Scale Your CPA Firm Without Adding Headcount

Build your offshore team that works your way, trained, compliant, and white-labeled under your firm.

👉 Book a Discovery Call

If you had “Sept 3–Oct 31, 2025” circled for a 2025 application, that date range actually belongs to the 2026 cycle. I will call out the correct timing below and cite sources for each item.

A quick story to set the stage

Last winter a tax director called me at 7 p.m. with that voice you recognize immediately, equal parts tired and determined. Their group had just closed a cross‑border financing, and someone asked the question nobody wanted to hear, do we owe an interim CAP filing for this. We pulled the deal memo, looked at the flows, then checked the new Form 14234‑E rules. Yes, since the transaction was material, an interim CBAQ was due within 30 days. The team filed on time. In the process they realized the bigger win, the firm needed a clean, repeatable way to spot these triggers, gather support, and get a reviewer the right package fast.

If you have felt that same 7 p.m. adrenaline, you are exactly who this guide is for.

Hundreds of Firms Have Already Used This Framework.

Join the growing list of CPA and accounting firms using Accountably’s Offshore Playbook to scale faster.

💬 Get Your FREE Playbook

👉 Visit Jugal Thacker’s LinkedIn

Send him a connection request and message “Playbook” to get your copy.

Key Takeaways

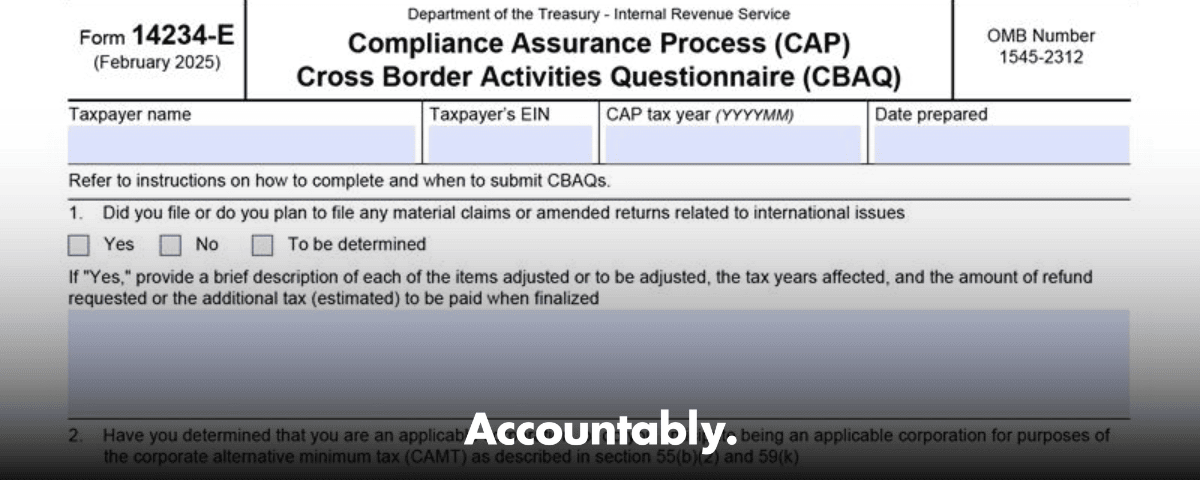

- Form 14234‑E is the CAP Cross Border Activities Questionnaire, the form the IRS added for 2025 to surface international transactions and positions early. Use the October 2023 PDF that displays OMB control number 1545‑2312.

- New 2025 CAP applicants submitted during the 2025 window, which ran September 4 to October 31, 2024. Returning CAP participants use 14234‑E on a recurring schedule. I list each deadline below.

- Returning participants file 14234‑E within 90 days after the prior tax year end, again with the return, and also file an interim CBAQ within 30 days after any material cross‑border transaction or activity.

- Bridge Plus is now permanent. You provide audited financials, a traceable book‑to‑tax reconciliation, and a draft return 30 days before filing so the IRS can review for consistency.

- The IRS expanded eligibility to domestic and foreign privately held C‑corps for the 2025 cycle. Asset threshold remains at 10 million or more, plus other criteria.

What Form 14234‑E covers and why it matters

Form 14234‑E, the Cross Border Activities Questionnaire, is the IRS’s focused intake on your international activity for CAP. It sits alongside the CRCQ, MITT, TCFQ, and other CAP documents, but 14234‑E is aimed at surfacing material cross‑border structures, positions, and transactions that could shape CAP scope or risk discussions. For 2025, IRS announced the new form as part of program updates, and it expects this information to improve early risk identification.

Under the Paperwork Reduction Act record for OMB 1545‑2312, Form 14234‑E is labeled “Form 14234‑E (10‑2023),” with file metadata created October 25, 2023, modified December 15, 2023, and the instrument code f14234‑e‑‑2023‑10‑00‑‑web. If you like to double‑check file lineage, the IC ID is 268243. These markers help you confirm you have the correct PDF in your document control system.

What the IRS uses it for

- To define the cross‑border scope inside CAP, so exam resources focus on where the risk actually lives.

- To time‑stamp material transactions as they occur, which is why interim filings exist.

- To coordinate with your other CAP disclosures, like the MITT for transfer pricing, rather than duplicate them. The MITT itself continues to serve as the structured transfer pricing transaction list.

Who must complete 14234‑E

If you apply to CAP or you are already in CAP for 2025, you complete the Cross Border Activities Questionnaire if you meet program eligibility. For 2025, eligibility expanded to domestic and foreign privately held C‑corps, in addition to SEC filers. The IRS communicated those changes in its 2025 CAP announcement.

Improve Margins Without Compromising Quality

Offshore staffing helps firms deliver more, scale faster, and stay compliant, without adding local headcount.

👉 Book a Discovery CallPlain English rule of thumb If you are a CAP applicant or participant with cross‑border transactions or positions that could be material, you should plan to complete 14234‑E and keep an eye on interim triggers.

New vs returning participants

- New 2025 applicants, application window already closed on October 31, 2024, were required to include 14234‑E with the CAP package.

- Returning participants, you submit 14234‑E within 90 days after the prior year end, again with the return, and within 30 days of any material cross‑border activity. This 30 day interim rule is new for many teams.

What changed for 2025

The IRS’s 2025 refresh did three big things that affect your workflow. It expanded eligibility to privately held C‑corps. It added Form 14234‑E to focus the cross‑border review. It made Bridge Plus permanent, with a draft return due 30 days before filing. The IRS announced these points in IR‑2024‑211 and professional summaries of the program updates.

- Expanded eligibility to domestic and foreign privately held C‑corps.

- New cross‑border questionnaire 14234‑E, with interim reporting within 30 days of a material transaction.

- Bridge Plus permanent, submit draft return 30 days before filing for pre‑file consistency checks.

Key dates and submission channels at a glance

Here are the time boxes that matter. I am keeping the 2025 and 2026 cycles separate to prevent calendar mix‑ups.

| Filing scenario | What you submit | When you submit | Where you submit |

| New 2025 CAP applicant | Full CAP package, including Form 14234‑E | Sept 4 to Oct 31, 2024 window | CAP program mailbox, as instructed in the announcement |

| Returning participant, annual | Form 14234‑E | Within 90 days after prior tax year end, and again with the return | To your assigned IRS CAP account coordinator |

| Interim filing, returning | Form 14234‑E interim CBAQ | Within 30 days after a material cross‑border transaction or activity | To your assigned coordinator, per your MOU |

| New 2026 CAP applicant | Full CAP package | Sept 3 to Oct 31, 2025 window | CAP program mailbox |

These windows come from the IRS announcements. 2025 cycle dates were Sept 4 to Oct 31, 2024. 2026 cycle dates are Sept 3 to Oct 31, 2025. The 30 day interim rule and Bridge Plus timing are documented in reputable program summaries that quote the IRS updates.

Why correct dating matters

CAP is a real time process. If you align 14234‑E timing with your monthly close and transaction committees, you avoid scrambling at month end and you reduce the chance that a material deal slips past your 30 day clock. I have watched that simple calendar tie‑in save teams many hours of review time.

File hygiene, document identifiers, and how to validate your PDF

Because CAP is documentation heavy, your reviewers will thank you for clean file control. Start by confirming you have the correct PDF and that your version stamps are visible in the document properties.

- Use “Form 14234‑E (10‑2023).”

- Confirm OMB control number 1545‑2312 is displayed.

- If you store metadata, note author string SE:LB:CBA:E:TR4:T1573, created 2023‑10‑25, modified 2023‑12‑15, and internal code f14234‑e‑‑2023‑10‑00‑‑web. These markers come from the OMB record for the CAP forms.

Keep your naming simple and consistent. A pattern like “TaxYear_Client_Form14234‑E_YYYYMMDD.pdf” prevents duplicate uploads and speeds reviewer search.

Pro tip Store 14234‑E alongside your MITT and CRCQ for the same period, then link them in your reviewer cover memo so the IRS can move directly from cross‑border facts to transfer pricing detail without digging. The MITT page confirms format and purpose for transfer pricing risk review.

Eligibility and suitability, do you actually belong in CAP for 2025

Start by confirming you meet the threshold items. CAP targets large corporate taxpayers that can work in real time with the IRS. For 2025, the IRS expanded eligibility beyond SEC filers to include domestic and foreign privately held C‑corps with audited financials. Minimum assets remain 10 million or more, and you must not be in an investigation or litigation that limits access to current records. The IRS announced these 2025 updates in IR‑2024‑211.

If you are a new applicant that is currently under exam, you can have up to three open years on day one of your CAP year as long as the IRS feasibility test says those years can close from the exam group within 12 months. That condition is formalized through the CAP MOU after acceptance.

Open year limits still apply. The 2025 cycle keeps the rule of one open filed return and one open unfiled return at the start of the CAP year, with a narrow exception if a year is open only for certain Inflation Reduction Act issues, for example CAMT, stock buyback excise tax, or clean energy credits. That year does not count as an open filed return for eligibility purposes.

A quick self test I ask teams to run

- Do you have 10 million or more in assets and clean access to records across your entities.

- Can you commit to audited financials and timely quarterly financials.

- Can tax, controllership, and legal respond quickly to reviewer questions without endless routing.

- Can you support interim filings within 30 days for material cross border activity.

If any of these raise a hard no, fix the operational blockage first, then apply. You will save time and reduce stress later.

What the IRS expects inside your 14234‑E package

Think of 14234‑E as your cross border intake. The IRS uses it to map transactions and positions that could drive risk. The form is the October 2023 PDF, labeled “Form 14234‑E (10‑2023),” and it displays OMB control number 1545‑2312. The OMB record shows author string SE:LB:CBA:E:TR4:T1573, created 2023‑10‑25, modified 2023‑12‑15, and internal code f14234‑e‑‑2023‑10‑00‑‑web. Keep these identifiers in your document properties so reviewers can validate the version quickly.

Typical content to have ready before you start typing

- Transaction descriptions for the year and near term pipeline, for example intercompany loans, capital contributions, cash pooling moves, IP migrations, principal conversions, CFC restructures, cost sharing updates, hybrid financing, and treaty claims.

- Materiality framework, including thresholds used by management, plus your 30 day trigger logic for interim filings.

- Transfer pricing alignment narrative, keep it short and point to the MITT.

- Tax attribute notes that often affect cross border years, for example foreign tax credits, GILTI, FTC carryforwards, BEAT history, CAMT interactions.

- Workpapers that show the numbers behind the description, clearly titled with dates and preparer names.

Document identifiers to lock into your control sheet

- File title and version, Form 14234‑E, 10‑2023.

- OMB control number 1545‑2312, IC ID 268243.

- The internal code f14234‑e‑‑2023‑10‑00‑‑web, which you will see on the OMB record and sometimes in PDF properties.

Regulatory references and where to grab the form

You will not find 14234‑E on the standard IRS forms index yet. The official listing for CAP application materials lives on the OMB information collection page under OMB 1545‑2312. That page lists 14234, 14234‑A through 14234‑D, the MITT, and the new 14234‑E with live PDF links and metadata. Bookmark the OMB page so you always pull the correct revision and can cite the control number in your MOU cover memo.

When you click the 14234‑E entry on OMB, you will see the October 2023 PDF and the same metadata you captured above. If your PDF viewer complains, update Adobe Reader and re‑download.

How timing works for 14234‑E, in plain English

- New 2025 applicants, the application window ran from September 4 to October 31, 2024. If you are planning ahead, the IRS opened the 2026 application window from September 3 to October 31, 2025. Mark those windows correctly so you prepare the right cycle.

- Returning participants, submit 14234‑E within 90 days after the prior tax year end, submit again with your tax return, and file an interim version within 30 days after any material cross border transaction or activity. This interim rule is the change most teams feel on the ground.

When does the 30 day clock start

Start the clock when the transaction is completed under your materiality standard and signed approvals, not when someone casually mentions a possible deal. In practice, I advise teams to trigger the clock when the corporate approvals are final and cash or ownership transfers have occurred, whichever is earlier under your policy, then build the reviewer package that week.

If you only change the name of a counterparty or fix a typo, that is not a new material transaction. If you change economics, risk, or tax posture, treat it like a new item and consider whether it needs an interim filing.

Build the workflow so 14234‑E does not become a fire drill

The most common failure is not technical, it is operational. People know what to put in the form, they just cannot get the right files to the right reviewer at the right time. Below is the way I set up a simple, repeatable workflow with clear ownership.

One page RACI that actually works

- Tax director, owns the 14234‑E narrative and materiality calls.

- International tax lead, drafts the transaction descriptions and ties to MITT references.

- Transfer pricing lead, confirms MITT and CBAQ are aligned, no duplicates, no holes.

- Controller, attaches the trial balance and the affected accounts for each item.

- Legal, confirms deal approvals, dates, and agreements in the data room.

- Reviewer, uses a short checklist, names files correctly, and signs off.

Your reviewer checklist, use it every time

- Does the PDF say Form 14234‑E, 10‑2023, and display OMB 1545‑2312.

- Are preparer and reviewer names and dates visible in the workpaper footer.

- Are transactions tied to MITT references.

- Do numbers foot to the ledgers, with roll forwards if needed.

- Is the 30 day interim window documented and met.

- Is the email subject line correct per your MOU.

How 14234‑E interacts with other CAP forms, no rework required

Each CAP subform has a job. Keep them in their lanes and reference across rather than repeating content.

- CRCQ, 14234‑A, covers research credit assertions and history.

- MITT, 14234‑B, lists material intercompany transactions for transfer pricing review.

- TIIL, sometimes referenced as the transaction list, supports scoping.

- TCFQ, 14234‑D, documents your tax control framework.

- CBAQ, 14234‑E, isolates cross border activities and positions that deserve early attention.

Practical tip Map each CBAQ item to a MITT row where relevant. Use the same naming for entities and legal agreements. Do not paste transfer pricing analysis into 14234‑E, point to the MITT and the study instead.

Bridge Plus, what you owe and when

Bridge Plus is now permanent. It is reserved for lower risk taxpayers, and it changes how you interact with the IRS during the year. You submit audited financials, a book to tax reconciliation, supporting schedules, and a draft return 30 days before filing so the IRS can check consistency. If the draft and support line up, you will be told to file, and then you receive an acceptance letter after the filed return matches the documentation.

A quick table you can copy into your close calendar

| Deliverable | Purpose | Timing cue |

| Audited financials | Establish your baseline framework, GAAP or IFRS | As soon as audit is final |

| Book to tax reconciliation | Tie financial lines to return positions | Immediately after audit release |

| Supporting schedules | Substantiate adjustments and classifications | With book to tax |

| Draft return | Allow a pre file consistency check | 30 days before filing |

Your internal definitions, decide them now

Materiality is where teams drift. Define it once, document it, and put examples on a one pager.

- Material deal types, sample thresholds for debt, equity, services, IP, and cost sharing.

- Triggers that always need a look, for example moving risk, changing a principal, or altering IP ownership.

- Transactions that never hit the form, for example a legal name change that does not change economics.

Then build a standing monthly huddle with legal and treasury. Keep it to 15 minutes, ask three questions, did anything sign, did any cash move, did any ownership move. That single habit keeps you ahead of the 30 day rule.

Compliance, confidentiality, and file security

Form 14234‑E sits inside a regulated program, so treat confidentiality and integrity as part of the work, not an afterthought. The OMB listing confirms that 14234‑E is a required response to obtain or retain CAP benefits, it is part of the CAP collection under OMB 1545‑2312, and it is available electronically. Include the control number on your cover page and keep your audit logs for who created, reviewed, and sent the file.

If you manage a distributed team, apply least privilege access, keep data in your firm systems, and enforce a zero local storage rule. Use encrypted transfer for any document exchange. When you send 14234‑E to the IRS, follow your MOU instructions for recipients and subject lines. Never send client PII that is not necessary for the review.

The “material within 30 days” muscle memory

- Put the 30 day rule in your tax policy.

- Train legal, treasury, and corporate development on the signal that starts the clock.

- Add a short form intake that fits on one screen, transaction type, dates, parties, amounts, approvals.

- Task a named person to open the interim CBAQ ticket and assign preparer and reviewer the same day.

Step by step, how to prepare and file 14234‑E without drama

- Confirm your cycle. If you are planning a new application, align to the correct window. The 2025 window already ran from September 4 to October 31, 2024. Planning for 2026, the window is September 3 to October 31, 2025.

- Build your control sheet. Copy the identifiers from the OMB listing into the sheet. Add your internal matter number and MOU reference.

- Draft the narrative. Keep it factual, short, and specific. Link to MITT rows, studies, and schedules.

- Attach the support. Workpapers, agreements, journal entries, ledger snaps, and reconciliations.

- Run the reviewer checklist. Check names, dates, foots, and version stamps.

- Submit through the correct channel. New applications go to the CAP mailbox during the window. Returning participants send to the assigned account coordinator and observe the 90 day, with return, and 30 day interim cadence.

- Store the package. Save final PDF, emails, and acceptance acknowledgments in your system of record.

Short example, what a clean interim filing looks like

- Subject line, CAP CBAQ Interim, TY2025, Company, Item 2025‑07, Intercompany Loan.

- Body, one paragraph describing the transaction, dates, parties, amounts, approvals, and why it is material.

- Attach, the filled 14234‑E PDF, the agreement, a ledger snapshot, the journal entries, and a tie to MITT.

- Copy, your coordinator and the exam email per the MOU.

You do not need a novel. You need clarity and a complete support set. Your coordinator will move faster, and you will close the loop with less back and forth.

How Accountably can help, only where it matters

If your bottleneck is capacity and file discipline, not tax judgment, an offshore delivery system can take the load of workpaper preparation, file naming, and checklists while your U.S. leads focus on risk calls and reviews. The key is structure, not resumes. At Accountably, our teams plug into your systems and templates, follow SOPs for 14234‑E, MITT, and CRCQ document sets, and run multilayer reviews that protect partner time. Use us for steady production during peak season or to stand up a white label team that meets your SLAs, without giving up control. Keep tax decisions with your leads, give us the workflow you approve, and we will handle the execution.

FAQs

What is Form 14234‑E in one sentence

It is the Cross Border Activities Questionnaire that CAP requires to surface international transactions and positions early, including interim filings within 30 days when a material cross border transaction closes. The IRS announced the new form for the 2025 cycle in IR‑2024‑211.

Who files 14234‑E, new or returning

Both. New applicants include it in the CAP package during the application window for their cycle. Returning participants submit within 90 days after the prior year end, again with the return, and file an interim version within 30 days of any material transaction or activity named in the questionnaire.

What happens if we miss a 30 day interim filing

Your coordinator may still accept the filing, but repeated misses can affect suitability for CAP or Bridge Plus in future cycles. Build the calendar tie‑ins now, for example a monthly 15 minute huddle with legal and treasury, so the trigger never gets lost.

Where do I get the correct PDF and how do I know it is current

Pull it from the OMB listing for OMB 1545‑2312, then check the metadata. You want Form 14234‑E labeled 10‑2023, with control number 1545‑2312 and the f14234‑e‑‑2023‑10‑00‑‑web code.

Is Bridge Plus lighter weight

It is lighter on in year interactions, but it still requires audited financials, a book to tax reconciliation, supporting schedules, and a draft return 30 days before filing for a pre file consistency check. The IRS made Bridge Plus permanent in the 2025 updates.

Related quick answers

What is the one time IRA eligibility relief I keep hearing about

For the 2025 cycle, a year that is open only for certain IRA issues does not count as an open filed return under the open year rule. This helps some applicants clear the open year hurdle while the IRS finishes IRA reviews.

What is the 2,500 expense rule

This refers to the de minimis safe harbor under the tangible property regulations that lets qualifying taxpayers expense items at or below a set threshold per invoice or item, often 2,500 for taxpayers without an AFS. It is not a CAP rule, but teams often ask while cleaning up books for Bridge Plus. Confirm your policy with your advisors.

Can I file my own extension online

Yes, corporations file Form 7004 electronically by the original due date to extend the return. Keep the acknowledgment and update your CAP calendar if the extension affects your with return CBAQ timing.

How do I get an EIN verification letter

Call the IRS Business and Specialty Tax Line at 800‑829‑4933. Have your EIN, legal name, address, and responsible party information ready, then request a copy of the EIN letter for your records.

Wrap up and next steps

You have the form, the dates, and a workflow that will keep you calm at 7 p.m. when a deal closes. Confirm your cycle dates, copy the OMB identifiers into your control sheet, align your 30 day triggers with legal and treasury, and keep 14234‑E mapped to the MITT. If you want a second set of hands for workpapers and checklists, our team can shoulder that load, while your partners make the judgment calls.

The goal is simple, you file cleanly, protect confidentiality, and move through CAP with speed and certainty. The updates for 2025 are here to help you do exactly that.

Simplify Delivery, Improve Margins, Stay in Control.

Offshore support that works exactly like your in-house team.

💼 Let’s Talk