Scale Your CPA Firm Without Adding Headcount

Build your offshore team that works your way, trained, compliant, and white-labeled under your firm.

👉 Book a Discovery Call

Good news, you can get this right with a short checklist and a few guardrails.

Key Takeaways

- Form 1098‑E shows how much student loan interest you actually paid, and the amount appears in Box 1.

- Servicers must furnish the form by January 31 for any year you paid $600 or more in interest to that servicer. You might receive more than one form.

- The 1098‑E is an information statement. The interest is potentially deductible up to $2,500, subject to income limits and filing‑status rules. It is claimed as an adjustment to income, so you do not need to itemize.

- If you paid less than $600 to a servicer and did not receive a form, you can still get the exact interest from your servicer portal and use it when you file.

- For the 2024 tax year filed in 2025, the deduction phases out when MAGI is between $80,000 and $95,000 for single filers, and $165,000 and $195,000 for joint filers. Always verify the latest thresholds before filing.

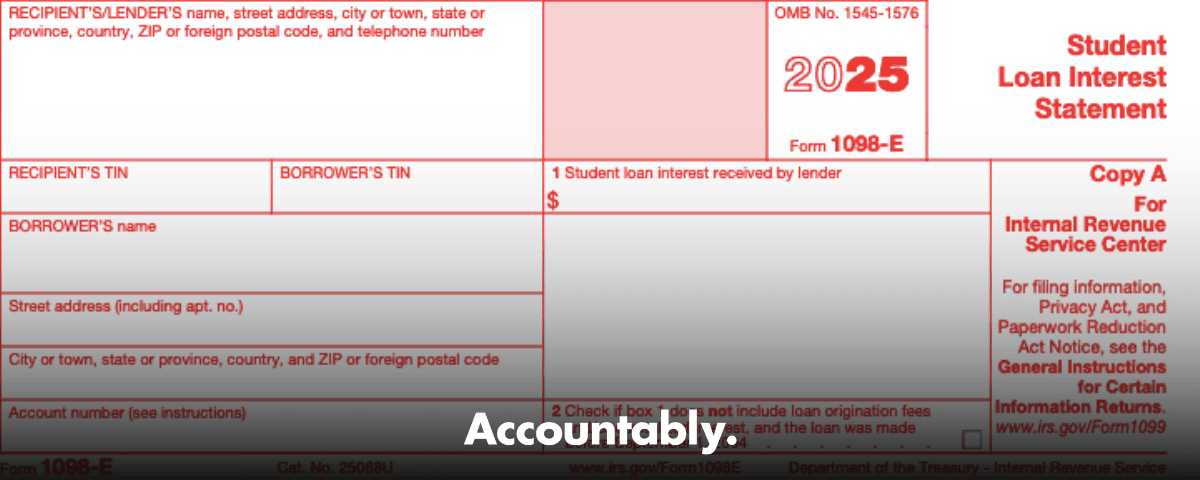

What Is Form 1098‑E?

Form 1098‑E, Student Loan Interest Statement, reports the interest you paid on qualified student loans during the calendar year. The number you care about lives in Box 1, and it reflects actual interest paid from January 1 through December 31, not principal or unpaid accruals. Use it as a source document when you prepare your federal tax return.

Why it matters. If you qualify, you can deduct up to $2,500 of student loan interest as an adjustment to income, which reduces your taxable income even if you take the standard deduction. That said, the deduction depends on your income, filing status, and other IRS rules, so the figure in Box 1 is not automatically deductible.

Hundreds of Firms Have Already Used This Framework.

Join the growing list of CPA and accounting firms using Accountably’s Offshore Playbook to scale faster.

💬 Get Your FREE Playbook

👉 Visit Jugal Thacker’s LinkedIn

Send him a connection request and message “Playbook” to get your copy.

Who Sends It and When

Your loan servicer, the company that processes your payments, must furnish a 1098‑E if you paid $600 or more of interest in the year. By IRS rules, the recipient copy must be furnished by January 31. If you worked with multiple servicers, each one that meets the $600 threshold will send a separate form. Many servicers post the PDF in your online account instead of mailing paper.

Didn’t get a form? Log in to each servicer portal and check the Tax Documents or 1098‑E section. For federal loans, if you are not sure who services your loans today, sign in at StudentAid.gov to see your current servicer and then grab the tax forms from that site. You can also call Federal Student Aid at 1‑800‑433‑3243 for help.

The $600 Rule, In Plain English

The $600 test applies per borrower and per servicer. If you paid at least $600 in interest to Servicer A, you get a 1098‑E from Servicer A. If you paid $600 to Servicer B, you get a second 1098‑E from Servicer B. You do not combine interest across servicers to force a form to be issued. If you paid less than $600 to a servicer, they are not required to furnish a form, but you can still pull the exact interest from your account for your taxes.

Improve Margins Without Compromising Quality

Offshore staffing helps firms deliver more, scale faster, and stay compliant, without adding local headcount.

👉 Book a Discovery CallQuick Scenario Table

| Scenario | Outcome |

| You paid ≥ $600 interest to a single servicer | That servicer furnishes a 1098‑E by Jan 31 |

| You paid < $600 interest to a single servicer | No 1098‑E required, get totals from portal |

| You had multiple servicers and paid ≥ $600 to each | Expect multiple 1098‑Es, one from each |

| You had multiple loans with one servicer | That servicer may issue one combined 1098‑E |

| Federal loans moved to a new servicer mid‑year | Each servicer may issue a form if its interest total is ≥ $600 |

Sources for the above table and rules include the IRS Instructions for Forms 1098‑E and 1098‑T and Federal Student Aid guidance.

Why You Might Have Two, Three, or Zero Forms

- Servicer changes during the year can split your interest across companies, which means multiple forms.

- Consolidation or refinancing can move your loans to a different servicer partway through the year. Each servicer applies the $600 test separately.

- If you never crossed $600 with any one servicer, you may receive no forms at all. You can still claim eligible interest using the totals in your online statements.

Pro tip from experience. I keep a short spreadsheet with each servicer name, the Box 1 amount, and the download date. It makes reconciliation easy if a form gets corrected or posting is delayed.

What Appears In Box 1, And How To Read It

Box 1 reports the total qualified student loan interest you actually paid during the calendar year to that servicer. It excludes principal, fees, and any unpaid interest that was capitalized but not yet paid. If one servicer handles several of your loans, Box 1 can reflect their combined interest for that borrower. If you have multiple servicers, each will show its own Box 1 total. Verify Box 1 against your payment history before you file.

Think of Box 1 as your starting line, not the finish. Eligibility rules still apply.

Multiple Loans, Multiple Servicers

When loans move or you pay different companies, you will need to total Box 1 across all 1098‑E forms you received. If a servicer did not issue a form because your interest there was under $600, add the exact amount from that account’s year‑end interest statement so your total reflects every dollar you paid. For federal loans, the StudentAid.gov Help Center explains that you can contact each servicer to obtain those numbers.

The Eligible Payment Period

Form 1098‑E covers interest you paid from January 1 to December 31 of the tax year. If you made an extra December payment, that can increase Box 1 for that year. If you made your January payment on December 31, that counts for the current year as well. Always align what you see in Box 1 with your posted payments for that exact calendar window.

How To Access Your 1098‑E Online

Start by confirming who services each of your loans. For federal loans, log in to StudentAid.gov to see your current servicer. For private loans, check your lender portal or your free annual credit report to find loan holders. Then download the form from each servicer’s Tax Documents section. If a servicer does not show a form because you paid under $600, look for an annual interest statement or transaction history and record the total.

Find Your Servicer, Step By Step

- Federal loans, sign in at StudentAid.gov and note the servicer listed on your dashboard.

- Go to each servicer’s site, open Documents or Tax Statements, and select the correct tax year.

- Download the PDF and save it with a clear file name, for example, “1098‑E_MOHELA_2024.pdf.”

- If you cannot find a posted form, request the interest total for the year. Servicers commonly publish guidance that confirms this process.

Quick Troubleshooting Tips

- Reset credentials early, since two‑factor authentication can slow you down near filing season.

- If your federal loans changed servicers, expect separate forms. Check messages for any notices about where tax documents are posted.

- Keep call notes with dates, agent names, and case numbers. Federal Student Aid’s contact center can help route you if you are stuck.

Timing And Delivery

The rule of thumb is simple. If you paid $600 or more of interest to a servicer, that servicer must furnish your 1098‑E by January 31. Electronic delivery counts if the servicer follows the IRS consent and access rules, which is why many borrowers find the form in their online account first. If January 31 falls on a weekend or holiday, the due date moves to the next business day.

If a form is missing on February 1, check your portal again, then contact the servicer and confirm your email and mailing preferences. Keep proof of your request.

Using 1098‑E For Your Tax Return

You will enter total student loan interest as an adjustment to income. The maximum potential deduction is $2,500, but it cannot exceed what you actually paid. The deduction phases out at higher income levels based on your filing status, and you cannot claim it if your status is married filing separately. Publication 970 provides the worksheet and rules, and Topic No. 456 gives a clear overview.

2024 Tax Year, Filed In 2025, Income Limits

For 2024 returns, the deduction phases out when MAGI is between $80,000 and $95,000 for single filers and between $165,000 and $195,000 for joint filers. Above those upper limits, the deduction is not allowed. Always check the latest IRS guidance in case thresholds change for the year you are filing.

Note, IRS pages are updated periodically. If you are filing for a different year, confirm the thresholds in the current Publication 970 or Topic No. 456 before you submit.

What‑How‑Wow, A Quick Framework

- What: Form 1098‑E reports student loan interest you paid, found in Box 1. It tells you what to consider for a potential deduction.

- How: Gather every 1098‑E across servicers, add Box 1 amounts, include under‑$600 interest from statements, then apply eligibility rules in Publication 970.

- Wow: Two small habits reduce mistakes. First, keep a one‑page tracker for servicers, Box 1 totals, and download dates. Second, save PDFs with consistent names so amended forms are easy to spot later.

A Borrower’s Mini‑Checklist

- Confirm all servicers in StudentAid.gov and private lender portals.

- Download every 1098‑E and save a copy to a secure folder.

- If a form is missing because you paid < $600, grab the annual interest total from the portal.

- Add up Box 1 amounts plus any under‑$600 interest to get your total paid.

- Enter the total in tax software or give it to your preparer. Use Publication 970 to check MAGI limits and the $2,500 cap.

- Keep records for at least three years with your return.

FAQs

What is a 1098‑E used for?

You use Form 1098‑E to document student loan interest you paid. If you qualify, you can deduct up to $2,500 as an adjustment to income, which can lower your taxable income even if you take the standard deduction.

Does entering a 1098‑E increase my refund?

Not automatically. The form itself does not trigger money back. If you qualify for the deduction, it can reduce taxable income, which may increase your refund or reduce what you owe, depending on your situation.

How much do I get back from a 1098‑E?

There is no fixed amount. The deduction is capped at $2,500 and limited by what you actually paid, your MAGI, and filing status. Your tax software or preparer will compute the impact based on your marginal rate.

What is the difference between 1098‑E and 1098‑T?

Form 1098‑E reports student loan interest paid. Form 1098‑T reports tuition and scholarship amounts used to claim education credits, such as the American Opportunity Tax Credit or Lifetime Learning Credit. They serve different purposes and come from different issuers. Check Publication 970 for details.

I changed servicers mid‑year. How many forms will I get?

One per servicer that received $600 or more in interest from you during the year. If no individual servicer crossed $600, you might receive no forms, but you can still use the interest totals from each account.

Common Pitfalls We See, And Easy Fixes

- Missing a second form after a mid‑year servicer transfer. Solution, search each portal for “Tax Documents” and filter by year.

- Assuming Box 1 equals your deduction. Solution, run the MAGI test in Pub 970 and respect the $2,500 cap.

- Waiting for paper. Solution, enroll in e‑delivery and download by early February. The IRS allows electronic furnishing with proper consent and access.

Light Touch For Firms And Pros

If you prepare returns, create a repeatable intake request. Ask clients to upload every 1098‑E, plus a year‑end interest statement for any servicer under $600. That one extra document closes the loop and prevents follow‑up. If your firm needs a structured, accountable way to standardize workpapers and quality checks across busy season, Accountably integrates disciplined SOPs and review layers with your systems. Use it only where it adds control, like intake checklists, workpaper standardization, and deadline tracking for tax forms such as 1098‑E. Keep it tight, keep it documented.

Final Notes, Accuracy, And Trust

- The IRS updated Topic No. 456 on October 9, 2025. Always check current guidance when you file, especially income thresholds.

- For 2024 returns filed in 2025, use the $80,000 to $95,000 single and $165,000 to $195,000 joint phaseout ranges from Publication 970, and verify changes for your filing year.

- If something looks off, contact your servicer and keep a dated record of the conversation. Federal Student Aid can help you identify your servicer or escalate issues.

Simplify Delivery, Improve Margins, Stay in Control.

Offshore support that works exactly like your in-house team.

💼 Let’s Talk