Scale Your CPA Firm Without Adding Headcount

Build your offshore team that works your way, trained, compliant, and white-labeled under your firm.

👉 Book a Discovery CallKey Takeaways

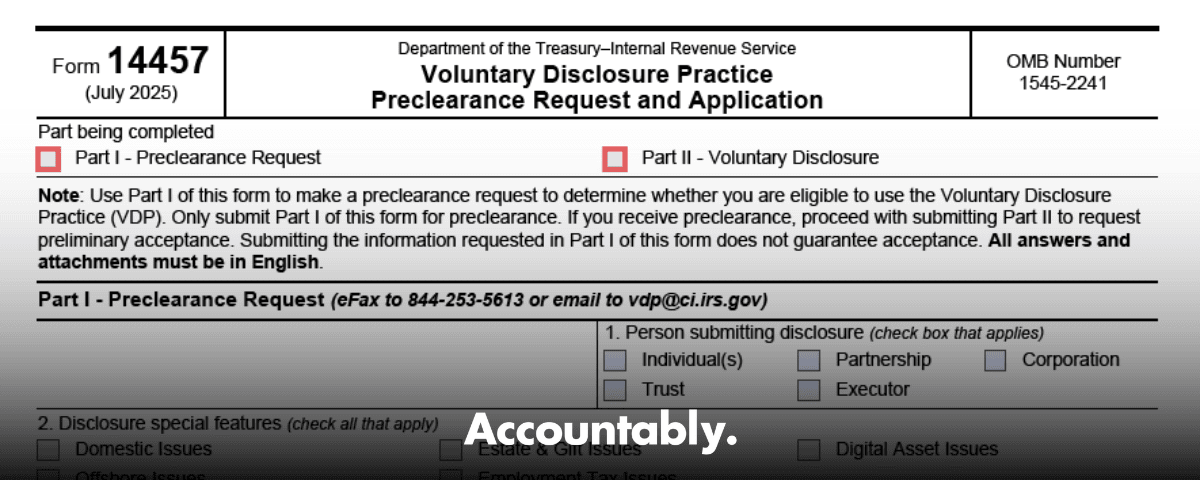

- Form 14457 is the two‑part application used to enter the IRS Criminal Investigation Voluntary Disclosure Practice, a path that can reduce criminal exposure if your noncompliance was willful.

- Part I, Preclearance, is submitted to CI, typically by fax, to confirm eligibility. If CI pre‑clears you, you must submit Part II within 45 days, with one possible 45‑day extension by written request.

- Expect to cooperate fully and pay tax, interest, and penalties. Civil fraud penalties of 75 percent can apply to the highest‑liability year in scope.

- The form and instructions now expect detailed digital‑asset information, reflecting the IRS’s focus on crypto and other digital assets.

- Move before the IRS contacts you, and keep your documentation complete, truthful, and timely to protect eligibility.

What is IRS Form 14457?

Form 14457 is the IRS Criminal Investigation Voluntary Disclosure Practice application. It runs in two parts. You first request preclearance with Part I, then, if accepted, you submit a much deeper Part II application within the deadline in your letter. CI uses this process to decide if you can enter the program, then your case moves to a civil examiner. You must cooperate and either pay in full or secure a full‑pay installment agreement.

Bottom line, if your noncompliance was willful, Form 14457 is the front door to resolving it and lowering criminal risk, provided you meet every requirement on time.

What counts as “willful” vs. a mistake

VDP is for willful violations, not simple mistakes. If you simply filed wrong or late without intent, consider amended or delinquent returns instead of VDP. The IRS also excludes illegal‑source income from VDP.

Who can use it

Individuals, businesses, trusts, and estates can apply. Acceptance is not guaranteed and remains discretionary. You must apply before the IRS starts an exam or obtains information about your specific noncompliance.

Hundreds of Firms Have Already Used This Framework.

Join the growing list of CPA and accounting firms using Accountably’s Offshore Playbook to scale faster.

💬 Get Your FREE Playbook

👉 Visit Jugal Thacker’s LinkedIn

Send him a connection request and message “Playbook” to get your copy.

When Should You Use the Voluntary Disclosure Practice?

Use VDP if you intentionally failed to report income or meet required filings. Typical red flags include undisclosed foreign accounts, unreported digital‑asset activity, or cash‑heavy business income that you chose not to report. If that is your situation, VDP can be the most protective path. If your issue is inadvertent, you likely have better, simpler options that do not involve CI.

Digital assets are front and center

The IRS revised Form 14457 to expand crypto and digital‑asset disclosures. Expect to supply asset types, exchange information, and detailed histories. Keep records of dates, amounts, counterparties, and fair market values in U.S. dollars. If you had digital‑asset transactions, you must report them and keep adequate records.

How the Two‑Part Process Works, At a Glance

- You submit Part I to CI to request preclearance. CI decides whether you can proceed. Submission is by fax per the current IRS page, and the IRM also lists mail as an option.

- If you are pre‑cleared, you must send Part II within 45 days. CI reviews Part II and, if approved, issues a Preliminary Acceptance Letter and sends your case to civil exam.

- If you cannot meet the Part II deadline, you may request one 45‑day extension by writing to the CI address provided, typically via the VDP email noted on the IRS page.

In July 2025, the IRS posted a refreshed PDF of Form 14457. Always download the current form and follow the submission method listed on the IRS site and the form’s instructions for that date.

Improve Margins Without Compromising Quality

Offshore staffing helps firms deliver more, scale faster, and stay compliant, without adding local headcount.

👉 Book a Discovery CallQuick Note on Penalties

VDP does not erase civil exposure. The IRS can assert civil fraud penalties of 75 percent on the portion of an underpayment due to fraud, among other penalties. You must plan for payment, including tax, interest, and penalties, and you may be asked to sign acknowledgments as part of cooperation.

This guide is general information, not legal or tax advice. Dates and contacts are current as of October 30, 2025. Always confirm procedures on IRS.gov and consult qualified counsel if you are considering VDP.

Part I Preclearance, What To Send, Where It Goes, And What Triggers Denial

Part I is short, but it is not casual. Treat it like a gatekeeper. You will list identifying details, the tax years involved, categories of noncompliance, related entities, and any prior IRS contacts. CI uses your answers to decide if you are eligible to proceed. If the IRS already has you under exam or has specific information about your noncompliance, preclearance will be denied.

Submission method that actually works

Per the current IRS CI page, Part I is submitted by fax to 844‑253‑5613. The IRM also notes mail as an option for Part I submissions. If you need more time later, you can request an extension by writing to the VDP email listed by CI after preclearance. Follow the most current instructions on the IRS page and in the form version you download.

Practical tip, do a same‑day transmission with a file‑stamped cover page, then store the confirmation with your internal index so you can retrieve it in seconds.

Disqualifying factors that trip people up

If you answer yes to certain screening questions on Part I, such as being under current exam or criminal investigation, you may be ineligible. That is why speed matters. File before the IRS learns about your case from third parties or initiates contact.

After preclearance, the 45‑day clock starts

If CI issues your preclearance letter, they will provide a case number and instructions. From that date, you have 45 days to submit Part II. If needed, you may request one 45‑day extension in writing, case by case. Missing the window risks removal.

Part II Application, What CI Expects

Part II is where you put the full story on the record. You will prepare a truthful, chronological narrative, identify all sources of unreported income, list foreign accounts and entities, and detail digital‑asset activity. You will also attach returns or drafts and supporting records, then certify cooperation.

Narrative quality matters

CI expects a complete and precise narrative. Describe who did what, when, why decisions were made, the roles of advisors, and the steps you are taking to correct the problem. The IRS has emphasized that the revised package calls for more specificity, especially around digital assets and advisor roles.

Digital‑asset detail to capture

Build a spreadsheet that covers wallet or account identifiers where available, exchange names, transaction dates and times, units, USD values at each event, and counterparties if known. The IRS’s public guidance stresses that you should maintain detailed records and identify transactions even when some custodial platforms do not provide a public hash.

If your team cannot build this quickly, assign one person to collect raw exports and a second to normalize columns and reconcile to Forms 1099 and bank flows. Aim for repeatable formats so your examiner can review in minutes, not hours.

Documents to gather

- Filed or draft returns for the disclosure years

- Bank, brokerage, and foreign account statements

- Digital‑asset exports and reconciliation schedules

- Prior FBARs or delinquent FBARs if applicable

- Entity records, ownership charts, and organizer notes

Keep a checklist in your case file and confirm each item as received. Incomplete packages get delayed or denied.

Where Payments Go And What “Full Cooperation” Means

The IRS expects you to pay tax, interest, and penalties, or to secure a full‑pay installment agreement. If you have preliminary acceptance and want to remit before assignment, the IRM provides the LB&I Austin address. Label checks by year and clearly reference “Voluntary Disclosure Practice.” Do not send returns to that address, only payments.

Civil fraud penalties can apply at 75 percent of the underpayment attributable to fraud. That is why timing, accuracy, and credible documentation are crucial.

Part I vs. Part II, Side‑By‑Side

| Step | Purpose | What You Send | How You Send It | Decision Window |

| Part I, Preclearance | Confirm eligibility and timeliness with CI | Identifiers, years, categories, entities, prior contacts | Fax to 844‑253‑5613 per current IRS page, IRM also notes mail | CI issues preclearance or denial |

| Part II, Application | Full narrative and documents for preliminary acceptance | Detailed narrative, returns or drafts, statements, digital‑asset schedules, certifications | Electronic submission per IRS instructions after preclearance | CI issues Preliminary Acceptance and routes to civil exam |

Always download the current form and follow the instructions on IRS.gov, which can change. The current PDF shows a July 2025 revision.

Common Pitfalls That Derail Good Cases

- Submitting Part I without having records ready for Part II, then missing the 45‑day window.

- Treating the digital‑asset section lightly when the IRS expects specificity.

- Weak narrative structure that hides the who, how, and why.

- Assuming penalties will be waived. VDP is about mitigating criminal exposure, not avoiding civil consequences.

Payment planning

If you cannot fully pay, disclose that and be ready with a proposed full‑pay arrangement and financial statements as required. The IRS has made clear that cooperation includes arranging payment. This is not the place to wing it.

Documentation tips that save review time

- Create a single index file with tabs for each year and entity.

- Use consistent file names, for example 2022‑1099‑Coinbase‑Doe.pdf.

- Reconcile totals across statements and returns before you submit, then note the tie‑outs in a cover memo.

You will spend hours either tidying the file or answering questions later. Tidying first is always cheaper.

Timeline Cheat Sheet

- Day 0, Fax Part I to CI. Save the transmission record and cover sheet.

- Day 1 to 30, Await preclearance. Organize records and draft the narrative while you wait.

- Preclearance received, The 45‑day clock starts for Part II. Ask for a single 45‑day extension only if truly needed and only once.

- After Preliminary Acceptance, Prepare to interact with a civil examiner and pay or secure a full‑pay plan.

For CPA, EA, And Law Firms, How To Operationalize VDP Work

VDP cases are documentation heavy and time sensitive. If your team is buried in compliance work, create a small internal “VDP pod” with a preparer, a reviewer, and a project manager who tracks the 45‑day milestones and keeps communication tight. Firms that lack stable capacity often benefit from structured help for data gathering, workpaper standardization, and review checklists.

Where this connects to Accountably, we focus on disciplined execution for U.S. firms that need clean workpapers, clear handoffs, and predictable turnaround. For VDP‑style projects, that means standardized naming, version control, and multi‑layer review that protects partner time while keeping the 45‑day deadlines in view. Use this only if it adds control, not noise.

FAQs

Does the IRS really expect me to admit willfulness?

VDP is designed for willful noncompliance, and the IRS requires a truthful, complete disclosure. If your situation was not willful, the IRS points you to other options like amended or delinquent returns instead of VDP. Talk with counsel before you decide.

Can I email my submission?

Follow the submission method on the IRS page and the current form. As of July 2025, the CI page directs you to fax Part I, then electronically file Part II after preclearance. The IRM notes mail as an option for Part I. For extension requests and status questions, CI lists email contacts on IRS.gov. Always follow whatever the current instructions say on the day you file.

How do payments work if my case is not yet assigned?

If you have Preliminary Acceptance and want to remit before assignment, the IRM gives an LB&I Austin address and formatting for checks. Label each year clearly and reference “Voluntary Disclosure Practice.” Only payments go there.

What penalties should I plan for?

Plan for tax, interest, and penalties. In fraud cases, IRC § 6663 authorizes a 75 percent civil fraud penalty on the underpayment attributable to fraud. Your examiner will apply the facts and the law. This is why accurate records and a credible narrative matter.

What if I cannot assemble every document in time?

Apply only when you can meet the timeline and documentation requirements. If you already have preclearance and cannot make Part II on time, you may request one 45‑day extension, case by case. If you still cannot complete the file, consider withdrawing and exploring other compliance options with counsel.

A Simple, Reusable Checklist

- Confirm VDP is the right path for your facts.

- Download the current Form 14457 and instructions from IRS.gov.

- Build your document index and assign owners for each item.

- Draft the narrative early, then refine it as records arrive.

- Validate totals, tie‑outs, and cross‑references before submission.

- Submit Part I per IRS instructions and save the fax confirmation.

- Prepare Part II so you can file within 45 days, with one extension if needed.

- Plan payment, including penalties, and be ready to cooperate with the examiner.

Closing Thought

If you are reading this and feeling that knot in your stomach, you are already doing the right thing by getting informed. VDP rewards honesty, timeliness, and discipline. Get your facts straight, get your documents in order, and meet every deadline. If you are a firm, protect partner time by designing a repeatable process for VDP cases. If you want help with workpaper structure and predictable throughput, our team at Accountably can support your internal standards without sacrificing control.

Time is not your friend on a VDP case. Start now, be complete, and follow IRS instructions exactly.

Compliance Note

This article is general information for educational purposes. It is not legal, tax, or accounting advice. Procedures, contacts, and form versions change. Confirm details on IRS.gov and consult qualified counsel before you act. Page dates and content referenced here are current as of October 30, 2025.

Simplify Delivery, Improve Margins, Stay in Control.

Offshore support that works exactly like your in-house team.

💼 Let’s Talk