Scale Your CPA Firm Without Adding Headcount

Build your offshore team that works your way, trained, compliant, and white-labeled under your firm.

👉 Book a Discovery Call

The e‑file rule had changed, and their plan to mail a few paper returns would not fly. They crossed the 10‑form threshold once W‑2s and 1099s were counted together. A quick pivot kept them on schedule and off the penalty list. That small catch made a big difference, and it is why a practical, current guide matters.

Use your 1095‑C as a reference, not a filing attachment. Keep it with your tax records and share details with your preparer if needed.

Key Takeaways

- Form 1095‑C reports your employer’s coverage offer and your eligibility by month if your employer is an Applicable Large Employer, generally 50 or more full‑time or full‑time equivalent employees.

- For 2024 coverage, employees must receive 1095‑C by Monday, March 3, 2025, since March 2 falls on a Sunday. Paper filings are generally due February 28, 2025, and e‑filings March 31, 2025.

- The e‑file threshold is now 10 or more total information returns for the year, aggregated across types, which captures ACA forms, W‑2s, and 1099s.

- Part I shows employer and employee identifiers. Part II shows Line 14 offer codes, Line 15 lowest‑cost self‑only premium, and Line 16 affordability or safe harbor codes. Part III appears only for self‑insured plans to list covered individuals.

- Good‑faith penalty relief ended. Penalties apply if you file late or incorrect forms, though reasonable‑cause relief may apply. For returns due in 2025, the tiers are $60, $130, $330, with $660 for intentional disregard.

Last verified for 2025 dates and rules on October 23, 2025.

Hundreds of Firms Have Already Used This Framework.

Join the growing list of CPA and accounting firms using Accountably’s Offshore Playbook to scale faster.

💬 Get Your FREE Playbook

👉 Visit Jugal Thacker’s LinkedIn

Send him a connection request and message “Playbook” to get your copy.

What Form 1095‑C Is, And Why You Receive It

Form 1095‑C is the employer’s annual report to you and the IRS about the health coverage your employer offered. If you worked full‑time for one or more months during the year at an Applicable Large Employer, you should get one, even if you declined coverage. The IRS uses these data to administer the employer shared responsibility rules, and to help determine your premium tax credit eligibility if anyone in your household bought Marketplace coverage. You keep the form for your records, you do not attach it to your tax return.

You may see this form arrive alongside W‑2 season, and in years when the deadline lands on a weekend or holiday, the due date shifts to the next business day. For the 2024 calendar year, the permanent furnishing extension places the employee copy deadline on March 3, 2025. Filing with the IRS follows a different calendar, detailed below.

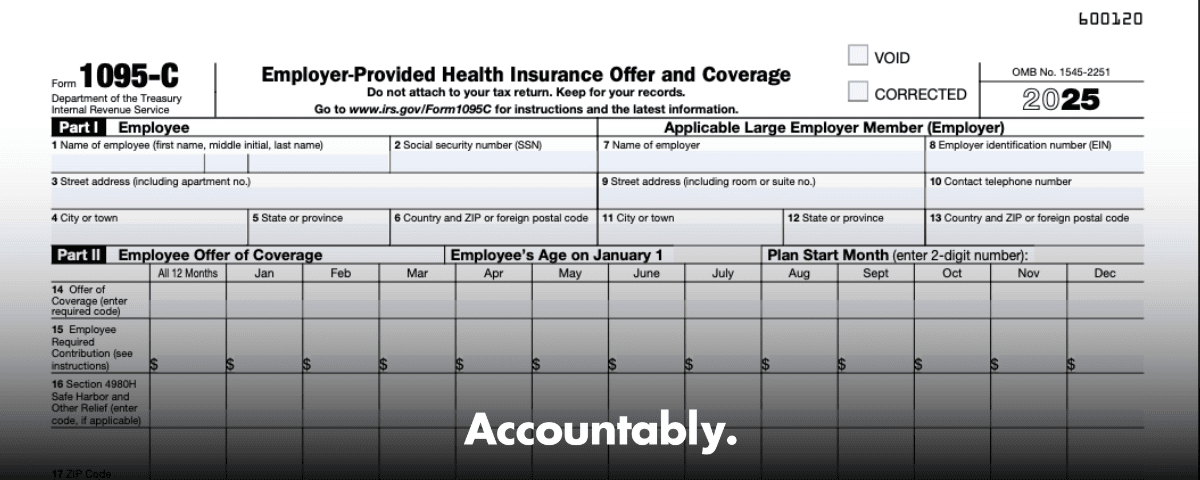

What You Will See On The Form

- Part I, Employer and Employee: employer legal name, EIN, address, and your name, TIN, and address.

- Part II, Offer and Affordability:

- Line 14, a monthly code that describes the coverage your employer offered to you, your spouse, and dependents.

- Line 15, your employee cost for the lowest‑cost self‑only plan that meets minimum value for months an offer applied.

- Line 16, a monthly code showing any affordability safe harbor or other relief the employer used.

- Part III, Covered Individuals, appears only if your employer is self‑insured, listing each covered person and the covered months.

If you enrolled in Marketplace coverage, you will also work with Form 1095‑A and reconcile advance credits on Form 8962. The 1095‑C helps the IRS confirm whether an employer offer affected eligibility for those credits.

Improve Margins Without Compromising Quality

Offshore staffing helps firms deliver more, scale faster, and stay compliant, without adding local headcount.

👉 Book a Discovery CallWho Must Receive It

You should receive a 1095‑C if you averaged at least 30 hours per week as a full‑time employee for one or more months, or if you were otherwise eligible for the employer plan during the year. Employers within a controlled group report at the ALE member level, so multi‑entity organizations still furnish forms for each full‑time employee.

Some employees worry when the form arrives after they have started their tax return. The IRS notes you can file without waiting for Forms 1095‑B or 1095‑C, although if you expect a 1095‑A from the Marketplace, you should wait for it. Keep your 1095‑C with your records.

Deadlines And How Filing Actually Works

There are two timelines to manage, one for furnishing copies to employees, and another for filing with the IRS using the 1094‑C transmittal.

- Furnish employee copies by March 2 most years, or the next business day when March 2 falls on a weekend or holiday. For 2024 forms, that date is March 3, 2025. This extension is now permanent.

- File with the IRS by February’s end on paper or by March 31 electronically. For 2024 forms, paper is due February 28, 2025, and e‑file is due March 31, 2025.

Quick 2025 Calendar For 2024 Forms

| Requirement | 2025 date for 2024 calendar year forms |

| Furnish 1095‑C to employees | March 3, 2025 |

| File 1094‑C/1095‑C on paper | February 28, 2025 |

| E‑file 1094‑C/1095‑C | March 31, 2025 |

Several state portals, agencies, and large employers publish the same set of dates for 2025, which provides a helpful cross‑check when planning internal mailings and e‑file windows.

E‑File Threshold And Systems

The IRS reduced the e‑file threshold from 250 to 10, effective for information returns due on or after January 1, 2024. The 10 is an aggregate count across return types, so an employer with a mix of W‑2s, 1099s, and ACA forms will likely need to e‑file. If you must e‑file, corrections must also be e‑filed.

ACA forms transmit through the AIR system, not FIRE. The IRS publishes current AIR specs and business rules in Publications 5164, 5165, 5258, and 5308, updated for processing year 2025. Confirm your software is using the TY2024 schema for 2024 forms and that your team has current TCC enrollment.

Your Transmittal, Form 1094‑C

Form 1094‑C is the cover file to the IRS. It summarizes your ALE member status, certifies offers of coverage, and reports headcounts. Paper filings are generally due at February’s end and e‑filings by March 31. You include 1094‑C with your 1095‑C batch, and if you e‑file due to the 10‑form rule, the entire submission, including corrections, should be electronic unless you have an approved waiver.

Inside Part II, Code Basics You Will Use

Offer codes can look cryptic, so here are a few you will see most often. Always use the official instructions for the full list.

| Line 14 code | What it means, in plain English |

| 1A | Qualifying Offer, affordable under the federal poverty line safe harbor, MEC with minimum value for employee, offer to spouse and dependents, no need to complete Line 15 when used correctly. |

| 1E | Offer of MEC providing minimum value to employee, plus offer to spouse and dependents. |

| 1H | No offer of coverage for the month. |

| 1G | Covered as a non full‑time individual all 12 months, for self‑insured reporting only. |

The IRS Q&A on employer reporting explains when a 1A Qualifying Offer may allow a simplified statement, and when self‑insured enrollment requires furnishing the full form.

Line 15 shows the employee share for the lowest‑cost self‑only option that provides minimum value, when required. Line 16 shows whether your employer used an affordability safe harbor, among other relief codes. Accurate coding reduces back‑and‑forth and audit risk.

Affordability For 2025 Plan Years

For plan years beginning in 2025, the employer affordability required contribution percentage is 9.02%. That percentage applies to W‑2, rate‑of‑pay, and federal poverty line safe harbors. For non‑calendar plans starting in 2025, apply 9.02% beginning on the start of that plan year.

Practical tip. If you rely on the federal poverty line safe harbor, document your monthly premium cap calculation and the FPL table used for the applicable plan year, then save the worksheet with your 1095‑C support file.

Penalties, Corrections, And What Changed

The IRS ended transitional good‑faith relief. If a form is late or incorrect, standard information return penalties under sections 6721 and 6722 apply unless you qualify for reasonable‑cause relief. For returns due in 2025, the per‑form tiers are $60 if corrected within 30 days, $130 if corrected by August 1, $330 if corrected after August 1 or not filed, and $660 for intentional disregard. Annual caps vary by employer size.

For 2026 due years, the top tier increases to $340, and intentional disregard rises to $680. Plan ahead because inflation adjustments shift these numbers.

If you are required to e‑file and do not, the IRS can assess a separate penalty for failing to e‑file, on top of late or incorrect filing penalties. Waivers are available via Form 8508, but request them early and keep the approval in your records.

Affordability Safe Harbors You Will Actually Use

- W‑2 wages safe harbor. You cap the employee’s required contribution so it does not exceed 9.02% of Box 1 W‑2 wages for the year.

- Rate‑of‑pay safe harbor. You cap the monthly contribution at 9.02% of hourly rate times 130, or 9.02% of salary for salaried employees, adjusted for plan year mechanics.

- Federal Poverty Line safe harbor. You cap the monthly contribution so it does not exceed 9.02% of the applicable annual FPL for a household of one, divided by 12. Track the HHS FPL table corresponding to your plan year.

These safe harbors let employers determine affordability without knowing each employee’s household income. Document the method, premium caps, and any midyear rate changes.

States With Their Own Mandates

Several jurisdictions maintain individual coverage mandates that may trigger separate reporting to states or the District of Columbia. California, Massachusetts, New Jersey, Rhode Island, and DC have such rules. Confirm whether you must file state forms or furnish a state version of coverage statements to residents.

A Practical 1095‑C Prep Checklist

- Reconcile HRIS eligibility, payroll deductions, and carrier enrollment early in January.

- Validate Line 14 logic against your plan’s eligibility and dependent rules.

- Confirm Line 15 amounts for every month an offer exists, especially for midyear hires, leaves, and rate changes.

- Select one affordability safe harbor per employee group and document it.

- Test your AIR transmission credentials and schemas in advance of production windows.

- Stage a sample file, then run error resolution workflows before the real deadline.

- Retain consent logs, access logs, and mailing proofs for furnished statements.

Small hiccups that delay e‑file by even a day can push you into higher penalty tiers. Build a buffer week, publish an internal codebook, and lock your SOP before the crunch.

Common Coding Pitfalls We See

- Using 1E when a spouse was not actually offered coverage for a month.

- Leaving Line 15 blank when 1A was not used.

- Coding 1H in a month that had COBRA for a full‑time active employee, instead of the correct code for an offer that met minimum value.

- Missing 1G on self‑insured statements for part‑time or non‑employee coverage when the individual was enrolled all 12 months.

When in doubt, walk through the IRS examples in the official instructions and align your templates to those examples.

FAQs

Do I file Form 1095‑C with my tax return?

No. Keep it with your records. The 1095‑C supports IRS administration of employer rules and can help confirm premium tax credit eligibility, but you do not attach it to your 1040.

What if I do not get my 1095‑C before I file?

You can generally file your return without waiting for 1095‑C. If you expect a 1095‑A from the Marketplace, wait for that one. Keep your 1095‑C when it arrives and share details with your preparer if requested.

Why does Line 15 not match what I pay?

Line 15 shows the lowest‑cost employee‑only premium for the plan that meets minimum value, not your chosen plan or family coverage. It is there to test affordability, not to mirror your exact payroll deduction.

Which months matter for my eligibility?

Each month stands on its own. Lines 14 to 16 are completed for every month, so midyear hires, terminations, leaves, and waiting periods will appear as month‑by‑month differences.

Where can I find official forms and instructions?

Use the IRS “About Form 1095‑C” page, the current 1094‑C/1095‑C instructions, and the AIR program resources for e‑file specs and testing.

For Employers, A Simple Process That Works

Here is a practical flow we use when helping teams finish strong.

- Decide your affordability safe harbor per employee group and set monthly caps for 2025 plan years using 9.02%. Save the workpaper with your support file.

- Build a one‑page code guide that maps HR events to Line 14 and 16 codes, then train reviewers with real employee examples.

- Lock your AIR setup early, confirm schema versions, and run a test transmission well before production windows open.

- Furnish employee copies by March 3, 2025, and track delivery. File with the IRS by February 28, 2025 on paper or March 31, 2025 electronically.

- Keep correction workflows ready. If you discover an error, fix it fast to stay in the lower penalty tier.

Where Accountably Fits

If you are an accounting or payroll team that is stretched thin, you do not need another stack of resumes. You need a repeatable way to turn messy inputs into clean 1095‑C files, on time, every time. Accountably integrates trained offshore staff into your process with SOP‑driven execution, structured workpapers, and layered review, which cuts revision cycles and protects reviewer time. We work inside common accounting and payroll systems, follow your templates, and maintain audit‑ready documentation so deadlines stop being a fire drill. Use this only if you want capacity without chaos.

Closing Thoughts

Form 1095‑C looks small, yet it carries real compliance weight. If you are the employee, hang on to it and use it as a reference. If you are the employer, lock your deadlines, code with care, and e‑file through AIR if you cross the 10‑form threshold once all information returns are counted.

When you build a simple, documented workflow, March stops feeling like a cliff, and your team gets its evenings back.

If you want a one‑page checklist and a code‑mapping worksheet, tell me your plan year and how many entities you report for, and I will tailor a version you can use immediately.

Simplify Delivery, Improve Margins, Stay in Control.

Offshore support that works exactly like your in-house team.

💼 Let’s Talk