Scale Your CPA Firm Without Adding Headcount

Build your offshore team that works your way, trained, compliant, and white-labeled under your firm.

👉 Book a Discovery Call

In the next few minutes, you will see exactly what Form 1099‑SB is, how it pairs with 1099‑LS, which deadlines actually apply in 2025, and how to avoid the small mistakes that trigger IRS notices.

Key Takeaways

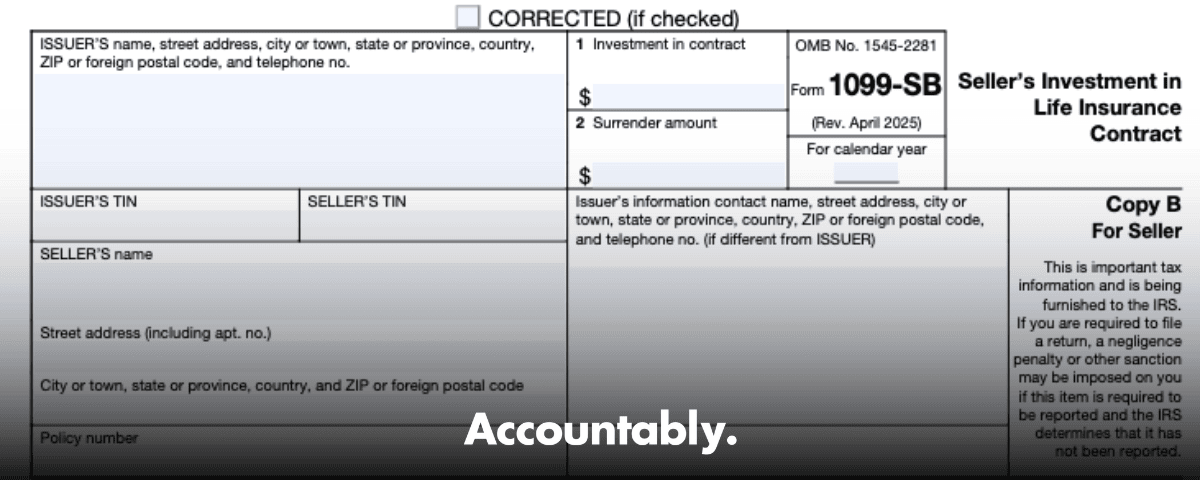

- Form 1099‑SB reports the seller’s investment in a life insurance contract and the policy’s cash surrender amount for a reportable policy sale or certain foreign transfers. It is furnished by the issuer.

- In 2025, the due date to furnish 1099‑SB to the seller is generally February 15, and the IRS filing due date is February 28 on paper or March 31 if e‑filed, with specific exceptions in the regulations.

- 1099‑SB does not, by itself, create income. Pair it with 1099‑LS to split the client’s gain into ordinary income up to the cash surrender amount and capital gain above it.

- E‑file is required if you file 10 or more total information returns in the year, aggregated across types. Most firms will e‑file via IRIS or FIRE.

- If the deal is rescinded, the issuer must issue a corrected 1099‑SB within 15 calendar days of notice.

Treat 1099‑SB as a facts anchor, not a tax bill. You use it to prove basis and to cap ordinary income.

What Is Form 1099‑SB

Form 1099‑SB is an information return the issuer uses to tell the seller and the IRS two things after a reportable policy sale, or when the contract is transferred to a foreign person: the seller’s investment in the contract and the policy’s surrender amount on the transfer date. Think of it as the form that sets your cost basis and shows contract value at the handoff.

Hundreds of Firms Have Already Used This Framework.

Join the growing list of CPA and accounting firms using Accountably’s Offshore Playbook to scale faster.

💬 Get Your FREE Playbook

👉 Visit Jugal Thacker’s LinkedIn

Send him a connection request and message “Playbook” to get your copy.

Why the IRS cares

Congress and Treasury created a reporting framework so sellers, buyers, and the IRS have the same numbers when a policy changes hands. The surrender amount helps determine how much of the sale is ordinary income and what portion, if any, is capital gain. That is why the surrender figure lives on 1099‑SB.

The Two Boxes That Matter

Here is how to read the form quickly:

| Box | What it shows | Why it matters |

| 1 | Investment in contract | This is the seller’s basis, generally total premiums or consideration paid, reduced by amounts previously excluded from income. |

| 2 | Surrender amount | What the seller would have received from the issuer if they had surrendered on the transfer date. |

Those definitions come straight from the IRS instructions and regulations for §6050Y reporting. Use Box 1 as your starting point for basis, and Box 2 to cap the ordinary‑income portion of the gain.

Improve Margins Without Compromising Quality

Offshore staffing helps firms deliver more, scale faster, and stay compliant, without adding local headcount.

👉 Book a Discovery CallQuick definitions you can trust

- Seller’s investment in the contract, for the original policyholder, generally equals the aggregate premiums or other consideration paid, reduced by previously excluded amounts. For later owners, issuers may report a reasonable estimate based on information they know.

- Surrender amount is what the seller would have received from the issuer on a same‑day surrender.

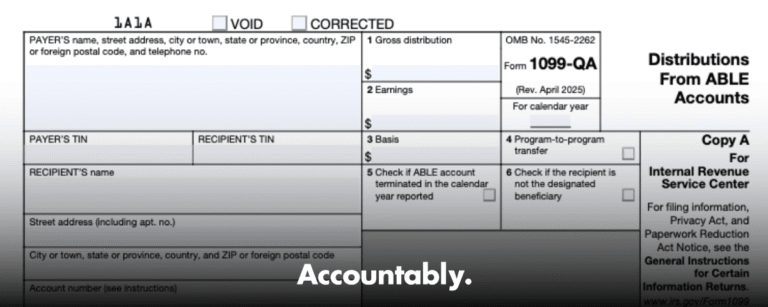

What Counts As A “Reportable Policy Sale”

A reportable policy sale occurs when an acquirer with no substantial preexisting family, business, or financial relationship with the insured acquires any interest in the contract, directly or indirectly. Life settlements and secondary‑market purchases are common examples. Issuers file 1099‑SB to report basis and surrender amount for these sales, and for certain transfers to foreign persons.

If the buyer is unrelated to the insured, pause and confirm whether the sale is reportable under §6050Y. That classification drives whether 1099‑SB and 1099‑LS should exist in the file.

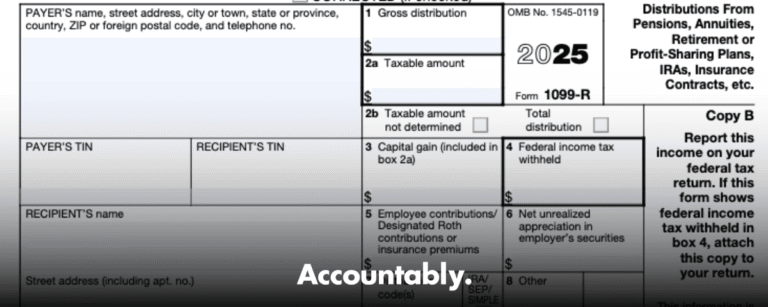

How 1099‑SB Fits With 1099‑LS

- 1099‑SB comes from the issuer and gives you basis and surrender amount.

- 1099‑LS comes from the buyer and shows the amount paid for the policy, plus the sale date. You compare proceeds on 1099‑LS to basis and surrender on 1099‑SB to determine tax character. Ordinary income runs up to the surrender amount, and any excess is capital gain. This treatment is grounded in IRS rulings and later guidance after the Tax Cuts and Jobs Act clarified basis.

Deadlines You Actually Have To Hit In 2025

Here are the dates that matter for calendar‑year 2025 filings:

- Furnish 1099‑SB to the seller by February 15, 2026, unless a regulation exception applies.

- File 1099‑SB with the IRS by February 28, 2026 on paper or March 31, 2026 electronically, except as provided in Reg. §1.6050Y‑3(c).

A few special timing rules you should know:

- If the issuer receives notice that a transfer involved a foreign person after early February, the 1099‑SB seller statement may be due 30 days after the date notice is received. Check Reg. §1.6050Y‑3(d)(2).

- If a reportable policy sale or a transfer to a foreign person is rescinded, the issuer must file and furnish corrected 1099‑SB forms within 15 calendar days of receiving rescission notice.

Do not forget the 1099‑LS timing

- Buyers must furnish 1099‑LS to the issuer by the later of 20 calendar days after the sale or 5 days after the rescission period ends, and in any case no later than January 15 of the following year.

- Buyers furnish 1099‑LS statements to payment recipients by mid‑February. These dates are spelled out in the IRS tables and the 1099‑LS instructions.

E‑File Threshold And Platforms

If you file 10 or more information returns in the calendar year, aggregated across types, you must e‑file. This 10‑return threshold applies beginning with returns required to be filed on or after January 1, 2024 and remains in effect for 2025 filings. You can e‑file 1099‑SB via IRIS or FIRE.

Practical tip, if you are anywhere near the threshold, standardize e‑file for all 1099s. Mixed modes create avoidable errors later in corrections.

Step‑By‑Step, From Form To Tax Character

You will determine gain character by pairing the two forms.

Matching boxes and identifiers

- Match the seller’s name, TIN, and policy number across both forms.

- Line up 1099‑LS Box 1, proceeds paid by the buyer, with 1099‑SB Box 1, investment in the contract, and 1099‑SB Box 2, surrender amount.

- If any identifiers are wrong, request corrected forms before you finalize tax entries.

Compute the ordinary and capital pieces

- Start with proceeds from 1099‑LS.

- Subtract the investment in the contract from 1099‑SB Box 1. The remainder is taxable.

- Classify the portion up to the surrender amount as ordinary income.

- Any excess over surrender amount is capital gain, reported on Form 8949 and Schedule D as short‑ or long‑term based on holding period. This split is supported by IRS rulings and the government’s policy sale framework.

Quick reference table

| Step | What you compare | Tax result |

| 1 | Proceeds (1099‑LS) vs. Basis (1099‑SB Box 1) | Amount above basis is taxable |

| 2 | Taxable amount up to Surrender (1099‑SB Box 2) | Ordinary income |

| 3 | Any amount above Surrender | Capital gain |

A Worked Example

Your client sells a policy for 80,000. 1099‑SB shows investment in the contract of 50,000 and a surrender amount of 70,000. The total gain is 30,000. Classify 20,000 as ordinary income, the piece between basis and surrender value, and 10,000 as capital gain, the amount above surrender. This matches the character split the IRS has outlined for sales of cash value contracts since Revenue Ruling 2009‑13, as updated after the TCJA clarified basis.

If the policy is term with no surrender value, and it is sold at a gain, the entire gain is typically capital, subject to basis rules after TCJA. Confirm facts and holding period.

Issuer Duties And The Fields You Cannot Get Wrong

If you are the issuer responsible for administering the contract, you must file a separate 1099‑SB for each seller after you receive the buyer’s statement under §6050Y(a) or notice of a foreign transfer. You will report the seller’s TIN, policy number, investment in the contract, and the surrender amount. Furnish a seller statement and follow correction procedures if rescinded.

The two sensitive data points

- Investment in contract, Box 1. Use the definition in the instructions and regulations. For original policyholders, it is generally aggregate premiums or consideration paid, reduced by amounts previously excluded from income.

- Surrender amount, Box 2. Report what the seller would have received on a same‑day surrender.

Common Mistakes We See, And How To Fix Them

- Wrong furnish date. Treat 1099‑SB like 1099‑LS for scheduling and you will miss the actual February 15 seller due date. Use the IRS table for the year you file.

- Basis inflated with dividends or prior withdrawals. Box 1 should reflect investment in the contract under the IRS definition, not account value.

- Forgetting the 15‑day correction clock after rescission. Build a calendar task from the rescission notice date.

- E‑file threshold missed. If your firm files 10 or more information returns across all types, aggregate and e‑file.

- Mismatched TINs and policy numbers. These trigger notices. Cross‑check both forms against the settlement documents before you post entries.

Practical Workflow, So You Do Not Burn A Night

Here is a simple, repeatable approach you can assign to a senior:

- File build. Pull 1099‑SB and 1099‑LS, settlement agreement, in‑force ledger, and any policy loan statements.

- Validate identifiers. Confirm names, TINs, policy number, and sale date match across all documents.

- Compute gain character on a one‑page workpaper. Separate ordinary income up to surrender amount and capital gain above it. Attach source documents.

- Book entries. Post ordinary income to Form 1040, Other income, and capital gains to Form 8949 and Schedule D with the correct holding period.

- Tie‑out. Confirm totals tie to 1099‑LS proceeds. Keep the workpaper in the permanent file.

- Year‑end check. If you are the issuer, confirm you furnished 1099‑SB by mid‑February and filed by the IRS due date. If you are the buyer, confirm your 1099‑LS issuer and recipient deadlines.

Software tips, vendor‑agnostic

- Create a smart naming convention for workpapers, for example “PolicySale_[Carrier][Policy#][TaxYear].pdf.”

- Use templates that force the three‑tier split, so preparers cannot miss the surrender cap.

- Build a review checklist item that reads, “Tie 1099‑LS Box 1 to 1099‑SB Boxes 1 and 2, verify character split.”

Our team has seen review time fall sharply when preparers attach a one‑page calculation and the two forms, with identifiers highlighted.

A short note on basis after TCJA

Pre‑TCJA guidance reduced basis by cost‑of‑insurance charges for sales. Congress changed that. For sales entered into on or after August 26, 2009, as clarified after TCJA, basis for sellers is not reduced by prior cost‑of‑insurance deductions, which generally reduces taxable gain compared with pre‑TCJA results. Always compute basis using current rules.

Security And Process, Briefly

Because this article lives on Accountably.com, a quick word on delivery. If you are buried in production and worried about form accuracy during peak periods, the fix is structure, not heroics. Accountably integrates trained offshore teams into your workflow with SOP‑driven workpapers, naming standards, and multi‑layer reviews that cut revision cycles and protect partner time. Use us sparingly where it helps, then keep your review in control.

This is not a sales push, just a reminder that capacity needs discipline to pay off.

FAQs

Does Form 1099‑SB mean the seller owes tax by itself?

No. 1099‑SB is informational. You pair it with 1099‑LS. Ordinary income runs up to the surrender amount, and any excess is capital gain. The IRS specifically frames the surrender amount as a way to identify the ordinary‑income portion.

What if the buyer never sends us a 1099‑LS?

Use the closing statement and bank records to determine proceeds. Document your method and request a late or corrected 1099‑LS from the buyer. Keep your calculation workpaper and correspondence in the file.

What are the 2025 deadlines again?

For 1099‑SB, furnish to the seller by February 15, 2026 and file with the IRS by February 28, 2026 on paper or March 31, 2026 electronically, unless a regulatory exception applies. For 1099‑LS, see the buyer‑to‑issuer January 15 and the mid‑February recipient deadlines.

Do we have to e‑file?

If you file 10 or more total information returns, yes. The 10‑return threshold is aggregated across forms. Most firms should plan to e‑file through IRIS or FIRE to avoid penalties.

How do we handle rescissions or corrections?

If the sale is rescinded, the issuer must file and furnish corrected 1099‑SB within 15 calendar days of receiving notice. For ordinary errors, follow the correction procedures and furnish corrected copies promptly.

What about term policies with no cash value?

When term policies are sold at a gain, the gain is generally capital because there is no surrender value component to treat as ordinary income, subject to basis and holding period rules. Confirm facts for each case.

Do we need to include cost‑of‑insurance in basis?

After TCJA guidance, sellers generally do not reduce basis for cost‑of‑insurance when calculating gain on a sale. Use the current rulings that modify the 2009 guidance.

Quick Checklist You Can Paste Into Your SOP

- Confirm the sale is a reportable policy sale under §6050Y.

- Gather 1099‑SB and 1099‑LS, plus the settlement agreement and loan data.

- Verify TINs, names, policy number, and dates across both forms.

- Compute gain character on a one‑page workpaper, attach both forms.

- Book ordinary income up to surrender amount, and capital gain above it.

- Hit the correct furnish and file dates for 1099‑SB and 1099‑LS.

- E‑file if you hit the 10‑return threshold across all information returns.

- If rescinded, calendar the 15‑day correction window.

Final Notes And A Gentle Nudge

Keep your language simple in client memos. Show the three‑tier result with numbers, then list the forms that will carry each piece to the 1040. If anything looks off, request corrected forms before filing. When the calendar is packed and the stakes are high, structure wins.

If you want a second set of hands that works inside your system with standardized workpapers and clear SLAs, Accountably can help you scale delivery without blowing up review. Use us for the heavy lift, keep strategy and client time for your partners.

Compliance Notice

This article is for general information only. It reflects IRS materials reviewed as of April to November 2025 and may change. Always consult the current IRS instructions for Forms 1099‑SB and 1099‑LS and the General Instructions for Certain Information Returns, or your tax advisor, before filing.

Simplify Delivery, Improve Margins, Stay in Control.

Offshore support that works exactly like your in-house team.

💼 Let’s Talk