Scale Your CPA Firm Without Adding Headcount

Build your offshore team that works your way, trained, compliant, and white-labeled under your firm.

👉 Book a Discovery Call

Start with Box 2 and Box 7. Box 2 tells you what is taxable, Box 7 tells you why it is being taxed that way.

Key Takeaways

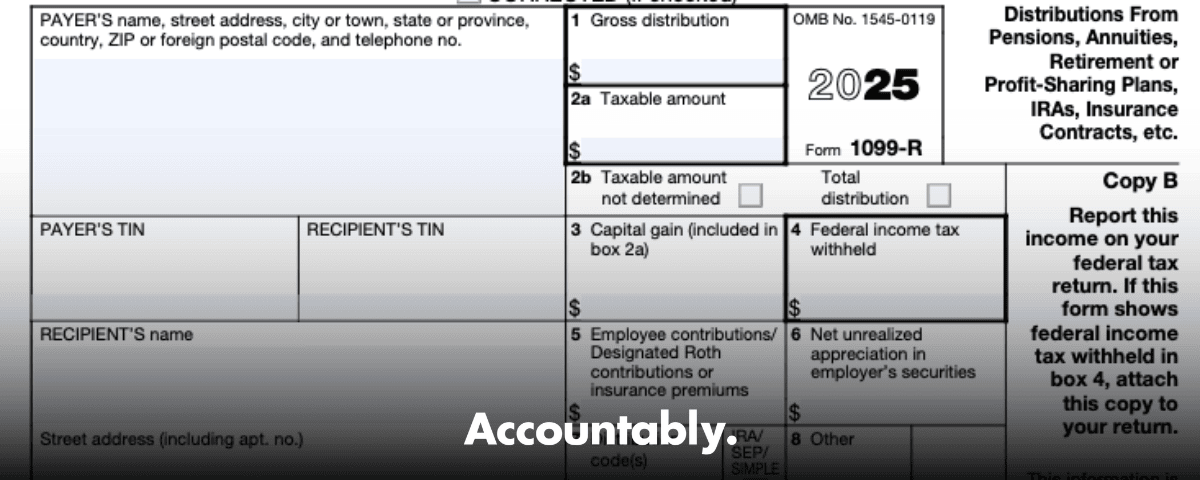

- Form 1099‑R reports $10 or more in distributions from pensions, annuities, IRAs, profit‑sharing plans, and certain insurance contracts for the year. Expect one form per payer.

- Watch four areas first, Box 1 gross distribution, Box 2a taxable amount, Box 4 federal withholding, Box 7 distribution code.

- Common codes you will see in Box 7 include 1 early, 2 exception, 3 disability, 4 death, 7 normal, G direct rollover, H direct rollover of a designated Roth account to a Roth IRA, L loan default, plus the new 2025 code Y for Qualified Charitable Distributions, which must be paired with 4, 7, or K.

- Timing, payers must furnish recipient copies by January 31. IRS filing is generally due March 31 if e‑filed. If your copy is late, check your online portal and request a duplicate.

- Reporting, IRA distributions go to Form 1040 lines 4a and 4b, pensions and annuities go to lines 5a and 5b. Use the gross amount on the “a” line and the taxable amount on the “b” line.

What Form 1099‑R Actually Reports

Form 1099‑R tells you, and the IRS, that money left a retirement or insurance account and the nature of that distribution. You receive it if you had $10 or more in distributions from a retirement plan, IRA, pension or annuity, or certain insurance contracts. Each payer issues its own 1099‑R, so multiple accounts often mean multiple forms.

Here is how to read the boxes you will use the most:

Hundreds of Firms Have Already Used This Framework.

Join the growing list of CPA and accounting firms using Accountably’s Offshore Playbook to scale faster.

💬 Get Your FREE Playbook

👉 Visit Jugal Thacker’s LinkedIn

Send him a connection request and message “Playbook” to get your copy.

- Box 1, Gross distribution, the total paid to you this year.

- Box 2a, Taxable amount, what the payer believes is taxable. This can be blank when they cannot determine it, for example with after‑tax basis in IRAs.

- Box 4, Federal income tax withheld, credit this on your return.

- Box 7, Distribution code(s), the shorthand that drives tax treatment and potential penalties.

If you rolled money directly from one plan to another, that is generally non‑taxable and is typically coded G for a direct rollover, or H for a direct rollover from a designated Roth account to a Roth IRA. You should still see the gross amount in Box 1 but a zero in Box 2a.

2025 Update You Should Know

For 2025 forms, the IRS added Code Y to flag Qualified Charitable Distributions, QCDs from IRAs sent directly to eligible charities. Code Y appears with 4, 7, or K, and helps the IRS recognize that the distribution can be nontaxable as a QCD. If you make QCDs, make sure your 1099‑R reflects this.

When You’ll Receive Your 1099‑R, And What To Do If It’s Late

Payers must furnish your copy by January 31. Many post it to your online account around that time. If paper mail runs slow, check your portal first, then request a duplicate if needed. For information returns filed with the IRS, most are due by March 31 when e‑filed, though your recipient deadline remains January 31.

Improve Margins Without Compromising Quality

Offshore staffing helps firms deliver more, scale faster, and stay compliant, without adding local headcount.

👉 Book a Discovery Call- PBGC participants, PBGC typically mails by January 31 and posts to MyPBA in early February. You can log in to MyPBA to download your 1099‑R, or call 1‑800‑400‑7242 for help.

- Federal retirees via OPM, you can request a duplicate 1099‑R or view it in Retirement Services Online, or call 1‑888‑767‑6738 for assistance.

If a form is still missing by mid‑February, check online, then contact the payer to send or correct it.

How To Access Or Request A Duplicate

Most plans, insurers, and government payers maintain an online document center with your last several years of 1099‑R forms.

- Sign in, open the “Tax Forms” or “1099‑R” menu, select the year, and download or print.

- For PBGC, use MyPBA and select “My 1099 form(s).”

- For OPM annuitants, use Retirement Services Online, or call if you need help linking your Login.gov account.

Always confirm your mailing address in your profile before requesting a mailed copy.

Understanding Taxable Amounts And Box 7 Codes

Think of Box 2a and Box 7 as a matched set. Box 2a tells you the taxable portion. Box 7 tells you the reason the money left, which can add a 10 percent additional tax for early distributions or flag exceptions that remove it.

Common Box 7 Codes You’ll See

| Code | What it means | Typical tax outcome |

| 1 | Early distribution, no known exception, under age 59½ | Income is taxable if pre‑tax, plus the 10% additional tax unless you claim an exception on Form 5329 |

| 2 | Early distribution, exception applies | Taxable income as applicable, no 10% additional tax |

| 3 | Disability | Taxable income as applicable, no 10% additional tax |

| 4 | Death distribution to a beneficiary | Taxable to the recipient as applicable |

| 7 | Normal distribution, age 59½ or older | Taxable as applicable, no 10% additional tax |

| G | Direct rollover to another qualified plan or traditional IRA | Generally non‑taxable rollover, Box 2a usually zero |

| H | Direct rollover of a designated Roth account to a Roth IRA | Generally non‑taxable rollover |

| J | Early distribution from a Roth IRA | Often basis first, may be nontaxable if qualified, exceptions vary |

| L | Deemed distribution from a plan loan default | Often taxable, may trigger penalties |

| Y | Qualified Charitable Distribution from an IRA, used with 4, 7, or K | Generally nontaxable QCD if requirements are met |

These codes and outcomes come from the IRS 2025 Instructions for Forms 1099‑R and 5498, including the new Code Y for QCDs.

Penalties And Exceptions, The Quick Version

- If you are under 59½, many early distributions are subject to the 10% additional tax. You claim an exception with Form 5329 when the payer did not code it as an exception on the 1099‑R. Recent law added exceptions for emergency personal expenses and domestic abuse distributions, so review current rules before you file.

- “Rule of 55” withdrawals from your current employer’s plan after separation can avoid the 10% additional tax, but they are still taxable income. (investopedia.com)

Roth Conversions And Rollovers

Conversions from a traditional IRA to a Roth IRA are reported on 1099‑R and are usually coded 2 if you are under 59½ or 7 if you are 59½ or older, with the IRA checkbox marked. Direct rollovers between plans use G, and designated Roth account rollovers to Roth IRAs use H. Watch Box 2a and the 2b “taxable amount not determined” checkbox on IRA conversions.

Where Do You Report 1099‑R Amounts On Form 1040?

You will report IRAs on lines 4a and 4b and pensions or annuities on lines 5a and 5b. The “a” line shows the total amount from Box 1. The “b” line shows the taxable amount, often Box 2a. The IRS instructions and Publication 575 include examples and the Simplified Method for annuities.

- If you have more than one distribution, add the gross amounts for the “a” line and the taxable amounts for the “b” line. Keep each 1099‑R with your records.

Practical Walkthroughs

You took a pension and a small IRA distribution

- Add both Box 1 amounts to line 4a or 5a as appropriate, and both Box 2a amounts to line 4b or 5b. If the IRA is fully taxable and the pension is partly taxable, only the taxable portion from each goes to “b.” Publication 575 shows how to compute the taxable annuity part using the Simplified Method when needed.

You did a direct rollover from a 401(k)

- Expect Code G and a zero in Box 2a. You still report the gross amount on the “a” line, and the taxable amount on the “b” line should be zero. Keep the 1099‑R and any confirmation of the rollover for your files.

You made a Qualified Charitable Distribution

- For 2025 forms, look for Code Y alongside 4, 7, or K. The distribution can be nontaxable if it meets QCD rules. You still list the gross amount on the “a” line and exclude it from the taxable “b” line as appropriate, documenting it as a QCD.

Corrections, Duplicates, And Fixing Wrong Codes

If a 1099‑R shows the wrong Box 1, Box 2a, or Box 7 code, contact the issuer right away and request a corrected form. If a correction will not arrive before you must file, you can file using accurate figures, attach explanations as needed, and file Form 5329 to claim an exception if the code does not reflect it. Then amend your return when the corrected 1099‑R arrives.

- PBGC retirees, if a form is missing or you received two, PBGC explains why that can happen in the first payment year and how to get a copy through MyPBA or by phone.

- OPM annuitants, if you cannot sign in, OPM’s help pages explain how to link Login.gov and who to call.

Withholding, Estimated Tax, And Your Refund

Your 1099‑R may show federal withholding in Box 4. That withholding reduces what you owe at filing, just like paycheck withholding. If you had a taxable distribution with little or no withholding, you may need estimated tax next year or to increase withholding on future payments. The IRS confirms the furnish deadline and encourages e‑filing of information returns because matching forms helps prevent fraud.

Retirees sometimes ask how to avoid underpayment penalties. One approach is to adjust pension or IRA withholding so enough tax is withheld over the year. The IRS treats withholding as if it were paid evenly throughout the year, which can help you avoid penalties compared to quarterly estimates. Review Publication 505 or your payer’s withholding forms to set the right amount.

Step‑By‑Step, Getting Your 1099‑R Online

- Log in to your plan, custodian, or agency portal.

- Open Documents or Tax Forms, select 1099‑R, choose the tax year, and download.

- PBGC, click “My 1099 form(s)” in MyPBA, select your plan, and download.

- OPM, use Retirement Services Online, and call 1‑888‑767‑6738 if your account needs a reset or passcode.

If nothing arrives by early February, check online first, then call the issuer to request a mailed copy or a correction.

FAQs

What is Form 1099‑R used for?

It reports retirement and annuity distributions, including rollovers, Roth conversions, loan defaults, corrections, and tax withholding. The form tells the IRS what left the account and why through Box 7 codes, and it allows your return to match what payers filed.

Do I have to report a 1099‑R on my tax return?

Yes. Report the gross amount and the taxable amount on Form 1040 lines 4a/4b or 5a/5b depending on whether it is an IRA or a pension or annuity. If the payer did not determine the taxable amount, you must compute it using IRS rules.

How much tax will I pay on a 1099‑R?

It depends on your taxable amount and your bracket. Early distributions may also carry the 10% additional tax unless an exception applies, which you claim using Form 5329 if your code does not already show it.

Can a 1099‑R increase my refund?

Yes, if Box 4 withholding exceeds what you owe. It can also reduce a refund if the distribution is taxable and withholding was low. Adjust future withholding or make estimated payments to dial this in for next year.

What if I rolled money over and my 1099‑R still shows a taxable amount?

Check Box 7 for Code G or H and verify Box 2a is zero. If it is not, contact the payer for a correction. Keep transfer confirmations to prove the direct rollover.

I made a Qualified Charitable Distribution. How should the 1099‑R look?

For 2025 forms, look for Code Y paired appropriately. You will still report the gross amount but exclude the QCD from taxable income on the “b” line as allowed.

For CPA Firms And Controllers

If you lead a firm, January can feel like a fire drill when 1099‑R questions stack up while teams juggle reviews and corrections. This is where a disciplined delivery system matters. At Accountably, we integrate trained offshore teams into your workflow with SOPs, structured workpapers, and review layers that protect partner time and stabilize turnaround. If you need consistent execution on tax season tasks like 1099‑R reconciliations, client follow‑ups, and document control, ask us about building capacity without chaos. We will work in your systems, templates, and deadlines, and we measure performance to SLAs so you keep control.

Offshore is not a shortcut to labor, it is an operating system. Done right, it reduces rework, protects reviews, and keeps delivery predictable.

We mention this here only because this page lives on Accountably.com, and many of our readers are firm owners who care about delivery quality as much as tax accuracy.

Closing Advice You Can Use Today

- Open each 1099‑R, then match Box 1 to the “a” line and Box 2a to the “b” line on Form 1040.

- Read Box 7 carefully and, if needed, use Form 5329 to claim an exception the code does not show.

- If a form is missing or wrong, ask for a correction as soon as possible.

- PBGC and OPM both offer online access and phone help if you cannot sign in.

You have everything you need to read, report, and, when necessary, fix a 1099‑R with confidence. Keep your copies, match them to your return, and do not hesitate to call the issuer or a tax pro if something looks off.

Notes and sources, current as of November 4, 2025, IRS: general deadlines and furnish rules, distribution codes, QCD Code Y, and 1040 line reporting.

Simplify Delivery, Improve Margins, Stay in Control.

Offshore support that works exactly like your in-house team.

💼 Let’s Talk