25,000 deficiency was forgiven and if you qualify for an exclusion on Form 982.

- Rental duplex, nonrecourse, foreclosure sale: Box 1 shows September 8, Box 2 is 280,000, Box 4 is 240,000, Box 5 is not checked. Amount realized is 280,000 on that date. Report on Form 4797, include depreciation recapture.

- Work equipment, recourse, repossession with later COD: Box 2 is 95,000, Box 4 is 70,000, Box 5 is checked. Amount realized is 70,000, and if a later 1099-C shows 25,000 forgiven, evaluate Form 982 exclusions. Keep the valuation support you used for Box 4.

Process tips for firm owners and controllers

- Standardize your intake, capture Boxes 1, 2, 4, 5, and 6 the moment a 1099-A lands.

- Build a one-page worksheet that computes amount realized under both recourse and nonrecourse, then locks the correct path based on Box 5.

- Add a state check line to catch differences early.

- Use named folders and consistent file names for sale statements, appraisals, and lender letters, so reviews move faster.

- If you want this built into your existing task manager, this is a common delivery pattern Accountably implements for firms during busy season, which reduces review time and rework without sacrificing control.

Frequently asked questions about Form 1099-A and 1099-C

Do I have to report a Form 1099-A on my return

Yes. You must analyze the sale or deemed sale using the boxes on 1099-A, then report gain or loss on Schedule D or Form 4797 as appropriate. If there is forgiven debt on a recourse loan, you also evaluate whether that creates COD income and whether you qualify for an exclusion on Form 982.

What is the difference between Form 1099-A and Form 1099-C

Form 1099-A reports a lender’s acquisition of, or knowledge of abandonment of, property that secured a debt. Form 1099-C reports canceled debt of 600 or more. You can receive both for the same property, or just 1099-C if the lender canceled the debt and used that form to report the acquisition details.

How do I know if my loan was recourse or nonrecourse

Start with Box 5 on 1099-A. Then check your loan documents and any state deficiency laws that applied. If Box 5 does not match your facts, ask the lender to correct it. Recourse status controls both timing and the potential for COD income.

Where do I report losses

- Personal-use property, losses are not deductible.

- Investment property, report on Schedule D.

- Business or rental property, use Form 4797 and apply the recapture rules.

Do I owe tax if the lender forgave the deficiency

Maybe. If the loan was recourse and you do not qualify for an exclusion, the forgiven amount is ordinary income. If the loan was nonrecourse, there is generally no separate COD income from a deficiency.

What documents should I keep

Keep the 1099-A and any 1099-C, the foreclosure or deed in lieu paperwork, appraisals or sale statements used for FMV, payoff letters, depreciation schedules for rentals or business assets, and any Form 982 worksheets. Keep the packet at least as long as your state’s audit window.

A simple worksheet you can copy into your process

- Confirm Box 1, then write down that date as your sale date if nonrecourse, or as your event date if recourse.

- Confirm Box 5, recourse or nonrecourse.

- Record Box 2 and Box 4.

- Choose the sales price based on Box 5 rules.

- Compute adjusted basis, add improvements and subtract any depreciation.

- Calculate gain or loss, then pick the right reporting form.

- If there is forgiven debt on a recourse loan, evaluate exclusions and complete Form 982 if you qualify.

- Add a state check, then finalize workpapers and label them with the property description from Box 6.

When to get help, and how Accountably fits for firms

If you are a taxpayer working through a complex situation, a seasoned tax pro can save you from costly mistakes. If you run a CPA or EA firm and your team loses hours in reviews on 1099-A cases, that is a delivery problem, not a sales problem. Where it makes sense, Accountably integrates trained offshore accountants into your workflow, inside your systems and templates, with SOPs, structured workpapers, and layered reviews. The goal is simple, your team spends less time untangling boxes and more time advising clients.

Final word

Form 1099-A is not a verdict, it is a map. Read Box 5 first, confirm Box 1, then use Boxes 2 and 4 to compute the amount realized. Decide where to report, and if a lender forgave a deficiency on a recourse loan, check the exclusions and complete Form 982 if you qualify. Keep tight documentation and ask for corrections quickly. With a clear process, you stay in control of the numbers, and you file with confidence.

Simplify Delivery, Improve Margins, Stay in Control.

Offshore support that works exactly like your in-house team.

💼 Let’s Talk