Scale Your CPA Firm Without Adding Headcount

Build your offshore team that works your way, trained, compliant, and white-labeled under your firm.

👉 Book a Discovery Call

The rules are clear, the schedules are firm, and a few small misses can snowball into notices and penalties. The good news, you can build a workflow that is calm, accurate, and on time.

Key Takeaways

- Form 1097-BTC reports annual tax credit amounts from specified tax credit bonds so recipients can claim credits on federal returns.

- File a separate form once a recipient’s calendar year credit from a bond reaches 10 or more. Issuers, authorized agents, and intermediaries must file.

- Furnish recipient statements quarterly, then furnish the annual statement by February 15 of the following year.

- File Copy A with the IRS by February 28 if eligible to paper file, or by March 31 if you e-file. If you file 10 or more information returns in aggregate, you must e-file.

- Accuracy hinges on complete monthly entries, correct bond type selection, CUSIP or unique ID, and consistent issuer and recipient TINs and addresses.

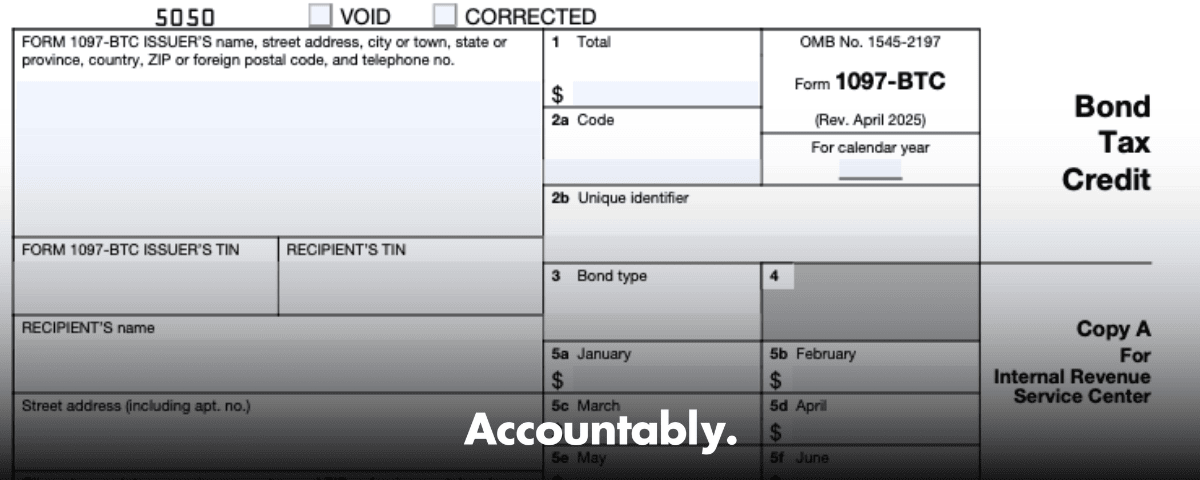

What Is IRS Form 1097-BTC

At its core, Form 1097-BTC is the information return for reporting bond tax credits that arise on specified tax credit bonds, so recipients can claim those credits on their federal returns. Even though certain statutory authorities for new issuance ended after December 31, 2017, many qualifying bonds remain outstanding, which means credit reporting continues for years.

In one line Form 1097-BTC tells recipients, and the IRS, exactly how much bond tax credit they are allowed for the year, supported by monthly entries that tie to credit allowance dates.

Hundreds of Firms Have Already Used This Framework.

Join the growing list of CPA and accounting firms using Accountably’s Offshore Playbook to scale faster.

💬 Get Your FREE Playbook

👉 Visit Jugal Thacker’s LinkedIn

Send him a connection request and message “Playbook” to get your copy.

Which bonds are in scope today? Common categories include new clean renewable energy bonds, qualified energy conservation bonds, qualified zone academy bonds, qualified school construction bonds, clean renewable energy bonds, and Build America Bonds, Tax Credit. Issuers, or their authorized agents, must file a separate Form 1097-BTC per bond, and for multi‑maturity issues, each maturity is reported separately. Intermediaries that further distribute credits, such as brokers, mutual funds, partnerships, and certain trusts or estates, aggregate credits and file one form per recipient or account.

A quick but important accounting note, the credit allowed to holders is treated as interest income for the recipient and is typically reported on Form 1099‑INT or 1099‑OID by the payor of interest, while Form 1097‑BTC reports the credit itself. That distinction trips teams up, so document it in your SOPs.

Who Must File and When Filing Is Required

You must file Form 1097‑BTC if, during the calendar year, you are an issuer of a tax credit bond, or an authorized agent, and you allow or distribute credits of 10 or more to a recipient. Nominees and intermediaries, including brokers, partnerships, trusts, estates, RICs, and REITs that receive credits and further distribute them also must file.

Improve Margins Without Compromising Quality

Offshore staffing helps firms deliver more, scale faster, and stay compliant, without adding local headcount.

👉 Book a Discovery CallHere is how the calendar works in practice.

Quarterly recipient statements

- For each credit allowance date that falls in a quarter, you furnish a recipient statement on or before the 15th day of the second calendar month after the quarter closes, for example May 15 for Q1, August 15 for Q2, and November 15 for Q3. Adjust when a due date lands on a weekend or federal holiday.

- You do not send a stand‑alone Q4 statement. Instead, you furnish the annual statement, which includes all months, by February 15 of the following year.

IRS annual filing

- Paper Copy A with Form 1096 is due February 28 in most years, with the date shifting when it falls on a weekend or holiday.

- Electronic filing is due March 31. If you will file 10 or more information returns in aggregate for the year, you must e-file. Form 1097‑BTC files through the IRS FIRE system.

Deadline table you can post to your calendar

| Item | Due date | Notes |

| Q1 recipient statement | May 15 | January through March credits, adjust if weekend or holiday |

| Q2 recipient statement | August 15 | April through June credits |

| Q3 recipient statement | November 15 | July through September credits |

| Annual recipient statement | February 15 (following year) | Includes all months and the yearly total |

| IRS paper filing | February 28 | Copy A with Form 1096, if eligible to paper file |

| IRS e-file | March 31 | Required if filing 10 or more information returns in aggregate |

How Bond Tax Credits Accrue Across the Year

Credit allowance dates drive your monthly entries. For qualified tax credit bonds and clean renewable energy bonds, the credit allowance dates are March 15, June 15, September 15, and December 15, plus the last day the bond is outstanding. For Build America Bonds, Tax Credit, the credit allowance dates are the interest payment dates. In many cases, each quarter represents 25 percent of the annual credit, with proration if the bond is issued, redeemed, or matures during the quarter. That is why accurate month‑by‑month reporting in boxes 5a–5l matters so much.

If you need a mental model, think of the annual credit as a pie. Most quarters get a quarter of the pie, and if your bond enters or exits during a quarter, you slice that quarter’s piece to match the days outstanding. The annual amount in box 1 must tie to the total of those monthly entries.

The Data You Need Before You Start

Strong filings start with tight data. Use this checklist before you touch the form.

- Issuer legal name, address, and TIN, exactly as they appear in IRS records.

- Recipient legal name, address, and TIN. Do not truncate TINs on Copy A to the IRS. Truncation is permitted on recipient statements under the general information return rules.

- Bond type, as defined in the instructions, and the correct check box selection.

- Box 2a code and Box 2b unique identifier. If you are the bond issuer or its agent, Box 2a is code C, and Box 2b generally must reflect the CUSIP for the bond or stripped coupon if a CUSIP exists.

- Monthly credit amounts for boxes 5a–5l, and the annual total for box 1 that reconciles to the sum of the monthly entries.

- Contact details that match what recipients and the IRS will see on statements.

Pro tip from the field, keep a simple mapping sheet that ties each CUSIP and maturity to the correct bond type selection and internal account. It reduces last minute guesswork and keeps reviews quick.

Step‑by‑Step, How to File Electronically

If you cross the aggregate 10‑return threshold, you must e-file. For Form 1097‑BTC, that means the IRS FIRE system. Here is a clean workflow teams follow.

- Get access and specs

- Confirm your FIRE credentials are current and your software aligns with Publication 1220 specs for electronic filing of Forms 1097, 1098, 1099, 3921, 3922, 5498, and W‑2G. If a vendor or service bureau transmits for you, confirm their TCC and service levels in writing.

- Prepare the file

- Validate issuer and recipient TINs, populate the right bond type, and include the CUSIP or unique identifier. Keep your monthly boxes complete, including proration for partial quarters. Run automated field checks to catch missing or conflicting data.

- Schedule transmission

- Target a transmission window at least a week before March 31, and keep time for error resolution. If you qualify to paper file, remember Copy A with Form 1096 is due February 28 in most years, with adjustments when dates land on weekends or holidays.

- Furnish recipient statements

- Deliver quarterly statements by May 15, August 15, and November 15, then furnish the combined annual statement by February 15. If you furnish electronically, follow the consent rules and keep an audit trail.

- Extensions and corrections

- If you need more time to file with the IRS, request an extension with Form 8809, which is generally automatic for most information returns. If you discover errors, follow the correction procedures in the General Instructions for Certain Information Returns and in the 1097‑BTC instructions, rather than voiding and reissuing at random.

Penalties, At a Glance, and How to Avoid Them

Penalties for missing or incorrect filings add up quickly. A common framework looks like this for information returns and payee statements, with inflation‑adjusted amounts each year. Always confirm the current year amounts before filing.

Penalty tiers for information returns and payee statements

| Scenario | Per‑form penalty | Notes |

| Corrected within 30 days | $60 | Lowest tier |

| Corrected after 30 days and on or before Aug 1 | $130 | Mid tier |

| Filed or furnished late after Aug 1, or not filed | $330–$340 | Final tier, varies by year |

| Intentional disregard | $660+ or a percentage of the amount that should have been reported | No maximum applies |

Two practical ways to avoid penalties, build a monthly reconciliation that locks each credit allowance date to a recipient record, and calendar the quarterly furnishing dates plus a two day buffer. If you have a heavy filing portfolio, schedule a mid March e‑file dress rehearsal to catch any formatting or TIN issues before the March 31 deadline.

Common Filing Patterns That Cause Notices

- Reporting only the annual total, but skipping the monthly boxes 5a–5l. The IRS expects both, and the monthly entries should reconcile to box 1.

- Missing CUSIP in box 2b when a CUSIP exists, or using the wrong code in box 2a. Issuers and their agents must show code C in box 2a.

- Forgetting the quarterly recipient schedule, then cramming Q1 through Q3 at year end. The instructions require quarterly furnishing, with a combined annual statement for Q4.

- Filing on paper even though you cross the 10‑return aggregate threshold. If you file 10 or more information returns in aggregate, you must e-file, and Form 1097‑BTC uses FIRE.

Quick reminder A quiet month end beats a frantic quarter end. If you reconcile each credit allowance date shortly after it happens, your May, August, and November deadlines become routine instead of a fire drill.

How Monthly Credits Flow Into Boxes 5a–5l

The instructions give you a clean two step method. First, compute the annual credit based on the applicable rate and face amount for the period the bond is outstanding. Second, for qualified tax credit bonds and clean renewable energy bonds, enter 25 percent of that annual amount in the quarter the credit allowance date falls, prorated when the bond enters or exits during the quarter. The result fills your monthly boxes 5a–5l and then rolls to the annual total in box 1.

Here is a quick example you can adapt. Suppose a qualified energy conservation bond is outstanding the entire year. You would enter one quarter of the annual credit in March, June, September, and December. If the bond matured on March 23, you would prorate the March quarter based on the days outstanding, then reflect that proration in your monthly boxes and carry the tie‑out to the annual total. Keep your proration worksheet with the return.

Map months to boxes for the annual filing

- 5a through 5l represent January through December.

- If a credit allowance date falls in March, you will typically show the first quarter’s 25 percent in the March box, with zeros for January and February, unless proration applies.

- For annual filing, you complete all monthly boxes and box 1, then furnish the annual recipient statement by February 15 and file with the IRS by February 28 on paper or March 31 electronically.

Documentation your reviewers expect to see

- A schedule tying each CUSIP and maturity to the monthly amounts entered.

- A proration worksheet for any bond issued, redeemed, or matured mid quarter.

- A tie‑out showing the sum of boxes 5a–5l equals box 1.

- Evidence of TIN validation and a log of quarterly furnish dates.

Paper Filing vs E‑file, Choosing the Right Path

Most filers should plan to e-file. If you file 10 or more information returns in aggregate, you must e-file under the final regulations, and Form 1097‑BTC is one of the forms you transmit through the FIRE system. Smaller filers under the threshold can choose to file on paper by sending Copy A with Form 1096. The instructions provide a scannable Copy A for eligible paper filers.

If you are new to FIRE, build lead time for testing and for any service bureau onboarding steps. Confirm that your software builds a 1097‑BTC file that meets Publication 1220 specs, and verify how your provider handles rejections, retransmissions, and corrections near deadline.

Recipient statement formatting and TIN display

You may truncate a recipient’s TIN on the statement you furnish to them when you follow the general information return rules. Do not truncate on Copy A to the IRS. Keep your statement consistent with the quarterly schedule, then roll everything into the annual statement by February 15.

Internal Controls That Keep You On Time

- Create a control calendar that includes the three quarterly furnishing dates, the annual February 15 recipient statement, and the IRS filing deadline that applies to you.

- Reconcile credits monthly instead of quarterly, then you can furnish earlier and reduce rush work.

- Use a standardized file naming convention that embeds CUSIP, maturity, quarter, and version.

- Require a short reviewer checklist, for example CUSIP present, Box 2a code correct, monthly boxes populated, box 1 ties to the months, TIN present and verified, quarter date in range.

- Keep a corrections log with who found the issue, what changed, and when you retransmitted or refurnished, so future reviews are faster.

Field note The quietest 1097‑BTC season happens when the monthly numbers are ready by the first business day after each credit allowance date. Everything else becomes a simple mail merge and a timely upload.

FAQs

Who must receive a Form 1097‑BTC from me?

Each person who is allowed a tax credit as a holder, directly or indirectly, of a tax credit bond or a stripped credit coupon during the year in an amount of at least 10 must receive a form. That includes recipients you pay directly and credits you pass through via nominees or intermediaries.

I am the bond issuer. Do I file one form per recipient or per bond?

As an issuer or agent, you file a separate Form 1097‑BTC for each bond, and for multi‑maturity issues you report each maturity separately. Intermediaries that redistribute credits file one form per recipient or account, aggregating credits across bonds.

What are the quarterly recipient deadlines, exactly?

For Q1, furnish by May 15, Q2 by August 15, and Q3 by November 15. You do not send a stand‑alone Q4 statement. Instead, furnish the annual statement, which includes all months and the total, by February 15 of the following year. Adjust when a date falls on a weekend or holiday.

When do I file with the IRS?

File Copy A with the IRS by February 28 if you are eligible to file on paper with Form 1096, or by March 31 if you e-file. Dates shift to the next business day when they land on a weekend or holiday.

Must I e-file if I only have a handful of 1097‑BTC forms?

You must e-file if you file 10 or more information returns in aggregate for the year across covered types. Form 1097‑BTC files through the FIRE system. If you are under the threshold, you may file on paper or electronically.

How do monthly boxes 5a–5l relate to the annual total in box 1?

Boxes 5a–5l capture the credit amounts for each month of the year, driven by the credit allowance dates. Box 1 is the sum of those monthly amounts for the calendar year. For many bonds, each quarter equals 25 percent of the annual credit, prorated if the bond is issued, redeemed, or matures mid quarter.

Can I truncate recipient TINs?

You can truncate the recipient’s TIN on statements you furnish to recipients when following the general information return rules. Do not truncate on Copy A that you file with the IRS.

What are the penalties if I am late or make mistakes?

Typical tiers are $60 if corrected within 30 days, $130 if corrected after 30 days and on or before August 1, and about $330–$340 if filed or furnished after August 1 or not corrected. Intentional disregard carries higher amounts and no maximum. These figures are inflation‑adjusted, so always confirm the current year before filing.

Are the underlying tax credit bond programs still active?

New issuance for several programs ended after 2017, but outstanding bonds continue to generate credits that must be reported for as long as they remain outstanding.

A Simple SOP You Can Adopt This Week

- Name a single owner for the 1097‑BTC calendar, with backup coverage.

- Build a quarterly packet that includes a recipient list, CUSIPs, maturities, monthly credit amounts, and reviewer sign off.

- Submit a test e-file to FIRE in mid March if you expect to e-file, so any rejects are cleared before March 31.

- Keep a one page job aid that lists box‑by‑box rules, the code C requirement for issuers in box 2a, and the CUSIP requirement for box 2b when applicable.

Keep it simple The best control is the one your team actually follows. One calendar, one checklist, one reviewer sign off per quarter.

Minimal‑Drama Corrections

Mistakes happen. When you find an error on a recipient statement, correct the amount on the annual statement and explain the change to the recipient. For IRS filings, follow the correction procedures in the General Instructions for Certain Information Returns and the 1097‑BTC instructions. Avoid voiding and reissuing unless the instructions tell you to do so.

If you are up against a deadline and data is incomplete, file what is accurate and correct promptly, rather than waiting so long that you miss the window. This often reduces the penalty exposure relative to a late or non‑filed return. The penalty framework rewards quick fixes made within 30 days after the due date.

How We See Teams Succeed, Year After Year

In my work with accounting leaders, trustees, and fund administrators, the standout performers do three things well.

- They treat 1097‑BTC like a monthly process, not a quarterly project.

- They document the connection between the bond’s credit allowance dates and the monthly boxes, which makes reviews fast.

- They e-file early, and they always have a plan for corrections.

Where Accountably fits

If your internal capacity is stretched and you need a disciplined way to produce accurate 1097‑BTC statements and files without slipping dates, a controlled offshore delivery model can help. At Accountably, we integrate trained teams into your workflow, use SOP‑driven execution, and maintain layered reviews so your preparers, seniors, and quality reviewers each do the right checks at the right time. You get predictable quarter deliverables, accurate annual files, and less partner time stuck in review. Use us where it makes sense for you, keep control of your workflow, and keep your standards high.

Compliance Note

This article is intended for informational purposes and reflects IRS guidance available as of October 28, 2025. Because penalties, due dates that fall on weekends or holidays, and e-file thresholds can change, always confirm the current year’s IRS instructions for Form 1097‑BTC and the General Instructions for Certain Information Returns before filing. If you handle high volumes or complex distributions, consider a brief review with your tax counsel or compliance team.

Ready‑to‑Use Templates

- Quarterly furnishing checklist, one page

- Monthly boxes 5a–5l tie‑out schedule

- Proration worksheet for bonds issued or redeemed mid quarter

- Reviewer checklist, two minutes per form

If you want editable versions, tell me your preferred format and how your internal review steps work, and I will tailor them to your workflow.

Final Word

You do not need drama to file Form 1097‑BTC. Put your calendar on paper, reconcile monthly, confirm CUSIPs and codes, and e-file early if you cross the threshold. Add a weekly ten minute review during credit season, and the May, August, November, and February dates stop being stress points. Precision is not fancy, it is a habit, and it keeps your recipients informed and the IRS satisfied.

Simplify Delivery, Improve Margins, Stay in Control.

Offshore support that works exactly like your in-house team.

💼 Let’s Talk