Scale Your CPA Firm Without Adding Headcount

Build your offshore team that works your way, trained, compliant, and white-labeled under your firm.

👉 Book a Discovery Call

Plain English up front, then details you can act on. You will get what to file, when to file it, what to include, and how to keep reviewers happy.

Key takeaways

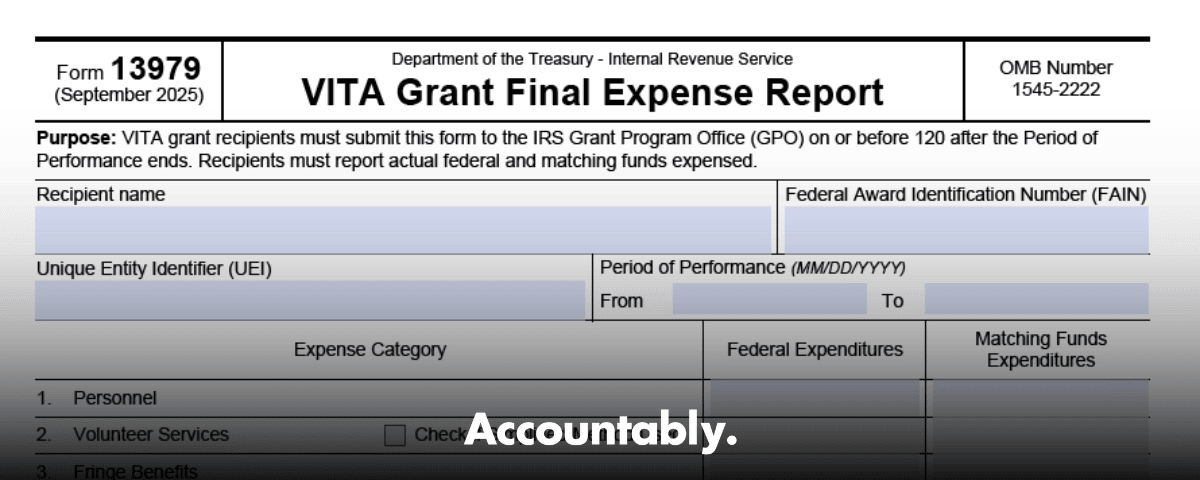

- In 2025, Form 13979 is the IRS VITA Grant Final Expense Report, part of OMB Control Number 1545‑2222, and the current form shows a June 2025 revision. It reports actual paid costs for your VITA grant, not projections.

- The VITA grant period of performance runs October 1 through September 30. The final report is due by January 28, which is 120 days after the period ends.

- Use actual disbursements only. Exclude encumbrances, obligations, and accruals that have not cleared your bank. Keep every line item traceable to source support.

- Keep records for at least three years from the date you submit your final financial report, longer if an audit, claim, or property rules apply.

- Related forms do different jobs: 13979-A covers the budget and narrative you propose, 13980 covers performance measures at year end. Do not mix them with 13979.

What Form 13979 is, in 2025 terms

Today, Form 13979 is the VITA Grant Final Expense Report. You use it to show the IRS exactly what was paid with federal funds and matching funds during the project year. The form is part of the IRS’s VITA/TCE grants information collection under OMB 1545‑2222, and the current listing labels 13979 as “VITA Grant Final Expense Report,” with a mid‑2025 update.

You submit the final report after the period of performance closes on September 30, and you have until January 28 to file the complete package. That timing comes directly from the IRS VITA grant recipient page. Treat January 28 as a hard stop. Build your internal calendar to close your ledger, reconcile your match, and finalize the form on time.

Hundreds of Firms Have Already Used This Framework.

Join the growing list of CPA and accounting firms using Accountably’s Offshore Playbook to scale faster.

💬 Get Your FREE Playbook

👉 Visit Jugal Thacker’s LinkedIn

Send him a connection request and message “Playbook” to get your copy.

If your Notice of Award or your IRS grant officer gives you a different date in writing, follow that instruction and keep the email with your grant file.

2025 update vs. legacy references

You might still see older materials, especially in archived folders or partner guides, that describe interim and year‑end windows for Form 13979. That is because the 2008 revision of 13979 was titled “Interim / Year End Budget Report,” with an interim report due by April 30 and a year‑end report due by September 30, both based on actual dollars paid. The modern, 2025 form is the final expense report for the full project year, not two in‑year checkpoints.

Quick compare, old vs. current

| Item | Legacy 13979 (2008) | Current 13979 (2025) |

| Title | Interim / Year End Budget Report | VITA Grant Final Expense Report |

| What it covers | Actuals for Oct 1–Mar 31 and Oct 1–Jun 30 | Actuals for Oct 1–Sep 30 |

| When it is due | Interim by Apr 30, Year‑end by Sep 30 | Final package by Jan 28 |

| What IRS expects | Actual dollars paid only | Actual dollars paid only |

| Control/Listing | Catalog 51538T, Rev. 6‑2008 | OMB 1545‑2222, listed Jun/Sep 2025 |

Note, TCE grantees have their own semi‑annual and annual reporting rhythm using separate TCE forms. Do not assume those deadlines apply to VITA Form 13979.

Improve Margins Without Compromising Quality

Offshore staffing helps firms deliver more, scale faster, and stay compliant, without adding local headcount.

👉 Book a Discovery CallWho inside the IRS reviews your report

Within IRS Taxpayer Services, the Stakeholder Partnerships, Education and Communication team, often called SPEC, operates the VITA/TCE Grant Program Office. SPEC’s Grant Program Office manages awards and compliance. Your final report goes to the grant office and is governed by program rules SPEC publishes, keeps, and updates. This is the team that checks your numbers against your award and guidance.

The real purpose

- Give the IRS a verified picture of how you used federal and matching funds.

- Confirm you stayed inside your award and allowable cost categories.

- Build a clean audit trail for future funding decisions.

What you will send with 13979

For most organizations, the final package includes:

- The completed Form 13979 showing actual federal and match expenditures.

- Your Federal Financial Report in HHS’s Payment Management System.

- The year‑end performance measures report and brief narrative. These components are laid out in IRS’s final reporting checklist and have been consistent across recent cycles.

Think of 13979 as the ledger, the FFR as the official cash report, and the performance measures as your story with numbers.

How to complete Form 13979 without rework

I like to run a short “pre‑close” two weeks after September 30. It catches any straggler invoices and helps your reviewers breathe easier. Here is the workflow we use with grantees.

Step‑by‑step

1.Lock the period

- Freeze transactions dated after September 30 until your reconciliation is complete.

- Cut a report of all paid expenses from October 1 to September 30 that map to your approved budget.

- Confirm “actual paid” status

- Match disbursements to bank clears. If it has not cleared, it is not an actual.

- Exclude unposted, encumbered, or promised amounts. Your final must reflect dollars paid.

- Reconcile the match

- Document in‑kind, volunteer time valuations, and third‑party contributions according to your terms and conditions.

- Tie every match line to support you can produce on request.

- Map to categories

- Use the categories and definitions in your budget narrative and award.

- Keep descriptions plain and specific. Avoid “to hire,” “estimated,” or “based on prior year.” Replace with the actual position, hours, rate, and date paid.

- Prepare the FFR in PMS

- Complete the Federal Financial Report in the Payment Management System. Align totals with 13979.

- Remember, FFR is due by January 28 for the full project year and is separate from quarterly cash transaction reports.

- Assemble the performance measures

- Update the required measures for returns prepared, e‑file rate, sites opened, and primary and secondary focus returns, then attach the brief narrative.

- Final review and submission

- Run a final cross‑check: 13979 totals match FFR totals, categories align with your award, and support is complete.

- Submit by January 28 and keep confirmation in your grant file.

What counts as “actual paid,” with examples

- Include: EFT to training venue on June 12 that cleared June 13, travel reimbursements paid March 7, software invoice paid November 2.

- Exclude: A purchase order issued in September that paid in October, unpaid stipends, pending invoices, or verbal commitments. Your report should match bank evidence and payment records.

Attachments and support reviewers expect

- General ledger detail for the period

- Bank statements highlighting cleared transactions

- Invoices, receipts, and payroll records

- Time sheets and valuation worksheets for match

- Contract agreements and proof of payment for services

Quality checks that save you hours

- The FFR total equals the sum of paid federal funds on 13979.

- Match totals are supported and calculated consistently with your award.

- Descriptions are specific, not placeholders.

- There are no expenses dated after September 30 in the project year.

Privacy, records, and access

Grant files need to be audit‑ready, and they also need to be protected. Limit access to people who work the grant, enforce role‑based permissions, and encrypt files at rest and in transit. Those are good practice expectations when you handle taxpayer‑adjacent information and volunteer data.

Under federal rules, keep your grant records for three years after you submit the final financial report, then follow any written direction to extend retention if there is litigation, property, or program income involved. Keep this clock visible in your compliance calendar.

The record‑retention clock starts when you submit the final financial report, not when the period of performance ends. Set your retention date off your FFR submission date.

The simple “What‑How‑Wow” for 13979

- What: A final expense report that shows actual dollars paid for your VITA grant year.

- How: Close the period, reconcile paid amounts, complete 13979 and the FFR, submit by January 28.

- Wow: A clean, timely package builds trust with SPEC, shortens questions, and strengthens your case for future awards.

Quick comparisons you will use during closeout

Form roles, at a glance

| Form | Purpose | Timing | Data type | Where it shows up |

| 13979 | VITA Grant Final Expense Report | Due by Jan 28, covers Oct 1–Sep 30 | Actual dollars paid, federal and match | IRS VITA grants listing, OMB 1545‑2222 |

| 13979‑A | VITA Grant Budget and Narrative | At application or updates as directed | Proposed categories and amounts | IRS forms listing |

| 13980 | VITA Grant Performance Measures Report | With final package | Counts, rates, and narrative | IRS forms listing |

Dates that matter

- Period of performance: October 1 to September 30.

- Final package due: January 28.

- Retention baseline: 3 years after your final financial report submission. Keep these three in a single calendar entry so your whole team sees the chain.

Common mistakes and how to avoid them

- Mixing projections with actuals, or leaving “to hire” in the description. Replace placeholders with real people, hours, and rates.

- Reporting obligations that have not cleared the bank. Wait for payment clearance or exclude the item.

- FFR number does not tie to 13979. Reconcile before you submit.

- Using an old interim schedule for VITA. The current 13979 is a final expense report. If someone asks for an interim check, confirm it in writing with your grant officer.

Ops discipline that keeps you on time

When your team runs tight SOPs, a January 28 deadline feels calm. Here is a simple cadence I recommend:

- Close bank reconciliations by the fifth business day each month.

- Tag VITA‑eligible costs and match in your accounting system with project codes.

- Keep a shared “support pack” folder with invoices, payroll proofs, and valuation worksheets, organized by category.

- Do a brief “pre‑close” after September 30 to catch late entries, then finalize 13979 and your FFR.

If you need structured help, Accountably can integrate SOP‑driven workflows, standardized workpapers, and review checkpoints so your 13979 support stays audit‑ready. We keep access role‑based, use encrypted transfer, and work inside your systems to protect confidentiality. Mention is brief here by design, because the form is the star of this page.

Frequently asked questions

What exactly goes on Form 13979 in 2025?

Form 13979 captures actual paid expenditures, both federal and matching funds, for the full grant year. It is the final expense report for VITA grants under OMB 1545‑2222, not an interim budget estimate.

When is my 13979 package due?

Your final report must be filed by January 28, which is 120 days after the period of performance ends on September 30. Mark the date and plan backward for internal review time.

Do I still file interim and year‑end versions of 13979?

No, not for VITA Form 13979. Older forms from 2008 used that cadence. The modern form is the final expense report. If your grant officer requests a mid‑year update, get the request in writing and follow it.

What about the Federal Financial Report?

You submit the FFR in the Payment Management System and align it with your 13979. The IRS’s final reporting requirements emphasize submitting the FFR by January 28 for the full project period.

How long do I keep support documents?

Keep records for three years from the date you submit your final financial report, longer if an audit, litigation, property, or program income rules apply. Set your retention clock from the submission date, not the period end.

Where can I verify the current form names and numbers?

The IRS forms listing shows 13979 as VITA Grant Final Expense Report, 13979‑A as VITA Grant Budget and Narrative, and 13980 as Performance Measures, all under OMB 1545‑2222. You can also see the OMB listing that references 13979 as the final expense report.

Final word

You do not need a heroic sprint at the end. You need a clear checklist, a tidy ledger, and support you can pull in minutes. Keep your eye on three anchors, period dates, January 28 for the final package, and a three‑year retention window. If you run that play, your 13979 will land clean, your reviewers will have fewer questions, and your team will get a quiet night’s sleep.

Simplify Delivery, Improve Margins, Stay in Control.

Offshore support that works exactly like your in-house team.

💼 Let’s Talk