Scale Your CPA Firm Without Adding Headcount

Build your offshore team that works your way, trained, compliant, and white-labeled under your firm.

👉 Book a Discovery Call

The core idea, only the earnings portion of a nonqualified ABLE distribution can be taxable, not your contributions.

Key Takeaways

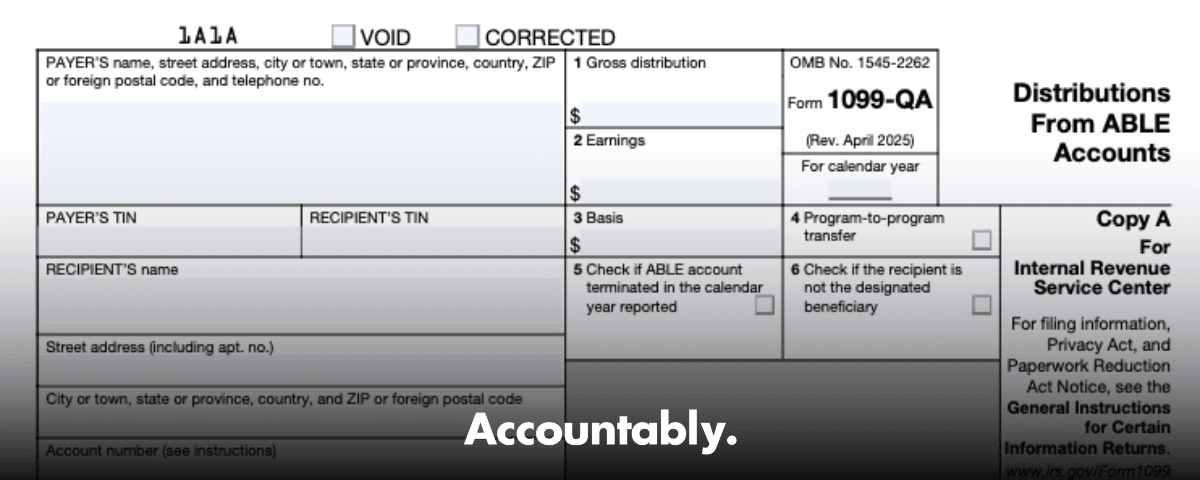

- Form 1099‑QA reports ABLE, also called 529A, distributions for the calendar year. You get it any year money leaves the account, including rollovers and closures.

- Box 1 shows the gross distribution, Box 2 shows earnings, Box 3 shows basis, and Box 4 flags program‑to‑program transfers or rollovers that stay nontaxable if the timing rules are met.

- If a payout is nonqualified, only the Box 2 earnings are taxable, and a separate 10% additional tax applies to that taxable portion unless a narrow exception applies.

- 2025 deadlines, furnish recipient statements by January 31, file with the IRS by February 28 if paper or by March 31 if e‑file. Mark the date on your calendar to avoid penalties.

- Rollover timing matters, generally 60 days, and the once‑per‑12‑months limitation can apply, so document dates and destinations.

What Is Form 1099‑QA

Form 1099‑QA, Distributions from ABLE Accounts, is the information return you receive whenever an ABLE account pays out during the year. It helps you split each withdrawal into basis and earnings so you can decide whether any earnings are taxable. Programs also check boxes that indicate rollovers, account terminations, and whether the recipient is the designated beneficiary.

- Box 1, gross distribution for the year.

- Box 2, the earnings portion of that distribution.

- Box 3, basis, also called return of investment.

- Box 4, checked for program‑to‑program transfers or rollovers.

If you spent the funds on qualified disability expenses, QDEs, earnings are excluded from income. If any amount is nonqualified, only the earnings slice becomes taxable.

Hundreds of Firms Have Already Used This Framework.

Join the growing list of CPA and accounting firms using Accountably’s Offshore Playbook to scale faster.

💬 Get Your FREE Playbook

👉 Visit Jugal Thacker’s LinkedIn

Send him a connection request and message “Playbook” to get your copy.

Understanding ABLE Accounts, Plus a 2026 Eligibility Update

ABLE accounts, section 529A programs run by states, let an eligible individual who had a qualifying disability that began before age 26 save and invest for disability‑related expenses. Growth is tax‑deferred, and distributions are tax‑free when used for QDEs such as housing, education, transportation, health care, assistive technology, and personal support services. One ABLE account per eligible individual is the norm, with rollovers allowed under specific rules.

Two timing notes you should keep in mind:

- 2025 season rules, the age‑26 onset threshold remains in place.

- Starting January 1, 2026, eligibility expands to disabilities that began before age 46, which will bring many more families into ABLE. If you advise clients close to that cutoff, plan ahead now. (blog.ssa.gov)

The What‑How‑Wow of 1099‑QA

- What, 1099‑QA tells you how much left the ABLE account and how much of that was earnings.

- How, match distributions to QDEs in the same tax year, keep receipts, and flag rollovers correctly.

- Wow, a little structure goes a long way. When you label documents as you go and reconcile to the boxes on the form, you avoid taxable surprises and save hours during review. In our experience supporting busy tax teams, a simple ledger plus a folder per year prevents nearly every 1099‑QA headache.

Quick Box Reference

| Box | What it shows | Why you care |

| 1 | Gross distribution | The total cash out you must reconcile |

| 2 | Earnings | The only piece that can become taxable |

| 3 | Basis | Contributions returned, not taxable |

| 4 | Transfer/Rollover | Tells you to apply timing rules and retain proof |

Source for box meanings, see the IRS 2025 instructions for Forms 1099‑QA and 5498‑QA.

Improve Margins Without Compromising Quality

Offshore staffing helps firms deliver more, scale faster, and stay compliant, without adding local headcount.

👉 Book a Discovery CallWhat Triggers Issuance of Form 1099‑QA

Any money leaving the ABLE account triggers a form, even if the transaction is a rollover or the account is closed. That includes partial withdrawals, final distributions at termination, and program‑to‑program transfers. The program must furnish statements to recipients, usually the beneficiary or a contributor who had an excess contribution returned.

- Expect the recipient copy by January 31 for the prior calendar year. If there was no distribution that year, there is no form.

Box‑by‑Box Details, With Practical Tips

On 1099‑QA, read the boxes as a story of the year.

- Box 1, Gross distribution. Start here and reconcile to your ledger and receipts.

- Box 2, Earnings. If any part of the withdrawal was not for QDEs, this is the number that could be taxable.

- Box 3, Basis. Box 1 minus Box 2, your contributions coming back.

- Box 4, Program‑to‑program transfer. Checked for rollovers or direct transfers, still reportable but generally nontaxable when done correctly.

- Box 5, ABLE account terminated. Signals a final year, so expect a clean reconciliation.

- Box 6, Other than designated beneficiary. Tells you the recipient was someone else, for example a contributor who received back an excess contribution.

Table, What Each Box Means

| Box | What it reports | Review cue |

| 1 | Gross distribution | Tie to bank statements and your QDE log |

| 2 | Earnings | If any spending was nonqualified, this portion is taxable |

| 3 | Basis | Not taxable, even if the spend was nonqualified |

| 4 | Transfer/Rollover | Confirm the 60‑day timing and destination |

| 5 | Account terminated | Close out records and retain final statements |

| 6 | Other than beneficiary | Check who received funds and why |

Source, IRS 2025 instructions for Forms 1099‑QA and 5498‑QA.

Qualified vs. Nonqualified Distributions

Your job is to sort each dollar into qualified disability expenses, QDEs, or not. Qualified categories include housing, education, transportation, health, prevention and wellness, employment training and support, assistive technology, and personal support services. When distributions match QDEs during the same tax year, earnings stay out of income.

- If you use ABLE funds for nonqualified expenses, only the earnings in Box 2 become taxable, not your contributions in Box 3.

- Keep receipts and notes that show who, what, when, and why, then reconcile to Box 1 totals. This is what protects tax‑free treatment if the IRS asks.

What Counts as QDEs, With Examples

Pay attention to whether the expense relates to the beneficiary’s disability and improves health, independence, or quality of life. Common examples:

- Education tuition, specialized software, testing fees.

- Housing rent, utilities, accessibility modifications.

- Transportation fares, vehicle adaptations, ride services.

- Health and wellness, therapy, medical devices, assistive tech.

- Personal support services and employment support.

Tip, make the timing match. Pay QDEs in the same tax year as the distribution. Keep a simple spreadsheet that lists date, vendor, amount, category, and whether the spend is QDE or not. That small habit turns April into a quick review instead of a scramble.

Rollovers and Program‑to‑Program Transfers, The Rules That Matter

You can move ABLE funds without tax if you follow the definitions and timing:

- Rollover, take money out and contribute it to another ABLE account within 60 days. The receiving account must be for the same designated beneficiary or another eligible family member, and rollovers to the same beneficiary are limited to once every 12 months.

- Program‑to‑program transfer, a direct transfer between ABLE programs with no intervening distribution. This is not taxable and is still reported on the form. Close the old account if you move the entire balance.

If you are assisting clients, keep proofs of timing, the receiving plan details, and the closing statement if an account was moved entirely. That documentation is what Box 4 is pointing you to save.

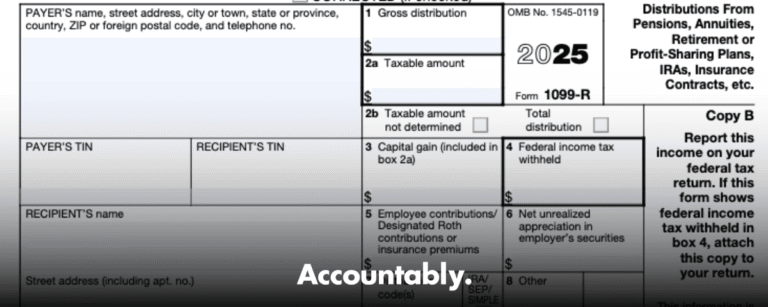

Tax Treatment and Penalties, Explained Simply

When ABLE withdrawals pay QDEs, nothing is included in income. When part of a distribution went to nonqualified uses, the earnings portion becomes taxable and an additional tax applies. The boxes on 1099‑QA are designed to help you compute that split.

Qualified Distributions Are Tax‑Free

Match your QDE receipts to distributions for the same tax year, then confirm that the total QDEs are at least as much as Box 1. If that is true, the earnings in Box 2 stay out of income. Keep invoices, bank statements, and a clean log that ties to each withdrawal.

- Double check that any rollovers are coded correctly, Box 4, and that the 60‑day rule was met. Nonqualified uses are about purpose and timing, so your paperwork is your best ally.

Nonqualified Earnings Are Taxable

If part of the year’s distributions did not pay QDEs, include the Box 2 portion related to those nonqualified expenses in gross income. Your contributions in Box 3 are never taxable on withdrawal. This is why your ledger matters, it shows exactly how much of Box 2 belongs in income.

The 10% Additional Tax, And The One Real Exception

ABLE has a specific penalty rule. If any amount of a distribution is includible in gross income, your income tax is increased by 10% of that includible amount. The primary statutory exception is for distributions made after the beneficiary’s death. That is why clean year‑end reconciliations and careful beneficiary changes matter.

If you have seen “disability” listed as a penalty exception in other contexts, be careful. ABLE’s 10% additional tax is narrower than some 529 education scenarios, so rely on section 529A and the final regulations.

Special Timing Notes Practitioners Ask About

- 529 plan to ABLE rollovers are permitted through December 31, 2025, and they count toward the ABLE annual contribution cap. Track dates and caps to avoid surprises.

- For 2025, the IRS instructions highlight ABLE contribution guidance and reinforce using the General Instructions for due dates and e‑file thresholds. If you file 10 or more information returns in aggregate, you are likely required to e‑file.

Key Dates And Filing Responsibilities For The 2025 Season

Here are the dates that trip people up, with the exact calendar context:

- January 31, 2025, furnish recipient statements for 2024 distributions, this includes 1099‑QA.

- February 28, 2025, paper filing due to the IRS for 2024 Forms 1099‑QA. The general rule is February 28, the IRS notes this date does not slide to February 29 in leap years.

- March 31, 2025, electronic filing deadline for 2024 Forms 1099‑QA. Check your IRIS or FIRE setup early.

- March 15, 2026, furnish beneficiary statements for 2025 Form 5498‑QA, while the IRS filing for 2025 5498‑QA is due by June 1, 2026. Mark both, they are easy to miss.

If the recipient statement or filing deadline falls on a weekend or legal holiday, use the next business day. Build a tiny checklist for your firm so these are never last‑minute scrambles.

Recordkeeping That Actually Works

A tidy process is worth more than a heroic clean‑up in April. Here is a simple system we coach teams to use.

Keep Receipts Organized

- Create a year‑indexed folder for the ABLE beneficiary, with subfolders for housing, education, transportation, health, and support services.

- Scan or save PDFs of receipts, invoices, bank or card statements, and cancelled checks, then back them up securely.

- Note the beneficiary’s name, amount, date, and how each item ties to QDEs. Store rollover confirmations with dates to show you met the 60‑day rule. Keep everything at least three years after the filing due date.

Track QDE Usage As You Go

Maintain a simple ledger with columns for date, payee, amount, category, QDE yes or no, and notes. Reconcile the total of QDEs to Box 1 on your 1099‑QA, then identify any nonqualified amounts so you can compute the taxable piece of Box 2. This one page saves hours of review time.

Retain Annual Statements

Keep Form 1099‑QA, Form 5498‑QA, and account statements side by side. Tie each distribution to the supporting receipts and the beneficiary’s QDE log. For rollovers, save proof of dates and destination accounts. This is what makes exams routine rather than stressful.

Using Form 1099‑QA With Tax Software

In TaxAct, enter 1099‑QA under Federal, Other Income, Distributions from ABLE Accounts. You will input Boxes 1 through 3 and indicate rollovers or transfers so the software treats timing correctly. Keep your receipts, the program’s math is only as good as your inputs.

TurboTax provides an interview path for ABLE distributions. In many cases you can search for “1099‑QA” and use the jump‑to link, then answer the ABLE distribution questions. Be sure to keep your own reconciliation, software prompts vary by version and year.

FAQs

What is Form 1099‑QA in one sentence?

It is the form that reports ABLE account distributions, including a split between basis and earnings, so you can determine whether any earnings are taxable.

Do I owe tax when I get a 1099‑QA?

Not necessarily. If you used distributions for qualified disability expenses in the same tax year, the earnings are excluded. Only the earnings tied to nonqualified uses become taxable.

Is there a penalty for nonqualified uses?

Yes. If any part of the distribution is includible in income, a 10% additional tax applies to that taxable amount. A key exception exists for distributions made after the beneficiary’s death.

How are rollovers shown and do they get taxed?

Rollovers and program‑to‑program transfers are still reported, Box 4, but they are not taxable when the 60‑day timing and family‑member rules are satisfied, and the once‑per‑12‑months limit for same‑beneficiary rollovers is respected. Keep confirmations.

When are copies due in 2025?

Furnish recipient statements by January 31, file with the IRS by February 28 if paper or March 31 if e‑file. Check the General Instructions table each year for any updates.

A Note For CPA Firms And Controllers

If your team handles dozens of ABLE distributions during busy season, standardize your intake, folders, and review steps, that is where delivery friction usually appears. At Accountably, we focus on disciplined delivery structures, not resume farming. If you ever need a repeatable workflow for 1099‑series processing across your tech stack, our offshore teams plug into your SOPs, templates, and SLAs so reviewers get clean, consistent files. Keep it lean, predictable, and audit‑ready.

Simplify Delivery, Improve Margins, Stay in Control.

Offshore support that works exactly like your in-house team.

💼 Let’s Talk