Scale Your CPA Firm Without Adding Headcount

Build your offshore team that works your way, trained, compliant, and white-labeled under your firm.

👉 Book a Discovery Call

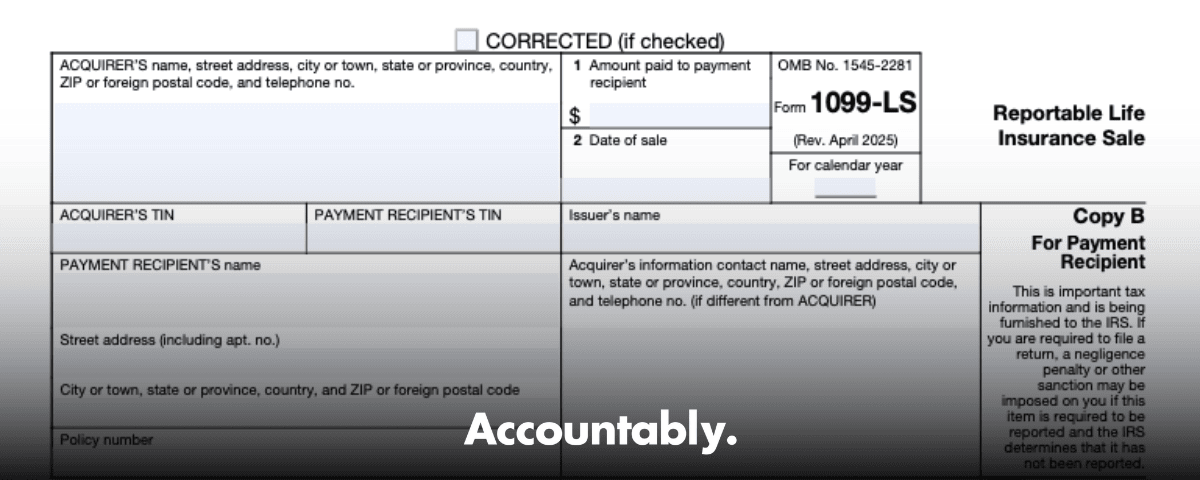

If you acquire interests in life insurance policies, Form 1099‑LS is your signal to the IRS that a reportable policy sale happened. You file it, you furnish it, and you keep the paper trail tight so the seller can report taxes correctly and the carrier can issue Form 1099‑SB.

Key Takeaways

- Form 1099‑LS is filed by the acquirer when there is a reportable policy sale under IRC section 6050Y. It identifies the payment recipient, the issuer, the policy number, the sale date, and the amount paid.

- Who gets what: file Copy A with the IRS, furnish Copy B to the payment recipient, and send Copy C to the issuer’s administrative office that handles ownership transfers. Keep your own records.

- Due dates in a nutshell: furnish recipient statements by January 31, then file with the IRS by February 28 if on paper or March 31 if e‑filing. If the date falls on a weekend or legal holiday, the next business day applies.

- E‑file rule for 2025 season: if you file 10 or more total information returns, you must e‑file. The 10‑return threshold is aggregated across all forms.

- Corrections and rescissions: if the sale is rescinded, you must file and furnish corrected forms within 15 calendar days of receiving the rescission notice.

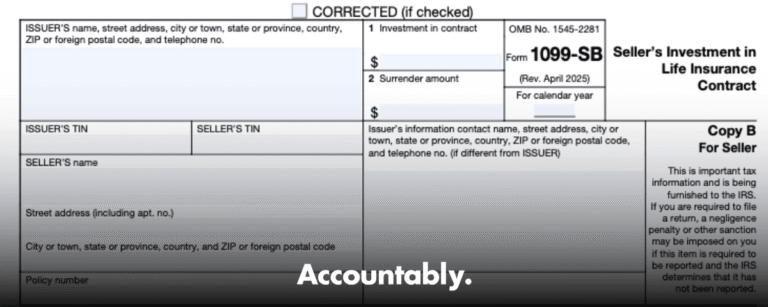

- Tie‑in with Form 1099‑SB: the insurer uses 1099‑SB to report investment in contract and surrender amount, which the seller needs to calculate tax. Use 1099‑LS and 1099‑SB together.

- 2025 penalty tiers if you file late or incorrect information returns: 60 per form if within 30 days, 130 by August 1, 340 after August 1, with at least 680 per form for intentional disregard, subject to annual caps.

In a life settlement, the seller’s tax result typically breaks into three layers, tax‑free return of basis up to premiums paid, ordinary income up to cash surrender value, and capital gain above cash surrender value. TCJA confirmed basis is not reduced by cost of insurance, and Rev. Rul. 2020‑05 cemented it.

What Form 1099‑LS actually is

Form 1099‑LS, Reportable Life Insurance Sale, is the information return you must file when you acquire any interest in a life insurance contract in a reportable policy sale. The form’s purpose is simple, help the IRS match settlement proceeds reported by the seller and ensure the issuer has what it needs to furnish basis and cash surrender value on Form 1099‑SB.

Hundreds of Firms Have Already Used This Framework.

Join the growing list of CPA and accounting firms using Accountably’s Offshore Playbook to scale faster.

💬 Get Your FREE Playbook

👉 Visit Jugal Thacker’s LinkedIn

Send him a connection request and message “Playbook” to get your copy.

A reportable policy sale is any direct or indirect acquisition of an interest in a life insurance contract where you, as the acquirer, do not have a substantial family, business, or financial relationship with the insured apart from the policy itself. That definition includes entity deals, for example buying into a trust or partnership that holds the policy.

- Who is the filer, the acquirer, meaning the buyer in the transaction.

- Who is the payment recipient, any seller or intermediary who actually receives consideration of 600 or more in the sale.

Why this form matters to you

If you are the acquirer, 1099‑LS is not optional. It is how you document the sale, meet your furnish deadlines, and avoid matching notices to the seller. It also protects you when a sale is later rescinded, because you have a clean, date‑stamped correction on file within the 15‑day window.

Quick compliance snapshot

- Identify the sale as reportable under §6050Y and check for exceptions under Reg. §1.6050Y‑2(f).

- Capture all required fields, names, addresses, TINs, issuer, policy number, sale date, and amount paid to each payment recipient.

- Furnish Copy B to the payment recipient by January 31. Send Copy C to the issuer. File Copy A with the IRS by February 28 if paper or March 31 if e‑file.

- E‑file if you have 10 or more information returns across forms. Use IRIS if you do not have a transmitter.

Who must file and who receives each copy

If you are the acquirer in a reportable policy sale, you must file a separate Form 1099‑LS for each payment recipient for each interest acquired. You must include your own contact information, and you must name the issuer that administers the contract and the policy number so the carrier can identify the exact contract.

Improve Margins Without Compromising Quality

Offshore staffing helps firms deliver more, scale faster, and stay compliant, without adding local headcount.

👉 Book a Discovery CallPayment recipient includes any seller plus brokers or intermediaries who retain part of the consideration. People other than a seller are not payment recipients if they received less than 600 in aggregate.

Copy routing and timing

- Copy A goes to the IRS.

- Copy B goes to the payment recipient.

- Copy C goes to the issuer’s administrative office that handles ownership transfers.

- Retain your records in case of CP2000 matching or a rescinded sale.

Timing rules that matter:

- Furnish statements to recipients by January 31.

- File paper returns by February 28 or e‑file by March 31. If a date falls on a weekend or legal holiday, use the next business day.

If you need more time:

- You can request a 30‑day extension to file returns using Form 8809.

- You can request up to 30 extra days to furnish recipient statements using new Form 15397, submitted by fax by the original furnish date.

What goes in each box, and how to complete it cleanly

Here is what actually drives matching and compliance on Form 1099‑LS.

- Box 1, Amount paid to payment recipient, enter the total paid to that payment recipient. This amount is not required to be reported to the issuer on Copy C, so it is optional on Copy C.

- Box 2, Date of sale, enter the closing date that establishes the tax year.

- Names, addresses, and TINs, enter both parties, acquirer and payment recipient, plus the issuer’s name and the policy number.

TIN rules that prevent headaches:

- You may truncate the recipient’s TIN on Copy B, for example XXX‑XX‑1234, but never truncate on anything filed with the IRS. Do not truncate your own TIN.

Rescissions, corrections, and practical tips

- If a reportable policy sale is rescinded, file a corrected 1099‑LS and furnish corrected statements within 15 calendar days after you receive the rescission notice.

- Match Box 1 to the settlement statement and make sure the sale date equals the closing date in the executed documents. That simple tie‑out prevents avoidable CP2000 notices.

- Keep your issuer routing clean. Copy C must reach the administrative office that handles ownership transfers, not a general correspondence mailbox.

The 1099‑LS and 1099‑SB handshake

Your filing triggers a second form. The insurer uses Form 1099‑SB to report the seller’s investment in the contract and the surrender amount. These numbers are critical for the seller’s tax calculation and for your own documentation that the sale is properly characterized.

Why we pair the forms during review

- 1099‑LS, proves who got paid, how much, and when.

- 1099‑SB, shows investment in contract and cash surrender value.

- Together, they support the three‑tier tax outcome the seller will compute, and they give you a clean file if the IRS has questions later.

Deadlines, e‑file rules, penalties, and a ready‑to‑run workflow

Dates to circle on your calendar:

- January 31, furnish Copy B to each payment recipient.

- February 28, mail Copy A to the IRS if you file on paper.

- March 31, e‑file Copy A if you submit electronically. If a due date lands on a weekend or legal holiday, file the next business day.

E‑file threshold you cannot ignore:

- If you file 10 or more information returns in total, across all types, you must e‑file. Use IRIS if you need a no‑cost e‑file option.

Penalties, updated for 2025:

- 60 per form if you file correctly within 30 days after the due date.

- 130 per form if filed by August 1.

- 340 per form after August 1 or not filed.

- At least 680 per form for intentional disregard, no maximum. Annual caps apply, and small businesses get lower caps.

Your 1099‑LS workflow, step by step

- Confirm the transaction is a reportable policy sale under §6050Y. If you qualify for an exception under Reg. §1.6050Y‑2(f), document it. Examples include certain foreign persons, sales where you reported to a non‑seller under §§6041 or 6041A, or a section 1035 exchange.

- Create a per‑recipient package, settlement statement, W‑9 or validated TIN, policy number, issuer name, sale date, and amount paid.

- Prepare 1099‑LS for each payment recipient, enter Box 1 and Box 2 carefully, and include your contact phone number on recipient statements.

- Furnish Copy B by January 31, and route Copy C to the issuer’s administrative office that handles transfers.

- File Copy A with the IRS by February 28 if paper or March 31 if e‑file, or request time via Form 8809. If you need more time to furnish statements, use Form 15397 by fax.

- If a sale is rescinded, file a corrected return and furnish corrected statements within 15 days of notice.

Quick reference table

| Item | What to do | Source |

| Who files | The acquirer files a separate 1099‑LS for each payment recipient | |

| Who receives | Payment recipient gets Copy B, issuer gets Copy C, IRS gets Copy A | |

| Furnish deadline | January 31 to recipient | |

| File with IRS | Paper by February 28, e‑file by March 31 | |

| E‑file rule | 10 or more total information returns must be e‑filed | |

| Rescission | Correct and furnish within 15 days of rescission notice | |

| TIN truncation | Allowed on Copy B for recipient TIN, never on IRS filings, never for acquirer TIN |

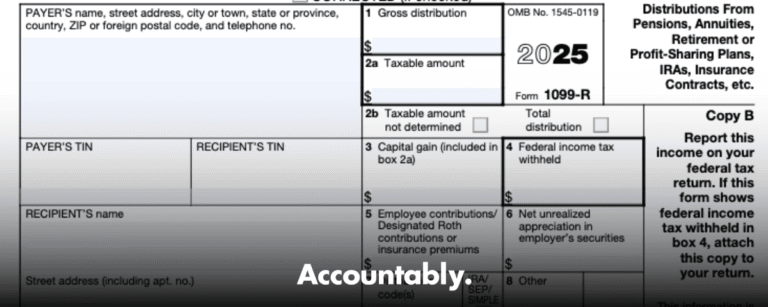

How the taxes actually work for sellers

Here is the framework many sellers use, and why your accurate 1099‑LS matters.

- Basis equals total premiums and other investment in the contract, without reducing for cost of insurance. That change is codified by TCJA and confirmed by Rev. Rul. 2020‑05.

- When a policy is sold, the total gain is sale proceeds minus basis. The portion up to cash surrender value, to the extent it exceeds basis, is ordinary income. Any excess above cash surrender value is capital gain. Rev. Rul. 2009‑13 explains the split.

- For viatical settlements, proceeds for a terminally ill insured can be excluded from income under section 101(g), but the reporting still matters for consistency and records.

Your 1099‑LS Box 1 and Box 2 feed this calculation, and the insurer’s 1099‑SB provides investment in contract and surrender amount, the missing pieces sellers need to finish the math.

Two common scenarios with numbers

Standard life settlement

Assume a seller receives 300,000 for a universal life policy. Their cumulative premiums are 70,000 and the policy’s cash surrender value is 80,000.

- Total gain is 300,000 minus 70,000, or 230,000.

- Ordinary income is the amount up to CSV over basis, 80,000 minus 70,000, or 10,000.

- Capital gain is the balance, 220,000. This three‑tier framework matches the approach in Rev. Rul. 2009‑13, with basis determined under TCJA and Rev. Rul. 2020‑05.

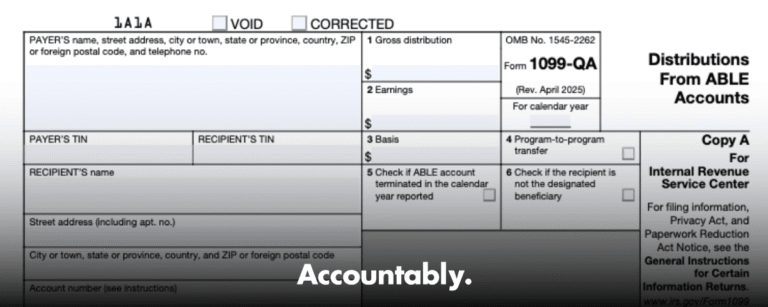

Viatical settlement for a terminally ill insured

If a licensed viatical settlement provider acquires a policy from a terminally ill insured and pays 150,000, the provider files 1099‑LS. The seller may exclude amounts under section 101(g), once the medical certification and provider requirements are satisfied. The form remains informational for IRS matching.

FAQs

What is Form 1099‑LS?

It is the information return the acquirer must file for a reportable policy sale of a life insurance contract. It lists the payment recipient, issuer, policy number, sale date, and the amount paid.

Why did I get a 1099‑LS from a settlement provider?

Because you sold rights in a life insurance contract and received consideration. The form helps the IRS match proceeds on your return, while the carrier’s 1099‑SB shows investment in contract and cash surrender value for your calculation.

Do I have to report proceeds from selling a policy?

Yes, unless an exclusion applies, for example certain viatical settlements for terminally or chronically ill individuals under section 101(g). Otherwise, sellers generally split results into basis recovery, ordinary income up to cash surrender value, and capital gain above that.

What if the sale falls through after forms are issued?

If the sale is rescinded, the acquirer must file and furnish corrected forms within 15 days after receiving rescission notice.

Can I truncate TINs?

You may truncate the payment recipient’s TIN on Copy B that you furnish. Do not truncate TINs on forms filed with the IRS, and do not truncate your own TIN on any copy.

A review checklist you can share with your team

- Confirm reportable policy sale status and check Reg. §1.6050Y‑2(f) exceptions.

- Validate W‑9s and TINs. Truncate recipient TINs on Copy B only.

- Enter Box 1 and Box 2 from the signed settlement statement and closing date.

- Route Copy C to the issuer’s transfer office, not a generic address.

- Furnish by January 31, file by February 28 or March 31. E‑file if you have 10 or more total info returns.

- If rescinded, correct and furnish within 15 days.

- Keep 1099‑SB alongside 1099‑LS in the workpaper binder.

Where disciplined delivery helps

If you manage dozens of settlements, volume is not your real problem, process is. A structured delivery system keeps Box 1 ties, sale dates, issuer routing, and rescissions on rails, which protects deadlines and avoids penalties. This is exactly the kind of repeatable workflow our team has built for accounting firms that want capacity without chaos, combining SOPs, versioned workpapers, and layered review to cut revision cycles while keeping security and control intact.

Final notes and disclaimer

- Dates and penalty amounts above reflect 2025 IRS guidance. Always check the current IRS instructions before filing.

- This guide is for general information only. It is not tax advice. For your facts, consult a qualified tax professional.

If you want a clean, reusable 1099‑LS playbook for your next settlement batch, make a copy of the workflow above and tailor the table to your process. You will feel the relief that comes from a calm, predictable January.

Simplify Delivery, Improve Margins, Stay in Control.

Offshore support that works exactly like your in-house team.

💼 Let’s Talk