Scale Your CPA Firm Without Adding Headcount

Build your offshore team that works your way, trained, compliant, and white-labeled under your firm.

👉 Book a Discovery Call

I have joined too many late night huddles where a team lead says, our 1095-C count on line 18 does not match payroll, and the AIR window closes in an hour. The fix is not heroics. It is a steady playbook for Form 1094-C, clean reconciliations, and one Authoritative Transmittal that ties every employee form together.

Form 1094-C is your cover sheet and scoreboard, it tells the IRS who you are, how many 1095-Cs you filed, and what you offered full-time employees each month.

Key Takeaways

- Form 1094-C is the transmittal and employer-level summary that accompanies all Forms 1095-C. It reports your ALE details, total 1095-Cs, monthly offer indicators, and employee counts, and it powers employer shared responsibility checks.

- Each ALE member files its own 1094-C and 1095-Cs. Mark exactly one 1094-C as the Authoritative Transmittal for that ALE member and complete Parts II–IV on that return.

- If you file 10 or more information returns in aggregate for the year, you must e-file. ACA returns go through the IRS AIR system.

- Furnish 1095-Cs by the permanently extended date in early March, file paper by February 28, and e-file by March 31. Weekends or holidays push to the next business day.

- Starting with returns after 2023, the IRS allows an alternative, request-only method to furnish 1095-Cs if you post a clear notice by the furnishing due date and keep it up through October 15. This does not change IRS filing due dates.

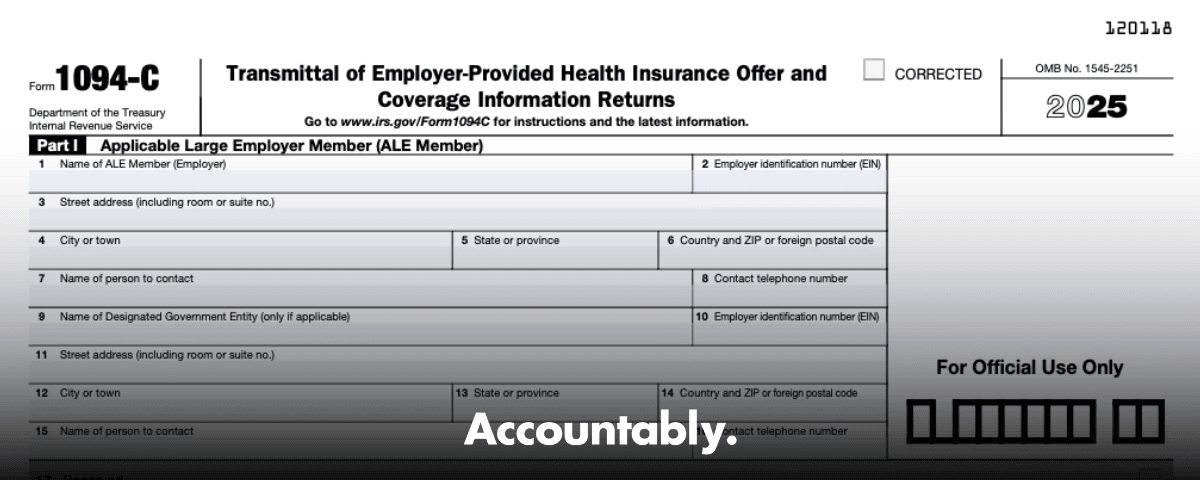

What is Form 1094-C?

Form 1094-C is the employer summary and transmittal for ACA reporting. You use it to submit and tie together all employee Forms 1095-C. The IRS relies on your 1094-C totals and monthly indicators in Part III to determine employer shared responsibility under section 4980H and to reconcile premium tax credit eligibility.

Hundreds of Firms Have Already Used This Framework.

Join the growing list of CPA and accounting firms using Accountably’s Offshore Playbook to scale faster.

💬 Get Your FREE Playbook

👉 Visit Jugal Thacker’s LinkedIn

Send him a connection request and message “Playbook” to get your copy.

On your Authoritative Transmittal, you certify employer-level numbers, including the total count of 1095-Cs and your monthly full-time employee counts. You also indicate whether you offered minimum essential coverage at the required level for each month. Keep this as the single source of truth for the year.

Who Must File Form 1094-C?

If you are an Applicable Large Employer, generally 50 or more full-time employees including FTEs in the prior calendar year, you must file Form 1094-C and issue a 1095-C to each employee who was full-time for any month. Each ALE member files under its own EIN.

Applicable Large Employers

Confirm ALE status with a month-by-month headcount. Count full-time employees, then compute FTEs by totaling part-time hours and dividing by 120 for each month, and average across the year. Keep the work you use for seasonality and partial-year hires, because these figures drive both filing and potential ESRP exposure.

Improve Margins Without Compromising Quality

Offshore staffing helps firms deliver more, scale faster, and stay compliant, without adding local headcount.

👉 Book a Discovery CallOnce you confirm ALE status, complete Form 1094-C and file a Form 1095-C for every employee who was full-time for at least one month. If you send multiple submissions for the same ALE member, designate one Authoritative Transmittal and reconcile all counts to that return.

Aggregated ALE Groups

Common ownership can pull separate entities into an Aggregated ALE Group for determining ALE status. Filing still happens at the ALE member level, not as a single combined filing for the entire group. Each member files its own Authoritative 1094-C and lists related members, up to 30, in Part IV as applicable.

Why The Authoritative Transmittal Matters

The IRS expects one, and only one, Authoritative 1094-C per ALE member. That check box on Part I, line 19 turns on employer-level reporting. If you mark it, complete Parts II–IV and ensure monthly counts match your eligibility records. Non-authoritative 1094-Cs are limited to reporting only the number of 1095-Cs attached to that batch on line 18.

A quick story. One controller sent three 1094-Cs, each marked Authoritative. The returns were rejected, the team spent a week rebuilding totals, and corrections went out under pressure. One check box can save dozens of hours and a few heart rates.

How 1094-C Ties To 1095-C

Your 1094-C is the front page, your 1095-Cs are the pages behind it. Part III’s offer indicators and headcounts must align with the employee forms and months reported on each 1095-C. If you use the 98 percent offer method, check box D on line 22, then follow the simplified rule for the full-time count in Part III as allowed in the instructions.

Authoritative Transmittal, When And How To Use It

For each ALE member, check Part I, line 19 on exactly one 1094-C. That return becomes your employer summary and requires you to complete Parts II, III, and IV, as applicable. Every other 1094-C you submit for the same EIN must be non-authoritative and limited to line 18, the count of 1095-Cs attached to that batch.

When To Designate

Designate any time you submit multiple batches for the same ALE member or simply want the IRS to anchor to a single employer summary. Choose the batch that best represents your full population, often the primary payroll run. Reconcile all 1095-C volumes and monthly counts before you transmit. The IRS guidance is explicit, each ALE member files one Authoritative Transmittal that reports only that member’s data.

Single vs Multiple Filings

Use one 1094-C if you send all 1095-Cs in a single batch. If divisions or service partners split the work, you can send multiple 1094-Cs for the same EIN, but only one carries totals. The others stay lean.

| Scenario | Action |

| Single ALE member, one submission | File one 1094-C as Authoritative, complete Parts II–IV, attach all 1095-Cs |

| Multiple transmittals for one ALE member | Mark one 1094-C as Authoritative, reconcile totals across batches, keep other 1094-Cs limited to line 18 |

| Aggregated ALE Group | Each ALE member files its own Authoritative 1094-C, and lists related members in Part IV if applicable |

This mirrors the IRS instructions and keeps you out of mismatch territory.

Required Form Details

On the Authoritative 1094-C, complete employer identity lines, indicate if you are part of an Aggregated ALE Group, and complete Part III with monthly offer indicators and headcounts. If you qualify for the 98 percent offer method, check box D on line 22. Confirm that line 18 equals the total 1095-Cs you will file for that ALE member.

Electronic vs Paper Filing Requirements

If you file 10 or more information returns in aggregate for the year, you must e-file. The threshold counts almost all information return types together, so a mix of W‑2s and 1099s can put you over the line even if your ACA forms alone are few. ACA returns are filed through the IRS AIR system, not FIRE or IRIS. New filers need an ACA Transmitter Control Code, and schema testing is mandatory each year.

Practical tip, store AIR credentials and contacts in a secure location that at least two responsible officials can access. If one is out, your filing does not stall.

E-File Logistics, In Plain Language

- Platform, use AIR for 1094-C and 1095-C.

- Credentials, apply for an ACA Transmitter Control Code.

- Validation, follow current year AIR schemas and business rules to avoid rejects.

- Submission, send one Authoritative 1094-C with your 1095-Cs for that ALE member, save acknowledgments.

Deadlines And Due Dates, 2025 Filing Season

For 2024 calendar-year reporting filed in 2025, plan for three dates.

- Furnish 1095-Cs by early March under the permanent 30-day extension that replaced January 31. If the date falls on a weekend or holiday, use the next business day.

- File paper 1094-C and 1095-Cs by February 28.

- E-file by March 31.

New in 2025, the IRS allows a request-only method for furnishing 1095-Cs if you post a clear, conspicuous, and accessible notice by the furnishing due date, keep it available through October 15, and promptly send the form when asked. This change does not affect the IRS filing due dates. Check state rules if you have state-level ACA reporting.

Calendar it now. Post the notice by the furnishing due date, keep it up through October 15, then e-file your returns by March 31.

How 1094-C Works With 1095-C, A Quick Checklist

- Match monthly data. If Part III shows you met the coverage threshold for March, your March 1095-Cs should reflect the correct offer codes and self-only lowest cost premium.

- Validate headcounts. Part III full-time counts should tie to eligibility by month. Document any limited non-assessment periods that affect the calculation.

- Coordinate group reporting. If you are in a controlled group, list related ALE members in Part IV. Each member files its own Authoritative Transmittal and its own 1095-Cs.

Where Accountably Helps, If You Need It

Many firms stall in February because delivery breaks under load, not because they lack demand. If your team already runs hot during tax season, put ACA reporting on an SOP with versioned workpapers, a defined preparer to senior to reviewer chain, and a clear calendar. If you need steady capacity without losing control, Accountably can integrate trained offshore staff into your tools and templates, with layered review and predictable turnaround, so managers spend less time in review and more time solving client issues. Use this only if it truly helps you hit clean, on-time ACA files.

Penalties For Late Or Inaccurate Filing

The penalties are tiered and indexed for inflation. For returns and statements required in 2025, the standard per-return penalty is 330, with lower amounts if corrected within 30 days and mid-tier amounts if corrected by August 1. Intentional disregard removes caps and raises the per-return amount. The Internal Revenue Bulletin lays out the 2025 schedule, and the IRM reproduces the same figures. Always confirm the current year before filing.

Typical 2025 penalty framework

- Correct within 30 days, 60 per return, with an annual cap that varies by filer size.

- Correct by August 1, 130 per return, with a higher annual cap.

- After August 1, 330 per return, with the highest annual cap.

- Intentional disregard, at least 660 per return, no overall cap.

Penalty defense is simple in theory, hard in practice. Send accurate data, match counts, keep your reconciliation workbook, and respond quickly to any IRS notice with a clean tie out. If you believe a proposed assessment is wrong, respond on time and request reasonable cause relief when appropriate.

Step-By-Step, Completing Form 1094-C

Work left to right, top to bottom, with your reconciliation workbook open.

- Part I, identify the ALE member, legal name, address, EIN, and a real contact with a phone number.

- Line 18, enter the total number of 1095-Cs for the Authoritative Transmittal. For non-authoritative filings, line 18 equals only the forms in that batch.

- Line 19, mark Authoritative Transmittal yes or no. If yes, complete Parts II–IV.

- Part II, complete the certifications of eligibility. Indicate Aggregated ALE Group status if it applies.

- Part III, complete monthly minimum essential coverage indicator, full-time count, and total employee count.

- Part IV, list other ALE members, up to 30, if you are in an Aggregated ALE Group.

Practical note, if you use the 98 percent offer method, check box D on line 22, then follow the simplified rule for full-time counts in Part III. Keep your documentation that shows you qualified.

Data Gathering And Documentation Checklist

Mirror the form, pull from systems of record, and keep your proofs.

- Employer identity, legal name, EIN, address, contact name, phone.

- 1095-C totals, by batch and in total for the ALE member.

- Monthly full-time counts, total employee counts, and coverage threshold indicator for each month.

- Aggregated ALE Group indicator, and list of related members with EINs.

- Proof of furnishing compliance, either copies sent by the due date or the request-only website notice posted by the due date and retained through October 15, plus logs of any requests fulfilled.

Retain AIR acknowledgments, extension requests, and any CP notices with your responses for at least three years, or keep the ability to reconstruct data for that period.

Common Errors And How To Avoid Them

- Two Authoritative boxes checked. Use only one Authoritative 1094-C per ALE member. Double-check line 19 before you transmit.

- Counts that do not tie. Reconcile Part III to eligibility and payroll, and reconcile line 18 to the actual 1095-Cs.

- Group confusion. Each ALE member files its own Authoritative 1094-C. The group does not file a combined Authoritative return.

- Missed e-file obligation. Hitting 10 total information returns across the business triggers electronic filing, even if you have only a handful of ACA forms.

A Note On Process And People

Delivery often breaks under peak load, which is why ACA season becomes overtime. Put ACA reporting on SOPs with versioned workpapers, a defined preparer to senior to reviewer chain, and a locked calendar. If you need to expand capacity without losing control, a disciplined offshore partner can operate inside your systems, follow your templates, and protect reviewer time. That is the kind of delivery discipline Accountably focuses on, used sparingly where it helps you hit clean filings with audit-ready documentation.

Resources And Tools For ACA Reporting Compliance

Start with primary sources, then add tools or vendors for scale.

- E-file overview and the 10-return aggregate rule, with links to e-file FAQs.

- AIR program page, including schemas, business rules, and 2025 acceptance details.

- Instructions for 1094-C and 1095-C, including Authoritative Transmittal rules, 98 percent offer method, deadlines, and record retention.

- Permanent 30-day furnishing extension for 6055 and 6056 statements.

- 2025 penalty amounts under sections 6721 and 6722 in the Internal Revenue Bulletin.

IRS Filing Deadlines, Quick Reference

- Furnish 1095-Cs by early March under the permanent 30-day extension, next business day if it falls on a weekend or holiday.

- File paper Forms 1094-C and 1095-C by February 28. E-file by March 31.

- Need more time to file with the IRS, submit Form 8809 by the original filing due date. Keep the approval with your records.

E-Filing Requirements, Quick Table

| Requirement | What To Do |

| Threshold | If you file 10 or more information returns in total, you must e-file |

| Platform | Use the IRS AIR system for 1094-C and 1095-C |

| Credentials | Apply for an ACA Transmitter Control Code and protect the login |

| Schemas | Validate against current-year AIR schemas to avoid rejects |

| Records | Save AIR receipts and acknowledgments for at least 3 years |

Request-Only Furnishing For 1095-C, What To Know

- Post a clear, conspicuous, and accessible notice by the furnishing due date, keep it up through October 15, and include contact details for requests.

- Send requested 1095-Cs by the later of January 31 of the following year or 30 days after the request, electronic delivery allowed with consent.

- This change affects furnishing, not IRS filing due dates, and state rules may still require automatic furnishing.

Authoritative Transmittal Steps, Recap

- Check line 19 on exactly one 1094-C, then complete Parts II–IV on that return.

- Enter the total 1095-Cs for the ALE member on line 18 of the Authoritative Transmittal.

- Complete Part III month by month, confirm coverage indicator, full-time count, and total employees.

- If applicable, list other ALE members in Part IV and indicate group status.

- Keep the reconciliation workbook and AIR acknowledgments with your files.

FAQs

What is Form 1094-C for?

It is the employer transmittal and summary for ACA reporting. You identify your ALE details, designate the Authoritative Transmittal, report the total 1095-Cs filed, and certify monthly offers and counts in Part III. The IRS uses this to test employer shared responsibility and reconcile premium tax credits.

Who gets a 1095-C?

Full-time employees of an ALE get a 1095-C for any month they were full-time, even if they did not enroll. Starting with returns after 2023, you may furnish 1095-Cs upon request if you post the required notice by the furnishing due date and keep it available through October 15. This change does not affect IRS filing due dates.

When is the 1094-C due?

For calendar-year reporting, paper filings are due February 28 and e-filings are due March 31 of the following year. If a due date falls on a weekend or legal holiday, use the next business day.

What are the penalties for not filing or for incorrect data?

For 2025, the general per-return penalty is 330, with lower amounts if corrected within 30 days and mid-tier amounts if corrected by August 1. Intentional disregard removes caps and increases the per-return amount. Verify current-year figures before filing.

Conclusion

You do not need a bigger team to get 1094-C right. You need a steadier system. Start with a single Authoritative Transmittal, a clean monthly headcount file, and an employee-level tie out you can explain six months from now. Build your calendar around early March furnishing, whether automatic or request-only with a posted notice, and March 31 e-file. Save proofs for everything.

If you want help building that steady system, look for partners who work inside your templates, follow documented SOPs, and protect reviewer time. That is how you clear ACA season without overtime, and how your 1094-C gets accepted the first time.

Simplify Delivery, Improve Margins, Stay in Control.

Offshore support that works exactly like your in-house team.

💼 Let’s Talk