Scale Your CPA Firm Without Adding Headcount

Build your offshore team that works your way, trained, compliant, and white-labeled under your firm.

👉 Book a Discovery Call

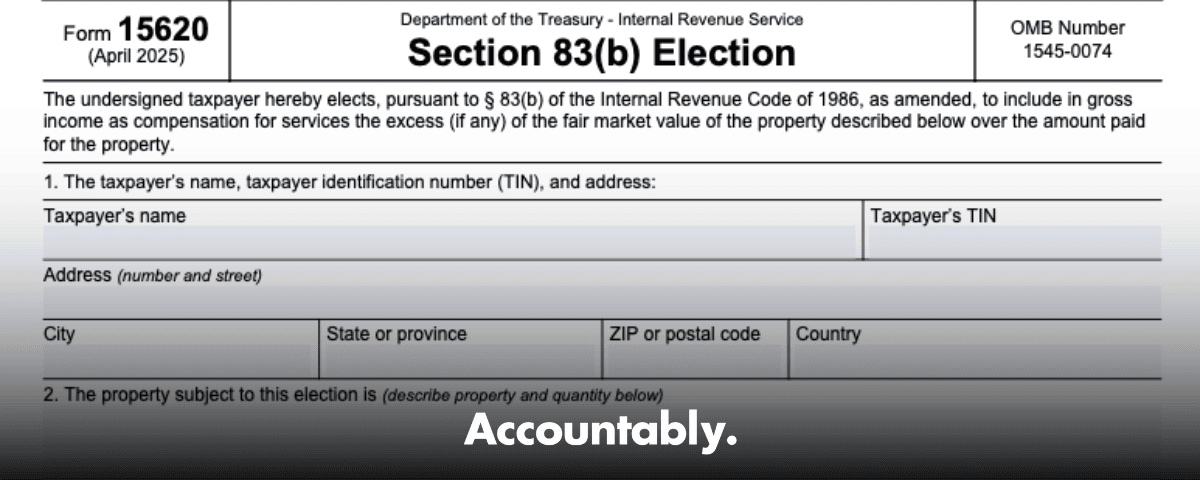

The IRS released Form 15620 and, as of 2025, you can file an 83(b) election online through the IRS’s mobile‑friendly forms system, which uses ID.me for sign‑in and gives you a confirmation you can download. If the online form does not fit your facts, you can still mail a signed paper Form 15620 to the IRS office where you file your return. Either way, the 30‑day clock is strict, so your plan matters.

Key takeaways

- You must file your 83(b) election within 30 calendar days of the transfer, not the grant approval meeting, and there are no extensions. If Day 30 lands on a weekend or federal holiday, you get the next business day.

- You can make the election by filing a written statement or by using Form 15620. The IRS no longer requires you to attach a copy to your tax return, but you must keep records.

- Online filing is available in 2025 through the IRS mobile‑friendly forms system. You sign in with your IRS Online Account, which uses ID.me, complete Form 15620, then download your confirmation. Paper filing by trackable mail still works.

- Give a copy to your employer or service recipient, and if someone else is the transferee, give that party a copy too. Keep proof of timely filing.

- If the online fields would misstate quantities or values, switch to a paper filing and preserve exact calculations. Practitioners have reported input constraints online, which is why a paper backup plan helps.

Quick note, this guide is educational, not tax advice. For your facts, always confirm with a qualified tax professional.

What is Section 83(b)?

When you receive property for services and it is still at risk of forfeiture, the default is to include income when that risk lapses. An 83(b) election flips that timing. You include the property’s fair market value at transfer, minus any amount you paid, in your income now, and your capital‑gains holding period starts immediately.

Hundreds of Firms Have Already Used This Framework.

Join the growing list of CPA and accounting firms using Accountably’s Offshore Playbook to scale faster.

💬 Get Your FREE Playbook

👉 Visit Jugal Thacker’s LinkedIn

Send him a connection request and message “Playbook” to get your copy.

If the company grows, more of the future upside can be taxed at long‑term capital gains rates when you eventually sell. The election is generally irrevocable and must be filed within 30 days of transfer.

When 83(b) usually applies, and when it does not

- Applies to restricted stock and to early‑exercised options that settle into unvested shares, since you hold property that can be forfeited.

- Does not apply to unexercised stock options or to RSUs at grant, because there is no transferred property yet.

- If you forfeit the shares later, you usually cannot recover the tax you already paid on the election.

Why Form 15620 matters

Form 15620 gives you a standardized way to make the election, so your statement includes the core elements Regulation 1.83‑2 expects, such as your info, a description of the property, transfer date, restrictions, fair market value, and amounts paid. The form embeds a penalty‑of‑perjury signature, which cleans up evidentiary quality without changing the 30‑day deadline.

Standardizes the election, reduces avoidable defects

Before Form 15620, most taxpayers mailed a custom letter. You can still do that if you prefer. Using the form simply reduces omissions because it mirrors what the regulations require for a valid election. The IRS also clarified in 2016 that you do not have to attach a copy to your return anymore, so standard documentation plus solid recordkeeping is the winning combo.

Improve Margins Without Compromising Quality

Offshore staffing helps firms deliver more, scale faster, and stay compliant, without adding local headcount.

👉 Book a Discovery CallElectronic filing in 2025, faster confirmation

The IRS mobile‑friendly forms system allows you to complete and submit Form 15620 online. You sign in with an IRS Online Account, which uses ID.me for authentication. After submission, you get a success message and a link to download your filed form, so you can share a copy with your employer and keep audit‑ready evidence. If you cannot or should not use the portal for your facts, print and mail a signed Form 15620 to the IRS office where you file your return.

A realistic call on using paper instead

Two scenarios call for paper. First, if online fields would round micro‑prices or otherwise distort your totals. Second, if you hit an online limit on units. Practitioners have flagged both issues, so when accuracy is at risk, print, sign, and mail by trackable service within the 30‑day window. Save all math and your mail proof.

Key changes vs older election statements

Employer or service recipient details, now clearly captured, but optional on the form

Regulation 1.83‑2 has always required you to furnish a copy to the person for whom services were performed, and Form 15620 makes room for that entity’s name, TIN, and address. The form labels this Box 9 as optional for making a valid election, however you still must give copies to the employer and, if different, the transferee. Using accurate legal names and addresses helps payroll and information reporting downstream.

Penalty‑of‑perjury signature

Form 15620 requires you to sign under penalties of perjury, affirming your entries are true and complete. That pushes you to verify grant details, restrictions, fair market value, and dates before you file. The 30‑day deadline still applies. If you discover a material error later, talk to your advisor fast because revocation generally needs IRS consent and is narrowly available.

No more attaching to your return

The IRS finalized a change in 2016, removing the old requirement to attach a copy of the election to your income tax return. You still file the election with the IRS within 30 days and give a copy to your employer, and you should keep excellent records. This also means you can e‑file your tax return normally later in the year.

Who should consider filing

You, if you are a founder, early employee, or contractor receiving stock that can be forfeited and your company value is low today with real potential to grow. Filing now can front‑load a small amount of ordinary income and start the capital‑gains holding period, which can improve outcomes if the company appreciates. Be sure you can afford the current tax, accept the forfeiture risk, and align with your plan documents.

- You received restricted stock or you early‑exercised options into unvested shares.

- Fair market value at transfer is low, so the ordinary income you include now is small.

- You expect meaningful appreciation before vesting and eventual sale.

- You can meet the 30‑day deadline and keep airtight documentation.

Timing rules and the 30‑day deadline

The deadline is measured in calendar days. Day 1 is the transfer date. Count each day straight through, including weekends and holidays. If Day 30 is a Saturday, Sunday, or legal holiday, you get the next day that is not a weekend or holiday. Miss the window and the election is invalid.

Getting the transfer date right

The clock starts when you receive substantially nonvested property and become the beneficial owner, for example when shares are issued to you after an early exercise. It is not the vesting start date or the board approval date. Anchor your timeline to the stock ledger, issuance paperwork, or transfer records.

Late or close‑call situations

There is no extension for an 83(b) election. If you are up against Day 30 and cannot submit online accurately, send a signed paper Form 15620 by a trackable service that provides a dated postmark or equivalent, and keep the receipt. If it is late, you default to ordinary income at vesting. Talk with an advisor about any fallout for payroll and reporting.

How to file by mail, step by step

- Complete and sign Form 15620 with your name, TIN, address, description of property, transfer date, restrictions, fair market value, and price paid.

- Mail it to the IRS office where you file your federal return. Use certified mail or a courier that gives you tracking, and retain the dated proof.

- Provide a copy to your employer or service recipient, and to the transferee if that differs.

- Keep a full copy set in your permanent records, including proof of timely mailing.

How to file online, step by step

- Create or sign in to your IRS Online Account, which uses ID.me for identity verification.

- Open the IRS mobile‑friendly forms page for Form 15620, complete the fields, and submit.

- Download the success confirmation and the filed form. Send a copy to your employer.

- File paper instead if online fields would misstate your share counts or values.

Online constraints to watch

Tax teams report that the portal may limit unit counts or round per‑share values. If the online input would change your math in a material way, choose paper and include exact computations in your file. When online entry works, keep your own detailed spreadsheet with precise per‑share and extended totals, then save the IRS confirmation PDF in two places.

Choose online or paper, a quick comparison

| Method | When it shines | What to watch | Proof to keep |

| Online Form 15620 | You want fast confirmation and clean records | Possible input limits or rounding, verify fields before submitting | Downloaded success message and filed form |

| Paper Form 15620 | You need micro‑price precision or very large unit counts | Mail timelines, make sure you get a dated postmark within 30 days | Certified mail receipt or courier tracking plus copy of the form |

Sources for process and proof: IRS mobile‑friendly forms guidance and Form 15620 instructions.

Information you must include on Form 15620

Form 15620 walks you through the required content. You will enter:

- Your name, TIN, and address.

- A description of the property and quantity.

- The transfer date and the tax year that includes it.

- The restrictions that apply, for example, forfeiture if you depart before vesting.

- The fair market value per item, the quantity, and the total fair market value.

- The price paid per item, the quantity, and the total paid.

- The net amount, fair market value minus price paid, to include in income.

- Optionally, the service recipient’s name, TIN, and address.

- A penalty‑of‑perjury signature and date.

Tip, Box 9 for the employer or service recipient is optional for validity, but you must still furnish copies as required by the regulations.

Coordinate with your employer and payroll

Send your filed election to the company right away, so payroll and equity records reflect inclusion at transfer. If there is immediate taxable income, expect wage reporting, and if applicable, withholding. Keep your confirmation or postmark with the grant agreement and the stock ledger entry, so future basis reporting matches the election.

Tax impact, risks, and basis tracking

An 83(b) election accelerates ordinary income to the transfer date and sets your basis then. Appreciation after that lives in capital gains, so if you hold more than a year before selling, you aim for long‑term capital gains treatment on the spread above your basis. The risk is real, if you forfeit or the value drops, there is no general refund of the ordinary income you recognized because of the election. Tie your FMV to a defensible valuation and keep the workpapers.

Recordkeeping and proof

Treat proof like part of the filing itself. Keep:

- Your executed Form 15620 or compliant statement.

- The valuation and all calculations used for fair market value and totals.

- The online confirmation or the original certified mail receipt and tracking.

- Evidence that you furnished a copy to the employer and, if different, the transferee.

The IRS processes elections and associates them with your account, and their own guidance underscores that a Form 15620 or a compliant written statement is acceptable if filed within 30 days. Your records are your safety net later.

Common pitfalls to avoid

- Missing the 30‑day deadline because you counted from the wrong date.

- Relying on a board minute or vesting start instead of the true transfer date.

- Forgetting to send a copy to your employer.

- Forcing online inputs that round your math, when paper would be accurate.

- Weak documentation that fails to tie out FMV, totals, and timing.

Practical next steps

Calendar your deadline from the actual transfer date, then plan to file within the first 7 to 10 days. 2) Decide online or paper based on accuracy, not just convenience. 3) Gather valuation support and verify your grant details, restrictions, and quantities. 4) File the election, send the copy to your employer, and save your proof in two places. 5) Update your basis tracker and confirm payroll reporting. For complex cross‑border situations or state rules, involve counsel early.

Real‑world example, early exercise

You early‑exercise 100,000 options at $0.05 when FMV is $0.05, and the shares are unvested. You file an 83(b) within 30 days, so ordinary income is effectively zero, your basis is $5,000, and your capital‑gains clock starts now. If those shares are worth $1.00 at vest and you eventually sell after a year, the spread above $5,000 can be eligible for long‑term capital gains. If the portal cannot accept two decimal precision that matches your price, file on paper and attach your exact math.

If you run an accounting firm, this is where delivery discipline shows. Standard checklists, SOPs for 83(b) support, and tight documentation reduce deadline risk and client stress. If you need trained offshore capacity that follows your workflow and maintains U.S. standards, Accountably can integrate teams into your systems with review protection and clear SLAs, so your staff is not firefighting on Day 29.

FAQs

Can I revoke a Section 83(b) election after filing Form 15620?

Generally, no. Revocation requires IRS consent and is narrow, usually limited to a true mistake of fact about the underlying transaction. If you think a mistake occurred, speak with your advisor immediately.

Do nonresident aliens use Form 15620 for U.S. equity grants?

If a nonresident receives substantially nonvested property in connection with services, they can make an 83(b) election, either by Form 15620 or a compliant statement, and still must meet the 30‑day rule and furnish copies. Online filing may not suit every situation, for example if an ITIN is involved, the IRS notes some signers may need to mail the form.

How do community property rules affect an 83(b) election?

Community property can affect ownership, basis, and reporting. Many taxpayers obtain spouse consent and align records so equity characterization and basis tracking stay consistent. Because state rules vary, confirm with counsel for your jurisdiction.

How are state taxes handled with an 83(b)?

States often follow the federal timing, but sourcing rules and withholding can differ, especially if you move during vesting. Coordinate with payroll and a state‑savvy advisor to avoid mismatches.

Do I still attach a copy of my 83(b) election to my federal tax return?

No. Since 2016, the IRS removed that attachment requirement. You still file the election within 30 days and keep thorough records.

What if the IRS online form rounds my per‑share price?

If rounding would materially change your totals, file a paper Form 15620 by trackable mail within 30 days, and include exact calculations in your workpapers. Practitioners have observed rounding limits online, so this is a known workaround.

Compliance checklist you can copy

- Confirm transfer date and start your 30‑day clock.

- Decide online or paper based on precision needs.

- Complete Form 15620 or a compliant statement, sign under penalties of perjury.

- File with the IRS within 30 days, and keep online confirmation or mail proof.

- Provide copies to the employer, and, if different, to the transferee.

- Update payroll, equity systems, and basis tracking.

What the rules actually say, in plain English

- The election must be filed within 30 days.

- You file it with the IRS office where you file your return.

- You give a copy to the employer and, if different, to the transferee.

- Your statement must include who you are, what you received, when, any restrictions, fair market value, and what you paid.

- The requirement to attach a copy to your tax return has been removed, but you must keep records.

Conclusion

If you want the upside of equity without a panic sprint on Day 30, plan your 83(b) workflow now. Decide whether the IRS online form will capture your facts precisely, or whether paper preserves needed precision. File within 30 days, send a copy to your employer, and keep bulletproof proof. Those simple habits give you a clean holding‑period start and fewer surprises at sale.

Sources and quick references

- IRS Form 15620, Section 83(b) Election, with instructions and the weekend rule under IRC 7503. (irs.gov)

- IRS mobile‑friendly forms program, including ID.me sign‑in and online submission plus download confirmation, and the listing that shows Form 15620 is available for online submission in 2025. (irs.gov)

- Treasury Regulation 1.83‑2, timing, content, and furnishing copies to the employer and, if different, the transferee. (law.cornell.edu)

- 2016 final rule removing the requirement to attach a copy of the 83(b) election to your return, still requiring the 30‑day filing and good records. (irs.gov)

- IRS update to Publication 525 confirming you can make the election via a written statement or Form 15620. (irs.gov)

- Practitioner note on online input constraints and when to choose paper. (thestartuplawblog.com)

Simplify Delivery, Improve Margins, Stay in Control.

Offshore support that works exactly like your in-house team.

💼 Let’s Talk