Scale Your CPA Firm Without Adding Headcount

Build your offshore team that works your way, trained, compliant, and white-labeled under your firm.

👉 Book a Discovery Call

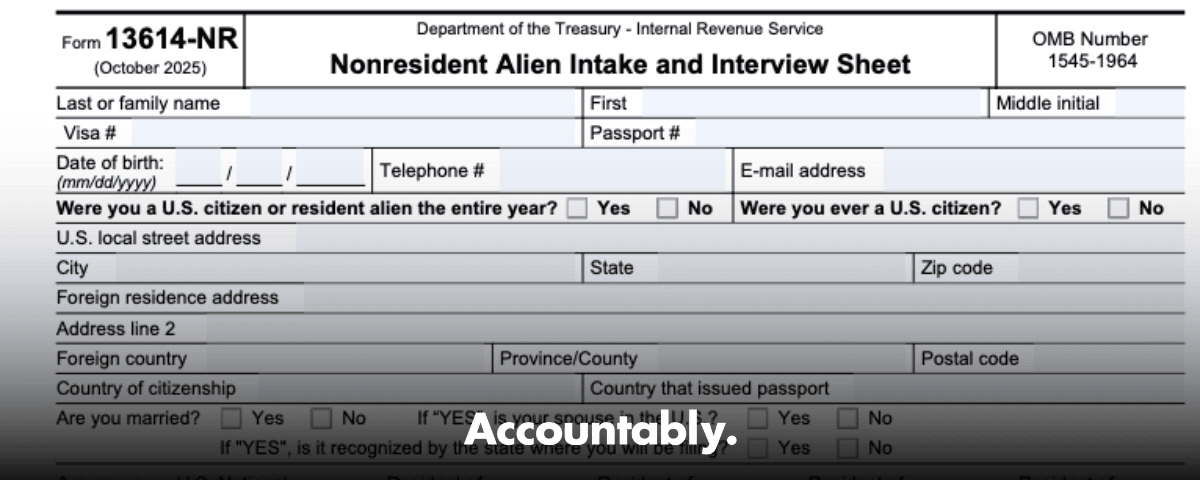

Quick context: Form 13614‑NR is the IRS Nonresident Alien Intake and Interview Sheet used by VITA and many preparers to figure out your residency status, treaty claims, and whether you should file Form 1040‑NR and possibly Form 8843. It is an intake document, not a tax return.

Key Takeaways

- Form 13614‑NR is an intake and interview sheet for nonresidents, commonly used at VITA and by preparers. You do not mail it to the IRS as a tax return.

- The current Form 13614‑NR shows an October 2025 revision. It asks for your 2023, 2024, and 2025 U.S. days, visa history back to 2019, and treaty information.

- Your intake helps determine whether you must file Form 1040‑NR, the due date you follow, and whether you also need Form 8843.

- Key documents to have nearby include passport and visa pages, I‑94 travel history, Social Security card or ITIN letter, and income forms like W‑2, 1042‑S, and possibly 1098‑T if you are a student.

- If your intake, or parts of your interview or quality review, happen virtually, many sites will also request Form 14446, the Virtual VITA/TCE Taxpayer Consent.

What Form 13614‑NR Is, and Why It Matters

Think of Form 13614‑NR as a nonresident profile that your preparer uses to make the first, most important decision, are you a nonresident for this tax year and which forms apply. The 2025 revision asks for your biographical details, immigration status, years and days present in the U.S., visa subtypes, treaty claims, and income categories like wages, scholarships, and investment income. It is designed for the VITA and TCE programs, and it aligns with how preparers review nonresident filings.

Two common outcomes flow from a careful intake:

Hundreds of Firms Have Already Used This Framework.

Join the growing list of CPA and accounting firms using Accountably’s Offshore Playbook to scale faster.

💬 Get Your FREE Playbook

👉 Visit Jugal Thacker’s LinkedIn

Send him a connection request and message “Playbook” to get your copy.

- It confirms you should file Form 1040‑NR, and it helps set the right due date. If you had wages subject to U.S. withholding for 2024, your 1040‑NR was due April 15, 2025. If you had no wages subject to withholding, your due date was June 16, 2025, since June 15 fell on a Sunday. Extensions are available, but interest can still apply.

- It flags whether you must include Form 8843. Nonresident students, scholars, and some other categories often file Form 8843 to explain excluded days for the substantial presence test.

How This Intake Protects You

A complete 13614‑NR reduces guesswork during preparation and review. When your travel dates, visa history, and income documents match what the IRS expects, your preparer can move faster and spend time on decisions that really matter, like treaty eligibility or state filing quirks. It also helps avoid duplicate questions, because your answers sit in one place that the reviewer can check.

What The Current 2025 Form Actually Asks

Here is a quick snapshot drawn directly from the October 2025 form:

- Identity and contact details, including passport and visa numbers

- Immigration status on entry and current status, plus any changes

- Visa history by year back to 2019

- U.S. presence days for 2023, 2024, and 2025

- Treaty claim details, if any, including country, article, prior months claimed, and current year exempt income

- Academic program contact information if you are a student or scholar

- Income categories for 2025, such as wages, scholarships, dividends, interest, retirement distributions, and other items

The Rules Behind The Questions

The intake mirrors the IRS rules your preparer must apply. A few quick anchors:

Improve Margins Without Compromising Quality

Offshore staffing helps firms deliver more, scale faster, and stay compliant, without adding local headcount.

👉 Book a Discovery Call- Due dates depend on whether you had wages subject to withholding. For 2024 calendar-year nonresident returns, that was April 15, 2025 with wages, or June 16, 2025 without wages.

- Form 8843 is used to claim excluded days if you are an exempt individual, for example, many F, J, M, or Q visa holders, or if a qualifying medical condition kept you in the U.S. longer.

- Substantial presence rules determine if you are a resident for tax purposes. Certain days do not count, for example some commuter days, transit under 24 hours, and days as an exempt individual.

Note, this guide is educational, not legal or tax advice. Always confirm your facts with a qualified preparer or your VITA site.

Who Should Complete Form 13614‑NR, and Who Can Skip It

If you are a nonresident with U.S. source income or you want a VITA or professional preparer to evaluate whether you must file, you should complete Form 13614‑NR. It is the standard intake for nonresident returns in the VITA program, and many firms use the same data points for their internal workflows. If you are a resident for tax purposes, VITA will generally use Form 13614‑C instead of 13614‑NR.

Quick decision table

| You should complete 13614‑NR if | You usually do not need 13614‑NR if |

| You are a nonresident and received U.S. source income such as wages or a taxable scholarship reported on W‑2 or 1042‑S | You had no U.S. source income and you are not seeking help with a return |

| You will file Form 1040‑NR and possibly Form 8843 | You are a resident for tax purposes and will use Form 13614‑C instead |

| You want VITA or a preparer to assess a treaty claim | Your only income is foreign‑source and not taxable in the U.S. |

W‑2 wages come from employment. Form 1042‑S reports many U.S. source payments to nonresidents, including scholarship income, and it can show treaty exemptions when they apply. Colleges issue Form 1098‑T to report certain tuition payments and scholarships, often relevant for students interacting with campus tax support.

What You Need Before You Start

You will make the process smoother if you gather everything below first:

- Passport identity page and U.S. visa page images

- I‑94 number and five‑year travel history printouts or screenshots

- U.S. mailing address and any foreign address used in 2025

- SSN or ITIN, if you have one

- Income forms, for example W‑2 for wages, 1042‑S for scholarships or other U.S. source income, and 1098‑T for students

- Prior year U.S. returns, if any, especially if you claimed a treaty before

- If any part of your intake or review will be virtual, many sites will also ask you to sign Form 14446, the Virtual VITA/TCE Taxpayer Consent, last listed with a November 2023 revision on IRS.gov.

Tip for travel history, retrieve your I‑94 record and travel history directly from CBP. The portal shows your most recent I‑94 and up to five years of entries and departures, which is exactly what preparers check against the days you list on the intake.

Inside The Form, Line By Line Priorities

Here is how I walk nonresident filers through the high‑impact parts, using the 2025 revision as the map.

- Identification and contact Use your legal name exactly as on your passport. If your mailing address will change during filing season, add a stable email your preparer can use for follow ups. The form specifically asks for passport and visa numbers, which help tie your travel and status details together.

- Immigration status and visa history The 2025 form records your entry status, current status, any changes, and your visa type for each year back to 2019. If your J‑1 had a specific subtype, pick the right one. This matters because treaty articles often depend on your status and primary activity.

- U.S. presence days Count every day you were physically present in the U.S., including partial days, with limited exceptions such as certain commuters, transit under 24 hours, and exempt individuals. If you are unsure, use your I‑94 travel history as a cross‑check. The 2025 form captures your days for 2023, 2024, and 2025.

- Treaty claim section If you intend to claim a treaty exemption, the form asks for your country, treaty article, months previously claimed, and the amount of exempt income this year. This helps your preparer match income on a W‑2 or 1042‑S to a valid treaty position.

- Income checklist Mark yes or no for wages, scholarships, dividends, interest, retirement income, and more. Attach the forms that support each item. Remember, some items may be exempt by treaty, but they still need to be listed so the preparer can compute the correct result.

Documentation Attachments, What To Provide

- Identity, passport photo page, visa page, and SSN or ITIN documentation

- I‑94 and travel history printouts for the years the form asks about

- All income forms, W‑2, 1042‑S, and 1098‑T if applicable

- If your site uses a virtual or hybrid process, a signed Form 14446 to allow remote intake and review

Keep digital files as clear PDFs or high‑quality images. Blurry uploads slow reviews and create follow‑ups you do not want during busy season.

How To Fill Out Form 13614‑NR In One Smooth Session

Here is a simple flow I use with first‑time filers.

- Set a 30 to 45 minute window Silence distractions. Keep your passport, visa, I‑94 travel history, and income forms open on the screen or printed.

- Start with identification Type your legal name as on your passport. Add your U.S. mailing address and a dependable email. Enter passport and visa numbers exactly as shown.

- Record your immigration status and changes Pick your entry status, current status, and note any changes with dates. Fill the annual visa type grid back to 2019. If you had J‑1, select the correct subtype, for example student, researcher, professor.

- Count U.S. presence days Use I‑94 travel history to list 2025 entries and departures, then tally days for 2023 and 2024. Exempt days and certain travel may not count toward substantial presence, but they still belong in your 8843 analysis.

- Add treaty details if you plan to claim an exemption Identify your country and treaty article and note how many months you claimed in prior years. Keep your 1042‑S or employer letters handy to support the amounts you list as exempt.

- Complete the income checklist Mark every category that applies. Attach W‑2 for wages, 1042‑S for many nonresident payments including scholarships, and 1098‑T if you are a student who received reportable scholarships or tuition payments.

- Final scan Look for mismatches between your travel days and the dates on your I‑94, and between treaty claims and the codes on your 1042‑S. Save a clean PDF and keep a copy for your records.

Deadlines You Should Know For 1040‑NR And 8843

- If you had wages subject to U.S. withholding for 2024, your Form 1040‑NR was due April 15, 2025. If you had no such wages, your due date was June 16, 2025. Extensions are possible with Form 4868, but interest and some penalties can still apply if tax is unpaid by April 15.

- If you are an exempt individual or claiming excluded days, many nonresident students and scholars must file Form 8843. Attach it to your 1040‑NR or mail it by the 1040‑NR due date if you do not otherwise have to file.

Substantial Presence Basics In Plain English

The substantial presence test decides whether you are a resident for tax purposes. Most days you are physically in the U.S. count, but some days do not, for example certain commuters, transit days under 24 hours, and days you are an exempt individual, such as qualifying students or certain teachers and trainees. Your intake captures the right data so your preparer can apply these rules correctly.

Where To Find The Things Preparers Always Ask For

- I‑94 and travel history, use CBP’s portal to print your most recent I‑94 and the past five years of history. This is the fastest way to verify your days.

- Scholarship reporting, check your 1042‑S statements, which report many U.S. source payments to nonresidents, including treaty‑exempt amounts when applicable.

- Tuition statements, some schools issue 1098‑T for certain transactions and scholarships. These statements are defined in the official instructions for Forms 1098‑E and 1098‑T.

Security And Privacy Tips While You Prepare

- Use a private network and a device you control.

- Save a local copy of your filled intake and supporting documents.

- If you are using a virtual or hybrid site, ask if they require Form 14446. The IRS lists the form with a November 2023 revision, still cited by the Service in 2025 resources.

Small note for peace of mind, the intake itself is not a tax return, but your answers should be accurate. Treat it like an interview on paper.

FAQs, Straight Answers

What is Form 13614‑NR used for, exactly?

It is the nonresident intake and interview sheet used by VITA and many preparers. It captures your identity, immigration status, travel days, income categories, and treaty information so the preparer can decide on residency status, the right forms, and needed disclosures. It is not filed as your tax return.

Do VITA sites really use this form?

Yes. The form is designed for VITA and TCE programs, and the IRS lists it as the Nonresident Alien Intake and Interview Sheet. Many professional firms follow the same structure so reviews go faster.

I am a student on an F‑1 or J‑1 visa. Do I need Form 8843?

Most nonresident students and scholars file Form 8843 to explain excluded days for the substantial presence test. Attach it to your 1040‑NR or mail it separately by the 1040‑NR due date if you do not otherwise file.

What are my 1040‑NR due dates for the 2024 tax year?

For 2024 calendar‑year returns, the due date was April 15, 2025 if you had wages subject to U.S. withholding, or June 16, 2025 if you did not. Filing extensions are available, but taxes still accrue interest after April 15 if unpaid.

What if my I‑94 history is missing a trip?

Start with the CBP I‑94 portal. If you still find an error, CBP’s guidance explains how to address records, and the portal provides printable history for five years, which usually satisfies preparers.

A Quick, Practical Checklist

- Confirm your visa and status history back to 2019, based on the form grid

- Print your I‑94 and five‑year travel history

- Collect W‑2, 1042‑S, and 1098‑T, plus prior returns if you claimed a treaty before

- Fill every required field on the 13614‑NR clearly, then save a clean PDF

- Attach Form 8843 if you are an exempt individual

- If your intake is virtual, sign Form 14446 when requested

For CPA and EA Firms Reading This

If you run a firm, you already know delivery, not demand, is the choke point. Our team at Accountably integrates trained offshore staff into your existing systems with SOP‑driven workpapers and multi‑layer review, so nonresident intakes and 1040‑NR cycles move with fewer bottlenecks and less partner time in review. We work inside the tools you already use and align to your templates and SLAs. Use this only if it genuinely helps your workflow, we keep the focus on disciplined delivery, not resume lists.

Final Word

Take a breath. You do not have to become a tax expert to complete Form 13614‑NR well. Gather your travel records and income forms, answer every field carefully, and keep a copy of everything you submit to your preparer or VITA site. If something is unclear, ask questions early. A clean intake now saves you time later, protects valid treaty claims, and helps you file on time with confidence.

Simplify Delivery, Improve Margins, Stay in Control.

Offshore support that works exactly like your in-house team.

💼 Let’s Talk