Scale Your CPA Firm Without Adding Headcount

Build your offshore team that works your way, trained, compliant, and white-labeled under your firm.

👉 Book a Discovery CallKey Takeaways

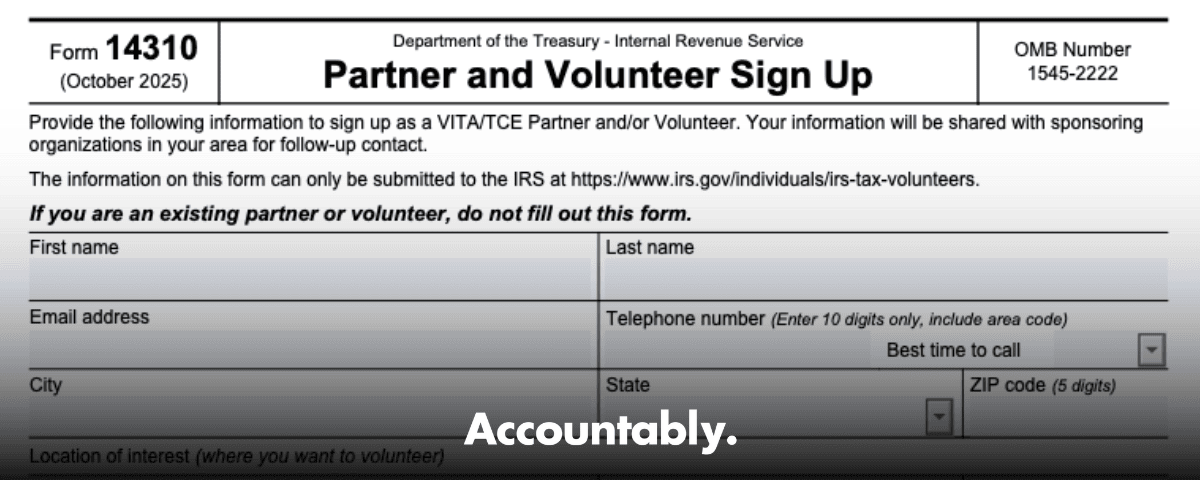

- Use the current PDF, Form 14310, Partner and Volunteer Sign Up, which shows Form 14310 (Rev. 10‑2025) in the header.

- Submit your information through the IRS volunteer page. The form states your details can only be submitted at IRS.gov, not by emailing a PDF.

- If you volunteered or partnered recently, do not complete Form 14310 again. Your sponsor will update your profile in Link & Learn Taxes.

- You do not need a PTIN to volunteer. PTINs are required for compensated preparers and for posting certain CE hours to a PTIN account.

- For taxpayers who can self file, the IRS Free File AGI limit for tax year 2024 is $84,000. Send them to Free File so you can focus on in‑scope returns.

What Form 14310 is, and who should use it

Form 14310 is the on ramp for two groups, individuals who want to volunteer with VITA or TCE, and community organizations that want to host or support a site. It collects contact details, language skills, a simple volunteer history, CE interest, and whether you are an IRS employee. If you are an organization, it also asks about space, equipment, and volunteers so SPEC can route you to the right IRS contact.

If you already volunteered recently or your organization already partners with the IRS, skip this form and work with your coordinator. The PDF explicitly tells existing partners and volunteers not to refill it, which prevents duplicate routing and slows no one down.

Your Form 14310 submission starts the conversation, your sponsor will follow up with orientation, training, and your first schedule.

What changed for 2025

Two useful updates stand out. First, the revision is now labeled October 2025, which makes version checks easy at a glance. Second, the form itself clarifies that submission happens through the IRS volunteer page, which reduces lost forms and speeds placement with local sponsors.

Hundreds of Firms Have Already Used This Framework.

Join the growing list of CPA and accounting firms using Accountably’s Offshore Playbook to scale faster.

💬 Get Your FREE Playbook

👉 Visit Jugal Thacker’s LinkedIn

Send him a connection request and message “Playbook” to get your copy.

Use the form as a checklist, then submit online

The PDF is a compact one pager. Use it to confirm you have the right details, then submit your information through the IRS volunteer page so coordinators receive it quickly. Expect training via Link & Learn Taxes and an invite to a local or virtual orientation after your inquiry routes to a sponsor.

Required fields done right

- Name, use your legal first and last name.

- Email and phone, list an inbox you check daily and a 10 digit phone number with area code, digits only.

- City, state, ZIP, include your current location and where you want to volunteer if different.

- Languages, add anything beyond English, even if conversational.

- Volunteer history, answer whether you served in the past 3 years.

- CE interest, check your status if you want CE tracked.

- IRS employee, select Yes or No.

- For partners, add organization name and whether you have space, equipment, and volunteers.

Field reference at a glance

| Field group | What you enter | Why it matters |

| Contact info | Full name, email, 10 digit phone | Coordinators use this to schedule training and placement |

| Location | City, state, ZIP, plus location of interest | Routes you to a nearby site |

| Languages | Any languages you speak | Supports taxpayers with limited English proficiency |

| Experience | Past 3 year volunteer status | Helps with role matching and training level |

| CE interest | EA, non credentialed preparer, CPA, attorney, CFP | Ties to tracking rules and PTIN posting |

| IRS employee | Yes or No | Ensures proper placement and conflict checks |

| Partner details | Org info, space, equipment, volunteers | Confirms readiness to host a site |

Common mistakes you can avoid

- Emailing the PDF to someone at IRS or a sponsor. The form tells you to submit through the IRS volunteer page.

- Using an old revision. The header should read Form 14310 (Rev. 10‑2025).

- Skipping language skills or best time to call. These two fields speed placement and reduce back and forth.

Quick win, add a realistic callback window. During peak recruiting, a fast response often depends on reaching you on the first try.

Step by step, complete Form 14310 without second guessing

Keep your ID nearby, have your calendar open, and if you maintain a PTIN for your paid practice, note it for CE posting later in Link & Learn. Then follow this short flow.

Improve Margins Without Compromising Quality

Offshore staffing helps firms deliver more, scale faster, and stay compliant, without adding local headcount.

👉 Book a Discovery Call- Open the current PDF and confirm the header shows Rev. 10‑2025.

- Review the fields, jot best time to call, list any languages, and decide your location of interest.

- Submit your details through the IRS volunteer page so your inquiry routes to local sponsors.

- Watch for your coordinator’s email with orientation steps and your Link & Learn training path.

Version control in plain English

Always match the year and revision in the header. If your file shows 2015 or 2020, replace it with the October 2025 edition. On the public forms listing, Form 14310 shows an October 2025 revision, which aligns with the current PDF.

Where your information goes

The IRS shares your inquiry with sponsoring organizations near you. They will contact you with training links, scheduling options, and whether the site is in person, virtual, or hybrid. This centralized intake is why Form 14310 works, your single form reaches the right local sponsors without guesswork.

CE credits, PTINs, and your training path

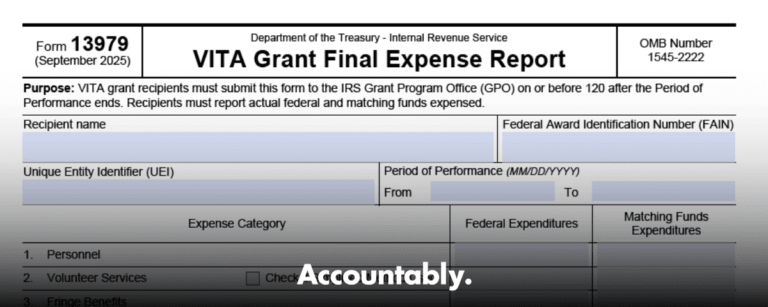

If you want CE credit, plan to certify in Link & Learn Taxes and complete minimum service hours in an eligible role such as preparer, quality reviewer, or instructor. The IRM explains the program clearly, volunteers can earn up to 18 hours when a specialty course is included, typically 14 hours for Advanced plus 4 for a specialty. SPEC reports CE for volunteers who request it and have a valid PTIN in Link & Learn.

If you only volunteer and receive no compensation, you do not need a PTIN to prepare returns at a VITA or TCE site. PTINs are for compensated preparers. If you want your CE to post to a PTIN account, add a valid PTIN in your Link & Learn profile. Attorneys and CPAs can earn SPEC CE without a PTIN, and if they provide one, their PTIN account reflects hours.

Your certification checklist

- Volunteer Standards of Conduct, score 80 or higher.

- Intake, Interview and Quality Review test, score 80 or higher.

- Advanced tax law certification, score 80 or higher.

- Generate and sign Form 13615 in Link & Learn and provide it to your coordinator.

Keep your CE certificates and attendance records, then confirm hours with your coordinator so reporting does not lag.

The documents you will rely on at the site

You will see three pillars at every site, certified training and testing in Link & Learn Taxes, standardized intake with Form 13614‑C, and a required quality review for every return. Coordinators also collect the current Form 13615 that Link & Learn generates after you certify. Current listings show Form 13614 C and Form 13615 updated in October 2025.

Why the intake sheet matters

Form 13614 C is not paperwork for paperwork’s sake. It drives a consistent conversation, it documents scope, and it gives the reviewer a clean starting point. Sites use it with every return because it is the simplest way to keep accuracy high when many volunteers rotate through busy shifts.

A quick word on scope and smart handoffs

When someone can self file comfortably, a two minute handoff to Free File can save you half an hour. For tax year 2024, the guided software options are available to filers with AGI of 84,000 or less, which frees your table for cases that truly need a certified preparer.

Start them at the IRS Free File page, that ensures they pick a true Free File offer and not a lookalike site.

Field by field coaching you can trust

Contact and location

Enter your legal first and last name, an email you actually check, and a 10 digit phone number, digits only. Add your city, state, and 5 digit ZIP. If your preferred volunteer site is in another part of town, use the separate “location of interest” line to say so. These small details speed placement.

Experience and language

Answer whether you volunteered within the past three years. Then list languages you speak other than English, even if you are conversational. Coordinators really search on this field, and it helps match you with taxpayers quickly.

CE credit interest

If you want CE, check your status, for example EA, non credentialed preparer, CPA, attorney, or CFP. Expect Advanced certification, minimum service hours, and, if you want hours posted to a PTIN account, a valid PTIN in Link & Learn.

IRS employment status

Select Yes or No. Your coordinator will confirm any placement notes if you are current or former IRS staff, then assign you to a role that fits.

Partner organizations

If you represent a community group, provide your organization’s name and whether you have space, equipment, and volunteers. This is the starting point for a sponsor conversation about hosting a site.

Avoiding delivery bottlenecks during filing season

Once you are placed, success comes down to structure. Keep your intake complete, standardize where you save documents, and follow the quality review script. Sites that run a tight intake and review can handle weekend spikes without burning out their teams, and that consistency is why the network handles about 3.5 million returns a year across 11,000 sites.

Security, privacy, and good habits from day one

Do not add Social Security numbers anywhere in Form 14310, and do not email filled PDFs to random addresses. Your sponsor will tell you how they want documents shared. If your site supports remote service, you will present the virtual consent and follow the site’s data handling steps before work begins.

FAQs about Form 14310 and getting started

What is Form 14310 used for in 2025?

Form 14310, Rev. 10 2025, is the IRS sign up for new VITA and TCE partners and volunteers. Use it to submit your interest through the IRS volunteer page so a local sponsor can contact you with training and scheduling details.

Do I need a PTIN to volunteer?

No. Volunteers who prepare returns without compensation do not need a PTIN. PTINs are for paid preparers. If you want CE credits posted to a PTIN account, you must have a valid PTIN in Link & Learn.

How many CE credits can I earn through VITA/TCE?

Volunteers who certify at the Advanced level and serve in eligible roles can earn up to 18 hours when a specialty course is included. SPEC reports credits for those who request CE and provide a valid PTIN in Link & Learn.

I volunteered last year. Should I complete Form 14310 again?

No. The form says existing partners or volunteers should not complete it again. Work with your site coordinator to update your training and schedule for this season.

How does virtual volunteering or review work now?

Many sponsors support virtual options, including document exchange and remote quality review when needed. Your coordinator will explain which tools your site uses and how to obtain the required consents.

For coordinators and firm leaders hosting a “VITA day”

If you run a firm hosted VITA day, standardize intake and certification early. Confirm every volunteer passed VSC, Intake and Quality Review, and Advanced, then collect a signed Form 13615 before they sit with taxpayers. Keep a one page triage at check in and a clear handoff to Free File for those who can self file.

If you are a CPA firm leader, borrow the site playbook, clear SOPs, consistent workpapers, and a layered review. This keeps reviews fast and protects quality when the lobby fills.

Mini guide, matching revision to year

Identify the current revision in the header

Look for “Form 14310 (Rev. 10 2025)” near the top of the PDF. That header stamp is your quick check that you are using the current edition for the 2025 recruiting season.

Submit in the right place

Even if you previewed or printed the PDF, you still submit your details through the IRS volunteer page. That is how your information reaches local sponsors for follow up.

Keep a copy

Save a copy with the revision date visible in case your coordinator asks which version you used. It makes intake conversations shorter and clearer.

Final checklist before you click submit

- Confirm the header shows Rev. 10‑2025.

- Proof your name, email, and 10 digit phone number.

- Add language skills and best time to call.

- Mark CE interest accurately, keep your PTIN handy only if you want hours posted to a PTIN account.

- If you represent an organization, confirm space, equipment, and volunteers are realistic.

- Submit through IRS.gov and watch for your coordinator’s message.

After you submit, what happens next

Your details route to sponsoring organizations in your area. Expect an invite with Link & Learn setup, training dates, and site options that fit your schedule. Sites are typically open nights and weekends, with virtual or hybrid roles available in many locations.

When you start, you will use the current Form 13614 C for every taxpayer and complete a required quality review before any return goes out. This structure is how programs handle millions of returns each season with consistent accuracy.

Helping taxpayers who can self file

Some visitors will not need a full appointment. If they are comfortable filing on their own and meet the AGI limit, point them to IRS Free File. For tax year 2024, guided software is available to filers with AGI of 84,000 or less. Starting from the IRS Free File page is important because that is where the true partner offers live.

A quick handoff to Free File opens a seat for a neighbor who really needs a certified preparer this week. That is smart triage in a busy lobby.

Light brand note for readers on Accountably.com

You came here for Form 14310, and you have everything you need to get started. If you run a CPA firm and plan a community VITA day, you can reuse the same habits your team already knows, SOPs, tidy workpapers, and a clear review path. That simple structure keeps quality high and prevents late night crunches, even when demand spikes. Mentioning it once is enough here, the focus is your Form 14310 and your first shift.

Closing thoughts

You are signing up to meet people at a stressful moment and make it manageable. The process is clear, the training is thorough, and the work is rewarding. Your single form gets you to the starting line, then your team and your training carry you the rest of the way. As of October 30, 2025, the steps above and the links cited are current. Check the form header and the IRS volunteer page again if you are reading this later in the season.

Resources

- Form 14310, Partner and Volunteer Sign Up, Rev. 10 2025.

- IRS Tax Volunteers, training, resources, and the online sign up.

- IRM 22.30.1, Link & Learn certification, CE rules, and roles.

- Form 13614 C, Intake and Quality Review, current listing.

- Form 13615, Volunteer Standards of Conduct Agreement, current listing.

- IRS Free File, AGI limit $84,000 for TY 2024 guided software.

Simplify Delivery, Improve Margins, Stay in Control.

Offshore support that works exactly like your in-house team.

💼 Let’s Talk