Scale Your CPA Firm Without Adding Headcount

Build your offshore team that works your way, trained, compliant, and white-labeled under your firm.

👉 Book a Discovery Call

You are in the right place. I will walk you through what the form is, when it is used, what to gather, how the IRS looks at your numbers, and the fastest, cleanest way to submit it. I will also point out the few places where the rules changed in 2025, so you do not rely on outdated advice.

Key Takeaways

- Form 433-F is a two-page Collection Information Statement the IRS uses to decide payment plans or whether to mark you Currently Not Collectible, based on your real ability to pay.

- For Offers in Compromise, you do not use 433-F, you must use 433-A(OIC) or 433-B(OIC) with Form 656. You can now file an OIC online in your IRS Online Account.

- If your balance on Form 9465 is more than 50,000, the IRS tells you to attach Form 433-F. There are also cases between 25,000 and 50,000 where they may still ask for it.

- The IRS uses Collection Financial Standards, updated April 21, 2025, to cap “allowable” expenses, then computes monthly disposable income from your form.

- How and where you submit 433-F depends on the notice. Some letters tell you to call with your 433-F in hand. Others give you a secure upload link or a specific mailing address tied to Form 9465. Do not guess. Follow the notice or the 9465 instructions.

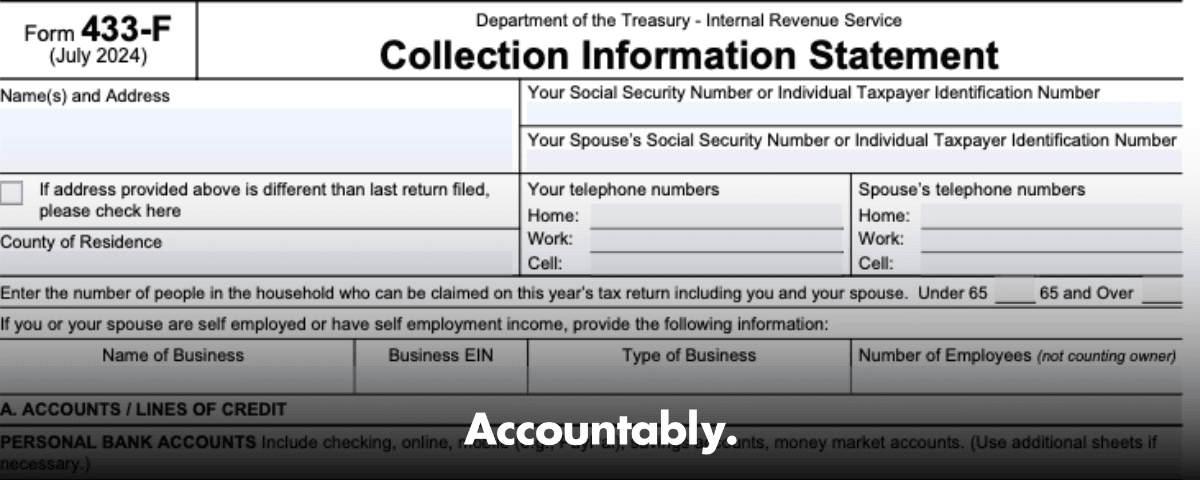

What Is IRS Form 433-F

Form 433-F is the IRS’s short financial statement. It asks for your income, household expenses, bank and investment balances, retirement accounts, real estate, vehicles, lines of credit, and other debts. The IRS uses it to decide whether to approve an installment agreement, set partial payment terms, or place your account in Currently Not Collectible status if you cannot pay without skipping essentials. The current 433-F is the July 2024 revision that the IRS posted on April 1, 2025, so be sure you are using that version.

Important boundary: 433-F is not for Offers in Compromise. If you plan to settle for less than the full balance, the required financial statements are 433-A(OIC) or 433-B(OIC) with Form 656, and the IRS now allows individuals to file an OIC through their Online Account.

Hundreds of Firms Have Already Used This Framework.

Join the growing list of CPA and accounting firms using Accountably’s Offshore Playbook to scale faster.

💬 Get Your FREE Playbook

👉 Visit Jugal Thacker’s LinkedIn

Send him a connection request and message “Playbook” to get your copy.

When You Should File Form 433-F

You complete Form 433-F when the IRS asks for a current financial picture. That happens most often when:

- You apply for a payment plan and the amount you owe or your proposed payment calls for a deeper look. If line 9 of Form 9465 is more than 50,000, the instructions say to attach 433-F. If you are between 25,000 and 50,000 and cannot meet the standard payment, the IRS may still require it.

- The IRS is reviewing your existing installment agreement and requests updated information. Some notices say to complete 433-F, then call a specific number to review it with an agent, and they explicitly tell you not to mail it because that will be too slow.

- You request Currently Not Collectible status because paying anything right now would push you below basic living needs. The IRS may ask for 433-F or another 433-series form plus proof of income and expenses.

How the IRS Uses Your 433-F

Here is the part that calms a lot of people. The IRS does not just eyeball your spending and pick a number. They use Collection Financial Standards, updated April 21, 2025, to cap “allowable” amounts for categories like food, clothing, personal care, housing, utilities, and transportation. They also allow a standard out-of-pocket health care amount each month, for example, 84 per person if under 65 and 149 if 65 or older, effective April 21, 2025. They compare your actuals to those caps, then compute your monthly disposable income. That figure drives your plan terms or whether they mark you Currently Not Collectible.

One more workflow detail that helps you prepare smart. In practice, Automated Collection System teams and campus operations rely on 433-F for individuals. Revenue officers can require 433-A or 433-B for deeper verification. That is straight from the Internal Revenue Manual.

Improve Margins Without Compromising Quality

Offshore staffing helps firms deliver more, scale faster, and stay compliant, without adding local headcount.

👉 Book a Discovery CallQuick mindset shift: the cleaner your 433-F, the faster the conversation moves from “prove it” to “here is what we can approve.”

433-A vs 433-B vs 433-F, What You Use and When

Think of the 433 series as three lenses, each with a different zoom level.

- 433-F, the short snapshot used by ACS and campuses for individuals, good for most payment plan reviews and many CNC requests. Not valid for Offers in Compromise.

- 433-A, the long individual statement revenue officers use when they need deeper verification, or for OIC cases as 433-A(OIC).

- 433-B, the business statement for entities and, for OIC, the 433-B(OIC).

Here is a quick comparison you can skim.

| Form | Who uses it | Typical use | Valid for OIC |

| 433-F | ACS and campuses for individuals | Installment agreements, CNC screening, financial updates | No |

| 433-A | Revenue officers for individuals | Detailed field reviews, complex cases | Only the 433-A(OIC) |

| 433-B | Businesses | Entity financials, business payment plans | Only the 433-B(OIC) |

Documents and Information You Will Need

Set yourself up to finish this in one sitting. Pull statements and numbers that match the date you sign.

- Bank, savings, money market, CDs, PayPal or similar, investment and retirement accounts, and any crypto wallets or exchanges.

- Real estate details, addresses, current values, mortgage balances, and recent refinance info.

- Vehicles, boats, RVs, equipment, with values, loan balances, and monthly payments.

- Income proof, recent pay stubs, award letters, benefits, and for the self-employed, a current P&L or year-to-date statement.

- Monthly bills, especially for housing, utilities, vehicle costs, health insurance, out-of-pocket medical, court-ordered support, and student loans.

These items let the agent validate your entries quickly against the IRS’s standards that are effective as of April 21, 2025.

Reporting Bank, Investment, and Crypto Accounts

List every account exactly as it exists on the date you complete the form. Include the institution, full account numbers, and current balance or market value. Retirement accounts count too, even if you would rather not touch them. If you hold virtual currency, identify the wallet or exchange and show a reasonable fair market value on the date you sign. The form the IRS posted on April 1, 2025, makes it clear they expect a complete snapshot, so do not leave anything off.

Practical tip you will thank yourself for later, save the PDFs of your bank and brokerage statements and name them in a way that matches the line items on your 433-F. When an agent asks for backup, you can send the exact pages without a scavenger hunt.

Disclosing Real Estate, Vehicles, and Other Assets

Real estate needs four numbers at a minimum, current market value, mortgage balance, resulting equity, and your ownership percentage. If you refinanced, keep those dates handy. If a property produces rent, show that amount cleanly. For vehicles and other personal property, list the year, make, model, value, loan balance, monthly payment, and the month the loan ends.

If an amount looks high compared to your county’s norm, expect questions. That is not personal, it is how the IRS tests numbers against typical costs in your area. The housing and utilities standards are published by state and county and were refreshed on April 21, 2025.

A quick valuation checklist

- Use a recent appraisal, online comps, or a reliable guide for property and vehicles.

- Show how you computed equity, value minus all recorded liens.

- Keep statements for mortgages and vehicle loans ready to upload if asked.

- If an expense runs high because of medical needs or similar, gather receipts and a short note that explains why a cheaper option will not work for you.

Income and Employment Details for Your Household

Write your employer’s name and address exactly as it appears on your pay stub, include your job title, hire date, pay frequency, and both gross and net pay per period. If your spouse lives with you or is liable for the tax and earns income, include their details too. List all non-wage income, Social Security, unemployment, rental income, child support received, and anything else that hits your bank the same month after month.

If you are self-employed, include the business name and EIN, average monthly gross receipts, and note distributions. A simple, current P&L helps the agent see income seasonality without a back-and-forth.

Helpful reality check, the IRS can and does verify bank deposits and pay information, so accuracy beats guesswork every time.

Monthly Living Expenses and the 2025 Allowable Standards

Here is the part that trips people up. You enter your actual monthly expenses on the form, however the IRS caps what counts as “allowable” using national and local standards. As of April 21, 2025, the national standards cover food, clothing, personal care, housekeeping supplies, and a small miscellaneous amount. Local standards by county cover housing and utilities, and transportation allows set amounts for ownership and operating costs. The IRS also allows a monthly out-of-pocket health care amount per person, for example, 84 if under 65 and 149 if 65 or older, in addition to your health insurance premium.

The IRS uses these standards to compute your disposable income, which drives your payment plan or a decision to place you in Currently Not Collectible status.

If your costs are higher than the standards

This is not an automatic “no.” You can claim reasonable, necessary amounts that exceed the caps if you provide documentation and a short, clear explanation. Medical needs, court-ordered payments, or location-specific realities sometimes justify higher numbers. If an agent can understand, verify, and defend your numbers, you have a path.

Completing Each Section of Form 433-F, Step by Step

Use current numbers that match your documents the day you sign.

- Section A, Accounts and lines of credit

- List every bank and investment account, retirement plans, and any virtual currency, with institution names, full account numbers, and current balances.

- Section B, Real estate

- Enter addresses, purchase dates, current fair market values, mortgage balances, and equity. Attach a quick equity calculation if space is tight.

- Sections C and D, Vehicles and other assets, plus credit cards

- For each vehicle, include year, make, model, value, loan balance, monthly payment, and final payment month.

- List other assets like equipment or collectibles with values and any debts tied to them.

- List each credit card with limits and current balances.

- Sections E and F, Business and employment

- If you run a business, note average monthly gross receipts and receivables.

- For employment, show employer details, pay frequency, and your gross, withholdings, and net.

- Sections G and H, Household income and monthly expenses

- Add every recurring income source.

- Enter actual monthly expenses, then be ready for the IRS to apply the April 21, 2025 standards when they compute your disposable income.

What happens after you submit

- If you applied online for a payment plan and meet the streamlined rules, you may not need a 433-F at all. If you do not meet the minimums, the online tool will tell you to provide a Collection Information Statement.

- If you requested Currently Not Collectible status, the IRS may pause collection after reviewing your 433-F and documents. Interest and penalties keep accruing, and they may file a lien to protect the government’s interest.

Where and How to Submit Form 433-F, Without Delays

There is no single address for everyone. Follow the directions that apply to your situation.

- If your notice says to call with your 433-F, do that. The CP522 notice example tells you to complete 433-F, then call the number in the letter, and it warns you not to mail the form because it will not arrive in time.

- If your letter provides a Document Upload Tool link and access code, use that option, then keep your upload confirmation. The CP523F notice explains this path.

- If you are filing Form 433-F with Form 9465, use the state-specific mailing address in the 9465 instructions or the IRS’s “Where to File” page. Addresses change, so check the latest page that was updated April 28, 2025.

Pro move, send mail by certified mail, keep the receipt, and save a PDF copy of everything you submit.

Common Triggers and Mistakes to Avoid

| Trigger | Risk | What to do instead |

| Missed payments on an existing plan | Fast-track to default and enforced collection | Complete 433-F quickly and follow your notice, call, upload, or mail, as instructed |

| Balance above 50,000 | Extra scrutiny and a required 433-F with 9465 | Reconcile statements to your entries and attach clean backup |

| Leaving out accounts or crypto | Credibility hit and delays | Disclose every account, include full numbers and current balances |

| Expenses way above standards without proof | IRS will cut them down to the cap | Provide bills and a short justification tied to the 2025 standards |

When To Bring In A Tax Professional

If you owe more than 50,000, have multiple properties or businesses, or your expenses sit above the standards, a pro can save you weeks. They will align your numbers with the standards and manage the back-and-forth with ACS or a revenue officer. For many people this is the difference between a plan they can live with and one that breaks their budget.

If Form 433-F drives the outcome, small mistakes snowball. Get help early if the dollar amounts are stressful or the case is complex.

For accounting firms and practitioners

If your firm handles 433-F requests at scale for clients, the bottleneck is usually documentation, naming, review loops, and missed SLAs, not finding clients. One way teams reduce cycle time is by standardizing SOPs, workpaper names, and internal checklists, then tracking progress in the same system clients use to share files. If your internal capacity is tapped, Accountably can integrate trained offshore staff into your workflow, with SOP-driven execution and layered quality control, so your seniors stay focused on review and client strategy. Mentioning us once is enough here, the point is that disciplined delivery matters more than raw headcount.

Frequently Asked Questions

What is Form 433-F used for?

It is the short Collection Information Statement the IRS uses to evaluate whether you can make payments or should be placed in Currently Not Collectible status. It is not used for Offers in Compromise, those require 433-A(OIC) or 433-B(OIC) with Form 656, which you can now file online in an Individual Online Account.

Can I submit Form 433-F online?

There is no universal online portal for every 433-F. Your notice controls. Some letters tell you to call with the completed form, do not mail. Others provide a secure Document Upload Tool link with an access code. If you are attaching 433-F to Form 9465, mail it to the address in the 9465 instructions for your state.

How do the 2025 Collection Financial Standards affect me?

The IRS uses national and local standards, effective April 21, 2025, to cap what counts as necessary living expenses. They add a monthly out-of-pocket health care allowance per person, then compute your disposable income. Your actual costs can exceed a cap, you just need strong documentation and a clear reason.

Does ACS always use 433-F, and do revenue officers use different forms?

Yes, that is the general practice. ACS and campus operations use 433-F for individuals. Revenue officers can require 433-A or 433-B for deeper reviews, and only the OIC versions work for offers. This comes straight from the Internal Revenue Manual.

If I get Currently Not Collectible status, does interest stop?

No. CNC pauses enforced collection, not interest or penalties. The IRS may still file a lien to protect its interest, and they will review your ability to pay again later.

Conclusion

If you just opened a letter asking for Form 433-F, you are not alone. Treat the form like a financial inventory day. Pull clean statements, fill every line with current numbers, match claimable expenses to the 2025 standards, and follow the submission method on your notice. If the math works, you get an affordable payment plan or a pause on collection while you get back on your feet. And if the math does not work on the first pass, accurate numbers and strong documentation give you options and time.

If you work inside a firm, remember that delivery discipline beats heroics. Clear SOPs, review protection, and predictable turnaround keep clients calm and partners focused on strategy. If you are a taxpayer, remember this, the IRS uses forms like 433-F to get to a decision, not to grind you down. Fill it once, fill it right, and keep copies. Then move on with a plan you can live with.

Simplify Delivery, Improve Margins, Stay in Control.

Offshore support that works exactly like your in-house team.

💼 Let’s Talk