Scale Your CPA Firm Without Adding Headcount

Build your offshore team that works your way, trained, compliant, and white-labeled under your firm.

👉 Book a Discovery Call

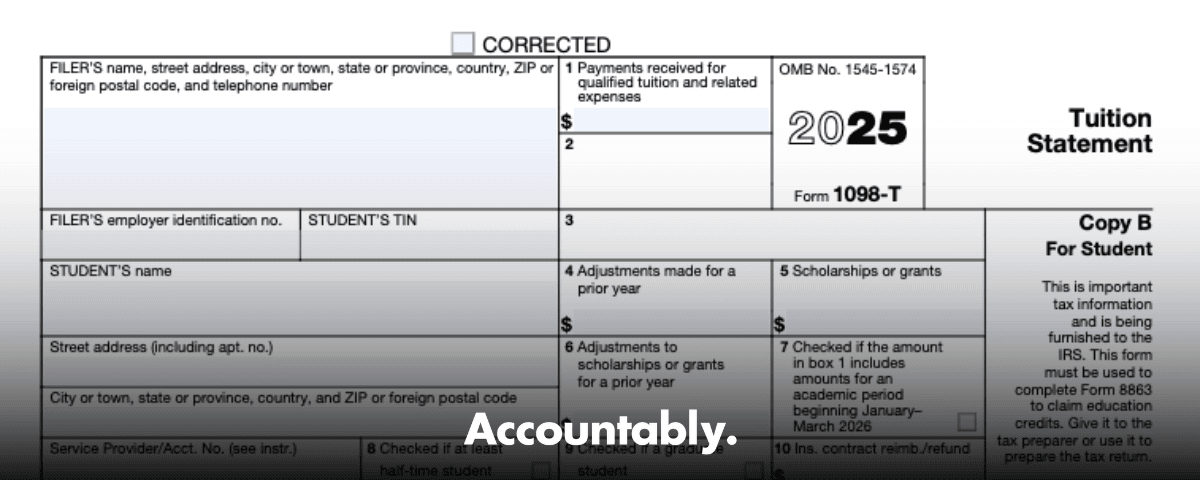

This guide walks you through Form 1098‑T in plain English, so you can claim the American Opportunity Credit or Lifetime Learning Credit with confidence. I will show you how each box works, how scholarships affect credits, and what to do if you never receive the form. I will also point out the specific rules that apply for the current filing season, including delivery deadlines and the January through March timing quirk. Where it helps, I cite the IRS directly.

Your school must furnish a 1098‑T each year a reportable transaction occurs, and most students receive it by January 31. For 2025 forms, that means by January 31, 2026.

Key Takeaways

- Form 1098‑T supports education credits. Box 1 shows payments received for qualified tuition and related expenses, from all sources, not reduced by scholarships in Box 5.

- Scholarships and grants in Box 5 usually reduce the expenses you can use for credits. Prior‑year adjustments appear in Boxes 4 and 6. Box 10 is for insurance reimbursements.

- For 2025 forms, Box 7 is checked if payments reported relate to an academic period beginning January through March of 2026. This timing rule matters for your credit year.

- Schools must furnish student copies by January 31, and they can deliver electronically with your consent. If you do not get a form but still qualify, the IRS outlines limited exceptions that allow you to claim a credit with solid records.

- You calculate the credit on Form 8863 after you determine adjusted qualified expenses. Special rules apply if a refund or scholarship changes a prior year.

What Is IRS Form 1098‑T, And Why It Matters

Form 1098‑T, Tuition Statement, reports tuition payments and certain adjustments so you can substantiate education credits on your tax return. Eligible educational institutions file it with the IRS and furnish a copy to you. If an insurer reimbursed tuition, the insurer may file a 1098‑T as well, which is why you can see Box 10 on the form.

Hundreds of Firms Have Already Used This Framework.

Join the growing list of CPA and accounting firms using Accountably’s Offshore Playbook to scale faster.

💬 Get Your FREE Playbook

👉 Visit Jugal Thacker’s LinkedIn

Send him a connection request and message “Playbook” to get your copy.

Beginning with current rules, schools report payments received in Box 1, not amounts billed. In practice, that means the number you see follows cash timing on your student account, including payments by you, a parent, or loan funds that the school applied to qualified tuition and required fees, minus any refunds of those same‑year payments. Scholarships are not netted in Box 1, they live in Box 5.

Snapshot, who receives 1098‑T: schools file for each enrolled student with a reportable transaction, except in specific situations like nonresident aliens, students with tuition fully covered by scholarships, or certain formal billing arrangements.

From a credits standpoint, the 1098‑T helps you complete Form 8863 for the American Opportunity Credit (AOC) or the Lifetime Learning Credit (LLC). Each credit has different eligibility rules, income phaseouts, and benefits, all spelled out in the IRS instructions.

Improve Margins Without Compromising Quality

Offshore staffing helps firms deliver more, scale faster, and stay compliant, without adding local headcount.

👉 Book a Discovery CallWho Should Expect A 1098‑T

You generally receive Form 1098‑T if you were enrolled and the school recorded a reportable transaction for qualified tuition and related expenses. You will not receive one if your qualified charges were entirely waived or entirely paid with scholarships or grants, or in a few other exceptions the IRS lists. Schools can deliver the form electronically if you have consented, or by mail if you have not. The deadline to furnish student copies is January 31 each year, which means January 31, 2026 for 2025 forms.

If you qualify for a credit but do not receive a form because the school is not required to furnish one, the IRS explains when you can still claim an education credit with proper documentation. In general, a 1098‑T is required, but there are exceptions.

Keep your student account ledger. If the 1098‑T has errors or is missing, your ledger is the fastest way to reconcile Box 1 payments and Box 5 scholarships.

How To Read The Boxes That Drive Your Credit

Payments Received

- What it shows, the total payments received during the calendar year for qualified tuition and related expenses, from all sources, reduced by any refunds of those same‑year payments.

- What it does not do, it does not subtract scholarships or grants. You use Box 5 for that.

- Timing tip, if Box 7 is checked, some of the payments in Box 1 relate to an academic period that begins in the first three months of the next year, which affects which tax year can claim the expense.

Practical example. You pay $3,000 in December for a spring term that begins in January. That $3,000 lands in Box 1 this year, and Box 7 should be checked. Whether you can count those dollars this year for AOC or LLC depends on the IRS prepaid expense rule in the credit instructions.

Scholarships And Grants, Boxes 5 And 6

- Box 5 lists scholarship and grant amounts the school administered or processed during the year. They generally reduce the pool of qualified expenses you can use for credits.

- Box 6 reports prior‑year scholarship adjustments, which can force you to revisit earlier returns.

Do not forget nonqualified spending. If part of a scholarship is used for room and board or other nonqualified costs, that portion does not reduce your credit expenses, but it can become taxable income to the student. See Publication 970 for details.

Enrollment Status, Boxes 8 And 9

- Box 8 indicates at least half‑time enrollment for one or more academic periods, which is a requirement for the AOC, among other rules.

- Box 9 shows graduate‑level enrollment. If it is checked, you may be ineligible for the AOC but still eligible for the LLC.

Quick filter. Undergraduate and half‑time can point you toward the AOC, graduate status often points toward the LLC, but always check the income limits and other criteria in the Form 8863 instructions.

When You Will Get Your Form And What To Do If You Don’t

Most schools post 1098‑T forms to student portals by late January, and they must furnish student copies by January 31. Electronic delivery requires your consent, otherwise a paper copy should arrive by mail. If you paid eligible charges and do not receive a form, contact Student Accounts or the bursar with your student ID and the tax year. If you still cannot obtain one, the IRS describes when you may claim a credit with other records.

| When | How you receive it | Your move |

| By January 31, 2026 | Student portal, if you consented | Download and save a PDF copy |

| By January 31, 2026 | Mail, if no electronic consent | Verify your mailing address |

| After January 31 | School files with IRS | Keep your copy with tax records |

| No form appears | You paid qualified charges | Ask bursar for a corrected or replacement copy |

If your form or account shows a refund or scholarship that changes a prior year, the Form 8863 instructions explain how to refigure that prior credit and report any additional tax in the year you received the refund.

What Counts As Qualified Expenses, And What Does Not

Qualified education expenses are tuition, required fees, and required course materials that the school bills as a condition of enrollment or attendance. Nonqualified costs include room and board, insurance, medical fees, transportation, and other personal expenses. Publication 970 and the 1098‑T instructions spell out the categories.

Quick Comparison Table

| Cost type | Qualified for credits? | Notes for compliance |

| Tuition and required fees | Yes | Must be required for enrollment or attendance |

| School‑billed required books or equipment | Yes | Only when the institution bills them as required |

| Room and board or meal plans | No | Treated as living costs, not qualified expenses |

| Health insurance or student health fees | No | Personal or medical cost category |

| Transportation and parking | No | Personal travel, not qualified |

| Optional activity fees | No | Unless the school designates them as required |

| Late fees or penalties | No | Not qualified by IRS rules |

If scholarships exceed qualified expenses, you usually cannot claim AOC or LLC for that student. If scholarships were used for nonqualified costs, that part may be taxable to the student, even though it does not reduce your credit base. Publication 970 covers the taxability of scholarships and how to report them.

Keep it clean. Start with Box 1 payments, subtract Box 5 scholarships that were used for qualified expenses, exclude all nonqualified costs, then move that adjusted number to your Form 8863 calculations.

How To Turn A 1098‑T Into A Credit On Your Return

Here is a simple workflow I use when helping family or clients.

1.Confirm eligibility.

- American Opportunity Credit, undergraduate, at least half‑time during the year, no more than four tax years claimed, additional rules apply.

- Lifetime Learning Credit, available for any level of postsecondary education, no half‑time requirement, but it is nonrefundable and has different income limits.

- Build your adjusted qualified expenses.

- Start with Box 1 payments received.

- Subtract the portion of scholarships and grants in Box 5 that were used for qualified expenses.

- Remove nonqualified costs completely.

- Consider Box 4 and Box 6 adjustments, and check Box 7 for the January through March rule.

- Use Form 8863.

- AOC equals 100% of the first $2,000 of adjusted qualified expenses plus 25% of the next $2,000, up to $2,500 per eligible student, subject to phaseouts.

- LLC equals 20% of up to $10,000 of adjusted qualified expenses per return, maximum $2,000, also with phaseouts. See the current instructions for income thresholds.

- Handle changes correctly.

- If you received a tuition refund after claiming a prior‑year credit, the instructions explain how to recompute the earlier credit and report any difference as additional tax in the year of the refund.

I keep a simple folder for each student, with the 1098‑T, the term ledger, proof of payments, and scholarship letters. If the IRS ever asks, you can show exactly how you computed adjusted qualified expenses.

Tip for accountants, standardized workpapers and checklists cut review time dramatically. On our side of the desk, the teams that label files consistently and tie Box 1 and Box 5 to the student ledger spend less time in rework and more time advising.

Timing Rules That Trip People Up

The January Through March Academic Period

If you pay tuition in December for a term that begins in January, February, or March, the school should check Box 7 on the 1098‑T. The credit rules treat that payment as if it relates to the earlier year, which is why you may be able to include a December payment for a spring term that starts in the first quarter of the next year. Form 8863 instructions include the prepaid expense guidance and examples.

No Form, Still A Credit, Sometimes

In general, a 1098‑T is required. However, the IRS explains limited exceptions, like when the institution is not required to furnish the form, or when you requested the form after January 31 but did not receive it before filing. You must still meet every other rule and be able to substantiate enrollment and payments.

Graduate Status And AOC

If Box 9 is checked, you are in a graduate program. That status disqualifies the student from the AOC, but the LLC may still apply if the income and expense rules are met.

Changes Over Time You Should Know

If you used a 1098‑T years ago, you may remember amounts billed in Box 2. That method is gone. Schools now report payments received in Box 1, with Box 2 reserved for future use. Today’s 1098‑T relies on Box 1, the scholarship and adjustment boxes, the enrollment indicators, and the insurance reimbursement box. The official 1098‑T pages and instructions reflect the current format.

TIN requirements also tightened. To claim the American Opportunity Credit, both the filer and the student must have valid taxpayer identification numbers by the due date of the return, and you need the school’s EIN on Form 8863. The current instructions make these requirements clear.

As always, income thresholds and examples for AOC and LLC are in the latest instructions and Publication 970. If you are reading this close to filing time, check the IRS page for any updates before you finalize your return.

Help, Disputes, And Getting A Corrected Form

Start with Student Accounts or the bursar. Ask for a detailed term‑by‑term ledger and confirm what was included in Box 1 and Box 5. If there is an error, the school can issue a corrected 1098‑T. If you are unsure whether something is qualified, check Publication 970 and the Form 8863 instructions, or speak with a tax professional.

A simple three‑step checklist:

- Match Box 1 to the ledger, then subtract the portion of scholarships in Box 5 that covered qualified tuition and required fees.

- Verify Boxes 4 and 6 for prior‑year changes, and look for Box 7 if you prepaid for a term beginning January through March.

- Confirm that Box 8 and Box 9 reflect your actual enrollment status.

If something still does not add up, document your request to the school in writing and keep copies with your return. That paper trail helps if you ever need to explain your calculations.

FAQs

What is a 1098‑T used for?

You use it to support education credits by documenting how much was paid for qualified tuition and related expenses, the scholarships and grants that reduce that amount, and certain status indicators like half‑time or graduate enrollment. It is not a bill, and it is not, by itself, your credit amount.

Do you get money back from a 1098‑T?

Not automatically. A 1098‑T feeds into Form 8863, which can create a refundable amount only if you qualify for the American Opportunity Credit and your numbers support it. The Lifetime Learning Credit is nonrefundable.

Who claims the credit, the parent or the student?

If the student is claimed as a dependent, the parent generally claims the credit and treats the student’s payments as if the parent paid them. If the student is not a dependent, the student claims the credit. See the instructions for details and examples.

I did not receive a 1098‑T. Can I still claim a credit?

Maybe. In general, a 1098‑T is required, but the IRS lists exceptions, such as when the institution is not required to furnish the form. You must keep strong records and meet all other rules.

Do loans count as payments in Box 1?

Box 1 reports the total payments received from all sources for qualified tuition and related expenses, which includes amounts applied by the school on your behalf. Box 1 is not reduced by scholarships in Box 5.

When should I expect my 1098‑T?

By January 31. For the 2025 calendar year, that is January 31, 2026. Schools may furnish it electronically with your consent, or by mail if not.

What is Box 10?

Box 10 shows reimbursements or refunds made by an insurer for qualified tuition and related expenses. This applies when an insurer, not the school, reports those amounts.

Final Pointers, So You File With Confidence

- Keep your ledger, your 1098‑T, scholarship letters, and receipts together.

- Reconcile Box 1 to qualified charges and Box 5 to scholarships, then remove all nonqualified costs.

- Use the Form 8863 instructions for the latest income limits and prepaid tuition rules, especially for December payments tied to January through March terms.

If you run an accounting firm, standardizing 1098‑T review with named workpapers and clear checklists reduces partner review time and protects quality. That kind of workflow discipline is how our team at Accountably builds delivery systems for busy seasons, although this guide is written for students and families first.

This article is general information, not tax advice. Always confirm details with the latest IRS guidance or a qualified tax professional. Key IRS sources used here include the 2025 1098‑T instructions, Publication 970, Form 8863 instructions, and the IRS education credits Q&A.

Simplify Delivery, Improve Margins, Stay in Control.

Offshore support that works exactly like your in-house team.

💼 Let’s Talk