Scale Your CPA Firm Without Adding Headcount

Build your offshore team that works your way, trained, compliant, and white-labeled under your firm.

👉 Book a Discovery Call

The CRCQ is not paperwork for paperwork’s sake. If you prepare it like a project dossier, you buy speed, predictability, and fewer post‑filing questions.

Key Takeaways

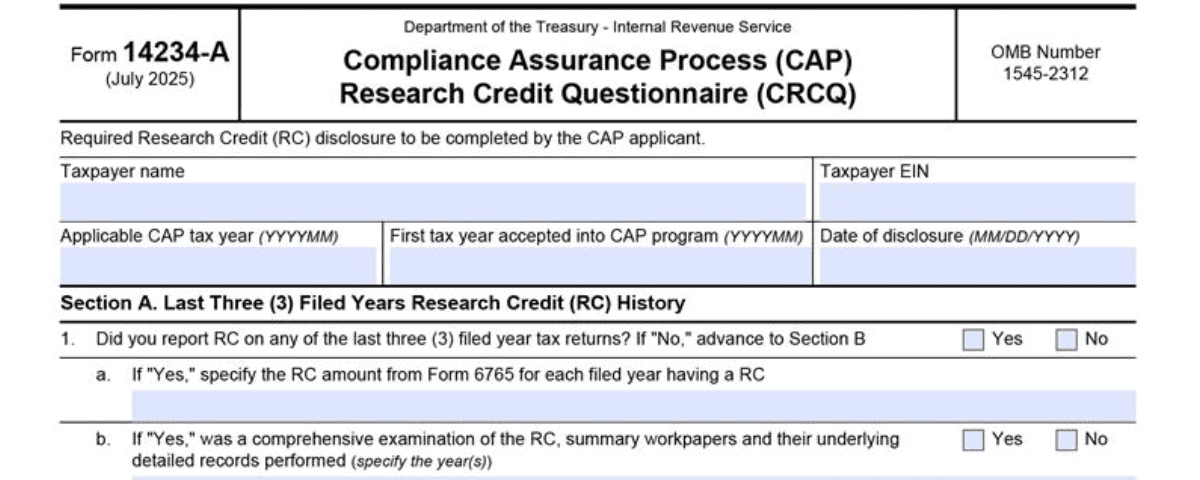

- Form 14234-A is the CAP Research Credit Questionnaire, the CRCQ. It lets the IRS risk assess and test your IRC §41 positions before you file.

- It is submitted as a sub‑form to Form 14234 during the CAP application or when your account coordinator asks. The application window for the 2026 CAP year runs from September 3 to October 31, 2025.

- The CRCQ captures your projects, methodologies, data sources, controls, and QREs, then ties them to contemporaneous records so reviewers can test eligibility and cost tracing in real time.

- Eligible CAP filers are generally LB&I taxpayers with assets of at least 10 million who meet suitability standards under the current IRM and CAP page guidance.

- Expect pre‑filing resolution and a shorter post‑filing tail when you submit complete CRCQ support and follow your MOU timelines.

What Form 14234-A Is, And Why It Exists

Think of Form 14234-A as your research credit storyline, told with evidence. It is the six‑page, fillable CAP Research Credit Questionnaire that surfaces your projects, the uncertainty you tackled, the experiments you ran, and the wages, supplies, and contract research you tie to those efforts. The goal is simple. Give the CAP team what they need to risk assess, test, and reach alignment early, so you are not defending the same facts months later.

- You frame projects against §41’s permitted purpose, technical uncertainty, and process of experimentation.

- You quantify QREs and show how you traced them to payroll, GL, and invoices.

- You point to contemporaneous technical evidence, not after‑the‑fact narratives.

The current CAP page and IRM both reference Form 14234‑A by name, and the IRS forms index lists the CRCQ updated in July 2025. That confirms you are working from an active, supported document.

Hundreds of Firms Have Already Used This Framework.

Join the growing list of CPA and accounting firms using Accountably’s Offshore Playbook to scale faster.

💬 Get Your FREE Playbook

👉 Visit Jugal Thacker’s LinkedIn

Send him a connection request and message “Playbook” to get your copy.

Where the CRCQ Fits Inside CAP

You already share plenty with CAP, but the CRCQ is the linchpin for research credit. Complete it during the application period if the credit is material, or when your account coordinator requests it. The form drives a faster planning phase, more targeted IDRs, and earlier agreement on scope. It also forces internal alignment across tax, R&D, finance, and accounting, which cuts review time later.

Submit a complete CRCQ, and the review becomes about testing and agreement. Submit a vague CRCQ, and the review becomes about discovery and delay.

What You Provide, And Why It Matters

| Focus Area | What You Provide | Why It Matters |

| Research activities | Project scopes, uncertainties, test cycles | Tests qualification under §41 |

| Expenses | Wages, supplies, contracts by project and period | Substantiates the credit base |

| Methodologies | Allocation, sampling, time tracking logic | Evaluates reliability and repeatability |

| Documentation | Lab notes, designs, test reports, prototypes | Corroborates your narrative with evidence |

| Timing | Submissions that meet CAP milestones and MOU | Keeps reviews on track for pre‑filing certainty |

Who Should Complete It

If you are applying to CAP for the next year and you expect to claim the research credit, complete Form 14234‑A with your application. Returning participants provide it per coordinator instructions during pre‑filing. Treat the CRCQ as both an eligibility screen and a working record of responsibilities across teams. The IRS confirms the CAP application window for the 2026 CAP year is September 3 to October 31, 2025 and lists Form 14234‑A among the required application documents.

Improve Margins Without Compromising Quality

Offshore staffing helps firms deliver more, scale faster, and stay compliant, without adding local headcount.

👉 Book a Discovery CallWhy Firms Struggle To Scale CRCQ Delivery

Most firms do not miss the credit because they lack good projects. They miss certainty because delivery breaks. Peak‑season spikes, partner time trapped in review loops, hiring delays, unstructured workpapers, and inconsistent documentation create a ceiling. You feel it when reviews bounce back for missing schedules, unclear roles, or weak ties between experiments and costs. That is why you need SOPs, standardized workpapers, a layered review, and turnaround SLAs that keep everyone honest.

Where relevant, our team at Accountably plugs in as an offshore delivery partner to reinforce those mechanics, not to swamp you with resumes. We standardize file logic, build internal checklists, and align CRCQ exhibits with your systems and templates inside tools like QuickBooks, Xero, and your tax software. Use offshore capacity only when it comes with structure, quality control, and accountable turnaround. Use it to reduce partner time in review, not to add another pile of rework.

Key Definitions And What Counts As Research Under §41

When the CRCQ asks about “qualified research,” it is really asking four plain questions, project by project. Did you pursue a permitted purpose, did you face a real technical uncertainty, did you run a process of experimentation, and was the work grounded in the hard sciences. If you cannot show those points with dated evidence, the credit will wobble in review.

- Define the business component, the hypothesis you tested, and why ordinary know‑how would not solve it.

- Spell out the experiments you tried, the alternatives you ruled out, and the results you got.

- Separate R&D from routine QA, data gathering, and production support.

- Tie wages, supplies, and contract research dollars to specific experiments and dates.

If someone outside your team cannot follow your experiment trail from hypothesis to result in five minutes, you need clearer records, not more adjectives.

What The CRCQ Expects You To Describe

- The project scope and timeline, including design and testing cycles.

- The people involved, their roles, and the hours tied to qualified tasks.

- The hard costs you consumed, and the contracts you controlled.

- The method you used to allocate time and costs, plus any sampling logic.

- The contemporaneous records that prove each statement.

Data And Documentation You Should Have Ready

Your narrative opens the door, your evidence earns certainty. Aim to prove each part of the four‑part test with records that already existed during the work, not recreated after the fact.

- Payroll extracts and time allocations mapped to projects and dates.

- Lab notebooks, commit histories, design drawings, test reports, defect logs.

- Supplier and contractor documents, including SOWs, invoices, proof of payment, and rights and control language.

- Book‑to‑tax reconciliations, including capitalized items, gross‑ups, and pass‑throughs.

- Intercompany agreements if cross‑border teams or shared services are involved.

| Evidence Type | Ties To | Why Reviewers Trust It |

| Dated technical logs and reports | Process of experimentation | Shows what you tested, when, and why |

| Payroll and project time mapping | Wages QREs | Quantifies labor to projects cleanly |

| Invoices, SOWs, and payment proof | Contract research and supplies | Confirms qualified scope and spend |

| Version control and ticket history | Experiment steps and outcomes | Proves iterations and decisions |

| GL to return reconciliation | Credit calculation | Connects books to the return position |

How To Work The Six‑Page Fillable PDF Without Spinning Your Wheels

The CRCQ is short, but it is dense. Treat it like a dossier, not a form. You can complete only the sections that apply, as long as the package is consistent and supported.

Purpose And Eligibility, In Practice

- Form 14234‑A captures the facts and methods the CAP team needs to assess your research credit before filing. That is the entire point of CAP, resolve issues in real time and reduce the post‑filing tail.

- Eligibility flows from CAP itself. Applicants are generally LB&I taxpayers with assets of at least 10 million who meet suitability standards, with the precise year’s window announced on the CAP page.

- The IRS lists Form 14234‑A on the CAP page with the other application documents, and the forms index shows the CRCQ last updated in July 2025.

What To Fill Out

- Activities summary, framed against §41.

- Qualified expenses, traced and reconciled to financials.

- Project listings that show uncertainty and experiments.

- A documentation index that maps evidence to each claim.

| Section Focus | What You Should Provide |

| Activities Summary | Short, testable descriptions tied to §41 criteria |

| Qualified Expenses | Traced amounts, with GL and payroll bridges |

| Project Listings | Hypotheses, experiments, and results |

| Documentation Index | Workpapers and mapping logic with timestamps |

A Simple Dossier Workflow

- Draft the project summaries with hypotheses, uncertainties, and steps tested.

- Pull a payroll extract by person, project, and period, then build the mapping worksheet.

- Collect SOWs, invoices, and payment proof for third‑party work, highlight rights and control.

- Snap a book‑to‑tax bridge that shows how QREs land on the return.

- Pin every claim to a dated record, then index it.

- Have a senior reviewer test one project from scratch, time‑boxed to ten minutes, to spot gaps.

Brief note on capacity and review: if your internal team is underwater, bring in help for assembly and QC, not just headcount. At Accountably, we join your systems and templates, standardize workpaper naming, and run a multi‑layer review that cuts partner time without sacrificing control. Use outside capacity when it comes with SOPs, checklists, and turnaround SLAs, otherwise you just move the bottleneck.

Coordinating 14234‑A With 14234, 14234‑B, 14234‑C, And 14234‑D/E

The CRCQ is one piece of a larger puzzle. Keep every form telling the same story.

- 14234, CAP Application, is your cover package.

- 14234‑B, the MITT, lists intercompany transactions that often intersect with R&D cost sharing and services.

- 14234‑C, the TIIL, flags initial issues, including research credit.

- 14234‑D, TCFQ, covers tax control framework, and 14234‑E, CBAQ, covers cross‑border activities that can affect research eligibility and allocations.

The CAP page hosts all of these forms in one place for the current cycle, so always pull the latest copies there.

A Coordination Checklist That Prevents Mismatches

- Cross‑reference CRCQ projects to TIIL issues, so risk and scope match.

- Mirror MITT facts where intercompany cost sharing, services, or IP arrangements touch R&D.

- Use the CBAQ to anchor cross‑border roles, rights, and costs, then copy the same facts into CRCQ narratives.

- Make sure your book‑to‑tax bridges and any §41 base period data match the return modeling in tax.

Dates And Deadlines You Should Actually Calendar

- For the 2026 CAP year, the application window is September 3 to October 31, 2025, with acceptances communicated in February 2026. Block those dates now.

- The IRM confirms you submit the application annually, during the period announced each year, and that acceptance and the MOU control your obligations and timing.

When your CRCQ and CBAQ tell the same cross‑border story, reviewers focus on testing, not reconciling facts between forms.

Common Issues In Research Credit Reviews, And How To Avoid Them

Reviewers deny claims for two recurring reasons, weak eligibility and weak tracing. You fix both with clearer project definitions and better evidence.

- Eligibility gaps: routine QA, maintenance, data collection, and production support mixed into qualified narratives.

- Tracing gaps: payroll that does not map to projects, contractor invoices without control or rights, and supplies that are not tied to experiments.

- Method gaps: sampling and allocation that is not explained or repeatable.

- Cross‑border gaps: CBAQ and MITT facts do not match CRCQ positions, creating exposure.

Tie Projects To The Four Tests

- Write the permitted purpose in one sentence per project.

- Name the technical uncertainty in plain terms.

- List the experiments and the alternatives you tried.

- Link each dollar to an experiment step, a date, and a person.

A quick guardrail, the IRM specifically instructs CAP teams to risk assess the research credit using your CRCQ and to communicate scope during planning. Give them a clean package upfront to earn a smaller scope.

Substantiation That Survives CAP

Build a contemporaneous record, not a pretty appendix.

- Use employee time logs or project allocations that reconcile to payroll and audited financials.

- Keep executed contracts, proof of payment, and control language for third‑party work.

- Retain receipts and inventory support for supplies.

- Preserve the book‑to‑tax bridge, including any gross‑ups, capitalization, or pass‑through adjustments.

If a number appears on the return, someone should be able to trace it to a source document in under ten clicks. That is your standard.

Timing And Submission Inside The CAP Cycle

Your timing depends on status. New applicants include the CRCQ with the CAP application during the announced window. Returning participants follow the account coordinator’s instructions and the MOU timeline during pre‑filing. The IRS repeats this annually and posts the period for the year, which for the 2026 CAP year is September 3 through October 31, 2025.

- Meet MOU deliverable dates or risk removal from CAP.

- If facts change after submission, send an interim update quickly, do not wait for filing.

- Aim to close research credit issues as early in planning as possible, so the post‑filing tail is short.

The IRS also explains that CAP pre‑filing review is not a formal examination, but the team can examine undisclosed or unresolved items post‑filing. Clear CRCQ disclosure protects you here.

Cross‑Border Considerations, CRCQ And CBAQ

If you develop across borders, align CRCQ projects and QREs with the CBAQ’s people, locations, rights, and funds flows, then match those facts in the MITT where services or cost sharing apply.

- Keep the same names, entities, and periods in all three places.

- Explain who owns what, who controls what, and who pays what, supported by executed agreements.

- Update CRCQ and CBAQ within thirty days of a material change, so the CAP team is not surprised later.

The CAP page and FAQ confirm CAP uses announced windows, and that eligibility rules for new and returning applicants can vary year to year. Check the current page before you finalize.

Recordkeeping That Makes Reviews Fast

Hold a central, indexed repository with immutable timestamps and access logs. Keep records for the statute period, longer if risk persists.

- General ledger detail and audited financials.

- Project‑level descriptions, timelines, and results.

- Time logs, payroll bridges, and allocation worksheets.

- Contractor SOWs, invoices, and proof of payment.

- Supply receipts and usage records.

- Credit computations with base period data and any ASC method details.

You are not storing files, you are building a time machine. Anyone should be able to jump back to what happened, who did it, when it ran, and what it cost.

Practical Tips To Complete And Review Form 14234‑A

Treat the CRCQ like a living project file.

| Action | Purpose | Evidence |

| Populate project details | Scope clarity | Names, dates, hypotheses, iterations |

| Link expenses cleanly | Quantification | Payroll bridges, invoices, GL extracts |

| Cross‑reference financials | Consistency | Audited FS, book‑to‑tax reconciliations |

| Date testing steps | Traceability | Lab notes, approvals, ticket history |

| Calendar CAP deadlines | Compliance | Application window, MOU due dates |

If you need extra hands to prep exhibits, consider structured help. Accountably works inside your systems with standardized naming, layered QC, and turnaround SLAs, so partners get out of review loops and back to advisory work. Keep mentions pragmatic and sparing, the work should speak for itself.

Resources, Forms, And Where To Get The Latest

- CAP overview page, including the current application window, eligibility, and links to all CAP forms and the MOU.

- News release confirming the 2026 CAP window, September 3 through October 31, 2025, and February 2026 notifications.

- IRM 4.51.8 sections that describe the annual application, MOU, and CRCQ risk review procedures.

- IRS forms index entries for 14234‑A, 14234‑B, 14234‑C, 14234‑D, 14234‑E, and 14234 with 2025 updates.

Key Eligibility Criteria, Summarized

- U.S. publicly traded filers, and privately held C‑corps, including foreign‑owned, with assets of at least 10 million, subject to suitability.

- One open filed return and one unfiled return rule for returning applicants, and specific limits on years under exam for new applicants, per the current FAQ.

- Annual application during the announced window, then acceptance and an MOU for the CAP year.

FAQs

Who should complete Form 14234‑A?

Any CAP applicant or participant with a material §41 research credit position for the CAP year should complete the CRCQ, either with the application or when requested in pre‑filing. The CAP page lists the CRCQ among required documents.

How do I avoid delays and last‑minute IDRs?

Submit a complete CRCQ with dated technical evidence, clean payroll bridges, contractor control language, and a documentation index. Follow the MOU calendar and send interim updates when facts change.

Where do I find the current application window and forms?

Always check the CAP overview page for the year‑specific window and download links for 14234, 14234‑A through 14234‑E, and the MOU. For 2026 CAP, the window is September 3 to October 31, 2025.

Does the CRCQ also cover §174 amortization topics?

Yes, per the IRM, CAP teams use your CRCQ as part of their risk review for the research credit and amortization of R&E expenditures. Give them clear disclosures up front.

Conclusion

When you present Form 14234‑A like a project dossier, you replace mystery with mechanics. Define projects in plain language, keep your evidence close to the work, and bridge every number to payroll, GL, and contracts. Align the CRCQ with the MITT, TIIL, and CBAQ so the same facts repeat everywhere. Submit on time, update quickly when facts change, and give reviewers a clean trail to follow.

If you want help building that machinery, our team at Accountably can plug in with SOPs, structured workpapers, and a layered QC workflow that protects partner time and keeps turnaround predictable. That way, you stop firefighting and start finishing.

Disclosure, for trust: This guide was drafted by Accountably’s Tax Ops Team with light editorial assistance from AI to standardize headings and tables. All dates and references were checked against current IRS pages as of October 29, 2025.

Simplify Delivery, Improve Margins, Stay in Control.

Offshore support that works exactly like your in-house team.

💼 Let’s Talk